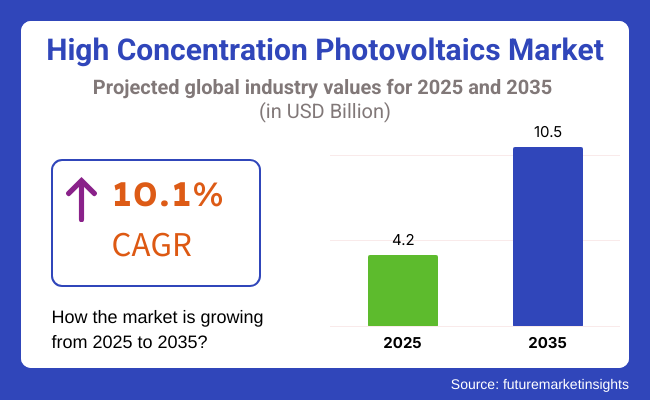

The high concentration photovoltaics (HCPV) market is expected to expand to USD 4.2 billion in 2025 and USD 10.5 billion in 2035 at a CAGR of 10.1% during the forecast period. Increasing need for the efficiency of solar energy conversion, increasing investment in renewable energy facilities, and technological advancements in multi-junction photovoltaic cells are driving the industry.

Advances in optical concentrator technology, heat control, and high-efficiency solar cells also facilitate increased business opportunities. In addition, the use of HCPV systems for off-grid power generation, solar farms, and industrial applications is also transforming the business landscape. Strategic investment in R&D, regulatory measures, and technology alliances among solar power companies, technology companies, and governments are driving business growth.

Apart from this, the increasing applications of HCPV systems in off-grid and decentralized power generation are driving robust industry growth. Industries and cities are employing HCPV technology to reduce carbon footprints, increase energy security, and achieve maximum power generation in regions of high solar irradiation.

The deployment of large-scale solar farms is drivinginvestment in HCPV systems and is expected to be the most significant driver, particularly in sunny regions. AI (Artificial Intelligence) and automation will bring about a fusion for HCPV operations that ensures proper power distribution across the smart gridnetworks.

Hybrid concentrated photovoltaic (HCPV) technology has already been designed and developed using sustainable manufacturing,enabling environmentally friendly best practices that will continue to minimize the carbon footprint associated with this technology. With increasing demand for clean energy, technological advancements, and government support, HCPVtechnology is positioned to be a driving force behind the transition to efficient and sustainable solar energy throughout the world.

Explore FMI!

Book a free demo

The industry is booming, with the driving force being the increasing requirement for solar energy solutions that are highly efficient in places with strong direct sunlight. HCPV is absolutely the best choice for such large-scale renewable energy plants because utility-scale power plants concentrate on efficiency and scalability. Nevertheless, the main problem is still the high initial costs.

Durability and maintenance, as well as the commercial and industrial sectors, are the major focus; therefore, they prove to be the long-term operational efficiency. The government and research institutions are backing HCPV for innovation and trial applications such as augmenting solar energy technology.

Heliographic distribution is a critical factor as the HCPV systems are most effective in regions where high direct normal irradiance (DNI) prevails, such as the Arab region, North Africa, some USA states, and Australia. Innovations that have been made in multi-junction solar cells and tracking technology are expected to make the HCPV industry grow, especially in the regions that are trying to achieve higher solar energy output and grid efficiency.

| Company | Contract Value (USD Million) |

|---|---|

| Arzon Solar | Approximately USD 150 - USD 200 |

| Lightsource bp | Approximately USD 1,000 - USD 1,200 |

Over 2020 to 2024, the industry for high-concentration photovoltaics (HCPV) grew exponentially as the demand for inexpensive solar power increased significantly through improved power generation and area size usage.

The developments were made in multi-junction photovoltaic solar cells, concentration optical systems, and heat dissipation systems, thus improving conversion efficiency and making HCPV a suitable application for large installations and standalone installations.

That led to heavy investment in renewable energy by governments and corporate players, which accelerated its adoption in geographies with abundant sun. New solutions to track the sun developed by companies put tools to use that offered AI-enhanced performance optimization to cut down on energy loss.

However, innovations came with challenges that included high capital cost, low penetrations in low-irradiance areas, and high maintenance complexity. The industry was integrated with hybrid energy systems. The supplier focused on scaleup and HCPV integration with hybrid energy systems until 2024. Focus on cost minimization, minimization of complexity, and optimization of flexibility.

From 2025 to 2035, the HCPV industry will be transformed by revolutionary innovation. AI will drive predictive maintenance, and novel optics with quantum-dot solar cells will push efficiency to above 50%, placing HCPV at par with conventional photovoltaics. On-site solar optimization based on the weather and grid demand will be taken to the next level with artificially managed energy.

The adaptation of HCPV in hydrogen technology and storage systems will further facilitate its application in clean energy. Smart grid development and decentralized systems will allow for standalone, self-sustainable solar farms, which will reduce costs and increase efficiency. Developments in flexible, transparent HCPV panels will push applications towards building-integrated photovoltaic (BIPV), aerospace, and mobile energy solutions.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Manufacturers enhanced multi-junction cells to over 40% efficiencies. | Fourth-generation perovskite and quantum-dot-based cells have efficiency levels over 50%, transforming HCPV technology. |

| HCPV entered the mainstream in sunny regions for utility-scale power production. | AI-optimized solar farms enable optimum output with real-time tracking and forecasting technology. |

| Initial high costs delayed adoption, drawing focus on material optimization and economies of scale. | Mass production techniques and new materials lower costs dramatically, making HCPV accessible in most of the world. |

| HCPV supplemented battery storage and wind power to increase grid resilience. | AI-based and hydrogen-powered HCPV systems enable smooth renewable energy solutions. |

| Early AI software tracked HCPV performance, enhancing predictive maintenance. | Sophisticated AI-based optimization forecasts panel efficiency tracks the tracker automatically, and optimizes energy output. |

| Initial studies investigated semi-transparent and flexible concentrator architectures. | Fully commercialized, transparent, and flexible HCPV panels are incorporated into smart buildings, aerospace, and electric vehicles. |

| HCPV contributed to decentralized microgrids in remote and off-grid locations. | Self-sustaining, AI-powered HCPV microgrids autonomously balance energy distribution and storage. |

| Space agencies experimented with HCPV for high-power satellite energy systems. | HCPV becomes the primary power source for satellites, space colonies, and deep-space exploration missions. |

| Early experiments integrated HCPV with water desalination and hydrogen generation. | Large-scale use of HCPV-fueled desalination and hydrogen production offers clean solutions. |

| Scientists enhanced endurance, lowering the degradation of performance in extreme temperatures. | Self-healing, temperature-resistant coatings extend panel longevity and retain high efficiency for decades. |

The risks faced by the industry include high capital costs, reliance on direct sunlight, technological difficulties, legal restrictions, and competition from other solar alternatives. It is necessary to deal with these risks as they are instrumental in supporting industry growth and, most importantly, the increase in adoption rates.

The most serious challenge is high capital expenditure (CAPEX). HCPV systems have the most sophisticated equipment, like precision optics, multi-junction solar cells, and intricate cooling systems. Therefore, they cost more than conventional photovoltaic (PV) systems.

This huge cost of the project because of the higher input investment may be the main reason why investors might refrain from putting in their money, thus restricting a common application even in industries that are sensitive to this issue.

Besides that, there are also technological problems. HCPV requires tracking systems that are extremely accurate to maintain the alignment of the sun. Kinks in the mechanical devices' track mechanism of any kind can lead to a decline in energy efficiency, increased maintenance problems, and higher operational costs. Furthermore, the delicacy of optical materials also accounts for the short lifetime of such materials.

HCPV is strangled by regulatory hurdles and uncertainty in the law that affect its usage. Power companies and politicians are chiefly preoccupied with grid integration, budgetary controls, and environmental regulation. On the other hand, if the government subsidizes traditional PV or other renewable energy sources more than HCPV, it could lead to slower industry penetration.

To reduce these risks, HCPV manufacturers and stakeholders should mainly concentrate on cutting costs, introducing new technologies, expanding to the most suitable regional industries, and, most importantly, lobbying for supportive policies that will both fortify their industry position and, at the same time, assure the long-term sustainability of the business.

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 12.5% |

| UK | 12.2% |

| European Union | 12.3% |

| Japan | 12.4% |

| South Korea | 12.6% |

The USA industry expands with the use of high-efficiency photovoltaic systems by solar energy organizations and utilities for mass-scale energy production. Organizations engineer complex HCPV technologies for peak energy conversion efficiency, less use of land space, and optimized sun tracking. Industry expansion occurs due to the need for cost-effective, high-performance solar applications.

Organizations focus on optimizing multi-junction solar cell efficiency, integrating artificial intelligence-based solar monitoring, and minimizing system costs to deliver maximum output. The USA industrial, commercial, and renewable energy industry uses HCPV systems to increase the generation and sustainability of solar energy.

The government policies and incentives force organizations to use solar energy technology advancements. Enhanced use of decentralized solar power generation, hybrid solar systems, and AI-based predictive maintenance increases industry growth. According to FMI, the USA industry for HCPV is anticipated to achieve 12.5% CAGR over the forecast period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Technological Innovation | Companies invest in multi-junction solar cells and AI-driven solar tracking to optimize energy conversion rates. |

| Government Policies | Incentives and tax credits boost solar investments across industries. |

| Commercial Adoption | Industrial and commercial sectors integrate HCPV systems to reduce operational costs and improve sustainability. |

| Decentralized Power | Businesses and communities embrace distributed solar power solutions for energy independence. |

The UK industry expands as energy companies and utilities invest in high-efficiency solar systems to develop renewable energy capacity. Companies adopt not only HCPV solutions to optimize solar farm efficiency, reduce fossil fuel consumption but also achieve momentum in net-zero emission initiatives. Industry expansion is fueled by concentrated sunlight technology demand, real-time performance monitoring, and grid integration solutions.

Increasing applications of solar tracking systems, concentrated photovoltaic modules, and artificial intelligence-based energy management solutions are increasingly driving the industry growth. Transition clean energy policies promote the adoption of HCPV systems in the residential and industrial segments at a large scale.

The adoption of battery storage systems and the trading of energy in blockchain further strengthen the industry growth potential. The UK HCPV industry, as per FMI, will experience growth. It is also anticipated that CAGR growth will register 12.2% during the forecast period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Energy Transition | Policies focus on reducing fossil fuel dependence and increasing renewable energy contributions. |

| Smart Energy Solutions | AI-driven energy management and blockchain-enabled energy trading improve efficiency. |

| Industrial Investments | Businesses invest in HCPV systems to align with sustainability goals. |

| Technological Enhancements | Improved solar tracking and multi-junction cell efficiency increase adoption rates. |

The European Union industry grows as governments, organizations, and research institutions invest in future-generation solar energy technology. The industry leaders in Germany, France, and Italy are prominent in the use of HCPV systems in megawatt-scale solar farms, commercial roof-top systems, and off-grid energy programs. HCPV is being adopted by industries driven by pressure to meet stringent carbon reduction targets.

EU possesses mandatory carbon abatement and clean energy policy and thus energy companies have invested in efficient multi-junction solar technology. Emerging technologies in multi-junction solar cells, predictive maintenance using AI, and real-time monitoring of the sun make the use of HCPV more efficient. Employing smart grid and AI-powered weather forecasting increases power output as well as efficiency.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| Renewable Energy Targets | The EU enforces strict policies to reduce carbon emissions and promote solar adoption. |

| Large-Scale Deployments | Germany, France, and Italy have led the integration of HCPV systems across the industrial and commercial sectors. |

| AI Integration | AI-based predictive maintenance and weather models enhance efficiency and reliability. |

| Research & Innovation | The EU funds solar research projects to improve HCPV technology and expand applications. |

The Japanese industry expands as companies and government entities integrate high-end solar power solutions to optimize clean energy generation. Companies engineer next-generation HCPV systems to increase efficiency, reduce space consumption, and optimize solar energy conversion. Increased focus on renewable energy storage and smart solar grid integration expands industry demand.

Japan focuses on the development of renewable energy innovation, smart grid infrastructure, and carbon neutrality, promoting HCPV adoption. HCPV is invested in the semiconductor manufacturing sector, aerospace sector, and smart city sector to finance sustainable energy applications. The development of ultra-lightweight panels for HCPV and predictive maintenance through AI technologies are important factors in the growth of adoption. Japan's HCPV industry will grow at 12.4% CAGR during the forecast period, as per FMI.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Renewable Energy Policies | Government initiatives promote the transition to solar power and sustainable energy solutions. |

| Smart Grid Integration | AI-based grid management and storage systems improve efficiency and reliability. |

| Industrial Applications | Semiconductor and aerospace industries utilize HCPV for high-precision energy needs. |

| Technology Advancements | Ultra-lightweight panels and AI-driven maintenance solutions enhance adoption. |

The South Korean industry grows as solar technology with high efficiency is adopted by energy utilities, industrial manufacturers, and public agencies. Government policy promotes renewable energy growth, increasing the installation rate of HCPV units in urban and rural power applications. Demand for highly efficient, long-lasting, and efficient solar panels drives industry growth.

Companies embrace AI-driven solar tracking, multi-layer solar cells, and cloud-maximized energy to improve HCPV performance and reliability. Ultra-high-efficiency PV modules, semiconductor solar tech innovations, and AI-driven forecasting increase industry prospects. Hydrogen-solar hybrids and future-generation solar power storage technologies drive South Korea's energy sustainability.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Government Support | Policies and incentives drive solar energy investments across industries. |

| Advanced Solar Technology | Multi-layer photovoltaic cells and ultra-high-efficiency modules optimize energy output. |

| AI-Powered Optimization | AI-driven tracking and forecasting improve performance and reduce costs. |

| Hybrid Energy Systems | Hydrogen-solar hybrid solutions strengthen renewable energy capabilities. |

The industry is categorized by application into electric power and thermal power. These applications increase solar efficiency in terms of land area and energy conversion through optical and tracking technologies. Electric Power generation is by far the largest segment of the HCPV market, which primarily uses high-efficiency multi-junction solar cells to convert sunlight into electricity.

HCPV systems can achieve efficiency rates of 40% or better, compared with silicon-based photovoltaics, with concentration levels surpassing 500 suns. Such systems are employed for utility-scale solar farms and off-grid power solutions, especially in high-direct normal irradiance (DNI) regions like the southwestern USA, Australia, and the Middle East.

Realistic energy efficiency figures range from 41% and above on a regularly used basis due to less light being generated, and the concentration of the light to the ultimate photon-light signal, and the photovoltaic cells and systems are at the top of the game, companies such as Arzon Solar, Soitec, and Suncore Photovoltaics are weaving better electric power systems focusing on HCPV where dual-axis tracking sun systems are technology cousins to high-efficiency glass mirrors and Fresnel lens, progressive designs that help acquire maximum energy production from the sun.

The HCPV sector is designed to use thermal (generated from the sun) to generate hot fluids for industrial applications, water desalination, and the establishment of hybrid solar thermal plants. Unlike traditional photovoltaic systems, HCPV thermal technology allows for the storage of excess heat for future energy use, reducing reliance on the grid and improving energy reliability.

The application of hybrid PV-thermal (PVT) systems is an emerging technology that is improving the overall utilization of solar energy. High-concentration solar collectors coupled with thermal storage are also being developed in companies such as Abengoa Solar and BrightSource Energy for a range of applications, including industrial steam generation, district heating, and solar-assisted chemical processes.

The industry is categorized on the basis of application into two key areas Industrial, Residential, and Commercial Roofs and Telecom or Mobile Towers both of which are witnessing increased penetration as solar energy adoption grows across industries.

The potential industry with high solar irradiance, rooftops on top of commercial buildings in industrial environments form a rapidly growing industry for HCPV technology. These systems generate renewable energy on-site, minimizing the dependence on conventional grid electricity, with minimal footprint in terms of ground space.

HCPV has the potential to significantly reduce land use and provide higher energy yield per square meter compared to conventional panels, making it especially attractive for commercial and industrial buildings or complexes with high energy needs.

SolFocus and Semprius have been working to create HCPV (high-concentration photovoltaic) modules that are small enough to be installed on rooftops so that businesses and homeowners can take advantage of solar power generation to lower their electricity bills.

HCPV technology is also proving useful in Telecom or Mobile Towers, another important area of application. Off-grid power solutions are a boon to the telecommunications sector and help keep the mobile towers operational in remote locations where grid electricity supply is limited or absent.

They offer a cost-effective, eco-friendly alternative to diesel generators, which are expensive and polluting. Top providers like Soitec and Suncore Photovoltaics are using high-efficiency HCPV modules to power mobile towers in regions flooded with sun, slashing operational costs and keeping connectivity flowing. As telecom operators work to lessen their carbon footprint and minimize energy costs, HCPV-powered telecom towers are positioned to become the go-to solution for sustainable network expansion.

Major players lead in terms of concentrator PV solution products, world-class solar cell technology, and scalable energy solution architectures: the list includes but is not limited to Soitec, SunPower Corporation, Semprius Inc., Solar Junction, and Magpower.

Startups and niche providers keep trying to come up with newer-age optical concentrators, hybrid solar solutions, and AI-optimized solar tracking systems, which promise to intensify competition-leveling in the industry. The advances in multi-junction solar cells, optics precision, and thermal management systems should permit higher conversion efficiencies than conventional photovoltaics.

In addition, off-grid applications, hybrid solar storage solutions, and large-scale solar parks are additional factors that propel the accelerated adoption trend. Strategic factors include cost reductions in multi-junction cells, improved efficiency, and embedding smart grid technology into the marketing strategy. Companies are focusing on automated solar tracking, artificial intelligence-based performance optimization, and hybrid renewable energy ecosystems to improve reliability and scalability in HCPV systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Soitec | 20-25% |

| SunPower Corporation | 15-20% |

| Semprius Inc. | 12-17% |

| Solar Junction | 8-12% |

| Magpower | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Soitec | Develops high-efficiency HCPV modules, advanced multi-junction solar cells, and AI-driven solar tracking systems. |

| SunPower Corporation | Provides high-performance solar concentrator technology, enhanced PV efficiency, and large-scale deployment solutions. |

| Semprius Inc. | Specializes in compact, high-efficiency solar cell technology and scalable concentrated PV systems. |

| Solar Junction | Focuses on multi-junction solar cell innovation, improving conversion efficiency and maximizing solar power output. |

| Magpower | Offers concentrated solar power solutions, hybrid energy integration, and cost-effective HCPV module designs. |

Key Company Insights

Soitec (20-25%)

The company is focused on introducing high-efficiency multi-junction solar cells, AI-assisted solar tracking systems and large concentrator PV solutions that mark it out as the leading firm in HCPV.

SunPower Corporation (15-20%)

The company increases renewable energy generation with high-efficiency solar concentrators, advanced PV technologies, and scalable deployment solutions.

Semprius Inc. (12-17%)

Semprius is focused on developing what could be considered the best compact high solar cell efficiency technology with a large-scale systems view into how to differentiate various applications.

Solar Junction (8-12%)

Solar Junction performs efficiency improvements through optimization of the design and manufacturability of multi-junction solar cells.

Magpower (5-9%)

Magpower takes charge of innovative concentrated solar power systems, hybrid power integration, and economically designed HCPV modules.

Other Key Players (20-30% Combined)

The industry will continue to grow as they integrate multi-junction solar cells, AI-driven energy optimization, and advanced concentrator PV systems to improve efficiency, reduce costs, and expand renewable energy adoption.

The industry is slated to reach USD 4.2 billion in 2025.

The industry is predicted to reach a size of USD 10.5 billion by 2035.

Abengoa Solar S.A, SunCore Energy Group, Cool Earth Solar, ES-SYSTEM, Green & Gold Solar Pty Ltd., Fullsun Photovoltaics, Arzon Solar LLC, BSQ Solar, Fraunhofer ISE, and RayGen are the key players in the industry.

The USA, driven by advancements in solar energy technology and increasing adoption of sustainable power solutions, is expected to record the highest CAGR of 12.5% during the forecast period.

Electric power remains the most widely used type in the industry, owing to its efficiency in converting solar energy into electricity for various applications.

By type of power generation, the industry covers electric power and thermal power.

By application, the industry includes industrial, residential, and commercial rooftops, telecom or mobile towers, rural electrification, water pumping solutions, street lighting, government or military (mobile off-grid), municipalities, hospitals, hotels, and restaurants.

By region, the industry spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Semiconductor Substrate Market Insights - Trends & Forecast 2025 to 2035

Hyperscale Cloud Market Trends - Growth & Forecast 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Non-volatile Dual In-line Memory Module (NVDIMM) Market Analysis - Growth & Forecast 2025 to 2035

Unattended Ground Sensors (UGS) Market Trends - Forecast 2025 to 2035

Total Carbon Analyzers Market Growth - Trends & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.