The Hydrocarbon Accounting Solution Market is experiencing robust growth as oil and gas companies increasingly adopt digital solutions to optimize operations, ensure compliance, and improve accuracy in hydrocarbon measurement and reporting.

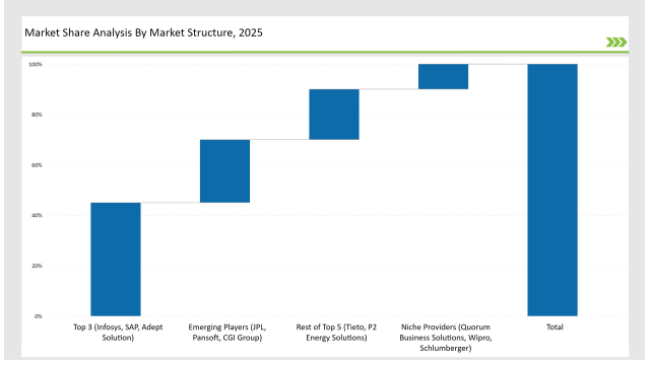

The top three vendors - Infosys, SAP, and Adept Solution - hold a 45% market share, offering comprehensive hydrocarbon accounting solutions with cloud-based integration, AI-driven analytics, and real-time monitoring capabilities.

The rest of the top five, including Tieto and P2 Energy Solutions, control 20% of the market, focusing on modular software solutions tailored for upstream, midstream, and downstream processes. Emerging players such as JPL, Pansoft, and CGI Group account for 25%, excelling in predictive analytics, AI-driven production forecasting, and real-time data visualization.

Niche providers like Quorum Business Solutions, Wipro, and Schlumberger capture 10%, addressing specialized needs in production optimization, regulatory compliance, and operational efficiency.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (Infosys, SAP, Adept Solution) | 45% |

| Rest of Top 5 (Tieto, P2 Energy Solutions) | 20% |

| Emerging Players (JPL, Pansoft, CGI Group) | 25% |

| Niche Providers (Quorum Business Solutions, Wipro, Schlumberger) | 10% |

The hydrocarbon accounting solution market is moderately consolidated, with top vendors controlling 45-65% of the market. Companies like Schlumberger and Halliburton dominate, but mid-sized vendors drive innovation for small and medium-sized enterprises (SMEs) in the oil and gas sector.

AI-Driven Hydrocarbon Accounting

AI-powered hydrocarbon accounting enhances accuracy through predictive analytics and automated reconciliation. AI algorithms analyze large datasets to detect anomalies, optimize resource allocation, and improve forecasting.

Blockchain-Based Transaction Audits

Blockchain ensures secure, immutable hydrocarbon transaction records, offering greater transparency and fraud prevention. This technology is particularly beneficial for regulatory compliance and supply chain tracking.

Cloud-Based Accounting Solutions

Cloud platforms provide real-time access to hydrocarbon data, enabling companies to streamline workflows, reduce errors, and ensure compliance with energy market regulations.

Integration with IoT & Digital Twins

IoT sensors and digital twin technologies allow companies to monitor hydrocarbons in real-time, improving asset management and operational efficiency.

Regulatory Compliance & Risk Management

Vendors integrate regulatory frameworks such as OGMP 2.0, IFRS 6, and Sarbanes-Oxley (SOX) into their platforms to help companies avoid legal risks and enhance governance.

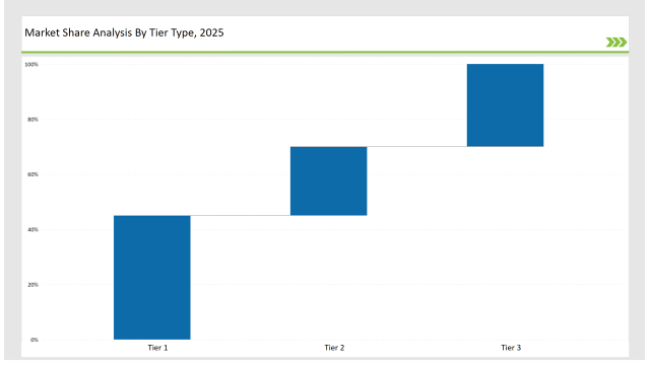

| Tier | Tier 1 |

|---|---|

| Vendors | Schlumberger, Halliburton, Quorum Software |

| Consolidated Market Share (%) | 45% |

| Tier | Tier 2 |

|---|---|

| Vendors | EnergySys, P2 Energy Solutions, AspenTech |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | Aucerna, Ikon Science, Seven Lakes Technologies, PetroSoft, Actenum |

| Consolidated Market Share (%) | 30% |

| Vendor | Key Focus |

|---|---|

| Schlumberger | AI-powered hydrocarbon tracking and production optimization |

| Halliburton | Cloud-integrated hydrocarbon accounting with digital twin capabilities |

| Quorum Software | Real-time asset performance monitoring and compliance tracking |

| EnergySys | No-code modular hydrocarbon reporting solutions |

| P2 Energy Solutions | Predictive analytics for production forecasting |

| AspenTech | AI-driven resource allocation and risk assessment |

| Aucerna | Data visualization and performance analytics |

| Ikon Science | Digital transformation for hydrocarbon exploration companies |

Vendors must refine AI-driven detection capabilities to proactively address hydrocarbon discrepancies and market risks. Machine learning models will improve accuracy in detecting irregularities, optimizing energy allocation, and automating compliance reporting.

Automation of hydrocarbon accounting enforcement actions, such as AI-driven compliance checks and risk analysis, will streamline operations and reduce manual workload.

Cloud-based hydrocarbon accounting platforms will continue to dominate, offering seamless integrations with ERP, CRM, and energy trading platforms for real-time market analysis and compliance management.

Expanding into emerging markets presents significant growth opportunities. Vendors must ensure regional compliance, multilingual interfaces, and jurisdiction-specific accounting tools to enhance global adoption.

Leading vendors Schlumberger, Halliburton, and Quorum Software hold 45% of the market.

Emerging players such as Adept Solutions, CGI, and Wipro account for 25%.

The market is moderately consolidated, with the top 10 players controlling 65-75% of the market.

Cloud-based solutions offer greater scalability, real-time access, cost efficiency, and seamless integration with digital oilfield technologies.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.