The global home blood testing devices market is poised for robust growth as consumer preferences shift toward convenient, at-home health monitoring solutions. These devices, which include blood glucose monitors, cholesterol testers, and hemoglobin analyzers, offer individuals a reliable way to manage chronic conditions, track overall health, and reduce the need for frequent clinical visits.

The rise in chronic diseases such as diabetes and cardiovascular conditions, coupled with increasing health awareness and technological advancements in portable diagnostic equipment, is driving market expansion. Additionally, the growing integration of digital platforms, data tracking apps, and telemedicine services is further enhancing the appeal of home blood testing devices.

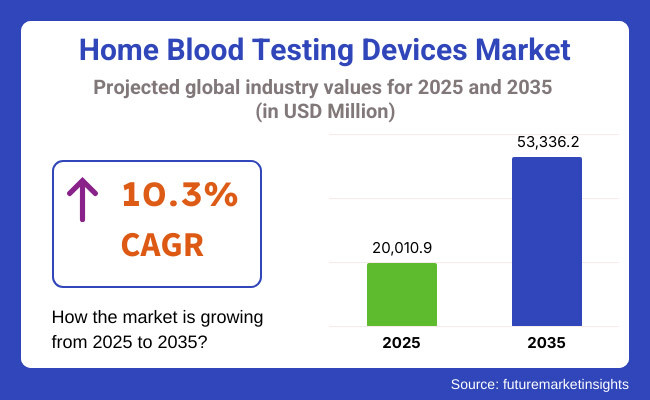

As the healthcare landscape evolves, this market is expected to see consistent growth through 2035. In 2025, the global home blood testing devices market is estimated to be valued at approximately USD 20,010.9 Million. By 2035, it is projected to reach around USD 53,336.2 Million, reflecting a compound annual growth rate (CAGR) of 10.3%.

The market for home blood testing devices, estimates North America as a leading market, attributable to a well-established healthcare system, high prevalence of chronic conditions, and early adoption of novel medical technologies. Americans enjoy good consumer awareness, reimbursement policies and the improving adoption of connected devices communicating with health platforms.

Europe is another important market based on health awareness among the people, government support for the management of chronic diseases, and a strong healthcare system. Germany, the United Kingdom, and France are leading the charge with home diagnostic tools. Demand remains strong region’s emphasis on preventive care and the convenience of home testing.

The home blood testing kits market in the Asia-Pacific region is growing at the fastest rate, with the growth being driven by high urbanization rates, higher healthcare spending a surge in chronic diseases burden. The demand is trending up in the countries like China, Japan, and India, due to growing middle-class population and increased awareness about self-care and the production of affordable diagnostic technologies. The Asia-Pacific will emerge as a key contributor to global growth as these factors unfold over time.

Challenges

Accuracy Concerns, Regulatory Compliance, and High Product Costs

Challenges faced in home blood testing devices market are related to accuracy of the at-home diagnostic devices. Consumers expect accurate results, in real time, but differences in how people use their devices, calibrate them and surrounding conditions can affect the reliability of tests, which may result in misdiagnosis or incorrect readings.

Regulations are another concern, as home-use blood testing devices need to conform to FDA, CE, and ISO standards that govern clinical-grade accuracy, information security and biosafety, among other things. In addition, expensive product features of advanced blood analyzers, CGMs, and biomarker detection devices restrict accessibility to lower-income regions, limiting the market growth.

Opportunities

Growth in AI-Powered Diagnostics, Personalized Healthcare, and Wearable Technology

Nonetheless, factors such as AI-enabled diagnostics, personalized healthcare solutions, and the emergence of wearable blood monitoring devices propel growth in the Home Blood Testing Devices Market. AI-powered smart blood testing devices are enhancing real-time health tracking, anomaly identification, and predictive analytics leading to early identification of diabetes, cardiovascular disorders, and infections.

Growing interest in personalized medicine propels personalized blood test kits that let users monitor individual biomarkers according to their health conditions. Wearable biosensors and non-invasive blood testing technologies also have the potential to transform the field of continuous health monitoring, eliminating the need for repeated blood draws and enabling more patient-friendly healthcare.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, CE, and ISO standards for home-use blood testing devices. |

| Consumer Trends | Demand for glucose monitors, cholesterol tests, and home-use COVID-19 test kits. |

| Industry Adoption | High use in diabetes management, infectious disease testing, and routine health screening. |

| Supply Chain and Sourcing | Dependence on disposable test strips, microfluidic lab-on-chip technology, and biosensor materials. |

| Market Competition | Dominated by medical device companies, diagnostic kit manufacturers, and telemedicine firms. |

| Market Growth Drivers | Growth fueled by increasing self-health awareness, demand for real-time diagnostics, and telehealth expansion. |

| Sustainability and Environmental Impact | Moderate adoption of biodegradable test kits and eco-friendly packaging. |

| Integration of Smart Technologies | Early adoption of Bluetooth-connected glucometers, remote patient monitoring apps, and IoT-enabled diagnostic devices. |

| Advancements in Blood Testing Technology | Development of microfluidic-based blood tests, smartphone-integrated diagnostic kits, and single-drop blood analyzers. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-powered diagnostic regulations, real-time health data privacy laws, and blockchain-based test result verification. |

| Consumer Trends | Growth in AI-driven blood biomarker tracking, genetic health testing, and wearable blood diagnostic devices. |

| Industry Adoption | Expansion into AI-assisted real-time diagnostics, self-monitoring for chronic diseases, and remote patient monitoring. |

| Supply Chain and Sourcing | Shift toward nanotechnology-based blood analysis, bio-compatible testing materials, and sustainable test kit production. |

| Market Competition | Entry of AI-driven healthcare startups, blockchain-enabled health data firms, and real-time digital health monitoring providers. |

| Market Growth Drivers | Accelerated by AI-powered predictive health analytics, personalized medicine-driven diagnostics, and real-time smart blood monitoring. |

| Sustainability and Environmental Impact | Large-scale shift toward zero-waste diagnostic solutions, AI-powered sustainable test manufacturing, and carbon-neutral home healthcare devices. |

| Integration of Smart Technologies | Expansion into AI-powered disease detection, blockchain-based test result authentication, and non-invasive biosensor-based blood testing. |

| Advancements in Blood Testing Technology | Evolution toward needle-free blood testing, AI-enhanced personalized diagnostics, and 24/7 wearable biomarker tracking. |

The market growth is driven by the rise in usage of smart blood glucose monitors, cholesterol testing kits, hemoglobin analyzers. The market growth is also supported by investment in telehealth and remote patient monitoring.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.4% |

In the United Kingdom, the growth of the home blood testing devices market is attributed to the rising consumer preference to use solutions for self-monitoring health conditions and early detection of diseases. Increasing cases of diabetes, cardiovascular diseases, and adoption of home-based diagnostics are driving market growth. Also, government-led initiatives encouraging preventive healthcare and digital health uptake are influencing market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.2% |

The home blood testing devices market in the European Union is growing rapidly due to the aging population, rise in the number of people suffering from chronic diseases, and growth of homecare based healthcare solutions. There is an increasing demand for smart blood testing kits integrated with AI-driven mobile applications. Booming market growth is also supported by stringent EU-high regulations on developing products that deliver precise and safe at-home diagnostics.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.3% |

The Japan home blood testing devices market is growing moderately driven by rapidly aging population, rising healthcare cost & advances in non-invasive blood testing technologies in the region. Demand is bolstered by the growing acceptance of wearable biosensors and smartphone-linked testing devices. Moreover, home-based healthcare solutions backed by government incentives is further fostering market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.2% |

The evolving landscape of home blood testing devices in South Korea. The collaboration and partnerships between private key players to offer unique uses of these devices in the region is also driving its growth. Furthermore, growing awareness about preventive health is also motivating people to spend more on these devices, which acts as a key consideration for the market growth.

The high introduction of connectivity and strong digital health infrastructure in South Korea also supports growth of the home blood testing devices market. Increasing need for self-monitoring of blood glucose, cholesterol, and hemoglobin levels is driving the market growth. Moreover, the expansion of the industry is being exacerbated by a shift towards digital diagnostics and remote patient monitoring by the government initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.4% |

The home blood testing devices market is booming as consumers increasingly demand at-home diagnostic products for chronic disease management, preventative healthcare, and early disease detection. Advancements in portable medical technology, AI-supported diagnostics, and telehealth services are making home blood testing devices, among other devices, the ideal mediums for patient-driven healthcare management.

It is based on Indication Type (Bacterial Infection Testing, Heart Condition Testing, Cancer Testing, Glucose Testing, Others), Distribution Channel (Hospital Pharmacies, Online Stores, Drug Stores, Retail Stores).

Due to the large use of blood glucose monitors by diabetic patients for real-time blood sugar monitoring and insulin management, the glucose testing market share is the largest. Rising incidence of diabetes, increasing health awareness and rising government initiatives to promote self-monitoring blood glucose (SMBG) devices are the major factors which are anticipated to fuel the demand for glucose testing solutions in home as a trend.

Driven by improvements in Continuous Glucose Monitoring (CGM) systems, smartphone-compatible glucometers, and non-invasive blood glucose monitoring, manufacturers are prioritizing user-friendly, pain-free, and digitized glucose checks to ensure better compliance and management of the disease.

Heart condition testing including, home-based cholesterol monitoring, lipid profile test, and cardiovascular risk assessment. Using proactive, at-home cardiovascular screening, people can determine early indicators of heart disease, pre-diabetes, and severe heart disease by taking cholesterol tests.

As cases of hypertension, stroke, and lifestyle-related heart diseases increase, the demand for portable, real-time heart health monitoring devices is growing among elderly populations, high-risk patients, and those using preventive healthcare.

Based on their distribution channels, the home blood testing devices market is segmented into Online Stores and Offline Stores, where Online Stores have captured a significant share due to growing preference among consumers to purchase medical devices, diagnostic kits and equipment to monitor their health at home directly on the internet. The convenience of purchasing online products at all, at varying prices, and receiving them directly at one's doorstep drives consumers to prefer online platforms to purchase self-testing devices.

As e-commerce penetration continues to climb and direct-to-consumer (DTC) diagnostic brands and telehealth-integrated diagnostic solutions are introduced into the market, demand for AI-powered smartphone-compatible home blood testing kits is growing through online marketplaces, brand websites and telemedicine platforms.

The hospital pharmacies segment is also showing strong demand as well, especially since healthcare professionals recommend trusted diagnostic devices to patients. Moreover, by going through an authentic hospital pharmacy, you can be assured that your test kits are regulated and medically certified for your trusted use, enhancing consumer confidence and meeting health service requirements.

Demand for home blood tests recommended by hospitals is expected to increase given that hospitals are increasingly forming partnerships with diagnostic device manufacturers and digital healthcare providers.

The global home blood testing devices market is predicted to witness lucrative opportunities owing to the increasing demand for real-time health monitoring solutions in a convenient manner.

The growth in chronic disease, elderly populations, and trend towards electronic health care are providing impetus to the development of AI-enabled diagnostic solutions, portable biosensors, and at-home lab-grade testing kits. To improve accuracy, ease of use, and telemedicine involvement, companies are concentrating on non-invasive, tech, AI-driven data analytics, and smart connectivity.

Market Share Analysis by Key Players & Home Blood Testing Device Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories | 18-22% |

| Roche Diagnostics | 12-16% |

| Siemens Healthineers | 10-14% |

| Dexcom, Inc. | 8-12% |

| Becton, Dickinson and Company (BD) | 5-9% |

| Other Home Blood Testing Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Abbott Laboratories | Develops AI-powered home blood glucose monitors, cholesterol testing kits, and telemedicine-integrated diagnostic devices. |

| Roche Diagnostics | Specializes in at-home coagulation monitoring, AI-driven blood sugar management, and smart blood testing solutions. |

| Siemens Healthineers | Provides AI-assisted home hematology analyzers, compact blood testing kits, and real-time data integration with healthcare providers. |

| Dexcom, Inc. | Focuses on continuous glucose monitoring (CGM) systems, AI-enhanced data analytics, and wearable blood testing solutions. |

| Becton, Dickinson and Company (BD) | Offers capillary blood collection devices, AI-driven home diagnostic kits, and smart biosensors for self-monitoring. |

Key Market Insights

Abbott Laboratories (18-22%)

Abbott leads the home blood testing market, offering AI-powered blood glucose meters, telemedicine-enabled diagnostics, and compact home cholesterol testing kits.

Roche Diagnostics (12-16%)

Roche specializes in AI-driven coagulation testing and remote blood analysis, ensuring high-accuracy home monitoring solutions.

Siemens Healthineers (10-14%)

Siemens provides AI-assisted hematology diagnostics, optimizing real-time blood health tracking and smart at-home testing kits.

Dexcom, Inc. (8-12%)

Dexcom focuses on continuous glucose monitoring (CGM) systems, integrating AI-powered data insights for diabetic patients.

Becton, Dickinson and Company (BD) (5-9%)

BD develops home-use blood collection devices and AI-enhanced self-monitoring solutions, ensuring high-precision at-home diagnostics.

Other Key Players (30-40% Combined)

Several healthcare technology companies, diagnostics startups, and wearable device manufacturers contribute to next-generation home blood testing innovations, AI-powered diagnostics, and non-invasive blood monitoring advancements. These include:

The overall market size for the home blood testing market was USD 20,010.9 Million in 2025.

The home blood testing market is expected to reach USD 53,336.2 Million in 2035.

Growth is driven by the rising demand for convenient and rapid diagnostic solutions, increasing prevalence of chronic diseases like diabetes and cardiovascular disorders, advancements in at-home testing technology, and growing adoption of self-monitoring health devices.

The top 5 countries driving the development of the home blood testing market are the USA, China, Germany, Japan, and the UK

Glucose Testing and Online Stores are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Home Decor Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Scales Market Size and Share Forecast Outlook 2025 to 2035

Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Homeland Security Market Size and Share Forecast Outlook 2025 to 2035

Home Wi-Fi Security Solutions Market Size and Share Forecast Outlook 2025 to 2035

Home Security Drone Market Size and Share Forecast Outlook 2025 to 2035

Home Healthcare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Homeopathic Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Care Services Market Size, Growth, and Forecast 2025 to 2035

Home Office Spending Market by Solution Deployment, Application & Region Forecast till 2025 to 2035

Home Baking Ingredients Market Growth - Consumer Trends 2025 to 2035

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA