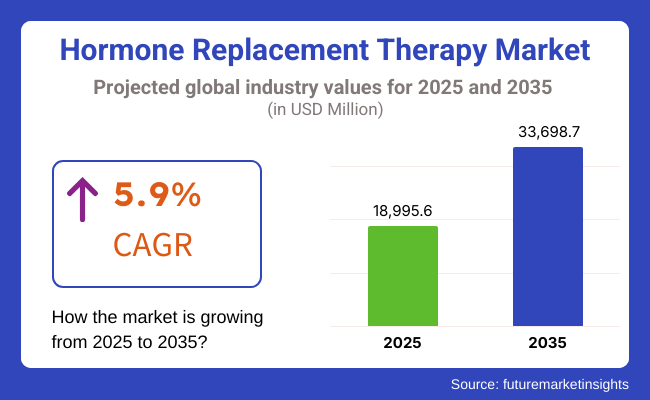

In the coming years the hormone replacement therapy products market is expected to reach USD 18,995.6 million by 2025 and is expected to steadily grow at a CAGR of 5.9% to reach USD 33,698.7 million by 2035. In 2024, hormone replacement therapy have generated roughly USD 17,937.3 million in revenues.

Hormone Replacement Therapy (HRT) is the introduction of synthetic or identical hormones in place of those that the body no longer produces and is often a byproduct of menopause or other hormone imbalances. HRT in particular counters the constantly occurring hot flashes, night sweats, mood moments, and vaginal dryness. Likewise, other uses included treating osteoporosis in women and avoiding heart diseases connected with postmenopausal women by decrease in estrogen in the body during that period.

Consequently, the increased usage of that particular therapy can be accounted for mainly by the increased knowledge about menstruation and the treatable symptoms that are caused by HRT. Women are now finding the advantages of HRT and consequently they are the ones who are asking for therapy, which in the end will enhance their life and reduce the discomfort.

Additionally, through the introduction of newer HRT drugs and products with fewer side effects and therefore, therapies are now being carried out but are much more favorable to patients. Health care services, insurance, and individualized treatment plans that are more accessible are really instrumental in the uptake of therapy.

Aging people more and the progress in medicine have given most of the people a reason to consider hormorne replacement therapy to eliminate hormonal imbalances They search for hormone therapy or HRT because of the increase of aging complexes and the better of medical technology and biomedicine as a prospective treatment for hormonal vulnerabilities.

Key Market Metrics

Factors such as hormonal imbalance has revolutionized the market of hormone replacement therapy (HRT) historically. The rise in women opting for treatments for such symptoms as hot flashes, sleep deprivation, and mood swings consequently increased the consumption of HRT. The introduction of better, safer, less side effect-prone formulations of such applications, bioidentical hormones, continues to contribute to growth.

The move toward personalized medicine also has an avenue through which treatment becomes individualized and thus contributes to better patient outcomes.

New delivery forms like transdermal patches, gels, and tablets make it patient-friendly regarding compliance. Telemedicine has increased convenience in consulting for HRT.

In the coming years, the continued increase in the aging population globally, as well as the growing concern for women's health, will continue propelling the demand for HRT. Growth will further be driven by the increasing coverage of insurance, improved access to healthcare, and, of course, the research into the effects of HRT on health in the long term.

Explore FMI!

Book a free demo

A steady increase in the numbers of women taking Hormone Replacement Therapy (HRT) with greater awareness of its advantages to women in menopause or hormonal problems anticipate the growth of the market. The continues rise of hot flush and hormonal imbalance condition among women leads to increase in demand for hormonal replacement therapy products as it treats such conditions while enhancing the quality of life.

Another leading development in the cause is the evolution in HRT drugs, such as the emergence of bioidentical hormones. Such therapies are safer with less side effects, thus creating trust among patients for uptake. The increase in personalized medicine, which enables customized treatment matching one's requirement, further boosts popularity.

North American healthcare practitioners are increasingly prescribing HRT as part of holistic menopause care, and thus there is greater acceptance among patients. Within the few years gone by, insurance coverage has increased, making the procedure more feasible for many women.

In addition, telemedicine, the newest innovation, has enabled remote consultations, making it easier for women to speak with their physicians regarding HRT. All of this availability has played a vital part in bringing HRT into the fold of a more common and socially acceptable method for treating those hormonal imbalances across North America.

Rising awareness among women, especially menopausal ones, has birthed an extremely high demand for HRT to regulate the symptomatologies of hot flushes, night sweats, and mood swings. Aging in countries like Germany, France, and the UK means that progressively greater numbers of women with each passing year are essentially in search of efficient remedies to cope with hormonal disarray.

Furthermore, improved formulations of HRT are also worthwhile contributors to greater acceptance. The use of bioidentical hormones, which replicate the body's own hormones, is witnessing a significant popularity among professionals and end users. This popularity is majorly due to its fewer side effects compared to synthetic alternatives.

In Europe, a patient-friendly regulatory environment and a positive EMA opinion have fostered a sense of trust among patients that HRT is safe and effective. Educational campaigns orchestrated by the British Menopause Society, among others, have further catalyzed increased demand.

Increased access to medical services and improved insurance systems, altogether, helped raise the amicableness and affordability of HRT and turned it into a trending choice among European women.

The growing recognition of menopause symptoms and the availability of HRT (hormone replacement therapy), therefore, is propelling the modicum of treatment undertaken by women. Due to aging populations, countries like Japan, China, and India also have increasing numbers of women entering menopause, thus generating an ever-greater demand for effective means to control such symptoms as hot flushes, mood swings, and night sweats.

The cultural milieu is also using a tool of its own in driving the HRT uptake. More and more women, searching for modern solution for health and wellbeing, with a plethora of Asian cultures having their traditional beliefs supplemented with modern medicine, are becoming more tolerant of HRT and other medical interventions.

With scientific evolutionary improvements to HRT formulation, particularly bioidentical hormones, the desire has many followers across Asia-Pacific. Such treatment modalities are thought to be safer and more acceptable.

And with better access to healthcare services, especially in urban centers, the convenience of HRT has increased manifold. Women with greater disposable income in places like China and India have the option of availing themselves of such treatments. Healthcare professionals have likewise been promoting more HRT in the wake of tangible proofs of its ability to positively impact the quality of life during menopause.

Side Effects Associated with Hormone Replacement Therapy Products hinders its Adoption in the Market

Hormone Replacement Therapy is difficult, if not impossible, due to continued fears regarding safety. The therapy is assured to relieve symptoms associated with menopause, but may cause a higher risk of breast cancer, blood clotting, and increasing the chances of stroke after long-term exposure.

Most women, therefore, opted for other therapies, such as herbal supplements and changes in diet, which in turn made medical practitioners more reserved toward prescribing HRT. In this case, more education on the pros and cons of therapy should be put forward to females so that more safe and personalized methods of treatment can be formulated that will help disabuse fears and lead women into more informing decisions.

Emphasis on Manufacturers on Developing Bioidentical Hormone therapies can bring New Business Opportunities to the Players

HRT seems to gain much momentum even in the personalized medicine context as the trend for many women shifts to more individualized approaches for better health during menopause. The body's hormone levels and needs are highly heterogeneous in women, which has invariably created a demand for individualized therapies in HRT, some specifically such as bioidentical hormones that mimic natural body function.

This general movement towards personalization and increased awareness of menopause and its symptoms represent a perfect opportunity for innovation in HRT. Considering that personalization will make it cheaper to avail these technologies, HRT will have vast potential for development in years to come, making it a safer, effective, and larger subsector in the field.

The Evolving Landscape of Hormone Replacement Therapy: Innovations, Growing Demand, and Regulatory Support:

Hormonal Replacement Therapy is a therapy that changes with time and brings about improvements in the treatments making it more patient-friendly. Some innovations like transdermal patches, gels, and long-acting implants release hormones continuously and minimize side effects and discomfort. At the same time, nanotechnology can now target hormone delivery more accurately and yield better results with less risk.

Increased numbers of men seeking HRT are also due to improved awareness on testosterone deficiency and hormone imbalance with aging in men. Symptoms of andropause and hypogonadism become better-known signs that push many to seek testosterone therapy replacement.

Additionally, the development of sports medicine and aging has increased the demand because men now want to look for ways in which they can retain their energy and vigor as well as general health.

Furthermore, moving the regulatory bodies ahead in the market will reduce the timelines of approval and provide more funding for clinical trials, which will open HRT for mass adoption. The concept of bioidentical hormones, mimicking natural ones, also contributes toward development. These treatments are becoming safer and more effective over time, as they are closely monitored in real-world use.

Bioidentical Hormones: The choice of more and more people for hormone replacement therapies mimicking their body's natural hormone production is responsible for the rising demand for bioidentical hormones. These naturally-derived alternatives are preferred by many because they tend to have fewer side effects.

There is an increasing number of compounding pharmacies, which means more options for individualized solutions to match the specific needs of every patient.

Growth of telehealth: The convenience of going online for consultations, hormone level testing done in the comfort of one's home, and deliveries to their home make the processes of hormone health management easy. All these have been a godsend to the people living in rural areas or those desiring to get the most comfortable, personal, one-on-one health care.

Hormone replacement therapy continually adds to a dynamic growth market as a consequence of certain significant variables effective in the women's health care sector. Because of the growing awareness of menopause manifestations, such as hot flashes, mood swings, and night sweats, the demand for effective channels for relief has emerged.

The aged population continues to drive the demand for the treatment options today, particularly in developed countries. Also, the demand for personalized medication is increasing, with women now favoring treatments that fit their individual hormonal needs, including bioidentical hormones as an option.

Developmental technologies associated with HRT contributed largely to the growth of this market. New delivery systems such as transdermal patches, gels, and topical therapy are less troublesome and associated with milder side effects than previous modalities. The focus has been on developing safer choices and bringing about self-assurance in the minds of women regarding HRT for their lifetime.

Hitherto, increased coverage by insurance for women, especially in countries such as North America and Europe, affords access to more therapies and adoption acceleration. Thus, with greater attention to women's health together with developments regarding HRT, the market will continue to grow.

More personalized care with improved safety profiles and greater awareness will make HRT a mainstream approach toward hormonal health management.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | FDA and EMA approvals focused on efficacy and safety of synthetic and bioidentical HRT. Growing emphasis on cardiovascular and cancer risks. |

| Technological Advancements | Advancements in transdermal patches, gels, and subcutaneous implants improved hormone delivery. |

| Consumer Demand | High demand for menopause and andropause management. Growth in gender-affirming HRT therapies. |

| Market Growth Drivers | Aging populations and rising cases of hormone deficiencies. Expanding awareness of hormone-related disorders and treatments. |

| Sustainability | Some manufacturers introduced eco-friendly hormone patch packaging and reduced synthetic hormone waste. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter safety monitoring and long-term clinical validation requirements. Standardization of AI-driven HRT dosing for personalized treatment plans. |

| Technological Advancements | AI-driven hormone tracking optimizes personalized dosing. Development of long-acting biodegradable hormone delivery systems. |

| Consumer Demand | Increased adoption of plant-based bioidentical hormones. Personalized HRT regimens based on genetic profiling and AI-driven diagnostics. |

| Market Growth Drivers | Growth in precision medicine and real-time hormone monitoring. Expanding telemedicine platforms for remote HRT consultations. |

| Sustainability | Widespread adoption of biodegradable patches, sustainable hormone sourcing, and low-carbon drug production. |

Market Outlook

An intervening trend to protect women's health is already being recognized especially since many more women want relief from menopausal symptoms. This need for HRT is increasingly supported by women's knowledge of its benefits as merely another health and wellness option. Better insurance coverage of HRT and a safer form of this treatment have enhanced access for women.

The USA, also a very high-demand region for personalized therapy, allows women to tailor choices to their own needs. The industry will position itself even higher by inventing more and more non-invasive forms of HRT treatment thereby giving women an unprecedented selection in terms of their health.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

Market Outlook

Familiarity is mounting in Germany about women's health, especially menopause, which is now generating the demand for hormone replacement therapy (HRT). Aging population, and so up the scale of effective control of menopause symptoms are women, looking for HRT increasingly as a preferred option.

The preventive approach of Germany's well-organized healthcare system has made it easier for women to access these therapies. Indeed, like with individualized therapies such as bioidentical hormones, HRT in Germany is speeding up on path to becoming a mainstream therapy. Increasing numbers of women are likely directed towards these terms with ever-changing rules coupled with improved coverage under insurance schemes.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.0% |

Market Outlook

With discussions about menopause and awareness about coping with menopause increasing among women, the experience of menopause is also changing for them. Amidst a rising middle class, women are searching for effective solutions-HRT being one for their tough life transition.

The health care network in India is undergoing a change with more hospitals and clinics offering HRT services, an indication that it is a more comfortable approach to treatment. With added emphasis on wellness and aging gracefully, expect a further boom as an increasing number of Indian women turn to this healthcare route.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.9% |

Demand for Hormone Replacement Therapy has grown in the sense that more females have entered into menopause and have desired ways to manage their symptoms. This idea of preventive medicine is gaining strength, and with knowledge of the advantages of HRT, the demand for HRT adoption is rising among women. With the improvements in the healthcare system, access to HRT becomes ever more common.

The government also intervenes through extended coverage in insurance programs, making such therapies accessible. The more women pursue healthier aging, the more there is potential for growth in the HRT market in China.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.2% |

Market Outlook

The boomerang effect of the aging population in Japan steers everyone toward Hormone Replacement Therapy to remedy the symptoms caused by menopause. This is complemented by a cultural shift of women toward wellness because they are more concerned with longevity and health. As the state continues improving accessibility to healthcare and further advances in developing safer forms of HRT, women are likely to be drawn towards using HRT in addressing their menopause symptoms.

The current momentum for non-surgical gains is further buoyed by evolving delivery techniques, and Japan's market for HRT is therefore bound to grow. In the very near future, with women putting health at the forefront of their concerns, the market for therapies of this nature is likely to increase more significantly.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.6% |

Increasing prevalence of menopause-related symptoms aid Estrogen Replacement Therapy (ERT) to hold Dominant Position in the Market

ERT is often administered in the management of hot flush, vaginal atrophy, or postmenopausal osteoporosis in women. The increasing population of aging women, coupled with the rising awareness of menopause treatment and continuous development of biogenic hormone therapies, propel the market upwards.

Introduction of new formulation as combination drugs including progesterone and SERMs also increased safety of patients by reducing the number of estrogen-induced complications. The North American market offers the best possible sound healthcare infrastructure, high awareness levels in the general population, and good reimbursement policies and followed closely by Europe.

The Asian pacific region is seeing an increasing demand due to improving accessibility of healthcare services along with rising awareness for menopausal healthcare. Future directions include non-hormonal alternatives and customizing ERT regimens with genetic and metabolic profiling.

Growing Off-label use of Growth Hormone Replacement Therapy (GHRT) anticipate its Market Growth

The GHRT market continues to proliferate with a surge of cases of growth hormone deficiency and as the recombinant human growth hormone (rhGH) preparations keep improving. Nowadays, modern forms of treatment are very much compatible with longer-acting injections and with the needle-free technology which is convenient for the patients in adapting to their therapies.

The growth in the demand for GHRT-off-label application for anti-aging and sports performance, though regulatory disputes are contentious, causes further impetus. North America is leading the market because of the high diagnosis rates, intensive investments in research, and a broad range of GHRT options.

Following this, in importance for treatment programs that support the government, Europe drives the growth. The Asia-Pacific region is also aggressively experiencing growth via increasing expenditures on health care and growing awareness of pediatric endocrine disorders. Moving forward, advancements like gene therapy for GH intervention and AI-enabled dosing units will revolutionize the methodology for administering growth hormones.

Oral Tablets/Capsules Dominate the Market owing to its Convenience and Affordability in the Market

Oral capsules and tablets are the most widely accepted route for hormone replacement therapies because they are easy, cheap, and easy to follow by patients. This category contains estrogen, thyroid, and testosterone replacement therapies, among others, and grows through compliance related to increasing demand for bioidentical hormone formulations and long-acting oral medications.

Moreover, innovative formulations that reduce the risk of thrombo-embolic events and liver metabolism influence have been built to enhance the treatment's safety. North America and Europe rule this segment as they have a strong governance system and broad access to prescription-based HRT products.

Hormone Implants are Gaining Traction in the Market owing to its Convenience and Effective Treatment Option

Hormone replacement therapy (HRT) has a new ally in hormone implants, which establish an even more efficient and convenient mode of therapy. The alternative, daily injections or oral medication, imply a much more controlled and steady release of hormones over an extended time span. Thus, patients will not need to bother with frequent visits to their physician or to remember to take their medicine daily, which will facilitate compliance with their treatment schedule.

Implants are very attractive to busy individuals as they require low maintenance. Implants also provide a more stable hormonal environment, minimizing fluctuations that are possible with some approaches. As HRT continues to become more personalized, it also helps doctors tailor treatments to the individual needs of patients.

The increasing demand for long-term therapy with minimum hassle is providing a fillip in the growth of this field, whereas increasing acceptance of the concept as the most convenient and reliable tool by both physicians and patients drives growth in this field..

The HRT space is a highly competitive one where international and regional players have joined the industry and together with installation of new technology growth and innovation are goals of the market. The awareness of menopausal diseases, the increase in the geriatric population and the improvement of drug delivery methods with the help of technology constitute factors behind development of more efficient HRT solutions.

For companies to be competitive, they will need to invest in the development of safe formulations, non-oral drug delivery systems and combination therapy. The HRT industry has taken its steam from the established pharmaceutical players and new biotech companies which has brought change to HRT altogether.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Pfizer, Inc. | 12.5% |

| F. Hoffmann-La Roche Ltd. | 10.6% |

| AbbVie, Inc. | 7.0% |

| Novartis AG | 6.8% |

| Other Companies | 63.0% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Pfizer Inc. | Provides a variety of HRT products, such as estrogen and combination treatments, with a focus on menopausal symptom management. |

| Novo Nordisk A/S | Exports hormone therapies, including products for managing menopause and growth hormone deficiencies. |

| Merck & Co., Inc. | Creates HRT solutions that address different hormonal imbalances and concentrate on new delivery systems. |

| Bayer AG | Offers hormone replacement therapies, with a focus on treating menopausal symptoms and conditions. |

| Abbott Laboratories | Provides a range of HRT products designed to treat hormonal deficiencies in men and women. |

Key Company Insights

Pfizer Inc.

As the dominant pharmaceutical house, it has a full range of HRT products that aim at addressing menopausal symptoms and enhancing the quality of life among women.

Novo Nordisk A/S

Novo Nordisk provides options for treating menopause, as well as cases of growth hormone deficiency, using advanced research and development facilities.

Bayer AG

Bayer provides hormone replacement therapy that will go a long way in managing menopausal symptoms and is predicated upon the very long history of Bayer in women's healthcare.

Abbott Laboratories

Abbott provides a full product line in hormone replacement therapies targeting the hormonal deficiencies in both sexes, focusing on improving patient health and therapy in the future.

Several other companies contribute significantly to the hormone replacement therapy market by offering innovative and cost-effective solutions. They include:

The overall market size for hormone replacement therapy market was USD 18,995.6 million in 2025.

The hormone replacement therapy market is expected to reach USD 33,698.7 million in 2035.

Growing Prevalence of hot flashes, vaginal atrophy, and postmenopausal osteoporosis in women anticipates the growth of the market.

The top key players that drives the development of hormone replacement therapy market are Pfizer, Inc., F. Hoffmann-La Roche Ltd., AbbVie, Inc., Novartis AG and Bayer Healthcare

Estrogen Replacement Therapy by therapy area in hormone replacement therapy market is expected to dominate the market during the forecast period.

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.