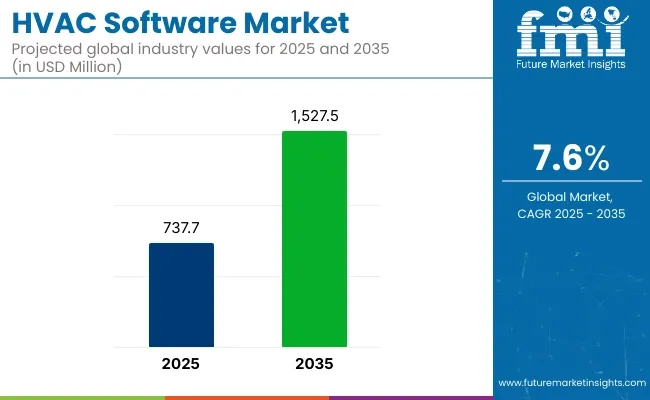

The global sales of HVAC software are estimated to be worth USD 737.7 million in 2025 and are anticipated to reach a value of USD 1,527.5 million by 2035, reflecting a CAGR of 7.6%. The revenue generated by HVAC software in 2024 was USD 685.9 million. The market is expected to exhibit a year-on-year growth of 6.3% in 2025.

This growth is primarily driven by the increasing adoption of smart building technologies, energy efficiency mandates, and the ongoing digital transformation in facility management. HVAC software plays a crucial role in the efficient management, operation, and optimization of heating, ventilation, and air conditioning systems across residential, commercial, and industrial sectors.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 737.7 million |

| Market Size in 2035 | USD 1,527.5 million |

| CAGR (2025 to 2035) | 7.6% |

HVAC software combines the capabilities of IoT, AI, and cloud technologies to enhance operational efficiency, reduce energy consumption, and promote sustainability. These software solutions provide feature-specific functionalities such as system monitoring, energy management, predictive maintenance, scheduling, and remote diagnostics.

By enabling smarter, connected building solutions, HVAC software is meeting the growing demand for energy-efficient, cost-effective, and sustainable building management systems. The integration of advanced technologies has significantly enhanced the capabilities of HVAC software, allowing real-time monitoring, improved maintenance, and optimized energy usage.

The global HVAC software market is set to grow rapidly, spurred by the expansion of the construction industry, particularly in emerging economies, and the increasing focus on sustainability. The rise of hybrid work models has further driven the demand for remote management solutions, making HVAC software a critical component for facility management teams globally.

As Peter Capuciati, CEO of Bluon, highlighted in the ServiceTitan Podcast in October 2024, “We provide the technical data for that piece of equipment and the support of how to fix it, diagnose it, troubleshoot it, in a way that the industry has largely ignored over the last 20 years.” Bluon’s innovative approach in supporting HVAC technicians by offering comprehensive technical resources aims to improve service quality and operational efficiency, further accelerating the demand for HVAC software solutions in the industry.

The below table presents the expected CAGR for the global HVAC software market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 14.1%, followed by a slightly higher growth rate of 14.3% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.5% |

| H2 (2024 to 2034) | 6.9% |

| H1 (2025 to 2035) | 7.6% |

| H2 (2025 to 2035) | 7.8% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 7.6% in the first half and remain relatively moderate at 7.9% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS while in the second half (H2), the market witnessed an increase of 50 BPS.

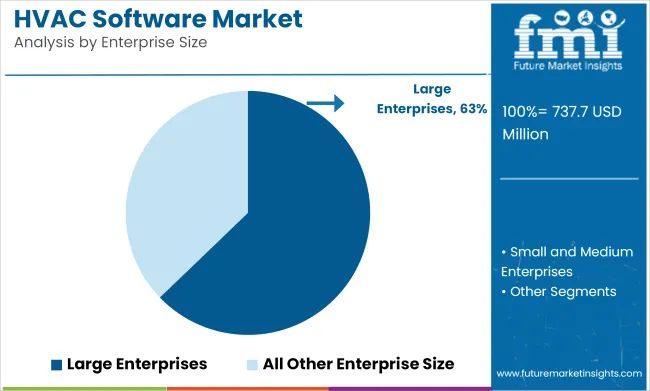

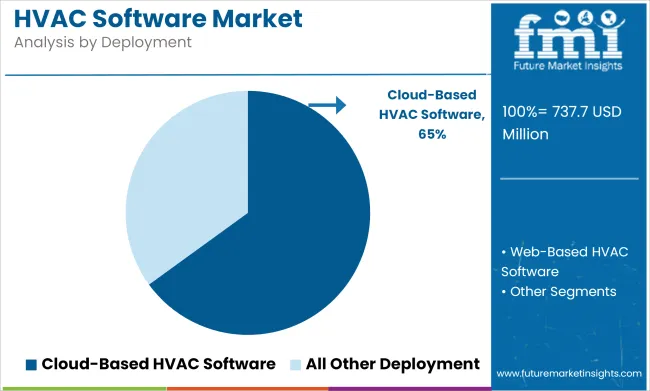

The HVAC software market is expected to see significant growth, driven by key segments such as large enterprises and cloud-based deployment types. Large enterprises are projected to dominate the enterprise size segment, while cloud-based solutions are expected to continue leading the deployment type category. These segments are expected to be pivotal in the market’s expansion, as businesses increasingly rely on advanced software solutions to optimize HVAC systems.

Large enterprises are expected to capture 62.8% of the HVAC software market share by 2025. These organizations typically require sophisticated, scalable HVAC software solutions to manage and optimize heating, ventilation, and air conditioning systems across multiple facilities or regions.

Large enterprises often have complex HVAC needs due to the size of their operations, including managing energy efficiency, predictive maintenance, and compliance with industry regulations. Companies like Honeywell, Johnson Controls, and Trane Technologies are key players offering comprehensive HVAC software solutions tailored to the needs of large businesses.

These solutions help enterprises achieve energy savings, improve system performance, and streamline operations. As large enterprises continue to prioritize energy efficiency and operational optimization, the demand for HVAC software is expected to grow, ensuring that large enterprises remain the dominant segment in the market. The increasing focus on sustainability and smart building technologies further supports the rising adoption of HVAC software in large-scale operations.

Cloud-based deployment is projected to capture 65% of the HVAC software market share by 2025. Cloud-based HVAC software solutions are gaining traction due to their flexibility, scalability, and ease of integration with other systems. These solutions enable businesses to remotely monitor and control HVAC systems, collect and analyze data in real time, and perform predictive maintenance without the need for on-premises infrastructure.

Leading companies like ServiceTitan, GridPoint, and EcoReal are at the forefront of providing cloud-based HVAC software, offering platforms that support system automation, energy management, and data-driven decision-making. Cloud-based solutions are particularly appealing to businesses seeking cost-effective and scalable HVAC management tools that can be accessed from anywhere, anytime.

As the demand for smart building technologies, energy efficiency, and real-time data analytics continues to grow, the adoption of cloud-based HVAC software is expected to increase significantly. With its ability to support remote access and centralized control, the cloud-based deployment model is anticipated to remain the dominant choice in the HVAC software market.

Growing Demand for Smart Building Technologies and Energy Efficiency Optimization

The growth in smart building technologies is highly driving the HVAC software market, since organizations focus on real-time control, automation, and energy efficiency of the building operation. Thus, this will develop predictive maintenance and intelligent scheduling systems and optimal HVAC system performance using HVAC software solutions, integrated with IoT.

In doing so, companies will achieve savings on energy consumption, contributing to sustainability initiatives promoted by international focus, hence achieving the demand from governments and regulatory bodies toward smart HVAC systems due to a stringent implementation of energy efficiency standards.

Integration of IoT and AI for Enhanced System Monitoring and Predictive Maintenance

It integrates the IoT and artificial intelligence into HVAC software, thereby changing how systems are monitored and maintained. IoT-enabled devices provide continuous data on system performance, while AI-powered analytics deliver actionable insights for predicting failures, optimizing energy usage, and minimizing downtime.

This allows the reliability and efficiency of HVAC operations to increase significantly, and, therefore, their operational costs among end-users can be reduced dramatically. Such immense growth in the adoption of these benefits, further complemented by increased adoption of connected devices, has led to the trend of sophisticated HVAC software solutions across residential, commercial, and industrial sectors.

Rising Adoption of Cloud-Based Solutions for Scalability and Remote Management

Cloud-based HVAC software is changing the dimensions of the industry by offering scalable, flexible, and accessible solutions that respond to varied needs of end-users. Cloud platforms provide easy integration with existing systems, remote monitoring, and easy updates.

This makes them attractive to businesses embracing hybrid work models or managing several sites. It is essential for businesses to have access and control over HVAC systems from anywhere for operational efficiency and adaptation to changes in business dynamics. This trend is gaining more momentum in high digital adoption regions, further propelling the growth of the market.

High Initial Implementation Costs and Resistance to Technology Adoption

Despite the myriad advantages, there are high deployment costs for HVAC software-based systems, discouraging market entry, especially to SMEs. The cost involved in acquiring a software system as well as training staff to learn how to interact with it prevents potential adopters; this is exacerbated in cost-conscious markets.

Again, the hesitation on the part of traditional operators, as well as poor technical knowhow in deployment of these complex systems, makes their adoption less widespread. This restraint is more dominant in areas where the infrastructure is thin and hence an impediment to market penetration and growth.

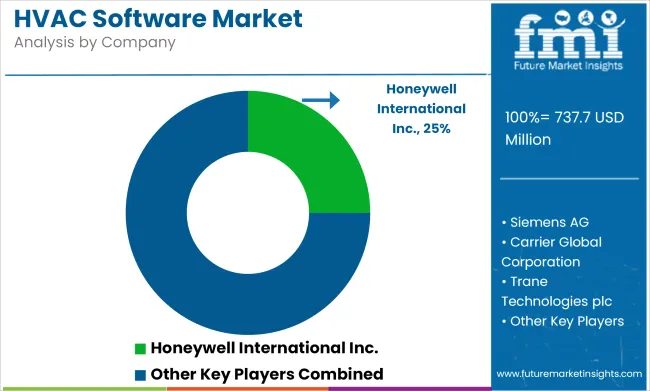

Tier 1: Some of the giants fall into this tier, such as Honeywell International Inc., Johnson Controls International plc, Siemens AG, Carrier Global Corporation, Trane Technologies plc, and Daikin Industries Ltd. These companies are major global leaders and possess a very powerful portfolio with HVAC hardware as well as IoT-enabled devices and integrated software solutions. The company has broad markets, strong brands, and wide-ranging experience in the management of HVAC systems.

Their software products are often bundled with leading-edge technologies like AI and predictive analytics, which they sell to major commercial and industrial customers. Leaders in the market, who maintain their leadership positions through consistent innovation, strategic partnerships, and considerable R&D, are these players.

Tier 2 companies, such as Lennox International Inc., Mitsubishi Electric Corporation, Schneider Electric SE, and Emerson Electric Co., are established players that maintain a balanced focus on HVAC hardware and software. They do not compete with Tier 1 players at the global level but command significant market share in specific regions or industries.

Their HVAC software solutions focus on operational efficiency, energy management, and ease of use, making them extremely attractive to mid-sized enterprises and regional commercial sectors. They expand using their existing client base and through expansion into tailored solutions and regional partnerships.

Tier 3 companies include FieldEdge (dESCO LLC), ServiceTitan, Inc., Jobber Software Inc., Housecall Pro, and SimPRO Software Group Pty Ltd, which offer HVAC software solutions targeting SMEs and service providers. These companies provide user-friendly, cloud-based platforms with features such as scheduling, billing, customer relationship management, and job tracking.

Their solutions are designed to enhance efficiency and profitability for HVAC contractors and service providers. These players always specialize in a particular niche and, mostly, focus on scalability, affordability, and intuitive interfaces.

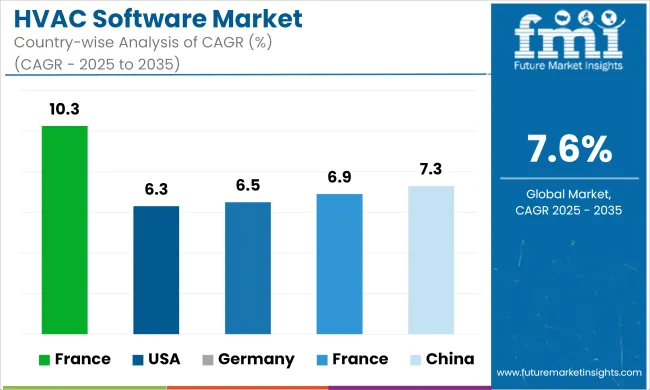

The section below covers the industry analysis for the HVAC software market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, Italy, China and India are provided.

The USA region expected to remains at the forefront in North America, with a value share of 58.6% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 8.6% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

| Germany | 6.5% |

| France | 6.9% |

| China | 7.3% |

| India | 8.6% |

The HVAC software market in the United States is highly influenced by high levels of digital penetration and government-mandated energy efficiency standards. The adoption of smart building technologies in the country supports the growth of the HVAC software market.

Large commercial and industrial infrastructures require more advanced solutions in monitoring and optimizing energy use. Programs such as ENERGY STAR and local building codes emphasize efficient HVAC systems, which creates a big market for software tools that will ensure compliance.

The hybrid work model post-pandemic also increased the demand for remote HVAC management solutions. The USA continues to lead in the implementation of innovative HVAC software solutions across sectors, with the presence of leading technology providers and an early adopter mindset.

India is the fastest-growing market for HVAC, considering the growth of the country in sustainable energy solutions for transport infrastructure, renewable energy infrastructure, and the development of smart cities. HVAC is also being widely used in electric buses, railways, and hybrid vehicles to efficiently provide power for such electric vehicles, helping to boost the performance of electric vehicles while reducing peak power consumption, especially due to the Government's vision for the transportation sector.

In addition, solar and wind power are gaining huge importance, thus providing an impetus for efficient energy storage systems in the country that will stabilize power generation from intermittent sources. HVAC are being deployed in large-scale renewable energy projects to stabilize the grid and smooth out energy.

Apart from this, the Indian government is aggressively pursuing various smart city initiatives. Such initiatives need advanced energy management systems that are going to trigger efficient development of urban infrastructure. The thrust by the country in reducing the carbon footprint and improvement of energy efficiency in a lot of different industries is driving India as an enormous growth market for HVAC.

This China HVAC software market is growing at a rapid pace due to the thriving industrial base of the nation, swift urbanization, and stringent governmental regulations on energy efficiency. Big infrastructure projects together with increasing uptake of smart city technology have been prompting the demand for advanced HVAC systems in which software forms the critical input for energy management and system optimization.

The government's efforts to reduce carbon emissions and achieve sustainability targets have further motivated the adoption of energy-efficient HVAC solutions. With the world's largest construction industry and an increasing number of green building certifications, China represents a critical market for HVAC software, particularly in commercial and industrial sectors where automation and efficiency are priorities.

Characteristic of the competitive landscape of HVAC software is large players and developing innovators; it is pushed by technology integrations and innovative solutions. Big market leaders would include Honeywell International Inc, Johnson Controls, Siemens AG, and Carrier Global, with expertise and global coverage dominating the whole market with an entire system for HVAC hardware-software ecosystems.

Leaders such as ServiceTitan, FieldEdge, and Housecall Pro remain leaders in niche, which will cater to user-friendly cloud-based platforms for small to medium-sized enterprises and service providers.

In today's highly competitive landscape, organizations have invested heavily in R&D, strategic partnerships, and regional expansion to achieve competitive advantage. Highly unique adoption of advanced AI, IoT, and Predictive Analytics is seen and differentiates the providers' offerings in terms of cutting-edge solution offerings based on highly increasing demand for energy efficiency, sustainability, and operational optimization.

Recent Industry Developments in HVAC Software Market

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 737.7 million |

| Market Size in 2035 | USD 1,527.5 million |

| CAGR (2025 to 2035) | 7.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Deployment Types Analyzed | Cloud-Based HVAC Software, Web-based HVAC Software |

| Enterprise Sizes Analyzed | Small and Medium Enterprises, Large Enterprises |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East and Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, GCC Countries, South Africa |

| Additional Attributes | Dollar sales by deployment type (cloud-based vs web-based), Dollar sales by enterprise size (SMEs vs large enterprises), Regional trends in HVAC software adoption across North America, Europe, and Asia-Pacific |

In terms of Deployment is segregated Cloud-Based HVAC Software and Web-based HVAC Software.

In terms of Enterprise Size, is distributed into Small and Medium Enterprises and Large Enterprises.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global HVAC industry is projected to witness CAGR of 7.6% between 2025 and 2035.

The global HVAC industry stood at USD 685.9 million in 2024.

The global HVAC industry is anticipated to reach USD 1,527.5 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 16.6% in the assessment period.

The key players operating in the global HVAC software include Honeywell International Inc., Johnson Controls International plc, Siemens AG, Carrier Global Corporation. and others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for HVAC Software in USA Size and Share Forecast Outlook 2025 to 2035

Demand for HVAC Software in Japan Size and Share Forecast Outlook 2025 to 2035

HVAC UV Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Coil Coating Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

HVAC Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

HVAC Centrifugal Compressors Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

HVAC Fan & Evaporator Coil Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA