The global high-silica fiber market size is estimated to reach USD 1.87 billion by 2025. Over the forecast period, the market demand is anticipated to expand at a CAGR of 10.2%. It will reach a valuation of USD 4.85 billion by 2035.

In 2024, the industry of high silica fiber saw significant growth owing to its rising applications across various industries. Technical fabric production was a dominant segment where high-performance fabrics saw more application in healthcare, sports, and aerospace sectors.

High silica fibers benefited from the high thermal resistance and long lifespan of the fibers, which were capable of fulfilling the stringent requirements of these industries.

Production of silica sleeves also saw a substantial rise. The glass, petrochemical, and metallurgy industries adopted silica sleeves to protect equipment and machinery from extreme heat, thereby enhancing efficiency and safety in operation.

Similarly, the construction industry also saw the growing application of silica braided ropes, which were valued for their heat resistance as well as durability and then came to be utilized in demanding applications in the marine and construction industries.

The high silica fiber market will remain on the upswing in the forecast period of 2025 to 2035. Increased application of high silica fibers in 3D printing technologies will provide new avenues for growth. In addition, strict regulatory laws for fire safety and insulation in the construction sector, as well as other companies, will drive industry demand even further.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 1.87 billion |

| Industry Value (2035F) | USD 4.85 billion |

| CAGR (2025 to 2035) | 10.2% |

Explore FMI!

Book a free demo

The industry for high silica fiber is on a robust growth path, spurred by rising demand for heat-resistant materials in aerospace, automotive, and industrial uses.

The primary beneficiaries are high-performance fabric, insulation solution, and protective gear manufacturers, while industries that lag in embracing these cutting-edge materials can expect efficiency and safety issues.

With fast-paced industrialization, increased fire safety standards, and technological advancements in 3D printing, the industry is poised for long-term growth until 2033.

Invest in R&D & Advanced Manufacturing

Increase R&D to improve fiber durability, thermal resistance, and cost-effectiveness. Invest in automation and advanced production methods to increase manufacturing scale while preserving quality.

Align with Emerging Industries Regulations & Trends

Take advantage of growing regulatory demands for fire safety and insulation by creating compliant, high-performance solutions. Improve industry positioning in high-growth segments such as Asia-Pacific and invest in sector-specific applications such as aerospace and industrial insulation.

Enhance Strategic Partnerships & Distribution Networks

Develop strategic partnerships with the major players in aerospace, automotive, and construction sectors to sign long-term supply agreements. Enlarged distribution channels worldwide to accommodate increasing demand and pursue M&A to take out niche players and enhance industrial presence.

| Risk | Probability & Impact |

|---|---|

| Supply Chain Disruptions (Raw Material Shortages) | Medium Probability - High Impact |

| Regulatory & Compliance Challenges | High Probability - Medium Impact |

| Competitive Industry Pressure & Price Volatility | Medium Probability - High Impact |

| Priority | Immediate Action |

|---|---|

| Supply Chain Resilience | Conduct a feasibility study on alternative raw material sourcing and supplier diversification. |

| Industry Expansion & Client Alignment | Initiate OEM and end-user feedback loop to assess demand for advanced high silica fiber applications. |

| Channel & Partnership Growth | Launch an incentive program for aftermarket and distribution partners to drive adoption and sales. |

To stay ahead, the company needs to hasten investments in next-generation manufacturing, strategic collaborations, and industry-led innovation.

With rising regulatory requirements and industrial take-up, leadership should focus on diversifying the supply base, moving into high-growth geographies, and utilizing R&D to create next-generation, high-performance fibers.

This insight foretells a change in direction toward aggressive engagement with OEMs, regulatory authorities, and leading industry influencers, assuring long-term leadership in the industry and top-line growth.

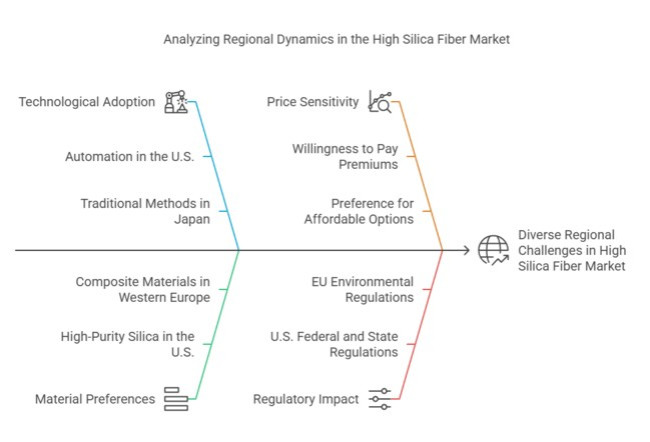

In Q4 2024, Future Market Insights conducted a comprehensive survey involving 450 stakeholders-including manufacturers, distributors, and end-users-from the United States, Western Europe, Japan, and South Korea. The survey aimed to capture nuanced perspectives on the high silica fiber industry, focusing on priorities, technological adoption, material preferences, price sensitivity, value chain challenges, future investments, and regulatory impacts.

Compliance with Safety and Performance Standards: A significant 85% of stakeholders globally identified adherence to stringent safety and performance standards as a "critical" priority, emphasizing the importance of high silica fibers' thermal resistance and durability.

Regional Variances:

High Variance Observed:

Return on Investment (ROI) Perspectives:

Consensus:

Regional Variances:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users:

Alignment:

Divergence:

High Consensus:

Across all regions, stakeholders agreed on the importance of compliance with safety standards, material durability, and addressing cost pressures.

Key Variations:

Strategic Insight:

A uniform strategy is ineffective in the diverse high silica fiber industry. Tailored approaches that consider regional priorities-such as emphasizing automation in the USA, sustainability in Western Europe.

| Countries | Regulations and Mandatory Certifications |

|---|---|

| India | Bureau of Indian Standards (BIS) Certification: The BIS has issued Quality Control Orders (QCOs) for different textile products, including technical textiles. Adherence to these standards is obligatory for manufacturing and importing certain products. For instance, the Indutech (Quality Control) Order, 2024, and the Ropes and Cordages (Quality Control) Order, 2024, mandate that products display the Standard Mark under a valid BIS license. Although high silica fibers are not specifically stated, suppliers must check if their products come under associated classes. |

| United States | Occupational Safety and Health Administration (OSHA) Standards: Exposure to airborne silica in the workplace is regulated by OSHA, affecting the manufacture and handling of silica products. Permissible exposure limits and the use of control measures must be complied with. |

| European Union | Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH): High silica fibers are subject to REACH rules, which require chemicals applied to be registered and tested for safety. |

| Japan | Industrial Safety and Health Act: Ensures safety when dealing with harmful substances such as silica materials in order to safeguard workers. |

| South Korea | Korea Occupational Safety and Health Agency (KOSHA) Regulations: Requires protective measures while working with materials having silica to ensure workers' health. |

The USA industry for high silica fiber is expected to register strong during the period 2025 to 2035, supported by high demand in the aerospace, defense, and industrial segments. The growing emphasis on energy efficiency in industrial processes, such as furnace use and thermal insulation panels, is a key driver.

High silica fibers are also being increasingly used in the automotive sector for light and heat-resistant parts. Along with this, increased investment of the USA military in leading-edge materials for thermal protection systems is driving industry growth.

FMI opines that the United States' high silica fiber sales will grow at nearly 10.8% CAGR through 2025 to 2035.

The UK industry is led by the aerospace, automotive, and renewable energy industries. As a major player in defense and aviation, the nation is also seeing rising demand for high-performance thermal insulation materials.

The net-zero emissions goal for 2050 by the UK is also fueling investments in renewable energy, where wind turbine components and insulation uses employ high silica fibers. In addition, the expansion of electric vehicles (EVs) in the UK is driving demand for lightweight and heat-resistant materials, adding to industry growth.

FMI opines that the United Kingdom’s high silica fiber sales will grow at nearly 9.5% CAGR through 2025 to 2035.

France's high silica fiber industry is driven by the country's dominant position in the aerospace and nuclear energy industries. The requirement for advanced thermal protection solutions in aircraft and defense is contributing greatly to industry growth. In addition, the heavy focus of France on nuclear power generation demands high-performance insulation products, hence increased the demand for high silica fibers. The increasing use of lightweight materials in the automotive sector to enhance fuel efficiency and lower emissions is another major reason for industry growth.

FMI opines that France’s high silica fiber sales will grow at nearly 10.0% CAGR through 2025 to 2035.

The German high silica fiber industry will grow due to its large demand coming from its automotive and industrial segments. As a center of automotive innovation, Germany is emphasizing advanced materials to improve vehicle performance and efficiency.

The industrial strength of the country, especially in high-temperature manufacturing processes, is propelling the demand for heat-resistant materials such as high-silica fibers. Moreover, Germany's emphasis on renewable energy, especially wind power, is likely to open up new avenues for industry growth.

FMI opines that Germany’s high silica fiber sales will grow at nearly 9.8% CAGR through 2025 to 2035.

The Italian industry for high silica fiber will surge due to the increasing demand from industries such as manufacturing, automotive, and energy. Italy's industry sector, comprising numerous high-temperature manufacturing processes, demands consistent thermal insulation solutions.

The increasing emphasis on electric and hybrid vehicle production in the country is also driving demand for sophisticated materials that provide increased heat resistance and durability.

FMI opines that Italy high silica fiber sales will grow at nearly 9.3% CAGR through 2025 to 2035.

South Korea is anticipated to experience robust industry growth largely driven by its thriving semiconductor, electronics, and automotive sectors. The rapidly growing semiconductor industry of the country, which demands high-performance thermal insulation materials, is a key driver of growth.

Furthermore, South Korea's initiative to adopt advanced EV technologies and thermal management systems for batteries is creating demand for high silica fibers. The country's high emphasis on automation and smart manufacturing is also causing the rising use of these materials in high-temperature applications.

FMI opines that South Korea’s high silica fiber sales will grow at nearly 10.6% CAGR through 2025 to 2035.

Japan's high silica fiber industry is driven by technological innovation and strong demand from the aerospace, automotive, and electronics sectors. Japan's robust R&D environment and dominance in high-tech production make it a leader in the use of advanced materials.

Japan's space exploration programs and growing investment in next-generation aircraft materials are also driving industry growth. Additionally, increased demand for heat-resistant components driven by the booming EV industry in Japan is supplementing industry growth.

FMI opines that Japan’s high silica fiber sales will grow at nearly 9.2% CAGR through 2025 to 2035.

The fastest-growing industry will boost due to growing industrialization and increasing construction, automotive, and electronics industries. The aggressive infrastructural development in the country is demanding high-performance materials for fire protection and insulation.

Moreover, China's position as a world manufacturing hub, particularly in consumer electronics and semiconductors, is driving demand for high silica fibers. The increased use of electric vehicles and government initiatives favoring high-performance materials in green manufacturing are also driving industry growth further.

FMI opines that China’s high silica fiber sales will grow at nearly 11.5% CAGR through 2025 to 2035.

The Australian and New Zealand high silica fiber market is driven by demand from the mining, renewable energy, and construction sectors. Australia boasts a strong mining sector that requires heat and wear-resistant materials that are appropriate for equipment and safety applications. There is also growing demand, driven by investment in wind and solar power programs, for high-quality thermal insulation products.

In the construction industry, an increasing emphasis on energy-efficient and fire-resistant buildings is fueling the industry's growth, with high silica fibers becoming a staple product for use in insulation.

FMI opines that Australia-NZ high silica fiber sales will grow at nearly 9.0% CAGR through 2025 to 2035.

As more industries look for high-performance materials for insulation and heat protection, the demand for technical fabric production is expected to increase dramatically over the forecast period. These textiles are crucial for industrial, automotive, and aerospace applications due to their exceptional resistance to high temperatures to their high silica content. In order to satisfy changing industrial demands, manufacturers will keep coming up with new ideas, concentrating on improving durability and thermal efficiency.

The silica sleeve production industry will continue to expand, with industries demanding strong, flexible, and heat-resistant sleeves for wiring and piping insulation. High silica fiber sleeves will continue to be the go-to option for thermal and fire protection in high-risk settings like power plants, automobile exhaust systems, and industrial machinery due to the expanding safety regulations across a variety of industries.

The silica braided ropes are essential for insulation and sealing at high temperatures, and the industry for their production will grow. Silica braided ropes will be used in industries like metallurgy, power generation, and refineries going forward, particularly for furnace doors, gaskets, and other applications that call for heat containment. To meet the rising demand for high-performance insulation solutions, manufacturers will concentrate on increasing the tensile strength and flexibility of rope.

Industries that need soft, lightweight, and highly insulating materials will increasingly use the silica fiber felt production segment. The industry will expand due to applications in industrial heat shielding, protective apparel, and thermal insulation panels. In industries that need thermal management solutions, silica fiber felt will be essential due to its capacity to tolerate high temperatures while retaining its flexibility.

The need for sophisticated heat-resistant solutions in industrial and aerospace applications will drive growth in the high-temperature silica tape production industry. Silica tapes will be widely used in sealing, wrapping, and shielding applications as a result of stricter safety regulations and a drive toward environmentally friendly insulation techniques.

As new industrial use cases appear, the other categories-such as mesh cloth applications and casing-will keep evolving. More cutting-edge uses in building, fireproofing, and specialized thermal insulation solutions will emerge as high silica fiber technologies undergo more research and development.

As industries prioritize increasing operational safety and energy efficiency, there will be a significant demand for insulation for furnaces and refractories. High silica fibers will remain essential for reducing energy loss, containing heat, and prolonging the life of refractory linings and industrial furnaces.

As businesses look for high-performance sealing materials that can tolerate high temperatures and chemical exposure, the gasket production industry will prosper. In industrial, automotive, and aerospace machinery, where dependable heat resistance is critical to preserving efficiency and safety, high-silica fiber-based gaskets will continue to be indispensable.

Applications for fireproofing, protective enclosures, and industrial filtration will all see a rise in the use of meshes. Silica fiber meshes will be essential to sophisticated thermal protection systems as industries prioritize workplace safety and heat-resistant solutions.

As high silica fibers become the material of choice for thermal and fire-resistant panels, the industry for panels will expand. Manufacturers will utilize these panels in high-temperature processing facilities, and the construction sector will incorporate them into commercial and industrial structures.

As energy efficiency and sustainability become top priorities in many industries, the industry for thermal insulation panels will grow. Superior thermal resistance offered by high-silica fiber panels will enable industries to use less energy and operate more efficiently overall.

Demand for hygro-metry panels will continue to grow, especially in settings that need regulated temperature and humidity levels. High silica fibers will aid producers in creating panels that improve climate control for use in scientific, industrial, and aerospace settings.

Stricter safety laws will boost the industry for fireproof panels by encouraging their use in high-risk industrial settings and critical infrastructure. These panels' high silica fiber content will guarantee their exceptional fire resistance, making them the go-to option for applications that prioritize safety.

The high silica fiber-based insulation materials are still essential in extremely hot conditions, the metallurgy (protection systems) segment will continue to grow. These materials will be used more often by foundries, smelters, and refineries to improve equipment longevity and worker safety.

As industries place a higher priority on protecting pipelines and mechanical joints exposed to high temperatures, the fittings and flange covers segment will grow. High silica fibers will be used extensively in covering and sealing applications to increase durability and prevent heat damage.

As manufacturers concentrate on heat containment and emission control, the automotive and aerospace sectors will increase their demand for engine exhaust pipe covers. Covers made of high silica fiber will be essential for increasing safety, lowering heat loss, and improving performance.

As advanced heat-resistant materials are required by workplace safety regulations, the protective clothing industry is expected to grow significantly.

As long as refineries continue to place a high priority on equipment protection and thermal efficiency, the oil refinery liner industry will grow. In order to create liners that can endure high temperatures and harsh chemical environments and guarantee operational dependability, high silica fibers will be essential.

As industries continue to investigate high silica fiber solutions for various thermal protection and insulation needs, new applications will appear in the other category. These fibers will continue to be at the forefront of advanced material science innovation in fields such as aerospace, defense, and high-tech manufacturing.

The high silica fiber industry is relatively consolidated, with leading players following strategies including innovation, strategic alliances, and expansion into new sectors in order to sustain competitive strengths. Leading firms concentrate on creating advanced materials, forming strategic alliances, and increasing their international presence in order to cater to increasing demand from different industries.

In July 2024, USA Silica Holdings, Inc. was acquired by funds managed by affiliates of Apollo, with a goal of building on USA Silica's performance materials expertise for future expansion. In August 2024, PPG entered into a deal to divest its silicas products business to QEMETICA S.A. for about USD 310 million so that PPG could concentrate on its core specialty and coatings products. These actions reflect a pattern of consolidation and strategic realignment in the industry.

Market Share Analysis

Stricter safety regulations, industrial insulation needs, and aerospace, automotive, and metallurgy applications.

Aerospace, defense, automotive, metallurgy, energy, and construction for heat resistance and fireproofing.

Compliance with safety and environmental laws is driving demand for certified, high-performance materials.

Innovations in fiber weaving, coatings, eco-friendly manufacturing, and lightweight, durable composites.

High raw material costs, complex production, R&D expenses, and competition from substitutes.

technical fabric production, silica sleeve production, silica braided ropes production, silica fiber felt production, high-temperature silica tape production, others (casing, mesh, cloth, etc.)

Furnaces and Refractory Insulation, Gaskets Production, Meshes, Panels, Metallurgy (Protection Systems), Fittings and Flange Covers, Engine Exhaust Pipe Covers. Protective Clothing, Oil Refinery Liners, and Others.

North America, Latin America, Europe, East Asia, South Asia and Pacific, the Middle East, and Africa

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenoxycycloposphazene Market Growth - Innovations, Trends & Forecast 2025 to 2035

Drag Reducing Agent Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.