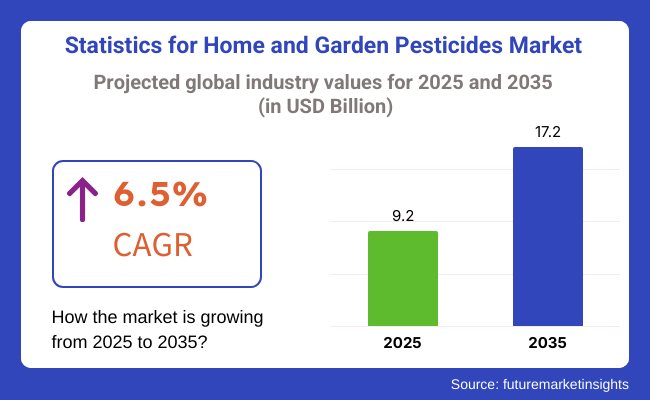

The home and garden pesticides market is slated to exhibit USD 9.2 billion in 2025. The industry is poised to expand at 6.5% CAGR from 2025 to 2035 and reach USD 17.2 billion by 2035.

The industry growth is driven by rapid urbanization, growing consumer awareness, and a high inclination toward home gardening. Pesticides like insecticides, herbicides, and fungicides, in particular, demonstrate their importance in shielding plants, lawns, and houses from deleterious insects, weeds, and fungi.

The primary reason behind the rapid development of the industry is the ongoing rise in pest-associated challenges, mostly in cities. Residents and horticulturists depend on pesticides as the main method to eliminate the creatures from their residences and outdoor areas, which, in turn, contributes to their health. Moreover, the demand for plant protection products has sharply increased due to the rise in home gardening and urban farming activities.

With the increase in the number of households growing fruits, vegetables, and flowers in their gardens, pest control has come to the fore as one of the vital concerns regarding safety and efficiency. The industry is witnessing the trend toward the adoption of biodegradable and environmentally sustainable pesticides. Most consumers have become aware of the dangers of artificial chemical pesticides and have opted to abstain from using them.

Between 2020 and 2024, the industry saw steady growth, driven by rising consumer interest in home gardening, urban green spaces, and pest control solutions. Increased concerns about vector-borne diseases and pest infestations boosted demand, while regulatory restrictions on chemical pesticides led to a shift toward bio-based and eco-friendly alternatives. E-commerce was important to the growth of the industry, offering a broader selection of pesticide products to homeowners.

In the coming 2025 to 2035 years, the industry will be influenced by tighter environmental regulations, biological pest control innovations, and increasing consumer demand for organic gardening products. AI-led smart pest control devices and precision application technology will be popularized with an aim at minimizing chemical misuse. On the other hand, plant-based and microbial pesticides will ensure that innovation in sustainable development is undertaken, while any shift in pest population dynamics driven by climate change may discontinue demand for some products. The industry would be slowly moving on towards safer, more effective, and environmentally sustainable solutions.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for domestic pest control owing to increasing urbanization and do-it-yourself gardening. | Growing up of intelligent and automated pesticide solutions specifically designed for urban and indoor gardening. |

| Growing use of chemical-based pesticides with enhanced performance and ease of use. | Growing trend towards biopesticides and organic options based on environmental awareness and regulation. |

| Stricter regulations on synthetic pesticides, leading to bans on certain toxic ingredients. | Further tightening of regulations, pushing manufacturers toward sustainable and biodegradable pesticide solutions. |

| Online sales surged as major retailers expanded their digital pesticide offerings. | Over 70% of pesticide sales expected online, driven by AI-powered recommendations and subscription models. |

| Rising consumer awareness about eco-friendly pest control methods but limited adoption. | Strong adoption of integrated pest management (IPM) and AI-driven pest detection technologies. |

In the context of the industry, one of the major threats is regulatory compliance. These pesticides, which are widely used, are subject to severe regulations concerning the disposal of waste materials, their safety, and environmental impacts, which are different in each region. Infringement of the laws relating to the active ingredient, labeling, and toxicity levels is enough to invite penalties, recalls, and in serious cases, bans.

The supply of raw materials is also a major risk. The creation of pesticides demands a particular ingredient of nature and chemical formulas. Shortages and the increased cost of production, which are the result of logistic disruptions, bans on some substances, or political conflicts affecting the export of raw materials happen quite often in the industry.

Health and environmental concerns are some of the greatest threats to manufacturers and suppliers. The knowledge of organic and eco-friendly products, in conjunction with the demand, have pushed firms to adapt to this era of synthetic pesticides which are more in demand. The alternatives to the synthetic compound products demanded by the public and the regulatory constraints have shifted the focus toward organic and eco-friendly alternatives. Not only the companies but also the whole economy in that region may be hurt if companies do not change.

Industry rivalry is at a height, with existing giants and new entrants continuously inventing new recipes and technologies. To retain their lead, companies must engage in both exploration and invention. An aspect where they lack is differentiating which would directly result in price wars, lower profit percentages, and a thrilling chance to be outpaced by better choices of the rivals.

The weather and the seasonal effect are the other great challenges. Weather and pest problems set different levels of need for pesticides. Changes in the climate, as in a long-term drought, can reduce the amount of pesticides thus the business will face difficulties in making the right distribution plan and the right quantity of stock.

Making pricing strategies in the home and garden pesticides sector is really a hard purpose involving both economy, efficacy, and the industry's general competitiveness. The rationale upon which these strategies should be built is well articulated in the fact that it is the customers who are the decision-makers. Thus, from the positioning viewpoint, the brands need to portray the products correctly to meet their respective industry segments.

The pricing scheme for pesticides that deliver exceptional value, especially those that vehemently stand against chemicals, non-toxicity, or environmental depletion is the value-based pricing system. A high percentage of customers would fall inappropriately be influenced to accept the high price for the organic, pesticide-free alternatives that they find a product with a value-added. This trick is about the recognition of the initiative value rather than the mere production costs.

Cost-plus pricing is an effective way of maintaining a balanced profit margin by simply adding a fixed percentage to costs incurred during production and distribution. This approach is undeniably clear but lacking a competitive edge in the price-sensitive market sector where consumers are more inclined to choosing the cheapest from a wide variety may be the case.

Competitive pricing is the most popular pricing method applied, especially, to the pesticides which are widely used in the industry. Matching prices with the opponent's or slightly off can contribute to the attraction of cost-conscious buyers. Nevertheless, the firms are to ensure their product differentiation via creativity in branding, formulation efficiency, or packaging before they try to sell only on the price basis.

The tool for seasonal demand fluctuations might be dynamic pricing. While the season for home gardening is growing together the price can climb up getting the maximal profit which can reduce the stock with the off-season discounts or bundle deals. This idea, in addition, will give the company a much higher profit and help to keep the sales steady throughout the year with a normal stock turnover.

Penetration pricing is one of the best tools for firms entering the markets or launching new products. With the introduction of lower prices, brands can gain the interest of customers and with that the industry will grow. However, it should be pointed out that this policy should be implemented in such a way as to make sure that the business is profitable after original discounts have been removed.

Insecticides lead the home and garden pesticide market because of their capability to manage numerous household and garden pests. Insects like mosquitoes, ants, cockroaches, termites, and garden pests may lead to property destruction, disease spread, and interference with plant health. Home gardeners and owners depend on insecticides to repel infestation, safeguard plants, and create a clean living space. Growing apprehension regarding vector-borne illnesses such as malaria and dengue has consequently fueled the need for insecticide-based solutions, particularly in areas that are susceptible to warm and humid weather.

Household applications are the primary force driving the home and garden pesticides industry because pest control products are commonly applied to both indoor and outdoor homes. Insecticides, rodenticides, and disinfectants are used by homeowners regularly to kill mosquitoes, cockroaches, ants, termites, and other pests that create health hazards and structural damage. The increasing awareness of vector-borne illnesses like malaria, dengue, and Lyme disease has also driven the demand for household pesticides, especially in urban regions where pest infestations are prevalent.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.90% |

| Germany | 5.30% |

| India | 7.10% |

| Australia | 5.40% |

| China | 6.70% |

The USA industry is growing gradually with increasing awareness among consumers about garden and pest control and increasing concern about insect-borne diseases. Increasing numbers of homeowners are using pest control services in a bid to prevent termites, mosquitoes, and other insects that can destroy the foundation of a house or be harmful to health. The application of fungicides, herbicides, and insecticides shot up during the pandemic, with the landscaping and gardening mania hitting new heights among homeowners. Home workers have grown in number, with others utilizing outdoors, and these need pest-free conditions.

Industry growth is fueled by one of the emerging trends of environment-friendly and organic pesticides because of environmental issues and government regulation of synthetic chemicals. Growing government and EPA regulations in the USA are fueling the adoption of biopesticides and other natural chemicals. Moreover, the combination of automated spraying equipment, AI-powered pest monitoring, and other intelligent pest control products is fueling industry growth. Pesticides are being sold more online, from professional-use to home-use pesticides, which is fueling industry growth as well.

According to FMI, the USA home and garden pesticides industry is expected to expand at a 5.9% CAGR over the study period.

Market Drivers in The USA

| Key Drivers | Description |

|---|---|

| Environmental Regulations | Stringent regulation pressures by governments drive the adoption of organic and eco-friendly pesticides. |

| Smart Pest Control Integration | AI-based pest monitoring and sprayer automation. |

| Growth in Internet Sales | Growth in online sales of pesticides widens industry reach. |

The urbanization surge coupled with a cultural preference for gardening and environmental landscaping is propelling growth in Germany's home and garden pesticides market. Beautiful gardens, balconies, and greens are all features of German homes, and this is propelling sales of herbicides, fungicides, and insecticides. Anxiety about invasive bugs-beetles and ticks, for instance, that ruin crops and household plants-is propelling the use of pesticides. Climate change has also introduced new types of pests, necessitating more efficient pest control measures for gardens and public areas.

Germany's emphasis on green and sustainable alternatives is the main driver of industry growth. Environmental regulations have pushed consumers and producers to look for organic and biodegradable pesticides, reducing dependence on man-made chemicals. The trend towards organic farming and home gardening has driven demand for biopesticides even further. Moreover, the highly established retail channel in Germany made up of approved garden shops and online shops provides extensive access to pesticides used in gardens and homes, thus contributing to a stable industry growth.

FMI predicted that the German industry will grow at a 5.3% CAGR over the forecast period.

Market Drivers in Germany

| Key Drivers | Description |

|---|---|

| Sustainable and Eco-Friendly Theme | Government policies fuel demand for biodegradable pesticides. |

| Urban Gardening Trend | Increased home gardening activity fuels increasing pesticide demand. |

| Expanding Retail and E-Commerce | Strong distribution channels guarantee industry expansion. |

India is witnessing urbanization and home gardening trend, and also terrace farming, is fueling home garden pesticide usage in India. Rapid urban expansion, with limited space, has encouraged balcony gardening, rooftop farming, and backyard farming, all of which require crop protection against pests and diseases. India's hot and wet climate is a favorable situation for pests and diseases, making household pest control products necessary. In addition, the rising middle class and rising disposable incomes have led to higher spending on gardening products, including pesticides. FMI states that the Indian industry is set to expand at 7.1% CAGR during the forecast period.

Household awareness of organic and environment-friendly pesticides is also responsible for industry trends. Care for food as well as environmental leaves of chemicals has seen families wanting bio-based pesticides to be utilized for backyard gardens. Government initiatives favoring sustainable agriculture and urban gardening support the shift in direction towards safer methods of pest control. Expanded growth in online shopping has also increased convenience for households to procure a variety of home and garden pesticides for indoor gardening and pest control.

Market Drivers in India

| Key Drivers | Description |

|---|---|

| Home Gardening and Urbanization | Rooftop, backyard, and balcony farming growth propels pesticide demand. |

| Increasing Disposable Income | Increased expenditure on gardening products, including pesticides. |

| Adoption of Eco-Friendly Pesticides | Shift in consumer preference towards bio-based and natural pesticides. |

Australian industry is expanding because of the distinctive climatic conditions of the country and the diversified environment, making pest control necessary for home owners. There are different types of insects such as termites, ants, spiders, and mosquitoes that threaten houses and health. Urbanization and rising residential settlements around nature have contributed to greater pest infestations, thereby creating high demand for home pest control methods. Australia hosts half a million gardens and possesses a rich horticultural culture, which generates high levels of pesticide and fungicide usage. FMI cites that the Australian industry is set to exhibit 5.4% CAGR during the study period.

A principal driving force behind the formation of the industry is the demand for green and environment-friendly insect control products. Environmental awareness has resulted in heightened rates of demand for organic and biodegradable pesticides. The intervention of government policies encourages the people to opt for non-toxic pesticide application, reflecting decreasing chemical exposure rates within domestic territories. Availability through retail distribution networks and the internet provides products more to potential clients.

Market Drivers in the Australia

| Key Drivers | Description |

|---|---|

| Distinct Climate & Pest Issues | Australian climate favors a high number of insect species, and therefore pesticide usage is high. |

| Strong Gardening Culture | Heavy pesticide usage owing to extensive gardening culture. |

| Environmental Awareness | Consumers are opting for organic and biodegradable pesticides. |

The Chinese home and garden pesticides market is expanding steadily because of fast urbanization and increasing popularity of home gardening. As people move into the cities, residents are catching up with rooftop gardens, balcony gardening, and neighborhood gardens. Moreover, rising demands for fresh, chemical-free produce have driven usage of pesticides to defend the crops against diseases and insects. The weather in China is humid, and it facilitates insects to enter and therefore there is the need for indoor insecticides and rodenticides. FMI cites that the Chinese industry will register 6.7% CAGR during the forecast period.

The growing middle class with increased disposable incomes is also fueling demand for pest-free homes and well-maintained gardens. Government policies towards environmental sustainability are also impacting industry trends. Pollution and food safety concerns have led consumers to shift towards organic and biodegradable pesticides. Regulations on chemical pesticides are strict, promoting the move towards safer alternatives. E-commerce has also boosted availability of home and garden pesticides to consumers, improving industry penetration.

Market Drivers in China

| Key Drivers | Description |

|---|---|

| Urbanization & Residential Horticulture | Urban green space development is a driver of demand for pesticide. |

| Weather & Pest Infestation | Insect infestation caused by excessive humidity boosts pesticide use. |

| E-Commerce Growth | Online availability enhances access to pesticides. |

The industry is fairly concentrated and comprises a combination of multinational corporations and local firms competing for industry share. Therefore, industry-leaders dominate the industry with comprehensive systems of pesticides for household and garden application, such as insecticides, herbicides, and fungicides. These players are helped by a good distribution system, brand name and significant underlying R&D expenditure, which endow them with the capacity to introduce innovative and green pest control products. Local and niche players are also performing well by offering niche consumer requirements, like organic and biodegradable pesticides that are coming in fast in light of environmental imperatives. Competition and product offerings are also driven by regulatory regimes and sustainability trends, which condition the industry.

Governments globally are putting more stringent regulations on synthetic pesticides, compelling firms to redesign their products or create bio-based alternatives. Such a shift has enabled small businesses selling an alternative to chemicals to establish a market niche. Also, e-commerce growth has neutralized the ground and smaller companies can access more customers without banking solely on bricks-and-mortar stores. Due to changing consumers' tastes, the industry is likely to stay competitive with an increasing emphasis on sustainable and technology-driven pesticide products.

Multinational giants dominate the home and garden pesticide market with multiproduct portfolios spanning insecticides, herbicides, and fungicides. These industry leaders employ technology-driven R&D for innovation on organic and eco-friendly, precision-targeted solutions for pest control-development trends that go hand in hand with ever-changing consumer behaviors. Such well-exposed brands, with an extensive distribution network and partnerships with retail chains, garden centers, and even e-commerce platforms, deposit their strong footprint in the industry.

Regional and niche players, on the other hand, managed to get traction through biodegradable and specialty pesticides in response to the growing demand for green, nontoxic alternatives. Most of the consumers nowadays shifted to organic pest control solutions, which is expected to be further triggered by the restrictions set by regulations on synthetic chemicals and the improvement of awareness by consumers regarding the environment. Smaller companies are butting heads with bigger brands, selling products directly to consumers using DTC model approaches, digital marketing, and subscription-based buying. Intense competition is evolving as awareness campaigns fueled by innovations in e-commerce and social media spread, giving rise to more progressive change in market restructuring in favor of sustainable and consumer-conscious solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Scotts Miracle-Gro Company | 18-22% |

| Bayer AG | 15-20% |

| Syngenta AG | 12-16% |

| Central Garden & Pet Company | 10-14% |

| Spectrum Brands Holdings, Inc. | 8-12% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Scotts Miracle-Gro Company | Leading provider of lawn care and pest control solutions, focusing on innovation and eco-friendly formulations. |

| Bayer AG | Offers a diverse portfolio of insecticides, herbicides, and fungicides, with a focus on sustainable and precision-targeted solutions. |

| Syngenta AG | Specializes in advanced pest management solutions, integrating biotechnology and digital tools for efficient application. |

| Central Garden & Pet Company | A major player in consumer garden products, providing natural and chemical-based pest control solutions. |

| Spectrum Brands Holdings, Inc. | Produces a range of home and garden insecticides, including pet-safe and biodegradable options. |

Scotts Miracle-Gro Company (18-22%)

Market leader in home and garden care leveraging brand loyalty as well as strong retail presence to remain competitive.

Bayer AG (15-20%)

One of the most inventive companies for pesticides is busy developing next-generation, eco-friendly pest control products.

Syngenta AG (12-16%)

Combines R&D-focused pest control solutions, particularly sustainable and digital farming-focused implementations.

Central Garden & Pet Company (10-14%)

Mix of both synthetic and organic pesticides; appeal to mainstream and niche gardening markets.

Spectrum Brands Holdings, Inc. (8-12%)

After this, the range of products includes pet-safe, non-toxic pesticide varieties, which appeal to environmentally conscious consumers.

Other Key Players (20-30% Combined)

By type, the industry is divided in to insecticides, fungicides, fumigants, and herbicides.

By application, the industry is bifurcated into garden and household.

By region, the industry is segregated into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Tons) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Volume (Tons) Forecast by Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Latin America Market Volume (Tons) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 21: Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Europe Market Volume (Tons) Forecast by Type, 2019 to 2034

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Europe Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: East Asia Market Volume (Tons) Forecast by Type, 2019 to 2034

Table 29: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: East Asia Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 33: South Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 34: South Asia Market Volume (Tons) Forecast by Type, 2019 to 2034

Table 35: South Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: South Asia Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: Oceania Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 39: Oceania Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: Oceania Market Volume (Tons) Forecast by Type, 2019 to 2034

Table 41: Oceania Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: Oceania Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: MEA Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 45: MEA Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: MEA Market Volume (Tons) Forecast by Type, 2019 to 2034

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: MEA Market Volume (Tons) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Tons) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 9: Global Market Volume (Tons) Analysis by Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 27: North America Market Volume (Tons) Analysis by Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 45: Latin America Market Volume (Tons) Analysis by Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 56: Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 57: Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 63: Europe Market Volume (Tons) Analysis by Type, 2019 to 2034

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Europe Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Europe Market Attractiveness by Type, 2024 to 2034

Figure 71: Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: East Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 81: East Asia Market Volume (Tons) Analysis by Type, 2019 to 2034

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: East Asia Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 89: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 90: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: South Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: South Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 99: South Asia Market Volume (Tons) Analysis by Type, 2019 to 2034

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 102: South Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: South Asia Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia Market Attractiveness by Type, 2024 to 2034

Figure 107: South Asia Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 109: Oceania Market Value (US$ Million) by Type, 2024 to 2034

Figure 110: Oceania Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: Oceania Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: Oceania Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: Oceania Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: Oceania Market Volume (Tons) Analysis by Type, 2019 to 2034

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 120: Oceania Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 121: Oceania Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: Oceania Market Attractiveness by Type, 2024 to 2034

Figure 125: Oceania Market Attractiveness by Application, 2024 to 2034

Figure 126: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 127: MEA Market Value (US$ Million) by Type, 2024 to 2034

Figure 128: MEA Market Value (US$ Million) by Application, 2024 to 2034

Figure 129: MEA Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: MEA Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: MEA Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 135: MEA Market Volume (Tons) Analysis by Type, 2019 to 2034

Figure 136: MEA Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 138: MEA Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 139: MEA Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 140: MEA Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: MEA Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: MEA Market Attractiveness by Type, 2024 to 2034

Figure 143: MEA Market Attractiveness by Application, 2024 to 2034

Figure 144: MEA Market Attractiveness by Country, 2024 to 2034

The industry is expected to be USD 9.2 billion in 2025.

The industry is expected to be USD 17.2 billion by 2035.

Major players include Scotts Miracle-Gro Company, Bayer AG, Syngenta AG, Central Garden & Pet Company, Spectrum Brands Holdings, Inc., FMC Corporation, BASF SE, S.C. Johnson & Son, Inc., Nufarm Limited, and Organic Laboratories, Inc.

Insecticides are widely used.

India, set to experience 7.1% CAGR during the study period, is poised for fastest growth.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.