The human milk oligosaccharides (HMO) market is dominated by a mix of multinational companies and niche biotech companies pushing the innovation. The leading MNC players control about 60% of the market, with industry leaders like Jennewein, KYOWA HAKKO BIO CO. LTD., and DuPont dominating synthetic HMOs and infant nutrition uses. 30% of the market belongs to regional leaders and mid-sized biotech companies that deal in niche applications and regional supply.

10% includes startups and niche companies with unique formulations and innovative methods of production. This market has a moderate to high degree of concentration where the dominant players hold a major part of commercial-scale manufacturing and distribution.

Explore FMI!

Book a free demo

| Market Structure | Top Multinationals |

|---|---|

| Industry Share (%) | 60% |

| Key Companies | Jennewein, KYOWA HAKKO BIO, DuPont, etc. |

| Market Structure | Regional Leaders |

|---|---|

| Industry Share (%) | 30% |

| Key Companies | zuChem Inc., Elicityl SA, BASF SE, Dextra Laboratories Limited, Carbosynth |

| Market Structure | Startups & Niche Brands |

|---|---|

| Industry Share (%) | 10% |

| Key Companies | Emerging biotech firms and specialized manufacturers |

The market is consolidated, with multinational entities dominating research, production, and commercialization, while regional biotech players add value through niche formulations and localized innovation.

Fucosylated HMOs capture 35% of the market, mainly because of their application in infant formula and their established status in immune modulation. Jennewein and DuPont have been at the forefront of commercializing 2'-Fucosyllactose (2'-FL), the most prevalent HMO in human milk. The availability of fucosylated HMOs in breast milk substitutes has fueled their growth into premium infant formula products.

40% of the market is made up of non-fucosylated neutral HMOs, reflecting high interest in their gut microbiota-enriching effects, particularly in dietary supplements aimed at gut health and digestion support for adults.

Sialylated HMOs make up 25% of the market, with BASF and Nestlé Health Science dominating research on their cognitive and neurological effects. These HMOs are increasingly being added to functional beverages and medical nutrition, especially in North America and Europe, where consumers are looking for scientifically supported wellness products.

Infant formula is still the leading use, accounting for 60% of HMO demand. Companies like Nestlé and DSM-Firmenich are adding multi-HMO blends to replicate the human milk composition. Premium infant foods are growing in China, Japan, and the USA because of increasing birth rates and health-conscious parents.

The dietary supplements category is 40% driven by consumers demanding HMOs for immune support and gut health. In North America and Europe, HMOs are being incorporated into probiotic-fortified capsules, powders, and RTD drinks, which provide targeted microbiome support. Growing scientific study is anticipated to propel the growth of HMO-based adult supplements in international markets.

The HMO market in 2024 saw strategic acquisitions, mergers, and innovation-led investments that transformed the competitive dynamics. Firms concentrated on the upscaling of fermentation-based production of HMOs, which allowed cost reduction and increased adoption. Further, growing regulatory approvals in North America and Europe allowed commercialization of several new HMO variants, leading to market growth.

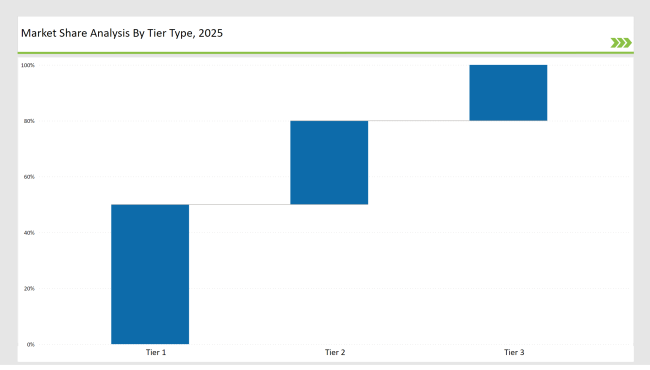

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Jennewein, KYOWA HAKKO BIO, DSM-Firmenich, Nestlé Health Science, DuPont |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | zuChem Inc., Elicityl SA, Carbosynth, Dextra Laboratories Limited |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Startups, emerging biotech firms, niche players |

| Brand | Key Focus |

|---|---|

| Jennewein | Expanded its HMO portfolio with new 6'-Sialyllactose (6'-SL) for cognitive health applications. |

| DSM-Firmenich | Acquired Glycom to strengthen its position in fermentation-based HMO production. |

| Nestlé Health Science | Launched an advanced infant formula featuring a complex blend of five HMOs. |

| BASF SE | Invested in precision fermentation to develop cost-effective HMO production methods. |

| KYOWA HAKKO BIO | Conducted clinical trials on HMOs for gut health improvement in adults. |

| DuPont | Focused on enhancing gut microbiome synergy through HMO-based probiotic formulations. |

| zuChem Inc. | Secured patents for synthetic HMO production techniques, improving large-scale affordability. |

| Elicityl SA | Partnered with functional food brands to develop innovative gut health solutions. |

| Carbosynth | Introduced synbiotic products incorporating HMOs with probiotics for enhanced digestive benefits. |

| Dextra Laboratories | Conducted research on the role of HMOs in immune modulation and allergy prevention. |

The need for personalized nutrition is increasing, with AI-based gut microbiome analysis allowing for customized HMO formulations. Firms that invest in precision nutrition solutions will be able to create bespoke HMO blends for specific health requirements like gut health, immunity, and cognitive function. Growth in direct-to-consumer (DTC) personalized supplement services will also fuel growth in this

Though HMOs are mostly applied in infant formulas, their usage in adult dietary supplements is gaining pace. Increasing popularity of HMOs as prebiotics that selectively promote good gut bacteria is driving the demand for HMO-enriched capsules, powders, and functional drinks. Consumers in geographies such as North America, Japan, and Europe are actively looking for gut health solutions, which will translate into more products across a wider spectrum of adult probiotic-HMO synbiotic on the shelves.

New studies are investigating the function of HMOs in exercise performance, recovery, and gut resilience. Sports nutrition brands are beginning to include HMOs in protein powders, hydration drinks, and endurance supplements to stimulate gut microbiota and reduce exercise-induced inflammation. This segment will gain significant traction in the United States and Europe, where functional and sports nutrition are priority consumer issues.

In addition to functional foods, HMOs are being increasingly studied for therapeutic use in the management of irritable bowel syndrome (IBS), allergies, and metabolic disease. North American and European clinical trials are examining how sialylated HMOs can promote neurological development, cognitive function, and immune modulation. Firms that invest in medical-grade HMO formulations will have a market advantage in pharmaceutical and clinical nutrition markets during the next decade.

The top five manufacturers-Jennewein, KYOWA HAKKO BIO, DSM-Firmenich, Nestlé Health Science, and DuPont-collectively control 60% of the global market.

North America and Europe lead in regulatory approvals, while Asia-Pacific is expected to grow at robust CAGR due to increasing awareness.

They are being incorporated into adult dietary supplements, sports nutrition, and medical nutrition for gut health benefits.

Advancements in fermentation technology, regulatory approvals, and increasing demand for immune-supportive nutrition are key drivers.

Precision fermentation allows cost-effective and scalable production of HMOs, enabling broader adoption.

A detailed analysis of the Australia Licorice Root industry and growth outlook covering form, and application segment

UK Licorice Root Industry Analysis from 2025 to 2035

USA Licorice Root Industry Analysis from 2025 to 2035

A detailed analysis of the Australia Mezcal industry and growth outlook covering product, source, concentration, and distribution channel segment

Comprehensive Analysis of Europe Mezcal Market by Product, Source, Concentration, Distribution Channel and Country through 2035

Comprehensive Analysis of ASEAN Mezcal Market by Product, By Source, By concentration, By sales Channel and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.