The global sales of hip and knee reconstruction is estimated to be worth USD 23,880.2 million in 2025 and is anticipated to reach a market of USD 41,071.4 million by 2035. Sales are projected to rise at a CAGR of 5.6% over the forecast period between 2025 and 2035. The revenue generated by hip and knee reconstructive in 2024 was USD 22,777.0 million.

Hip and knee replacements are vital for the treatment of severe joints degeneration due to increasing prevalence of osteoarthritis, rheumatoid arthritis and trauma cases. By replacing damaged joints with prosthetic implants, these arthroplasty procedures relieve chronic pain, enhance mobility and also improve overall function often after a conservative treatment fails.

The growth of the industry is stimulated by the rising prevalence of osteoarthritis cases, especially among elderly population and high obesity prevalence. However, due to economic and cultural inequalities, there are still gaps in accessing early diagnosis, surgical care to receive satisfactory outcome. Additionally, the demand for these orthopedic implants is shaping by evolving patient expectations which includes longer implant lifespans and faster recovery times, reflecting a dynamic interplay of medical innovation and demographic trends.

Global Hip and knee Reconstructive Industry Analysis

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 22,777.0 million |

| Estimated Size, 2025 | USD 23,880.2 million |

| Projected Size, 2035 | USD 41,071.4 million |

| CAGR (2025 to 2035) | 5.6% |

Obesity drives the growth of the hip and knee reconstruction sector. The extra body weight significantly stresses weight-bearing joints, particularly the hip and knee, speeding up the degradation of cartilage. This eventually results in degeneration of joints leading to chronic pain and lead to decrease in mobility.

Most of the patients undergoing such surgeries suffer from joint replacements. Research indicates that the relationship of obesity to osteoarthritis, remaining the main cause for hip and knee reconstructions because of mechanical overload or due to the inflammation caused by excess fat tissue.

From a market perspective, the global obesity epidemic has increased the pool of obese patients seeking these procedures. In the United States nearly 42% adults are overweight, making orthopedic surgeries among the fastest-growing interventions. The trend continues in European and emerging nations, where lifestyle-related changes contribute to rising obesity rates.

In response to this, the implant manufacturers have introduced prosthetics designed to better handle higher loads in obese patients. At the same time, improvements in minimal invasive surgical techniques and the expansion of ambulatory surgery are creating access to shorter recovery times from these procedures. These technologies together with population trends are driving the market of hip and knee reconstructive, with obesity as the trend driver.

The global Hip and knee reconstructive market compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 6.5%, followed by a slightly lower growth rate of 6.2% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 6.5% (2024 to 2034) |

| H2 | 6.2% (2024 to 2034) |

| H1 | 5.6% (2025 to 2035) |

| H2 | 5.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.6% in the first half and remain relatively moderate at 5.2% in the second half. In the first half (H1) the industry witnessed a decrease of 90 BPS while in the second half (H2), the industry witnessed a decrease of 100 BPS.

Increase in Sports Injuries is Rising Demand for Hip and knee Reconstruction driving market growth

The increase in the number of sports and fitness-related activities worldwide has contributed much to the increase in hip and knee injuries. This is therefore one of the major drivers for the reconstructive market. Many athletes as well as fitness enthusiasts, especially in high-impact sports such as football, basketball, and running, have injuries such as ligament tears, fractures, and cartilage damage.

Eventually, these injuries become joint degeneration. This can give them pain relief and restore mobility through hip or knee reconstruction surgery.

The American Academy of Orthopaedic Surgeons estimates that more than 3.5 million sports-related injuries occur each year in the United States, the most common injuries of which are among athletes: the knee. In younger patients who suffer an injury, a partial reconstruction is necessary, whereas an older patient may have to receive a total joint replacement because they already have a damaged joint.

This trend creates a demand for sophisticated implants and surgical techniques targeted for active lifestyle consumers, with long-lasting materials and minimally invasive techniques ensuring more rapid recovery. The trend for outpatient surgery centers is growing for younger, more active patients, but as long as sports participation is on an uptrend, this driver will remain a factor for the expansion of the market.

Growing Medical Tourism for Orthopedic Procedure is driving the industry growth

Medical tourism is emerging as a significant growth driver in this industry as patients of developed countries are increasingly traveling to countries that provide high quality, cost-effective treatments. India, Thailand, Mexico, and Turkey are leading regions where advanced healthcare infrastructure, skilled orthopedic surgeons, and significantly lower costs draw international patients.

For example, in the USA the cost of knee replacement will vary between USD 30,000 and USD 50,000, while the same procedure in India or Mexico can be available for as low as USD 5,000 to USD 10,000 with travel and accommodation costs. Moreover, most of the tourism medical destinations do have shorter waiting periods as compared to developed countries where healthcare organizations have waiting lists.

Rising needs have made hospital authorities in health tourism destinations add the latest modern equipment, offer robotic-assisted surgeries, and have facilities approved for international standards catering to these medical tourists. Many governments of health tourism destinations market medical tourism heavily through policies or partnerships with various healthcare providers as well.

As more patients seek affordable alternatives without compromising quality, medical tourism is expected to drive the demand for hip and knee reconstructive procedures, contributing significantly to the market’s global growth.

Personalized Implant in the hip and knee reconstructive creates further growth opportunity in the market

The major opportunity in hip and knee reconstruction is the use of customized implants due to advances in 3D printing and patient-specific solutions. Customized implants are based on the actual anatomy of a patient and therefore have better fit, functionality, and comfort compared with standard implants. It reduces complications related to implant misalignment or loosening, ensuring better surgical outcomes and higher patient satisfaction.

The advancement of 3D printing technology has highly dominated the manufacture of such implants. This has been possible through precise modeling based on CT or MRI scans, thus allowing surgeons to work on specific challenges in patients characterized by odd bone structures, severe deformities, or requirements for revision surgery. Personalized implants also reduce surgery time since intraoperative adjustments are eliminated.

An increasingly booming demand in developed regions of high-end, bespoke solutions in leading orthopedic companies pushes up their investments in R&D. Partnership between a manufacturer of a medical device and the hospital with integrating personalized implant offering further uplift this opportunity.

Considering the increase focus on value-based healthcare that majorly takes account of patient's experience as well as the desired outcomes of his treatment, there is considerable space for taking significant market shares from the market share of the reconstructive hip and knee in this region.

High procedure costs may restrict market growth

High reconstructive procedures for hip and knee are an important cause of constraint within markets, especially in regions with limited healthcare coverage or low-income populations. The major costs of these surgeries include an implant cost besides surgical fees, hospital stay, and postoperative rehabilitation.

Thus, within the United States, a total knee replacement may range from USD 30,000 to USD 50,000, and hip replacements may fall in the range of USD 20,000 to USD 40,000. These are expensive for many patients, especially those who have no insurance or whose countries use out-of-pocket payment systems.

Even in developed countries with health insurance, high deductibles and co-payments discourage patients from undergoing these surgeries mainly if they are considered elective and non-emergency. In developing countries, limited healthcare funding and absence of government subsidies limit access to such surgical interventions.

The cost factor also affects healthcare providers and insurance companies, who would wish to avoid or delay such surgeries due to the cost burden they pose. Although improvements in minimally invasive techniques and outpatient care aim to lower overall costs. Still, affordability remains as a major challenge. Competitive pricing, greater insurance coverage, and developing cost-effective implant solutions can be key factors to overcome this restraint to allow more patients to have reconstructive surgery.

The global Hip and knee reconstructive market recorded a CAGR of 4.5% during the historical period between 2020 and 2024. The growth of Hip and knee reconstructive market was positive as it reached a value of USD 41,071.4 million in 2035 from USD 23,880.2 million in 2025.

Historically, orthopedic surgeries, including hip and knee replacements, were limited by less advanced techniques, longer recovery times, and higher risks of complications. Most early implants had basic materials and were not strong, thus revising them regularly. The major surgeries involved a large incision, long-term hospital stay, and long-time rehabilitation.

On the other hand, emerging techniques such as robotic-assisted surgeries require smaller incisions which reduces pain and also shorten recovery periods. Modern implants use durable materials like titanium and ceramics, improving their longevity greatly. Enhanced preoperative imaging and individualized implants increase the chance of better results. Outpatient surgery centers and medical tourism also made the availability of these options much easier and less expensive.

Expansion of both private providers and government-funded insurance coverage has ensured a greater degree of access to hip and knee reconstructive surgery. In several areas, it has become very common for many of the joint replacement procedures-implants, surgery, and postoperative care-to be covered in large parts of insurance policies, which has consequently relieved patients from most of their financial burdens as they seek care for joint conditions.

With programs like Medicare and Medicaid within the United States, and similar programs across the world, age-based patients are likely to become the primary target, as these treatments have become cheaper. Moreover, employer-sponsored and private insurers may also cover elective surgeries, thereby covering a larger population. The increasing access through this factor is creating room for growing markets.

Tier 1 companies are the industry leaders with 58.8% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. These companies frequently get involved in strategies such as acquisition and product launches. Prominent companies within tier 1 include Zimmer Biomet, Smith & Nephew plc., Stryker and Johnson & Johnson.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 31.7% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include John MicroPort Scientific Corporation, B. Braun SE, CONMED Corporation and Exactech Inc.

Compared to Tiers 1 and 2, Tier 3 companies offer hip and knee reconstructive, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. The companies such as Limacorporate S.p.a., CeramTec and Others and others falls under tier 3 category. They specialize in specific products and cater to niche markets, adding diversity to the industry.

The market analysis for hip and knee reconstructive in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below. It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 86.7%. By 2035, China is expected to experience a CAGR of 6.4% in the Asia-Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

| Germany | 4.0% |

| UK | 4.3% |

| France | 4.8% |

| China | 6.4% |

| South Korea | 5.8% |

| India | 7.1% |

Germany’s market is poised to exhibit a CAGR of 4.0% between 2025 and 2035. The Germany holds highest market share in European market.

Hospitals in Germany are equipped with the most advanced technology: robotic-assisted surgical systems, 3D imaging, and precision navigation tools. With these systems, surgeons are able to conduct procedures with minimal invasiveness and optimum results within a short time followed by recovery periods and minimum complications.

The orthopedic surgeons in Germany are well trained and have good experience; most of them are even international known. So with high-class medicine, a rigidly implemented system, and following the best standards, these hospitals offer care to the highest quality of medical practice worldwide. There are special centers in Germany where all sorts of orthopedic conditions, especially the most complex revision cases, can be dealt with.

In addition, the country has patient-centric care supported by robust rehabilitation services and post-operative monitoring, which are integral to the recovery process. These factors improve the quality of life for patients which encourage individuals to opt for reconstructive surgeries when needed.

Germany's reputation in medical excellence, when it comes to healthcare infrastructure attracts both domestic and international patients, making it one key factors propelling the growing demand in the Hip and knee reconstructive sector.

United States is anticipated to show a CAGR of 4.6% between 2025 and 2035.

The high participation rate in sports and fitness activities is a significant driver for the Hip and knee reconstructive market in the United States. In football, basketball, soccer, and running, repetitive stress causes most acute injuries that include tears in the ligaments, fractures, or damage to the cartilage. In many cases, chronic joint problems have been brought about by these injuries and necessitated surgical interventions like hip and knee reconstructions.

Increasing fitness and athleticism among people within all age ranges increases participation in recreational and competitive sports. Sports & Fitness Industry Association reports claim more than 30 million American citizens are currently athletically active. This has been associated with a higher incidence of sporting injuries, especially in the knees, due to their frequency of being the injured joints.

Third, advancements in the technology of orthopedics in the United States will be seen in increased minimally invasive procedures and durable implants for active patients, meaning that such patients will likely seek surgical solutions. In addition, sports medicine centers and comprehensive insurance coverage stand to facilitate market growth. Rising participation in sports is sure to increase demand for hip and knee reconstructive surgeries in the United States

China is anticipated to show a CAGR of 6.4% between 2025 and 2035.

The increasing reputation of China as a destination for medical tourism is heavily propelling the demand for hip and knee reconstructive surgeries. China has modern medical facilities, orthopedic surgeons, and complex technologies at significantly lower costs relative to those in the West. Such cost advantages also attract patients from other countries, particularly its neighbors and regions like Southeast Asia, who do not have easy access to affordable, good quality care.

The example of a hip replacement in China: the cost will be much lesser than in the United States or Europe; besides, costs for travel and accommodation are covered. China heavily invested in building its healthcare infrastructure with many hospitals in Beijing, Shanghai and Guangzhou has specialized in arthroplasty and sports medicine to boost medical tourism .

The government actively promotes medical tourism through policies that simplify travel, such as medical visas and collaborations with healthcare providers. The sector is expected to expand further, given the focus on affordability, quality, and accessibility, thereby boosting the demand for hip and knee reconstructive procedures among both domestic and international patients.

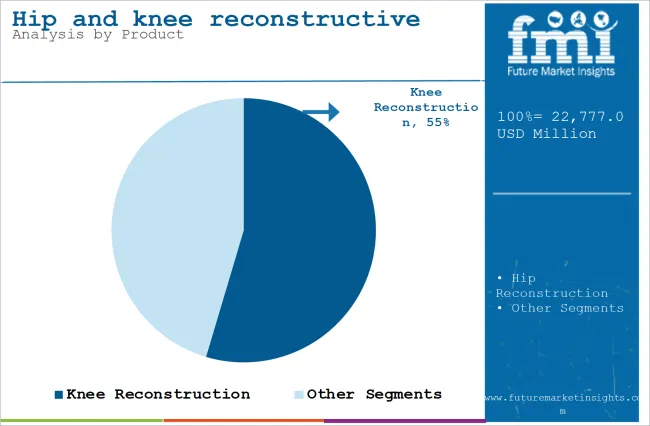

The section contains information about the leading segments in the industry. Based on product, the knee reconstruction segment is expected to account for 54.6% of the global share in 2023.

| By Product | Knee Reconstruction |

|---|---|

| Value Share (2025) | 54.6% |

The knee reconstruction segment is projected to be a dominating segment in terms of revenue, accounting for almost 54.6% of the market share in 2025.

The knee reconstruction segment would command the highest share in Hip and knee reconstructive market due to the higher incidence of knee-related conditions and injuries. Osteoarthritis, which is a major reason for joint replacements, is more common with the knee than with the hip, especially among geriatric populations. Furthermore, sports-related injuries like ligament tears and cartilage rupture that require surgical intervention often occur in the knee.

Demographic factors also contribute to the degeneration of knees, for instance, with the rise in obesity, putting extra pressure on knee joints. In addition, technological advancement in knee implants such as minimally invasive procedures and patient-specific implants, which has increased the outcomes and recovery times, have fueled the demand.

Knee reconstruction is also a common procedure for the younger and active population, which would translate to a larger patient base. All these combined factors place knee reconstruction as the largest segment of the market due to its broad requirement among various age groups and conditions.

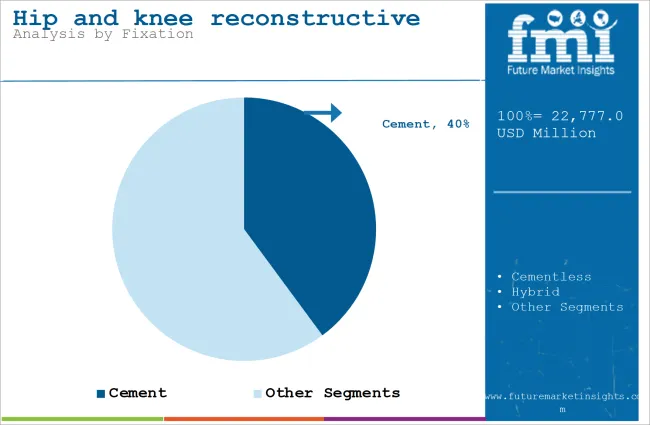

| By Indication | Cementless |

|---|---|

| Value Share (2025) | 40.1% |

The cementless segment will dominate the industry in terms of revenue, accounting for almost 40.1% of the market share in 2025.

The cementless fixation segment is projected to dominate the Hip and knee reconstructive market because of growing adoption, mainly among younger, more active patients. Cementless implants allow natural bone growth for securing the implant, providing a more durable, long-lasting solution than cemented options. These are thus very suitable for patients with a longer life expectancy who may otherwise require revision surgeries.

Advances in implant materials, including porous coatings and 3D-printed surfaces, have further advanced the success rate of cementless fixation. These improvements enhance osseointegration for better stability and long-term outcomes.

Cementless techniques save surgery time and risks associated with cement-related complications, such as bone cement implantation syndrome. As clinicians and surgeons increasingly focus on durability and patient outcomes, the cementless fixation segment is gaining traction, especially in developed markets with access to advanced surgical technologies.

Key players in the market are actively embracing different strategies to stay ahead in competition. They are constantly launching products with new materials and designs for improved durability and patient outcomes. Manufacturers are also embracing towards obtaining new regulatory approvals in different geographies to enhance their product portfolio and new markets access.

Manufacturers are also focusing on niche product development to further strengthen their R&D capabilities through mergers and acquisitions. They are collaborating with new healthcare providers to conduct training programs for surgeons to ensure better adoption of their products. They are also investing more in robotic-assisted surgery and 3D printing technologies in order to make them innovative and user friendly.

Besides this, companies are also expanding their distribution network and focusing on building channel partners in order to capture more share of the market.

Recent Industry Highlights in Hip and knee reconstructive market

In terms of product, the industry is divided into hip reconstruction (partial hip reconstruction implants and revision implants), and knee reconstruction (total knee reconstruction implants and partial knee reconstruction implants)

In terms of fixation, the industry is segregated into cement, cementless and hybrid

In terms of end user, the industry is divided into Hospitals, orthopedic clinics and ambulatory surgical centers.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global hip and knee reconstructive industry is projected to witness CAGR of 5.6% between 2025 and 2035.

The global Hip and knee reconstructive industry stood at USD 22,777.0 million in 2024.

The global hip and knee reconstructive industry is anticipated to reach USD 41,071.4 million by 2035 end.

China is expected to show a CAGR of 6.4% in the assessment period.

The key players operating in the global hip and knee reconstructive industry Zimmer Biomet, Smith & Nephew plc., Stryker, Johnson & Johnson, MicroPort Scientific Corporation, B. Braun SE, CONMED Corporation, Exactech Inc., Limacorporate S.p.a., CeramTec, and Others

Table 01: Global Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Product

Table 02: Global Hips & Knees Reconstructive Market Volume (Units) Analysis and Forecast 2012–2032, by Product

Table 03: Global Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Fixation

Table 04: Global Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by End User

Table 05: Global Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Region

Table 06: North America Hips & Knees Reconstructive Market Value (US$ Bn) Analysis 2012-2021 and Forecast 2022–2032, by Country

Table 07: North America Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Product

Table 08: North America Hips & Knees Reconstructive Market Volume (Units) Analysis and Forecast 2012–2032, by Product

Table 09: North America Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Fixation

Table 10: North America Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by End User

Table 11: Latin America Hips & Knees Reconstructive Market Value (US$ Bn) Analysis 2012-2021 and Forecast 2022–2032, by Country

Table 12: Latin America Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Product

Table 13: Latin America Hips & Knees Reconstructive Market Volume (Units) Analysis and Forecast 2012–2032, by Product

Table 14: Latin America Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Fixation

Table 15: Latin America Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by End User

Table 16: Europe Hips & Knees Reconstructive Market Value (US$ Bn) Analysis 2012-2021 and Forecast 2022–2032, by Country

Table 17: Europe Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Product

Table 18: Europe Hips & Knees Reconstructive Market Volume (Units) Analysis and Forecast 2012–2032, by Product

Table 19: Europe Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Fixation

Table 20: Europe Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by End User

Table 21: South Asia Hips & Knees Reconstructive Market Value (US$ Bn) Analysis 2012-2021 and Forecast 2022–2032, by Country

Table 22: South Asia Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Product

Table 23: South Asia Hips & Knees Reconstructive Market Volume (Units) Analysis and Forecast 2012–2032, by Product

Table 24: South Asia Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Fixation

Table 25: South Asia Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by End User

Table 26: East Asia Hips & Knees Reconstructive Market Value (US$ Bn) Analysis 2012-2021 and Forecast 2022–2032, by Country

Table 27: East Asia Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Product

Table 28: East Asia Hips & Knees Reconstructive Market Volume (Units) Analysis and Forecast 2012–2032, by Product

Table 29: East Asia Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Fixation

Table 30: East Asia Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by End User

Table 31: Oceania Hips & Knees Reconstructive Market Value (US$ Bn) Analysis 2012-2021 and Forecast 2022–2032, by Country

Table 32: Oceania Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Product

Table 33: Oceania Hips & Knees Reconstructive Market Volume (Units) Analysis and Forecast 2012–2032, by Product

Table 34: Oceania Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Fixation

Table 35: Oceania Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by End User

Table 36: MEA Hips & Knees Reconstructive Market Value (US$ Bn) Analysis 2012-2021 and Forecast 2022–2032, by Country

Table 37: MEA Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Product

Table 38: MEA Hips & Knees Reconstructive Market Volume (Units) Analysis and Forecast 2012–2032, by Product

Table 39: MEA Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by Fixation

Table 40: MEA Hips & Knees Reconstructive Market Value (US$ Bn) Analysis and Forecast 2012–2032, by End User

Figure 01: Global Hips & Knees Reconstructive Market Volume (Units), 2012 – 2021

Figure 02: Global Hips & Knees Reconstructive Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2022–2032

Figure 03: Hips & Knees Reconstructive, Pricing Analysis per unit (US$), in 2022

Figure 04: Hips & Knees Reconstructive, Pricing Forecast per unit (US$), in 2032

Figure 05: Global Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2012 – 2021

Figure 06: Global Hips & Knees Reconstructive Market Value Forecast (US$ Bn), 2022-2032

Figure 07: Global Hips & Knees Reconstructive Market Absolute $ Opportunity, 2021 - 2031

Figure 08: Global Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022-2032

Figure 09: Global Hips & Knees Reconstructive Market Y-o-Y Analysis (%), by Product, 2022-2032

Figure 10: Global Hips & Knees Reconstructive Market Attractiveness Analysis by Product, 2022-2032

Figure 11: Global Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022-2032

Figure 12: Global Hips & Knees Reconstructive Market Y-o-Y Analysis (%), by Fixation, 2022-2032

Figure 13: Global Hips & Knees Reconstructive Market Attractiveness Analysis by Fixation, 2022-2032

Figure 14: Global Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022-2032

Figure 15: Global Hips & Knees Reconstructive Market Y-o-Y Analysis (%), by End User, 2022-2032

Figure 16: Global Hips & Knees Reconstructive Market Attractiveness Analysis by End User, 2022-2032

Figure 17: Global Hips & Knees Reconstructive Market Share Analysis (%), by Region, 2022-2032

Figure 18: Global Hips & Knees Reconstructive Market Y-o-Y Analysis (%), by Region, 2022-2032

Figure 19: Global Hips & Knees Reconstructive Market Attractiveness Analysis by Region, 2022-2032

Figure 20: North America Hips & Knees Reconstructive Market Value Share, by Product, 2022 (E)

Figure 21: North America Hips & Knees Reconstructive Market Value Share, by Fixation, 2022 (E)

Figure 22: North America Hips & Knees Reconstructive Market Value Share, by End User, 2022 (E)

Figure 23: North America Hips & Knees Reconstructive Market Value Share, by Country, 2022 (E)

Figure 24: North America Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2012 – 2021

Figure 25: North America Hips & Knees Reconstructive Market Value Forecast (US$ Bn), 2022-2032

Figure 26: North America Hips & Knees Reconstructive Market Attractiveness Analysis by Product, 2022-2032

Figure 27: North America Hips & Knees Reconstructive Market Attractiveness Analysis, by Fixation 2022-2032

Figure 28: North America Hips & Knees Reconstructive Market Attractiveness Analysis by End User, 2022-2032

Figure 29: North America Hips & Knees Reconstructive Market Attractiveness Analysis by Country, 2022-2032

Figure 30: U.S. Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 31: U.S. Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 32: U.S. Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 33: U.S. Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 34: Canada Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 35 : Canada Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 36: Canada Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 37: Canada Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 38: Latin America Hips & Knees Reconstructive Market Value Share, by Product, 2022 (E)

Figure 39: Latin America Hips & Knees Reconstructive Market Value Share, by Fixation, 2022 (E)

Figure 40: Latin America Hips & Knees Reconstructive Market Value Share, by End User, 2022 (E)

Figure 41: Latin America Hips & Knees Reconstructive Market Value Share, by Country, 2022 (E)

Figure 42: Latin America Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2012 – 2021

Figure 43: Latin America Hips & Knees Reconstructive Market Value Forecast (US$ Bn), 2022-2032

Figure 44: Latin America Hips & Knees Reconstructive Market Attractiveness Analysis by Product, 2022-2032

Figure 45: Latin America Hips & Knees Reconstructive Market Attractiveness Analysis by Fixation, 2022-2032

Figure 46: Latin America Hips & Knees Reconstructive Market Attractiveness Analysis by End User, 2022-2032

Figure 47: Latin America Hips & Knees Reconstructive Market Attractiveness Analysis by Country, 2022-2032

Figure 48: Brazil Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 49 : Brazil Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 50: Brazil Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 51: Brazil Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 52: Mexico Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 53: Mexico Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 54: Mexico Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 55: Mexico Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 56: Argentina Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 57: Argentina Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 58: Argentina Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 59: Argentina Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 60: Europe Hips & Knees Reconstructive Market Value Share, by Product, 2022 (E)

Figure 61: Europe Hips & Knees Reconstructive Market Value Share, by Fixation, 2022 (E)

Figure 62: Europe Hips & Knees Reconstructive Market Value Share, by End User, 2022 (E)

Figure 63: Europe Hips & Knees Reconstructive Market Value Share, by Country, 2022 (E)

Figure 64: Europe Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2012 – 2021

Figure 65: Europe Hips & Knees Reconstructive Market Value Forecast (US$ Bn), 2022-2032

Figure 66: Europe Hips & Knees Reconstructive Market Attractiveness Analysis by Product, 2022-2032

Figure 67: Europe Hips & Knees Reconstructive Market Attractiveness Analysis by Fixation, 2022-2032

Figure 68: Europe Hips & Knees Reconstructive Market Attractiveness Analysis by End User, 2022-2032

Figure 69: Europe Hips & Knees Reconstructive Market Attractiveness Analysis by Country, 2022-2032

Figure 70: Germany Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 71: Germany Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 72: Germany Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 73: Germany Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 74: Italy Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 75: Italy Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 76: Italy Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 77: Italy Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 78: France Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 79: France Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 80: France Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 81: France Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 82: UK Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 83: UK Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 84: UK Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 85: UK Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 86: Spain Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 87: Spain Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 88: Spain Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 89: Spain Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 90: BENELUX Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 91: BENELUX Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 92: BENELUX Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 93: BENELUX Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 94: Russia Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 95: Russia Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 96: Russia Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 97: Russia Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 98: South Asia Hips & Knees Reconstructive Market Value Share, by Product, 2022 (E)

Figure 99: South Asia Hips & Knees Reconstructive Market Value Share, by Fixation, 2022 (E)

Figure 100: South Asia Hips & Knees Reconstructive Market Value Share, by End User, 2022 (E)

Figure 101: South Asia Hips & Knees Reconstructive Market Value Share, by Country, 2022 (E)

Figure 102: South Asia Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2012 – 2021

Figure 103: South Asia Hips & Knees Reconstructive Market Value Forecast (US$ Bn), 2022-2032

Figure 104: South Asia Hips & Knees Reconstructive Market Attractiveness Analysis by Product, 2022-2032

Figure 105: South Asia Hips & Knees Reconstructive Market Attractiveness Analysis by Fixation, 2022-2032

Figure 106: South Asia Hips & Knees Reconstructive Market Attractiveness Analysis by End User, 2022-2032

Figure 107: South Asia Hips & Knees Reconstructive Market Attractiveness Analysis by Country, 2022-2032

Figure 108: India Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 109: India Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 110: India Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 111: India Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 112: Indonesia Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 113: Indonesia Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 114: Indonesia Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 115: Indonesia Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 116: Thailand Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 117: Thailand Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 118: Thailand Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 119: Thailand Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 120: Malaysia Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 121: Malaysia Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 122: Malaysia Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 123: Malaysia Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 124: East Asia Hips & Knees Reconstructive Market Value Share, by Product, 2022 (E)

Figure 125: East Asia Hips & Knees Reconstructive Market Value Share, by Fixation, 2022 (E)

Figure 126: East Asia Hips & Knees Reconstructive Market Value Share, by End User, 2022 (E)

Figure 127: East Asia Hips & Knees Reconstructive Market Value Share, by Country, 2022 (E)

Figure 128: East Asia Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2012 – 2021

Figure 129: East Asia Hips & Knees Reconstructive Market Value Forecast (US$ Bn), 2022-2032

Figure 130: East Asia Hips & Knees Reconstructive Market Attractiveness Analysis by Product, 2022-2032

Figure 131: East Asia Hips & Knees Reconstructive Market Attractiveness Analysis by Fixation, 2022-2032

Figure 132: East Asia Hips & Knees Reconstructive Market Attractiveness Analysis by End User, 2022-2032

Figure 133: East Asia Hips & Knees Reconstructive Market Attractiveness Analysis by Country, 2022-2032

Figure 134: China Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 135: China Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 136: China Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 137: China Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 138: Japan Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 139: Japan Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 140: Japan Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 141: Japan Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 142: South Korea Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 143: South Korea Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 144: South Korea Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 145: South Korea Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 146: Oceania Hips & Knees Reconstructive Market Value Share, by Product, 2022 (E)

Figure 147: Oceania Hips & Knees Reconstructive Market Value Share, by Fixation, 2022 (E)

Figure 148: Oceania Hips & Knees Reconstructive Market Value Share, by End User, 2022 (E)

Figure 149: Oceania Hips & Knees Reconstructive Market Value Share, by Country, 2022 (E)

Figure 150: Oceania Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2012 – 2021

Figure 151: Oceania Hips & Knees Reconstructive Market Value Forecast (US$ Bn), 2022-2032

Figure 152: Oceania Hips & Knees Reconstructive Market Attractiveness Analysis by Product, 2022-2032

Figure 153: Oceania Hips & Knees Reconstructive Market Attractiveness Analysis by Fixation, 2022-2032

Figure 154: Oceania Hips & Knees Reconstructive Market Attractiveness Analysis by End User, 2022-2032

Figure 155: Oceania Hips & Knees Reconstructive Market Attractiveness Analysis by Country, 2022-2032

Figure 156: Australia Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 157: Australia Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 158: Australia Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 159: Australia Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 160: New Zealand Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 161: New Zealand Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 162: New Zealand Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 163: New Zealand Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 164: MEA Hips & Knees Reconstructive Market Value Share, by Product, 2022 (E)

Figure 165: MEA Hips & Knees Reconstructive Market Value Share, by Fixation, 2022 (E)

Figure 166: MEA Hips & Knees Reconstructive Market Value Share, by End User, 2022 (E)

Figure 167: MEA Hips & Knees Reconstructive Market Value Share, by Country, 2022 (E)

Figure 168: MEA Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2012 – 2021

Figure 169: MEA Hips & Knees Reconstructive Market Value Forecast (US$ Bn), 2022-2032

Figure 170: MEA Hips & Knees Reconstructive Market Attractiveness Analysis by Product, 2022-2032

Figure 171: MEA Hips & Knees Reconstructive Market Attractiveness Analysis by Fixation, 2022-2032

Figure 172: MEA Hips & Knees Reconstructive Market Attractiveness Analysis by End User, 2022-2032

Figure 173: MEA Hips & Knees Reconstructive Market Attractiveness Analysis by Country, 2022-2032

Figure 174: GCC Countries Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 175: GCC Countries Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 176: GCC Countries Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 177: GCC Countries Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 178: Turkey Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 179: Turkey Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 180: Turkey Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 181: Turkey Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 182: South Africa Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 183: South Africa Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 184: South Africa Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 185: South Africa Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Figure 186: North Africa Hips & Knees Reconstructive Market Share Analysis (%), by Product, 2022 & 2032

Figure 187: North Africa Hips & Knees Reconstructive Market Share Analysis (%), by Fixation, 2022 & 2032

Figure 188: North Africa Hips & Knees Reconstructive Market Share Analysis (%), by End User, 2022 & 2032

Figure 189: North Africa Hips & Knees Reconstructive Market Value Analysis (US$ Bn), 2022 & 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hip Kits Market Size and Share Forecast Outlook 2025 to 2035

Hip shield Market

Hipot Tester Market Analysis – Share, Size, and Forecast 2025 to 2035

HIPAA-Compliant Messaging Services Market

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Ship Plate Market Size and Share Forecast Outlook 2025 to 2035

Ship Anchor Market Size and Share Forecast Outlook 2025 to 2035

Chip-On-Flex Market Size and Share Forecast Outlook 2025 to 2035

Chip Warmers Market Growth – Trends & Forecast 2025 to 2035

Chip Antenna Market

Ship Rudders Market

Chip Resistor Market Size and Share Forecast Outlook 2025 to 2035

Chipboard Box Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Chipboard Box Industry

Shipping Label Market Size and Share Forecast Outlook 2025 to 2035

Shipping Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Shipping Tapes

Shipping Supply Market Size and Share Forecast Outlook 2025 to 2035

Ship Pod Drives Market Size and Share Forecast Outlook 2025 to 2035

Shipping Mailers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA