The home baking ingredients market includes various products from flour to leavening agents, sweeteners, mixes, dairy alternatives, and flavourings that consumers use to bake at home. Market analysis, home baking ingredients growth is driven by increasing interest in home cooking and baking, fueled by social media trends, healthy feeding patterns with plant-based and gluten-free foods gaining popularity. In addition, demand for food kit DIYs, clean labels, and quality baking ingredients is also on the rise.

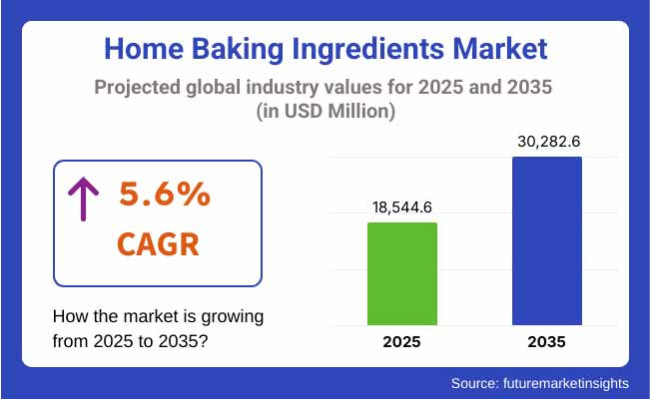

In 2025, the global home baking ingredients market is projected to reach approximately USD 18,544.6 million, with expectations to grow to around USD 30,282.6 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 5.6% during the forecast period.

The anticipated CAGR highlights the sustained consumer interest in baking as a lifestyle activity, it indicates that consumer excitement for baking as a way of life is not dying down anytime soon, reinforced by an opening and expansion of e-commerce, technology developments in convenience bakery products and a growing appetite for allergen-free and health-enhancing ingredients such as fortified flours and sugar replacers.

Rising consumer spending on packaged ingredients, increasing demand for healthy baking, and widespread home baking culture contribute a significant share to the North American healthy baking market. Online Sellers of Organic, Keto, and Sugar-Free Baking Items, Such as Amazon or Buy Box USA. The growing presence of specialty baking kits and social media (remember bread baking) is also driving the demand for online purchases.

Germany, France, and the UK, with their rich artisanal baking tradition and premium home-baking products, belong to Europe's biggest market share. The focus on clean-label and organic ingredients, increasing vegan and gluten-free product development ,is driving demand. Private-label goods and sustainable packs are also trending across the European supermarket chain.

Asia-Pacific will offer the strongest growth, with urbanization, rising disposable incomes and the impact of increasing Western-style cooking trends in China, India, Japan, and South Korea driving demand. The home-based baking businesses are thriving, and with social media and online access to ingredients, demand for the market is increasing. In addition, localized flavors and culturally tailored baking kits are gaining popularity across the region.

Challenges

Price Sensitivity and Supply Chain Volatility

Price sensitivity from home bakers and volatility in the prices of key ingredients such as flour, butter, eggs and chocolate challenge developers in the Home Baking Ingredients Market. Supply chain disruptions, especially for the organic, gluten-free, and specialty ingredients, can create stockouts and variable quality. Additionally, higher demand for clean-label and allergen-free products further increases pressure for product reformulation, effectively increasing production costs and product complexity.

Opportunities

Rise of Health-Conscious, DIY, and Functional Baking Trends

With growing interest in DIY baking kits, clean-label, gluten-free, and plant-based ingredients driven by the continued expansion of home baking culture, especially following the pandemic, the market is currently enjoying the rewards of success.

Premium categories are being driven by advances in functional baking ingredients, such as protein-enriched flours, sugar replacers, probiotics and superfood inclusions. E-business platforms, social media baking influencers, and AI-scripted personalized baking recommendation features are also contributing to the growth of experimentation and ingredient diversity for home bakers.

The market grew due to a spike in home baking activity amidst pandemic lockdowns, with households spending more time at home and a newfound interest in scratch baking driving sales from 2020 to 2024. During this period, there was also an increase in demand for healthy baking and organic/natural ingredients. Inconsistent quality, short shelf life of fresh ingredients, and specialty products present challenges.

Moving towards 2025 to 2035, the market will cater towards functional, sustainable, and digital-personalized baking ingredients. The key innovations will be climate-resilient crops (sorghum, millet, etc.), AI-powered recipe recommendations, and sustainable packaging. Allergen-free, plant-based, gut-friendly ingredients will define the next wave of home-baking innovation.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and clean-label standards |

| Technology Innovations | Rise of organic flours, natural sweeteners, and baking mixes |

| Market Adoption | Popularity of sourdough, banana bread, and traditional recipes |

| Sustainability Trends | Increased use of non-GMO and eco-conscious packaging |

| Market Competition | Dominated by ingredient brands (King Arthur, Bob’s Red Mill, General Mills, Ardent Mills, Pillsbury, Nestlé) |

| Consumer Trends | Demand for comfort food, nostalgia baking, and clean-label mixes |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter labeling for allergenic ingredients, food safety traceability, and sustainability certifications |

| Technology Innovations | Growth in AI-personalized ingredient kits, 3D-printed molds, and smart kitchen integration |

| Market Adoption | Expansion into plant-based egg substitutes, protein flours, and functional baking blends |

| Sustainability Trends | Large-scale adoption of recyclable packaging, regenerative agriculture-sourced ingredients, and carbon-neutral delivery |

| Market Competition | Rise of DTC baking ingredient startups, health-focused pantry brands, and personalized baking kit companies |

| Consumer Trends | Growth in health-optimized baking (keto, high-protein, gluten-free) and global flavor experimentation |

The USA home baking ingredients market is witnessing a gradual growth. From high demand for organic, gluten-free, and plant-based baking ingredients to demand for at-home baking kits and DIY recipes, growing priorities such as clean-label ingredients, no digestible sugars, and health-promoting flour are propelling the market. Consumers, meanwhile, continue to expand their reach and interest through online retail and influencer-driven baking culture.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

With the health, recreational, and cost-saving aspects, customers turn to home baking, supporting the UK home baking ingredients market. Oat flour, aquafaba, and dairy substitutes are some examples of vegan and allergen-free baking ingredients that are driving the market.

Government campaigns on healthy eating and a revived interest in old-style bakery recipes have also helped boost demand. Innovations within pre-measured baker’s kits, as well as sustainable packaging, are providing impetus elsewhere.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

North America and Europe will lead the home baking ingredients market as home cooking and baking are increasingly becoming an integral part of people's lives. European countries have a strong cultural affinity towards homemade products. In regions such as Germany, France, and Italy, consumers are choosing local, organic, and non-GMO ingredients.

Purchasing behavior is being driven by sustainability, sourcing transparency and the clean-label trend. Moreover, the rising demand for specialty flours, alternative sweeteners and functional ingredients such as protein-enriched baking powders is revolutionizing the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.3% |

The home baking ingredients market in Japan is steadily rising, driven by the growing popularity of Western-style baked goods and home-baked healthier alternatives. Consumers are experimenting with premium, photogenic ingredients such as matcha powders, rice flour and natural colorants.

The demand for small-size baking packs, convenience-oriented products and low-sugar ingredients have a good match with Japanese preferences toward quality and simplicity. Market trends are still driven by social media movements and home confectionery.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

The South Korean home baking ingredients market. Almond flour, vegan egg replacers, and natural leavening agents are among the specialty baking ingredients that are attracting ever more interest from Korean consumers.

And a shift towards home café baking or minimalist desserts creates a need for bakery products that are simple yet mercurial in taste, smell, & texture. Grocery stores are moving online and into your mobile, giving you access to the products needed.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

Bread has been one of the great staples of home bakers, as homes around the world embraced either centuries-old sourdough methods or new no-knead versions. The COVID-19 lockdowns acted as a trigger, spurring on an at-home bread baking explosion driven by social media fads, do-it-yourself videos, and a more earnest engagement with artisanal food-making.

Here’s one of the main factors that contributes to the continued popularity of bread in baking at home: its versatility. “Bread is aspirational for all diet appetites, with room for alternatives, like whole grain, multigrain, gluten-free and keto loaves. Due to rising health awareness among consumers, there has been a growing demand for fiber-fortified flours, organic yeast, plant-based oils, and low-sodium ingredients for making bread.

Otherwise, home bakers now are trying their hand at techniques like fermentation, slow proofing and natural leavening, which is a more science-meets-art method of bread-making. Two response modes have occurred: At scale, multinational food companies and artisan flour brands reacted to sales with home-friendly product sets, many of which include pre-measured mixes, freeze-dried starters, and enriched blends with ancient grains.

Despite growing, the bread space faces challenges related to consistency, shelf-life, and the expertise level required for newbies. In response, manufacturers are in turn dropping imperfection-proof bread kits, loaded-up bake mixes, and online road maps into hands, enabling the newly born to turn out pro results in living rooms. Cake Baking Continues to be Popular with Emphasis on Occasions, Indulgence, and Customization.

Cakes remain among the top two home-baking decisions, largely thanks to their association with celebrations, creativity and indulgence. For birthdays, anniversaries or holidays, cakes are still baked to celebrate; they are the default baked item of choice - even in the home kitchen.

The ever-increasing popularity of kits for custom decorating cakes, allergy-free cake mix and all-natural frosted flavour are among some of the prominent trends expected to influence the growth of the market. And people are experimenting with different substitutes, like coconut sugar, almond flour and avocado oil while baking, successfully mixing things to make it healthy and palatable.

Flavors such as matcha, chai spice, blood orange and rose are finding their way into homemade baked cakes, suggesting that vanilla and chocolate are being shunted aside. At the same time, diet-specific variants such as eggless, vegan cakes, and high-protein desserts are beginning to resonate with specialty consumer segments.

The trend of leaning towards “mini” or single-serving cakes also reflects changing household composition, as smaller family sizes and health-focused consumers increasingly pursue portion control without sacrificing indulgence. More companies have seized the moment by launching microwaveable, mug-cake mixes, zero-sugar cake preparations and high-fiber sponge substitutes.

But the cake category has its challenges, too. Shelf-life stability of ingredients, particularly fresh dairy-based mix-ins, and accurate leavening often deter novice bakers. In response, many companies are launching extended-shelf-life in icings, ambient stable emulsifiers and one-bowl cake formulas that strip away baked sophistication and eliminate unpredictability.

The main reason that baking mixes have become so ubiquitous is that they can make baking manageable for rookies and frazzled people. From muffin and pancake mixes to brownie and cookie bases, these pre-measured forms eliminate the need for measuring, sifting and mixing from scratch.

Beyond convenience, baking powders and mixes also offer fortified and specialty types, including some that provide protein, calcium and plant fiber. Many companies are similarly launching certified gluten-free, nut-free and sugar-free products for greater accessibility by families managing food sensitivities or clean eating.

Another big trend is flavor diversification. Consumers are gravitating toward spiced blends, citrus zest, superfoods like matcha and acai, and other global flavors like cardamom and pandan in baking mixes. This perhaps suggests a continuing appetite for exploration of cuisine within the safe confines of home kitchens.)

But these blends are on the ropes from scratch baking, especially from seasoned home bakers. In turn, manufacturers are offering semi-homemade alternatives - like base mixes that can be customized with add-ins, like nuts, chocolate chips, fruits or spices.

Oils, fats, and shortenings provide important functional benefits in the baking process, contributing to crumb structure, shelf life, flavor richness, and mouthfeel. As home bakers become more sophisticated in their ways, they have developed a greater understanding of how the different types of fat can influence the outcome of what they bake.

Traditional ingredients, such as hydrogenated shortening and butter, are still go-tos, particularly in cookie and pastry production, where they are integral to texture and flakiness. Until recently, there has been a shift toward health-promoting alternatives like plant-based margarine, ghee, avocado oil and cold-pressed oils.

The increasing popularity of unrefined coconut oil, olive oil and nut oils as clean-label substitutes often leaves bakers scrambling for recipes that are free of Trans fats, cholesterol or dairy fats. These trends are especially potent among vegan homes and fitness junkies.

“The food manufacturers are developing these multi-purpose fat blends in response because they want to have the shelf-life of shortening with the taste of butter or the health benefits of omega oils.” They are marketed as “clean-label baking fats” and often have non-GMO, allergen-free and plant sterol-fortified claims on pack.

The challenges in this group are fat migration in shelf-stable blends and the volatility of these ingredient-cost to process, and the difference in perceived taste by conventional vs alternative fat. To overcome, the majority of manufacturers are investing in microencapsulation technologies, flavour masking agents, and fat stabilizing emulsifiers for better functionality and shelf life.

The home baking ingredients market is growing strongly due to the rising home-based cooking trend, improved health awareness, and the necessity for natural and organic baking ingredients. The little chocolate and very traditional-looking macaroons have also accompanied the dessert, always with a clean-label, gluten-free, low-sugar and plant-based stamp for pies, breads, cookies and pastries.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| General Mills, Inc. | 18-22% |

| Associated British Foods plc (ABF Ingredients, AB Mauri) | 14-18% |

| Cargill, Incorporated | 12-16% |

| Archer Daniels Midland Company (ADM) | 10-14% |

| Bob’s Red Mill Natural Foods | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| General Mills, Inc. | Offers Betty Crocker and Pillsbury baking mixes, flour, and ready-to-use frosting for cakes, cookies, and muffins. |

| Associated British Foods plc | Produces yeast, baking enhancers, and dough conditioners under AB Mauri for home and semi-professional bakers. |

| Cargill, Incorporated | Supplies sugar substitutes, plant-based fats, cocoa, and emulsifiers for baking applications. |

| Archer Daniels Midland Company (ADM) | Offers grain-based flours, fiber ingredients, and gluten-free flour blends for home baking. |

| Bob’s Red Mill Natural Foods | Specializes in whole-grain, organic, and allergen-free baking ingredients, including alternative flours and baking powders. |

Key Market Insights

General Mills, Inc. (18-22%)

General Mills dominates the home baking segment with its iconic brands and ready-to-use baking mixes, frostings, and all-purpose flours, appealing to mainstream consumers.

Associated British Foods plc (14-18%)

ABF’s AB Mauri division focuses on yeasts, baking enhancers, and flavoring agents, supporting both home bakers and small-scale artisan setups.

Cargill, Incorporated (12-16%)

Cargill supplies core baking ingredients and fat replacers, catering to the growing low-fat, low-sugar, and clean-label demand in home baking.

Archer Daniels Midland (10-14%)

ADM offers high-quality grain blends, natural leavening agents, and fiber-based flour solutions, supporting gluten-free and high-protein baking trends.

Bob’s Red Mill Natural Foods (8-12%)

Bob’s Red Mill is a leader in the natural and specialty segment, with organic, vegan, and allergen-friendly flours, baking sodas, and mixes.

Other Key Players (26-32% Combined)

Numerous regional and niche players are contributing to the market with innovative, health-focused baking solutions, including:

The overall market size for home baking ingredients market was USD 18,544.6 million in 2025.

The home baking ingredients market is expected to reach USD 30,282.6 million in 2035.

Rising interest in home cooking and baking, growing demand for clean-label and organic ingredients, and increased availability of baking products through online channels will drive market growth.

The top 5 countries which drives the development of Home baking ingredients market are USA, European Union, Japan, South Korea and UK.

Baking powders & mixes expected to grow to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Home Decor Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Scales Market Size and Share Forecast Outlook 2025 to 2035

Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Homeland Security Market Size and Share Forecast Outlook 2025 to 2035

Home Wi-Fi Security Solutions Market Size and Share Forecast Outlook 2025 to 2035

Home Security Drone Market Size and Share Forecast Outlook 2025 to 2035

Home Infusion Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Healthcare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Homeopathic Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Care Services Market Size, Growth, and Forecast 2025 to 2035

Home Sleep Apnea Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Office Spending Market by Solution Deployment, Application & Region Forecast till 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA