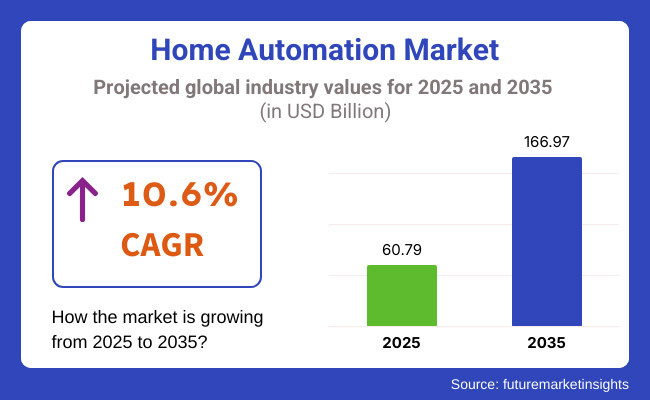

The home automation market will witness spectacular growth in 2025 to 2035 with the growing adoption of smart home technology, AI-driven automation, and networked devices through the IoT. The industry is projected to grow from USD 60.79 billion in 2025 to USD 166.97 billion in 2035 at a CAGR of 10.6% over the forecast period.

With energy-efficient solutions, improved security solutions, and home connectivity becoming mainstream, consumers are making investments in smart lighting, voice-controlled assistants, automated heating and cooling systems, and AI-driven security monitoring systems.

The integration of wireless communication protocols, cloud remote control systems, and machine learning-based automation is also enhancing user convenience and operation efficiency. Furthermore, innovation in edge computing and 5G-based smart home networks is expanding the application scope of industry platforms.

Key industries driving industry growth are consumer electronics, security solutions, and residential real estate, with increasing use of voice-based integrations, smarter hubs, and smart devices. North America and Europe lead the industry because of the high penetration of smart home appliances and high investment in IoT-enabled home automation.

Yet, the Asia-Pacific industry is also growing strongly with the help of increasing disposable incomes, urbanization, and government support towards the development of smart cities. With home assistants based on AI, predictive analytics-based energy efficiency, and blockchain-based smart home networks continuing to develop further, the industry is poised for widespread adoption and long-term innovation, redefining modern lifestyle experiences in the next ten years.

The luxury segment has the largest industry share, 32.4%, in 2025. The technological segment continues to expand, pumped up due to high-end smart home solution adoption that can, for example, handle AI-enabled voice assistants, smart climate control, or fully integrated security systems. Luxury homeowners desire system integration that creates continuity of comfort, security, and energy savings.

Ultra high-end homes are increasingly inquiring about customized automation solutions, with the leading brands being Crestron Electronics, Control4 (Snap One), and Savant Systems. High-end smart home ecosystem building, automated lighting, home theaters, and biometric access control are among the offerings of commercial players catering to the upper-crust customer base, such as builders and developers that benefit from exclusivity and premium functionality.

The greater availability and affordability of smart home technologies are fueling rapid progress within the mainstream segment, which includes the domestic aspects of the process. The IoT category increasingly adopts IoT-based automation, the provision of Internet connectivity, and increased consumer awareness, making the implementation of the IoT easier.

Demand for mainstream automation is being driven by middle-income households incorporating smart devices like voice-controlled assistants, app-based lighting systems, and budget-friendly security options. In this space, emerging players like Google (Nest), Amazon (Alexa Smart Home), and Samsung SmartThings are competing to build user-friendly, low-cost automation.

In 2025, the safety & security segment will be the largest application of luxury segment, with a 26.7% industry share. The boom in home security systems further benefits the automated security systems industry, as homeowners increasingly fear package theft and break-ins and turn to AI for surveillance and biometric authentication.

Due to their need for heightened security, high-net-worth individuals and high-end homeowners want systems that offer real-time monitoring, remotely activated access control, and sensor-driven threat detection. Companies such as ADT Inc., Honeywell, and Control4 (Snap One) lead this space, packaging facial recognition cameras, motion sensors, and smart locks along with 24/7 remote monitoring into integrated packages.

The rise of burglary incidents and apprehension with regard to unauthorized access also contribute to the growth of these advanced networks. The lighting segment is one of the largest shareowners in terms of luxury segment and is witnessing increasing adaption as demand increases for energy-efficient, customizable, and aesthetic lighting solutions.

Enhanced comfort with high-grade illumination and extremely efficient energy usage comes as smart lighting systems with the growing IoT, voice assistant, and auto-control over brightness. Brands such as Lutron Electronics, Philips Hue (Signify), and Savant Systems lead the way with high-end offerings enabling consumers to operate lighting through mobile apps, voice prompts, and automation schedules. Ambient and productivity-enhancing applications of home lighting, such as circadian rhythm lighting, mood-based presets, and dynamic scene adjustments.

The industry is experiencing tremendous growth, the major driving forces behind which are smart security, energy efficiency, and IoT integration. Residential consumers look for the most cost-effective smart home solutions mainly based on security, lighting control, and energy savings. Commercial buildings are interested in centralized automation for HVAC, lighting, and access which can improve operational equipment.

The hospitality industry, hotels in particular, introduce smart technologies like thermostats, lighting, and voice-controlled assistants which improves customer experiences. Segments vary by cost sensitivity, the more price-sensitive individual household owners and the wealthy homes which are more interested in the high-end automation.

The industry growth is anticipated as a result of the invention of AI-driven automation, wireless connectivity, and voice control technologies which together a wide variety of devices can be used in various sectors.

| Company | Contract Value (USD Million) |

|---|---|

| Google Nest | Approximately USD 50 - USD 60 |

| Amazon Alexa | Approximately USD 40 - USD 50 |

| Honeywell Home | Approximately USD 30 - USD 40 |

| Samsung SmartThings | Approximately USD 35 - USD 45 |

| ADT Security | Approximately USD 45 - USD 55 |

In 2020, the industry expanded mainly because of advancements in IoT technology, AI-driven smart assistants, and growing energy efficiency requirements. Smart security continues to be among the largest categories of applications, while huge numbers of individuals also utilize voice-controlled devices and climate control automatically.

AI-powered doorbells, camera-enabled motion detectors, and cloud-connected security systems provided more safety for homes, and facial and real-time threat detection added more accuracy to it. However, the building blocks of voice devices - Amazon Alexa, Google Assistant, Apple HomeKit - regulated lights, heating and cooling, and home entertainment systems.

AI-powered Learning pushed energy resources to the limit, providing convenience and savings. Following smart thermostats, smart lighting, and solar power control systems, energy efficiency became mainstream as homeowners were urged to reduce utility bills.

Governments legislated for green technology and this accelerated industry adoption. In 2024, industry leaders will address all of the fundamentals - interoperability, cyber intrusions, and price - through standardized protocols, encryption, and low-cost remedies. 2025 to 2035: It will further expand on AI-based personalization, decentralized security, and enhanced connectivity.

Artificial intelligence-controlled automation will be equipped to record individuals' daily habits, setting light, heat, and entertainment settings up or down as needed. Secure device-to-device communication by blockchain-based networks is necessary for data security. With 6G and edge computing, real-time automation will achieve the world's real-time communication and feedback.

The robotics will replace the houses with artificially intelligent home-aide for cleaning homes and locking the houses and elderly care system. The artificially intelligent solar panels, water conservation mechanisms, and smart grids guarantee that sustainability is at no high cost to the environment. This type of technology will align it with our global sustainability objectives while maximizing convenience, security, and energy efficiency.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter regulation (GDPR, CCPA) compelled smart home device manufacturers to implement greater encryption, user consent frameworks, and secure cloud storage of data. | AI-driven, blockchain-protected smart home platforms offer end-to-end data privacy, decentralized identity management, and quantum-proof authentication for networks. |

| AI-powered systems improved energy efficiency, security, and predictive maintenance in smart home devices. | AI-native, self-learning platforms autonomously adjust temperature, lighting, and security based on user habits, real-time occupancy, and predictive analytics. |

| Homes integrated IoT-connected devices, allowing seamless automation of appliances, entertainment systems, and security sensors. | AI-powered, real-time IoT orchestration creates self-optimizing home environments, adaptive energy management, and end-to-end autonomous device collaboration within smart ecosystems. |

| Smart assistants such as Alexa, Google Assistant, and Siri provided voice-controlled automation for hands-free user interaction. | AI-powered, multimodal interaction platforms offer sophisticated voiceprint recognition, gesture controls, and emotion-sensing automation for effortless smart home experiences. |

| The industry included AI-driven security functionalities like facial recognition, intelligent locks, and remote surveillance. | Decentralized AI-based biometric identification offers real-time, tamper-proof security access, adaptive threat protection, and autonomous response to incidents. |

| Energy-saving automations optimized lighting, heating, ventilation, and air conditioning systems, and appliances to reduce the consumption of electricity and carbon footprints. | Self-sustaining smart homes enabled by AI predict energy optimization, real-time tracking of carbon footprint, and integration with smart grids for zero-energy home living. |

| Improved 5G networks increased connectivity for real-time automation, smart surveillance, and cloud-controlled home systems. | AI-enabled, 6G-based industry supports ultra-low latency device synchronization, real-time AI decision-making, and immersive AR/VR-based smart living experiences. |

| Increased cyber threats resulted in the implementation of AI-driven security monitoring, encrypted device communication, and zero-trust authentication models. | AI-enabled, quantum-secure home networks automatically detect security intrusions, apply real-time self-healing protocols, and protect smart homes from cyber-attacks. |

| Virtual reality (VR) and augmented reality (AR) enriched home entertainment, gaming, and virtual fitness software. | Immersive AI-based smart home spaces integrate holographic interfaces, adaptive spatial computing, and metaverse-based automation for next-generation home experiences. |

| Smart homes included solar-powered automation systems, water-conserving sensors, and eco-friendly materials. | AI-based, autonomous platforms enable fully autonomous eco-homes by utilizing real-time climate adaptation, sustainable utilization of materials, and AI-optimized resource consumption. |

The industry presents several challenges, including but not limited to, the threat of cyber-attacks, the high cost of implementation, interoperability problems, regulatory barriers, and the ever-changing consumer preferences. These risks must be acknowledged and effectively managed in order to promote the development and adoption of the industry in the future.

Moreover, another issue at stake is the high initial price of a smart home. Various gadgets the homeowner can control, such as thermostats, high-security cameras, lights, and smart appliances, seem to be expensive for many consumers despite the advantage they bring to automation and energy efficiency.

Interoperability issues pose a significant risk. The industry comprises a large number of producers that deal in communication standards like Zigbee, Z-Wave, Wi-Fi, and Bluetooth. Without visible integration among different platforms, the consumer may get frustrated and the system may not work properly, leading to a negative message towards automation consequently.

The ultimate impact of shifting consumer expectations and industry trends is the demand for the product. The arrival of innovative products such as AI-based automation, voice assistants, and eco-friendly smart options makes manufacturers innovate and develop new products. Failure to meet consumer needs can result in the product going out of fashion.

To deal with these threats, firms should focus on cybersecurity as a major issue, throw resources on cost-effective solutions, improve interoperability by the means of universal standards, ensure compliance with rules and regulations, and innovate in accordance with the changes in the industry.

| Countries/Region | CAGR (%) |

|---|---|

| USA | 10.1% |

| UK | 9.7% |

| European Union | 9.9% |

| Japan | 9.6% |

| South Korea | 10.3% |

The USA industry is growing at an exponential rate as homeowners increasingly adopt AI-based automation solutions for convenience, security, and energy efficiency. Voice control systems, smart lighting, and home security automation are becoming the highlights of smart homes.

The Department of Energy (DOE) and leading technology players spend significantly on AI-based home energy management systems, smart HVAC systems, and real-time security automation. Expanding the use of IoT-based smart home systems are revolutionizing house living. Amazon, Google, and Honeywell develop AI-based predictive maintenance, home assistants, and cloud-based automation systems to make energy savings and security easy. FMI is of the opinion that the USA industry is slated to grow at 10.1% CAGR during the study period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| AI-based energy management | Predictive analytics and smart thermostats optimize power consumption, keeping electricity bills to a minimum. |

| Security automation | Smart security solutions, motion detection sensors, and distant monitoring ensure greater home safety. |

| Voice-operated assistants | AI-driven, voice-controlled assistants enhance the functionality and usage. |

| IoT-based smart homes | More interconnecting devices offer streamlined integration of the capabilities. |

The UK industry is growing increasingly larger, and programs focusing on sustainability and AI-based energy management are fueling the adoption of smart homes. The government's push towards net-zero carbon homes has accelerated the evolution of AI-based, smart security, and future energy management solutions.

The availability of 5G networks and IoT connectivity enables real-time automation, such as automated lighting, security, and climate control. Lutron Electronics, Hive, and British Gas invest in AI-based smart thermostats, voice-controlled home assistants, and home security automation to enable consumer convenience. FMI is of the opinion that the UK industry is slated to grow at 9.7% CAGR during the study period.

UK Growth Drivers

| Key Drivers | Details |

|---|---|

| Sustainability efforts | The government promotes net-zero carbon homes, driving smart home uptake. |

| AI-driven energy management | AI systems save energy and lower domestic emissions. |

| 5G and IoT expansion | Better connectivity enables real-time automation of domestic functions. |

| Smart security solutions | AI-driven surveillance and predictive security automation enhance home security. |

The European Union industry is a strong growth industry, as smart city creation and energy efficiency regulation drive widespread adoption. Smart HVAC systems, AI-driven security solutions, and home energy management platforms drive industry leadership in Germany, France, and the Netherlands.

Green home automation and IoT-based security monitoring are the drivers of the industry. Industry players like Bosch, Schneider Electric, and ABB invest in AI-based energy-efficient solutions, smartness for home security, and networked ecosystems for raising the capability to automate. FMI is of the opinion that the industry in the European Union is slated to grow at 9.9% CAGR during the study period.

European Union Growth Drivers

| Key Drivers | Details |

|---|---|

| EU directives for energy efficiency | Regulations compel home dwellers to deploy intelligent energy management systems. |

| Government spending leads to smart city development | Government spending for adoption drives the adoption of the industry. |

| Home security smartness | Home security increases home security due to AI-driven home security. |

| IoT-based monitoring | Increased connectivity in smart homes enhances efficiency and automation. |

Japan's industry is undergoing a drastic transformation with government bias toward the development of smart cities and AI-based home security systems. Robotics and AI-based automation bring the next-generation home intelligence solutions. AI-based home security, intelligent kitchen automation, and predictive energy management are the areas of investment by the Ministry of Economy, Trade, and Industry (METI).

AI-driven smart lighting and voice-operated home assistants remain popular. Panasonic, Sony, and Mitsubishi Electric hold leadership positions in home robotics, energy-efficient home appliances, and IoT-based automation solutions. FMI is of the opinion that the Japanese industry is slated to grow at 9.6% CAGR during the study period.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| AI-based security | Better protection with sophisticated surveillance systems. |

| Robotics integration | Greater efficiency with home appliances running autonomously. |

| Smart lighting systems | AI-driven lighting systems optimize energy utilization. |

| Voice-controlled assistants | Hands-free automation adds convenience. |

South Korean industry is growing strongly with countrywide plans for smart infrastructure and higher uptake of AI-based technology. The Ministry of Science and ICT (MSIT) encourages AI-driven voice command-based automation, cloud-based energy consumption management, and smart security technologies.

The voice-controlled and AI-based predictive maintenance and real-time home safety monitoring industry continues to grow. Samsung, LG Electronics, and SK Telecom invest in future-proofing the home with next-generation smart home platforms and AI-powered personal assistants. FMI is of the opinion that the industry in South Korea is slated to grow at 10.3% CAGR during the study period.

South Korea's Growth Drivers

| Key Drivers | Details |

|---|---|

| Smart infrastructure programs | National programs on a large scale provide support for automation. |

| Automation by AI | Home efficiency is increased through predictive maintenance. |

| Energy management by cloud | Real-time analysis maximizes energy consumption. |

| Security by IoT | AI-powered safety systems make home security possible. |

The industry is rapidly expanding with smart technologies impacting the residential living spaces with an increasing demand for convenience, security, and energy efficiency. Consumers are increasingly incorporating IoT-enabled devices, AI-driven voice assistants, and solutions for automated energy management into their daily lives.

The industry is dominated by major players such as Amazon, Google, Apple, and Samsung SmartThings, as well as Control4, having an extensive network of smart home ecosystems, AI-powered voice control, and cloud automation solutions. Startups and niche companies are working on specific segments of the industry solutions, focusing on security systems and energy optimization technologies, thereby adding to competition in the industry.

The evolution of the industry is being driven by advances in AI home intelligence with inter-device compatibility, with the advent of Matter (the unification standard for smart homes) to support cross-platform communication. With the advent of edge computing and real-time automation, now aided by AI prediction in home management, the growth in the industry has received another boost.

The strategic determinants of industry competitiveness include affordability, cybersecurity, and energy-efficient automation. To make their offerings unique and capture a larger spectrum of the emerging industry, the firms are working on privacy-first smart home solutions, AI-pumped security systems, and smart energy optimization.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amazon (Alexa) | 20-25% |

| Google (Google Nest) | 15-20% |

| Apple (HomeKit) | 12-16% |

| Samsung SmartThings | 10-14% |

| Control4 (Snap One) | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amazon (Alexa) | Develops AI-powered voice assistants, smart home integration, and security solutions. |

| Google (Google Nest) | Specializes in smart thermostats and AI-driven security cameras. |

| Apple (HomeKit) | Innovates in secure, privacy-focused industry with seamless device compatibility. |

| Samsung SmartThings | Focuses on IoT-enabled for security, lighting, and climate control. |

| Control4 (Snap One) | Provides high-end, fully customizable systems for smart living. |

Key Company Insights

Amazon (Alexa) (20-25%)

Amazon dominates the industry through seamless integration in its AI-driven Alexa ecosystem over smart homes, security features, and entertainment platforms.

Google (Google Nest) (15-20%)

Google Nest is using AI-enabled security cameras, thermostat control, and voice control for a whole new automated living-interconnected experience.

Apple (HomeKit) (12-16%)

Apple is leading secure and private smart home solutions with seamless compatibility and encryption-based home automation for greater privacy.

Samsung SmartThings (10-14%)

Samsung SmartThings offers a simple and connected experience, with IoT devices combined for smart security, lights, and energy.

Control4 (Snap One) (6-10%)

Control4 deals in premium home automation solutions, with customized smart home experiences for luxury residential use.

Other Key Players (20-30% Combined)

By product, the industry covers luxury, mainstream, managed, and DIY (Do It Yourself) home automation systems.

By application, the industry includes safety and security, lighting, entertainment (audio and video), heating, ventilation, and air conditioning (HVAC), and others.

By networking technology, the industry covers wired, wireless, computing network home automation systems, and others.

By region, the industry spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industry is slated to reach USD 60.79 billion in 2025.

The industry is predicted to reach a size of USD 166.97 billion by 2035.

AMX, ADT Pulse, Control4 Corporation, Crestron, Vera, HomeSeer, SmartThings, Frontpoint, Savant, Siemens AG, Johnson Controls, and Honeywell are the key players in the industry.

South Korea, driven by the rising adoption of smart home technologies and AI-powered automation, is expected to record the highest CAGR of 10.3% during the forecast period.

The luxury segment and AI-driven smart home solutions are among the most widely used in the industry.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Automation Technology Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Automation Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Automation in India – IoT & AI-Driven Growth

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Home Healthcare Software Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Home Decor Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Dialysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Home Scales Market Size and Share Forecast Outlook 2025 to 2035

Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Homeland Security Market Size and Share Forecast Outlook 2025 to 2035

Home Wi-Fi Security Solutions Market Size and Share Forecast Outlook 2025 to 2035

Home Security Drone Market Size and Share Forecast Outlook 2025 to 2035

Home Infusion Therapy Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Home Healthcare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Homeopathic Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA