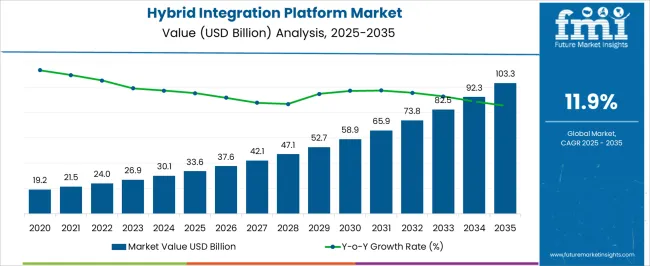

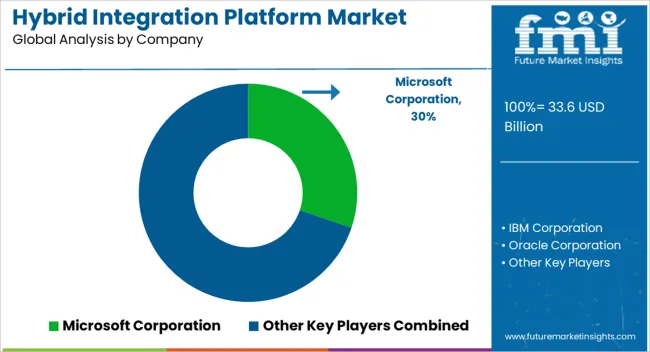

The Hybrid Integration Platform Market is estimated to be valued at USD 33.6 billion in 2025 and is projected to reach USD 103.3 billion by 2035, registering a compound annual growth rate (CAGR) of 11.9% over the forecast period.

| Metric | Value |

|---|---|

| Hybrid Integration Platform Market Estimated Value in (2025 E) | USD 33.6 billion |

| Hybrid Integration Platform Market Forecast Value in (2035 F) | USD 103.3 billion |

| Forecast CAGR (2025 to 2035) | 11.9% |

The Hybrid Integration Platform market is being expanded steadily due to the growing need for seamless connectivity between cloud and on-premise systems across enterprises. The current market environment reflects increasing investments in digital transformation initiatives, as organizations seek to integrate diverse applications and data sources without disrupting existing workflows.

The demand for agility, scalability, and real-time data access has further strengthened the market, while the adoption of multi-cloud strategies has driven the need for robust integration frameworks. The growing reliance on automation, AI-driven analytics, and API-based architectures has also contributed to the acceleration of adoption.

The future outlook for this market is favorable, with organizations aiming to enhance operational efficiency and reduce costs by implementing hybrid integration solutions that support legacy systems and emerging technologies As businesses continue to prioritize business continuity and accelerated innovation, the hybrid approach to integration is expected to remain at the forefront of enterprise IT strategies.

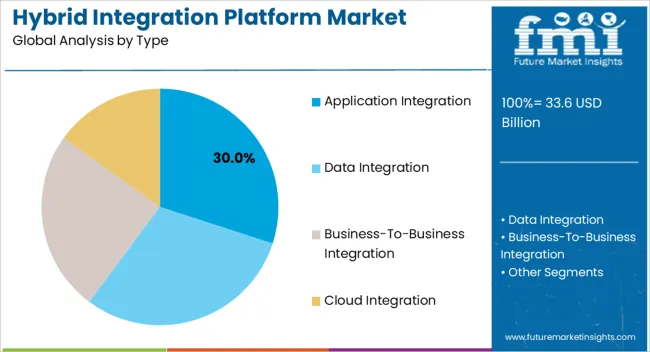

The application integration segment is expected to hold 30.00% of the Hybrid Integration Platform market revenue in 2025, marking it as the largest segment by type. This leading position has been attributed to the growing requirement for connecting heterogeneous systems within enterprises, ensuring data consistency and process automation. Organizations are increasingly focusing on improving interoperability between various applications, which has been achieved by deploying integration platforms that offer API management, event-driven architecture, and data orchestration.

The segment’s growth is being further supported by the need for faster deployment cycles and minimizing operational silos, especially in enterprises undergoing digital transformation. As organizations seek to reduce complexity while improving scalability and reliability, application integration platforms are being prioritized.

The flexibility to connect legacy systems with new cloud-native applications through a single integration layer is also boosting adoption The ability to integrate without extensive redevelopment has made this segment highly favorable among enterprises of various sizes and industries.

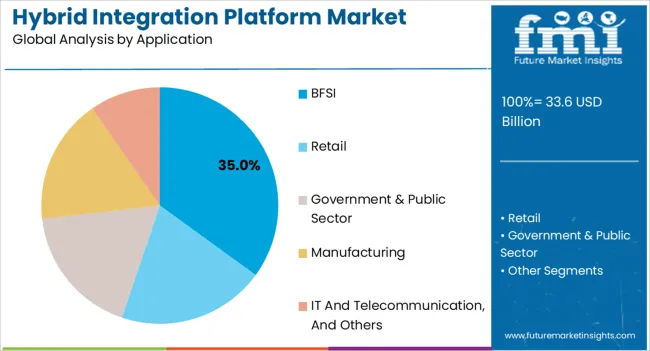

The BFSI segment is projected to account for 35.00% of the Hybrid Integration Platform market revenue in 2025, making it the dominant application area. This position has been driven by the sector’s increasing focus on digital modernization, regulatory compliance, and customer experience enhancement. Financial institutions are leveraging hybrid integration platforms to connect internal systems with external services such as payment gateways, customer data platforms, and fraud detection tools.

The need to process large volumes of real-time transactions securely and efficiently has further propelled the adoption of integration platforms. Additionally, banks and insurance companies are seeking to reduce operational costs and improve agility by integrating their core systems with cloud services without compromising data security.

The segment’s expansion is also being supported by the requirement to quickly adapt to changing customer expectations and evolving market trends As the BFSI sector continues to invest in digital infrastructure and automation, hybrid integration platforms are expected to play a pivotal role in enabling seamless, scalable, and secure connectivity across their business networks.

The growing need for integrating on-premise and cloud applications with existing systems in order to drive digital business transformation is the primary growth driver of a hybrid integration platform. Moreover, the advancement in cloud computing technology is playing an important role in driving the growth of the hybrid integration platform sector. Also, the digital era has greatly accelerated the change and evolution of new products, services, and business models.

A hybrid integration platform connects the network that is divided between enterprise and customers & suppliers, BYOD (enterprise mobile), and big data in order to allow the on-premises application to integrate with cloud-based applications ultimately due to this, the adoption of a hybrid integration platform is increasing. Also, the increasing demand for hosting apps, data, and services on the cloud is also one of the key factors due to which the demand for hybrid integration platforms is increasing.

Apart from this, the increase in the number of hybrid integration platform providers and the paradigm shift in the way of developing applications are some of the factors which are fuelling the growth of the hybrid integration platform industry.

| Attributes | Details |

|---|---|

| Hybrid Integration Platform Market CAGR (2025 to 2035) | 12.5% |

| Hybrid Integration Platform Market Size (2025) | USD 26,576.4 million |

| Hybrid Integration Platform Market Size (2035) | USD 86,557.1 million |

The lack of standardization and uniform integration type for hybrid integration platforms are some of the factors which hinder the growth of the hybrid integration platform business in near future. Also, high cost and security issues are the factors that are likely to restrain the growth of the market.

| Country | Market Share (2025) |

|---|---|

| United States | 16.6% |

| Germany | 8.1% |

| Japan | 3.2% |

| Australia | 2.1% |

North America is anticipated to capture the leading market share regarding revenue, owing to the increasing need to integrate data and processes between the public cloud and on-premise applications and the presence of various key players in the region. In addition, nearly all end-user sectors are using cloud services for storing datasets and managing security threats.

Owing to the reasons mentioned above, North America held a market share of 29.1% for the hybrid integration platform in 2025.

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 14.3% |

Asia Pacific is anticipated to be the second leading market in terms of revenue in the hybrid integration platform Industry over the next coming years due to high digitalization and the increasing spending of enterprises to improve infrastructure. Moreover, the increasing penetration of end-user sectors is easing the complex process of storing information in the Asia Pacific.

Due to the aforementioned above, Asia Pacific procured a 30% market share in 2025.

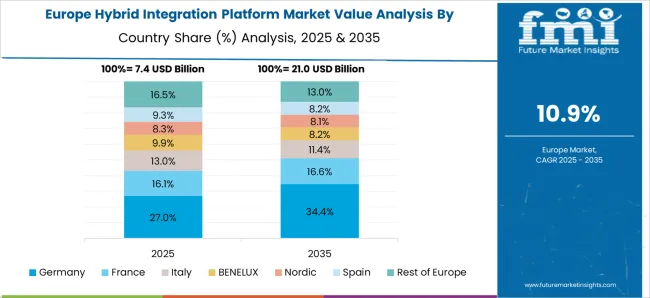

The hybrid integration platform sector in Europe is expected to witness high growth rates in the coming period due to the emergence of advanced and secured cloud-based solutions. Moreover, the strong presence of the healthcare and automotive industry is increasing the demand for hybrid integration platforms in the region. Europe possessed a 18.3% market share for the market in 2025.

Key start-up players in the hybrid integration platform sector are Virtustream, Hewlett Packard Enterprise, Gigas, Stratoscale, and Quali

Many big corporations are contending for market dominance in the fiercely competitive market for hybrid integration platforms. In order to provide seamless integration between on-premises and cloud-based apps, systems, and data, these businesses provide a variety of solutions and services.

The global hybrid integration platform market is estimated to be valued at USD 33.6 billion in 2025.

The market size for the hybrid integration platform market is projected to reach USD 103.3 billion by 2035.

The hybrid integration platform market is expected to grow at a 11.9% CAGR between 2025 and 2035.

The key product types in hybrid integration platform market are application integration, data integration, business-to-business integration and cloud integration.

In terms of application, bfsi segment to command 35.0% share in the hybrid integration platform market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Sleeve Cartridges Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Reactive Power and Harmonic Compensation Device Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA