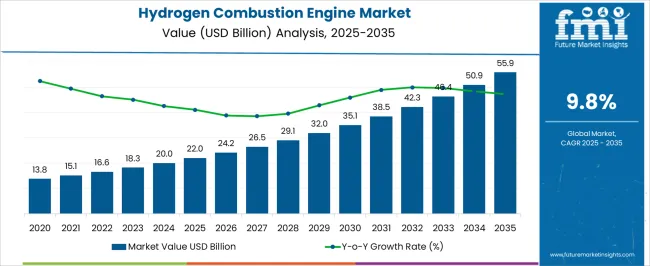

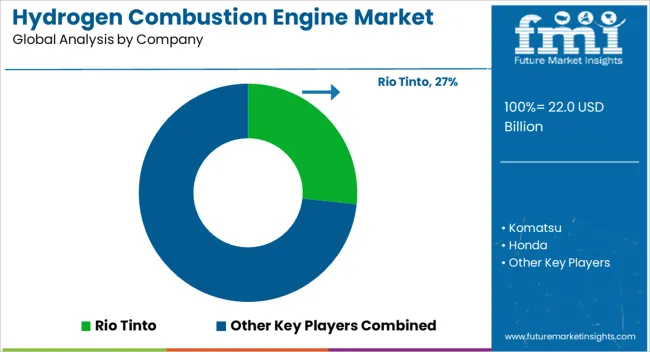

The Hydrogen Combustion Engine Market is estimated to be valued at USD 22.0 billion in 2025 and is projected to reach USD 55.9 billion by 2035, registering a compound annual growth rate (CAGR) of 9.8% over the forecast period.

| Metric | Value |

|---|---|

| Hydrogen Combustion Engine Market Estimated Value in (2025 E) | USD 22.0 billion |

| Hydrogen Combustion Engine Market Forecast Value in (2035 F) | USD 55.9 billion |

| Forecast CAGR (2025 to 2035) | 9.8% |

The hydrogen combustion engine market is gaining traction as industries and governments seek low emission alternatives to traditional fossil fuel powered engines. Advancements in hydrogen fuel infrastructure, combined with regulatory incentives supporting zero emission vehicles, are accelerating adoption across multiple vehicle classes.

This market growth is further driven by increased investments in hydrogen research and pilot programs by major automotive manufacturers. Hydrogen combustion offers a transitional path toward carbon neutrality, particularly in segments where battery electric solutions face limitations such as long haul transport or extreme operating conditions.

As public and private sectors align on decarbonization goals, the hydrogen combustion engine market is positioned to expand steadily. Passenger and commercial vehicles, along with specialized equipment, are expected to see increased integration of hydrogen based powertrains due to performance flexibility and reduced greenhouse gas emissions.

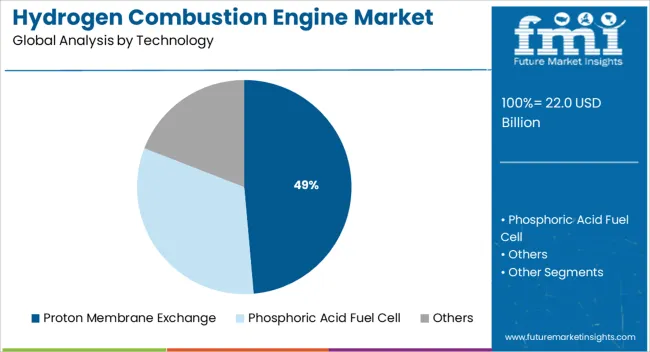

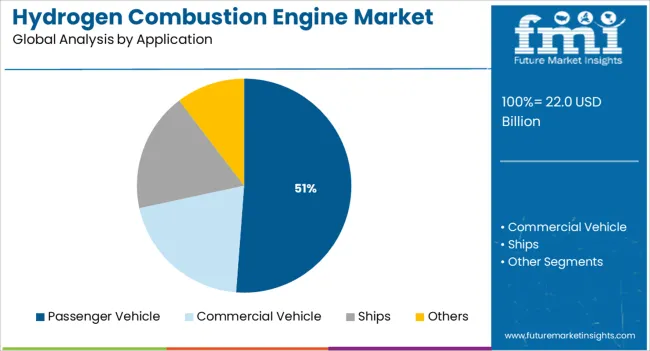

The market is segmented by Technology and Application and region. By Technology, the market is divided into Proton Membrane Exchange, Phosphoric Acid Fuel Cell, and Others. In terms of Application, the market is classified into Passenger Vehicle, Commercial Vehicle, Ships, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The proton membrane exchange segment is projected to hold 48.60% of the overall revenue by 2025 within the technology category, making it the leading segment. Its dominance is attributed to high energy efficiency, compact design, and rapid response capability.

The technology supports lower operating temperatures, which improves safety and enables quicker startup times, especially important in automotive applications. The scalability of this technology has also made it suitable for various power outputs, facilitating its integration into passenger and light commercial vehicles.

Further, ongoing investments in membrane durability and cost optimization have expanded its applicability across regions with supportive fuel cell infrastructure. The growing interest in hydrogen powered mobility, especially in urban and intra city transit, has reinforced the leadership of proton membrane exchange technology in the market.

Passenger vehicles are expected to contribute 51.20% of the total market revenue by 2025 under the application segment, establishing their position as the dominant end use. The rise in consumer demand for sustainable mobility solutions, coupled with tightening emission standards, has prompted automakers to introduce hydrogen powered passenger vehicles as part of their clean energy portfolios.

These vehicles offer fast refueling times, longer driving ranges, and lower environmental impact compared to conventional fuel types. Additionally, the growing availability of hydrogen refueling infrastructure in key markets such as Europe and Asia is enabling commercial rollout.

Supportive policy frameworks, including subsidies and emission credit systems, have further incentivized adoption. As a result, passenger vehicles are leading market uptake due to their alignment with performance expectations, infrastructure readiness, and sustainability targets.

Key players have recognized that an essential to decarbonizing the automotive sector is combustion engines that operate on fossil-free fuels such as biogas, renewable hydrogen, and other choices, such as hydrogen combustion engines.

While it is expected that the vast majority of commercial vehicles may be electric in the future - a hybrid of hydrogen fuel cell and battery electric - there are likely to certainly be uses of hydrogen combustion engines that may be required for a long time. This is expected to accelerate the global hydrogen combustion engine market growth.

In recent years, top market players have announced that batteries are a perfect answer for shorter/medium-range applications, such as use inside the city for buses, garbage collection, local distribution, and regional haulage, with regular returns to a permanent depot - allowing for convenient recharging.

As battery technology and charging, facilities improve, it is projected to be employed for longer and heavier road shipments. They accept the possibility of reducing emissions in the energy- and emissions-intensive refining stage of the aluminum supply chain by switching from fossil fuels to clean hydrogen in the alumina refining process. Exploring these new clean energy technologies and methodologies is therefore a critical step in producing green aluminum, which is predicted to boost the expansion of the hydrogen combustion engine market share.

Key players in several areas have extensive customer knowledge and application expertise. The global fuel landscape is projected to alter over time, driven by the requirements of various applications, markets, and geographies. As the world progresses toward fossil-free propulsion technologies such as Battery Electric Vehicles (BEV), fuel cells (FCEV), and biofuels, hydrogen combustion engines are expected to be an option.

Key corporations are continuing to follow through on their pledge to drive change toward a net-zero future. Companies have started releasing new products that are anticipated to offer crucial insights into the possibilities offered by hydrogen combustion engines and fuel cells as they continue to research their upcoming product development programs. This comes after the completion of a multi-stakeholder research project aimed at breaking new ground in hydrogen technology. These factors are estimated to surge product demand and expand the global hydrogen combustion engine market size and generate market opportunities.

| Report Attribute | Details |

|---|---|

| Hydrogen Combustion Engine Market Value (2025) | USD 18.22 Billion |

| Hydrogen Combustion Engine Market Anticipated Value (2035) | USD 46.31 Billion |

| Hydrogen Combustion Engine Projected Growth Rate (2025 to 2035) | 9.78% |

Internal combustion engines have consistently gained popularity over time. However, rising crude oil prices, severe emission standards, fuel supply security, and noise pollution have prompted OEMs to turn their attention toward natural gas and hydrogen-powered engines.

For instance, one key player declared that it is developing a hydrogen-fueled combustion engine for use in sports vehicles, with the goal of creating a prosperous and sustainable mobility society.

Around 25% of the world's hydrogen combustion engines run on fossil fuel oil, accounting for 10% of global greenhouse gas (GHG) emissions. In the case of automobiles, hydrogen combustion engines power 90% of all vehicles worldwide. As a result, increased reliance on oil is projected to spur development in the hydrogen combustion engine market trends.

The statistics accumulated by Future Market Insights, reveal the global forum of hydrogen combustion engines which has witnessed an unprecedented surge over the past few years.

The key providers in the market are in conjunction with the increasing demand for hydrogen combustion engines. There has been a gradual rise in CAGR registered during the period of 2020 to 2025 and is likely to expand at a massive 9.78% in the forecast period.

Hydrogen is utilized as a substitute fuel in cars, portable power systems, and power generation. The worldwide hydrogen combustion engine market was expected to increase at a healthy rate over the recent decade due to a growing need for sustainable energy. The market is gaining significant traction throughout the world as a result of infrastructure advances in the sector of hydrogen generation. Owing to the transition to high-performance, zero-emission automobiles have grown more popular, there has been an increased demand for low-emission vehicles.

Technological developments enable the hydrogen combustion engine to evolve, allowing it to produce greater power while consuming less fuel. Meanwhile, engines are projected to continue to play an important part in the growth of the automobile industry. They may also improve in areas like as thermal efficiency, pollution, and electrification.

Low-temperature combustion (LTC) is a cutting-edge combustion notion for hydrogen combustion engines that has lately received a lot of interest. Hence, the adoption of a hydrogen combustion engine is anticipated to rise in the forecast period.

By technology type, the market is segmented into proton membrane exchange and phosphoric acid fuel cells, and other technologies based on those. It has been studied by the analysts at Future Market Insights that the proton membrane exchange segment is estimated to hold a major market share, through the forecast period.

The vital elements determining the momentum of this segment are:

By application type, the market is segmented into passenger vehicles, commercial vehicles, ships, and others. It has been studied by the analysts at Future Market Insights that the commercial vehicles application segment is estimated to hold a major market share, through the forecast period.

The pivotal aspects determining the momentum of this segment are:

One of the primary aspects driving the market is growing public awareness regarding the benefits of the adoption of hydrogen combustion engines. Aside from that, governments in several countries are launching measures to build ICE infrastructure.

They are also supporting the usage of hydrogen fuel combustion vehicles (FCVs) to minimize greenhouse gas emissions, which is helping to drive market growth.

Diesel and gasoline costs have risen dramatically in recent months, both globally and locally, encouraging a move toward hydrogen vehicles. The global desire for high-performance, low-emission automobiles will drive the automobile market in the future. Furthermore, the increasing frequency of reimbursement rules in the automation business is driving expansion in the hydrogen vehicle industry.

Owing to the rising global prices of gasoline and diesel, there has been an increase in demand for fuel-efficient automobiles. This, together with the depletion of fossil fuel supplies, is likely to accelerate the demand for hydrogen combustion engines.

Furthermore, leading market players are heavily spending on research and development (R&D) efforts to create improved fuel cell trucks and hydrogen-powered engine buses to carry people, which is positively affecting the market.

The electrolysis method, which involves running a strong electric current through water to remove oxygen and hydrogen atoms, is commonly used to extract hydrogen (in gaseous form) from water. Due to the significant energy requirements, the electrolysis method is very expensive. Additionally, hydrogen presents design challenges for mass and space needs, as well as for managing and storing fuel onboard aircraft.

On the contrary, the deployment of hydrogen fuel cell technology, which provides powertrains that do not release hazardous pollutants such as nitrogen oxides (NOX) and particulate matter, has witnessed a growth in recent years. This, together with the increasing automotive industry, is anticipated to propel the hydrogen combustion engine market size. Furthermore, the growing development of hydrogen fuel cell infrastructure provides industry investors with significant growth potential in the forecast period.

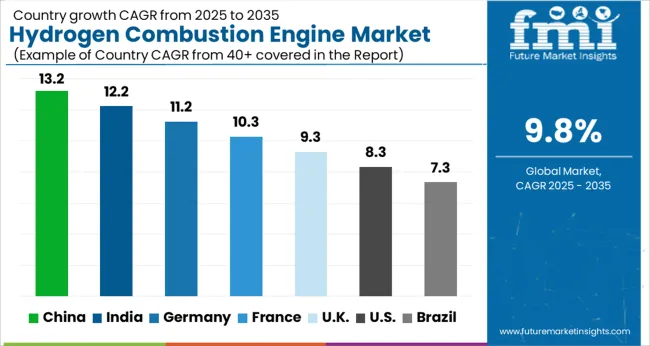

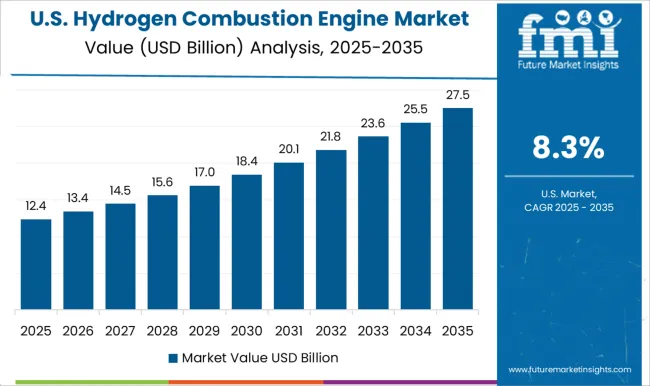

North America currently holds the largest share of the hydrogen combustion engine market with a significant share. This is attributed to increased Research and Development spending to develop cutting-edge solutions and fulfill end-user expectations. Furthermore, the USA government's programs for renewable energy are encouraging market development throughout the region.

OEMs in the USA off-highway spaces are bracing for further decarbonization demand from customers. Major mining corporations have set aggressive decarbonization objectives in the last two years, aiming for Scope 1 and 2 CO2 neutrality. Furthermore, 15 USA states, led by California, have additional rules in place requiring 30 percent of trucks sold to be zero-emission by 2035. These factors are expected to augment the hydrogen combustion engine market growth.

Consumers are increasingly interested in hydrogen combustion engines owing to their adaptability and use as a fuel source in a variety of industries. Moreover, they are also preferred as they can also be compressed into gas or liquefied to make transportation easier and less expensive. Key players are exploring replacing this with blue or green hydrogen, which is projected to drastically reduce carbon emissions.

Key players in the USA acknowledge hydrogen as a clean energy option for sections of the economy that are difficult to decarbonize, such as industrial processes, industrial and household heat, and difficult-to-electrify transportation (such as heavy-duty vehicles or ships). Furthermore, it may harness current technology to give a zero-emissions option for certain use cases while promoting the expansion of hydrogen infrastructure.

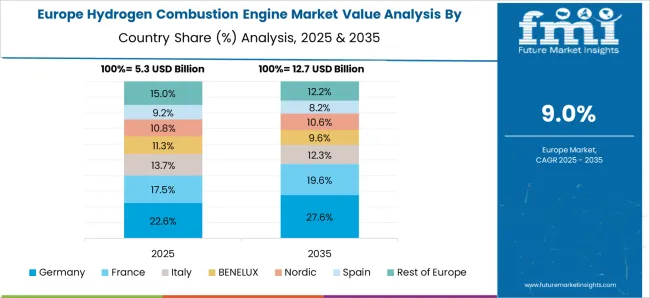

The hydrogen combustion engine market in the United Kingdom has significant growth potential. This is owing to stringent government laws relating to CO2 emissions, as well as an increasing emphasis on the usage of electric cars within the area. Additionally, the European Union has urged manufacturers to decrease CO2 emissions from new on-highway cars by around 30% beginning in 2035.

In the United Kingdom, there are just 15 functioning hydrogen refueling stations. Key players are introducing hydrogen cars that differ slightly from low-emission trucks in that they use hydrogen combustion engines rather than fuel cells and an electric motor. Furthermore, their approach is to keep raw emissions low by using extremely lean and hence cooler combustion, allowing them to do away with an exhaust after-treatment system.

Top engineers in the country have ruled that the hydrocarbons in 'conventional' hydrogen automobiles still emit pollutants into the atmosphere. As a result, they are producing MLE trucks that do not release these components through their more standard engine type.

Key manufacturers strive to shorten the time it takes to achieve zero carbon emissions while simultaneously lowering the cost of change for consumers. Furthermore, companies are trying to collaborate with major fleet owners to convert their existing fleets, particularly those operating in metropolitan areas. In addition, the initial refit plans might involve garbage collection vehicles and local deliveries, where a truck could easily return to its station to refill.

Germany has witnessed significant growth in its hydrogen combustion engine market share. The German Federal Ministry of Economics and Energy has contributed funds to the development of innovative vehicle and system technologies. Furthermore, prominent corporations are stepping up their efforts to promote climate-neutral powertrain technology.

To accomplish climate protection objectives, the potential of all existing powertrain technologies is being harnessed in the country. Key companies have consequently kept an open stance to all technologies: in addition to e-mobility, including fuel cells. Moreover, they also believe the climate-neutral combustion engine, which is fueled by non-fossil fuels such as hydrogen, to be one of the essential future technologies for a sustainable powertrain mix.

Key players in the country are actively developing a hydrogen internal combustion engine, promoting the pan-European objective of becoming the world's first climate-neutral continent by 2050, based on their extensive expertise and many years of research experience in this sector. Furthermore, the goal of their development project is to improve the efficiency potential of multi-port and direct-injected hydrogen engine concepts for the direct propulsion of a commercial vehicle with an existing standard powertrain.

India is a growing hydrogen combustion engine market with immense growth opportunities. The presence of multiple automakers, as well as rising demand for passenger cars in several of the region's main nations, including India and China, are likely to expand the global market size. Furthermore, the absence of charging infrastructure for electric vehicles and the high cost of electric motors support market growth.

To reduce tailpipe emissions, key players are investigating the use of hydrogen in the hydrogen internal combustion engine. Furthermore, the Delhi government initiated a trial project with 50 HCNG buses in the city in 2024 to explore its benefits. This followed the Supreme Court's admonition to look into alternative fuels that might lower emissions and assist combat air pollution. While the study has yet to produce definitively good results, the potential of HCNG is expected to offer market possibilities throughout the projection period.

Achieving the zero-emissions objective is a difficult aim for the automobile industry, one that it is working hard to fulfill with efforts from all angles. Investing time and effort in developing hydrogen technology, whether in the form of transitional HCNG, prospective FCEVs, or revolutionary hydrogen combustion engines, can offer encouraging rewards. In addition, government backing, through programs like as the National Hydrogen Energy Mission Programme, along with the collective talents of business leaders, is likely to be critical in ushering in a clean and green future of mobility.

Start-up companies are offering services, components, and other assistance to market players that is likely to help augment the global hydrogen combustion engine market size:

The hydrogen combustion engine market share reflects a very competitive and concentrated landscape. To promote the development of their businesses, suppliers in this sector are increasingly focused on supplying their clients with new and improved items at significantly reduced prices. The main strategy they use to increase their place in the global market is technological upgrades in present goods.

The global hydrogen combustion engine market is estimated to be valued at USD 22.0 billion in 2025.

The market size for the hydrogen combustion engine market is projected to reach USD 55.9 billion by 2035.

The hydrogen combustion engine market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in hydrogen combustion engine market are proton membrane exchange, phosphoric acid fuel cell and others.

In terms of application, passenger vehicle segment to command 51.2% share in the hydrogen combustion engine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenated Palm Oil Market

Hydrogenerators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA