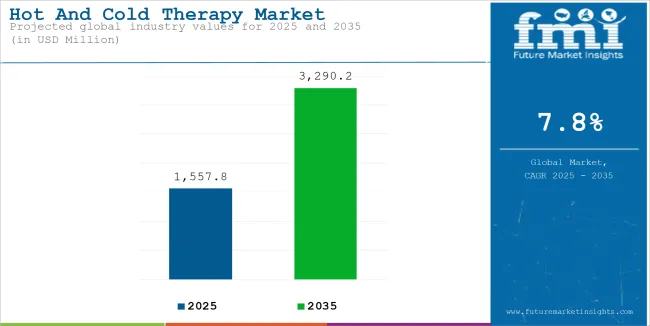

The global sales of hot and cold therapy is estimated to be worth USD 1,557.8 million in 2025 and anticipated to reach a value of USD 3,290.2 million by 2035. Sales are projected to rise at a CAGR of 7.8% over the forecast period between 2025 and 2035. The revenue generated by hot and cold therapy in 2024 was USD 1,459.3 million.

Hot and cold therapies are simple, drug-free methods of pain management and inflammation. Cold therapy is done by numbing the pain and reducing swelling and is good for acute injuries, including sprains or muscle strains. On the contrary, heat therapy relaxes the muscles, dilates the flow of blood, comforts chronic pain, and is usually employed for arthritis and lower back pain.

This is driven on the one hand by growing awareness of non-invasive methods for pain management, with an increasing number of people seeking an alternative to medication due to side effects or the risk of addiction. This demand is further being fueled by the continuously increasing incidence of different chronic pain disorders worldwide.

Global Hot and Cold Therapy Industry Analysis

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 1,459.3 million |

| Estimated Size, 2025 | USD 1,557.8 million |

| Projected Size, 2035 | USD 3,290.2 million |

| CAGR (2025 to 2035) | 7.8% |

The market for hot and cold therapy is being significantly driven by the rising incidence of chronic inflammation, especially in the form of arthritis along with muscle strains and back pains. An aging population is being affected by these chronic conditions, hence driving a demand for effective and non-invasive solutions that manage pain.

For instance, arthritis, which ails millions of older people, causes joint pain and stiffness, and therefore affects life quality. Similarly, back pain and muscle strain are other common complaints that may persist for a long period.

Hot and cold therapy is available as a simple, drug-free approach to treating such pain. Cold therapy decreases inflammation and is usually employed to numb the pain when something like arthritis or a muscle strain becomes acutely activated.

In contrast, heat therapy relaxes muscles, increases blood flow, and can help to decrease chronic pain or stiffness, which is why it is particularly useful in back pain or discomfort in the arthritic joint.

This has only made hot and cold therapy products more in demand as more and more people shift to other treatments other than medications, driven by concerns about side effects and dependency.

This trend, together with the effect on the market from the fast growth in the elderly population and the growing burden of chronic pain, has propelled growth and increased uptake for long-term management of pain.

The global hot and cold therapy market's compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation. The first half (H1) is the period from January to June, and the second half (H2) is July to December.

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 8.8%, followed by a slightly lower growth rate of 8.4% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 8.8% (2024 to 2034) |

| H2 | 8.4% (2024 to 2034) |

| H1 | 7.8% (2025 to 2035) |

| H2 | 7.3% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 7.8% in the first half and remain relatively moderate at 7.3% in the second half. In the first half (H1) the industry witnessed a decrease of 100 BPS while in the second half (H2), the industry witnessed a decrease of 110 BPS.

Increase in sports injuries is increasing the need pain management products and driving the market growth

The increase in the number of sports and fitness-related activities worldwide has contributed much to the increase in injuries. This is therefore one of the major drivers for the market. Many athletes and fitness enthusiasts, especially in high-impact sports such as football, basketball, and running, have injuries such as ligament tears, fractures, and cartilage damage. Eventually, these injuries become joint degeneration. This can give them pain relief and restore mobility through hip or knee reconstruction surgery.

The American Academy of Orthopaedic Surgeons estimates that more than 3.5 million sports-related injuries occur each year in the USA, the most common injuries of which are among athletes: the knee. In younger patients who suffer an injury, a partial reconstruction is necessary, whereas an older patient may have to receive a total joint replacement because they already have a damaged joint.

This trend creates a demand for sophisticated implants and surgical techniques targeted for active lifestyle consumers, with long-lasting materials and minimally invasive techniques ensuring more rapid recovery. The trend for outpatient surgery centers is growing for younger, more active patients, but as long as sports participation is on an uptrend, this driver will remain a factor for the expansion of this market.

Growing demand for non-invasive pain management procedure is driving the industry growth

The major growth driver for this market has been the demand for non-invasive pain management. More people are opting for alternatives to pharmaceutical drugs, in particular, with the growing fears over side effects, addiction, or the long-term use of pharmaceuticals and hot and cold therapy seem to be an excellent, non-invasive answer. These are easy to apply and provide exceptional relief for muscle soreness or joint pains due to injuries.

Cold therapy is good to reduce inflammation, numb pain and is very much useful in the case of acute injuries or flare-ups of chronic conditions. Heat therapy, by contrast, will promote blood flow, relax muscles, and reduce stiffness, thus relieving the chronic pain or tension. Home-based, non-medical supervision allows for its full accessibility.

Natural, drug-free options are widely in demand-whether it be for medical purposes, personal home health applications, due to a raised health-conscious perspective of self-health maintenance, but generally due to people seeking relief through noninvasive means by means of treatment in hot or cold therapy-based products from rudimentary items like hot packs or a cold compress as seen with newer versions in medical or physical products designed as body wear.

Increased adoption in post-surgical recovery creates further growth opportunity in the market

Key opportunity within the hot and cold therapy market is the expanding post-operative recovery market. Most patients experience swelling, inflammation, and pain after surgery, which temporarily impede healing and prolong recovery.

The increased demand within this area can be attributed to the basic safety profile of hot and cold therapy, providing a non-invasive and efficient method for the treatment of these symptoms with minimal risk of side effects and drug interactions.

Cold therapy, generally used postoperatively in the first day or two after surgery, assists in reducing edema and desensitizing pain through the constriction of blood vessels and inhibition of inflammation.

It may be particularly helpful in soft tissue surgeries, such as joint surgery, or with orthopedic surgeries. Heat is usually applied toward the end of recovery to improve blood flow, relax muscles, and reduce stiffness to facilitate recovery.

In this regard, with the health care industry focusing more on post-operative recovery and having minimal dependence on pain medications, the impact of hot and cold therapy products in clinical and home settings is becoming prominent.

This can be perceived as an ever-evolving market potential as patients and healthcare providers to ensure effective recovery in a safer, more accessible manner gradually seek after the therapies. Demand for hot and cold therapy products will be driven by this trend, which will positively affect the market expansion.

Competition from pharmaceutical alternatives may restrict market growth

Competition by pharmaceutical pain medicines is one major restriction in the market for hot and cold therapy. A large part of the people are still hooked to pharmaceutical medications such as NSAIDs or opioids that can easily deliver stronger, quicker relief against the pain caused by acute and chronic conditions.

Hot and cold therapy, compared to pharmaceutical medicines, may fail to provide equally strong or even more effective or fast relief to those patients that use these.

Because it can provide solutions for very extensive pain conditions, such as those that manifest very highly in intensity, there is no considerable appeal from invasive options into less invasive like the hot and cold therapy in persons with significant levels of pain.

For instance, though the inflammation may decrease from the cold, people with serious pain or consistent, intense discomforts may demand to be placed on stronger pharmaceutical drugs.

In addition, the easy availability and access to over-the-counter pain relief medications also work against the use of hot and cold therapy. Though hot and cold therapy products can be used to treat specific conditions, they do not match pharmaceuticals in the level of pain relief that these can offer. This, in turn, constrains their potential market share and limits consumer preference for non-drug-based treatments.

The global hot and cold therapy market recorded a CAGR of 6.3% during the historical period between 2020 and 2024. The growth of hot and cold therapy market was positive as it reached a value of USD 1,459.3 million in 2024 from USD 1,143.5 million in 2020.

Main pain management methods commonly used are nonsteroidal anti-inflammatory drugs; opioids, a medicine and a muscle relaxant; although effective, often cause side effects that lead to dependence and long-term health risks, among others, such as therapy, massage, and acupuncture; these are known time consuming as well as slow action.

In contrast, current methods such as hot and cold therapy provide non-invasive, drug-free alternatives. Cold therapy reduces inflammation and causes pain numbness, while heat therapy increases the blood flow, relaxes muscles, and does not cause major risks.

Hence, it is the most commonly adopted technique for dealing with both acute and chronic pains. With advancements in therapy products, such as wearable devices, these methods are becoming more effective and user-friendly.

Advances in therapy products are driving significant growth in the hot and cold therapy market. For example, wearable ice packs provide targeted cooling without restricting movement, while electric heating pads with adjustable temperature settings enhance the effectiveness and convenience of these therapies.

These products are better in comfort, easy to use, and more portable, so the consumers can deal with pain and inflammation more effectively in their homes or when traveling.

Since these products have become more complex and user-friendly, they draw in a wide variety of customers, including athletes, patients during post-surgical recovery, and chronic pain patients, which broadens the scope of market demand.

Tier 1 companies are the industry leaders with 38.8% of the global industry. These companies stand out for having a large product portfolio and a high production capacity.

These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. These companies frequently get involved in strategies such as acquisition and product launches. Prominent companies within tier 1 include Cardinal Health Inc., 3M, Medline Industries and Bruder Healthcare Company.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 31.7% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology.

The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Caldera International Inc., Breg Inc., and Dynarex Corporation.

Compared to Tiers 1 and 2, Tier 3 companies offer hot and cold therapy, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base.

The companies such as Polar Products Inc., ThermaCare, Mueller Sports Medicine and Others and others falls under tier 3 category. They specialize in specific products and cater to niche markets, adding diversity to the industry.

The market analysis for hot and cold therapy in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below.

It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 87.7%. By 2035, China is expected to experience a CAGR of 9.2% in the Asia-Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

| Germany | 5.9% |

| UK | 6.4% |

| France | 7.0% |

| China | 9.2% |

| South Korea | 8.3% |

| India | 10.1% |

Germany’s hot and cold therapy market is poised to exhibit a CAGR of 5.9% between 2025 and 2035. The Germany holds highest market share in European market.

The demand in Germany for noninvasive pain control is a major catalyst for the increase in the use of hot and cold therapy, as the healthcare delivery system is strongly emphasizing preventive measures and alternatives for pharmaceutical treatments and many people are being driven to not use drugs alone for pain due to side effects and long term dependency.

Hot and cold therapy is one of the safest, drug-free options that may be used easily both at home and in clinical settings, in alignment with the current trend toward self-care and holistic health.

Germany's advanced healthcare system and high health literacy also promote these treatments. Increasing cases of diseases like arthritis, muscle pain, and sports injuries, as well as cultural changes toward natural treatment, are making people seek the most effective and non-invasive pain management treatment.

Thus, more and more hot and cold therapy products are entering the market and consumers are accepting it, which has been contributing to the growth of this market in Germany.

United States is anticipated to show a CAGR of 5.5% between 2025 and 2035.

In the United States, the rising incidence of chronic pain is considered as one of the important drivers for market growth in the USA People are becoming aged, which means various conditions, like, arthritis, back pains, or a muscle strain is common, due to increased age.

There are millions of Americans with some form of chronic pain; also, in a significant population among elders. Increasing incidences of chronic pain are also forcing the need for effective pain management solutions.

Hot and cold therapy is non-invasive, drug-free alternative approach to pain management, which may be especially interesting as people find ways to rely less on prescription drugs, especially opioids, considering the addiction danger and side effects.

Cold therapy addresses inflammation and gives a numbing effect to patients, while hot therapy encourages increased blood flow within the body with the relief from muscle stiffness. These therapies can be easily practiced, are quite inexpensive, and are effective treatments for both acute and chronic pain. They have thus become popular for the management of long-term pain relief.

As the aged population continues to rise and there is a greater emphasis on holistic and non-invasive treatments, hot and cold therapy products are becoming increasingly adopted in the United States, driving market growth.

China is anticipated to show a CAGR of 9.2% between 2025 and 2035.

There is an increasingly huge demand for hot and cold therapy products in China as health and wellness continue to gain more popularity. In particular, more individuals are taking pain management to non-invasive, drug-free paths.

This is particularly due to greater awareness about holistic health, physical fitness, and overall well-being. A growing aged population, in cities, are looking for a more practical method of pain management as opposed to the traditional prescription drugs for simple pains such as muscular pain, arthritis, and stiffness.

Hot and cold therapy provides consumers with an easily implemented, accessible solution to their pains that integrates seamlessly into the overall self-care behaviors of the target audience.

These therapies are not only widely available but also increasingly promoted through wellness and recovery trends, with products like wearable ice packs, heating pads, and massaging devices gaining popularity.

The integration of these therapies into fitness recovery routines, especially among China's growing number of active individuals and athletes, further fuels their demand.

The hot and cold therapy market is experiencing healthy growth in China, primarily based on trends from health and wellness. This happens as more individuals increasingly seek non-invasive treatments for recovery and relief of pain.

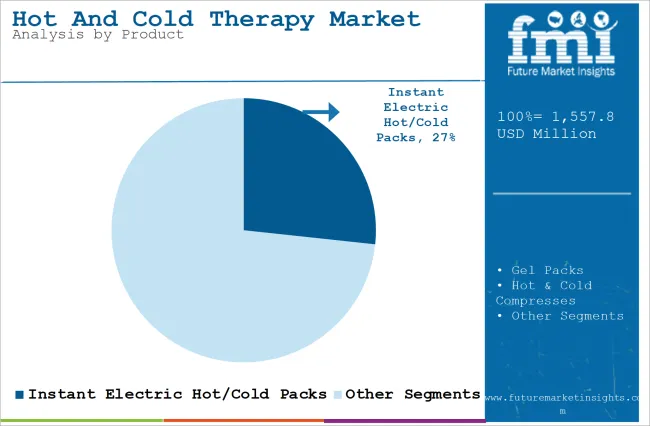

The section contains information about the leading segments in the industry. Based on product, the instant electric hot/cold packs segment is expected to account for 26.7% of the global share in 2023.

| By Product | Instant Electric Hot/Cold Packs |

|---|---|

| Value Share (2025) | 26.7% |

The instant electric hot/cold packs segment is projected to be a dominating segment in terms of revenue, accounting for almost 26.7% of the market share in 2025.

The instant electric hot/cold packs are expected to lead the market for hot and cold therapy. These are very convenient, efficient, and popular among consumers because they can easily apply heat or cold with a push of a button and give fast relief from pain, inflammation, and muscle stiffness.

They are highly versatile because they quickly switch between hot and cold. They are really good for all those conditions that run the gamut from sports injuries to chronic pain.

Electric packs are increasingly being used in clinical and home settings because they provide a constant temperature, unlike traditional packs that have to be prepared manually.

The demand for non-invasive, easy-to-use pain relief solutions, along with advancements in product design and portability, further contributes to the dominance of the segment. As consumer awareness of these benefits rises, instant electric hot/cold packs are expected to lead the market.

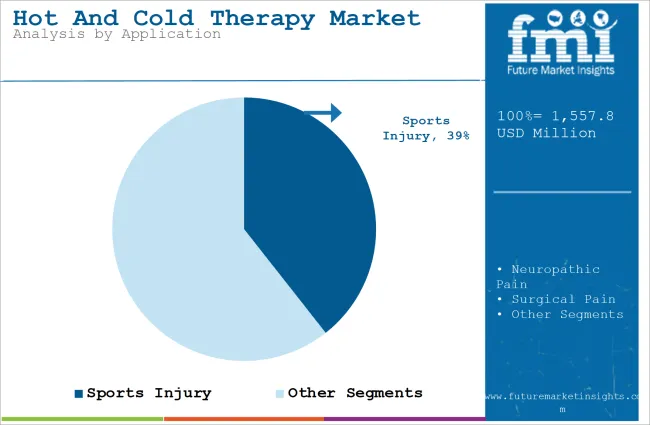

| By Application | Sports Injury |

|---|---|

| Value Share (2025) | 39.4% |

The sports injury segment will dominate the industry in terms of revenue, accounting for almost 39.4% of the market share in 2025.

The sports injury segment is going to lead the market due to rising participation in sports and physical activities, which ultimately leads to sports-related injuries.

Hot and cold therapy are mainly sought by athletes, fitness enthusiasts, and active people to provide pain relief as early as possible and also ensure recovery without delay. Cold therapy is used immediately after an injury as it reduces swelling and numbs the pain, whereas heat therapy aids in muscle relaxation during rehabilitation.

The focus of the population has now increased upon sports performance and injury prevention, thus raising a growing demand for the therapy products. Some examples include ice packs, compression wraps, and heating pads.

Both professional and amateur athletes widely utilize these therapies; thus, it contributes to its dominance in the market. Rising awareness regarding hot and cold therapy being an effective form of therapy for sports injuries is likely to make this segment more dominant in the market.

Key market players in the hot and cold therapy market are adopting several growth strategies to expand their market presence. These strategies include product innovation, where companies develop advanced products such as wearable electric hot/cold packs and smart therapy devices, offering enhanced usability and targeted relief.

Partnerships and collaborations with healthcare providers, sports organizations, and fitness influencers help increase brand visibility and reach new customer segments.

Additionally, players are focusing on geographical expansion, targeting emerging markets where demand for non-invasive pain relief is growing, such as in Asia Pacific and Latin America.

E-commerce platforms are also being leveraged to increase direct-to-consumer sales, making products more accessible and convenient. Lastly, companies are investing in marketing and awareness campaigns to educate consumers on the benefits of hot and cold therapy.

Recent Industry Developments in Hot and Cold Therapy Market

In terms of product, the industry is divided into Instant electric hot/cold packs, gel packs, hot & cold compresses, dry & moist packs, cryotherapy devices and others

In terms of application, the industry is segregated into sports injury, neuropathic pain, surgical pain and other applications

In terms of sales channel, the industry is divided into hospitals, clinics, retail pharmacies, online pharmacies and others.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global hot and cold therapy industry is projected to witness CAGR of 7.8% between 2025 and 2035.

The global hot and cold therapy market stood at USD 1,459.3 million in 2024.

The global hot and cold therapy industry is anticipated to reach USD 3,290.2 million by 2035 end.

China is expected to show a CAGR of 9.2% in the assessment period.

The key players operating in the global hot and cold therapy industry Cardinal Health Inc., 3M, Medline Industries, Bruder Healthcare Company, Caldera International Inc., Breg Inc., Dynarex Corporation, Polar Products Inc., ThermaCare, Mueller Sports Medicine and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Hot Air Sterilization Dust Mite Controller Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Intermediate Joint Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hot Stamping Foil Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesive Tapes Market Size and Share Forecast Outlook 2025 to 2035

Hotplate Stirrers Market Size and Share Forecast Outlook 2025 to 2035

Hot Runner Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hot Sauce Market Size and Share Forecast Outlook 2025 to 2035

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Hotel Central Reservation System Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesives Market Growth - Trends & Forecast 2025 to 2035

Hot Sauce Powder Market Analysis by Sauces, Dips, Soups, Convenience Food Products and other Applications Through 2035

Hotel Ice Dispensers Market - Hospitality Trends & Industry Forecast 2025 to 2035

Hot Chamber Die Casting Machine Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Hot Fill Packaging Manufacturers

Hotel Channel Management Market Analysis – Growth & Forecast 2024-2034

Hot Melt Equipment Market

Hot Rolled Or Cold Finished Alloy Steel Bars Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA