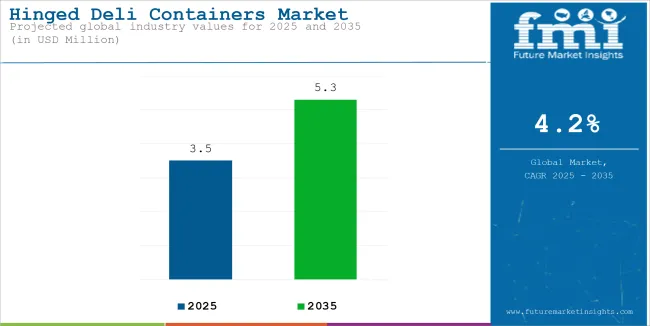

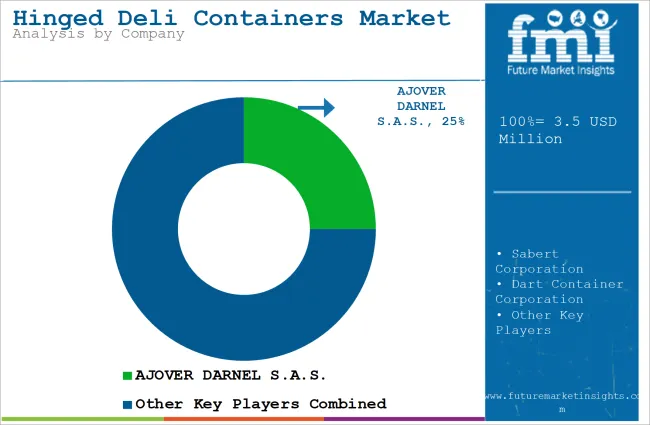

The global hinged deli containers market is estimated to account for USD 3.5 million in 2025. It is anticipated to grow at a CAGR of 4.2% during the assessment period and reach a value of USD 5.3 million by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Hinged Deli Containers Market Size (2025E) | USD 3.5 million |

| Projected Global Hinged Deli Containers Market Value (2035F) | USD 5.3 million |

| Value-based CAGR (2025 to 2035) | 4.2% |

Hinged deli containers are food packaging solutions with an attached lid that is hinged to the container, so no separate lids are required. The most common materials used in the production of these containers include polyethylene terephthalate (PET), polypropylene (PP), or even biodegradable plastics and recycled materials.

The market is expanding as consumers are seeking convenient, easy-to-use packaging. The products are best suited for grab-and-go food items, as they provide a secure yet simple way to package and transport ready-to-eat meals, snacks, and deli products. Their hinged design eliminates the need for separate lids, which makes them more user-friendly for both consumers and businesses. With the increase in on-the-go lifestyles and urbanization, these containers are increasingly preferred for their convenience in food service applications.

Growth in the Food Delivery and Takeaway Industry to Surge Uptake

The growth in food delivery and takeaway services, which is driven by the popularity of online food delivery apps, is a major driver of the hinged deli container market. Restaurants and food service providers prefer these containers because they can securely package and preserve the freshness of food during transport.

Their leak-resistant and sturdy design ensures that food items remain intact, enhancing the overall customer experience. As food delivery increases globally, there is a rising demand for safe and reliable packaging solutions such as hinged deli containers.

Increasing Emphasis on Food Safety and Hygiene to Boost Adoption

Food safety and hygiene is now an utmost concern in packaging, especially with rising awareness post the COVID-19 pandemic. Hinged deli containers made of PET or PP are highly safe against contamination and prevent the spoilage of packed products. Their transparent structure also enables contents to be viewed without the need to open the container, which makes them highly attractive to retailers and consumers alike. This focus on hygiene and quality assurance is promoting adoption in any of the many applications of food services.

Growing Concerns Over Plastic Waste May Hinder Uptake

The most common restraint for hinged deli containers is the alarming increase in concern over plastic wastes. Most single-use plastics utilized in the manufacture of hinged deli containers contain polypropylene (PP) or polystyrene, materials that are extremely polluting and contribute to immense landfill accumulation. Increasing government laws and consumer sensitivity toward the disposal of nonbiodegradable substances are creating huge pressure to prevent the use of plastic packaging products.

In comparison, sustainable alternatives are expensive and not readily available, and a compatible production infrastructure is required to produce them. This environmental scrutiny can limit the growth of the hinged deli containers market in regions with rigid regulations against single-use plastics.

Shift toward Sustainable Materials

There is a new trend in the market for hinged deli containers that is moving toward sustainability and eco-friendliness. With rising consciousness about environmental issues among consumers, businesses are using packaging alternatives that minimize plastic waste and reduce their impact on the environment. Hinged deli containers made of recyclable material, such as post-consumer recycled polyethylene terephthalate, rPET, or biodegradable materials, like plant-based plastics, are expected to gain significant market share in the coming years.

Manufacturers are also innovating to meet the demand by producing compostable and bio-based containers that have all the durability, clarity, and functionality of plastic. This is driven not only by consumer preferences but also by global and regional regulations targeting single-use plastics and encouraging sustainable packaging practices. Consequently, businesses that use eco-friendly hinged deli containers position themselves as environmentally responsible, attracting eco-conscious consumers and reinforcing their commitment to sustainability.

Preference for Transparent Packaging

One of the most significant consumer trends in the hinged deli containers market is the growing demand for transparent and aesthetically pleasing packaging. Modern consumers highly value the ability to see the freshness and quality of food before buying it, making clear hinged deli containers a favorite. These containers enable customers to view the contents without opening the packaging, ensuring convenience and boosting confidence in the product's freshness.

This is most evident in ready-to-eat food sections, where appealing appearances can influence the purchase. The easy viewing flexibility of transparent deli containers, which can display the most colorful salads, meats, baked goods, or desserts, makes them popular in supermarkets, delis, and food service chains. Clear also fits the consumers' need for the transparency: this time, not only visual clarity but also quality and sustainability of the ingredients used, which adds even more to their desirability.

| Attributes | Details |

|---|---|

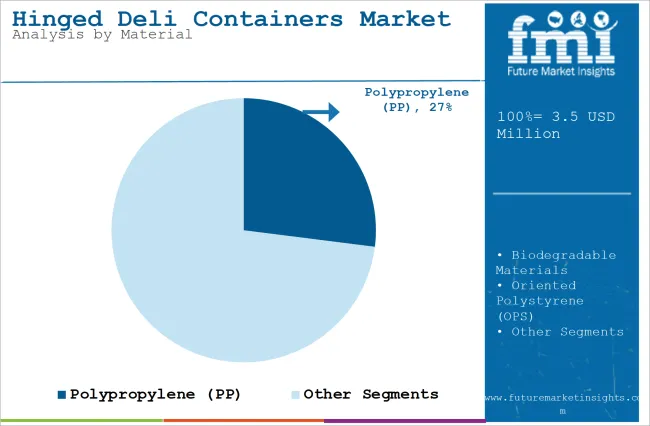

| Top Material | Polypropylene (PP) |

| Market Share in 2025 | 27% |

In terms of material type, the market is divided into biodegradable materials, polyethylene terephthalate (PET), oriented polystyrene (OPS), polypropylene (PP), and others. The polypropylene (PP) segment is set to experience a 27% share in 2025. PP hinged deli containers are very popular for their high durability and resistance to damage.

PP is strong, lightweight material that can absorb physical stress well. It will be ideal to package food products that have to face much handling and moving during transport and storage. The ability to resist cracking or breaking, even upon falling, means the packaged food will be safe and consumers confident of the product.

| Attributes | Details |

|---|---|

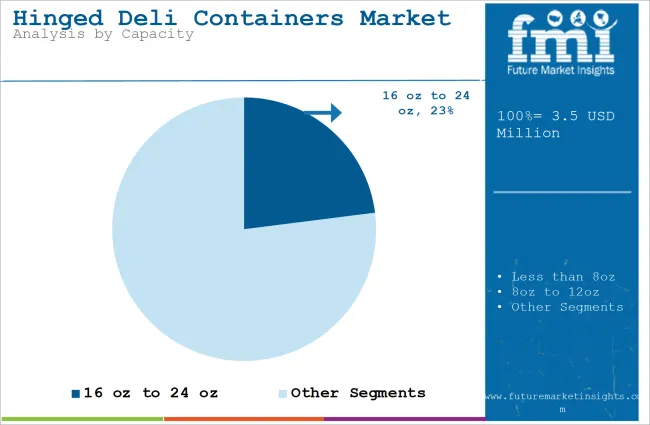

| Top Capacity | 16 oz to 24 oz |

| Market Share in 2025 | 23% |

With respect to capacity, the market is classified into less than 8oz, 8oz to 12oz, 12oz to 16oz, 16oz to 24oz, and 24oz & above. The 16 oz to 24 oz segment is slated to register a 23% share in 2025. The size range is widely used because it meets all the major food packaging requirements optimally.

It best fits portioning single-serving meals, salads, desserts, and deli items, which makes it popular in retail and food service applications. They offer versatility in addressing the demand for ready-to-eat meals, snacks, and pre-packaged portions, and therefore, this makes them the right size and practical for most foods.

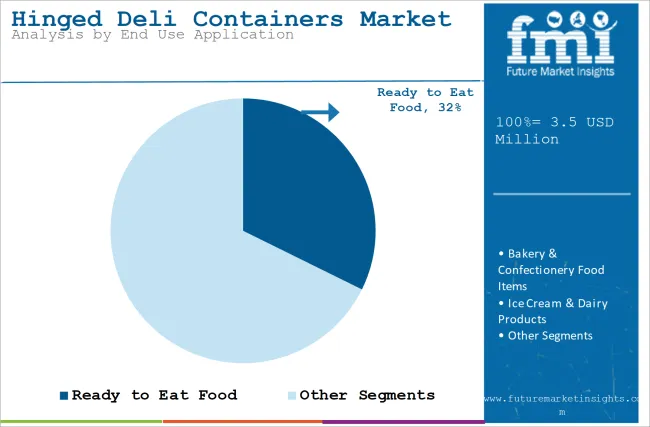

In terms of end use application, the market is segregated into ready to eat food, bakery & confectionery food items, ice cream & dairy products, frozen food, and meat, seafood & poultry items. Hinged deli containers are widely used for ready-to-eat food items such as salads, sandwiches, pasta, and pre-prepared meals.

Their convenience, secure closure, and leak-resistant design make them ideal for grab-and-go options, popular in delis, supermarkets, and takeout services. Additionally, their clear construction enhances product visibility, allowing consumers to see the food quality and freshness, which is a crucial factor in this category.

The USA market is slated to depict a 23.7% share in 2025. The hinged deli containers market is expanding in the USA because of the increasing demand for convenient packaging solutions from consumers. In a fast-paced lifestyle and a significant focus on grab-and-go meals, these containers are ideal for packaging ready-to-eat foods, deli items, and meal prep kits. Their user-friendly design, combining a lid and container into one unit, eliminates the hassle of separate components, making them a popular choice for both consumers and businesses.

This hinged deli containers market is rising in the UK as more consumers increasingly seek on-the-go and takeaway food options. These are widely used in packaging ready-to-eat foods, snacks, and deli items for the busy urban lifestyles and an increasingly dependent market for quick meal solutions. Their convenience, secure closures, and ease of use make them a popular choice among foodservice providers and retailers catering to the fast-paced UK market.

Food delivery services are becoming popular in Germany, particularly among the young consumers and the urban population. Hinged deli containers are used by restaurants and various food delivery platforms to pack meals securely, ensuring they reach at their destination fresh and intact. These leak-resistant containers may hold both hot and cold foods; hence, they are indispensable to this developing food delivery industry.

The hinged deli containers market in China is growing rapidly with the food delivery and takeout culture. As food delivery apps are increasingly used, and people seek convenient meal options, restaurants and foodservice providers need to ensure that the food is delivered safely and securely, and the customers have a positive experience. Hinged deli containers are popular because they can securely hold a variety of food items, from stir-fried dishes to soups and salads.

The demand for convenient and pre-packaged meals, such as bento boxes, salads, and ready-to-eat snacks, is high in Japan. These containers fit perfectly into Japan's culture of convenience, where consumers value compact, neatly packaged meals that are easy to carry and consume on the go. Hinged deli containers' secure lids and portion-friendly sizes make them an ideal choice for this demand.

With its cost-effectiveness and adaptability, the hinged deli containers are gaining adoption in every sector across India. Salads and desserts are packaged like curries and snacks by the street vendors all the way up to high-end restaurants. In a country of diverse food offers like India, its durability and functionality make it more apt for various culinary offerings.

The market includes major players such as Pactiv Evergreen Inc., Berry Global Group, Inc., Amcor plc, and Dart Container Corporation, which capture the market with innovative products and efficient operations. These companies use advanced manufacturing technologies to produce long-lasting, leak-proof, and stackable containers that can be used for different types of food packaging.

Such key focus areas also form the core foundation for many brands, such as investments in rPET (recycled polyethylene terephthalate) and similar recyclable/biodegradable material-related initiatives to focus on the growth of environmental awareness.

They then further extend into the market due to partnerships developed with food service providers and other retail chains.

The niche players are smaller yet competitive. For example, Genpak LLC and Sabert Corporation focus on niche markets and customized packaging solutions. These strategies include the variety of sizes and designs that fit specific applications such as bakery, deli, and meal prep. Most of these companies are working actively with eco-friendly businesses and launching green initiatives to ride on the trend of sustainability.

The growth of food delivery services has also led manufacturers to develop lightweight, tamper-resistant, and temperature-resistant packaging, keeping pace with the evolving demands of consumers and the industry. These strategic efforts collectively strengthen the competitive landscape of the market.

Several new-comers include a deli container company: Eco-Products, Inc.; and Good Start Packaging. This firm produced biodegradable and compostable packaging using bioplastic. Their materials comprise of plant-derived plastics like polylactic acid (PLA) or even bagasse sugarcane fibre.

The start-ups cater for the rising desire of environmentally savvy consumers and producers searching for reduced-carbon footprint as part of efforts of attaining greater sustainability. These startups focus on innovation in materials and design, ensuring their products meet functional needs such as durability, leak resistance, and stackability.

Such start-ups often emphasize collaboration with small foodservice business, cafes, and grocery stores to gain an early foothold. They have a direct-to-consumer sales channel, with digital marketing to reach eco-conscious buyers while also offering flexible ordering options for smaller businesses with less volume. Besides, collaborations and certifications with such organizations that work toward sustainability also add credibility. With a combination of green innovation and targeted marketing, these companies are creating their niche in the competitive market.

In terms of material type, the market is divided into biodegradable materials, polyethylene terephthalate (PET), oriented polystyrene (OPS), polypropylene (PP), and others.

By Capacity, the market is classified into less than 8oz, 8oz to 12oz, 12oz to 16oz, 16oz to 24oz, and 24oz & above.

By end use application, the market is segregated into ready to eat food, bakery & confectionery food items, ice cream & dairy products, frozen food, and meat, seafood & poultry items.

From the regional standpoint, the market is segregated into Latin America, Asia Pacific, the Middle East & Africa, North America, and Europe.

The hinged deli containers market is anticipated to reach USD 3.5 million in 2025.

The hinged deli containers market is predicted to reach a size of USD 5.3 million by 2035.

Some of the key companies manufacturing the product include AJOVER DARNEL S.A.S., Sabert Corporation, Genpak, LLC, and others.

The USA is a prominent hub for product manufacturers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hinged Dual Flap Caps Market Size and Share Forecast Outlook 2025 to 2035

Hinged Lid Tins Market Size and Share Forecast Outlook 2025 to 2035

Hinged Dispensing Caps Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Hinged Dispensing Caps Providers

Hinged Lid Compostable Container Market

PET Hinged Container Market Innovations & Trends 2024-2034

Foam Hinged Take-Out Containers Market

Clear Hinged Container Market

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

Deli Meat Market Growth – Demand, Trends & Industry Forecast 2025-2035

Deli Cup Market Analysis – Trends & Growth 2024-2034

Deli Paper Market Analysis – Growth, Trends & Forecast 2024-2034

Deli Food Container Market Trends & Industry Growth Forecast 2024-2034

Delinting Machine Market Growth – Trends & Forecast 2024-2034

Mandelic Acid Market Size and Share Forecast Outlook 2025 to 2035

Candelilla Wax Market

IOL Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA