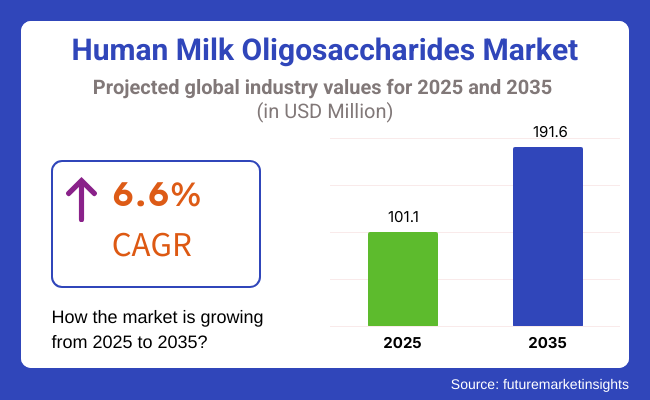

Global Human Milk Oligosaccharides sales will reach approximately USD 101.1 million by the end of 2025. Forecasts suggest the market will achieve a 6.6% compound annual growth rate (CAGR) and exceed USD 191.6 million in value by 2035

The market for Human Milk Oligosaccharides (HMO) is expected to tremendously grow between 2025 and 2035 as a result of increased demand for scientifically validated infant nutrition, advancements in the production of fermentation-based facilities, and extended use beyond the conventional infant formula.

Continues increment of evidence for HMO's positive influence on gut, immunity, cognitive etc., health is leading to varying products, as manufacturers alter product lines to suit consumer demands across gender, age, health issues, etc.

The largest and most prominent area in the HMO market is still the infant formula section where the main manufacturers operate like Abbott, Nestlé, FrieslandCampina, BASF, and shift to the integration of different HMO formulations into their products.

People seem to show a greater preference towards the products that look like real human breastfeeding instead of using a mixture of 2'-Fucosyllactose (2'-FL) and Lacto-N-neotetraose (LNnT) such as 3'-Sialyllactose (3'-SL) and 6'-Sialyllactose (6'-SL), which are great for the development of the immune system and the brain.

The regulatory permits provided by China, Europe, and North America have made sure that they penetrating the markets pretty widely, turning the HMOs into a default component in reputable infant nutrition products.

Besides the fact that the infant health is prioritized, HMOs are also making gains in adult and senior wellness products, for instance, gut health, immunity, and metabolic privileges. The current discussions have further raised the awareness that HMOs have a potential to affect improbable microbiota in the gut which in turn is beneficial for cognitive treatments. The results will thus be seen in distinctive foods, dietary supplements, and medical nutrition that companies like Kyowa Hakko Bio, BASF, and Inbiose sell.

HMO-infused probiotics, prebiotic supplements, and specialized nutritional goods are being introduced by some companies like Kyowa Hakko Bio, while BASF and Inbiose target adults with digestive disorders, immune deficiencies, to mention a few, Metabolic Syndrome. The rise in the demand for gut-brain health solutions and the provision of more personalized foods holds a prospect of even further development in this area.

All the companies are moving towards a fermentation-based HMO production which is going to be cost-effective, and high-purity. The loops' like Chr. Hansen and Friesland Campina as of the moment are extending their microbial fermentation capacities with HMO being affordable for exciting mid-tier formula brands as well as functional food manufacturers.

Additionally, the busyness of networking contracts, solid trials, and the rest of the products to increase the sales of a particular segment are to be carried on. Such as Friesland Campina with the launch of Aequival® HMO blends, while multisachharides are introduced by Nestlé's NAN SUPREME PRO who innovates the entire infant nutrition segment.

Through the process of regulatory approvals taking place everywhere, the performance of clinical trials extending and the resulting customer becoming more aware of it, the HMO has moved from a small market to be a component of standard products in the markets of food, nutrition, and health.

The category of health solutions that are to be added to the mainline include evidence-based strategies for the promotion of health as well as gut microbiome-centric interventions. The overall effect is to increase the growth of this market and by doing so, to promote the development of the entire human health industry together with HMO as one of the important factors at work.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 6.2% (2024 to 2034) |

| H2 2024 | 6.7% (2024 to 2034) |

| H1 2025 | 6.5% (2025 to 2035) |

| H2 2025 | 6.8% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 6.2% in the first half (H1) of 2024 and then slightly faster at 6.7% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 6.5% in the first half of 2025 and continues to grow at 6.8% in the second half. The industry saw a decline of 43 basis points in the first half (H1 2025) and an increase of 52 basis points in the second half (H2 2025).

Gut-Brain Axis Integration in Infant Nutrition

Recent human milk oligosaccharides (HMOs) in infant nutrition have significantly shifted the primary focus to cognitive development. Studies provide evidence for active gut-brain axis HMOs, which in turn affect brain function, neurodevelopment, and stress response.

That is the reason for the development of multi-HMO formulations, which have found their place in cognitive health products, reinforced by the further positioning of HMOs as cognitive health agents in research beyond gut health.

2’-FL, 3’-SL, and 6’-SL are the oligosaccharides that the infant formula manufacturers including Abbott, Nestlé, and Friesland Campina add to the products, in order to simulate the neuroprotective functions of breast milk. Scientific proofs of the connection between HMOs and better memory, lower inflammation, and more emotional regulation are the reasons for their inclusion in premium infant formula products.

By showing for example, through brain-targeted nutrition claims, and product differentiation strategies, the growth of the market is gaining manufacturers with the trust of clinical research results. There has been a proliferation of infant nutrition products with brain-boosting properties due to both regulatory approvals and parental demand, so the sector is therefore accelerating.

Expansion of Fermentation-Based HMOs for Cost Efficiency

Producing HMOs using the traditional method was costly and resource-consuming which affected widespread adoption. Seen from the angle of valuing the money, it is hard to beat the gains from new age precision fermentation which brings the value of HMO purity and scalability up to maximum results.

The big fish like Chr. Hansen, Inbiose, and BASF are going for microbial fermentation technology to sell cheap HMOs. This has turned into the fermentative production of LNT possible on a large scale, thus giving them wider distribution in infant formula and functional foods. The fermentation-based HMOs option's cost impact is yielding a higher occurrence among the medium tier brands that are fostering market reach.

Companies that are engaged in bioprocess optimization, strain engineering, and high-yield techniques are addressing the need for economic viability. In line with the mounting demand for HMOs, it is expected that fermentation will supersede all other forms of production, thus, HMOs will become a cheaper and standardized ingredient in the global supply chain.

Regulatory Standardization and Recognition Across Regions

Regulatory approvals represent both the challenges and opportunities for HMO manufacturers. Despite the disparity in regulations with Asia-Pacific and Latin America still linking up, Europe and North America have excised several HMOs from the list of food additives in infant nutrition.

As per the companies, Nestlé, BASF, and Friesland Campina support with, food safety authorities (FDA, EFSA, and China’s SAMR) to expand their HMO accessorized portfolio worldwide. Companies are increasing evident clinical trials and toxicology studies to fast-track approvals in emerging markets.

Due to the gaining of GRAS (Generally Recognized as Safe) among several nations, the growth of the businesses is increasing. The implementation of the alignment of regulations across areas marks the path for the launch of multiple HMO blends and empowers manufacturers to create region-specific formulas. The companies are paying special focus on labelling compliance, clinical validation, and consumer education to build market credibility.

Diversification of HMO Blends Beyond 2’-FL

2’-Fucosyllactose (2’-FL) is continuing to be the most significant presence in the market yet research buildup is indicating the interplay of multiple HMOs in terms of synergy in both infant nutrition and medical applications. The result is that there is a surge in Lacto-N-Tetraose (LNT), Lacto-N-Neotetraose (LNnT), 3’-Sialyllactose (3’-SL), and 6’-Sialyllactose (6’-SL).

The lead companies like dsm-firmenich, FrieslandCampina, and Inbiose are including several HMO enzymes in their product lines to offer a closer-to-nature breast milk formula. The fashion is sending the formulation of hydrated HMO with specific health benefits, namely, immune support, gut health, and cognitive development in the front line.

Manufacturers make use of biology-based production, improvements in stability, and increased bioavailability of these HMOs. The expectation is that the setting for the personalized product plates will emerge in the current infant formula, functional foods, and specialized medical nutrition partly due to this diversification process.

Between the years of 2020 until 2024, the HMO passed through the highest phase that it could reach, and the main factor behind it was the growing recognition of the nutrient in infant products, the government permits, as well as the progress made in the fermentation process.

Moreover, with the knowledge about gut health and immunity benefits more and more people will use it, namely 2'-FL. Big enterprises dealt with the main HMO manufacturers' problems by implementing measures that increased the quality and the selling sector which diverse the HMO from infant formula and into functional foods and dietary supplements.

As we look into the horizon it can be seen that the demand for the HMO market will increase drastically due to things like multi-HMO formulations, potential expansion into adult nutrition, and the endorsement of the health implications, which are the main reasons that this market will escalate.

The companies are undertaking new combinations of the ingredient with technical and marketing innovation, where they are placing HMOs as a foundation for a mainstream functional ingredient. The industry is moving from high-cost energy to low-cost energy using high-yield fermentation technology, which in turn would make the process efficient, widespread, and innovative.

HMO sector, which includes both the large international enterprises and narrow-specialized companies, constitutes the human milk oligosaccharides (HMO) market. The sector is indeed concentrated with some key players dominating it.

The MNCs like Nestlé Health Science (Switzerland), BASF (Germany), and Abbott Nutrition (USA) are situated on the HMO market's first line. They are the companies with the underlying infrastructure and considerable financial resources, report the latest findings from the i.. Furthermore, these industries have their own distribution networks to expand into the global market.

The second tier of the market is occupied by more specialized players, such as Chr. Hansen (Jennewein Biotechnologie) (Denmark/Germany), Friesland Campina Ingredients (Netherlands), and DSM-Firmenich (Glycom) (Denmark). These companies put in a considerable amount of effort to carrying out HMO research, development, and production, and they are commonly associated with their high level of specialization in this area.

In the third tier, we find a more fragmented group of players, including Inbiose (Belgium), Kyowa Hakko Bio (Japan), ZuChem (USA), and GlycoSyn (New Zealand). These smaller-sized companies and sometimes only concentrate on local or HMO market sub-sectors that are more specialized.

The human milk oligosaccharides market, being quite diverse is made of organized and unorganized segments, where the top-tier MNCs Lead, while the second and third tiers form a rich diversity and competition.

The buowsienen hmos are the hmos, The Monohmo sector's concentration level debts on considerable investment and the technology platform required to create and introduce new processes to the market and the smaller companies can that cause barriers to entry.

The following table shows the estimated growth rates of the top three countries. USA, China and Germany are set to exhibit high consumption, and CAGRs of 4.8%, 6.8% and 3.5% respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 4.8% |

| China | 6.8% |

| Germany | 3.5% |

HMO-infused functional drinks have newly found ground in the USA market, shifting their course from infant formula to adult nutrition and wellness drinks. The inclusion of HMOs, ready-to-drink (RTD) gut-health beverages, immune-boosting shakes, and metabolic wellness drinks by companies like Abbott, dsm-firmenich, and Nestlé Health Science are among the most prevalent.

As more people learn about the benefits of the gut-brain axis and microbiome health, HMOs are tapped as the latest functional prebiotics in the beverage industry. The trend of establishing dairy-based and plant-based HMO drinks is an answer to the customer necessity for easy, scientifically supported gastrointestinal well-being options.

Companies are supporting HMO-added drinks with clinical trials and branding strategies to ensure that they are taken off the shelf from the traditional probiotics and fiber-based drinks. This development is believed to be the major cause of the functional beverage segment rebranding with HMOs becoming a common ingredient in adult nutrition.

In China, the infant formula companies have begun the process of customization of HMO compositions for different regions of the country, effectively considering the local diet and the gut microbiome of babies.

Major players like Feihe, Mengniu, Yili, and Nestlé China are infusing individual HMO blends in premium formulas, which are made according to the different provinces' lactose tolerance, gut flora diversity, and infants' nutritional needs. The government efforts in promoting the nutrition of early life are the gateway for the approvals of different HMOs to be added in formulas (more than 2'-FL and LNnT).

The idea of multi-HMO formulations, which are close to breast milk in terms of diversity, is presented as a scientific alternative to standard formulas. Chinese parents are ever more demanding on personalized nutrition; thus, producers are announcing the HMO technology secures region-specific formulas as the best choice for gut health, immunity, and cognitive development.

Germany is now the top player in the HMO-based footsteps of Mexico, especially through its flagship manufacturers like Friesland Campina, BASF, and Chr. Hansen which have introduced therapeutic HMO formulations meant for treatment of metabolic disorders, inflammatory diseases, and gut microbiome restoration.

The medical professionals in Germany are focusing more on HMOs and are already including some in clinical nutrition products for patients suffering from IBD, gut dysbiosis occurring after antibiotics, and immune-compromised conditions. Unlike the USA, where HMOs are used in functional foods, Germany has shown greater uptake in prescription-based products and hospital-administered nutrition.

BASF and Friesland Campina are steering the direction in HMO-related research on microbiome modulation viscera-chronic inflammation, marking the introduction of HMO-augmented enteral nutrition and pharmacological grade supplements. The regulatory leverage imitated by scientific validation has made Germany stand out in the field of HMO-therapies, which, apart from infant nutrition, are now being added in clinical diet management.

| Segment | Value Share (2025) |

|---|---|

| Fucosylated HMO (Product Type) | 35% |

Fucosylated HMOs, especially 2'-Fucosyllactose (2'-FL), take a lion's share of the global HMO market owing to their exceptional properties of promoting gut health and boosting the immune system. These HMOs encompass closely the most prevalent oligosaccharides being present in human breast milk, which is the reason why they are being used by renowned brands like Abbott, Nestlé, and Friesland Campina.

Laboratory findings underscore the potential of fucosylated HMOs in stimulating beneficial gut bacteria (Bifidobacterium), inhibiting the adhesion of pathogens, and bolstering the immune response. The leading dealers are expanding the scale of fucosylated HMOs production, using the fermentation process and other technologies, that helps to economically practice economies of scale.

Besides baby formula, fucosylated HMOs are now also making headway in adult prebiotics, medical nutrition, and functional foods. The research is geared at solidifying the benefits of these ingredients in health promotion decision-making processes; thus, they are expected to explore leadership and expedite product development.

| Segment | Value Share (2025) |

|---|---|

| Infant Formula (End Use Application) | 60% |

Breastmilk oligosaccharides (HMO) have a major role in the regional human milk oligosaccharide (HMO) market and the infant formula section in particular, as their use is rising due to breastfeeding difficulties, consumer education on gut health, and the trend towards the premiumization of baby food.

Similac (Abbott), Aptamil (Danone), NAN (Nestlé), and HiPP are the primary brands in this sector and are pushing to include multi-HMO formulations, which appear to be a good substitute for the complex oligosaccharide profile of breast milk. The two most important oligosaccharides are 2'-Fucosyllactose (2'-FL) and Lacto-N-neotetraose (LNnT).

These oligosaccharides act as prebiotics, boost immunity, and support cognitive development. As the regulatory approvals cover more geographical regions, like China, Europe, and the USA, the manufacturers are upgrading the scaling of COO fermentation-based HMO production to satisfy the increased customer demand. The upscaling market of HMO in infants' nutrition is driven further by its premiumization as parents are in search of HMO-enriched formula powder that closely couples the effects of human breast milk.

The HMO sector is one of the highly competitive markets operated in by the top companies like Chr. Hansen, BASF, FrieslandCampina, Abbott, dsm-firmenich, and Nestlé Health Science; thus, it remains the toughest market to operate in. Manufacturers are switching gears to group products as well as introducing new courses of production which include fermentation processes and obtaining regulatory permissions in fledgling markets. Businesses have also started cutting out of infant formula applications such as the launch of HMO functional foods, dietary supplements and medical nutrition products.

Product novelty is one of the strategies a company would follow, as proven by the recently released Friesland Campina Aequival® 2'-FL&LNnT which focuses on gut health and immune defence. Nestlé gave a briefing about the SUGON WANPIAN that uses HMOs for cognitive and microbiome support.

Strategic alliances are another means of makers are opting to take, as they speed up the processes of both research and product sell. Custom HMO blends are the next big thing in the HMO market with many businesses trading them as personal sellers, especially with consumers who are looking for more personalized options.

Within the Forecast Period, the Global HMO market is expected to grow at a CAGR of 6.6%.

By 2035, the sales value of the Human Milk Oligosaccharides industry is expected to reach USD 191.6 million.

Prominent players in the Human Milk Oligosaccharides manufacturing include Chr. Hansen (Jennewein Biotechnologie) - Denmark/Germany BASF - Germany Friesland Campina Ingredients - Netherlands Abbott Nutrition - USA dsm-firmenich (Glycom) - Denmark Nestlé Health Science - Switzerland Inbiose - Belgium Kyowa Hakko Bio - Japan ZuChem - USA GlycoSyn - New Zealand. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Fucosylated, Silylated, Non-fucosylated Neutral

Infant Formula, Dietary Supplements

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.