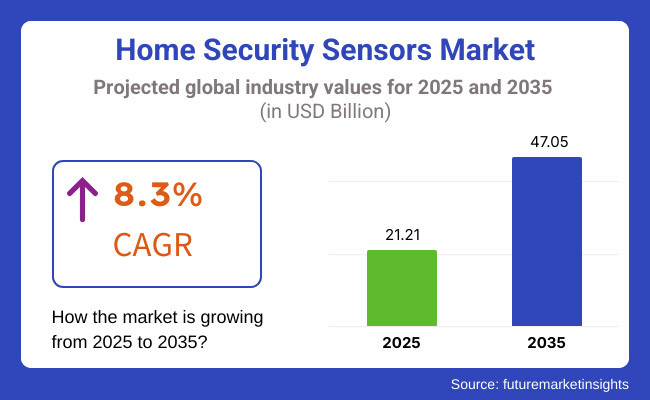

Between 2025 and 2035, the home security sensors market will see immense growth driven by widespread use of intelligent security solutions and continuing advances in domestic monitoring technology. The industry will grow from USD 21.21 billion in 2025 to USD 47.05 billion in 2035; and, during this forecast period, it is expected to maintain a CAGR of 8.3%.

Homeowners are increasingly likely to place a premium on home security and favor live security solutions so customer demand for motion detectors, glass break sensors, door/window sensors and smart surveillance cameras is on the rise. Also, AI-driven threat recognition, the integration of IoT data-generators with devices, and cloud-based security platforms all are beginning to make home safety into more than just a sum of parts: they are turning the security apparatus smarter and more effective.

This industry forms an essential element in today's security systems, capable of identifying unauthorized entry, intrusion and potential dangers. By teaming with intelligent alarms, surveillance cameras and household automation systems, the sensors provide real-time notifications together with remote-control monitoring functions.

The public's more acute awareness of home safety, combined with the convenience of a wireless security system, is encouraging homeowners to invest in better home protection technology. And increased worry about burglary prevention, with the dawn of affordable, easy-to-use security systems, is making the market for this industry among residential users in metropolitan and suburban areas grow.

Different forces are driving growth in this industry. Well, people originally used smart home technology to control lights, heating and air conditioning, and kitchen appliances. As it evolved it added functions like security systems or other home use facilities around the system platforms.

Now, people have also added security systems to their automation platforms for household use like Google Nest, Amazon Ring and Apple HomeKit. Developments in machine learning (ML) and artificial intelligence (AI) have also equipped even more intelligent security features, such as facial recognition, behavior analysis and predictive threat detection.

As the penetration rate of IoT devices in homes rises, the network of security sensors is also continually expanding. Homeowners can immediately receive notifications regardless of where they are located. They can also remotely monitor via mobile phone app what 's happening at home and also, government policies that encourage the development of smart cities and home security standards are further driving industry growth. So far, the industry has expanded vigorously, but there are some issues that may affect the use of them.

Expensive initial installation fees for advanced security systems are a major deterrent for budget-conscious end users. To an even greater extent, problems of data privacy and cyber-attacks related to networked devices pose immense risks, because intelligent home security systems can be hijacked or unlawfully accessed. The first is the cost of installing advanced security systems with high technology at the initial stage, which is a barrier to budget-conscious users.

Another consideration is privacy issues and computer attacks from networked equipment. Smart home security systems are open to hacking unauthorized access without permission even if they have been installed properly and comply with industry standards. Incompatibility between different security devices and smart home systems of users. This places consumer seeking a smooth integration into their lifestyle for their security systems under restrictions.

New trends and technological innovations are changing the face of the industry. The adoption of wireless security systems is reducing installation complexity and improving user convenience. Voice-activated AI-based assistants and automatic security alert notifications are simplifying security systems, making them more responsive.

The demand for cloud-based security management is growing, allowing homeowners to safely store surveillance footage and view it remotely. Moreover, the addition of 5G connectivity will likely result in faster response times for security sensors-which means that when it comes to detecting or responding to potential dangers, efficiency is key! Wi-sun Alliance-China Market Leads 5G Cities with smart home technology developing, the industry is expected to remain robust and talented, providing innovative solutions to household security needs.

Explore FMI!

Book a free demo

The photo printing and merchandise market is anticipated to see steady development over the next decade, with sales reaching USD 25.16 billion in 2025 and likely USD 40.1 billion by 2035. That represents a CAGR of 5.1 % from 2025 to 2035.

The growing demand for personalized and high-quality printed items is pushing growth, with consumers and firms seeking customized photo-based gifts, branding materials, and artistic applications. The web-based platforms and mobile apps, along with the wide variety available in photo printing services worldwide, have further simplified customization procedures.

The photo printing and merchandise industry deals with the transformation of digital and physical images into print products such as prints and photo books, calendars, home decor items, and clothes.

Nowadays, the quality of digital printing technology varies, just as it does for traditional and digital services. Public and event organizers all utilize the company's services for merchandise customization and promotion. These have led to product availability and making purchasing as well as designing customized goods easier and more convenient for users.

Several key drivers push the market forward. Encouraged by the popularity of personalized gifts, customized photo-based products like mugs or canvases, as well as framed prints, are in demand. Businesses are also using customized products for promotion, corporate branding, and as gifts to employees.

The maturation of digital printing technology has led to improved natural quality and longer life, as well as lower production costs of custom printing. On the other hand, the increasing popularity of social media and digital cameras has driven people to capture their memories in the form of printed items and in this way has further stimulated market growth.

However, the market does face some difficulties. Chief among these is the premium pricing of high-grade printing materials and state-of-the-art printing technology. Besides, the growing tendency to share photos digitally through cloud storage has cut down on the need for hard copies in many instances. There are also concerns about environmental sustainability and the future of ink used in printing. It is changing consumer behavior, so manufacturers are developing environmentally friendly technologies to fulfill people's needs.

Moreover, supply chain disruptions and raw material price fluctuations remain challenges for manufacturing companies as well as retailers. Trends in the industry see AI-assisted design technologies making it easier for customers to produce high-quality customized prints. Eco-friendly printing techniques utilizing things like water-based inks or biodegradable-printing supplies have heightened consumer awareness.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 25.16 billion |

| Industry Size (2035F) | USD 40.1 billion |

| CAGR (2025 to 2035) | 5.1% |

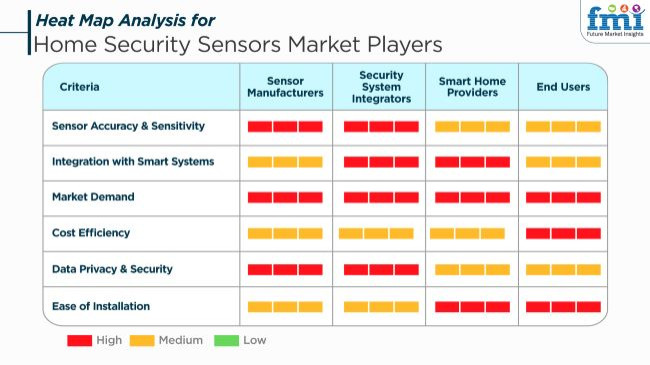

The industry is on the fast track with more people being concerned about their homes becoming safe, the smart home market on the increase, and the progress of IoT-based security technologies. Sensor manufacturers are all about the precision, connectivity, also include the AI-based threat detection, and integration with security systems as the main tasks. Security system integrators find it important to be able to connect to centralized surveillance and smart automation platforms, and in this way, they secure the customers' needs with individualized security solutions.

Smart home providers play with the idea of integrating security sensors with voice assistants and automation hubs for user convenience and remote monitoring. Clients living in their own homes or renting like that such sensors are affordable, simple to set up, and wireless which provide notifications in real-time, remote access, also have a long battery life.

The key determinants of sensor purchase are reliability, compatibility with the current security system, price, as well as compliance with the data privacy rules. The residential sector with the advancing statistics of urbanization and break-ins is presumed to have a rise in the demand for superior security sensors.

| Company | Contract Value (USD Million) |

|---|---|

| Honeywell International Inc. | Approximately USD 80 - USD 90 |

| Bosch Security Systems | Approximately USD 70 - USD 80 |

| ADT Inc. | Approximately USD 60 - USD 70 |

| Ring (Amazon Inc.) | Approximately USD 50 - USD 60 |

A growing concern towards personal safety and developments in smart home technology propelled the steady growth of the industry from 2020 to 2024. Wireless sensors and AI-based sensors topped the charts with functionality pertaining to real-time monitoring, motion detection, and integration with home automation platforms. In urban areas, the demand for smart door and window sensors and glass break detectors skyrocketed. H

owever, exorbitant installation costs and cybersecurity issues became a hindrance, slowing the rate of adoption in cost-oriented industries. Manufacturers, in turn, worked on developing simple self-installation solutions that provided encrypted connectivity to secure data from malicious non-adopters. Between 2025 and 2035, another phase in the industry expansion will be driven by AI threat detection, edge computing for low latency, and integration with the broader 5G-enabled smart home network.

Biometric-enabled sensors and multi-factor authentication technologies will further line up the security barriers, while the focus will also shift to sustainable innovations like solar-powered sensors. As home security systems mature into autonomy, predictive analytics and machine learning algorithms will clearly indicate potential threats before their occurrence, making residential security much more proactive and efficient.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter regulations made the home security providers enhance data privacy, encryption, and user consent for smart home sensors. | AI-driven, blockchain-backed home security networks ensure real-time compliance, decentralized identity verification, and privacy-preserving data sharing for connected security ecosystems. |

| AI-powered security sensors improved motion detection, facial recognition, and real-time threat assessment for home surveillance. | AI-native security sensors autonomously analyze behavior patterns, predict security threats, and self-adjust sensitivity based on real-time environmental factors. |

| Smart sensors integrated with IoT ecosystems, allowing seamless automation with lighting, locks, and alarms. | Artificial intelligence-powered, IoT-enabled security environments provide instant threat detection, automatic emergency dispatch, and preventative maintenance for household safety systems. |

| Home safety systems incorporated face recognition, voice recognition, and fingerprint readers to ensure better access control. | Machine learning-based, multi-factor biometric security systems offer instant identification verification, gesture recognition-based access control, and dynamic authentication to provide friction-free, ultra-safe home entry. |

| These sensors were compatible with Alexa, Google Assistant, and Siri for voice-controlled security management. | AI-based, voice-controlled security systems combine real-time voiceprint identification, predictive voice command recognition, and AI-powered intrusion defense functionalities. |

| Battery- and solar-powered security sensors enhanced energy efficiency and minimized dependency on wired installations. | AI-optimized, self-generating security sensors utilize energy harvesting for bringing the power usage to its minimum. |

| AI-fueled cameras and motion sensors lowered false alarms as they can know the difference between human, pet, and environmental motions. | AI-born security analytics automatically detect anomalies, analyze real-time video insights, and actively notify homeowners and emergency responders with situational awareness. |

| Faster 5G networks enhanced real-time remote monitoring, decreasing latency in security notifications and live video streaming. | AI-powered, 6G-based home security networks offer ultra-low latency, predictive threat detection, and real-time encrypted communication between security devices and emergency responders. |

| Growing hacking risks created more robust encryption, AI-based cybersecurity measures, and tamper-resistant chips in smart sensors. | AI-based, quantum-resistant home security architectures detect cyber attacks on their own, encrypt every sensor communication, and block unapproved access to smart home networks. |

| Smart home security companies emphasized eco-friendly materials and batteries that could last longer. | Green home security systems powered by AI utilize biodegradable materials, energy-efficient IoT. |

Related to the industry, there are several risks associated with cybersecurity threats, technological breakthroughs, supply chain hindrances, regulatory compliance, and consumer adoption trends. The vulnerability of cybersecurity is the primary worry of the integrated modern security systems that use Wi-Fi, IoT, and the cloud.

Weak encryption, software bugs, or unsecured networks can expose users to hacking risks, unauthorized surveillance, and data breaches. It is paramount to secure the end-to-end encryption, perform the necessary regular firmware updates, and have the anomaly detection managed by AI. Technological advancements offer an opportunity but also risk.

The company that falls short in relation to the adaptation of new technologies is likely at the risk of extinction due to the changes in the sector - particularly the coming of AI powered motion detection, thermal imaging, and smart home integration. The industry is embracing technology such as artificial intelligence and machine learning for features like predictive analytics, better decision-making, and increased efficiency in operations. Trends in consumer adoption have a direct participation in the industry stability level.

In contrast to the increasing industry demand for DIY security systems, the competition that is being pushed by large technology firms like Google Nest, Ring, and Arlo makes it really hard for traditional security companies to survive. The way out is to sell package deals which combine custom solutions, subscription-based monitoring, and the automation of AI as the primary focus of differentiation.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.4% |

| China | 11.1% |

| Germany | 9.7% |

| Japan | 9.9% |

| India | 11.5% |

| Australia | 9.8% |

The USA industry is expanding at a fast pace with increasing demand for AI-based security systems, smart home automation, and IoT-based surveillance systems. The USA residential industry has been embracing high-end security solutions in increasing numbers to offer enhanced real-time monitoring, intruder evasion, and home security improvement. Expenditure on AI-based motion detectors, smart alarm systems, and cloud-based platforms has been the growth driver. In 2024, the USA home security industry spent over 15 billion USD on sensor-based surveillance products. FMI is of the opinion that the USA industry is slated to grow at 10.4% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| AI-Based Security Analytics Growth | Growth in the use of AI is being experienced in the USA, with improved real-time motion detection, facial recognition, and intrusion detection. |

| Evolution of Cloud-Based Security Management | Cloud technology facilitates scalable remote monitoring with real-time data processing, making security management efficient and accessible. |

| Increasing Applications in Smart Homes | With the growing demand for smart homes, intrusion prevention security systems, fire detection security systems, and emergency response security systems have gained prominence. |

China's industry is expanding at a very high pace as a result of emerging home automation through AI, IoT-based security systems, and the government's push towards the adoption of smart city development. As one of the world's largest home automation industries, China has seen increased demand for residential complexes, gated communities, and commercial complexes for security sensors.

The government focuses on smart security systems, and AI-based monitoring has been a major industry growth driver. 18 billion USD was used by China in 2024 on home security sensor systems and AI-based surveillance systems. FMI is of the opinion that the Chinese industry is slated to grow at 11.1% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Smart Home Security Government Support | The government is encouraging the use of smart home security systems and AI-powered surveillance systems, fueling the pace of industry growth. |

| AI and IoT Developments for Security Management | Growing applications of smart alarm panels, video analytics, and intelligent motion sensors are fueling the adoption of security systems in office spaces and home dwellings. |

| Growing Demand for Safer Housing Defense | Growing security challenges for homeowners living in residential and urban settings include the growing need for highly functional and extensible security systems. |

Germany's industry is picking up momentum with its strong technology adoption, focus on GDPR-compliant security systems, and increasing home security concerns. Germany is a key smart home technology industry in Europe, which is adopting advanced security sensors for intruder detection, environmental threat sensing, and intelligent emergency alerts. AI-based security network adoption within home residences and commercial establishments is gaining momentum in Germany. FMI is of the opinion that the German industry is slated to grow at 9.7% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Rising Demand for High-Precision Security Sensors | There is a growing demand for high-precision security sensors among the German people and property developers so that effective security and automation for homes can be achieved. |

| Augmented Use of AI-Based Systems | Home security systems powered by AI are picking up universal implementation for threat real-time detection and autonomous emergency activation in homes. |

| Technological Innovations in Surveillance System Cybersecurity | The increasing significance of cybersecurity is fueling the application of AI-based security platforms to deliver encrypted, safe home surveillance. |

Japan's industry is expanding with the smart home security technology boom, growing adoption of AI-based intrusion detection systems, and IoT-based home automation technology. Japan's tech industry uses AI-based security solutions to enhance real-time monitoring, fire detection, and smart emergency alerts. Japan's robotics and AI-driven automation leadership has fueled the penetration of these solutions in homes and offices.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI Application in Home Security | Japan is applying AI in home security systems for real-time surveillance, advanced threat identification, and emergency response in automation. |

| Home Automation Explosion Due to IoT | Mass-scale application of IoT across houses empowers security sensors as well as video surveillance systems to coordinate together towards more security. |

| Cloud-Associated Security Sensors | The cloud allows for real-time observation, and homeowners are given the flexibility of watching their security systems live as well as responding quickly to any alert. |

India's industry is also increasing at a very high rate, driven by home automation investments, increasing demand for security solutions at low costs, and government-initiated digital surveillance programs. The "Digital India" program is also driving the adoption of AI-based security analytics, which is driving the demand for these sensors in residential colonies, gated communities, and smart cities. New indigenous smart security start-ups are also driving the industry expansion.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Support for Smart Cities | Government initiatives like 'Digital India' are promoting the use of AI-based security solutions and IoT-based surveillance solutions in cities. |

| Expansion of AI-Powered Intrusion Detection | The use of AI-powered systems in residential segments of India is increasing, with a focus on intrusion protection and fire extinction. |

| Demand for Scalable, Affordable Security Systems | Cloud security measures are less expensive and more accessible, thus finding applications among business and domestic users for real-time protection and monitoring. |

Australia's industry is slowly but surely growing with increasing investments in AI-driven security analytics, cloud-based surveillance, and real-time home monitoring. Property developers, security service providers, and homeowners are adopting smart sensor solutions for fire protection, threat detection, and general security. Australia's focus on the convergence of smart homes and an evolving regulatory landscape are driving demand for advanced home security systems.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Government Drive Towards AI-Based Security | Australian government drives are encouraging the usage of IoT-based home security systems, which are increasingly becoming economical for homeowners. |

| Penetration of Wireless Security Sensors | Increased growth in wireless security systems allows homeowners to install and monitor homes remotely with real-time security. |

| Demand for Cloud-Based Security Solution | Homeowners are embracing cloud-based solutions for scalable and automated security systems with remote monitoring and emergency response. |

Door and window sensorsare some of the most common security devices that make up the first line of defense against intruders. These sensors sense the opening of adoor or window and send an alert to the homeowner or security service. Other companies, including Ring (owned by Amazon), ADT, Honeywell, and SimpliSafe, have developedwireless, battery-powered, smart-embedded door and window sensors that integrate with home automation platforms such as Alexa, Google Home, and Apple HomeKit. Today, advanced sensors feature AI-driven false alarm reduction, real-time mobilealerts, and geofencing capabilities.

With the proliferation of smart homes, homeowners loveIoT-enabled sensors that integrate with security cameras and alarm systems for remote monitoring and automation. The rise in adoption of these sensors can be attributed tothe increasing urbanization, rising crime rates, and emphasis on home security. Sensors for glass break add a complementary level of security for forced entry attempts throughwindows and glass doors. Glass break sensors aredifferent types of motion sensors, they work using acoustic sound analysis or vibration detection to sense the precise frequencies of a shattering piece of glass.

At the same time, leading players like Vivint, Bosch, Honeywell, and Resideo have introduced smart glass break sensors with dual-detectionprocesses, AI-based false alarm filtering, and long-range sound detection. It dismissesa real break-in but also false alarms triggered by background noise.

Security sensors suchas windows or magnetic sensors are among the most widely used types of security solutions. These sensors run on a two-part system that includes a magneticstrip and a sensor unit that sends out an alert when the circuit is opened (i.e., door/window opens).

Such long-rangemagnetic sensors, available from companies such as GE Security, Honeywell, and ADT, are tamper-resistant and wireless, providing very high reliability and low-cost false alarms. Many of these sensors integrate with home security hubs, smart locks, and voice assistants, allowing homeowners to keep an eyeon their property, even when away from home.

At the same time, leading players like Vivint, Bosch, Honeywell, and Resideo have introduced smart glass break sensors with dual-detectionprocesses, AI-based false alarm filtering, and long-range sound detection. It dismissesa real break-in but also false alarms triggered by background noise. This affordability, combined with ease of installation, makes magneticsensors very common for homeowners and small businesses.

As DIY smart home security measures becomemore prevalent, there is expected to be steady growth for magnetic sensors. From doors and windows to drywall, vibration sensors can detect attempts to gain entry into a home. These sensors are designed to identify unusual vibrations caused by tampering, drilling, or impacts. They are manufacturers of battery-powered, wireless, AI false alarm control vibration sensors Bosch, Ecolink, Swann,and other companies. These sensors are really helpful in grabbing access in high-risk areas where burglars use locks ormaneuvers to break down doors.

Even ashome security technology is advancing, interconnecting with cloud-based security systems, AI analytics, and remote monitoring applications, vibration sensors are increasingly becoming a necessity. Forhomeowners seeking such multi-layered combined, integrated solutions that, as a whole, function as effective security solutions for the home, vibration sensors are being combined with motion detectors, glass break sensors, smart cameras, and other protective options.

Security threats are increasing in number, homes are getting smarter, and IoT-enabled solutions are getting developed. Homeowners and companies are focusing on real-time threat detection, and response systems that are automatic. This is propelling demand for smart security sensors.

The convergence of AI-driven analytics and cloud-based monitoring is revolutionizing home security systems, making them predictive and more efficient. Industry leaders such as ADT Inc., Honeywell International, and Bosch Security Systems are using these technologies to strengthen their product offerings and stay ahead in the competition. They are mainly focusing on making the sensors more precise, reduce false alarms, and ensure smooth integration with smart homes.

Industry competition is getting stronger day by day as firms launch wireless security offerings, self-monitoring capabilities, and bring subscription models. Companies are constantly conducting research and partnering with other players in order to make their offerings more secure. As consumer preference for low-cost, flexible security solutions gains traction, firms have to trade off affordability against sensor technology of high performance. The changing scenario offers both incumbent brands and new entrants the opportunity to ride the rising tide of demand for integrated home security solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ADT Inc. | 20-25% |

| Honeywell International | 15-20% |

| Bosch Security Systems | 10-15% |

| Johnson Controls | 8-12% |

| Ring (Amazon) | 5-10% |

| SimpliSafe | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| ADT Inc. | Smart security sensors and cloud-based solutions for monitoring. |

| Honeywell International | AI-driven security systems with smart motion detection and remote monitoring. |

| Bosch Security Systems | Advanced motion, glass break, and door/window sensors with AI-enhanced detection. |

| Johnson Controls | They offer security solutions where one has better access control and can also do real-time surveillance. |

| Ring (Amazon) | Wireless security sensors with smart home integration and cloud storage. |

| SimpliSafe | Affordable, DIY home security sensor systems with 24/7 monitoring services. |

Key Company Insights

ADT Inc. (20-25%) – ADT dominates the industry through its AI-driven monitoring capabilities, intelligent intrusion detection, and cloud-based security offerings.

Honeywell International (15-20%) – Honeywell deals in smart security systems, providing AI-based motion detection and integrated smart home security solutions.

Bosch Security Systems (10-15%) – Bosch offers high-accuracy motion, glass break, and door/window sensors with sophisticated AI-based detection.

Johnson Controls (8-12%) – Johnson Controls provides total security solutions in the form of access control, smart surveillance, and real-time monitoring.

Ring (Amazon) (5-10%) – Works mainly on wireless sensors. They combine cloud-based video storage and smart home automation.

SimpliSafe (4-8%) – SimpliSafe offers affordable, DIY security with professional, 24/7 monitoring and simple-to-install sensor systems.

Other Key Players (30-38% Combined)

The remaining industry share is distributed among various global and regional home security sensor providers, including:

The industry is projected to reach USD 21.21 billion in 2025.

The industry is anticipated to grow to USD 47.05 billion by 2035.

India is forecasted to grow at a CAGR of 11.5% from 2025 to 2035, making it the fastest-growing industry.

Omron Corporation, Pepperl+Fuchs GmbH, Rockwell Automation Inc., Honeywell, ABB, Schmersal GmbH & Co. KG, Baumer, Ifm Efector Inc., Shanghai Pubang Sensor Co. Ltd., and Hytronik Industrial Ltd. are the key players in the industry.

AI-powered home security sensors are being widely used.

By application, the industry is segmented into door and window sensors, glass break sensors, motion sensors, and boundary protection sensors.

By product, the industry is segmented into magnetic sensors, vibration sensors, motion sensors, passive infrared (PIR), microwave (MW), dual technology, area reflective, ultrasonic, and photoelectric beam sensors.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.