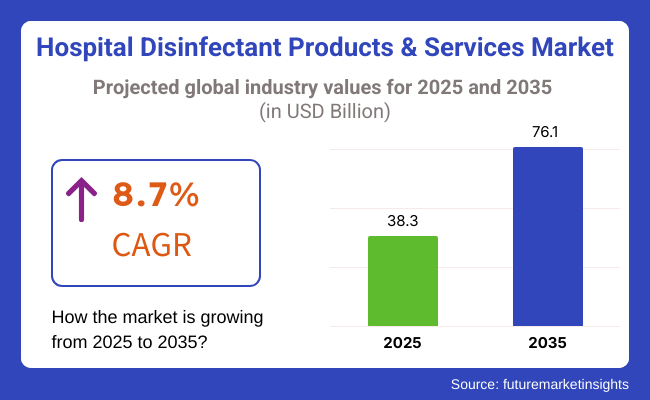

The hospital disinfectant products & services industry will witness rapid growth during the period between 2025 and 2035 because of heightened fear related to hospital-acquired infections (HAIs), tight regulatory controls, and technical innovation in sterilization technology. The industry would grow from USD 38.3 billion in 2025 to USD 76.1 billion in 2035 with a CAGR of 8.7% between 2025 and 2035.

Growing demand for hospital-grade disinfectants such as surface disinfectants, instrument sterilization solutions, and hand sanitizers will propel industry growth. Growth in automated disinfection systems will propel industry growth as well as increased usage of UV-C and hydrogen peroxide vapor technology.

Governments around the world are tightening sanitation standards, compelling hospitals to invest in effective infection control systems. The COVID-19 pandemic has also heightened awareness levels for hospital hygiene, making high-performance disinfectants and sanitization services even more important.

North America is going to dominate the industry with established healthcare infrastructure and rigorous infection control mandates, while Europe will be focusing on green and toxic-free disinfectants. Rapid growth in the Asia-Pacific will be spearheaded by increasing healthcare expenditures and increased hospital construction activity. These developments will see steady growth of the industry through 2035.

Explore FMI!

Book a free demo

The industry is escalating due to rising awareness of infection prevention, the strict hygiene regulation, and growing hospital-acquired infections (HAIs) in patients. Hospitals and clinics predominantly select products for ensuring patient safety and regulatory compliance that are most effective against germs, follow the rules and regulations, and are formulated as eco-friendly products.

Disinfectants in the pharmaceutical and medical device industries are among those that guarantee equipment compatibility and process adherence, thus securing product integrity. The diagnostic centers that handle big patient volumes also require relatively less thick yet powerful choices for cleaning, thus avoiding contamination.

The industry is experiencing a transformation towards the use of biodegradable, non-toxic disinfectants and self-operated disinfection alternatives like UV-C technology and fogging systems. The pandemic of Covid-19 has further highlighted the significance of infection control and thereby, the demand for state-of-the-art hospital disinfectant products and services has remained constant, resulting in innovation and sustainability in this critical healthcare sector.

From 2020 to 2024, the industry expanded at a high growth rate due to an increase in infection control practices, the COVID-19 pandemic, and increasing healthcare-associated infection (HAI) concern. Hospitals enhanced the utilization of disinfectant wipes, sprays, UV-C disinfection systems, and electrostatic sprayers for ensuring sterile environments.

There was an increased requirement for safe environmental, non-toxic disinfectants with the health centers striving to make compromises between effectiveness and safety in handling patients. Automated cleaning technologies and AI-based monitoring enhanced adherence and minimized human error. Distracting and costly supplies, companies concentrated on recasting formulations and creating international supply chains.

In 2025 to 2035, industry growth will be fueled by AI-based disinfection systems, antimicrobial nanotechnology, and green disinfectants. Robots and UV-C units with embedded AI will enable real-time pathogen detection and automatic surface disinfection.

Antimicrobial coatings and nano-disinfectants will be long-lasting, minimizing the need for multiple applications. Green products that are biodegradable and have natural ingredients will find favor with green goals. Blockchain-based supply chain tracking will ensure product quality and regulatory compliance, and predictive analytics will help hospitals to more accurately predict and prevent infection outbreaks.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Hospital-grade disinfectants with enhanced virus and bacterial killing capabilities were introduced by brands. UV-C light disinfection and electrostatic sprayers become mainstream. | Pathogen-detecting AI-based disinfection robots become the new standard. Nanotechnology-based disinfectants impart long-term antimicrobial protection. |

| Eco-friendly, biodegradable disinfectants and refillable systems become the norm among businesses to reduce waste. Water-efficient cleaning technologies emerge. | Zero-waste disinfection solutions for hospitals are the trendsetters. AI-controlled cleaning schedules reduce chemicals and enhance effectiveness. |

| Disinfection systems that were IoT-enabled allowed for remote operation and scheduling. Smart dispensers provided optimized use of disinfectant solutions. | Smart hygiene management systems with AI capability interface with hospital networks for real-time monitoring of sanitation. Blockchain technology provides transparency on hygiene compliance. |

| Growing emphasis on infection control during the post-pandemic era drove demand. Hospital accreditation requirements and regulatory adherence influenced buying habits. | Low-cost, AI-driven disinfection products are being developed by emerging economies. Infection control plans are made easy through predictive analytics using AI. |

| Improved hospital hygiene standards imposed by WHO and CDC pushed claims of product performance into transparency. Toxic-free and residue-free disinfectants gained traction. | Worldwide regulations require carbon-free, antimicrobial hospital surfaces and AI-based compliance tracking systems. Blockchain powers traceability of disinfectant supply chains. |

| Brands launched surface-specific disinfectants for operating rooms, ICUs, and high-touch surfaces. Subscription-based sanitation services gained popularity. | AI-powered disinfection solutions adjust to hospital configurations and patient flow. 3D-printed antimicrobial coatings offer customized infection control for high-risk areas. |

| Healthcare professionals, healthcare influencers, and infection control specialists promoted innovative hospital disinfection solutions. LinkedIn and industry webinars drove awareness. | Virtual hospital sanitation experts and metaverse-based medical sanitation training revolutionize learning. AR-enabled simulations demonstrate product efficacy in real time. |

| Hospitals preferred EPA-registered, rapid-disinfecting disinfectants with a wide range of efficacy. There was increased demand for touchless and automated disinfection technologies. | Hospital hygiene drawing from biohacking involves in situ pathogen detection in real-time. Disinfection algorithms based on artificial intelligence create completely automated, self-disinfecting medical environments. |

The industry is prone to many risks including regulatory compliance, supply chain disruptions, antimicrobial resistance and fierce competition. The main priority for permanent growth is to provide the products that are effective and safe while keeping the cost efficiency under control.

Regulatory compliance can be counted as one of the highest challenges. Disinfectants are required to comply with the norms of FDA, EPA, CDC and WHO and failing to do so would incur heavy penalties, product recalls or even bans. Corporations ought to keep a vigilant eye on the amendments in international health rules and implement strict testing and product certifications.

Supply chain disruptions may affect the procurement of raw materials such as ethanol, hydrogen peroxide, and quaternary ammonium compounds. Geopolitical conflicts, health crises, and logistical issues lead to price fluctuations and production delays, which in turn harm hospital operations. In order to alleviate these risks, it is feasible to set up both multi-source suppliers and in-house production plants.

Antimicrobial resistance (AMR) is a potential issue that has to be addressed no matter the circumstances. Unnecessary use or improper application of disinfectants can form the resistant pathogens which will bring to inefficiency of the previous solutions. The companies should allocate a fraction of their resource towards formulating new products, UV-based sterilization, and AI-driven sanitation protocols to deal with this issue first.

Lastly, cut-throat industry competition forces firms to have cost productivity and at the same time be innovative. Health facilities are looking for value solutions that do not damage the efficiency of the product, therefore, the product differentiation and the strategic alliances are the keys for sustainability.

The liquid disinfectant segment will continue to dominate the industry, accounting for 65-70% of total sales in 2025. Used widely in hospitals, operating rooms, ICUs, and patient care areas, these disinfectants in diverse formulations are also relatively broad-acting against both bacteria and viruses. The most frequently used formulations include those based on alcohol, those based on chlorine, and those using quaternary ammonium compounds (QACs).

Some of the leading manufacturers, including 3M, Ecolab, and Diversey, offer hospital-grade solutions with formulations approved by the EPA and WHO that are compliant with international healthcare hygiene regulations. The growing awareness towards the prevention of hospital-acquired infections (HAIs) and strict adherence to infection control protocols are major growth factors for this segment.

Demand for disinfectant wipes and spray is also expected to contribute about 15-20% of industry sales, primarily as they are portable and convenient to use. These products are common for rapid surface disinfection in patient rooms, medical equipment, and high-touch surfaces.

Hospital-grade formulations dominate this segment, with brands such as Clorox, Lysol (Reckitt), and CaviWipes (Metrex). Segment size differences (5-10% industry share) are compensated in UV disinfection with the rapid growth of this non-chemical, eco-disinfection method.

Hospitals are spending more on Ultraviolet-C disinfection robots from companies like Xenex and Tru-D SmartUVC that automate killing pathogens in patient rooms and surgical suites. As the need for disinfecting products and in turn are inestimably high, the need for new and cutting-edge technology in the field cannot be taken lightly.

Based on the application, the industry is segmented into skincare (hand sanitizers, skin cleansers) and surface cleansers (toilet, floor, and general disinfectants).

The industry is mainly driven by surface disinfectants, responsible for 55-60% of the total sales in 2025. These products are essential for infection prevention in ICUs, operating rooms, patient wards, and high-touch surfaces like doorknobs and medical instruments.

Liquid disinfectants, sprays, and wipes are commonly used, with a host of brands like Ecolab, Diversey, and Clorox offering hospital-grade products and EPA- and WHO-approved formulations. With strict disinfection protocols in place due to the rising incidence of hospital-acquired infections (HAIs), which affect approximately 7-10% of all hospitalized patients worldwide, demand for advanced cleaning technology is increasing.

Skincare disinfectant accounts for 40-45% of the industry and is primarily driven by increasing awareness towards hand hygiene compliance in healthcare settings. Commonly used formulations to disrupt pathogen transmission include hand sanitizers, skin-compatible antiseptic solutions, and moisturizing disinfectant lotions.

This space is dominated by alcohol-based hand sanitizers, with brands like Purell (GOJO), Dettol (Reckitt), and Clorox, which rapidly kill bacteria and viruses. Studies have shown that 80% of infections are spread through hands, leading healthcare facilities to adopt touch-free sanitizer dispenser lines and skin-friendly formulations to enhance hygiene adherence.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.9% |

| UK | 7.5% |

| Germany | 7.6% |

| India | 8.3% |

| China | 8.5% |

The USA industry is increasing with increased awareness of hospital-acquired infection (HAI), stricter healthcare regulations, and improvements in sterilization technology. Hospitals are increasingly using high-performance disinfectants and the top three industry leaders, 3M, Ecolab, and STERIS Corporation are leading the way.

Antimicrobial-resistant pathogens have also driven demand for effective disinfection solutions. The innovation of automated disinfection technology, e.g., UV-based sterilizing robots, has improved hospital sanitation with fewer human contacts and greater efficiency. FMI is of the opinion that the USA industry is slated to grow at 7.9% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Advanced Disinfection and Sterilization | Hospitals adopt advanced technologies like UV-C disinfection robots to fight superbugs. |

| Stricter Regulatory Compliance | Healthcare legislation ensures stringent sanitation standards, fueling demand for high-performance disinfectants. |

| Growing Use of AI-Based Cleaning Solutions | AI-based workforce disinfection robots, for example, are used in large hospitals to simplify infection control. |

The UK industry is growing as healthcare facilities highly prioritize not getting infected. Cleanliness policies from the government, spending on health care facilities, and a transition towards environmentally friendly disinfectants drive the industry.

Reckitt, Diversey, and PDI International are giant firms that have launched non-toxic and degradable disinfectants to serve the purpose of green sanitary goods. FMI is of the opinion that the UK industry is slated to grow at 7.5% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Hospital Emphasis on Sanitation | Healthcare facilities employ high-tech cleaning to prevent HAIs. |

| Growth in Eco-Friendly Disinfectants | Eco-awareness increases demand for biodegradable and non-toxic disinfectants. |

| AI-Based System Emergence | Smart disinfection systems enhance hospital hygiene. |

Germany's industry is growing strongly as healthcare facilities require certified high-performance sterilizing agents. Infection prevention has led to increased demand for surface and air disinfectant products like fogging and UV sterilization. Schülke & Mayr, BODE Chemie, and Hartmann Group are investing in eco-friendly, highly effective disinfecting products. FMI is of the opinion that the German industry is slated to grow at 7.6% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Hospital-Grade Disinfectant Demand | Disinfectants found to be effective against multi-drug-resistant pathogens are of maximum priority to hospitals. |

| Bounce in Air Disinfection and Surface | Accelerated application of advanced sterilization technology such as UV fogging. |

| Bounce in Environmental Disinfection | Environmental programs by hospitals promote the use of organic cleaning products. |

India's industry is growing very fast with the evolving healthcare infrastructure, government pro-hospital sanitation initiatives, and rising awareness of HAIs. Value-for-money and high-performance disinfectants are sought after, and retailing channels through the internet help in making them available across the board.

Established brands like Godrej Protekt, ITC Savlon, and Diversey India are competitively setting industry presence. FMI is of the opinion that the Indian industry is slated to grow at 8.3% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Initiatives for Hygiene | Policies demand strict infection control in private and public hospitals. |

| Need for Cost-Effective Disinfectants | Cost-effective healthcare centers seek low-cost products of good quality. |

| Healthcare E-commerce Development | Web-based portals make online purchases easy and distribute them mass. |

China's industry is growing at a fast pace, fueled by rises in healthcare spending, stringent hospital hygiene rules, and the demand for automated disinfection systems. AI-based and touchless disinfection systems are becoming more popular, with hospitals embracing advanced sterilization technology to improve infection control. Blue Moon, Guangzhou Lifeng, and Johnson & Johnson China lead the industry through expansion. FMI is of the opinion that the Chinese industry is slated to grow at 8.5% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| AI-Based Disinfection Demand | Utilization of contactless sanitizing systems is promoted by hospital smart software. |

| Cross-Border Online Consumption Hike | Foreign disinfectant companies enter China through online outlets. |

| Government-sponsored Sanitation Policies | Regulations improve the facilitation of rigorous sterilization and sanitation rules. |

The industry is quickly expanding with growing stakes against HAIs, stricter hygiene policies, and increasing developments in disinfection technologies. AI-powered monitoring and automated disinfection systems are quickly becoming part of the norm in adoption trends for healthcare facilities, with eco-friendly solutions adding a paradigm of compliance for enhanced patient safety.

Ecolab, 3M, Procter & Gamble, Reckitt Benckiser, and Johnson & Johnson are among the key players offering hospital-grade disinfectants, UV-C disinfection systems, and electrostatic sprayers. Most start-ups and niche providers are focusing their efforts on biodegradable disinfectants, AI-driven hygiene monitoring, and antimicrobial surface coatings as their way to be unique in the industry.

Industry evolution is driven by new technological innovations such as touchless disinfection, IoT-linked sanitization tracking, and hydrogen peroxide vapor systems. That is non-toxic and leaves no residues, and it is being used to supplement high-efficacy formulations that hospitals and clinics are adopting in their infection control measures.

Other strategic factors influencing competition include product efficacy, legal compliance, sustainability, and automation. Companies investing in smart disinfection technologies, antimicrobial resistance (AMR) research, and personalized infection prevention solutions will gain a competitive edge in this high-demand industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ecolab Inc. | 15-20% |

| 3M Company | 10-15% |

| Procter & Gamble Co. | 10-12% |

| Reckitt Benckiser Group PLC | 8-10% |

| Johnson & Johnson | 5-8% |

| Other Companies | 35-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ecolab Inc. | Provides a comprehensive range of disinfectant products and services, including surface cleaners, hand sanitizers, and sterilization solutions. |

| 3M Company | Offers disinfectant products such as surface wipes, sprays, and hand hygiene solutions, focusing on innovation and efficacy. |

| Procter & Gamble Co. | Supplies hospital-grade disinfectant products, including surface cleaners and sanitizers, leveraging strong brand recognition. |

| Reckitt Benckiser Group PLC | Produces a variety of disinfectant products under well-known brands, catering to hospital hygiene needs. |

| Johnson & Johnson | Offers disinfectant solutions and sterilization products, emphasizing safety and effectiveness. |

Key Companies Insights

Ecolab Inc. (15-20%)

Ecolab Inc. ranks first, with perhaps the widest range of disinfectants in the industry. The company works towards providing innovative solutions to meet new healthcare demands, endeavoring to enhance product efficacy and safety through research and development.

3M Company (10-15%)

3M Company works toward innovation opportunities for infection control in healthcare disinfectant products with the effective application of substantial development resources on advanced materials and technologies.

Procter & Gamble Co. (10-12%)

Procter & Gamble uses its well-known brand name to provide hospitals with reasonably dependable disinfectant products. It ensures that hygiene products developed for the specific needs of healthcare facilities are regulatory compliant so as to broaden their offerings.

Reckitt Benckiser Group PLC (8-10%)

Under its established disinfectant brands, Reckitt Benckiser Group PLC provides demand for hospital cleanliness. Its focus is to expand its industry presence by means of further product development and improved distribution channels.

Johnson & Johnson (5-8%)

Offering disinfectant solutions and sterilization products, Johnson & Johnson stresses safety and efficacy. It researches to develop products that truly withstand the stringent demands of healthcare environments.

Other Key Players (35-50% Combined)

The industry is slated to reach USD 38.3 billion in 2025.

The industry is predicted to reach a size of USD 76.1 billion by 2035.

Colgate-Palmolive Company, Contec Inc., Ecolab Inc., Georgia-Pacific LLC, GOJO Industries, Inc., Henry Schein, Inc., Johnson & Johnson Company, Kimberly-Clark Corporation, Reckitt Benckiser Group plc, S. C. Johnson & Son, Inc., The Clorox Company, The Procter & Gamble Company, 3M Company, Belimed AG, Getinge AB, SAKURA SI Co. Ltd., Steelco S.p.A., STERIS PLC, Terragene S.A., and Tuttnauer are the key players in the industry.

China, slated to grow at 8.5% CAGR during the forecast period, is poised for the fastest growth.

Liquid disinfectants are being widely used.

By product type, the industry is segmented into liquid, gel & lotions, spray & foam, wipes, devices, other types.

By application, the industry is segmented into skincare (skin cleansers, hand sanitizers, surgical scrubs, skin conditioners, other skincare), surface cleansers (toilet cleansers, floor cleansers, surface sanitizer, instrument decontaminant solution, disinfectant instrument accessories), hand sanitizer dispensers (UV disinfectant, fogger disinfectant, air purifier, water sterilizer, other accessories), water cleaners (water disinfectant solution, water disinfectant products), air cleaners (air neutralizer, air freshener), surveillance providers (antimicrobial stewardship, infection prevention, other surveillance providers).

By region, the industry spans North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East & Africa.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.