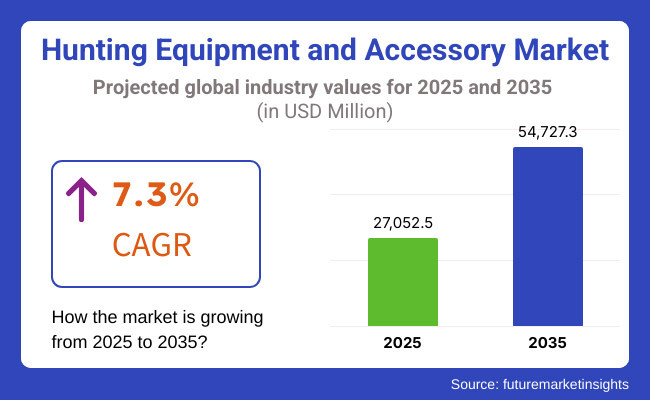

The global hunting equipment and accessory market is forecast to grow from USD 27 billion in 2025 to USD 54.7 billion by 2035, registering a CAGR of 7.3%. This growth is underpinned by increasing participation in recreational hunting, the revival of sport shooting, and rising consumer investment in high-performance outdoor gear.

Governments in countries like the USA, Canada, and New Zealand continue to promote ethical and seasonal hunting through licensing and conservation programs, helping sustain a regulated and responsible market. As more consumers embrace outdoor lifestyles, both traditional and modernized hunting cultures are expanding across regions.

Ammunition is expected to lead product demand, growing at a 6.4% CAGR, fuelled by steady usage across both sport and game hunting. Recent innovations include biodegradable and lead-free ammunition designed to reduce environmental impact while complying with tightening wildlife regulations.

Optics, advanced gear systems, and modular firearm components are also seeing increasing adoption. On the apparel side, brands are releasing camo gear made with sustainable, weather-adaptive materials that offer both stealth and comfort in extreme environments, particularly appealing to younger, tech-savvy hunters.

Specialty stores will remain the primary distribution channel, expanding at a 6.2% CAGR through 2035. These outlets continue to attract loyal customers with expert advice, tailored fittings, and access to exclusive brands. However, e-commerce is rapidly reshaping the retail landscape.

The rise of virtual testing tools, augmented reality-assisted fittings, and bundled online packages is making digital channels more attractive, particularly for hunters in remote areas or those purchasing advanced accessories and apparel. Subscription models for consumables like ammunition and cleaning kits are also gaining popularity.

Recent developments are driving a new wave of innovation in the industry. In 2025, Savage Arms and Browning introduced rifles integrated with ballistics computers for real-time data syncing, enabling greater precision. Sitka Gear launched AI-powered camo clothing that adjusts patterns based on terrain recognition, offering dynamic concealment in diverse landscapes.

Meanwhile, the market has seen growth in archery equipment, fuelled by renewed interest in traditional and bowhunting styles. Brands have also introduced modular DIY kits and tools for custom broadhead sharpening and equipment assembly. These trends reflect a broader shift toward personalization, sustainability, and smart hunting technologies, setting the stage for an evolved and consumer-driven market through 2035.

The below table presents the expected CAGR for the Hunting Equipment and Accessory industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 7.8% |

| H2(2024 to 2034) | 7.2% |

| H1(2025 to 2035) | 8.1% |

| H2(2025 to 2035) | 6.7% |

The CAGR exhibits a fluctuating trend, initially increasing by 78 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. Further, a slight increase of 81 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external growth.

Growth declines in H2 (2025 to 2035) with a 67 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

The ammunition segment is projected to hold a dominant 27.4% share of the hunting equipment and accessory market in 2025, driven by its indispensable role in every hunting expedition. Ammunition is the core consumable in the hunting value chain, requiring constant replenishment, unlike durable equipment.

Companies such as Hornady, Remington, and Winchester are heavily investing in ballistic innovation to create specialized ammunition for different game types and environments. For instance, Hornady’s Precision Hunter line addresses long-range shooting, while Remington’s Core-Lokt series offers controlled expansion for ethical kills.

The rising popularity of game-specific hunting and ethical harvest practices has led to demand for tailored bullet designs, including lead-free, bonded core, and polymer-tip variants. In North America and Europe, regulatory emphasis on environmental conservation has also led to a shift toward eco-friendly ammunition alternatives.

With the emergence of newer calibers and the popularity of semi-automatic hunting rifles, the need for high-performance, compatible ammunition continues to rise. As recreational and competitive hunting grow globally, consistent advancements in design, velocity, and terminal ballistics ensure that ammunition remains the most vital and invested-in segment.

Specialty stores are expected to capture 35.8% of the market share by 2025, benefiting from their ability to offer curated, high-quality hunting products and personalized services. These stores go beyond simple product distribution by tailoring their offerings to specific hunting cultures and regional game species.

Leading retailers such as Bass Pro Shops, Cabela’s, and Scheels serve as prime examples of this model. They combine expert staffing, immersive retail experiences, and a wide selection of premium brands to meet nuanced consumer needs. For instance, Scheels offers in-store shooting simulators and workshops on rifle fitting and optics calibration, attracting both novice and seasoned hunters.

Specialty stores often maintain exclusive deals with brands like Leupold, Sitka, and Browning, providing access to premium gear not available in general retail chains. Furthermore, their ability to offer expert consultation on compliance with local hunting regulations, weapon safety, and ethical practices adds immense value. As hunters increasingly seek community-driven, experience-rich purchasing environments, specialty stores continue to thrive by blending traditional trust with evolving product trends and technical guidance.

Digital Hunting Technology, Ballistic Computers Make Everything Better

Advanced rifle scopes are now being digitized in the hunting equipment and accessory industry for enhanced features. This allows connection with a ballistics computer to give the hunter the ability to know in real-time the ballistics of bullet drop, wind drift, and atmospheric conditions.

It does add to long-range accuracy and has made hunters take more ethical shots. It's a trend that is going to redefine hunting to a level of precision that has not been realized.

Sustainable Materials Gain Foothold in Hunt Apparel

The concept of sustainability is increasingly sweeping through the hunting equipment and accessory industry. There have been concerns from eco-conscious hunters pushing the demand toward sustainable fabrics in production, such as recycled polyester.

Indeed, the shift to sustainable materials is catching on due to increased knowledge about the impacts of conventional methods of manufacturing. The manufacturers have reacted to this demand by developing innovative camouflage patterns on eco-friendly fabrics so that they might maintain their effectiveness in the field with the least environmental effects.

Hunting Blinds Go Stealthy with Advanced Camouflage Technology

Hunters blind manufacturers are continuously innovating to give hunters a prime factor in the playing field. State-of-the-art camouflage technology is put to use in the making of virtually invisible hunting blinds for wary games.

Advanced photorealistic patterns with 3D textures added give it a natural look. These advances in camouflage technology are the ones designing the making of better hunting blinds, therefore keeping the hunters unseen from prey.

DIY Broadhead Popularity Soars, Hunters Embrace Customization

Broadhead sharpening tools, which can be categorized as DIY, are becoming common in the hunting equipment and accessory industry, as the need for hunters has risen to design their broad heads for specific game hunting and field conditions.

DIY broad head sharpening tools put the power back in the hunter's hands with the right edge sharpness and angle for his broad heads to ensure the hunter gains a clean kill and maximum efficiency with the least possible damage or destruction of meat. This trend is attributed to the increased demand by hunters to engage themselves physically in this craft.

Crossbow Technology Attracts New Hunters, Accessibility is the Key

New hunters are attracted by innovations in crossbows because of their ease of use. The technological improvements in crossbows have been a central factor in the interest of new hunters to the sport.

Examples are improvements in construction, such as lighter weight designs, and advances in cocking mechanisms-improvements that make a crossbow user-friendly to a whole new list of people.

This makes the trend particularly attractive for those hunters who feel bothered by traditional archery techniques or who simply want a more stable platform for hunting. The crossbow is a weapon that is continually growing in popularity, with more innovative and user-friendly designs from the manufacturers.

Leadership positions in the worldwide hunting equipment marketplace exist for Tier 1 companies because they supply high-end products combined with frontier technologies and renowned brands. The companies enjoy significant international business presence because of their broad distribution systems and essential strategic alliances and event sponsorship in main hunting and outdoor sports.

The companies allocate resources to development research which leads to frequent innovations across hunting firearms and their accessories and optics systems alongside tracking devices and camouflage equipment. The market leadership of such companies is reinforced through their dedicated commitment to hunting regulations and sustainability efforts. Major Tier 1 enterprises encompass Vista Outdoor with Bushnell, Federal Ammunition and Primos and Sturm, Ruger & Co., Remington Arms, Browning along with Beretta.

The market segment of Tier 2 companies comprises established organizations which sell various hunting products at attractive pricing. These companies supply various client groups that extend from recreational shooters to outdoor enthusiasts and professional users.

The companies specialize in certain market segments including archery gear, hunting apparel and survival equipment yet they deliver top-quality products at reasonable prices. Their market expansion happens because of their focused marketing programs along with business connections across regions and prominent internet sales. The notable Tier 2 companies in the industry consist of Mossy Oak, Leupold & Stevens and PSE Archery and TenPoint Crossbow Technologies and Sitka Gear.

New entities and particular operators in the hunting equipment sector comprise the profit zone of Tier 3 companies. The companies reach their target audience through their focus on specialized market spaces including unique items like hunting knives with custom designs along with handmade bows and nature-friendly hunting accessories.

Most of these businesses establish loyal customer bases by introducing innovative products and personalized services in addition to forging direct relationships with their end-users. Their market growth depends on their response to new market trends through professional hunting partnerships despite encountering resistance from dominant brands.

The important businesses operating at Tier 3 level consist of Vortex Optics alongside ALPS OutdoorZ as well as Tactacam and BOGgear and First Lite.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 5.2 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 3 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 3.5 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 2.5 |

| Country | Australia |

|---|---|

| Population (millions) | 26.3 |

| Estimated Per Capita Spending (USD) | 4 |

Per capita spending in the USA hunting equipment and accessorie sector amounts to USD 5.20 because Americans both heavily participate in hunting and have extensive hunting lands. Market expansion is caused by increased gun ownership combined with established hunting laws together with rising outdoor recreational practice. Innovations within the domains of optics and hunting technology and camouflage equipment drive consumers to spend more on products.

Market spending at USD 3.00 per person allows the United Kingdom to maintain a carefully managed game-hunting industry together with developing wildlife management interests. Rising recreational hunting and shooting sports membership and conservation programs drive up demand for top-quality firearms and tracking tools along with hunting apparel.

Germany dedicates USD 3.50 to its citizens to support its focus on specific engineering methods and proper hunting standards. The market demands advanced and high-performing hunting equipment, sustainable hunting products and precision optics because of strong consumer interest. High-quality equipment utilization is guaranteed by stricter hunting regulations which drives extra spending.

The Japanese hunting market stays low at USD 2.50 due to national restrictions on firearm ownership and minimal opportunities to hunt. The steady demand for hunting accessories persists because of increasing outdoor survival activities combined with rising interest in bow hunting.

The Australian hunting market draws its strength from its extensive wide-open lands and extensive pest control hunting priorities at a per capita spending level of USD 4.00. Experts in hunting and sports along with professional hunters maintain robust interest in durable firearms together with advanced optical devices and camouflage gear.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.60% |

| Australia | 7.70% |

| Germany | 5.30% |

| India | 11.3% |

| China | 10.5% |

Boasting a long and rich history of hunting, the United States has developed a mature hunting equipment and accessory market. However, the United States market is forecasted to record a CAGR of 4.6% during the forecast period, 2025 to 2035, indicating a mature giant.

This moderate growth tends to give an assumption for a focus on consolidations and innovations in the industry. Opportunities lie in developing sophisticated gear, such as ballistics computers and sustainable-hunting-apparel materials, because the industry is already used to rapid growth in emerging markets.

The adoption rate in the USA is not as fast as in the markets that are experiencing rapid growth, but it is still a large market due to the built-up infrastructure and core group of developed consumers.

According to forecast statistics, the Chinese market for hunting equipment and accessories will rise at a 10.5% annual growth rate through 2035. Multiple elements contribute to this growth such as the rising middle class with new attitudes and resurging outdoor engagement.

Manufacturers have strong opportunities ahead to serve new generations of hunters because the target market for outdoor gear has reached maturity levels. All these developments are also to be adopted speedily and are expected to quickly overtake mature markets like that of the USA Thus, China is also expected to be one of the significant hubs for players in the upcoming years.

A CAGR of 11.3% is anticipated to drive growth in the Indian hunting equipment and accessory industry between 2025 and 2035. The industry growth will strengthen because of a combination of Indian hunting legacy history along with expanding population size and developing interest in outdoor activities. Manufacturers find it convenient to market their products to such a diverse market segment by offering affordable models alongside premium selection options.

Integration of technology into the gear of hunting, ballistics computers, and other forms of advanced optics is likely to be easily accepted by a generation of hunters already into tech. The rapid growth shown by India hints at its future as a major player in the global hunting equipment and accessory market, possibly overshadowing the well-established markets in the years to come.

Hunting equipment makers contend intensely in the competitive market by implementing combined strategic methodologies to capture increasing market segments. The main focus of research and development takes place at the core where major manufacturers fund the development of innovative products.

This translates to the development of ballistics computers for higher precision, high-performance clothing materials for better comfort and weatherproof features, and the practice of sustainable production methods to reach out to environmentally sensitive consumers.

On top of this, big brands would use sponsorships, sportspeople endorsement, and appropriate marketing strategies to build brand images and customer loyalty in the hunting society. A strong distribution network through specialty stores, online retailers, and distributors in all regions, ensures that the product is maintained in proper availability to reach potential hunters from every part of the world.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 27 billion |

| Projected Market Size (2035) | USD 54.7 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed | Ammunition, Accessories |

| Distribution Channels Analyzed | Specialty Stores, Others |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, China, India, Japan, Australia, UAE, South Africa |

| Key Players Influencing the Market | American Outdoor Brands Corp., Beretta Holding SA, BPS Direct LLC, Buck Knives, Inc., Dick’s Sporting Goods, Inc., SPYPOINT, Under Armour, Inc., Spyderco, Inc., Sturm Ruger and Co. Inc., Vista Outdoor Inc. |

| Additional Attributes | Dollar sales growth by product type (ammunition/accessories), regional demand trends, competitive landscape, pricing strategies, distribution channels, emerging market opportunities, consumer behavior insights |

Ammunition and Others are the key segments driving market growth.

The Distribution Channel is segregated into Specialty Stores and Others.

The market spans across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa.

The market is expected to grow at 7.3% CAGR between 2025 and 2035.

The industry stood at USD 27 billion in 2025.

The market is projected to reach USD 54.7 billion by 2035.

South Asia is expected to grow at a 10.3% CAGR during the forecast period.

Major players American Outdoor Brands Corp., Beretta Holding SA, BPS Direct LLC, Buck Knives, Inc., and Dick’s Sporting Goods, Inc. among others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hunting Boots Market Growth – Trends & Demand Forecast to 2035

Market Share Breakdown of Hunting Equipment Manufacturers

USA Hunting Equipment & Accessories Market Trends, Growth and Forecast 2025 to 2035

Threat Hunting Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA