Global High Content Screening (HCS) Market Research Report, high content screening is a technique that allows the analysis of multiple quantities expressed in images obtained from sample cells, which can be used for a variety of applications in drug development, Cell health, cell cycle analysis, and apoptosis, etc. do thorough analysis.

High content screening (HCS) is a cell-based imaging and analysis technique that allows for automated high-throughput screening of biological samples, making it a key technology in pharmaceutical, biotechnology and carry-over institutes.

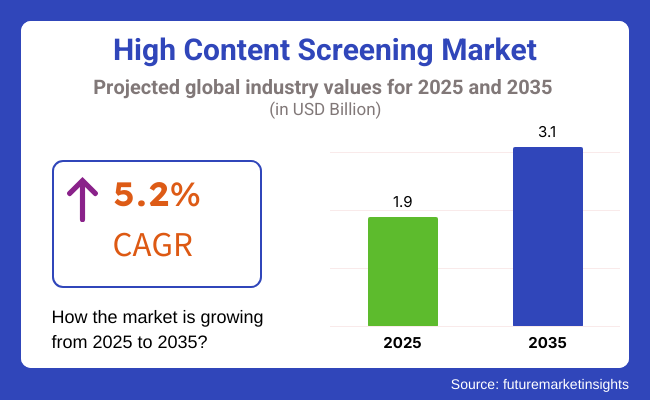

The worldwide HCS industry is anticipated to grow from around USD 1.9 Billion in 2025, to USD 3.1 Billion by 2035, at a CAGR of 5.2% during the predicted years. High-content analysis (HCA) platforms are increasingly being embraced in research laboratories due to the need for rapid and efficient screening of potential drug candidates, toxicity determination, and imaging of cells.

Additionally, innovations such as automated AI-powered image analysis and machine learning implementation in HCS systems have improved data accuracy and sped up drug discovery. In addition, the growing use of 3D cell cultures, organoids and stem cell applications are broadening the use of HCS technologies beyond drug screening.

Personalized medicine and increasing adoption of high-throughput imaging systems in disease research are some factors that will augment the growth of the HCS manufacturers during the forecast period. Moreover, the adoption of cloud-based data analytics and remote access capabilities in screening platforms is transforming workflow efficiency in the field of biomedical research.

Explore FMI!

Book a free demo

North America dominates the global HCS market due to presence of key pharma and biotech companies, high investment levels in R&D, and governmental funds for life sciences research. Key markets of the study include the United States and Canada, which are driven by Innovations in automated cell imaging technologies High adoption of AI-based HCS platforms Well-established contract research organizations (CROs) Presence of a well-structured regulatory system

The National Institutes of Health (NIH) and major pharmaceutical companies still fund research projects that depend on drug testing and biomarker discovery through high throughput screening. Moreover, the increasing adoption of 3D cell-based assays for cancer research and personalized medicine is also contributing to the growth of the market.

Europe, Germany is at a lead, followed by the UK and France, where heavy investment from biotechnology and pharmaceutical companies in automation-led drug discovery is taking place and the region is a major market in high-content screening. Key factors which are driving the growth of cell based imaging market are: Governments support for biomedical researches Development of malignant biotechnology clusters and research institutes increased demand for cell based imaging in toxicology screening and personalized medicine

EMA promotes high-content analysis technologies in drug testing and validation. There is also increasing collaboration between academic institutions and biotech companies for high-throughput analysis of disease models, neurodegenerative disorders, and regenerative medicine applications in the region

The HCS market is expected to grow at the highest rate in the Asia-Pacific region due to rapid growth in pharmaceutical R&D and rising government investment in drug discovery and chronic disease areas. Demand is being driven in key markets including China, India, Japan, and South Korea through: Increased clinical trial and biopharmaceutical research activities growing use of AI-powered screening tools Investments in precision medicine and stem cell research

China’s aggressive expansion in the field of biotechnology, as well as government-backed life sciences funding, are driving the growth of high-content screening platforms. Likewise, rising pharmaceutical firms and clinical research outsourcing practices in India are boosting demand for advanced cell imaging and drug screening technologies.

Combining high-content imaging with artificial intelligence proves to be a powerful player for efficiency and accuracy in Asia's growing research markets.

Challenges

HCS systems are Expensive: Advanced HCS systems comprise an expensive screening platform, data analysis tools, and automated imaging systems that pose a financial limitation for smaller research laboratories and academic facilities.

Management and Analysis Complexity: High-throughput image acquisition produces large datasets that must be analysed with advanced bioinformatics tools and computational expertise.

Stringent Regulatory Approvals for Drug Testing: The need to adhere to global regulatory frameworks including FDA, EMA, and other authorities can stall drug discovery routes employing HCS technologies.

Shortage of Trained Professionals: The field grapples with a shortage of trained experts skilled in high-content image analysis and the implementation of AI-driven screening methodologies.

Opportunities

HCS Platforms with Integrated AI and Machine Learning: AI-driven image analysis leads to advanced pattern recognition, automated cell classification, and anomaly detection, leading to faster and more accurate drug discovery.

The Expansion of Stem Cell Research and Regenerative Medicine: HCS is essential for regenerative therapies, stem cell differentiation studies, and personalized medicine applications.

Growing Need for 3D Cell Culture and Organoid Research: HCS systems are increasingly being utilized for 3D cell imaging, pixelated cancer research, and neurobiology analysis, leading to new growth opportunities.

Big Data Analysis and Remote Data Access Solutions: The cloud-integrated HCS platforms empower data sharing, collaboration, and synchronous data analysis among researchers globally.

The high content screening (HCS) market exhibiting substantial growth between 2020 and 2024 can be attributed to progress in cell-based imaging, drug discovery, and AI-based image analysis. High-content screening platforms were rapidly adopted by pharmaceutical and biotechnology companies to accelerate phenotypic drug discovery, toxicity assessment, and biomarker discovery.

The increasing adoption of precision medicine, personalized drug development, and regenerative medicine has led to a surge of investments in the HCS automated systems, cellular imaging software powered by AI, and HTS solutions.

To address this, regulatory bodies like the USA FDA, EMA, and NIH focused on areas such as cell-based assay validation, in vitro toxicology testing, and dose escalation with development of new imaging modalities, aiming to improve drug candidate safety and efficacy. High-content imaging systems based on fluorescence microscopy, confocal imaging or live-cell analysis have been utilized by researchers for elucidating disease mechanisms, gene expression, and compound activities on cellular pathways.

This led to the progress of 3D cell culture models, organ-on-a-chip systems and CRISPR based gene-editing platforms which significantly broadened the usefulness of high-content screening in functional genomics and disease modelling.

Researchers developed cloud-based bioinformatics platforms, machine learning algorithms, and real-time image analytics to enable the quantitative extraction of phenotypic data from high-throughput imaging datasets to improve lead compound identification and studies of drug mechanism-of-action.

The capability to analyze multiple cellular targets simultaneously improved throughput and efficiency in the early stages of drug discovery using high-speed fluorescence imaging and multiplexed biomarker detection techniques.

Although sizeable improvements had been achieved, the premium expense of HCS machinery, difficulties with assay calibration and the requirement for specialists continued to be major obstacles to market acceptance. Automated, unbiased methods for cellular image interpretation at scale were desired but represented another challenge, as did the barriers of data management and AI-based imaging algorithm validation.

In fact, due to the ongoing development of high-content analysis (HCA), 3D cell imaging, and single-cell screening technologies, HCS was increasingly adopted by pharmaceutical companies, contract research organizations (CROs), and academic research centres, resulting in continued market expansion.

However, from 2025 to 2035, the high content (high throughput) screening market will be transformed by artificial intelligence-enhanced cellular imaging, optical quantum computer-based image processing, and real-time multi-omics data integration. Ultra-fast, super-resolution microscopy and adaptive AI-driven cellular recognition combined with deep-learning-based phenotypic profiling will lead next-generation automated high-throughput imaging platform to a paradigm change in drug discovery, regenerative medicine and disease modelling.

The rise of 3D bio printing, lab-on-a-chip systems, and organoid-based disease models will also facilitate physiologically relevant high-content screening assays to enhance predictive accuracy of drug responses and toxicity profiling. Genomics, transcriptomic and proteomics data will be combined with cellular imaging through AI-driven multi-modal image analytics to realise the precision phenotypic drug discovery.

The convergence of quantum computing and neuromorphic AI architectures will allow for enhanced interpretation of large-scale cellular images, multi-dimensional biomarkers, and real-time deep learning-assisted assay validation for HCS, making the assay process more efficient and scalable.

The advances in microfluidics-based high-content screening will enable miniaturized, high-speed, and cost-efficient cell imaging assays with reduced consumption of samples and reagents. This will free researchers from manual tasks of real-time image annotation, drug response prediction, and compound toxicity assessment through continually improving AI self-learning bioinformatics platforms that reduce human bias and increase the throughput of screening.

Personalized high-content screening assays will facilitate cell models derived in a patient-specific context, the selection of therapies based on artificial intelligence-assisted methodologies, and regenerative medicine strategies, thereby leading to transformational clinical decision support in oncology, neurology, and rare genetic diseases.

Edged computing, block chain-encapsulated imaging data storage, and federated learning algorithms will be adapted for the collaborative research in high-content screening, which then produce available large-scale imaging datasets across global institutions without compromising data privacy and security. AI-powered, energy-efficient imaging systems, cloud-based HCS analytic infrastructure and open-access imaging databases will enable sustainability and cost reduction efforts, providing greater access to biopharmaceutical and academic researchers.

High-content screening will become an indispensable tool in next-generation precision medicine, further catalyzed by next-generation, CRISPR-based functional genomics screening platforms that will optimize cellular pathway elucidation, enable personalized drug screening, and allow for AI-assisted cellular reprogramming.

| Market shifts | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory authorities endorsed HCS-based drug toxicity screening, biomarker validation, and AI-driven cellular imaging. |

| Technological Advancements | Advanced techniques included AI-based image segmentation, deep-learning cellular profiling, and the integration of 3D cell culture to improve drug discovery efficiency. |

| Industry Applications | HCS gained traction in phenotypic drug discovery, CRISPR-based functional genomics, and regenerative medicine research. |

| Adoption of Smart Equipment | Assay efficiency improved using AI-powered high-speed fluorescence imaging, multiplexed biomarker detection, and cloud-based HCS bioinformatics. |

| Sustainability & Cost Efficiency | Traditional HCS platforms required high-cost microscopy, expensive reagents, and qualified personnel for imaging analysis. |

| Data Analytics & Predictive Modelling | Cellular response assessment was optimized using phenotypic profiling and AI-driven image annotation based on deep learning. |

| Production & Supply Chain Dynamics | High instrumentation costs, assay standardization challenges, and data management issues hindered market penetration. |

| Market Growth Drivers | Market growth resulted from increasing demand for phenotypic drug discovery, AI-powered imaging, and automatic cellular analysis. |

| Market shifts | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Gene editing will enable cell lines to be used in phenotypic drug screening with automated imaging analysis. Regulations will emerge for AI-assisted phenotypic drug screening, federated learning-based imaging data compliance, and standards for automated cellular imaging. |

| Technological Advancements | The future of high-content analysis will be driven by quantum-assisted cellular imaging, neuromorphic AI-powered HCS analytics, and multi-omics driven phenotypic screening. |

| Industry Applications | AI technology will revolutionize drug development through AI-enabled single-cell imaging, regenerative medicine using synthetic biology, and phenotypic testing of patient-specific drugs. |

| Adoption of Smart Equipment | Edge AI will empower cellular monitoring, block-chained secured imaging data platforms, and real-time deep learning-Driven compound screening systems to expedite high-throughput phenotypic assays. |

| Sustainability & Cost Efficiency | Automation using AI, miniaturized screening via microfluidics, and high-throughput cellular imaging with energy-efficient optics will make HCS scalable and cost-effective. |

| Data Analytics & Predictive Modelling | Future HCS will combine quantum-powered cellular simulation with generative AI-assisted cellular morphology prediction and real-time adaptive drug response modelling. |

| Production & Supply Chain Dynamics | AI-driven supply chains, decentralized HCS production, and open-access AI-driven cellular imaging platforms will improve market accessibility. |

| Market Growth Drivers | Quantum-powered cellular imaging analytics, AI-based individualized medicine, and real-time edge computing-assisted high-content screening in drug pipeline development will fuel growth. |

The USA High Content Screening (HCS) Market is poised to witness steady growth in the upcoming years owing to rising investments in drug discovery, growth in demand for automated cell imaging, and growing AI powered image analysis. Key volume drivers fuelling market expansion are also its strong biotechnology and pharmaceutical sectors, along with extensive government funding for biomedical research.

High R&D spending in drug discovery and toxicology screening is one of the primary factors driving the growth of the market. NIH and BARDA spent more than 45 billion on life sciences research every year, significantly increasing demand for HCS platforms in cellular and phenotypic screenings.

AI and Machine Learning Heavily Impacting the Market Pioneering biotech companies such as Thermo Fisher Scientific, PerkinElmer, and Molecular Devices are embedding deep learning algorithms into their automated image processing, remarkably cutting down the amount of screening time and leading to greater assay accuracy.

Moreover, the growing application of HCS in precision medicine and cancer research is fuelling adoption in academic and clinical research institutes. The growth of organ-on-a-chip and 3D cell culture models is driving even more demand for advanced HCS platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

United Kingdom High content screening (HCS) market is anticipated to grow on account of government funding towards precision medicine, mounting emphasis on AI-driven drug discovery, and the increasing utilization of high-throughput screening in life sciences research.

The UK National Health Service (NHS) and Biotechnology and Biological Sciences Research Council (BBSRC) are funding advanced cell imaging and AI-assisted drug discovery, respectively, in both the disease modeling and drug toxicity screening areas leading to increased adoption of HCS technologies.

The number of world-class research institutions, like Oxford University, Cambridge University, and the Francis Crick Institute, are paving the way for advances in phenotypic screening, CRISPR-based screening, and 3D imaging platforms.

Moreover, the growing UK biotech ecosystem, supported by over 1 billion of government investment into life sciences, promotes academia pharma collaborations, and is ensuring wider uptake of high content imaging systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.1% |

European Union has a promising growth for High Content Screening (HCS) Market owing to Strong Government Funding in Life Sciences, Growing Demand for High Throughput Screening in Drug Discovery, and Increasing Collaborations between Biotech Firms and Research Institutions.

With a €95 billion expenditure on R&D projects, the EU’s Horizon Europe Program is leading the development of cell-based screening, AI-motivated drug discovery, and 3D imaging-based phenotypic screening.

Germany and France (in particular the Netherlands, associated with plant studies) leads the highest content imaging applications, and significant research centers such as the EMBL (European Molecular Biology Laboratory) and Max Planck Institute form much of the basis of next generation cell imaging techniques in Europe.

Moreover, the increasing demand for automation in toxicity screening and disease modeling is spurring the adoption of isotonic robotics as part of HCS systems, thus enhancing assay reproducibility and scalability.

Moreover, the increasing applications of HCS in regenerative medicine and gene editing area, especially in CRISPR library screening, are as well contributing to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.2% |

HCS is being driven globally by leaps in AI-assisted microscopy, an increase in HCS in regenerative medicine, and steady government backing on life sciences research.

The funding for biomedical research by the Japanese government amounts to 250 billion (1.8 billion) for next-generation drug discovery technologies such as high-content imaging for cellular screening.

Japan can be seen as the world leader in the field of stem cell as well as regenerative medicine with its institutes like RIKEN and Kyoto University pioneering applications of induced pluripotent stem cells. Rising demand for HCS in stem cell differentiation and tissue engineering is augmenting the market.

The utilization of AI-focused microscopy approaches and deep learning in phenotypic screening is another leading contributor, helping to automate cell segmentation, image analysis, and detection of cellular responses during drug testing.

The growing pharmaceutical industry, featuring leaders such as Takeda and Astellas, is, therefore, also a major driver, as these companies invest billions in high-throughput screening technologies for faster drug development pipelines.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

The South Korea High Content Screening (HCS) Market is growing due to the significant government investments in biotechnology sector, increased integration of AI in drug discovery and the technological advancements in automated cell imaging systems.

Driven by these advances in high-content imaging, the South Korean government has pledged 3 trillion (2.3 billion) in life sciences and biopharmaceutical research and development (R&D) accelerating adoption of the technology for precision medicine and toxicology screening.

In South Korea, the nation’s top research institutes including KAIST and POSTECH are taking the lead in AI based HCS applications that accelerate cellular imaging analysis and high-throughput phenotypic screenings.

South Korea’s booming pharmaceutical and biotech industries, led by firms such as Samsung Biologics and Celltrion, are also boosting investment in automated screening platforms for faster drug discovery.

Moreover, the expansion of high-throughput screening across numerous application areas, coupled with the increased adoption of organ-on-a-chip technology and 3D cell culture models, is accelerating early predictive screening for personalized therapy applications, thus contributing to the demand for advanced high-content imaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

The HCS instruments and reagents & assay kits segments account for the largest share of the market decision factors due to growing adoption of advanced imaging, automated screening, and high-throughput analysis in pharmaceutical companies, biotechnology firms, and research institutions around the world to accelerate drug discovery and cellular research.

They are indispensable in phenotypic screening, toxicology, cancer research, and functional genomics, providing quick and reliable data on cellular mechanisms, drug interactions, and disease pathophysiology.

Technologies based on HCS instruments have become an integral component of high-throughput drug screening, biomarker discovery, and cell- based experiments, as they allow for acquisition of high-resolution images of cells and analysis of complex cellular phenotypic data in high-throughput fashion, screening for potential drug candidates more efficiently.

Unlike traditional cell-based assays which are restricted to adhere to only biochemical methods, the HCS platforms incorporate with features of the fluorescence microscopy together with image-based cytometry, followed by AI-based image analysis, enabling quantitative and qualitative assessment of cellular responses towards drug treatment.

Pharmaceutical and biotechnology companies are devoting substantial resources in HCS instruments to improve lead identification, enable hit validation and profile compounds in drug discovery programs. Multiparametric analysis of cellular phenotypes in high-throughput assays can allow for a more accurate and scalable way of assessing drug toxicity, cell viability, apoptosis, and intracellular signaling pathways and such capabilities are even enabled with the use of these automated screening systems.

Increasing adoption of high-end HCS instruments is primarily associated with the growing demand for personalized medicine and targeted therapies, as researchers engage in disease modeling, stem cell research, and 3D cell culture assays. The rise of organ-on-a-chip technology and patient-derived cell models have grounded the need for high-resolution imaging, near-cellular real-time monitoring, and high-content screening (HCS) data analytics.

AI and ML have been implemented into the HCS instruments themselves, making automation of image-, predictive analytics, and deep learning-based analysis faster and more precise, leading to the potential for high-throughput identification of drug candidates. Processing millions of data points at once takes a fraction of the time of a manual analysis, powered by AI HCS instruments which greatly increase the research productivity and decision-making process.

High-end HCS Platforms in Drug Discovery - In the field of oncology, high-end HCS platforms have been increasingly used, enabling the characterization of cancer cells, modeling of the tumor microenvironment and screening of immunotherapeutic providing scientists with a capacity to assess drug efficacy in complex disease settings.

HCS instruments boast powerful capabilities, but also come with high acquisition costs, data complexity, and technical expertise requirements. Recent improvements in cloud-based HCS data storage, easy-to-use AI-based analysis software, and miniaturized, affordable screening platforms are further bringing down costs while maximizing usability and accessibility, enabling continuous market growth.

Due to the need for robust, standardisation solutions to increase throughput in high-content imaging experiments, reagents & assay kits have received significant market uptake within cell-based assays, toxicology screening, and pathway analysis. Moreover, unlike classical assay development reagents, ready-to-use kits provide improved reproducibility and lower variability with greater sensitivity in biological screens.

In addition, the rise of phenotypic screening and 3D cell culture studies has led to an increased demand for fluorescent dyes, labelled antibodies, and genetically encoded biosensors that allow researchers to monitor cellular processes, protein interactions, and gene expression in real time.

HCS assay kits play a vital role in these pharmaceutical and healthcare industries as they help in determining cell viability, apoptosis, autophagy and cytotoxicity, therefore promoting processes such as drug candidate screening and toxicity prediction. At pharmaceutical companies, validated, high content assay kits are used to remove nonviable compounds from the drug development pipeline earlier to save costs and improve the chances of clinical success.

Some of the advances that have improved data quality, efficiency, and throughput are multiplexed or multichannel assays, such as 100-plex assays, and high-throughput immunofluorescence staining kits. This multiplexed reagent enables scientists to visualize dynamic cellular changes, discover new drug targets, and investigate complex signaling pathways in a variety of disease models, from neurodegenerative diseases to cancer and infectious diseases.

The increase in use of gene editing technologies, including but not limiting to CRISPR-Cas9, has further propelled the need for HCS-compatible gene expression assays and functional genomics reagent kits as researchers screen genetic perturbations, examine loss-of-function effects and verify gene targets in live cell imaging experiments.

The reagent & assay kits are widely utilized but have some issues like lot-to-lot variability, storage stability problems and high reagent cost. But recent developments in fluorescent probe engineering, AI-optimized reagents, and automation-compatible assays are improving signal specificity, reproducibility, and cost-effectiveness, driving unrelenting demand for new HCS reagent solutions

High content screening market that held in the pharmaceutical & healthcare segment and biotechnology segment, as large end-use segments, as manufacturers are investing upstream in high-throughput screening platforms, advanced cell-based models and AI assisted drug development technologies.

The pharmaceutical and healthcare sector continues to be the largest end user of high content screening solutions as drug developers and clinical researchers need state-of-the-art imaging, automated screening and AI-driven analysis platforms to expedite drug discovery and preclinical testing.

This base platform is used in early-stage drug screening for drug optimization by pharmaceutical companies, target identification by pharmaceutical and biotechnology companies, and lead compound optimization leading to more precise and faster selection of therapeutic candidates. High-content imaging platforms enable versatile multiparametric cellular profiling that provides the resolution needed by screeners to assess how compounds affect not only cell morphology but also how they influence downstream signalling pathways and protein interactions.

This surge in demand for precision medicine and targeted cancer therapies has stimulated the adoption of high content statistical instruments for personalized drug response profiling, immuno-oncology studies and for modeling the tumor microenvironment. This will allow companies to can combine high-content imaging with patient-derived organoids, ex vivo models and immune profiling techniques that should promise more predictive, patient-specific treatment strategies.

The emergence of AI-driven drug screening and in silico modelling has supercharged HCS applications in virtual drug design, toxicity prediction and mechanistic pathway analysis - enabling pharma to decrease R&D timelines and costs.

HCS continues to be critical to pharma R&D, but adoption in healthcare is challenged by high instrument costs, complex regulatory compliance and data interpretation challenges. However, The paradigm shift to artificial-intelligence (AI) based screening automation, cloud-based HCS data management, and miniaturised imaging platforms are improving cost-effectiveness, user-friendliness, and scalability, promising continued growth in the market.

The biotechnology sector has further embraced high content screening technologies for genetic screening, biotherapeutics development and line cell therapy optimization, as HCS gain traction in companies for real-time cell analysis and high-throughput screening applications.

HCS is employed by biotech companies to guide regenerative medicine programs and stem cell research, allowing for real-time monitoring of differentiation tracking, gene expression profiling, and cell viability in human-induced pluripotent stem cell-derived organoids, three-dimensional (3D) spheroid cultures, and tissue-engineering models.

Growing adoption of HCS-based CRISPR screening, RNAi libraries, and protein expression assays across biologics development, protein engineering, and recombinant antibody production can be attributed to the expanding role of synthetic biology and functional genomics in biotechnology.

Here, we discuss how HCS can transform the biotechnology industry to industry evolves from HCS platforms with its challenges, scaling methods, assay development optimization, and data produced in high-throughput imaging workflows. Although, new advancements in cloud-based bioinformatics, AI-based phenotype classification, and automated liquid handling systems are facilitating workflow efficiency, reproducibility, and data integration, recharge the expansion of the market.

Growing demand for drug discovery, toxicology studies, and cell-based research is driving the rapid growth of the High Content Screening (HCS) market. Thus addressing the market potential, companies are developing AI based image analysis, automation, and high-throughput screening solutions to boost the applications such as cell imaging, phenotypic screening, and biomarker identification.

The market comprises of global players and niche biotechnology companies, focusing on various products like fluorescence microscopy, live-cell imaging, and data- driven bioinformatics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific, Inc. | 12-17% |

| PerkinElmer, Inc. | 10-14% |

| Becton, Dickinson and Company (BD Biosciences) | 9-13% |

| Molecular Devices, LLC (Danaher Corporation) | 7-11% |

| Yokogawa Electric Corporation | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific, Inc. | Develops high-throughput HCS platforms, fluorescence imaging systems, and AI-powered image analysis tools for drug discovery and cellular research. |

| PerkinElmer, Inc. | Specializes in high-resolution cell imaging, multi-mode detection systems, and automated screening platforms for pharmaceutical and life sciences research. |

| Becton, Dickinson and Company (BD Biosciences) | Manufactures HCS instruments with multiplex fluorescence capabilities, real-time live-cell imaging, and phenotypic screening solutions. |

| Molecular Devices, LLC (Danaher Corporation) | Offers fully automated high-content imaging systems, integrated bioinformatics platforms, and AI-assisted cellular analysis tools. |

| Yokogawa Electric Corporation | Provides confocal-based high-content imaging systems with real-time kinetic screening capabilities for stem cell and cancer research. |

Key Company Insights

Thermo Fisher Scientific, Inc. (12-17%)

Thermo Fisher is the leader in the High Content Screening (HCS) market, providing cutting-edge fluorescence imaging, artificial intelligence (AI)-driven cellular analysis, and high-throughput screening solutions. The company used machine learning combined with real-time cellular imaging techniques to leverage drug discovery efficiency.

PerkinElmer, Inc. (10-14%)

PerkinElmer focuses on multi-mode detection systems, high-resolution imaging, and phenotypic screening. The company has an emphasis on automated drug screening platforms and cell-based assay development.

Becton, Dickinson and Company (BD Biosciences) - 9-13%

BD Expands Fluorescence and Live-Cell Imaging Systems for High-Content Analysis in Toxicology, Oncology and Neurological Research BD Biosciences specializes in fluorescence and live-cell imaging systems for high-content analysis in toxicology, oncology and neurological research. The company, which focuses on multiplexed imaging and AI-based data processing,

Molecular Devices, LLC (Danaher Corporation) (7-11%)

Molecular Devices provides high-content imaging platforms with cloud-based analytics and automation. The company’s real-time image processing and deep learning tools enhance the accuracy of cell-based assays.

Yokogawa Electric Corporation (5-9%)

Confocal-based imaging systems and AI-driven image processing solutions allows optimizing stem cell research and kinetic cellular screening. The firm combines real-time imaging and precision optics for advanced cellular analysis.

Some of the advanced screening techniques, high speed cellular imaging (using drones!) and AI-based bioinformatics are being supplied by a range of biotechnology firms. These include:

The overall High Content Screening Market was USD 1.9 Billion in 2025.

High Content Screening Market value is predicted to reach USD 3.1 Billion by 2035.

The growth of the High content screening market can be attributed to the increasing drug discovery activities, increasing adoption in pharmaceutical and biotech research, advances in imaging technology, and the demand for efficient cell analysis in toxicity studies and precision medicine development.

High Content Screening Market is driven by IOT and AI in USA, UK, Europe EU, Japan and South Korea.

Healthcare and Biotechnology to have the largest share in the evaluation period.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.