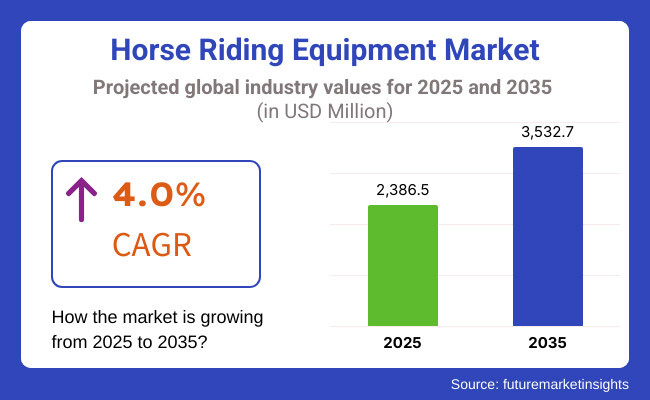

The global horse-riding equipment market is poised for substantial expansion, increasing from USD 2,386.5 million in 2025 to USD 3,532.7 million by 2035. The market is expected to grow at a CAGR of 4.0% from 2025 to 2035.

Awareness grows around the risks involved with horse riding; riders are investing in certified helmets, protective vests, and specialized footwear to minimize risk. This has bolstered the horse riding equipment demand. Stringent safety regulations and a burgeoning equestrian events scene will fuel growth in the horse-riding equipment marketplace in developing regions.

An increase in research and development will provide manufacturers with advanced materials and design features to enhance safety and performance. E-commerce has expanded dramatically, increasing the number of vendors by making it easier for riders to access a wide range of safety gear. This growth parameter also drives market growth.

Growing awareness surrounding the risks taken in horse riding is a case in point where riders are investing in certified helmets, protective vests, and specialized footwear to reduce risk. This is a big reason for the growth of the horse riding equipment market. Nailed-up safety regulations and a rising equestrian events background will increase the sales of horse riding equipment market in developing markets.

More research and development will provide the manufacturers with advanced materials and the needed design features to enhance safety and performance. The boom in e-commerce has burgeoned-and a multitude of vendors emerged with simplified access for riders to a wide range of safety equipment. This trend has also been known to drive market growth.

Leading horse riding equipment brands and manufacturers are integrating technology for improved safety (e.g., airbag vests) or performance monitoring. Horse riding equipment market share analysis of key players shows nascent growth with innovations and variation according to rider’s needs.

Competitive strategies and marketing trends in the horse riding equipment industry continue to grow and innovate, with stakeholders attuning to running trends. Expansion of equestrian sports and recreational riding activities have been propulsion to development. Around the world, increasing participation in disciplines like show jumping, dressage, trail riding, and evening planning has created strong demands for tailored equipment.

Moreover, increasing urbanization and spending income in emerging economies are pushing up equestrian tourism and leisure activities. These trends present opportunities for manufacturers and other major players to meet the needs and come up with products for the riders globally.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the horse riding equipment industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.5% (2024 to 2034) |

| H2 2024 | 3.6% (2024 to 2034) |

| H1 2025 | 4.7% (2025 to 2035) |

| H2 2025 | 3.3% (2025 to 2035) |

The CAGR exhibits a fluctuating trend, initially increasing by 45 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. Further, a slight increase of 47 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external growth.

Growth declines in H2 (2025 to 2035) with a 33 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

Increase in Popularity for Horse Riding Sport and Competitors Becoming Many

The growth of horse riding, both for competitive and recreational purposes, is likely to drive the demand for saddles, bridles, protective gear, and riding attire.

Such a trend mostly exists in regions with strong equestrian culture as well as the emerging markets where equestrian sport is rising. Therefore, increasing participation in and the popularity of this sport has driven sales of horse riding investments.

Safety Concerns and Technological Advancements in Fabrics Used

That's what has driven the demand amongst the riders for certified helmets, protective vests, and more equipment. Riders are looking for products that would offer maximum safety and comfort combined with their performance. Manufacturers have been responding to the call for a few more investments in research and development to bring innovative safety solutions to the market.

Pop loose helmets of state-of-the-art impact absorption technology and modern lightweight breathable fabrics for protective vests rose to popularity and spiked sales. These parameters set the path for the further growth of this sector.

Expansion of Equestrian Tourism and Leisure Riding

Increasingly, urbanization and changing lifestyles and spending capabilities allow many more people to indulge their interests in outdoor recreational activities like horseback riding. While in the past couple of years’ equestrian tourism destinations have invited riders to appreciate beautiful trails, conduct guided rides, and witness horse culture in various locales, such encounters have pivoted to create greater demand for the supply of this sort of equipment.

Technological Advancements in Design

Manufacturers highly positively respond to technological improvements in materials science and product design that the riding equipment updates undergo. Manufacturers are taking advantage of this technology to make products that provide more durability, functionality, and aesthetic appeal.

Modern design and technology have influenced equestrian riding gear where the internal padding bears the impact of spent materials such as breathable fabric, synthetic fibres, and lightweight polymer. Trade in custom or made-to-order horse riding wear has also gained tremendous momentum with technology. The craze among followers and rider groups of teams and the same jerseys has created such increasing demand for the equipment across the continuum.

The global horse riding equipment market was registered at a CAGR of 3.1% from 2020 to 2024, with a valuation of USD 2,017.4 million in 2020. The sector faced many hurdles with the pandemic and the affordability of this equipment. Manufacturers faced huge problems with raw material costs and availability. Also, many major companies lack customers to depend on.

Increasing participation in horse riding as a result of social media influencers strengthens the revenue streams of this sector. The impact of social media influencers on equestrian fashion and equipment choices doubled the sales of this sector. The visibility of brands and marketing strategies hold significant pat with the onset of social media.

This change in scenario also shaped the balance of this sector. Social media fame, collaborations, and huge responses raised bars for the common populace, and this spurred the rise of second-hand marketplaces for horse riding equipment catering to affordability and accessibility to all people.

With huge demand and growing sales channels than ever before, the industry shows a gradual rise in development scale. The industry is now estimated to report a CAGR of 4.0% from 2025 to 2035. Customization and depersonalization also created a new era for this sector.

As demand for luxury and premium products heightened and expanded the landscape to a broader range. Innovations and the integration of modern technology have also benefitted the development of this landscape in the last few years.

The Tier 1 companies will be recognized for quality workmanship, creativity, and commitment on grounds of rider safety and comfort. They also possess a very substantial presence in the global market for horse riding equipment, providing opportunities for them to establish an effective distribution network and sound partnerships.

Tier 2 companies are also making notable strides in the global horse-riding equipment sector. They are not as exciting as tier 1, but they offer a wide range of quality products at competitive prices, appealing broad spectrum of riders.

These companies often focus on specific niches or segments within the sector. They leverage their expertise to meet the diverse needs and preferences of riders. Tier 2 companies include Kerrits, Dublin, Tredstep Ireland, Troxel, and Shires Equestrian Products.

Tier 3 companies are carving out their place in this industry, facing stiff competition from larger brands. Still, they differentiate themselves through specialization in unique products or innovative solutions. These companies often prioritize customer stratification, product quality, and durability, earning customer loyalty.

Through targeted marketing campaigns, collaborations with equestrian -professionals, and adaptation to emerging trends, they continue to survive. Tier 3 companies are Cashel Company, EquiFit, Back on Track, Weaver Leather, and Professional’s Choice.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 3.2 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 2.5 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 2.8 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 2.2 |

| Country | Australia |

|---|---|

| Population (millions) | 26.3 |

| Estimated Per Capita Spending (USD) | 2.7 |

The United States, with a per capita spending of USD 3.20, is driven by a deeply rooted culture of horseback riding in both professional and recreational settings. At the same time, demand for high-quality horse-riding equipment, especially safety gear, is expected to be driven by this growth in interest in equestrian sports and disposable incomes.

The United Kingdom's equestrian market, with a per capita spending of USD 2.50, rides on a long tradition of equestrianism. Increased interest in the sport of horseback riding, along with government safety regulations and a higher focus on competitive riding events, has contributed to an ever-growing demand for high-grade riding equipment.

The final per-capita expandable market of Germany can be seen with the last figure at USD 2.80, stressing quality in the equestrian judgment. It tends rather toward durable and innovative riding equipment, primarily driven by professionals engaged in equestrian competition and leisure riding.

With per capita spending of USD 2.20, the Japanese equestrian market is slowly emerging. The found demand stretches from immense interest in horseback riding as a leisurely activity to significant investment in riding clubs and riding schools. Advances in the technology of horse riding equipment attract purchase power from safety-focused consumers, hence pushing demand.

The horse-riding culture of Australia consumes per capita spending of about USD 2.70 and is rooted mostly in the stem of equestrian rather than rural and rural-oriented competitions. The market thrives on demand for premium-quality saddles, safety gear, and performance standards in riding equipment, though this sector is equally favoured by professionals and amateurs.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 8.4% |

| China | 7.3% |

| Australia | 6.9% |

| Germany | 4.3% |

| United States | 3.8% |

India has cultural significance in horse riding. Indian landscape has seen an uptick in the establishment of riding schools, clubs, and equestrian events. This has driven demand for quality horse riding equipment. Government initiatives to promote sports and recreational activities have also played a notable role in boosting the equestrian sector.

Also, the rise of social media and digital platforms has made question sports more accessible and appealing to young audiences. This expansion has triggered the Indian horse riding equipment market with an estimated CAGR of 8.4% through 2035.

Indian brands such as Rider’s Own, Royal Sports, and Riders International have gained recognition for producing durable and competitively priced equipment.

These brands are leveraging India’s skilled craftsmanship and extensive leather industry to produce premium products. This approach and developments are appealing both domestically and internationally, making India hold a leading position in this industry.

Australia's favourable climate, vast grassy plains, established horse breeding, and racing traditions create very promising demand for equestrian riders in the Australian equestrian industry, which attains a CAGR of 6.9% for the period 2025 to 2035, supplementing equestrian events such as show-jumping, dressage, and endurance riding.

This has forced the demand for good quality riding equipment. Australia holds strong government support and private investments in equestrian sports essential for the country’s development. Also, Australian riders have success rates on international stages; this has increased parallel demand for premium and specialized riding gear, meeting international standards.

Economic stability and disposable income contribute to the ability of American consumers to invest in high-quality gear. Growing awareness of safety standards and the adoption of advanced materials and technology in equipment design have spurred the growth of the horse-riding equipment industry in the United States.

The United States is estimated to report a CAGR of 3.8% through 2035. Several prominent brands are leading the United States horse riding equipment landscape. Ariat, Dover Saddlery, and Tipperary Equestrian are only a few of the major respected names that provide great quality products enhanced by advanced designs; for example, Ariat is known for providing advanced technologies in its footwear systems.

| Segment (Product Type) | CAGR (2025 to 2035) |

|---|---|

| Helmets | 3.5% |

The design of riding helmets are dedicated to preventing head injuries, which are common and the most severe in equestrian sports. Increased awareness of the safety standards has implemented the equestrian organizations and strict regulations of riding schools for a huge increase in the sale of helmets.

Compliance with these regulations usually enforces wearing accredited helmets both during competitions as well as leisure riding. This is leading to a steady demand for helmets. Thus helmets have covered a value share of 27.1% for 2024.

Progress in helmet technology about materials for better impact absorption, ventilation systems, and comfort has made helmets even more appealing to riders today. This is further propelling growth. Also, the popularity of helmets in the horse riding equipment industry is influenced by rising participation in equestrian sports globally.

| Segment (Material Type) | CAGR (2025 to 2035) |

|---|---|

| Leather | 3.8% |

The work of equestrian activities requires gear capable of withstanding rigorous use and exposure to the elements, and it is leather that provides sufficient strength and resilience to make it the most desirable. Products such as saddles, bridles, and boots made from leather provide the best combination of flexibility and firmness.

This gives support and comfort for both rider and horse, plus, leather conforms to both rider and horse over time. It improves fit and performance. Thus leather is the ideal choice for furthering this gain in popularity and legacy and has quite an impressive value share of 39.3% in 2024.

The case for leather products as a good investment is saved by the long-lasting quality of the product. This is a consolidating factor in leather riding equipment gaining more punch in that regard. The load from the design makes leather the material of choice being aesthetically and culturally relevant.

The association of leather with equestrian traditions goes far back and instantaneously symbolizes craftsmanship and heritage. This is attractive to a range of competitive and recreational riders. Leather is one of those luxurious materials that adds a sophisticated look and feel, bringing great class and quality, like a boon to dominate the market.

Manufacturers are focused on craftsmanship with modern technology. This ensures both aesthetic appeal and functional excellence. Riders are increasingly preferring customizable and ergonomic equipment that can be tailored to their needs.

Thus, major brands are continuously innovating and improving their offerings. Also, key companies are expanding their product lines and enhancing their online presence to reach a broader audience. Brands are focusing on incorporating ergonomic design with sustainable materials to reach international safety standards:

Recent Industry Developments

The market is expected to grow at ~4.0% CAGR between 2025 and 2035.

The industry stood at USD 2,386.5 million in 2025.

The market is projected to reach USD 3,532.7 million by 2035.

South Asia is expected to grow at an 8.4% CAGR during the forecast period.

Major players Colonial Saddlery, Dainese, Georg Kieffer Sattlerwarenfabrik GmbH, Decathlon, and Cavallo GmbH among others.

Helmets and Others are the key segments driving market growth.

The material type segment is segregated into Leather and Others.

The market spans across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Children Mattress Market Product Type, Ingredient Type, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Fabric Softener Market Analysis by Nature, Product Type, End Use, Sales Channel & Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.