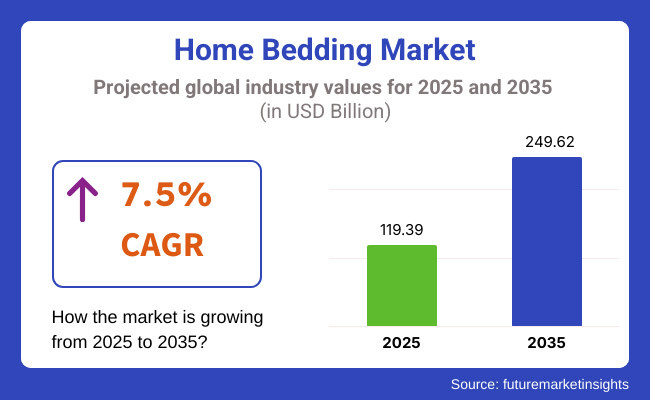

The global home bedding market is expected to reach USD 119.39 billion in 2025 and expand to USD 249.62 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.5% over the forecast period. This sustained growth underscores rising consumer preferences for comfort, quality, and personalized sleep solutions.

Key growth drivers include increasing health awareness, particularly regarding sleep quality, and a growing appetite for luxury and customized bedding. Innovations in materials-such as organic cotton, bamboo fibers, and temperature-regulating fabrics-enhance product appeal. Additionally, urbanization and rising disposable incomes, especially in emerging industries, are fueling demand for premium home bedding.

Restraints include fluctuating raw material costs, particularly for cotton and synthetic fibers, and the presence of low-cost counterfeit products, which may affect brand reputation. High prices of premium bedding may also limit accessibility for budget-conscious consumers, while environmental concerns regarding the production and disposal of synthetic bedding materials can challenge sustainability.

Opportunities exist in eco-friendly and sustainable bedding, driven by consumer demand for ethical products. Growth in the hospitality sector, especially luxury and boutique accommodations, boosts commercial demand. Technological integration-such as smart textiles with sleep monitoring features-also provides avenues for differentiation and new customer engagement strategies.

Trends include the rise of online bedding retail, driven by e-commerce platforms offering convenience and variety. Consumer interest in aesthetic home decor is influencing demand for coordinated bedding collections. Moreover, subscription-based bedding services and direct-to-consumer models are gaining traction, reshaping traditional retail landscapes and enhancing customer accessibility to high-quality bedding.

In 2020 to 2024, home bedding saw healthy growth driven by shifting lifestyles, wellness trends, and sustainability technologies. Increased growth of work-at-home culture resulted in consumers wanting comfort and the quality of their sleep, raising demand for higher-thread-count bedsheets, memory foam pillows, and temperature controllers in mattresses.

Weight blankets and aromatherapy-infused fabrics trended for stress and improved sleep. Direct-to-consumer (DTC) strategies, AI-driven recommendations, and subscription-based mattress tests by companies like Brooklinen, Parachute, and Casper played a role. Virtual shopping features like fabric touch simulations and 3D visualizations enhanced the customer experience. Sustainability was the driving force of change, with demand growing for organic cotton, bamboo, and hypoallergenic fabric and brands migrating to GOTS and OEKO-TEX certification.

Circular economy functionalities such as the rental of bedding and recycling action on mattresses gained momentum. Smart bedding technology also ruled with temperature control, sleep monitoring in the form of biometrics, and AI-based sleep coaching. Inflation and supply chain constraints were difficult, but local supply integrated with automated manufacturing maintained balance.

From 2025 to 2035, it is expected that intelligent bedding will develop with AI-driven sleep monitoring, intelligent fabrics that adapt to body heat, and biometric feedback for better sleep. Personalization will increasingly strengthen, with consumers wanting customized bed solutions in line with sleeping behaviors and health information. Sustainability will remain significant, with increased use of biodegradable fibers, recyclable resources, and closed-loop manufacturing systems.

Companies will apply carbon-neutral manufacturing and novel natural dyes to meet sustainable needs. Sleep health will become mainstream as a health issue, with smart mattresses and sleep apps as part of larger health systems, establishing a more individualized and tech-enabled bedding market.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Comfort focus, organic materials | AI-powered personalized bedding, lab-grown fabrics |

| E-commerce and DTC dominance | AI-powered customization, virtual bedding trials |

| Organic cotton, bamboo fabrics | Zero-waste, biodegradable, and modular bedding systems |

| Smart mattresses, temperature control | AI-powered sleep coaching, neurotechnology-infused bedding |

| High-thread-count sheets, premium materials | Fully personalized fabric blends, genetic-based bedding designs |

| Supply chain disruptions, local sourcing | Carbon-neutral manufacturing, blockchain traceability |

| Awareness of sleep health, expansion through e-commerce | Sleep optimization by AI, adoption of circular economy |

The industry is affected by the rising demand of consumers for comfort, aesthetic pleasure, and innovative products to solve sleep issues. Luxury bedding continues to prevail with high-quality materials like Egyptian cotton and silk, which emphasize the main attributes that of softness, breathability, and long-life span.

Discount bedding has a charm for those consumers who tend to be cost-conscious and, thus, it is very accessible to them. The main requisites for hotel and hospitality items are lifespan extensiveness, labor-saving, and aesthetic features. Healthcare and institutional bedding needs to be designed with antibacterial, hypoallergenic, and flame-resistant materials to secure the customer's hygiene and safety.

The intelligent bedding category is the fastest to change, linking today's technology, such as cooling, sleep monitoring, and adjustable firmness, to enhance the quality of sleep. Sustainability is and will always remain a key driver, and biodegradable materials like organic cotton, bamboo, and recycled materials are making their way into this industry.

Additionally, online stores and some level of personalization options such as customized embroidery and color schemes are also influencing customers' buying decisions.

The industry has tough competition with long-established brands as well as new firms committing to innovations. Price wars of online retailers and aggressive discounting can have a direct effect on profit margins, which in turn will result in the need for conventional stores to adjust or may even put them at risk of losing customers.

Increased raw material costs, as a feature of supply and demand, pose a threat to cash flow. Cotton, silk, and synthetic fibers experience sharp fluctuations in prices due to hampered supply chains, natural disasters, or trade policy measures. Higher material costs can have the effect of reducing profit margins or leading to increased prices of the final products at the retail level that the consumers would opt not to purchase.

Customer preferences are among the elements that may result in unreliable performance. For instance, customers today prefer bedding from eco-friendly materials, organic compounds, and non-allergenic materials. Companies that fail to adjust accordingly may end up being out of date. The utilization of renewable resources and ethical production is one of the requirements for a long-lasting market.

Transitional problems in the supply chain can lead to a standstill of commodities and delivery. Foreign dependence on suppliers, broken transport means, and labor shortages can influence inventory volumes. Businesses should establish relations with second-tier suppliers and put efforts into logistics improvement in order to provide proper functioning and customer satisfaction.

Based on type, the bed linen segment held the largest share of the market, accounting for nearly 60% of the total market share in 2025. This covers bedsheets, pillowcases, duvet covers, and even blankets as the demand for luxury, organic, and eco-compatible fabrics like cotton, bamboo, and linen increases. The ascendancy of home décor trends and luxury hotel-chic bedding also propels sales. Brands such as Brooklinen, Parachute, and Boll & Branch have found success marketing their sustainable and higher-thread-count iterations.

The growing market for the mattress segment will be chiefly propelled by advancements in memory foam, such as hybrid and orthopedic mattresses, as innovations will help the mattress segment garner nearly 40% market share by 2025. A greater awareness of sleep health, spinal alignment, and pressure relief has also propelled demand for expensive mattress techniques, such as cooling gels and adjustable firmness.

Tempur-Pedic, Casper, and Saatva, the three brands, have all begun deploying their sleep-tracking iterations in an effort to lure the health-minded shopper. The transition to bed-in-a-box has also transformed the mattress market, making it easier to find high-quality sleep solutions in the marketplace.

Offline retailing is expected to have a market share of ~65% by 2025, as numerous consumers often want to verify the texture, quality, and comfort of bedding products by inspecting them physically before purchasing them. This includes department stores, specialty bedding stores, and big-box retailers like Bed Bath & Beyond, IKEA, and Macy’s, all of which stock a wide array of bedding products.

For example, the increase in experiential retailing, whereby brands build immersive in-store shopping experiences, is also helping brands engage consumers more. Though e-commerce has boomed, the brick-and-mortar format is still key for high-value buys, such as a mattress, because people are looking for expert recommendations and places to try the product.

Retail sectors such as E-commerce are and would be the catalytic growth factor in the Non-store-based retailing market, which is why online channels are anticipated to have a share of 35% (2025), with the main driving factors being online convenience, product customization, and direct-to-consumer (DTC) models. Popular brands such as Casper, Brooklinen, and Parachute use online platforms and offer personalized bedding solutions, subscription models, and AI-driven recommendations.

Examples of this include marketplaces like Amazon, Wayfair, and Walmart, which have added hundreds of new bedding options, from organic and hypoallergenic to luxury bedding. Furthermore, the emergence of virtual reality (VR) shopping experiences and better return policies have also boosted consumer confidence in online mattress and bedding shopping.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 6.9% |

| The UK | 6.5% |

| France | 6.7% |

| Germany | 7.0% |

| Italy | 6.8% |

| South Korea | 7.3% |

| Japan | 6.8% |

| China | 7.5% |

| Australia | 6.6% |

| New Zealand | 6.4% |

It is expected that the USA will grow with a CAGR of 6.9% during 2025 to 2035. This is because of growing consumer awareness toward sleep wellness, bed-tech textiles, and firm e-commerce trends. Technology is powering innovation within the USA industry, with companies continually innovating smarter textiles, microbe-repellent textiles, and temperature-regulation bed linen.

Consumers prefer better quality, long-lasting, and attractive products, which is pushing companies out of the box when developing products. Additionally, green consumers are leading the demand for organic cotton bed sheets, bamboo fiber bed sheets, and environment-friendly mattresses.

Industry leaders like Tempur-Pedic, Brooklinen, and Parachute are putting investments in AI-powered sleep tracking, ergonomic mattress design, and eco-friendly manufacturing. The expansion of the direct-to-consumer business model and subscription bedding services also influence the industry. Growing demand for hybrid and adjustable mattresses and technological advancements in sleep-improving pillow design continue to make the USA a global leader among home bedding companies.

2025 to 2035 CAGR for the UK is approximately 6.5%, as a result of increasing consumer interest in sleep health, luxury bedding, and environmentally friendly materials. The UK is supported by a strong home improvement culture and increasing green bedding spending. Consumers in the UK are interested in temperature-control, hypoallergenic, and environmentally friendly sourced bedding, indicating the country's luxury home decor trend. For AI-based sleep technology and customized bedding designs, there is consistent growth in demand.

Luxury brands like Dunelm, The White Company, and Soak & Sleep prioritize sustainable materials, integration of smart fabric technology, and ergonomic pillow design. The industry witnesses the growth of hybrid mattress technology and multi-layer duvets to cater to varied sleeping requirements. The transition to fair-trade-certified cotton and sustainable sleep accessories consolidates the UK's position as a sustainable consumer base for home bedding.

France is expected to grow with a CAGR of 6.7% during the forecast period due to sleep preference for luxury goods, environment-friendly usage of textiles, and locally produced components. Most problematic concerns in French consumers' sleep and bedtime furniture needs result in greater usage of linen- and silk-enriched products. The adoption of smart technology in bed designs, e.g., the adoption of artificial intelligence sleep monitorability and adjustable firmness beds, is increasingly being accepted.

French brands such as Yves Delorme, Anne de Solène, and Carré Blanc take the lead with attention to high-quality bedding, organic materials, and hand-craft production. Antimicrobial natural dye-coated pillow and mattress sales are increasing as well. In addition, scientific knowledge on thermoregulating duvets and pressure-relieving mattresses is also on the rise to appeal to consumers interested in sleeping products with a scientific base.

Germany will grow with a CAGR of 7.0% during the forecast period, owing to the demand for technology-fueled sleeping products and environmentally friendly manufacturing processes. Mattresses are highly treasured by Germans owing to their long-lastingness, ergonomic shape, and technology-driven material. Since engineering accuracy runs through the blood of the nation, intelligent beds, and multi-purpose sleeping surfaces have tremendous demand.

Industry leaders like Paradies, Centa-Star, and Frankenstolz are dedicated to sustainability, implementing biodegradable fibers and toxin-free production. There is a fast growth in sleep-tracking technology integrated into mattresses and pillows. Germany's strictly regulated standards for environmentally friendly textiles compel brands to create innovative, high-performance bedding that satisfies comfort as well as sustainability criteria.

Italy is expected to grow with a CAGR of 6.8% during the forecast period due to the fact that Italy's home bedding industry relies on artisanal quality, luxurious touch, and top-grade sleeping comfort. Italian buyers prefer sleep products with hand stitching, and high-textured fabrics like Egyptian cotton and silk blends take priority. Beddings temperature-responsive and artificial intelligence-driven sleep analytics are in high demand.

Luxury brands like Frette, Gabel, and Bellora focus on comfort and refinement by utilizing eco-friendly production methods. Hypoallergenic fibers and cutting-edge weaving technology ensure the durability of products. The great reputation of Italy for creating quality textiles also supports the industry, with foreign importers looking for premium sleeping solutions.

The CAGR from 2025 to 2035 will be 7.3% for South Korea as high-tech sleeping solutions and premium sleep products gain a greater demand. South Korean homeowners need intelligent sleeping technology in the shape of auto-adjusting mattresses and AI-enabled sleep-tracking systems. Home decor also comes into play, with a very high demand for stylish yet practical bedding.

Companies such as Casper Korea, Allerman, and EMons specialize in high-end sleeping systems, temperature-regulating bed sheets, and plant-based fabrics. Household culture diffusion of the K-way of life has facilitated the fast uptake of influencer-endorsed bedding technology. Eco-living in South Korea promotes the utilization of organic hemp and natural ingredient-based memory foam.

2025 to 2035 CAGR will be 6.8% due to minimalist living, ergonomic sleeping technology, and space-saving bedding in urban homes. Japanese consumers utilize multi-functional futons, space-saving mattresses, and climate-controlling beddings to meet their limited living space.

Key leaders such as Nishikawa, FranceBed, and Tokyo Nishikawa invest in sleep monitoring using AI, antibacterial bed sheets, and personalized sleeping solutions. Smart beddings that respond to body temperature, organic cotton, and pressure-relieving pillowings are just a few of the things that consumers increasingly look for. Online sleep tips and personalized mattress settings also shift consumer trends.

China is among the fastest-expanding markets, with a 2025 to 2035 CAGR of 7.5%. Urbanization, higher disposable incomes, and growing concern for sleep quality drive consumer demand for high-quality bed products. Chinese consumers prefer organic products, intelligent sleep products, and person-specific requirement-driven personalized designs in mattresses.

Local brands like Luolai, Mercury Home Textiles, and Fuanna are the leaders with their innovative offerings. AI-enriched bedding and eco-friendly materials are revolutionizing the game, and sustainability is becoming a top-of-mind consideration in buying decisions. Antibacterial bedding fabric and hybrid mattress designs remain popular.

Australia is expected to grow at a CAGR of 6.6% during 2025 to 2035. Natural fiber bedding requirements, breathable fabric, and premium sleep products drive it. Bamboo bedding, organic cotton, and merino wool bedding are sought after by Australians, ensuring airflow and comfort.

Key players Sheridan, Adairs, and Ecosa are at the forefront with green ideas and superior craftsmanship. Growing demand for cooling gel-infused mattresses and temperature control duvets reflects consumers' need for sleep hygiene and comfort.

New Zealand’s expected CAGR of 6.4% during 2025 to 2035 is indicative of consistent growth of the bedding industry. New Zealanders prefer locally made, and eco-friendly products and wool-based bedding systems are at the top of their list.

Hand-stitched quality bedding is provided by Sleepyhead, Baksana, and Dreamwool brands. Ergonomic pillow and naturally hypoallergenic bedding system market demand has risen in response to the nation's focus on green living and quality sleep.

The industry is moderately fragmented, featuring a mix of established home goods brands, luxury bedding manufacturers, and innovative direct-to-consumer startups. Companies are focusing on comfort, wellness, and sustainability, investing in organic materials, temperature-regulating fabrics, and personalized bedding solutions. Digital customization and eco-conscious production practices are key drivers of competitive differentiation in this space.

Leading Players include Tempur Sealy International, Serta Simmons Bedding, Sleep Number Corporation, Brooklinen, and Boll & Branch, leveraging advanced sleep technologies, premium materials, and direct-to-consumer strategies to maintain a presence.

Key Offerings focus on memory foam and hybrid mattresses, smart adjustable beds, and ethically sourced bedding, with a growing emphasis on hypoallergenic fabrics, digital customization, and eco-friendly product lines.

Industry Evolution is shaped by consumer demand for wellness-centric sleep environments, sustainable living, and technology-integrated bedding. The rise of digital retail channels and personalized sleep solutions continues to transform the way consumers engage with home bedding brands.

Strategic Factors include sustainable sourcing, investment in smart sleep technology, and customer-centric digital platforms. Companies are differentiating through product innovation, ethical practices, and enhanced customer experience in the premium and affordable bedding segments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tempur Sealy International | 20-25% |

| Serta Simmons Bedding | 15-20% |

| Sleep Number Corporation | 12-16% |

| Brooklinen | 10-14% |

| Boll & Branch | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Tempur Sealy International | Specializes in memory foam and hybrid mattresses with luxury bedding collections. |

| Serta Simmons Bedding | Innovates in pressure-relieving mattresses and sustainable sleep solutions. |

| Sleep Number Corporation | Focuses on smart adjustable beds with personalized sleep tracking technology. |

| Brooklinen | Provides high-quality, affordable, and modern bedding with direct-to-consumer sales. |

| Boll & Branch | Pioneers in organic, ethically sourced bedding products for eco-conscious consumers. |

Key Company Insights

Tempur Sealy International (20-25%) Tempur Sealy leads with advanced memory foam and hybrid mattresses, combining technology with luxurious, high-performance bedding.

Serta Simmons Bedding (15-20%) Serta Simmons focuses on innovative, pressure-relieving sleep solutions, offering a mix of high-end and affordable mattress and bedding options.

Sleep Number Corporation (12-16%) Sleep Number revolutionizes sleep with its smart bed technology, integrating personalized comfort and sleep tracking features for enhanced rest quality.

Brooklinen (10-14%) Brooklinen is disrupting the home bedding space with high-quality, affordable sheets and comforters, leveraging digital-first retail strategies and stylish designs.

Boll & Branch (6-10%) Boll & Branch is a sustainability-driven bedding company offering premium organic cotton and ethically sourced linens with a strong commitment to eco-conscious production.

Other Key Players (30-40% Combined) Several other companies are driving the industry forward with innovation in materials, sustainability, and personalized comfort. These include:

The market covers bed linen, mattresses, pillows, blankets, and others.

The market is segmented into offline and online channels.

The market spans North America, Latin America, Europe, Japan, Asia Pacific, excluding Japan, and Middle and East Africa.

The overall market size for the Home Bedding industry was USD 119.39 Billion in 2025.

The Home Bedding Market is expected to reach USD 249.62 Billion in 2035.

The demand will grow due to rising consumer focus on home aesthetics, increasing demand for premium and eco-friendly bedding products, and the growing hospitality industry.

The top 5 contributors to the Home Bedding Market are the USA, China, India, Germany, and the UK.

Sheets, pillows, and mattresses are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 103: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 106: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Home Decor Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Scales Market Size and Share Forecast Outlook 2025 to 2035

Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Homeland Security Market Size and Share Forecast Outlook 2025 to 2035

Home Wi-Fi Security Solutions Market Size and Share Forecast Outlook 2025 to 2035

Home Security Drone Market Size and Share Forecast Outlook 2025 to 2035

Home Infusion Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Healthcare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Homeopathic Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Care Services Market Size, Growth, and Forecast 2025 to 2035

Home Sleep Apnea Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Office Spending Market by Solution Deployment, Application & Region Forecast till 2025 to 2035

Home Baking Ingredients Market Growth - Consumer Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA