Growing demand for food and beverage and animal feed industry will drive the growth of hydrolyzed corn protein market during the forecast period from 2025 to 2035. In addition, the increasing demand for plant-based protein complemented with the improvement in the food processing technologies is also expected to boost the market growth.

Due to its strong umami flavor and gelling characteristics, hydrolyzed corn protein is commonly incorporated as a flavor enhancer in soups, sauces, snacks, and ready-to-eat meals. Moreover, the rising awareness regarding clean-label and non-GMO ingredients is influencing the processors to use hydrolyzed corn protein's in a number of food formulations that can adhere to sustainable production practices and adapt to changing consumer demands.

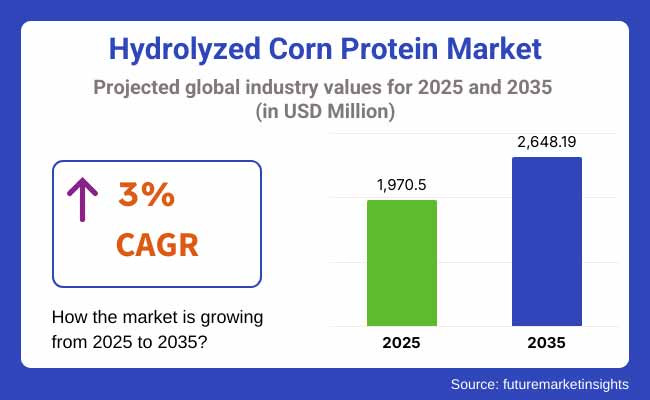

In 2025, the hydrolyzed corn protein market was valued at approximately USD 1,970.50 million. By 2035, it is projected to reach USD 2,648.19 million, reflecting a compound annual growth rate (CAGR) of 3%. The market expansion is attributed to rising demand for plant-based protein solutions, heightened focus on improving animal nutrition, and the use of hydrolyzed corn protein in personal care and cosmetics products.

Furthermore, developments in enzymatic hydrolysis techniques, improved production efficiency, and enhanced supply chain management are enabling cost-effective manufacturing and product diversification. The rising trend of using plant-derived proteins in specialized dietary formulations, including infant nutrition and sports supplements, is expected to further drive market adoption globally.

North America is also a significant hydrolyzed corn protein market, backed by robust demand from the food processing, beverage, and animal feed industries. Snack foods, seasonings, and convenience meals containing hydrolyzed corn protein are gaining preference in the region owing to the growing consumer inclination toward using natural flavor enhancers in food.

Bolstered by strong regulatory frameworks, attention to sustainable sourcing, and increasing use of probiotics in the likes of pet food and dietary supplements. Moreover, the surge in vegan and flexitarian diets combined with advancements in protein hydrolysis technologies drive the development of new product formulations for health-conscious consumers.

Demand for hydrolyzed corn protein in Europe is driven by stringent regulation to ensure a safe food supply, increasing consumer interest in plant-based ingredients, and greater use in bakery, confectionery and other processed foods. Market growth is consistent in countries like Germany, France and the UK owing to increasing awareness of natural food additives and alternative protein sources.

Sustainability, ethical sourcing practices, and compliance with non-GMO certifications are driving manufacturers to invest in product innovation and clean-label offerings across the region. In addition, the growth of brands specializing in plant-based food ingredients and research on their applications in alternative protein form are further contributing to the overall growth of the market.

Furthermore, Asian and Pacific market for hydrolyzed corn protein is likely to grow fast owing to growing processed food consumption, animal feed expansions, and disposable income. Countries such as China, India, and Japan are seeing increasing demand for protein sources from plants owing to changing dietary patterns and rising concerns about food security.

On top of this, the growing food processing industry in the region, with scientific advances in fermentation and hydrolysis technologies, now enables the mass production of hydrolyzed corn protein, which can be used for specific applications. Moreover, the market outlook is further strengthened by the rising presence of global food manufacturers, governmental initiatives to increase plant-based nutrition, and innovative food flavoring solutions.

These factors, along with rising demand for plant-based proteins, increasing applications across food and animal nutrition, and ongoing advancements in the hydrolysis of protein technology, will contribute to steady growth of the hydrolyzed corn protein market in the next ten years. Climatic challenges drive higher investments in sustainable production (both in-feed and on-farm), processing efficiencies, and protein-based innovations or formulations fit for global consumption.

Challenges

Regulatory Compliance and Food Safety Concerns

Issues with tight food safety regulations and compliance are also hindering the growth of the hydrolyzed corn protein market. The global differences in regulatory frameworks (e.g. requirements for labeling, allergen declaration, usage level etc.) can pose challenges to the manufacturers.

Maintaining product safety, preventing contamination, and adhering to stringent quality control protocols involves significant investments in state-of-the-art testing and traceability technologies. It compels companies to keep pace with shifting regulatory frameworks and to increase transparency to sustain consumer confidence and market integrity.

Fluctuations in Raw Material Prices and Supply Chain Disruptions

Volatile corn prices and supply chain disruptions are challenging factors for the hydrolyzed corn protein market. The availability and cost of raw materials directly impacting production expenses and profit margins are hampered by climate changes, trade embargoes, and geopolitical instability.

Wholesale agreements, distribution, and everything in between often face delays. To avoid such risks, companies should consider developing resilient sourcing strategies, forming local partnerships to help find local, quality supply, and investing in alternative ingredient solutions.

Opportunities

Rising Demand for Plant-Based and Clean Label Ingredients

Hydrolyzed corn protein market is expected to gain significant growth during the forecast period owing to the rising consumer interest in plant based clean-label food products. Hydrolyzed corn protein is used by many food manufacturers as a natural, non-GMO, and allergen-free flavor enhancer and functional ingredient in a wide variety of applications as different manufacturers continue to move away from artificial ingredients.

Food and beverage brands should take advantage of the growing consumer demand for plant-derived proteins by offering their products that maintain a focus on sustainability, transparency around sourcing, and cutting-edge formulations.

Expansion in Functional Food and Pet Nutrition Sectors

Rising application of hydrolyzed corn protein in functional foods and pet nutrition is expected to deliver a lucrative growth landscape. Wheat protein, which is primarily extracted from gluten, is used as a functional ingredient in a variety of packaged goods for its capacity to enhance flavor, improve texture, and supply essential amino acids to protein-fortified snacks, dietary supplements, and specialty pet food products.

Moreover, innovations in food technology and tailored nutrition solutions are fuelling growth of hydrolyzed protein applications. The changes in consumer lifestyle have prompted businesses to focus on creating strong formulations that not only provide quality but also contain versatility to market their products successfully.

The hydrolyzed corn protein market has seen significant developments during the period of 2020 to 2024 due to the growing inclination of consumers towards plant-based foodstuffs, rising awareness about the health benefits offered by functional ingredients, and increasing applications of hydrolyzed corn protein in the pet food sector.

Nonetheless, the market was not free from challenges, as rising raw material prices, regulatory complexities, and supply chain disruptions affected stability. Realizing the importance of supply chain resilience, firms shifted to finding the most sustainable sourcing routes for essential ingredients while tightening quality assurance protocols.

From 2025 to 2035, the market promisingly grows in enzymatic hydrolysis methods and sustainable production optimization process along with AI supply chain optimization. The use of biotechnology to facilitate efficient protein extraction and personalized nutrition solutions will change the shape of the market.

Future growth will come from increasing investments in sustainable agriculture, eco-friendly packaging, and digital traceability systems. Those best placed in the Hydrolyzed corn protein industry are those leading the way in innovation, regulatory compliance and consumer-centric product development.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with global food safety and labeling regulations |

| Technological Advancements | Growth in enzymatic hydrolysis and clean-label processing |

| Industry Adoption | Increased use in plant-based foods and pet nutrition |

| Supply Chain and Sourcing | Dependence on conventional corn production |

| Market Competition | Dominance of established ingredient suppliers |

| Market Growth Drivers | Demand for plant-based protein alternatives |

| Sustainability and Energy Efficiency | Early adoption of eco-friendly processing methods |

| Integration of Smart Monitoring | Limited digital traceability in ingredient sourcing |

| Advancements in Product Innovation | Development of allergen-free and clean-label formulations |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter allergen control measures, enhanced traceability, and harmonized international food standards |

| Technological Advancements | AI-driven ingredient optimization, biotechnological protein enhancement, and eco-friendly extraction methods |

| Industry Adoption | Expansion into sports nutrition, medical foods, and bioactive ingredient applications |

| Supply Chain and Sourcing | Shift toward regenerative agriculture, sustainable sourcing, and carbon-neutral supply chains |

| Market Competition | Rise of niche, organic-certified brands, and direct-to-consumer ingredient solutions |

| Market Growth Drivers | Personalized nutrition trends, functional food innovation, and health-conscious consumer preferences |

| Sustainability and Energy Efficiency | Large-scale implementation of zero-waste production, renewable energy usage, and biodegradable packaging |

| Integration of Smart Monitoring | Blockchain-based food traceability, AI-powered quality control, and IoT-enabled supply chain monitoring |

| Advancements in Product Innovation | Precision fermentation for customized protein solutions, hybrid plant-protein blends, and adaptive food ingredients |

Hydrolyzed corn protein represents a lucrative market in USA with growing inclination of consumers towards plant-based protein ingredients in food as well as beverages. Hydrolyzed corn protein is used in snacks, seasonings, processed foods due to increasing demand for clean-label, non-GMO products.

Moreover, the functional advantages, including enhanced solubility and flavor enhancement, are further driving its popularity. Additionally, the rise of global food and beverage manufacturers that are adding hydrolyzed corn protein into their products is another key factor fueling market growth. The popularity of high-protein diets is also boosting demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

Steady growth of the market aided by increasing preference for plant-based and allergen-free food ingredients is boosting the United Kingdom market for hydrolyzed corn protein. Food manufacturers are now infusing hydrolyzed corn protein into meat substitutes, soups and sauces as consumers increasingly search for protein-filled alternatives sourced from sustainable places.

Moreover, adoption is being addressed from a regulatory standpoint, with support for clean-label ingredients. Market penetration is also being enhanced by the growth of private-label food brands and online retailing. Demand from the sports nutrition sector, where hydrolyzed corn protein serves as a dairy-based protein alternative, is also growing.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.9% |

In the European Union, the hydrolyzed corn protein market is majorly spurred by Germany, France, and Italy due to their strong food processing industries and rising awareness of plant-derived proteins among consumers. As vegan and vegetarian diets have gained popularity, hydrolyzed corn protein has appeared in lots of processed foods and snacks.

The use of hydrolyzed proteins has been further facilitated by regulatory approvals for their use in food applications as safe food ingredients. Technical improvements in food technology to increase the taste & functionality of hydrolyzed corn protein are also driving this market. The sustainable production processes and trends towards green packaging additionally fuel the market expansion.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.1% |

The processed food industry, which emphasizes umami, has high applications in Japan's hydrolyzed corn protein market. Hydrolyzed corn protein an ingredient used in seasonings, instant soups, and soy-based products is in high demand from consumers seeking new, bold flavors.

Plant-based protein demand is further growing due to increased inclination towards functional and health-focused food ingredients. The latest trends also reflect Japan's strict food safety regulations and emphasis on the quality of innovative ingredients. Furthermore, the growing consumer inclination towards the consumption of natural food ingredients is increasing the need for the hydrolyzed corn protein as a clean-label flavor enhancer.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.3% |

The hydrolyzed corn protein market in South Korea is growing as a result of an increase in demand for hydrolyzed corn protein in processed consumables, especially sauces, seasonings, and instant foods. The growing demand for functional and protein-rich food ingredients has been contributing to the increasing use of hydrolyzed corn protein in the food industry of the country.

Market drivers include the growing segments of health-conscious consumers and the influence of international dietary trends. Moreover, the trend of clean-label ingredients in the food industry is also driving the manufacturers towards using hydrolyzed corn protein instead of artificial flavor enhancers. The rise of online retail and direct-to-consumer sales channels is also breaking down barriers to market access for smaller producers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.4% |

The hydrolyzed corn protein market is anticipated to expand over the succeeding years, driven by the surging adoption of plant-based protein substitutes, the increasing need for natural flavor enhancers, and a rise in the usage in food, cosmetics, and pharmaceutical sectors. End use-wise, the hydrolyzed corn protein market is categorized into food & beverage, cosmetics & personal care, and pharmaceuticals, all of which are driving the versatility of hydrolyzed corn protein.

Hydrolyzed corn protein is commonly used as a flavor enhancer, protein source, and texturizing agent for the food & beverage industry and allows products such as soups, snack foods, seasonings, and processed foods to be formulated. Formulated care cosmetics & personal care cosmetics applications (moisturizing, conditioning and strengthening) are avenues for hydrolyzed corn protein in hair and skincare.

Furthermore, bioactive peptides and functional protein properties of hydrolyzed corn protein are being harnessed by the pharmaceutical industry, resulting in increased utilization for nutraceuticals or dietary supplements and medicinal applications.

Hydrolyzed corn protein segment based on the form includes, Powder, Paste, and Liquid. The powdery version is popular throughout the food and beverage industry for its long shelf life, ease of distribution, and ability to easily blend with other ingredients. Kmsg is commonly employed in seasonings, meat products, soups and processed snacks, where it can improve umami and savory flavors.

The paste form is used in cosmetics and high-moisture food products; here, its high solubility and emulsifying properties help maintain texture, stability, and nutrient retention in the final products. On the other hand, its liquid form is being used more and more in pharmaceutical and in industrial food because it is quickly absorbed, has a high bioavailability, and can easily be incorporated into a liquid formulation, perfect as a functional food, supplement and medicinal syrup.

The hydrolyzed corn protein market is experiencing innovation, with continuous research and development in extraction techniques, clean-label formulations, and sustainable production processes. The growing trend for the use of non-GMO, organic, and gluten-free protein ingredients among consumers is driving manufacturers to produce advanced hydrolyzed corn protein products.

Moreover, developments of enzyme hydrolysis process, protein isolation, or flavor-masking technologies are broadening the application scope of hydrolyzed corn protein in high-protein diets, vegan meat substitutes, and specialized medical nutrition. The growing adoption of plant-based nutrition and regulatory approvals for hydrolyzed protein ingredients are likely to continue to drive market penetration.

The hydrolyzed corn protein market at a global level, showing strong growth in its demand across the food and beverage, animal feed, and cosmetics industry. In meeting this need, manufacturers are creating and producing protein-rich, clean label ingredients to boost overall flavor and nutrient profile.

Some of the notable trends include rising adoption of enzyme in plant-based food products, increasing consumer inclination towards natural flavor enhancers, and technological developments in hydrolysis processes. Under the guidance of regulations for clean-label and non-GMO offerings, market players are focusing on innovations and providing sustainable and high-purity hydrolyzed corn protein products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 18-22% |

| Archer Daniels Midland (ADM) | 15-19% |

| Tate & Lyle PLC | 12-16% |

| Roquette Frères | 9-13% |

| Ingredion Incorporated | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | Produces high-quality hydrolyzed corn protein for food applications, emphasizing natural flavor enhancement and nutritional benefits. |

| Archer Daniels Midland (ADM) | Develops hydrolyzed corn protein for both human and animal nutrition, focusing on clean-label and sustainable production. |

| Tate & Lyle PLC | Specializes in innovative hydrolysis processes to create protein-rich ingredients for functional food and beverage applications. |

| Roquette Frères | Offers premium-grade hydrolyzed corn protein for plant-based foods, aligning with growing consumer demand for alternative protein sources. |

| Ingredion Incorporated | Focuses on hydrolyzed corn protein solutions with non-GMO and allergen-free formulations for diverse food and personal care applications. |

Key Company Insights

Cargill, Inc. (22-26%)

Keeping itself ahead of the hydrolyzed corn protein market is Cargill with focuses on sustainable, quality, and innovation. Archer Daniels Midland, USA: The Company has enzymatic hydrolysis that produces highly digestible protein ingredients to be used across food, drink and animal nutrition applications.

Its state-of-the-art processing technologies are designed to retain nutritional benefits while enhancing solubility and flavor-enhancing properties. In addition to traditional animal protein production, Cargill has invested resources into research and development to address opportunities in the marketplace for food that is plant protein-based and allergen-free.

Archer Daniels Midland (ADM) (18-22%)

Another significant player in the hydrolyzed corn protein market is ADM. ADM offers high-quality protein solutions that are customized for the food and beverage industry. Its proprietary enzymatic hydrolysis techniques also enhance the functional properties of the protein, making it suitable for applications in sports nutrition, meat substitutes, and flavor-enhancing formats. They are a proven leader with sustainability and clean-label ingredients at their core, continuing to invest in their plant-based protein innovations and their transparent supply chain.

Roquette Frères (14-18%)

Roquette Frères has wide portfolio for plant-based protein ingredients, including hydrolyzed corn protein for health-aware consumer. They focus on developing functional food ingredients with improved solubility, taste, and stability. With a strong focus on sustainability and environmentally conscious production methods, Roquette has become the go-to source for manufacturers in search of high-quality, plant-based protein solutions. The company also works alongside food brands to develop bespoke formulations for specialized dietary requirements.

Tate & Lyle PLC (10-14%)

Tate & Lyle specializes in developing cutting-edge protein solutions for the food and beverage market, with a keen focus on texture enhancement, stability, and nutrition fortification. Its hydrolyzed corn protein products are used in a wide variety of preparations, including soups, sauces, snacks and dairy alternatives.

Tate &a Lyle constantly invest in research to improve protein extraction techniques and to understand new uses in functional and fortified foods. The company’s initiatives in advocating for sustainable ingredient sourcing and clean-label formulations are in tandem with the rising consumer demand for transparent food production.

Agridient Inc. (6-10%)

Agridient Inc. delivers tailor-made hydrolyzed corn proteins to food, beverage and animal nutrition markets. The products backed by ultra-high digestibility, enhanced palatability, and functional advantages. Dynamic ingredients are tailored to meet the needs of food manufacturers seeking cost-effective, high-performance protein alternatives. Through ongoing investments in hydrolysis process refinement, it has made sure, to produce top quality protein ingredients that comply with global regulatory requirements and changing consumer preferences.

Other Key Players (30-40% Combined)

The hydrolyzed corn protein market comprises multiple manufacturers that specialize in diverse product innovations, sustainability-driven processing, and enhanced functionality. The companies listed specialize in high-quality protein sources, advanced hydrolysis techniques, and customized solutions for food, beverage, and feed applications. Some notable players include:

The overall market size for hydrolyzed corn protein market was USD 1,970.50 million in 2025.

The hydrolyzed corn protein market expected to reach USD 2,648.19 million in 2035.

The demand for the hydrolyzed corn protein market will be driven by increasing applications in the food and beverage industry as a flavor enhancer, rising demand for plant-based protein alternatives, growing use in animal feed and pet food, and advancements in food processing and clean-label ingredient trends.

The top 5 countries which drives the development of hydrolyzed corn protein market are USA, UK, Europe Union, Japan and South Korea.

Innovations and market expansion driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrolyzed Casein Market Size, Growth, and Forecast for 2025 to 2035

Hydrolyzed Egg Market Trends – Functional Benefits & Applications 2025 to 2035

Hydrolyzed Starch Market Trends - Business Progress & Growth

Hydrolyzed Bovine Collagen Market

Hydrolyzed Oat Protein Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Whey Protein Market Analysis by Product Form, Application, Sales Channel and Region through 2035

Hydrolyzed Animal Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Vegetable Proteins Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Vegetable Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Landscape of Hydrolyzed Vegetable Protein Providers

UK Hydrolyzed Vegetable Protein Market Trends – Demand, Innovations & Forecast 2025-2035

USA Hydrolyzed Vegetable Protein Market Insights – Size, Share & Industry Growth 2025-2035

ASEAN Hydrolyzed Vegetable Protein Market Report – Demand, Growth & Industry Outlook 2025-2035

Europe Hydrolyzed Vegetable Protein Market Analysis – Size, Share & Trends 2025-2035

Partially Hydrolyzed Guar Gum Market Size and Share Forecast Outlook 2025 to 2035

Australia Hydrolyzed Vegetable Protein Market Growth – Innovations, Trends & Forecast 2025-2035

Enzymatically Hydrolyzed Carboxymethyl Cellulose Market

Latin America Hydrolyzed Vegetable Protein Market Insights – Size & Forecast 2025–2035

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA