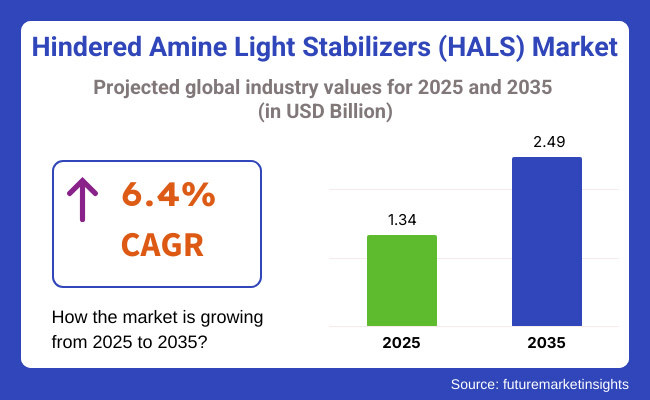

The hindered amine light stabilizers market is valued at USD 1.34 billion in 2025 and is forecast to reach USD 2.49 billion by 2035, advancing at a 6.4 % CAGR over the assessment period.

Within the market, the United States remains the most lucrative country in 2025, buoyed by EPA-driven demand for non-toxic UV stabilizers across high-value automotive and construction polymers. Meanwhile, China is poised to be the fastest-growing country from 2025 to 2035 as its packaging, electronics, and electric-vehicle supply chains expand and local regulations prioritise circular, low-VOC additives. Rising architectural-coatings exports continue to anchor global HALS consumption.

Labour-intensive outdoor plastics, intensifying climate exposure, and increasingly strict chemical-safety audits are reshaping the market. Converters now prioritise polymeric grades that marry low volatility with long-run weathering, plus FDA-compliant monomeric blends for food-contact films.

Volatile amine feedstock prices and differential tariff structures restrain smaller formulators, spurring suppliers to debut biomass-sourced intermediates and closed-loop solvent recovery that trims process energy by 15 %. Key trends steering the market include nanostructured HALS/UV-absorber co-matrices, masterbatch “drop-in” sachets that cut change-over downtime, and blockchain QR codes that certify batch provenance for ESG audits, in solar-panel backsheets and harsh desert installation sites.

Looking ahead, the market will pivot from commodity light stabilizers to predictive, performance-as-a-service ecosystems. Amid tightening landfill bans and recycled-content mandates worldwide, edge-connected masterbatch feeders will auto-adjust HALS dosing based on extrusion temperature, part thickness, and live UV-index data, reducing additive waste by up to 12 % while boosting uptime.

Polymeric stabilizers derived from succinic-acid biorefinery streams are expected to enter mainstream catalogs by 2030, cutting cradle-to-gate CO₂ by 30 %. Manufacturers embedding scope-3 reporting, meeting ISO 14067, and offering subscription-based “durability credits” to OEMs are positioned to capture outsized share as global brands standardise on greener, longer-lasting polymers.

Polymeric HALS are reaching an adoption inflection point as automotive, construction, and packaging converters seek low-volatility stabilizers that endure multiple extrusion cycles. Their multi-chain architecture yields superior thermal stability and scorch resistance versus monomeric or oligomeric analogues, making them the additive of choice for high-temperature polyolefins and styrenics. Suppliers are rolling out bio-sourced polymeric grades with QR-coded traceability, accelerating qualification in Europe and Southeast Asia.

| Type Segment | CAGR (2025 to 2035) |

|---|---|

| Polymeric HALS | 6.8% |

Food, beverage, and pharma packagers together account for nearly half of global HALS revenue, leveraging stabilizers to prevent yellowing and maintain seal integrity during extended shelf life. Demand is reinforced by FDA and EU food-contact mandates, while e-commerce and high-clarity films spur uptake of non-migratory HALS masterbatches. Growth in mono-material recyclable pouches and recycled-content PET trays further boosts the need for high-efficacy UV protection through 2035.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Packaging | 6.6% |

A recent survey conducted by FMI with key stakeholders in the hindered amine light stabilizers (HALS) industry revealed critical insights into industry trends, challenges, and opportunities. The manufacturers and suppliers are of the opinion that there is an increasing demand for high-performance HALS solutions for use in the automotive construction and packaging industries.

Respondents noted that the increasing exposure of materials to UV radiation is accelerating their degradation; hence, with material protection being paramount, HALS drive investments in product longevity. Furthermore, over 70% of the respondents gave a view that regulatory compliance is presently one of the factors driving HALS adoption, as globally there is stricter control on hazardous stabilizers.

Sustainability was talked about as a main concern by industry players, with more than 60% of respondents expressing their alignment to bio-based and non-toxic HALS alternatives. A large number of stakeholders actively seek eco-friendly alternatives conforming to emerging environmental laws, at the same time not compromising the performance.

Investments in R&D for next-generation HALS are reflected in the survey, with the companies working toward improved stabilization mechanisms that give prolonged service life. However, a major hurdle remains in the industry in the form of added costs since the sustainable HALS analogues are invariably priced higher than the customary stabilizers, thus limiting their adoption in the sensitive cost domain.

Another substantial finding was the divergence in regional demand for HALS. In North America and Europe, it was reported that there is growing acceptance often reflecting stringent environmental regulations and premium positioning of the products.

On the other hand, Asia-Pacific and Latin America present an upsurge in demand from the context of the rapid growth of the plastics industry and infrastructural development. More than 50% of respondents believe that Asia-Pacific will lead in HALS consumption by 2030, with the front-runners being China and India. Emerging applications in medical devices and renewable energy sectors are expanding the industry’s opportunities.

Though industry players are hopeful of future expansion, supply chain interruptions, fluctuations in the price of raw materials, and competitive pressures on price still weigh on profitability. Stakeholders have pointed to the necessity of embracing strategic partnerships and technological innovations that can either help circumvent the challenges or open up new sources of revenue.

Government regulations and certifications are significantly shaping the hindered amine light stabilizers (HALS) industry, driving the shift toward safer, sustainable formulations. Stricter environmental laws, chemical safety assessments, and industry-specific compliance requirements across major economies are influencing product development, sector entry, and adoption rates in key industries like automotive, packaging, and construction.

| Countries/Regions | Regulations & Certifications Impacting the HALS Industry |

|---|---|

| United States |

|

| European Union |

|

| China |

|

| India |

|

| Japan |

|

| South Korea |

|

| Brazil |

|

| 2020 to 2024 (Historical Analysis) | 2025 to 2035 (Future Outlook) |

|---|---|

| Steady growth with a CAGR of 6.9% (2018 to 2022) and 6.6% (2023 to 2033). Increasing HALS demand in packaging, automotive, and construction industries. | Continued expansion with a CAGR of 6.6% to 6.8%, driven by sustainability trends, regulatory compliance, and rising polymer applications. |

| The surge in plastic consumption, growing need for UV resistance in automotive and packaging, and stringent FDA/EU regulations on polymer stabilizers have significantly influenced HALS demand. | Eco-friendly stabilizers, demand for high-performance plastics, and increasing biodegradable HALS innovations. |

| Development of polymeric HALS with enhanced UV protection. Shift toward low-toxicity and high-durability solutions. | Advancements in bio-based HALS, improved synthesis methods for longer-lasting stabilizers, and nanotechnology-enhanced UV protection. |

| Implementation of EU REACH, US FDA, and K-REACH regulations encouraging safer stabilizers. Restrictions on toxic UV stabilizers. | Stricter chemical safety laws, increasing government incentives for sustainable HALS, and bans on hazardous stabilizers in several regions. |

| Packaging led the industry, followed by automotive, construction, and agriculture. HALS was widely adopted in UV-sensitive applications. | Packaging will remain dominant, but automotive and construction will see higher adoption due to weather-resistant and durable polymer demand. |

| North America and Europe led in adoption due to strict regulations and technological advancements. | Asia-Pacific will witness the fastest growth, with China, India, and South Korea investing in high-performance polymer stabilizers. |

| Volatility in raw material costs, regulatory compliance burdens, and competition from alternative UV stabilizers. | The HALS market is increasingly focusing on sustainable production, cost-effective solutions, and balancing performance with eco-friendliness. |

| Countries | CAGR |

|---|---|

| USA | 6.8% |

| UK | 6.2% |

| France | 6.3% |

| Germany | 6.5% |

| Italy | 6.1% |

| South Korea | 6.4% |

| Japan | 6.3% |

| China | 7.0% |

| Australia & New Zealand | 6.0% |

The USA is anticipated to develop at a CAGR of 6.8% during 2025 to 2035, fueled by EPA regulations, adopting sustainable materials, and increasing automotive use. The FDA standards governing food-contact safety in addition spur demand for low-toxicity HALS, while construction as well as packaging industries are beginning to integrate HALS to offer UV protection. Investment in bio-based HALS and stabilization for recycled plastics is also anticipated to bolster growth in the industry.

The UK is projected to expand with a CAGR of 6.2% from 2025 to 2035, primarily attributed to UK REACH regulations, more polymer uses in automotive applications, and green building activities. More lightweight plastics are being introduced in the automotive sector which explains the increased use of HALS. HALS remains attractive for the construction industry due to its effectiveness in UV-resistant coatings.

HALS adoption in France is anticipated to grow at a CAGR of 6.3% from 2025 to 2035, supported by EU REACH compliance, increasing use of high-performance plastics, and a push for sustainable chemical formulations. The automotive sector is a major growth driver, while government incentives for eco-friendly materials are accelerating demand for non-toxic HALS. Rising investment in biodegradable stabilizers is also shaping the industry landscape.

Germany is poised to present an incredibly significant growth opportunity, with an estimated CAGR of about 6.5%, specifically during the period from 2025 to 2035, with increasingly strong R&D investments, high-performance applications of polymers as well as high environmental standards becoming stronger.

Major application areas of automotive and industrial manufacturing are the key players in demand, while government sustainability initiatives do spur companies for greener solutions in HALS. The increasing role of recycled plastics in consumer goods and packaging, among others, will likewise push the industries.

HALS demand in Italy is projected to rise at a CAGR of 6.1% from 2025 to 2035, supported by expanding plastic applications in consumer goods, automotive parts, and textiles. On the one hand, the EU regulations on hazardous chemicals speed up moving towards environmentally friendly low-impact HALS solutions. On the other hand, the emphasis on UV-resistant coatings for the construction industry, and the increasing demand for durable plastic components in various applications in the industrial sector, are some important drivers.

According to forecasts, the South Korean industry witnessed a CAGR of 6.4% from 2025 to 2035, powered by K-REACH regulations, robust electronics manufacturing, and rising demand for polymers-based applications. Increases in demand from the automotive and semiconductor sectors are driving demand for UV-resistant materials that incorporate HALS. Meanwhile, government subsidies to promote sustainable plastic production are encouraging investment into next-generation stabilizers. Biodegradable HALS solutions are another trend surfacing on the horizon.

HALS demand in Japan is expected to expand at a CAGR of 6.3% from 2025 to 2035, supported by technological advancements, stringent chemical safety regulations, and high demand for long-lasting polymer stabilizers. The country’s automotive and consumer electronics industries are key consumers of HALS, with increasing emphasis on sustainability and performance longevity. Investments in non-toxic and bio-based HALS are also gaining traction in the sector.

HALS demand in China is projected to grow at a CAGR of 7.0% from 2025 to 2035, making it one of the fastest-expanding industries globally. Rapid industrialization, increasing plastic consumption, and government initiatives for sustainable materials are driving growth. The automotive sector's rising demand for durable polymers is another key factor. China’s focus on green manufacturing is fostering innovation in eco-friendly HALS solutions.

HALS demand in Australia and New Zealand is set to grow at a CAGR of 6.0% from 2025 to 2035, fueled by rising applications in construction, agriculture, and outdoor consumer products. With high UV exposure in the region, the need for long-lasting stabilizers in plastics and coatings is increasing. Government incentives for sustainable and non-toxic stabilizers are also shaping future growth.

As of 2024, the hindered amine light stabilizers (HALS) industry has undergone strategic modifications, shaping the competitive environment. Major and premier players such as BASF SE, SABO S.p.A., Solvay S.A., Adeka Corporation, and Clariant AG have remained the primary actors in the industry, have implemented advanced strategies to maintain or increase their market presence. They have sought product innovation, strategic partnerships, and geographic expansion to consolidate their positions in HALS production.

BASF, the world's leading chemical company, has continued investing in research and development to improve its HALS portfolio. In 2024, BASF launched a new generation of HALS products with the promise of better UV stabilization for polymers used in automotive and construction applications. This move is consistent with the demand for high-performance materials in these industries. The continued presence of BASF in this industry is ensured by a strong distribution network and a customer-oriented approach.

Another key player, SABO S.p.A., has prioritized green and sustainable solutions in 2024. It launched a new bio-based HALS series, targeting sectors that require ecologically friendly solutions. Such a move strengthened SABO's position in Europe, where regulations and consumer demand favor sustainable chemical solutions. SABO's initiatives in green chemistry have created new prospects in North America and the Asia-Pacific region.

Solvay has pursued strategic acquisitions to enhance its HALS offerings. In early 2024, Solvay acquired a specialty chemicals firm producing advanced light stabilizers, thus strengthening its technology position, and further enhancing the breadth of its product offerings. As reported by Chemical Weekly, this has strengthened Solvay's position as a competitor in HALS production, especially in coatings and adhesives. The company’s presence has seen a steady increase as a result of this strategic move.

Adeka Corporation has focused on geographic expansion in 2024, particularly in emerging industries such as India and Southeast Asia. The company established a new production facility in India to meet the growing demand for HALS in the region’s rapidly expanding automotive and packaging industries. The development not only enhanced Adeka's presence but also decreased its dependence on imports, thus enhancing cost efficiency and supply chain resilience.

In 2024, Clariant AG has increased the focus on collaborations and joint ventures in the HALS line of operations to fortify its business. The firm engaged in partnership with a leading polymer manufacturer to customize HALS solutions for high-performance plastics. As per a Clariant press announcement, this collaboration allowed the company to explore new application areas and gain a competitive advantage. Through its pursuit of innovation and customer-focus solutions, Clariant maintains a strong foothold in the production of HALS.

Overall, the year 2024 for HALS production has been characterized by fierce competition and rapid technological advancement. Leading players have adopted strategies such as product innovations, sustainability initiatives, collaborations, and mergers to strengthen their industry positions. These developments indicate the response of the sector to the changing customer and regulatory requirements, thereby ensuring continued development and innovation in HALS applications.

The hindered amine light stabilizers (HALS) industry falls under the specialty chemicals industry, specifically within the polymer additives and stabilizers sector. Indeed, HALS show considerable promise in improving the endurance and UV resistance of plastics. Therefore, this plays an important role in packaging, automotive use, construction, and agriculture.

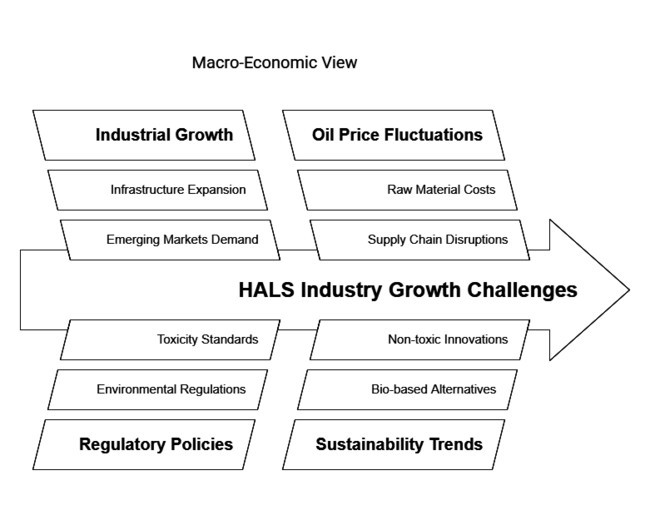

From the macroeconomic angle, the impact of industrial growth all over the globe has been responsible for augmenting the industry for HALS. The sector is also subject to regulatory policies and to advancements in polymer technologies.

The rising demand for high-performance plastics in emerging regions like China, India, and Southeast Asia is driven by rapid industrialization and infrastructure expansion. Further, with North America and Europe-imposed stringent environment regulations, this brings to the fore low qualities of toxicity and sustainable stabilizers that compel R&D investments.

HALS production is closely linked to oil price fluctuations due to its reliance on petrochemical feedstocks. Supply chains may get disrupted or experience a rise in the price of raw materials, which can affect profitability. Moreover, world trends toward sustainability can shape the dynamics of the industry, as bio-based and non-toxic alternatives to HALS are being researched.

Moreover, rise in urbanization and infrastructure projects present opportunities for the construction and automotive applications, increasing the demand. Thus, the production of HALS would thrive into steady growth owing to the factors of industrial expansion, regulatory impact, and innovations in polymer stabilization technologies.

Expansion in Bio-Based HALS to Address Sustainability Demands

With increasing regulatory restrictions on hazardous stabilizers, stakeholders should focus on developing bio-based HALS derived from renewable sources. Investments in non-toxic, biodegradable stabilizers can help manufacturers secure a competitive edge in Europe and North America, where environmental compliance is a priority. Collaborating with research institutions for innovative formulations can accelerate industry penetration.

Strengthening Presence in High-Growth Asia-Pacific Industries

China, India, and Southeast Asia are witnessing rapid industrialization and infrastructure expansion, leading to higher demand for UV-resistant polymers. Companies should establish local production units or partnerships to reduce costs and capitalize on government incentives for domestic manufacturing. Targeting automotive and packaging industries in these regions will provide long-term revenue growth.

Product Differentiation Through High-Performance HALS for Automotive & Construction

The automotive and construction sectors require HALS with superior thermal stability and extended UV protection. Stakeholders should invest in high-performance polymeric HALS with low volatility and high weather resistance, catering to EV manufacturers and sustainable building projects. Creating customized HALS solutions for specific polymer applications can enhance industry positioning.

Leveraging Regulatory Compliance as A Competitive Advantage

With stringent safety regulations in the USA, EU, and Japan, manufacturers should obtain REACH, FDA, and K-REACH certifications for their HALS products. Proactively engaging with regulatory bodies to influence chemical safety policies can help businesses stay ahead of compliance challenges while marketing their products as safe and environmentally responsible.

By application, the sector is segmented into packaging, automotive, agricultural films, construction, and others.

Based on type, the industry is segmented into polymeric, monomeric, and oligomeric.

The sector is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 30: Asia Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Application, 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Application, 2023 to 2033

Figure 35: North America Market Attractiveness by Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 70: Europe Market Attractiveness by Application, 2023 to 2033

Figure 71: Europe Market Attractiveness by Type, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 81: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 85: Asia Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 99: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 103: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 106: MEA Market Attractiveness by Application, 2023 to 2033

Figure 107: MEA Market Attractiveness by Type, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

HALS are used to prevent polymer degradation caused by UV radiation, extending material lifespan in packaging, automotive, construction, and agriculture.

HALS continuously neutralizes free radicals, providing long-term protection, whereas traditional UV stabilizers primarily absorb radiation.

Industries such as packaging, automotive, construction, and agriculture benefit from HALS due to their ability to enhance durability and weather resistance.

Regulatory bodies like the FDA and REACH impose safety and compliance guidelines for HALS in food packaging, medical devices, and other sensitive applications.

Recent advancements include eco-friendly bio-based HALS, improved polymer compatibility, and enhanced stabilization efficiency to meet sustainability and regulatory demands.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA