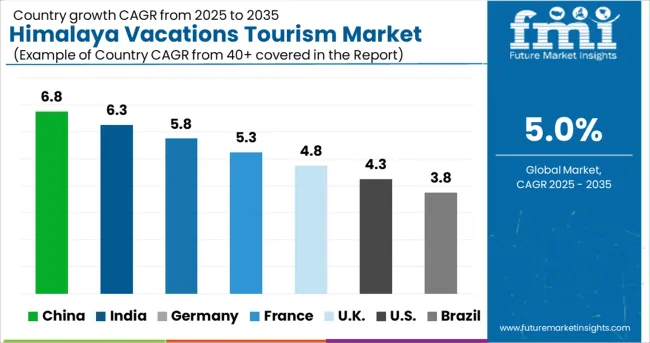

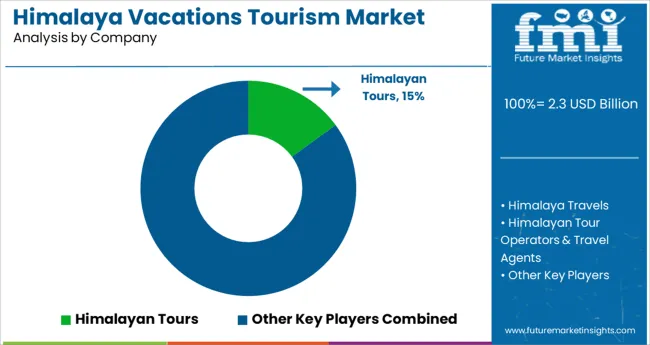

The Himalaya Vacations Tourism Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The Himalaya vacations tourism market is undergoing a notable transformation, driven by a combination of rising disposable income, growing interest in wellness and eco-tourism, and increased infrastructure development in Himalayan regions. Favorable government initiatives promoting sustainable tourism, improved road and air connectivity, and digital outreach by local tourism boards have expanded access to remote destinations.

The market is also benefiting from a demographic shift among travelers, with younger tourists seeking nature immersion and physical activity, fueling demand for customized and thematic travel experiences. The rising integration of mobile apps, travel portals, and virtual concierge services has enhanced online visibility and consumer convenience, accelerating digital bookings.

Future growth is expected to be supported by year-round tourism models, cultural tourism integration, and partnerships between local businesses and national tour operators to enhance service delivery and value proposition.

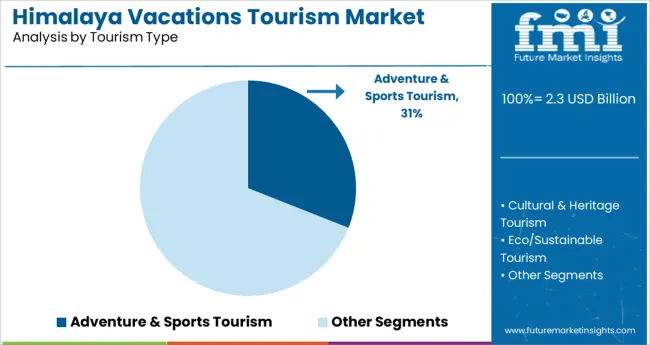

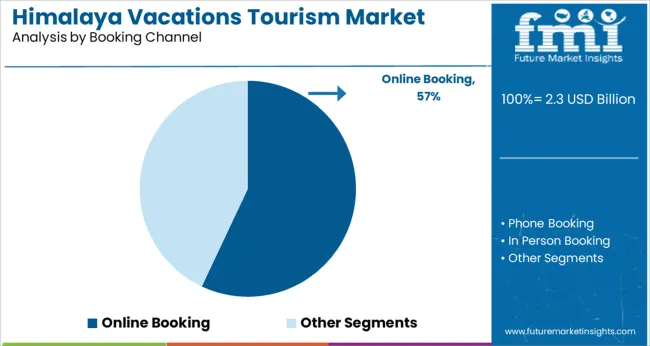

The market is segmented by Tourism Type, Booking Channel, Tourist Type, and Age Group and region. By Tourism Type, the market is divided into Adventure & Sports Tourism, Cultural & Heritage Tourism, Eco/Sustainable Tourism, Wellness Tourism, and Others. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking.

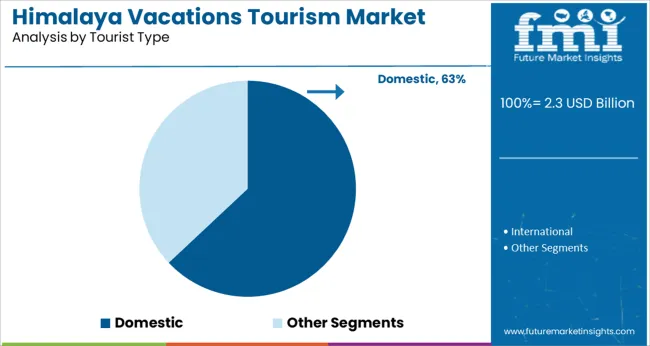

Based on Tourist Type, the market is segmented into Domestic and International. By Age Group, the market is divided into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Tourism Type, Booking Channel, Tourist Type, and Age Group and region. By Tourism Type, the market is divided into Adventure & Sports Tourism, Cultural & Heritage Tourism, Eco/Sustainable Tourism, Wellness Tourism, and Others. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking.

Based on Tourist Type, the market is segmented into Domestic and International. By Age Group, the market is divided into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Adventure & sports tourism is expected to command 31.0% of the overall market share in 2025, making it the leading tourism type segment. This dominance is being shaped by the Himalayas’ natural terrain, which offers a wide spectrum of physical and exploratory activities suitable for all experience levels.

Increased focus on mental and physical well-being post-pandemic, coupled with the appeal of risk-based experiences, has shifted preferences toward outdoor and adventure-centric travel. The region’s elevation diversity, glacier-fed rivers, and trekking routes have made it a hotspot for climbers, hikers, and rafting enthusiasts.

Supportive state-level tourism policies, such as adventure insurance mandates and safety certification programs, are further encouraging participation. As travelers seek meaningful and immersive journeys away from crowded destinations, adventure and sports tourism in the Himalayas continues to attract both domestic and international attention..

Online booking is projected to hold 57.0% of the total revenue share in 2025, establishing it as the dominant booking channel for Himalaya tourism. This segment’s strength is being attributed to the rising digital literacy, widespread mobile penetration, and increasing reliance on user-generated content and reviews to guide travel decisions.

Digital platforms offer real-time access to pricing, packages, availability, and itinerary customization-factors that are increasingly influencing travel behavior. Integration with fintech services and digital wallets has made transactions smoother, especially among tech-savvy urban travelers.

The growing popularity of influencer marketing and online travel communities has further amplified the visibility of lesser-known Himalayan destinations, converting awareness into bookings. The ability to offer personalized packages and flexible rescheduling policies has positioned online channels as the preferred medium for both planned and spontaneous travel arrangements.

Domestic tourists are expected to contribute 63.0% of the market revenue in 2025, marking them as the primary customer base in the Himalaya vacations tourism market. This lead is being driven by rising intra-national travel interest, affordability concerns, and a stronger cultural connection to the Himalayan region.

Increased promotion of Dekho Apna Desh campaigns and discounted domestic travel packages by government and private operators have boosted local travel sentiment. The post-pandemic recovery has witnessed a substantial redirection of travel budgets from international to domestic locations, particularly toward safe, open-air, and nature-centric destinations like the Himalayas.

Additionally, ease of travel without visa formalities and shorter planning cycles have made domestic tourism more viable and accessible for a larger demographic. Improved road networks and regional air connectivity continue to support this trend, ensuring sustained growth in domestic travel volumes.

The Himalayas are a popular tourist destination, both for Domestic and international tourists. The Himalayas has a heritage as a Holy Land, having multiple pilgrimages around them. Along with pilgrimages, people come here for adventures, there is a number of treks, camps, and safaris. Uttarakhand, Jammu, Kashmir, West Bengal, Assam, and Meghalaya are famous tourist destinations, having thousands of tourists visiting every year.

In 2024, both domestic and foreign tourists substantially decreased, with an 81% drop in visits from 2020. A rise in tourism was noted in 2024, up 75% from 2024. These figures are indicating positive signs for tourism in the Himalayas in the years upcoming.

The Himalayas are filled with diversity and lots of destinations to visit. According to the destination, the Himachal Pradesh Tourism Policy is classifying the tourism attraction. As these destinations are classified, the tourists can focus on what they want to see around the Himalayas or they can plan their vacation around visiting and performing activities they want. The diversification is carried out based on the locations and the significance of such locations in terms of culture and heritage.

Such diversification is also helpful transformation and development of tourist places, accelerating the process as organizations know where to focus and understand the requirements.

Many adventure enthusiasts come to the Himalayas to climb a number of mountains and finally conquer the 8,850 meters tall mountain itself. But mountain climbers are not allowed to climb the mountain directly. Climbers must practice and gain an understanding of the conditions there. One needs to travel to Nepal to begin the ascent of the Himalayas. Mountains in Nepal that are under the supervision of the ministry and that they permit climbers to ascend before beginning the actual climb are between 5,000 and 7,000 meters high.

recently ministry of Nepal opened 104 peaks, which were closed due to avalanches, leading to the death of Sherpa in the area. Due to the accident, all Himalaya climbs were canceled, as Sherpa guides refused to climb with tourists and mountain climbers.

Himachal Pradesh is a land with abundant natural beauty, with vast snowy peaks, lush green fields and deserts, and forests. Gushing rivers and lakes surrounded by mountains and valleys, all these natural phenomena make this place an amazing tourist destination. Tourists visiting the Himalayas cannot decide what to visit and what activities they should do. As there is no plan, they miss many great opportunities to explore unseen destinations.

Himachal Tourism has suggested the Himachal Pradesh Tourism Policy for 2020 in order to facilitate convenient and sustainable tours in the Himalayas. According to this approach, the destinations are divided into categories based on their attributes. The main attraction of these destinations is ecotourism, pilgrimage tourism, snow tourism, and adventure tourism. This step will make the Himalayas a sustainable tourism destination and might create employment opportunities, helping in economic elevation.

Tourism in Nepal, like in other countries, is some of the phenomenon and relationships arising from activities like travel and stay of nonresidents in so far as they don't lead to permanent residence and are not connected with any kind of earning activities. Those activities made by tourists include recreation, holidays, adventures, businesses, and other special interest activities. The physical manifestations of Nepal's mountain tourism industry include attractions such as the snow-capped Great Himalayan ranges, deep gorges, picturesque landscapes, lovely forests an abundance of wild animals and a pleasant climate, traditional culture, numerous festivals, Hindu temples, and Buddhist monasteries, among others.

The Himalayas in Nepal are an important part of international tourism, generating revenue and providing employment and business opportunities to residents. The locals guide tourists around popular destinations and are capable of offering services to tourism-related enterprises. Apart from local communities, the government, private sector tourism entrepreneurs, tourists, and international assistance organizations & agencies, are interconnected and crucial components for the development of Himalaya Tourism in Nepal.

Bhutan is restarting its tourism sector for tourists all around the world, but this time, there are certain changes to the norms and regulations for visitors that have drawn conflicting responses. After surviving the Covid epidemic, Bhutan recently reopened its borders to visitors. However, this time, the per diem tourism tax has been expanded. This increase in tax covers Indian tourists as well, who have historically enjoyed passport and visa-free access to the Himalayan state. The accommodation and travel costs have also been extended.

Bhutan is also taking steps towards the development of eco-tourism, as it is banning tobacco and cigarettes, saying it not only degenerates the environment but also increases the healthcare costs, which are coming from foreign direct exchanges. Bhutan will also concur about updates to the BBIN Motor Vehicles Agreement, which will help in the reduction of air pollution, caused by vehicles.

The traveling agencies planning tours in the Himalayas are giving tons of variety in tours. The tours may include only sightseeing, or treks of Himalayan mountains, or will give options of selecting multiple destinations like lakes and mountains and forests to visit, or can give freedom of selecting destinations tourists are interested to visit. Along with these options, for pilgrimages and events taking place in the Himalayas, travelers can travel at specific times of the year.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Region Covered | Asia |

| Key Countries Covered | India, Nepal, Bhutan, China, and Others |

| Key Segments Covered | Tourism Type, Booking Channel, Tourist Type, Tour Type, Age Group, and Region. |

| Key Companies Profiled | Himalayan Tours; Himalaya Travels; Himalayan Tour Operators & Travel Agents; Enchanting Travels; Himalayan Holidays; Sherpa Expedition and Trekking Pvt. Ltd.; Trafalgar; G Adventures; Explore; Nepal Hiking Team; Himalaya Heart Treks & Expedition |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global himalaya vacations tourism market is estimated to be valued at USD 2.3 USD billion in 2025.

It is projected to reach USD 3.8 USD billion by 2035.

The market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types are adventure & sports tourism, cultural & heritage tourism, eco/sustainable tourism, wellness tourism and others.

online booking segment is expected to dominate with a 57.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Himalayan Salt Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lake Vacations Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Global Ecotourism Market Insights – Growth & Demand 2025–2035

Agritourism Market Size and Share Forecast Outlook 2025 to 2035

Art Tourism Market Analysis by, by Service Category, by End, by Booking Channel by Region Forecast: 2025 to 2035

Analyzing War Tourism Market Share & Industry Leaders

War Tourism Market Insights - Size, Trends & Forecast 2025 to 2035

Dark Tourism Market Forecast and Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA