The HVAC Blower and Fan Systems Market is poised for steady growth over the next decade, driven by increasing demand for efficient heating, ventilation, and air conditioning (HVAC) solutions across residential, commercial, and industrial sectors.

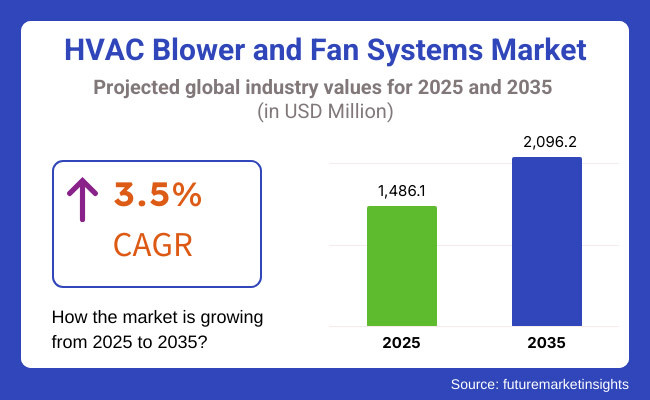

The market, valued at USD 1,486.1 million in 2025, is projected to reach USD 2,096.2 million by 2035, growing at a CAGR of 3.5%. Factors such as urbanization, stringent energy efficiency regulations, and advancements in fan and blower technology are expected to play a pivotal role in shaping the market dynamics.

The growing emphasis on energy-efficient and sustainable HVAC solutions is significantly impacting the HVAC Blower and Fan Systems Market. The trend of increase the amount of smart buildings along with the rising problems for the indoor air quality are the key factors behind the acceleration of the ventilation systems suction.

Real estate development in the expanding industries and the constructions of the infrastructures are among the most important actions related to the market increment of the pipe fan systems. Added to the above are the climbing temperatures associated with global warming and urban heat island effect which increases the requirement of proper cooling and ventilation devices. In order to fit the needs of both residential and commercial users, manufacturers are aiming for the production of low-noise, top-class HVAC fans and blowers.

The increasing adoption of smart HVAC systems is revolutionizing the industry, with energy-efficient blowers and fans becoming a key focus. The need for both better air quality and adjusting life parameters due to climate changes is driving the industrial and residential sectors toward improved ventilation equipment. Apart from that, the industrial and commercial sectors move ahead, which leads to higher investment in HVAC infrastructures for larger projects, for instance, factories, hospitals, and data centers.

Technological innovations such as variable speed drives (VSDs) and the Internet of things-enabled smart fans are the primary factors behind the market surge. What is more, power-saving restrictions that have been recently adopted globally by governments will bring about the result of the high-performance HVAC systems and at the same time are going to be the root of the bigger demand for low-noise and high-efficiency blowers and fans.

The HVAC Blower and Fan Systems Market in North America has been growing consistently owing to energy efficiency regulations and standards introduced by regulatory offices such as the Environmental Protection Agency (EPA) and the Department of Energy (DOE). The United States is the largest market mainly because of the vast amount of smart HVACs applied in commercial and residential sectors.

The trend of building the green structures and integration of IoT-based HVAC systems are the other factors pushing market development. Canada has witnessed an increase in HVAC demand due to the harsh winter and the rising necessity of energy-efficient heating methods.

As well, the retrofitting projects in older buildings are proving to be helpful in terms of a bigger sale of high-efficiency blowers and fans. Advanced data centers, hospitals, and commercial properties are bringing in demand for effective HVAC solutions as well.

The HVAC blower and fan systems market in Europe is experiencing rapid growth, mainly attributable to the environmentally friendly policy of the region and the regulations on the construction industry. The directives from the European Union on energy efficiency such as the Energy Performance of Buildings Directive (EPBD) are pushing for the employment of high-efficiency HVAC systems.

Smart ventilation solutions and eco-friendly building designs are the regional lifesavers for Germany, France, and the UK which constitute the main markets. The retrofitting demand of aged HVAC infrastructure is dramatically increasing, especially in Western Europe.

The goal achievement of becoming carbon-neutral by 2050 acts as a catalyzer for investment in the upgrade to the next generation of environmentally friendly HVAC fans and blowers. Meanwhile, Eastern Europe is manifesting itself as an increasing market through urban growth and infrastructure uplift.

The Asia-Pacific HVAC Blower and Fan Systems Market are going to score the biggest growth due to urbanization, increasing disposable incomes, and extreme climatic conditions. The move of China, India, Japan, and South Korea to advance their infrastructure has given a boost to this sector which is providing the general population with effective ventilation and cooling systems.

The rise in smart city projects, and the development of commercial and residential real estate are the next reasons for market growth. The governmental campaigns to promote green buildings have also been effective in getting the people to adopt energy-efficient HVAC systems. The manufacturing sectors of both China and India, which are extending, have caused the demand for non-residential HVAC systems, that are installed with high-flow blower and fan units, to soar.

The HVAC Blower and Fan Systems Market in Latin America, the Middle East, and Africa is showing slight uptrends due to the rise in investments in commercial and residential infrastructure. The Middle East region, through Saudi Arabia and the UAE, is at the forefront of demand for the superior capacity cooling system necessary for desert temperatures.

By the leadership of Brazil and Mexico, Latin America is now concentrating on expanding its commercial real estate sector, increasing HVAC installations. Africa shows a similar pattern trail, dovetailing with urbanization and industrialization. But the high initial costs and the limited number of regulations and the enforcement in some locations constrict the speedy implementation of the solutions.

High Initial Investment Costs

One of the main issues that plague the HVAC Blower and Fan Systems Market is the high initial monetary constraints in developing, and implementing energy saving equipment. Jumping to an intelligent IoT-connected HVAC system requires upfront deployment, sensor, and automation technology costs.

Many potential adopters like small and medium enterprises (SMEs) and residential users tend to ignore these strong energy disputes for high installation costs at the beginning, apart from the benefits over time. In the case of main industrial standards, the stress of individual needs for high capacity custom HVAC blowers and fans among the financial worries makes broad take-up slow progress, particularly in price sensitive markets.

Regulatory and Compliance Challenges

The HVAC Blower and Fan Systems Market face various challenges since these systems are under strict energy efficacy, emission and noise control regulations that are region-specific. To comply with the regulations, companies have to dedicate a large portion of their budgets to the R&D initiatives that create the systems that will meet the global as well as the regional standards.

Multi-regional players cannot just race against time to find the best employees, instead, they need to ensure that their products are in accordance with the required performance, noise, and emissions that need to be met in every location, leading to increased costs of production.

To add to this, frequent changes in government policies and environmental laws create uncertainty, requiring manufacturers to adapt their designs and technologies to remain compliant, leading to potential delays in market entry and product development.

The Changing Climate for Smart and Energy-Efficient HVACs

The transition to smart, IoT-enabled HVAC systems has turned out to be a viable option in the HVAC Blower and Fan Systems Market. The improvements in AI and machine learning in HVAC solutions have made breakthroughs in their capability for predictive maintenance, remote monitoring, and automated energy optimization thus enhancing efficiency and lowering living costs for the end customers.

Adoption of energy-efficient contracts from the governments around the globe is persuading businesses and residences to substitute with environmentally friendly HVAC solutions. Thus, it is predicted that adoption of high-performing, low-noise blower and fan systems is going to be higher in commercial and industrial sectors where energy savings can lead to substantial cost reductions over a longer period of time.

The fast-growing HVAC Applications in the Industrial and Data Center sectors

The fast pace of industrial and data center facilities growth is unlocking opportunities in HVAC blower and fan systems. Manufacturing facilities, warehouses, and industrial plants that need high-volume terms of cooling and ventilation in the process of making optimal working conditions are among the many examples.

On the other hand, the flourishing of the data center market, which is being fueled by the burgeoning of cloud computing and digital storage, is consuming precision cooling in order to maintain the operating servers that are not overheating. As data center investments spike across the globe, the demand for advanced HVAC systems with high efficiency, reliability, and sustainability for the market is expected to grow largely.

The HVAC blower and fan systems market gained a lot of growth from 2020 to 2024 energy-efficient solutions, advancements in smart HVAC technologies, and regulatory mandates for reducing emissions. Market growth benefited significantly from indoor air quality (IAQ) and the increase in variable speed fans adoption.

From 2025 to 2035, the market is expected to change with the introduction of AI-driven climate control systems, the imposition of tougher energy efficiency standards, and the reliance on renewable energy sources for HVAC operations. IoT-enabled monitoring systems will aid in the adoption of the above-mentioned technology, and sustainability initiatives will play a role fundamental in the transition to the future.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Assuring energy efficiency through targeted measures like the USA DOE's energy conservation standards for HVAC systems. |

| Technological Advancements | Integration of variable frequency drives (VFDs), intelligent sensors, and upgraded fan designs for increased airflow effectiveness. |

| Industry-Specific Demand | Higher needs in the household and commercial areas are stimulated by the phenomenon of urbanization and the building of infrastructure. |

| Sustainability & Circular Economy | Initial efforts to improve energy efficiency and reduce carbon footprint. |

| Market Growth Drivers | Rising urbanization, smart building adoption, and increasing consumer awareness of IAQ. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Worldwide environmental restrictions, the discontinuation of conventional refrigerants, and elevated efficiency compliance. |

| Technological Advancements | AI propulsion predict maintenance, IoT inclusion of real-time air quality monitoring, and hybrid ventilation systems. |

| Industry-Specific Demand | The increase of data centers, healthcare facilities, and industrial applications that demand accurate climate regulation. |

| Sustainability & Circular Economy | Widespread use of recyclable materials, circular economy initiatives for HVAC components, and integration with renewable energy sources. |

| Market Growth Drivers | Accelerating demand for net-zero energy buildings, stricter global efficiency standards, and technological integration with smart city initiatives. |

The USA HVAC blower and fan systems market is experiencing impressive growth as a result of the relentless need for the deployment of innovative energy-saving heating and cooling systems in the residential, commercial, and industrial sectors. The federal and state energy regulations, including DOE efficiency standards, are the main factors that foster the development of more advanced HVAC technologies.

The use of smart HVAC systems with IoT integration and variable-speed fans is now trending. The growth of the construction field and the process of reconfiguring old buildings add more heat to the market growth. Seeking high-performance ventilation systems, people are increasing the demand for these products. The market is expected to grow at a CAGR of 3.8% between the years 2025 and 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

The UK market is experiencing growth mainly due to the green policies, net-zero carbon targets, and government rebates for HVAC systems that are energy efficient. The trend is for high-performance ventilation and heat recovery systems which is mainly growing in commercial and residential applications. Smart buildings and automated HVAC solutions are the trend; they optimize on energy consumption.

The additional retrofitting of projects for the purposes of improving energy efficiency in existing buildings will also further assist the growth of the market area. The increase in the recognition of the importance of indoor air quality in offices and residences is also the reason behind the increase in the demand for new blower and fan systems. The market is expected to grow at a CAGR of 3.2% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.2% |

Strict energy efficiency regulations are the main drivers of the EU market, including the Energy Performance of Buildings Directive (EPBD) and Eco-design standards. The growing environmental awareness of carbon emissions and the promotion of green buildings have been key factors in the rapid spread of high-efficiency HVAC technologies.

The innovative development of variable-speed and smart ventilation systems has furthered the energy optimization. Both residential and commercial sector HVAC upgrades are strongly driven by the governmental encouragements through achieving the climate goals. The concern about the health status of indoor air has led to the demand for the market growth in this area. The CAGR of the market is supposed to be 3.5%, with the increase from 2025 to 2035.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

Japan's HVAC market is surging, primarily because of the rising urbanization, the prevalent adoption of smart buildings, and the formulation of energy efficient policies. The government is promoting the use of ventilation and air management systems that are high-performance to slash down energy use. AI-supported HVAC solutions as optimization of energy use and airflow have a higher share in application in commercial and residential spaces than ever before.

The requirement of maintaining indoor air quality is becoming tougher thus the number of advanced blower and fan systems is expected to go up more. The innovativeness of the compact and high-efficiency HVAC systems is also driven by the country emphasis on earthquake-resistant and space-efficient construction. The market is projected to follow 3.4% CAGR growth during 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

The HVAC blower and fan systems market in South Korea is growing at a fast pace driven by rapid urban growth, smart city ventures, and energy-saving construction policies. The green building initiatives and the use of eco-friendly HVAC facilities are being adopted with government subsidies as the drivers for it. The commercial sector has increased the integration of smart HVAC which, in turn, improves the operational efficiency.

The strong manufacturing sector and the investments in automation have resulted in the rising need for superior quality ventilation systems. The growing awareness of the importance of indoor air quality and health standards are, in turn, boosting the growth of the sector. The demand for more residential housing is also a reason for the steady growth of the market. The CAGR for the period from 2025 to 2035 would be 3.6% for the sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

Axial Fans Dominate the Market Due to High Efficiency in Airflow Management

The axial fans are the biggest competitor in the market HVAC blower and fan systems because of their great efficiency in lifting a huge amount of air with very little pressure. These fans have greatly been used in the industrial cooling, ventilation, and HVAC systems in big commercial buildings. They are very much adopted due to their cost-effectiveness, energy efficiency, and concise design.

They have the advantage of the newest technological developments such as possibilities of variable-speed drives and smart control integration. The progressing industrial sector's ventilation needs, together with strict rules and regulations for indoor air quality, are the additional factors for the market activation. North America and Europe are the central markets for axial fans due to compliance with energy efficiency regulations, whereas Asia-Pacific presumes the increase in demand due to urbanization and industrialization.

Centrifugal Fans Gain Traction in HVAC Systems for Their High-Pressure Capability

Centrifugal fans are being more and more implemented in HVAC tasks, thanks to their opportunity to work on a high static pressure. It is a very suited fit for these fans to be used in duct systems that need a strong wind and also in particular environments such as cleanrooms.

These fans are specifically used in air handling units, exhaust systems, and cleanroom ventilation due to their superior air filtration capabilities. The windmills are being developed with energy-saving motors and new blade constructions, and centrifugal fans are becoming eco-friendlier and cost-effective as a result.

The rise in the commercial real estate sector, particularly with regard to the construction of high-rise buildings and the need for smart HVAC systems, is driving demand. North America and Europe are the top markets for centrifugal fans due to their concern about energy-efficient HVAC solutions; conversely, Asia-Pacific is witnessing rapid development by the introduction of new construction in countries like China and India.

Industrial Use Leads the Market Due to Heavy-Duty Ventilation Needs

The sector of industries is primarily using HVAC blower and fan systems, due to the need for ventilation, cooling, and air circulation functions in manufacturing plants, refineries, and power plants. The work safety and air quality regulations are stringently forcing the need for industrial HVAC solutions, such as OSHA and EPA standards in the United States.

Special air handling systems are required in firms like pharmaceuticals, food processing, and automotive manufacturing to maintain controlled conditions. The use of artificial intelligence for the smart ventilation and the energy-efficient focus is the primary drivers of development in the sector. Massive markets in North America and Europe are where the segment is highly developing, alongside Hong Kong, India, and Southeast Asia, which have booming industrial sectors.

Commercial Use Expands Rapidly with Smart HVAC Adoption

The commercial sector has been increasing productivity substantially in the last few years, additionally, expansion in the building of infrastructures such as high-rise office building, shopping malls, and hospitals has also boosted it. The demand for energy-efficient heating and ventilation is the main driver of market growth. Governments in different regions stimulate energy-saving by issuing strict regulations.

For example, in the USA, LEED certification is mandatory, while in Europe, BREEAM standards have known success as well. The concerns of indoor air quality post pandemic have also resulted in big improvement plans in air filtration and ventilation systems. North America and Europe are still first due to regulatory rules, while Asia's rapid urbanization is creating a setting for commercial infrastructure development.

HVAC Blower and Fan Systems Market is being driven significantly by the growing demand for energy-efficient ventilation systems and is thus witnessing growth. Urbanization, infrastructure expansion, and stringent energy regulations are shaping the industry. Key players are focusing on smart HVAC technology, integrating IoT-enabled systems and variable speed drives to enhance efficiency.

The market consolidation through mergers and acquisitions is evident, with the projects undertaken by companies to strengthen weak monopoly positions on the global scale. Innovative technology, environmental sustainability, and elevated R&D investments are fueling the competition.

The companies are launching the new smart ventilation product line intended for commercial, residential, and industrial sectors. The businesses of new players and local producers are becoming popular by providing the best prices and flexible products that meet the particularities of the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Greenheck Fan Corporation | 15-20% |

| Systemair AB | 10-14% |

| Twin City Fan Companies, Ltd. | 8-12% |

| FläktGroup Holding GmbH | 7-10% |

| ebm-papst Group | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Greenheck Fan Corporation | Energy-efficient HVAC fans and blowers, advanced control systems |

| Systemair AB | Commercial and industrial ventilation solutions, smart HVAC tech |

| Twin City Fan Companies, Ltd. | Custom-built industrial fans, high-performance air movement systems |

| FläktGroup Holding GmbH | Sustainable air handling solutions, HEPA filtration integration |

| ebm-papst Group | EC fan technology, low-noise, high-efficiency blowers |

Key Company Insights

Greenheck Fan Corporation

Greenheck Fan Corporation is the top distributor of commercial and industrial HVAC ventilation systems in the world. This is mostly because of its robust global distribution system and an all-embracing range of HVAC solutions. This company advocates its energy-efficient and low-noise products that are addressed to these demanding sectors like commercial buildings, healthcare, industrial manufacturing.

With the integration of advanced data centers and virtual reality, Greenheck has improved indoor air quality; thus, the company is reducing energy consumption. The company's recent investments in digital automation and smart monitoring have further strengthened their position as the leading innovator in HVAC solutions.

Their successful entry into the emerging markets and their partnership with the HVAC integrators have strengthened their market presence. The ongoing sustainability measures include manufacturing eco-friendly products and the optimization of product life that help meet strict environmental rules.

Systemair AB

Systemair AB is one of the biggest companies in HVAC Sphere in Europe and is continuously growing in North America and Asia-Pacific regions. The firm is dedicated to producing ecological ventilation systems that comply with international energy efficiency norms. Systemair's product portfolio mainly includes air distribution systems, air handling units, and energy-efficient climate control solutions.

Through investing in R&D each year, the company has made significant strides in the production of sophisticated filtration systems that stop dust and other particles in the air from residential, commercial, and industrial places. The firm integrates digital HVAC solutions, which improve system performance by means of real-time performance monitoring. Systemair increases its market capacity by supplementing production and merges with other businesses, and by promoting customer-centric products which are compliant with changing global guidelines.

FläktGroup

Fläkt Group is an eminent global supplier of intelligent air handling solutions for commercial and industrial areas. This company has put special emphasis on the adaptive management of airflows and utilizes sensor technology fully to the maximum to achieve optimum energy consumption. To the industrial sector, and with large-scale commercial buildings, FläktGroup ceaselessly designs high-performance HVAC systems that comply with an ecologically-friendly standard.

It has added new digital functions to their product line this has come in the form of cloud-based performance monitoring and predictive maintenance which in turn improves operational efficiency. FläktGroup's customer-oriented approach enables various sectors to obtain ventilation solutions in a customized way.

In the fast-changing HVAC market, the emphasis on sustainability and innovative product development has enabled the company to sustain its competitiveness and through technological breakthroughs and strategic alliances it has achieved a firm foothold HI.

Howden Group

The attachment of Howden Group to industrial ventilation machines directed especially to heavy-duty applications in areas like power generation, mining, and oil & gas is what makes this company a unique one in the industry. This company is built around engineering discipline and dependability, resulting in the perfect air movement in these critical environments.

The extreme fan technology of Howden supports not only the effective cooling but also the circulation of air, which practically is a good solution for high energy costs in these industrial clients. The desire to achieve economic goals by being more environmentally friendly has led Howden to incorporate energy-efficient systems thus they could meet challenging environmental standards.

The digital transformation is a big priority and they are employing monitoring tools based on the IoT which will give the end-user system real-time information. Howden Group also takes active participation in corporate acquisitions that add to the technology portfolio and extend market reach. Howden remains a large-scale HVAC and industrial ventilation leader by focusing on innovation and operational efficiency.

Other Key Players

In terms of Product Type, the industry is divided into Axial, Centrifugal, Backward Inclined Fan-based, Other Product Types

In terms of End Users, the industry is divided into for Industrial Use, for Residential Use, for Commercial Use

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global HVAC Blower and Fan Systems market is projected to reach USD 1,486.1 million by the end of 2025.

The market is anticipated to grow at a CAGR of 3.5% over the forecast period.

By 2035, the HVAC Blower and Fan Systems market is expected to reach USD 2,096.2 million.

The Axial segment is expected to dominate the market, due to its high airflow efficiency, energy savings, compact design, and widespread use in ventilation, cooling, and industrial HVAC applications.

Key players in the HVAC Blower and Fan Systems market include Greenheck Fan Corporation, Systemair AB, ebm-papst Group, FläktGroup, Howden Group.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Users, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Users, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Users, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Users, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Users, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End Users, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Users, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Users, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Users, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Users, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Users, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End Users, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Users, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End Users, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Users, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVAC Fan & Evaporator Coil Market Size and Share Forecast Outlook 2025 to 2035

Automotive HVAC Blower Market Trends - Size, Share & Growth 2025 to 2035

Industrial & Commercial Fan & Blower Market Size, Trend & Forecast 2024-2034

HVAC UV Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Coil Coating Market Size and Share Forecast Outlook 2025 to 2035

Fanfold Market Size and Share Forecast Outlook 2025 to 2035

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

HVAC Market Size and Share Forecast Outlook 2025 to 2035

Fan-Out Wafer Level Packaging Market Size and Share Forecast Outlook 2025 to 2035

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

HVAC Centrifugal Compressors Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Software Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

Fan Engagement Market Insights – Trends & Growth 2025 to 2035

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators & Warmers Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutrition Hydrolysate Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA