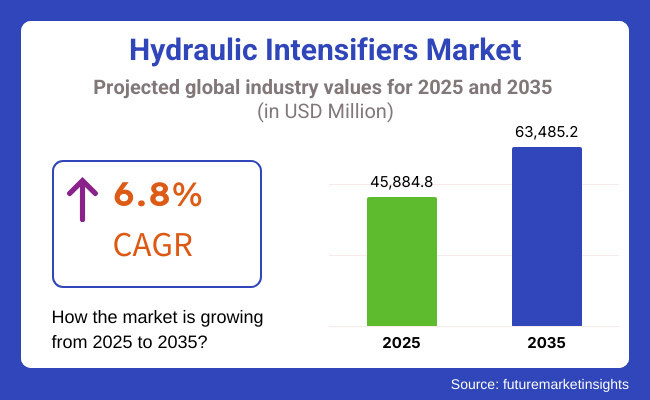

The Hydraulic Intensifiers Market is projected to grow from USD 45,884.8 million in 2025 to USD 63,485.2 million by 2035, reflecting a CAGR of 6.8% over the forecast period. This growth is driven by the increasing demand for high-pressure hydraulic systems across industries such as manufacturing, construction, aerospace, oil & gas, and mining.

The hydraulic intensifiers are devices that are used to double the hydraulic pressure and hence increase the output of machines, industrial equipment, and fluid-based systems. The development of new compact and highly efficient intensifier designs besides the AI-powered and energy-saving hydraulic technologies now being widely used are the main reasons for the growth of the sector.

The market is primarily driven by the increasing demand for high-pressure hydraulic systems in industrial automation, heavy machinery, and efficient fluid systems. In the metalworking industry, hydraulic intensifiers are the most frequently used tools for processes such as forming, hydrostatic testing, clamping, and high force applications, as they operate with only a small amount of energy to produce a higher output of pressure.

Technical enhancements like electronic pressure control, intelligent monitoring units, and the introduction of miniature hydraulic intensifiers are the factors that lead to increased effectiveness and a decrease in the time when machines are down. The market is boosted by the investments being made in oil & gas exploration, renewable energy, and infrastructure where the applications of high-pressure hydraulic solutions are a must for damning functions.

The addition of hydraulic intensifiers in fields like robotics, automation, and military is considered to be a considerable growth factor. The paradigm of industries adopting customized, and energy-efficient hydraulic intensifiers has shifted towards the goal of machine optimization, precision control, and energy conservation

Explore FMI!

Book a free demo

The North American region is witnessing a remarkable growth trajectory as a direct result of the technological progress in hydraulic systems, the expanding scope of automation in industries, and the burgeoning oil & gas exploration projects. The USA and Canada have emerged as the major markets for the super-efficient hydraulic intensifiers used in a variety of sectors including manufacturing, aerospace, and defense.

The market is also emerging as the site of the newfound popularity of intelligent hydraulic systems that feature digital pressure monitoring and AI-driven optimization.On the other hand, the sharp environmental regulations that prohibit hydraulic fluid emissions and the cutting-edge electrical-driven alternatives indirectly challenge the scenario.

The market is expected to be driven by the long-term paradigm shifts with the introduction of compact and energy-efficient intensifiers enabled with remote monitoring.

The European hydraulic intensifier sector is mainly driven by the ongoing industrial automation, sustainability projects, and the rising demand for precision engineering. The powerhouse economies of Germany, France, and the UK are implanting highly efficient hydraulic systems into their automotive, aerospace, and infrastructure projects.

The trend towards energy-efficient and low-maintenance hydraulic systems is a key factor in the increasing need for electronically pressure-controlled intensifiers. Nonetheless, the stringency of emission regulations and the inflation of expenses of cutting-edge hydraulic technology continue to be hurdles. The rendering of bio-degradable hydraulic fluids, compact designs of the intensifier, and the creation of digital solutions is backgrounding sustainability-oriented growth in the region.

The Asia-Pacific region is evolving as the fastest-growing market by virtue of the rapid industrialization, urbanization, and infrastructural development. Majorly, countries such as China, India, and Japan act as the drivers in the usage of hydraulic intensifiers for construction, mining, manufacturing, and automotive sectors.

The metal processing, power generation, and industrial automation sectors are pushing for high-pressure hydraulic systems thus accelerating the market growth. However, difficulties arise due to the fluctuations of raw material costs and disruptions in the supply chain. In the region, the investment trend is geared towards developing cost-effective hydraulic intensifiers, which, in turn, would facilitate the adoption of digital automation and IoT-based monitoring systems for the attainment of higher machine efficiency and operational reliability.

The Middle East & Africa (MEA) hydraulic component market has a positive spiral as a result of escalating investments in oil & gas, construction, and industrial manufacturing. Major players such as Saudi Arabia and the UAE are heavily investing in hydraulic technologies for drilling rigs, refineries, and offshore fields that, in return, are generating the demand for high-pressure intensifiers.

Africa is experiencing a rise in the mining, power generation, and industrial maintenance applications sector. However, the economic instability and the import of hydraulic components primarily affect the initial phase. Adoption of rugged, high-durability hydraulic intensifiers with anti-corrosion material is expected to increase sales in such extreme climates.

The hydraulic intensifier market in Latin America is set to grow significantly with the current rise in industrialization, mining sectors, and automobile manufacturing. Top countries involved as manufacturers are Brazil, Mexico, and Argentina, who advocate for hydraulic automation for manufacturing systems, energy infrastructure, and transportation as well.

The hydrostatic testing equipment's greater demand and heavy-duty hydraulic machinery amplified the market further. However, the economic flux, with high investment in equipment and less development in technology, stands as a prominent obstacle. Making the use of cheap, efficient hydraulic intensifiers with smart pressure control systems will lay the foundation for the expanding market in the form of the new industrial hubs.

Challenges

High Energy Consumption and Environmental Regulations

Hydraulic intensifiers face the issue of being energy and hydraulic fluid hogs thus causing the question of efficiency to arise and compliance with government regulations to be checked. Hydraulic systems are subjected to strict emission regulations by the government, compelling the manufacturers to implement energy-efficient designs with the use of eco-friendly hydraulic fluids.

The persistent quest to diminutive the carbon footprints has brought about low-emission, high-efficiency hydraulic solutions. The companies that don't meet environmental requirements will be fined, restricted from operations, and could make production more expensive. With the emergence of sustainability as a core value, the firms that are backing the green hydraulic technologies, waste management programs, and energy-saving designs will not only meet the environmental regulations but also secure a competitive edge in the market.

Rising Costs of Hydraulic Components and Maintenance

Steel, aluminum, and specialized hydraulic fluids which the hydraulic intensifier is made up of are faced with price fluctuations and supply chain interruptions. The manufacturing sector and market pricing which are affected by the scarcity of raw materials, geopolitical issues, and increased transport costs are also in trouble.

Alongside, the expensive maintenance of seals, valves, and high-pressure devices also affects operational budget. Industries searching for a cost-effective solution have started inspecting the use of different high-pressure systems that do not need hydraulic parts which are costly. Manufacturers should address these financial difficulties and keep growing in the market through better materials use, supply chain diversification, and advanced maintenance plans.

Competition from Alternative High-Pressure Systems

Impressive development of electric and pneumatic technological devices has started to question the earlier dominant hydraulic intensifiers. They also seek energy-efficient and maintenance-free alternatives like electromechanical actuators, air-driven pressure boosters, and hybrid pressure intensifiers.

These types provide lowered operational costs, fluid independence, and greater precision that are not present in the industries that are changing to automation and sustainability that much. By throwing in a fiber pressure solution for their compact, high-performance valve needs the market for hydraulic intensifiers will be transformed by new energy-efficient, reliable performance, and smart automation features.

Opportunities

Advancements in Smart Hydraulic Intensifiers

The Internet of Things and artificial intelligence are changing the game for low-energy hydraulic intensifiers with enhanced pressure monitoring and automated functions. Smart intensifiers allow real-time diagnostics, automated pressure adjustments, and remote monitoring, resulting in operational efficiency and minimal downtime. Industries will be able to enhance their machines' reliability and operational efficiency without any operator interference by introducing sensor-based analytics, self-regulating control units, and the cloud for data aggregation.

The positive impact of these developments is the reduction of maintenance costs, the elimination of system failures, and the demand for increased energy-efficiency. The companies which manufacture the hydraulic units with digitally embedded concepts will find themselves truly automatable, precise, and environmental sustainably dealing with the industry, hence staying in line with the innovation race.

Expansion in Renewable Energy and Infrastructure Projects

The acceptance of hydraulic intensifiers in renewable energy and infrastructure construction is an avenue through which the company realizes tremendous growth. These systems are vital in the service of hydraulic-powered wind turbine, hydroelectric power plant operation, and the construction of smart cities. Countries all over the world take part in building green energy, mass construction projects, and high-pressure hydraulic applications which they use to promote urban sustainability and power.

The demand for high-performance hydraulic intensity inenergy grids, water control systems, and industrial automation is boosted due to the fact that hydraulic technology becomes more effective and reliable. The makers of hydraulic intensifiers that are energy-saving and long-lasting will be the ones to expand because these are the qualities that the projects on water and power sustainability will demand.

Growing Demand for Compact and Lightweight Intensifiers

The development of portable, high-efficiency hydraulic intensifiers in sectors like aerospace, defense, and mobile machinery is becoming pronounced. The industries are looking for hydraulic solutions that can withstand more pressure with less energy and be lightweight and save space as well. The trend for new materials such as titanium, composite alloys, and reinforced polymers has led to the invention of compact, strong, and durable hydraulic intensifiers that promise to improve performance.

Aircraft maintenance, defense vehicles, and other remote industrial equipment gain from hydraulic solutions that can be easily transferred and are precisely controlled. Businessmen who are backing the compact, lightweight, and powerful hydraulic intensifier designs will be the first to enter the emerging industrial and defense markets where they will have a better position.

The hydraulic intensifiers market has experienced steady growth from 2020 to 2024, driven by the rising demand for high-pressure hydraulic systems in industries such as manufacturing, construction, aerospace, and energy. The need for compact, efficient, and high-performance pressure-boosting solutions has led to technological advancements in hydraulic intensifiers.

Additionally, increasing automation and industrial efficiency requirements have contributed to the adoption of precision hydraulic equipment. Looking ahead to 2025 to 2035, the market is expected to see further innovations in energy efficiency, digital integration, and sustainable hydraulic fluid applications.

Comparative Market Analysis:

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Safety and performance regulations driving improvements in hydraulic system design. |

| Technological Advancements | Development of compact, lightweight intensifiers with enhanced pressure capabilities. |

| Industry-Specific Demand | Growth in industrial automation, construction, and aerospace applications. |

| Sustainability & Circular Economy | Initial adoption of energy-efficient hydraulic systems and eco-friendly materials. |

| Production & Supply Chain | Stable demand with regional manufacturing hubs supporting industrial sectors. |

| Market Growth Drivers | Rising need for high-pressure applications, automation in heavy industries, and demand for compact hydraulic systems. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter energy efficiency and environmental regulations promoting sustainable hydraulic fluids and low-energy systems. |

| Technological Advancements | AI-driven pressure control, smart monitoring systems, and integration with Industry 4.0 for predictive maintenance. |

| Industry-Specific Demand | Expansion into renewable energy, electric vehicle manufacturing, and robotics for high-precision applications. |

| Sustainability & Circular Economy | Increased use of biodegradable hydraulic fluids, advanced recycling methods, and carbon-neutral manufacturing processes. |

| Production & Supply Chain | AI-driven supply chain optimization, localized production, and advanced material sustainability initiatives. |

| Market Growth Drivers | Increased adoption of smart hydraulic solutions, integration with IoT, and the shift toward energy-efficient industrial processes. |

The United States Hydraulic Intensifiers Market is experiencing a steady increase as a result of industrial automation, aerospace, and energy sector investments. The increasing demand for high-pressure hydraulic systems in the defense and manufacturing industries is the primary driver.Hydraulic presses in metalworking and construction equipment are the sectors that contribute further to the growth of the market.

Furthermore, the oil & gas sector along with its requirement to have high-pressure hydraulic systems for drilling and extraction processes is one reason for the market to grow. Development of the smart hydraulic technology is also one of the factors that spur the demand for more compact and efficient intensifiers.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.4% |

The United Kingdom Hydraulic Intensifiers Market is booming as a result of the increased amounts of financial capital put into the advanced manufacturing, aerospace, and construction industrial sectors. The surge of innovative processing technology and robotics in industries is what is driving the demand for high-pressure hydraulic solutions. The UK's renewable energy sector, especially offshore wind and hydrogen production, is also creating new opportunities for hydraulic intensifier applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.1% |

The European Union Hydraulic Intensifiers Market is seeing positive development due to the increasing industrial automation, automotive advancements, and the trend of going to energy-efficient hydraulic systems. Countries such as Germany, France, and Italy are leading the way in driving demand with advanced manufacturing, robotics, and renewable energy projects.

EU's sustainability guidelines on energy consumption and carbon footprint are pushing sectors significantly toward energy-saving solutions like the increased application of smart hydraulic systems which enhance productivity while consumingless energy.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.2% |

The huge scaling of industrialization, infrastructure development, and the automotive and energy sectors have made the China Hydraulic Intensifiers Market a hotbed of activity. The manufacturing dominance is the one factor that the country is leading with. Increased pressure for hydraulic systems in metalworking, forming, and automation is the increased operator on-site times driving demand for high-pressure hydraulic applications.

Furthermore, the course of hydraulic applications in mining, oil & gas, and renewable energy is a huge support for the development of hydraulic intensifiers.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 3.6% |

The Japan Hydraulic Intensifiers market is showing a good constant grwoth due to its advanced manufacturing sector, automation and precision engineering. Japan's automotive and robotics automobiles industry is in need of high-speed hydraulic intensifiers in testing, production, and automated systems.

Furthermore, the expansion of aerospace and infrastructure projects is contributing to market demand. The push from Japan's industries for energy-efficient solutions is also a driving force behind the development of hydraulic systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.0% |

The South Korea Hydraulic Intensifiers market is developing due to the country's remarkable growth in automotive, heavy machinery, and industrial sectors. High-pressure hydraulic systems demand is increasing because of the dominant position of South Korea in the shipbuilding and steel industries.

Additionally, government support for smart factories and industrial robotics is driving the adoption of advanced hydraulic intensifiers. The automotive and shipbuilding industries are increasing demand for hydraulic pressure amplifiers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.3% |

The growth of high-pressure applications has brought gas hydraulic intensifiers to the forefront and the gas-based hydraulic intensifiers segment leads the market because of the fact that they are extensively used in gas compressor, pressure testing, and high-pressure gas delivery systems. Gas hydraulic intensifiers are also important in petrochemical processing, industrial gas supply, and power plant operations applications which require precise pressure control.

Wellhead control systems, natural gas distribution, and pipeline maintenance are the cases where the oil & gas sector especially persists with the aid of gas intensifiers.The increase in the utilization of hydrogen as a conventional energy source will allow further development of gas hydraulic intensifiers not only in hydrogen fuel cells but also in their storage systems beside.

Sections of the Liquid-Based Hydraulic Intensifiers Have Their Prominence Gained by the Growth of Industrial Automation

The liquid-based hydraulic intensifiers segment is welcoming in the expansion of this technology in the manufacturing, automotive, and construction sectors where a high-pressure liquid is needed for processes like metal forming, injection molding, and hydrostatic testing.

Along with this, these intensifiers contribute in improving hydraulic power efficacy in industrial machinery, cutting down operational costs, and optimizing fluid flow control. With automated and precision-based mass fabrication becoming the tendency in industries, the liquid intensifiers are placing themselves as hydraulic presses, CNC machining, and metal stamping operations' important elements.

Construction Industry Leads the Market of Hydraulic Systems via Demand for High Pressure

The construction sector becomes the most important driving force of the hydraulic intensifiers market since these devices are widely used in pile driving, bottom concrete, tunneling, and heavy machinery applications. Other than that, hydraulic intensifiers improve the operation of hydraulic hammers, excavators, and lifting instruments by making it possible to apply a greater force with less energy consumption.

With the ongoing development of smart construction technologies and widespread use of automated machines, demand for compact and high-efficiency hydraulic intensifiers is spiking, particularly in large-scale infrastructural and city projects.

Petrochemical Industry Follows the Family with High-Pressure Fluid and Gas Control

The petrochemical industry has an extensive dependence on hydraulic intensifiers for fluid pump, gas injection, and control functions under high pressure. High-pressure hydraulic intensifiers are the key players guaranteeing and regulating the pressure levels during oil refining, chemical processing, and pipeline transportation.

More than ever, the global demand for natural gas and chemicals has led to the implementation of advanced hydraulic intensifiers, with better survival and corrosion resistance, in oil refineries, offshore platforms, and chemical plants to ensure the safety of workers and improve the overall efficiency of the processes.

The Power & Energy Sector is the latest with growing demand due to the expansion of renewable energy

Hydraulic intensifiers are the latest innovation being adopted in the power & energy sector such as hydro plants, turbine control systems, and high-pressure hydraulic power generation. In the case of the nuclear and fossil plants, they also put these intensifiers to use in valve actuation, steam control, and pressure testing of critical components.

The trend is shifting towards renewable energy sources such as wind and hydrogen. In this way, hydraulic intensifiers are being also used for applications in hydraulic energy storage systems, hydrogen fuel compression, and wind turbine braking mechanisms.

The Hydraulic Intensifiers Market is undulating with continuous demand for high-pressure hydraulic systems from manufacturing, aerospace, oil & gas, construction, and mining sectors leading to the sales boom. These intensifiers, also referred to as pressure boosters, allow fluid pressure to exceed pump capacity, thereby promoting efficiency, accuracy, and power in demanding conditions.

Innovations with stuffing box pressure changer, which is a compact energy-efficient design, and pressure loss systems conversion are responsible for market evolution. Advanced features like real-time diagnostics, high-performance materials, and durability are driving the metabolism of the sector by the adoption in metal forming, hydraulic testing, and industrial automation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Parker Hannifin Corporation | 15-18% |

| Bosch Rexroth AG | 12-15% |

| Enerpac Tool Group | 10-12% |

| Haskel (Ingersoll Rand) | 7-10% |

| Maximator GmbH | 5-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Parker Hannifin Corporation | Market leader in high-pressure hydraulic intensifiers, focusing on energy efficiency and durability. |

| Bosch Rexroth AG | Develops compact and modular hydraulic intensifiers for industrial automation and heavy machinery. |

| Enerpac Tool Group | Specializes in portable and high-force hydraulic intensifiers for construction, mining, and oil & gas applications. |

| Haskel (Ingersoll Rand) | Offers advanced hydraulic pressure boosters with precision control for aerospace and defense sectors. |

| Maximator GmbH | Provides high-pressure hydraulic intensifiers designed for testing, automotive, and material forming applications. |

Key Company Insights

Parker Hannifin Corporation

Parker Hannifin is an American company that is a global hydraulic solutions provider and also offers the mainly high-pressure intensifiers used in industrial automation, aerospace, and heavy machinery applications. It pursues the concept of energy-efficient design and uses the latest sealing technology and super strength materials in order to improve the control of the pressure and increasing the life of the products.

Parker Hannifin is putting the latest pressure monitoring systems of the Internet of Things into operation, providing customers with the possibility for real-time diagnostics and the delivery of hydraulic optimization in key applications.

Bosch Rexroth AG

Bosch Rexroth is an engineering company that is responsible for the development of compact, high-performance hydraulic intensifiers as the core product for industrial automation, metal forming, and construction equipment.

The company is focused on the modular hydraulic booster system of Bosch Rexroth, making it possible for the clients to develop their own pressure solutions that would be suitable for different branches of the economy. Bosch Rexroth is also taking steps to incorporate breakthroughs in digitally controlled hydraulic systems, which will lead to higher productivity, safety, and accuracy when applying pressure.

Enerpac Tool Group

Enerpac is a global company that deals with portable and heavy-duty hydraulic intensifiers and they are prominently used in oil & gas, construction, and mining sectors.

The company's high-force pressure boosters ensure hydraulic control that is accurate, long-lasting, and trustworthy even in hostile spaces. Enerpac is in the process of creating portable, lightweight, and user-friendly hydraulic intensifiers that will be used on-site more effectively and productively.

Haskel (Ingersoll Rand)

Haskel, which is a subsidiary of Ingersoll Rand, is the manufacturer of the precision hydraulic intensifiers which are the ones to primarily provide the high-pressure boosting solution for the aerospace, defense, and automotive testing applications.

The hydraulic pressure amplifiers of this company not only make the pressure output consistent but also allow for decreasing energy consumption and increasing safety. Haskel is investing in smart hydraulic monitoring systems, which control pressure adjustment and complicated handling automatically.

Maximator GmbH

Maximator GmbH is a company that produces high-pressure hydraulic intensifiers, mainly for fluid testing, automotive, and industrial forming applications. The company is directed to tailor‐made hydraulic pressure solutions, which are secure and also have a digital pressure control system. Maximator strengthens its already great offer with hydraulic test rigs and automated pressure boosting systems, all of which enhance trustworthiness and efficiency in major industrial processes.

The global Hydraulic Intensifiers market is projected to reach USD 45,884.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 3.3% over the forecast period.

By 2035, the Hydraulic Intensifiers market is expected to reach USD 63,485.2 million.

The industrial machinery segment is expected to dominate due to the increasing demand for high-pressure hydraulic systems in heavy-duty applications such as metal forming, material handling, and construction equipment.

Key players in the Hydraulic Intensifiers market include Enerpac Tool Group, Bosch Rexroth AG, Parker Hannifin Corporation, HYDAC, Haskel, and Atos S.p.A..

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Turbidimeter Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.