The high-pressure pumps market is likely to reach USD 3.0 billion in 2025, and USD 4.4 billion in 2035, showing a CAGR of 3.5% during 2025 to 2035.

In outlook towards 2025 and beyond, the sector is expected to grow as per demand owing to infrastructure development, renewable energy integration, sustainability, etc.

Steady growth of the high-pressure pumps market in 2024 is likely due to technological advancements, expansion of the industrial sector, and rising demand from the end user industries.

Pump manufacturers included smart monitoring capabilities as well as predictive maintenance capabilities embedded into pump systems to improve efficiency and minimize downtime.

The oil and gas industry, after dealing with some volatility, experienced a resurgence in investment in exploration and production activities, increasing demand for high-pressure pumps used in drilling and hydraulic fracturing.

Moreover, governments across the globe escalated investment for implementation of water treatment and desalination plants to mitigate water scarcity and pollution, thus driving the industrial growth.

Geothermal energy, biofuels, and the move towards cleaner energy sources are all growth drivers for a high-pressure pump segment. Demand in construction, water management and power generation sectors will be further boosted by rapid urbanization and infrastructure projects, particularly in emerging economies.

Moreover, as end users demand energy-efficient and environmentally compliant equipment, pump manufacturers will work on more energy-efficient and versatile pump systems. Trends are expected in the form of increased mergers, acquisitions and strategic collaborations improving the competitive landscape, expansion of global players.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.0 billion |

| Industry Size (2035F) | USD 4.4 billion |

| CAGR (2025 to 2035) | 3.5% |

Explore FMI!

Book a free demo

Future Market Insights (FMI) conducted an extensive survey and a series of expert interviews with key stakeholders in the high-pressure pumps industry to develop a deeper understanding of existing trends, challenges, and future opportunities.

Participants included manufacturers, industry experts, end-users from sectors such as oil & gas, water treatment, and manufacturing, as well as regulatory authorities.

The survey also indicated that there was a growing demand for energy-efficient and environmentally friendly pumping solutions. End customers demand pumps that comply with high environmental requirements and contribute toward sustainability goals. Manufacturers responded to this trend by committing to develop greener products that align with customer fluid handling requirements.

Stakeholders further complained about problems such as fluctuations in raw material costs, as well as high entry barriers for the latest generation of high-pressure pumps.

These factors could potentially hinder the adoption rate, particularly in small and medium-sized enterprises.

On the other side, stakeholders were optimistic, expecting evergreen segment growth in the future due to industrial growth and technological advancements.

| Countries | Regulation & Impact on High-Pressure Pumps Landscape |

|---|---|

| European Union | Pressure Equipment Directive (PED) 2014/68/EU - Sets standards for the design and fabrication of pressure equipment, including high-pressure pumps, ensuring safety and free product placement within the EU. Compliance is mandatory for manufacturers targeting the European sector. |

| United Kingdom | Boiler Upgrade Scheme - Provides grants to homeowners for installing environmentally friendly heat pumps, supporting the UK’s broader goal of reducing greenhouse gas emissions by 81% by 2035. While heat pumps contribute to this target by lowering emissions in residential heating, the reduction figure applies to the UK’s overall carbon reduction strategy across all sectors. |

| Germany | Subsidy reductions for heat pumps have led to a decline in heat pump installations, which may indirectly affect demand for related pumping systems in heating and industrial applications. However, high-pressure pumps are primarily used in industrial processes, water treatment, and energy applications rather than domestic heating systems. |

| France | Pressure Equipment Directive (PED) Compliance - France adheres to the European Union's PED 2014/68/EU, which sets standards for the design and fabrication of pressure equipment, including high-pressure pumps. Compliance ensures safety and facilitates free industrial placement within the EU. |

| South Korea | Korean High-Pressure Gas Safety Control Act - This law regulates the production, storage, and transportation of high-pressure gases and equipment. Manufacturers must obtain certification to ensure safety standards are met, impacting the design and operation of high-pressure pumps. |

| India | Gas Cylinder Rules, 2016 - Governed by the Petroleum and Explosives Safety Organization (PESO), these rules regulate the manufacture, storage, and transportation of high-pressure gas cylinders. Compliance is mandatory for manufacturers and influences the design and testing of high-pressure pumps. |

| China | Regulations on Safety Supervision of Special Equipment - Overseen by the State Administration for Market Regulation (SAMR), these regulations cover boilers, pressure vessels, and other special equipment, including high-pressure pumps. Manufacturers must adhere to stringent safety and quality standards. |

| Japan | High Pressure Gas Safety Law - This law ensures public safety by regulating the production, storage, sale, transportation, and consumption of high-pressure gases, along with the production and handling of containers for such gases. Compliance is mandatory for manufacturers and importers of high-pressure pumps. |

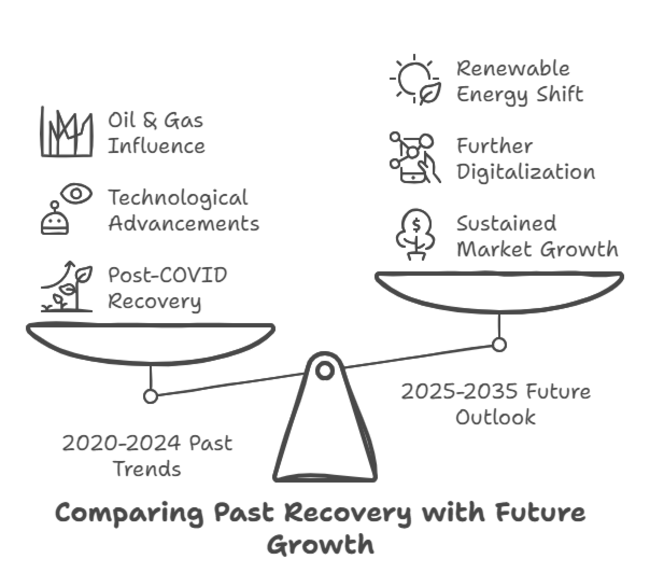

| 2020 to 2024 (Past Trends & Segment Performance) | 2025 to 2035 (Future Outlook & Projections) |

|---|---|

| Segment Recovery Post-COVID-19: The industry saw a slowdown in 2020 due to pandemic-related disruptions in supply chains and industrial operations. However, recovery began in 2021, with increasing demand from oil & gas, manufacturing, and water treatment sectors. | Sustained Market Growth: The industry is expected to grow steadily, driven by rising infrastructure development, automation, and expansion in industrial applications. The CAGR is projected to remain around 3.5%. |

| Technological Advancements: Smart pumps with IoT integration, remote monitoring, and predictive maintenance gained traction, improving efficiency and reducing operational downtime. | Further Digitalization & Automation: AI-driven pump systems, advanced energy-efficient designs, and real-time monitoring solutions will become standard, enhancing operational reliability and efficiency. |

| Oil & Gas Industry Influence: The oil & gas sector fluctuated due to global energy price volatility, affecting pump demand. However, the revival of drilling and fracking activities in 2024 boosted sales. | Shift Toward Renewable Energy: High-pressure pumps will be increasingly used in green hydrogen production, geothermal energy, and biofuel processing, reducing dependence on fossil fuels. |

| Regulatory Compliance & Sustainability: Stricter environmental laws and energy efficiency mandates influenced manufacturers to develop eco-friendly and energy-saving pump solutions. | Stronger Environmental Regulations: Governments worldwide will impose stricter emission and efficiency standards, encouraging the development of sustainable and high-performance pump technologies. |

| Regional Industry Growth: Asia-Pacific, particularly China and India, led the industrial growth due to rapid industrialization and infrastructure expansion. Europe and North America focused on upgrading existing systems. | Emerging Segment Expansion: Developing economies in Africa and Latin America are expected to drive new demand, while mature industry in Europe and North America will focus on system modernization and energy efficiency. |

The high-pressure pumps research report comprehensively covers the competitive and vendor landscape of the high-pressure pumps landscape.

As a strategy to remain competitive, top manufacturers are concentrating on the cost-effective production of high-quality products.

Many companies are using economies of scale to provide competitive pricing while also ensuring customization to meet varied industry requirements.

Furthermore, Hi-tech advancements are reflected in smart mapping and smart interfacing, firms in the segment are increasingly investing in IoT set-enabled smart pumps, automation, and energy-efficient designs for performance improvement, maintenance cost reduction, and building sustainability.

To fuel growth, these industry leaders are engaging in strategic collaborations, acquisitions, and mergers to broaden their global footprint and product offerings. Integration with real-time monitoring and predictive maintenance software through partnership with industrial automation firms and AI software houses is now commonplace.

Another crucial strategy is tapping into developing segments, like Asia-Pacific, Latin America, and the Middle East, where industrialization and infrastructure are growing rapidly.

In addition, manufacturers are aligning with regulatory compliance trends by developing green, low-emission, and high-efficiency pump systems that will remain competitive in the long term and adhere to advanced environmental regulations in the future.

The year 2024 saw several notable mergers, acquisitions and regulatory changes in India's corporate landscape. In a notable deal, Tata Group integrated Air India and Vistara to create a single full-service carrier, consolidating its aviation assets and creating a single full-service airline.

In media, Reliance's Western Asia merger of USD 8.5 billion with Disney India seemed a move to mobilise high-end content and distribution mechanisms to potentially form a dominant media enterprise, pending regulatory approvals. There was also a rush to the capital segments, with several companies, including Hyundai Motor India. Swiggy, NTPC Green, Ola Electric, and Bajaj Housing Finance making their debut, a sign of strong investor appetite across sectors.

The Competition Commission of India (CCI) issued deal value thresholds warranting mandatory merger approval for M&A Transactions above USD 250 million. CCI also amended the rules of 'Green Channel', under which the automatic approval criteria will now be stricter, further scrutinising the mergers of big contestants to fight with unfair competition.

Market Share Analysis

| Company | Industry Share |

|---|---|

| Grundfos | 20-25%, Grundfos leads the segment with 20-25% share, driven by its strong presence in water treatment, industrial, and energy sectors. |

| Danfoss A/S | 15-20%, Danfoss A/S holds 15-20%, focusing on energy-efficient solutions and a wide product portfolio. |

| Sulzer Ltd. | 10-15%, Sulzer Ltd. accounts for 10-15%, specializing in high-performance pumps for industries like oil & gas and chemicals. |

| ANDRITZ AG | 5-10%, ANDRITZ AG, The Weir Group PLC, and GEA Group AG each hold 5-10%, catering to niche industries like mining, food processing, and wastewater treatment. |

| The Weir Group PLC | 5-10%, Smaller players like Cat Pumps, COMET S.p.A., Zhejiang Danau Industries, Maximator GmbH, Teledyne Isco, and Udor S.P.A. collectively hold 10-15%, focusing on specialized applications and regional sectors. |

| GEA Group AG | 5-10%, Mid-sized players like ANDRITZ AG, The Weir Group PLC, and GEA Group AG will likely retain their 5-10% shares by focusing on niche applications and innovation. |

| Cat Pumps and COMET S.p.A. | 2-4%, Smaller players (Cat Pumps, COMET S.p.A., Zhejiang Danau Industries, etc.) may see slight growth due to increasing demand for specialized pumps in emerging sectors. |

| Zhejiang Danau Industries Co., Ltd., Maximator GmbH, Teledyne Isco, Inc., Teledyne Isco, Inc., Udor S.P.A | 2-4%, key player in the Asian market, particularly in China, offering cost-effective high-pressure pumps for industries like textile, chemical, and food processing. |

| Other Players | 10-15% , Other Players are projected to hold 10-15%, as regional and emerging companies continue to cater to localized demand. |

Macroeconomic factors are a significant driver that impacts the global pump demand and hence the global high-pressure pump landscape as well, including industrial development, energy demand, infrastructural development, and sustainability initiatives. The industry grew moderately from 2020 to 2024 due to industrial recovery post-pandemic, increased investments in wastewater treatment, and rising oil & gas exploration. Nonetheless, disruption and inflation pressures in supply chains have added questions to a mix of high raw material costs and production delays.

Demand for high-pressure pumps will be driven by steady industrial expansion, urbanization, and the transition toward sustainable energy in 2025 and beyond. The increasing adoption of hydrogen as an energy carrier, particularly in storage, transportation, and fuel cell applications, will drive demand for high-pressure pumps. Government policies promoting clean energy as well as stricter environmental regulations will drive industries toward energy-efficient pump technologies.

Investment cycles are likely to be influenced by economic volatility, geopolitical risks, and fluctuating oil prices. But as automation grows, digital monitoring solutions make it possible to see everything from afar in real time, and AI-driven predictive maintenance cuts down on downtime, high-pressure pumps will become an important part of Industry.

The sector has been segmented on the basis of type, pressure, and end-use industry, under which each compartmentalized industry contributes to a different size of the high-pressure pumps segment.

The dynamic pump segment is dominating the sector based on type. It is forecast to exhibit a CAGR of 3.3% between 2025 and 2035.

Dynamic pumps account for the highest share among the types of pumps due to their extensive utilization in manufacturing and power generation.

On the other hand, in the chemical and pharmaceutical industries, positive displacement pumps are gaining traction where precise movements are necessary. Increasing industrial automation and strict regulations on the operations of fluid handling have resulted in increasing demand for energy-efficient, high-performance pumps in various industries.

The dynamic pressure pump segment is projected to thrive at a CAGR of 3.1% during the forecast period. This, in turn, is due to its existing use in manufacturing, commercial cleaning, and municipal water treatment.

These pumps are widely used because they strike a balance between power and efficiency, making them the preferred choice for mid-range applications.

On the contrary, the 101-500 bar segment is growing moderately but steadily owing to the growing implementation of higher pressure solutions in industrial cleaning, hydrostatic testing, and some chemical processes.

The above-500-bar segment is small but growing, mostly due to its use in oil & gas exploration, mining, and ultra-high-pressure cleaning systems.

Among applications, oil & gas is the leading end-user of high-pressure pumps, holding a substantial industry share due to its involvement in drilling, enhanced oil recovery (EOR), fracking, and refining.

Nonetheless, the manufacturing industry is the fastest-growing segment, expected to register a compound annual growth rate (CAGR) of 3.8% over the next decade.

This upturn is driven by growth in sectors such as automotive, steel production, and food processing, where high-pressure pumps are employed in hydraulic systems, metal cutting, and sanitation processes.

The demand for energy efficiency, automation, and advanced fluid control is rising, and so are the industries transitioning to smart pump systems fitted with IoT and AI-based monitoring.

The global high-pressure pumps segment, with accelerating trends including urbanization and industrialization and the need for sustainability in fluid management systems.

The high-pressure pumps landscape in the United States is expected to reach a value of approximately USD 808.0 million by 2035 and is expected to develop at an approximate CAGR of 3.6% through 2025 to 2035.

The growth of this industry is mainly due to the strong presence of industries like oil & gas, chemical processing, and manufacturing. Strong infrastructure development and technological innovations are driving the demand for high-pressure pumps in the USA.

Moreover, the trend towards energy conservation and compliance with environmental legislation drives industries to employ highly efficient pumping solutions, thus driving segment growth. However, industry saturation and stringent regulatory frameworks may complicate rapid expansion.

The high-pressure pump market in the United Kingdom is expected to reach USD 157.8 million by 2035. Over the assessment period, sales of high pressure pumps in the United Kingdom are projected to climb at 3.4% CAGR. In the UK, the high-pressure pump segment is driven by an increasing emphasis on renewable energy and wastewater treatment facilities.

The gradual recovery of the manufacturing sector and the government’s infrastructure initiatives likely drove growth within the industry.

But the pace of expansion could be weighed down by economic uncertainties and Brexit-related trade dynamics. The UK government has agreed to a legally binding commitment to reduce carbon emissions and improve energy efficiency, which is an opportunity for high-pressure pump manufacturers through the introduction of new innovative, green products.

The France high pressure pumps industry size is estimated to reach USD 250.7 million by 2035. The high-pressure pump industry in France is expected to grow at a compound annual growth rate (CAGR) of approximately 3.3% between 2025 and 2035.

Water treatment, chemical, and pharmaceutical industries have been boosting the demand for high-pressure pumps in the country due to such strong chemical and pharmaceutical industries, along with evolving water treatment and energy industries.

The rise of government initiatives, such as sustainable development and industrial modernization, also supports the growth of the landscape. On the other hand, economic uncertainty and strict environmental laws could create obstacles.

Germany high pressure pumps industry value is anticipated to total USD 340.9 million by 2035. From 2025 to 2035, the segment for high-pressure pumps will continue to see a CAGR of around 3.5% in Germany.

The demand for high-pressure pumps is further bolstered by the nation's long-established automotive and manufacturing sectors.

Germany's emphasis on industrial automation and energy-efficient solutions is well matched to the adoption of innovative pumping solutions.

This also contributes to the growth of the sector, along with the shift to sustainable energy sources and the upgrading of infrastructure.

Italy high pressure pumps industry value is anticipated to total USD 210.8 million by 2035. From 2025 to 2035, the high-pressure pumps segment in Italy is forecast to witness a CAGR of about 3.2% in the next 10 years.

Industries such as manufacturing, food processing, and textiles, among others, supplement the demand landscape for high-pressure pumps in the country.

Italy's focus on modernization of industrial equipment and greater energy efficiency also plays into industrial growth.

Nonetheless, the pace of growth may vary due to economic uncertainties and regional disparities.

Sustainable practices are coupled with technological advancements, providing further opportunities for segment players to offer new and innovative product solutions.

The South Korea high pressure pumps industry size is estimated to reach USD 211.2 million by 2035. The forecast period indicates a CAGR of 3.5% for the South Korea high-pressure pumps sector.

Rapid industrialization, technological advancements, and strong industries in sectors such as electronics, automotive, and shipbuilding fuel the demand for high-pressure pumps.

Government initiatives that promote infrastructure development and energy efficiency also aid the industry.

Nonetheless, factors like uncertainty in the global economy and competition from other countries in the region can potentially affect growth over time and force a focus on creating opportunities in new sectors.

The Japan’s High-Pressure Pumps market is expected to reach USD 382.5 million and is anticipated to grow at a compound annual growth rate (CAGR) of 3.4% during the forecast period from 2025 to 2035.

The automotive sector, the evolution in power generation, and the greater acceptance of technological and innovative practices are driving the country's need for high-pressure pumps. Japan's energy-efficient approach to sustainable practices is fuelling the growth of advanced pumping systems.

But the aging population and stagnant economy could constrain industrial growth and also lead to a shift in economic priorities, which may impact the demand for high-pressure pumps. Labor shortages, meanwhile, might speed up automation, increasing demand for advanced energy-efficient pumping solutions.

The high-pressure pumps sector in China was valued at USD 425.7 million in 2025 and is projected to reach a revised size of USD 600.4 million in 2035, growing at a CAGR of 3.7% over the analysis period 2025 to 2035.

Rapid industrialization, urbanization, and infrastructure development in the country are the major factors contributing to the demand for high-pressure pumps.

China plays a major role in manufacturing, chemical processing, and energy, which are considered the three primary areas of industry growth.

Government programs that stress protecting the environment and using energy efficiently also encourage the use of more advanced pumping solutions. Yet environmental issues and regulatory pressures may affect the dynamics.

The total market size of Australia and New Zealand in 2035 is likely to be USD 180.5 million in Australia and New Zealand. Further, government initiatives towards inclusive infrastructure development and sustainable water management are anticipated to support the growth of this segment.

Yet, potential economic volatility and environmental policies could disrupt that growth path. The focus on technological innovation and energy savings provides scope for segment players to present innovative solutions.

India is anticipated to register a compound annual growth rate (CAGR) of 3.7% during the forecast period. Industry valuation in India is set to reach around USD 310 million in 2025 and USD 440.0 million by 2035.

India's high pressure pumps segment is expanding based on increasing demand across industries such as manufacturing, oil & gas, power generation, and water treatment.

Policies by the government like the "Make in India" program together with infrastructure programs Smart Cities Mission, AMRUT: Atal Mission for Rejuvenation and Urban Transformation are driving the segment.

But oil & gas remains a critical contributor with new refineries coming up and the exploration required that involves high-pressure pumps for drilling and transporting.

Sustained industrialization and growing investment in manufacturing, power generation, and oil & gas are creating strong growth opportunities in emerging economies such as India, China, and South Korea.

These organizations need to establish localized manufacturing bases and regional distribution channels to reduce costs and enhance access to the sector.

They can establish alliances with regional OEMs and EPC companies that can facilitate better industry penetration and faster adoption.

IoT-powered high-pressure pumps are significantly transforming the pharmaceutical, wastewater utility, and industrial automation industries.

Firms must install AI-driven diagnostics, predictive maintenance, and cloud-enabled monitoring systems with intelligent pumping solutions. Performance optimization with connectivity to software providers will create customers with enhanced efficiency and cost savings.

Mergers, acquisitions, and strategic alliances are all the most important things to growth as companies buy niche pump manufacturers to expand and enrich their product lines.

Joint ventures with oilfield service providers and infrastructure developers can create opportunities for long-term contracts, as they need dependable suppliers.

Growing industrial applications of pumps, recent developments in fluid handling technology, and an increasing demand for energy-efficient solutions are driving the demand for pumps in various segments.

These pumps are extensively used in the oil & gas, manufacturing, power generation, chemicals, and water treatment sectors for efficient operation.

Industries are required to move towards compliant and sustainable pumping solutions due to stringent energy efficiency norms, environmental policies and safety standards.

Pump technology is being transformed and operational costs are being lowered with IoT enabled smart pumps, AI powered predictive maintenance and energy efficiency designs.

The Asia-Pacific, North America, and Europe are seeing the most impressive growth due to rapid industrialization, infrastructure development, and advances in technology.

Dynamic and Positive Displacement

30 to 100 Bar, 101 to 500 Bar, and Above 500 Bar

Oil & Gas, Manufacturing, Chemicals & Pharmaceuticals, Power Generation, and Other End Uses

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Composting Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.