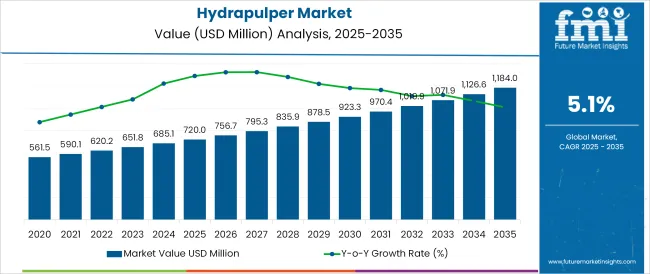

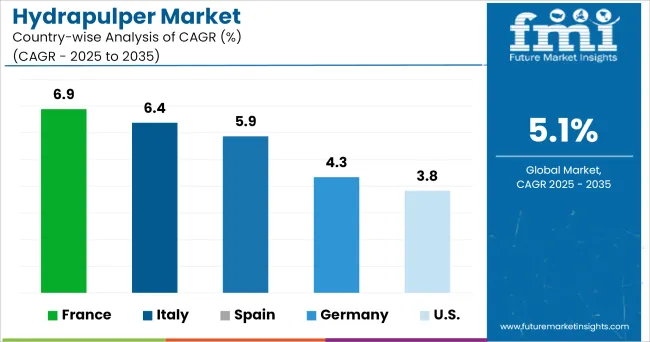

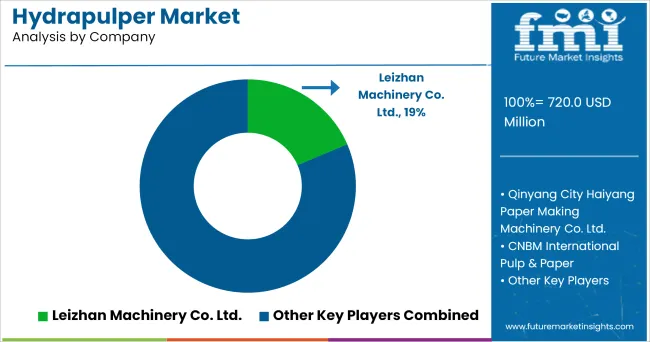

The Hydrapulper Market is estimated to be valued at USD 720.0 million in 2025 and is projected to reach USD 1,184.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The hydrapulper market is experiencing steady expansion, driven by rising demand for efficient fiber recovery systems and enhanced processing capabilities in the global pulp and paper industry. Emphasis on sustainability, waste reduction, and circular economy practices has led to increased reliance on hydrapulpers for recycling and repulping recovered paper, board, and virgin pulp.

Manufacturers are focusing on innovations in rotor design, energy efficiency, and contamination resistance to improve processing speeds and reduce operational downtime. The transition toward high-consistency pulping systems and automation-integrated setups is enabling mills to enhance productivity and reduce manual intervention. Moreover, regulatory frameworks promoting eco-friendly industrial practices are accelerating the adoption of equipment that supports closed-loop water systems and minimal fiber loss.

As global paper consumption stabilizes and recycled paper usage grows, the market outlook remains positive, with growth opportunities centered around smart machinery integration, reduced energy consumption, and capacity scaling across both greenfield and brownfield pulp mill projects.

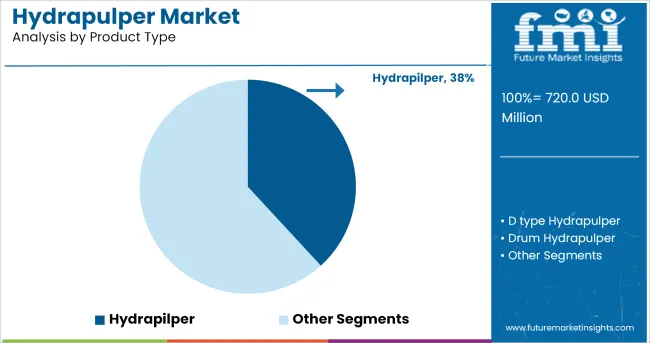

It is observed that the hydrapulper sub-segment within the product type category holds a 38.20% share of the total market in 2025, establishing itself as the leading variant. This dominance is attributed to the equipment’s robust performance in breaking down recycled and virgin paper material into slurry form, offering high efficiency and versatility across diverse pulping processes.

Hydrapulpers are being preferred for their adaptability to both batch and continuous operations, reduced fiber loss, and compatibility with high-consistency pulping. Further advancements in design-such as optimized rotor configurations and energy-efficient drives-have contributed to lower power consumption and improved throughput.

These operational benefits, combined with reduced maintenance requirements and scalable designs, have enhanced their adoption across new and modernized mills. The hydrapulper’s role as the core equipment in repulping and fiber recovery has reinforced its leading position in the product segment.

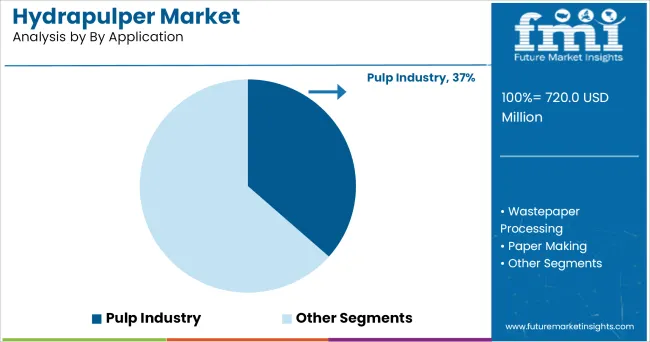

It has been noted that the pulp industry sub-segment accounts for 36.50% of market revenue in 2025 within the application category, positioning it as the dominant sector. This leadership is driven by increased deployment of hydrapulpers in primary fiber processing, wastepaper repulping, and secondary fiber recovery within both integrated and non-integrated pulp mills.

Pulp manufacturers are adopting advanced hydrapulpers to support high-capacity, continuous production lines, ensuring uniform fiber consistency and minimizing contaminants in the furnish. The equipment’s compatibility with different grades of raw material-including OCC, mixed wastepaper, and virgin pulp-has added to its utility in diverse production settings.

Moreover, the integration of energy-saving and automation technologies is allowing pulp producers to meet operational efficiency goals and sustainability targets. As global demand for packaging and hygiene paper rises, investments in efficient pulping solutions by the pulp industry continue to elevate the share of this application segment.

The use of paper for a variety of purposes in all aspects of life has increased over time, from communications such as (writings, stamps, newspapers, and greeting cards) to business (advertisements, money, and cheques) to food and beverage packaging (paper crockery and cutlery, coffee filters, liquid carton board, and folding box-board) etc.

Aside from that, the popularity of creating various grades of paper from virgin pulp, as well as the use of sawn timber for furniture and building, has fueled demand for additional paper for the aforementioned industries.

Consumer demand for pre-packaged food continues to rise in sophisticated nations, and a growing worldwide population is also fueling the demand for hydro pulper machines. This is becoming more typical in newly industrialized countries with rapidly growing urban population.

Packaging technology can be critical to a company's strategic success, since it can be a key to gaining a competitive advantage in the food sector. This can be accomplished by catering to the end user's needs and wants, opening up new distribution channels, improving presentation quality, lowering costs, increasing profits, enhancing product/brand distinction, and improving logistics.

Furthermore, the advantages of the hydro pulper machine are the ability to quickly crush waste paper, a big capacity, low power consumption, and the ability to save vapor medication.

It is also simple to maintain, has a long service life, produces less noise, has minimal vibration, is stable in operation, and may conserve energy. Apart from that the manufactures are working to provide more advanced hydro pulper machines in order to boost the sales and expand their business globally.

For example, CNBM International Pulp & Paper has produced high-quality paper pulper machines that are shipped to many nations across the world, including Russia, Ukraine, India, Brazil, and others, based on superior technology support and manufacturing capacity.

Global trends are leading to a new era for the paper pulp sector, with new challenges and potential for developing value-creating growth roles for forest products. The industry's traditional linear value chains, for example, are giving way to more collaborative arrangements with both inside and outside players.

Furthermore, the prospects such as new producer-distributor partnerships; pulp players collaborating more innovatively with non-integrated players; paper and packaging companies cooperating more intensively with retailers, consumer goods companies, and technological professionals; and new products such as bio-refinery products requiring novel go-to-market partnerships.

As a result of the covid-19 epidemic, the world is experiencing enormous health, economic, and environmental crises. The governments of the United States and Canada have taken a number of steps to disrupt the coronavirus's transmission chain and prevent it from spreading, including imposing curfews and lockdowns, as well as restricting international trade.

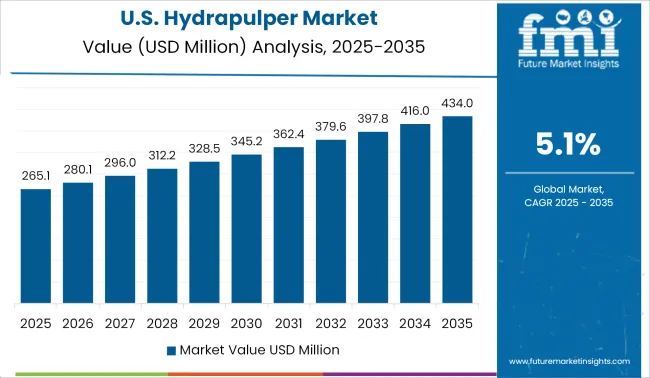

In today's world, paper is the most environmentally friendly and recyclable packaging material. Due to growing environmental concerns, both manufacturers and consumers are changing their focus to more environmentally friendly paper packaging products, which is likely to drive up demand for hydro pulper machines in the region.

In addition, rising demand for paper products such as tissue papers, paper towels, and other such items is predicted to stimulate demand in USA & Canada.

The COVID-19 problem had a significant impact on many EU countries, resulting in a drop in economic activity. Severe lockdowns and halts in the production process, as well as the closure of industries, resulted in a significant slowdown in hydro pulper sales in the region.

The market for hydro pulper machines is expanding in Europe, because to new technology that allows manufacturers to produce more. As a result, the supply of raw materials is abundant, and the need for food packaging products is growing in the region. Furthermore, the rising industrialization of European countries is helping the region's trade growth.

Some of the leading manufacturers and suppliers of hydro pulper include

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global hydrapulper market is estimated to be valued at USD 720.0 million in 2025.

The market size for the hydrapulper market is projected to reach USD 1,184.0 million by 2035.

The hydrapulper market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in hydrapulper market are hydrapilper, d type hydrapulper, drum hydrapulper and others (low-consistency pulper).

In terms of by application, pulp industry segment to command 36.5% share in the hydrapulper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA