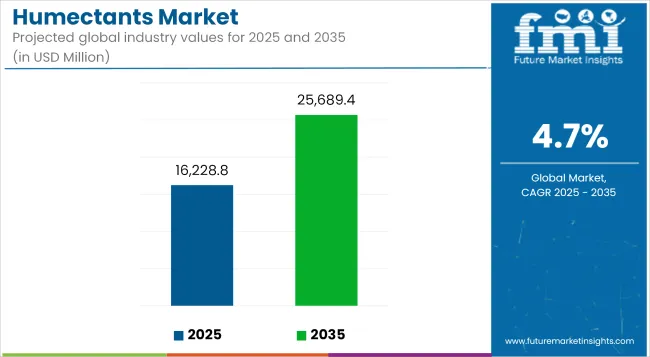

The global humectants market is estimated at USD 16,228.8 million in 2025 and is forecast to reach USD 25,689.4 million by 2035, growing at a CAGR of 4.7%. Growth is driven by increased demand in personal care, food & beverage, and pharmaceutical sectors, where moisture retention, texture stability, and shelf-life extension are critical.

| Metric | Value (USD) |

|---|---|

| Industry Size (2025E) | USD 16,228.8 million |

| Industry Value (2035F) | USD 25,689.4 million |

| CAGR (2025 to 2035) | 4.7% |

Bio-based and fermentation-derived humectants are gaining prominence across personal care and cosmetic formulations. Manufacturers are adopting amino acid-based compounds and sugar alcohol derivatives to cater to consumer preferences for mild, skin-compatible ingredients.

These developments are supported by growing demand for climate-adaptive and functionally enhanced moisturizers. Korean beauty brands and global clean-label producers are integrating these materials into skincare products with a focus on hydration and low-irritation performance.

In food and beverage applications, polyols such as sorbitol and xylitol continue to dominate, particularly in reduced-sugar, diabetic-friendly, and functional food formulations. These humectants maintain moisture content and improve texture while helping manufacturers meet reformulation goals tied to public health initiatives. The use of upcycled raw materials such as fruit peels and grain residues is also expanding, supporting circular economy models and cost-efficiency in production.

Pharmaceutical formulations rely on humectants to stabilize active ingredients and enhance product consistency. Glycerin, propylene glycol, and other high-purity compounds are used in oral liquids, topical preparations, and controlled-release applications. Regulatory pressure and consumer scrutiny have prompted a shift away from synthetic variants like polyethylene glycol, with manufacturers exploring biodegradable and low-toxicity substitutes.

Smart formulation platforms are introducing data-driven approaches in product development, particularly in cosmetics. AI-assisted design tools are being applied to create customized humectant blends that optimize performance under specific environmental conditions. In Europe, ingredient traceability is being addressed through digital verification systems, with blockchain being piloted for origin disclosure and carbon footprint tracking.

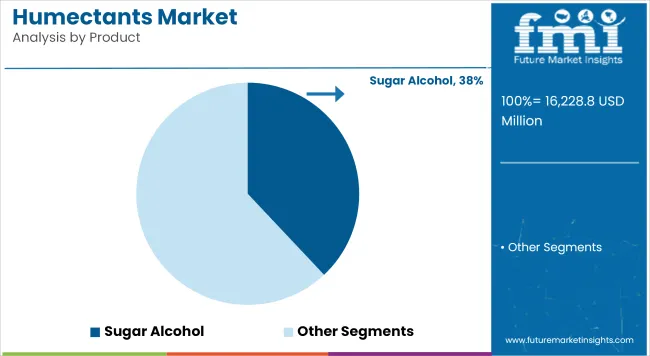

Sugar alcohols including glycerin, sorbitol, xylitol, and maltitol are estimated to hold 38% of the humectants market in 2025 and are projected to grow at a CAGR of 4.9% through 2035. These compounds are widely utilized in food and personal care applications due to their moisture retention properties, low calorific value, and non-cariogenic nature.

Glycerin, in particular, is prominent in skincare and oral care, while sorbitol is heavily used in sugar-free confectionery and toothpaste. The segment is expanding as manufacturers shift toward bio-based production methods to meet sustainability goals.

Regulatory support for clean-label ingredients in North America and Europe, along with rising demand for functional foods and natural personal care products, contributes to segment growth. Companies are investing in fermentation and enzymatic synthesis to enhance yield and reduce environmental impact. These innovations are further driving the adoption of sugar alcohols across nutraceuticals, beverages, and dermo-cosmetic formulations.

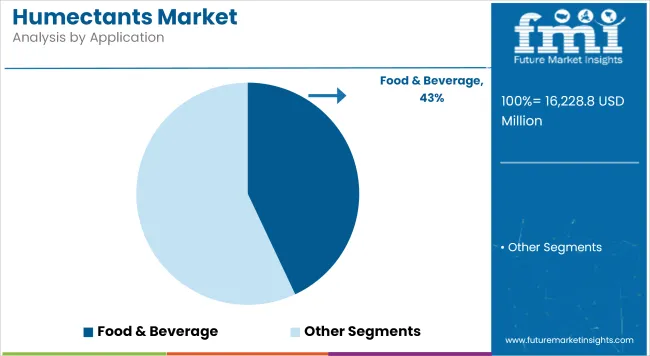

The food and beverage segment is projected to capture around 43% of the global humectants market in 2025, with growth expected at a CAGR of 5.0% through 2035. Humectants are essential for moisture retention, texture stability, and shelf-life extension in baked goods, confectionery, processed meats, and beverages. Glycerin and sorbitol are commonly used in sugar-free products to maintain softness and prevent crystallization.

Market growth is driven by consumer preferences for low-sugar, clean-label, and long-shelf-life foods. Manufacturers are reformulating legacy products using humectants to meet regulatory and labeling requirements in regions like Europe and APAC.

Innovations such as natural-derived humectants and blends with synergistic preservatives are being developed to improve product stability without compromising ingredient transparency. Partnerships between ingredient suppliers and food processors are increasing to develop customized humectant systems that align with functional and sensory requirements of modern food products.

Regulatory Pressures and Safety Perception

Manufacturers are under increasing scrutiny regarding the use of synthetic humectants, such as propylene glycol and polyethylene glycol, which are on regulatory watch lists in various countries over concerns about skin sensitivity and toxicity. Evolving ingredient regulations and increasing consumer demand for transparency on labels are driving brands to reformulate and substantiate claims about ingredient safety and sustainability.

Demand for Natural and Multifunctional Formulations

This trend towards natural, organic and multifunctional ingredients creates tremendous potential for humectant suppliers. Consumers are also turning to plant-derived versions, such as glycerine from coconut or soy, honey-based variations, and hyaluronic acid for their skin care. These ingredients are increasingly well-known in the market to not only support hydration, but also speak to clean-label, cruelty-free and sustainable product positioning.

The USA humectants market is one of the major owing to high demand with personal care, food & beverage and pharmaceutical industries growing steadily. Humectants such as glycerine and hyaluronic acid are key ingredients in moisturising and anti-ageing skincare/cosmetic formulations. The growth of clean-label beauty and health conscious food products are also driving the market. The surge in R&D of multifunctional ingredients and growing consumer consciousness regarding skin wellness adds fuel to the market traction.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

With a surge in the demand for natural content in personal care and wellness products, the humectants market is witnessing an upsurge in the UK. With the rising appeal of clean beauty, the use of humectants such as honey, sorbitol, and aloe Vera extract have surged in cosmetics. Also, the food industry is adopting humectants to improve palace moisture retention and increase shelf life in confectionery and bakery products. Regulatory backing for safer, transparent formulations further supports sustained market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

With widespread use in cosmetics, food preservation, and oral care products, the laws of humectants in the EU is a most growing area. Germany, France, and Italy are some of the countries performing strongly on consumption due to their developed consumer goods industries, and their focus on product quality and sustainability.

And data with regulatory force, like EU standards in favour of safe, bio-based ingredients, has led many manufacturers to look for humectants sourced from nature. Humectants popular in the food industry are used for maintaining moisture equilibrium and texture in ready-to-eat meals and sugar-free confections.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 4.6% |

The humectants market in Japan is going gradually with the influence on the country’s developed beauty industry and aging population. Humectants are instrumental for moisture retention and sensitivity control in functional skincare, haircare, and oral hygiene products.

Japanese consumers value quality, purity, and gentle formulations, and have been leaning toward natural humectants, fuelling demand. Food and pharmaceutical applications mainly in functional snacks and health supplements - are further contributing to broader market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The potentially strong humectants market in South Korea is driven in part by the county's world-leading beauty and personal care industry. The K-beauty industry’s obsession with dewy, hydrates skin has put humectants front and center as a key ingredient in serums, creams and masks.

Domestic manufacturers are also looking to innovate with sugar alcohols and amino acid-based humectants that fit in with the clean beauty trend. They are also increasingly used in the manufacturing of processed foods and health drinks, a trend underpinned by the increasing consumption of functional and convenience products.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

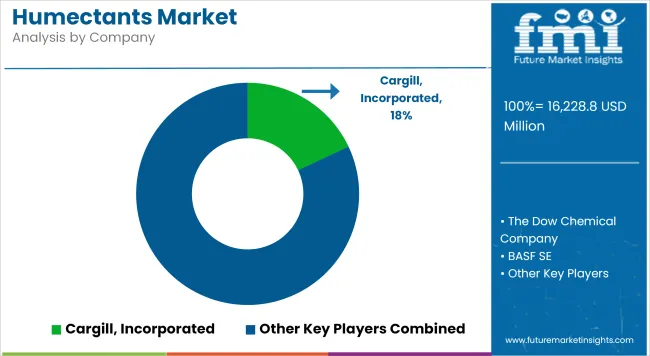

The humectants market is experiencing a phase of structured consolidation, with key players focusing on vertical integration and regional capacity expansion. Companies are investing in R&D to align formulations with regulatory and clean-label demands, especially in food and personal care applications. Strategic partnerships and acquisitions are being used to access patented technologies and extend geographic presence.

Manufacturers are responding to pricing pressures by optimizing raw material sourcing, particularly for bio-based inputs like glycerin and sorbitol. Meanwhile, regional firms are strengthening distribution networks to serve local consumption patterns. The competitive landscape remains defined by product diversification, supply chain efficiency, and compliance with environmental and safety standards across North America, Europe, and Asia Pacific.

The overall market size for the humectants market was USD 16,228.8 million in 2025.

The humectants market is expected to reach USD 25,689.4 million in 2035.

Demand will be driven by increasing use in personal care and cosmetic products, rising consumption in food and beverage formulations, expanding applications in pharmaceuticals and animal feed, and growing awareness around moisture-retaining ingredients in health and wellness sectors.

The top 5 countries driving the market are the United States, China, Germany, Japan, and India.

The food & beverage segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Humectants Cosmetic Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA