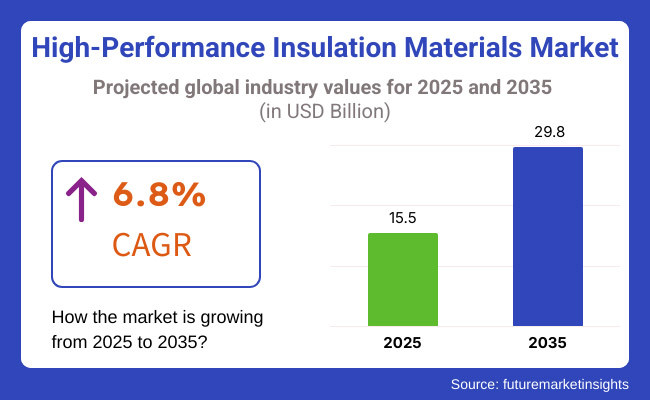

The global high-performance insulation materials market is set for substantial growth between 2025 and 2035, driven by rising demand for energy efficiency, increasing adoption in industrial applications, and advancements in nanotechnology-based insulation solutions. The market is projected to reach USD 15.5 billion in 2025 and expand to USD 29.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.8% over the forecast period.

High-performance insulation materials be made with some features that are very light and can handle high heat just like steel and these materials are strong enough to be used in construction, automotive, aerospace, oil & gas, and industrial applications. The constant growth of the importance of reducing carbon emissions, optimizing energy consumption, and improving fire safety standards is the main reason for the market boom.

Moreover, technology progress in aerogels, vacuum insulation panels (VIPs), and phase-change materials (PCMs) is changing the insulation efficiency in high-performance applications. As the governments and industries turn their attention to green building initiatives, the high-performance insulation materials are anticipated to be a significant factor in the energy conservation improvement across many areas.

The increasing need for advanced thermal insulation, stringent energy regulations, and expansion of high-tech industries are key factors contributing to market expansion. Additionally, the growing role of nanomaterials and smart insulation solutions is expected to drive further innovations and market penetration.

North America is indeed the major market for high-efficiency insulating materials and these are largely due to the tough rules on energy efficiency and the growing use of such materials in aerospace and automotive sectors, and the growing need for them in the construction of high-end building insulation. The country of the USA and Canada is bringing in more Greensearch Building, Industrial Insulation Improvements, and the addition of Renewable Energy Projects, which is why advanced insulation solutions are needed more and more.

The USA Department of Energy (DOE) and the Environmental Protection Agency (EPA) have put down strict guidleines regarding the installation of buildings' thermal insulation for both commercial and residential facilities, and encourage the applications of high-performance insulation materials. Additionally, the breakthrough of aerogels and vacuum insulation panels (VIPs) in the fields of aircraft and electric vehicles (EVs) is expanding the capacity of the local market.

Sustainability, renewable energy, and industrial adoption are the drivers for the growth of the European high-performance insulation materials market. Among the leading nations are Germany, France, and the UK that are the main users of advanced insulation materials in intelligent infrastructure, energy-efficient buildings, and railway systems.

The insulation products that are thermal resistant and fireproof in addition to the European Union's Zero Energy Building (ZEB) policies and climate goals are becoming more and more common. Moreover, the increasing investments in the hydrogen energy sector and industry heat recovery projects are the additional reasons for this region's market growth.

The speed of development in insulation materials in the Asia-Pacific region is the beginning of the age of the fastest growth and the primary drive is the rapid industrialization, increase in the construction sector, and the rise of automotive manufacturing. Smart city projects, solar-thermal high-efficiency thermal insulation for power plants, and urban sustainability development have attracted investments from China, India, Japan, and South Korea, which in turn has increased the need for advanced insulation technologies.

The surge in the aerogel and VIPs among other materials being adopted in commercial and residential infrastructure projects is attributable to the growing manufacturing industry of China and its commitment towards the energy conservation. In India, the acceptance of the high-performance insulation in green construction projects is increasing, while, on the other hand, Japan and South Korea are the countries that make giant strides in technological developments in ultra-thin insulation materials for electronics and transportation.

The MEA region is witnessing a significant rise in the request for premium insulation products, especially in oil & gas, construction, and industrial settings. Nations like Saudi Arabia, UAE, and South Africa have begun to put funds into energy-saving facilities along with high-quality thermal insulation specifically for the weather extremities.

The growth of infrastructure projects is spurred by accommodative factors like the creation of smart cities, airports, and renewable energy facilities which translate into insulation materials that are durable and fireproof. Furthermore, the oil & gas industry which is centered on the reduction of heat losses in pipelines and refining units is most probably the reason for the spreading of high-performance thermal insulation solutions.

Challenges

High Initial Costs and Complex Manufacturing Processes

One of the major obstacles that the high-performance insulation market encounters is the expensive initial costs of advanced materials including aerogels, VIPs, and nanomaterial-based insulation. These materials require intricate manufacturing processes and superior quality raw materials, which is why they are pricier than traditional insulation products.

Due to the cost factor, it is not possible for the industries that are sensitive to this aspect to adopt them which has been a major reason for minimal growth in these areas financially. In these markets, conventional insulation materials such as fiberglass and mineral wool are still preeminent and dominant. As the process of expanding production to guarantee supply chain conditions for high-performance insulation materials is still a major concern, manufacturers are facing challenges here too.

Hence, firms are resorting to optimizing materials, automating processes, and large-scale production strategies to first cut costs and secondly, enhance market accessibility.

Stringent Regulatory Compliance and Sustainability Challenges

When it comes to fire safety, energy efficiency, and environmental impact, the insulation industry is bound by strict guidelines. Adhering to the different country and international construction standards, energy performance codes, and fire resistance regulations that manufacturers must follow is a scale of complexity in the product design and commercialization.

Also, even though the benefits of high-performance insulation materials, there are still issues such as the negative effects of artificial insulation materials on the environment and disposal difficulties. The industry is concentrating on the creation of non-harmful reciclable and biodegradable insulation products to meet the sustainability challenges and to follow global environmental regulations.

Opportunities

Advancements in Nanotechnology and Smart Insulation Materials

The combination of nanotechnology and insulation materials is opening up new doors for the production of ultra-thin, lightweight, and super-efficient thermal insulators. In this regard, the use of nanomaterials in the aerogels, phase-change materials, and graphene as a source of insulation for construction, aerospace and information technology fields.

Moreover, the emergence of intelligent insulation materials that can autonomously vary their thermal properties, outstand moisture, and be more durable is rapidly changing the face of energy-efficient insulation solutions. In addition, the implementation of artificial intelligence-driven monitoring systems and IoT-enabled thermal management solutions is also contributing to a line of economic and environmental benefits in modern infrastructure with the added efficiency of insulation materials

Growing Demand for Energy-Efficient Infrastructure and Sustainable Construction

A worldwide quest for energy-saving and carbon-neutral buildings as well as climate-resilient buildings proliferation is the main reason for the fast-growing need for innovative insulation materials. As the policies of green building codes, net-zero energy targets, and decarbonisation policies are being embraced by government bodies, the demand for high-performance insulation materials is anticipated to go up in many branches.

The construction of nearly passive houses, IoT C-2 smart commercial buildings, and thermally controlled industrial facilities is the primary force for insulation materials with the most favourable energy conservation properties. Further to it, the electric vehicle (EV) battery thermal management solutions and energy-efficient transportation systems becoming popular expand the marketplace for advanced insulation materials.

The high-performance insulation materials market that started its journey in 2020 and will go through 2024 will be on the track to continuous growth due to the effectiveness of energy-saving rules, increased need for the ecologically friendly construction method, and progress in thermal management technology that is envisaged.

Aerogels, vacuum insulation panels (VIPs), microporous insulation, and polymer-based high-performance insulators which are the thermally most resistant materials consumed by the majority of the building & construction, aerospace, automotive, oil & gas, and electronics industries respectively were used to increase the thermal resistance and consequently, lower the energy cost.

Moving to the zero-energy buildings (ZEBs), electric vehicle (EV) battery thermal management, and high-temperature industrial applications, lightweight, ultra-low thermal conductivity materials saw their demand rise. However, widespread use was hampered by problems like elevated production costs, intricate assembling procedures, and the issue of material sustainability.

The forecast for the 2025 to 2035 period shows that the high-performance insulation materials market will succeed through AI-driven smart insulation systems, nanotechnology-enhanced insulators, and carbon-neutral sustainable insulation solutions.

The rising concern over net-zero energy buildings, AI-integrated thermal management, and fire-resistant nanomaterials will be the major driving forces behind the next stage of market growth. Moreover, the launch of the bio-based aerogels, self-heating insulation coatings, and adaptive thermal insulation technologies will revolutionize efficiency in the industrial, residential, and high-tech insulation applications.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Energy Efficiency & Building Sustainability | Increased adoption of high-performance insulation in green buildings, retrofits, and passive house designs. |

| Aerospace & Automotive Thermal Management | Use of ceramic fiber and aerogel-based insulation in space missions, EV battery packs, and aerospace heat shields. |

| Electrification & EV Thermal Insulation Demand | Growth in battery thermal insulation for electric vehicles (EVs) and hydrogen fuel cell cars. |

| Industrial & High-Temperature Insulation | High demand for microporous insulation and refractory ceramic fiber in oil & gas, metallurgy, and manufacturing. |

| Advanced Materials & Nanotechnology Integration | Expansion of vacuum insulation panels (VIPs), aerogels, and polymer foams for high-performance applications. |

| Fire-Resistant & Sustainable Insulation Solutions | Shift toward halogen-free, fire-resistant, and low-VOC insulation materials in construction and industrial applications. |

| Market Growth Drivers | Growth fueled by rising energy efficiency mandates, increasing EV adoption, and demand for lightweight insulation in aerospace & defense. |

| Market Shift | 2025 to 2035 |

|---|---|

| Energy Efficiency & Building Sustainability | AI-powered adaptive insulation, self-regulating smart thermal barriers, and 3D-printed sustainable insulation materials. |

| Aerospace & Automotive Thermal Management | Nano-enhanced insulation for extreme aerospace environments, ultra-thin graphene thermal barriers, and AI-driven battery temperature control. |

| Electrification & EV Thermal Insulation Demand | Self-healing EV battery insulation, AI-integrated phase-change materials (PCMs), and hydrogen-ready thermal barriers. |

| Industrial & High-Temperature Insulation | Carbon-free industrial insulation, AI-optimized heat shielding, and ultra-high-temperature nanocomposite insulators. |

| Advanced Materials & Nanotechnology Integration | Nano-porous aerogels, graphene-based insulation, and phase-change smart insulators for next-gen thermal management. |

| Fire-Resistant & Sustainable Insulation Solutions | Bio-based aerogels, smart fire-retardant coatings, and AI-monitored thermal insulation for disaster resilience. |

| Market Growth Drivers | Market expansion driven by next-gen AI-powered insulation, ultra-lightweight nanomaterials, and adaptive smart thermal solutions for extreme conditions. |

The USA high-performance insulation materials market is burgeoning and is led by the forces of energy efficiency regulations, the growth of green building construction, and the prospected space in aerospace and automotive insulation technology. The Department of Energy (DOE) and the Environmental Protection Agency (EPA) have set the bar high by launching more rigorous energy efficiency regulations that consequently lead to the broader application of high-performance insulation technologies in housing, trading, and manufacturing sectors.

The surge in electric vehicles (EVs) and lightweight automotive manufacture has, in turn, generated the need for high-temperature insulation resistance materials which are extensively used in battery packs and thermal management systems. Another aspect is that the aerospace and defense sectors invest in ultra-lightweight as well as fire-resistant insulation materials to improve safety and the fuel efficiency of air vehicles.

The growing data center sector and the establishment of high-tech manufacturing facilities are also boosting the demand for advanced thermal and acoustic insulation materials; thus, ensuring appropriate temperature control as well as noise reduction.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

The United Kingdom high-performance insulation materials market is progressing at a gradual rate, motivated by stringent building energy efficiency rules, development in renewable energy projects, and the growing need for environment-friendly construction materials.

The UK government’s goal of achieving net-zero emissions by 2050 is pushing investments into green buildings and high-efficiency insulation solutions. Moreover, the expansion of offshore wind energy and hydrogen infrastructure is driving the need for high-performance thermal insulation in energy storage and transportation systems.

The increasing application of vacuum insulation panels (VIPs) and aerogels in commercial buildings, transportation, and luxury residential projects is a boost to market growth. Meanwhile, the UK aerospace sector and advanced manufacturing are increasingly using lightweight, high-temperature insulation materials in heat-sensitive applications.UK Net Zero 2050 Targets & Green Building Initiatives: Higher adoption of high-performance insulation in residential & commercial buildings.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

The market for high-performance insulation materials in the European Union is rapidly developing, mainly due to the implementation of stringent energy efficiency regulations, the increase in industrial applications, and the rise in the use of sustainable building materials. Germany, France, and the Netherlands, for instance, are the most active countries in terms of zero-carbon building projects pushing the demand for High-R-value insulation.

The EU's Energy Performance of Buildings Directive (EPBD), which is a significant factor, declared mandatory energy-efficient construction and renovation work, thus, augmenting the interest in new types of insulators including aerogels, nanotechnology-based insulation, and phase change materials (PCMs).

Moreover, the fast production of electric vehicles (EVs) in Europe notably in Germany and Sweden has led to an increase in the demand for high-temperature insulation, primarily in EV batteries, and thermal management systems. In addition, the increase in liquefied natural gas (LNG) storage and industrial processing facilities spurs the adoption of high-performance cryogenic insulation.Strict EU Energy Performance of Buildings Directive (EPBD) Regulations: Higher adoption of high-performance insulation in green buildings.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.7% |

High-performance insulation materials market in Japan is continuing its growth due to the challenging energy efficiency norms, developing urban areas and rising of high-tech insulation solutions with their discoveries. The country is pouring cash in energy-saving insulation materials for use in commercial and residential buildings as it strives for carbon neutrality by the year 2050.

Due to the solid standing of Japan in the car and electronics production, the interest in better thermal insulation is increasing in EV batteries, semiconductors, and advanced industrial equipment. The other situation is that the building materials which can resist earthquakes and insulate together are sparking innovations in lightweight and high-strength insulation solutions.

The data center market in Japan is also improving the demand for the high-performance insulating materials in thermal management and energy-efficient improvement.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

The high-performance insulation materials market in South Korea is growing amid smart construction, electric vehicle (EV) battery production investments, and the manufacture of energy-efficient products. The increase in the semiconductor and high-tech industries in South Korea is boosting the requirement for high-quality thermal and acoustic insulation materials for sensitive electronic applications.

High efficiency, low energy costs, and the construction of green buildings through energy policies such as these are turning demand for insulation materials in high-rise buildings, airports, and smart city projects.

Hydrogen energy and LNG storage infrastructure, which are being developed, are also increasing the number of cryogenic insulation materials being used. The EV battery sector is increasingly attracting South Korea which in turn brings the necessity of high-performance insulation materials for cooling, power electronics as well as electric drivetrains in batteries.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

Aerogel continues to be the frontrunner in the insulation materials market, thanks to its extraordinary capability to withstand high temperatures, light weight, and low thermal conductivity. As one of the utmost insulating materials aerogel finds its utilization extensively in the oil and gas, construction, aviation, and a range of other niche markets where its adversarial resistance and negligible loss of heat are pivotal.

In contrast to conventional insulating materials, aerogel's capacity to perform at least five times better in terms of thermal dynamics offers an outstanding solution to the extreme heat environments present in offshore drilling, LNG storage, and industrial processes.

The fact that it is a hydrophobic material means that it will not absorb water hence, thereby diminish the prevalence of corrosion under insulation (CUI) in oil refineries and chemical plants. The surging growth of investments in energy-saving solutions and green production processes keeps the market for aerogel-based insulation materials across a wide spectrum of industries burgeoning.

Interestingly, the consumption of aerogel sectors is on a rise amid multiple industries disposing of their part of the wastage and utilizing the resources more efficiently.

Ceramic fiber's popularity is on the rise, especially in power plants, industrial furnaces, and automotive exhaust systems, where heat resistance and fireproofing are the two mandatory factors. The construction of these fibers with the help of hard battens, wires, and sailcloth is similar to the construction of temporary houses to be used for building works. Additional to that, these fibers are used in kilns, furnaces, and high-temperature insulation panels because of these characteristics, providing high durability and excellent thermal shock resistance.

Ceramic fiber insulation used in power plants and industrial facilities to increase energy efficiency and to protect crucial equipment from overheat. Also, car manufacturers involve these ceramic fibers in their catalytic converters and exhaust heat shields for the purpose of better thermal management and emission control systems.

The overlapping of automotive parts and insulation allows the company to save space and weight. Besides being much cheaper, they also offer a range of advantages, such as the use of fewer internal components with the same, or more, pre-heating effect. The use of this type of insulation is popular in the development of new and sustainable technologies in the energy sector and all branches of industry.

The oil and gas sector is the largest end user of high-performance insulation materials, and this is mainly because of the necessity for efficient thermal management in the extreme operational environment. Insulation materials including aerogel, ceramic fiber, and vermiculite are prevalent in offshore drilling rigs, refineries, LNG plants, and subsea pipelines, where the issues of maintaining ideal thermal performance and preventing heat loss are crucial for safety and operational efficiency.

The industry is also increasingly using fireproof and corrosion-resistant insulation technology to improve worker safety, cut down on energy loss, and meet severe environmental rules. Furthermore, as the construction of LNG infrastructure and new deep-sea exploration projects continue, the need for lightweight, high-performance insulation is projected to grow even more.

The construction industry is experiencing an increase in the need for advanced insulation materials, as the governments and the developers are mainly concerned with the green construction, energy efficiency, and sustainable construction practices. Various high-performance insulation materials such as aerogels, glass bubbles, and vermiculite are now being used in walls, roofs, and HVAC systems resulting in the reduction of heat transfer, and hence, the improvement of indoor temperature control.

In contrast to the traditional fiberglass and foam insulation, the aerogel-based construction panels which are made of these materials bring an advantage of the thermal resistance that is above the average while reducing the bulk, making it ideal for use in the high-rise buildings, prefabricated structures, and intelligent urban projects.

Moreover, the demand for vermiculite-based insulation is also on the rise due to its fireproofing and acoustic insulation properties, delivering the advantages of enhanced building safety and occupant comfort. The advanced insulation materials have a pre-determined pivotal role in the development of innovative building technologies, which are mainly tied to the construction of net-zero energy buildings (NZEBs) and the ideas behind passive houses.

The global high-performance insulation material market is on an upward trend as the energy efficiency that is the main driver of the demand, and the environmental regulations which are rising fast are the two major factors causing the increase in the insulation material market.

High-performance insulation materials, such as aerogels, vacuum insulation panels (VIP), and high-temperature fiber insulations, offer exceptional thermal resistance, fire protection, and durability, making them essential in high-tech industries and sustainable infrastructure projects.

The trends are primarily manifested in the developments in nanotechnology-based insulation systems, the surrounding growing demand for green and bio-based materials, and the investment surge in high-performance thermal management systems. The top manufacturers strive for the production of lightweight, ultra-efficient insulation materials, better durability, and enhanced safety features to target industrial, commercial, and residential applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Aspen Aerogels, Inc. | 10-12% |

| BASF SE | 9-11% |

| Cabot Corporation | 8-10% |

| Morgan Advanced Materials plc | 6-8% |

| Knauf Insulation | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| Aspen Aerogels, Inc. | A leader in silica aerogel insulation, offering ultra-lightweight, high-thermal-resistance materials for aerospace, oil & gas, and industrial applications. |

| BASF SE | Develops polyurethane and VIP-based insulation materials, integrating fire-resistant and energy-saving properties for construction and automotive industries. |

| Cabot Corporation | Specializes in high-performance aerogels and nanoporous insulation materials, ensuring superior thermal protection for industrial and commercial uses. |

| Morgan Advanced Materials plc | Provides high-temperature fiber insulation solutions, catering to aerospace, industrial processing, and automotive applications. |

| Knauf Insulation | Manufactures mineral wool and fiberglass-based insulation materials, ensuring enhanced durability and energy efficiency for buildings and industrial plants. |

Key Company Insights

Aspen Aerogels, Inc.

Aspen Aerogels is a global leader in aerogel-based insulation, delivering high-performance, lightweight insulation products for aerospace, industrial, and energy applications. Featuring the company’s Pyrogel and Cryogel, these two series are endowed with exceptional thermal resistance, fireproofing, and energy savings, thus they are perfect to use in high-temperature and cryogenic applications.

Besides being a producer of aerogels, Aspen Aerogels is also a nanotechnology-based insulation company that promises to not only improve efficiency but also deliver reduced carbon footprints in key industries.

BASF SE

BASF has a strong focus on polyurethane-based and VIP insulation materials that allow for innovation in the integration of high-strength, lightweight, and fire-resistant properties. The SLENTITE and SLENTEX series of the company provide the best insulation due to their thin dimensions, while at the same time, they optimize energy consumption in buildings, vehicles, and industrial equipment. BASF is extending its line of eco-friendly insulation product offerings through the support of sustainability initiatives in green construction and net-zero emission buildings.

Cabot Corporation

Cabot Corporation is a major player in the aerogel and nanoporous insulation materials, offering high-performance thermal insulation for the oil and gas, industrial, and energy storage applications areas. The company’s Enova aerogel line is featured with high-temperature resistance, moisture protection, and durability, thus it extends the period of time the user has in extreme conditions. Cabot is focusing on a sustainable way of producing aerogel, thus he will not only reduce energy but also material waste in the manufacturing processes.

Morgan Advanced Materials plc

Morgan Advanced Materials is a high-temperature fiber insulation solution provider, focusing on the needs of aerospace, industrial processing, and automotive sectors. Through its Superwool and Fire Master series, the company heads low thermal conductivity, high fire resistance, and excellent durability, making them ideal for furnaces, kilns, and thermal processing units. Morgan is embracing a growth behavior based on fiber insulation that is more advanced and efficient when it comes to use in extreme industrial environments.

Knauf Insulation

Knauf Insulation is a top player in manufacturing mineral wool and flax glass insulating materials, providing energy efficient, and high-durability insulation solutions for both commercial and residential buildings. Among the products, the company offers ECOSE Technology and Smart Roof insulation solutions, which are made with bio-based binder and sustainable materials and therefore provide low-carbon, high-performance options. Besides, Knauf is broadening its product range with green building solutions, the purpose of which is to assist construction in an environmentally friendly way and promote energy-efficient infrastructure. development.

Aerogel, Vacuum Insulation Panel (VIP), Extruded Polystyrene (XPS), Polyurethane (PUR), Polyisocyanurate (PIR), Fiberglass, Ceramic Fiber

Ultra Low, Low, Moderate, High, Ultra-high

Building Construction, Aerospace, Automotive & Transportation, Industrial, Cryogenics, Datacenters, Healthcare, Others

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa

The global high performance insulation materials market is projected to reach USD 15.5 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 6.8% over the forecast period.

By 2035, the high performance insulation materials market is expected to reach USD 29.8 billion.

The aerogel segment is expected to dominate due to its superior thermal insulation properties, lightweight nature, and increasing adoption in aerospace, construction, and industrial applications where high energy efficiency and space-saving insulation solutions are required.

Key players in the high performance insulation materials market include Aspen Aerogels, Inc., Cabot Corporation, BASF SE, Owens Corning, and Kingspan Group.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Insulation Materials Market

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Demand for Thermal Insulation Materials in EU Size and Share Forecast Outlook 2025 to 2035

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cork Insulation Market Size and Share Forecast Outlook 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA