The hunting gear and accessory industry within the United States is becoming increasingly high-tech, environmentally friendly, and consumer-pleasing. Growing interest in outdoor recreation, conservation, and high technology advance in hunting gear forms the major reasons for the growth of this industry.

Consumers are now seeking hunting gear that is not only able to perform well but also more durable and environmentally friendly so that it complements hunting activities while ensuring ethical hunting practices.

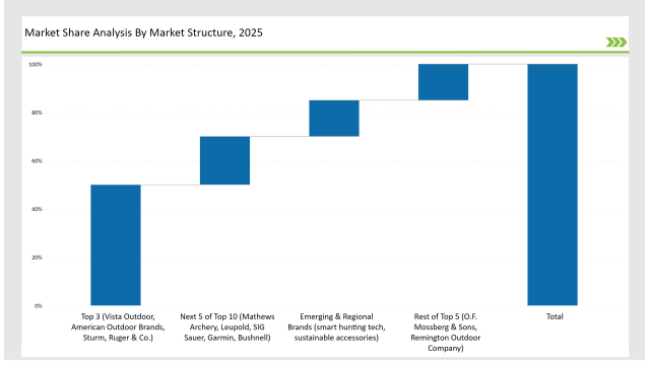

The leading players, including Vista Outdoor, American Outdoor Brands, and Sturm, Ruger & Co. account for the market share of 50% just because of strong brand recognition, product innovation, and strategic partnerships at the retail end.

Independent and regional manufacturers of hunting gear account for 30%, responding to specialized needs with localized, individually personalized equipment. Finally, new entrants such as 'smart hunting technology' and sustainable hunting accessories are estimated to occupy about 20% of the market.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Vista Outdoor, American Outdoor Brands, Sturm, Ruger & Co.) | 50% |

| Rest of Top 5 (O.F. Mossberg & Sons, Remington Outdoor Company) | 15% |

| Next 5 of Top 10 (Mathews Archery, Leupold, SIG Sauer, Garmin, Bushnell) | 20% |

| Emerging & Regional Brands (smart hunting tech, sustainable accessories) | 15% |

The hunting equipment market in 2025 is fragmented, with the top players accounting for 25% to 50% of the total market share. Leading brands such as Vista Outdoor, American Outdoor Brands, Sturm, and Ruger & Co. dominate the segment, while specialty retailers and niche hunting gear manufacturers add competitive diversity. This market structure reflects strong brand influence while allowing space for eco-friendly hunting gear and advancements in tracking technologies.

Outdoor & Sporting Goods Retailers drive the market, with 50% of sales, because consumers want to go into the store to see and test their hunting gear. E-commerce & Direct-to-Consumer Sales have reached 30%, as this is convenient and often priced lower than in other channels, in addition to being able to read reviews from others. Hunting & Conservation Clubs drive 10%, as club memberships often provide access to high-end hunting equipment. Finally, Specialty Firearms & Ammunition Stores drive 10%, for those hunters looking for customized arms and ammunition.

Firearms & Ammunition are the leader at 45%, for hunting. The Optics & Scopes take 20% of the pie, with advanced thermal imaging and night vision hunting efficiency. Hunting Apparel & Footwear accounts for 20%, which keeps one dry in rain, neutralizes scent, and has camouflaged looks. Lastly, Calls, Decoys & Trail Cameras represents 15%, as Smart hunting technology, and AI-based tracking devices became more popular in the year.

The hunting equipment market changed as new entrants and market leaders adopted strategic choices based on the changing preferences of customers.

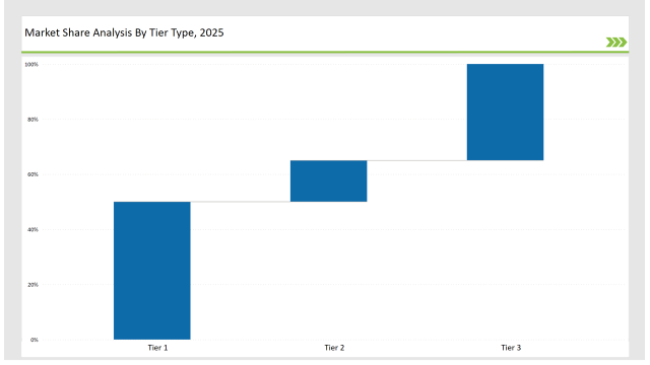

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Vista Outdoor, American Outdoor Brands, Sturm, Ruger & Co. |

| Market Share (%) | 50% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | O.F. Mossberg & Sons, Remington Outdoor Company |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Mathews Archery, Leupold, SIG Sauer, Garmin, Bushnell |

| Market Share (%) | 35% |

| Brand | Key Focus Areas |

|---|---|

| Vista Outdoor | Eco-friendly ammunition & smart hunting accessories |

| American Outdoor Brands | High-performance, all-weather hunting gear |

| Sturm, Ruger & Co. | Lightweight firearm technology & improved accuracy |

| Garmin | GPS-enabled hunting tools & real-time tracking |

| Emerging Brands | AI-driven trail cameras & digital scent tracking |

Advances in smart hunting technology, renewed attention to environmental protection, and the evolution of consumers are contributing factors for uninterrupted growth in hunting equipment and accessory market. Key growth will continue from digital innovators that cater for personalization needs while offering product compliance towards newer, tougher standards set under regulations governing this hunting equipment segment. Hunting is headed towards the techno-future- environment-friendly and diversified one.

Leading players such as Vista Outdoor, American Outdoor Brands, and Sturm, Ruger & Co. collectively hold around 50% of the market.

Independent and regional brands contribute approximately 15% of the market, focusing on specialized hunting gear.

Startups specializing in AI-powered trail cameras and digital hunting accessories hold about 10% of the market.

Online sales represent around 30% of the market, as more hunters prefer digital shopping experiences.

High for companies controlling 50%+, medium for 30-50%, and low for those under 30%.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.