The high barrier packaging films for pharmaceuticals market is fast growing owing to drug protection, shelf-life extension, and anti-counterfeiting packaging demand. High barrier films have superior moisture, oxygen, and light resistance, thus becoming irreplaceable for pharmaceutical blister packs, pouches, sachets, and unit-dose packaging. The future for high barrier films appears bright with the arrival of biodegradable materials and smart packaging solutions implementing AI-driven quality control systems in the next decade.

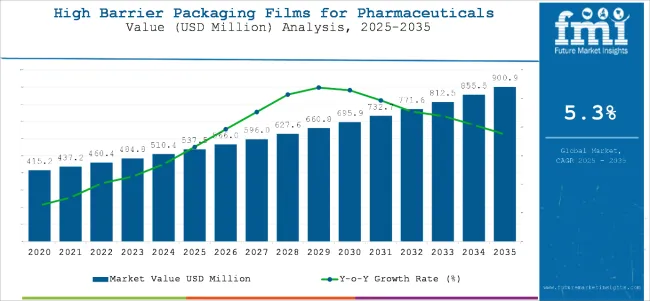

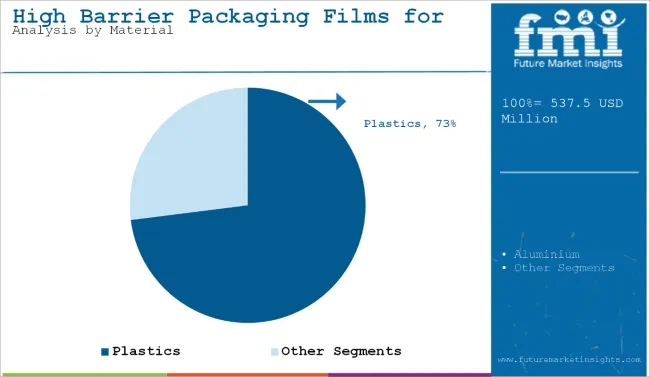

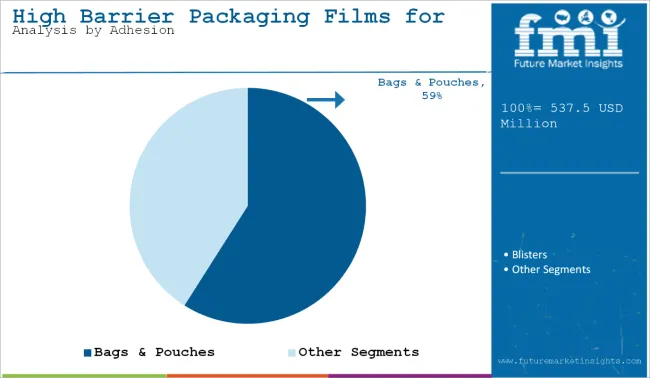

The market size of the high barrier packaging films for pharmaceuticals industry is projected to reach an estimated value of USD 537.5 Million in 2025 and is expected to grow with a 5.3% CAGR from 2025 to USD 900.9 Million by 2035.

The growth of this industry is primarily attributed to the growing regulatory requirements for drug safety among pharmaceutical manufacturers, demand for unit-dose and personalized medicine packaging, and technological innovations in multilayer high-barrier materials. The advancement of nano-coatings, AI-based defect detection, and fully recyclable high-barrier films is also enabling market adoption.

Also working favorably towards market growth are the need for child-resistant, tamper-evident, and eco-friendly pharmaceutical packaging, as well as government policy supporting sustainable alternatives to conventional plastic-based packaging materials. Growing preference for sustainable flexible high-barrier pharmaceutical packaging solutions, as well as innovations within antimicrobial and UV-resistant films, have widened the application field.

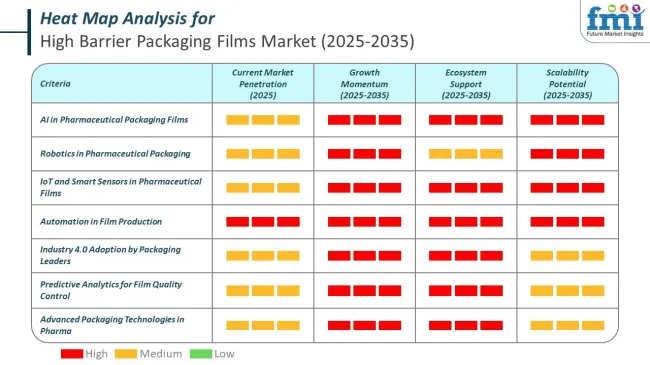

In 2025, the high barrier packaging films for the pharmaceuticals market is undergoing a technological transformation. Manufacturers are incorporating AI and robotics into production workflows to elevate consistency, output precision, and material control. Film coating lines are now guided by vision-based AI systems that detect and correct anomalies before errors propagate across batches.

The industry is now more reliant on predictive accuracy rather than manual intervention, reshaping operations and demand handling across global packaging facilities.

Automation now dominates post-processing steps, including slitting, lamination, and roll transfer. High barrier pharmaceutical film manufacturers are equipping their plants with robotic arms and intelligent drive systems that dynamically recalibrate based on batch type and packaging format.

This transition supports faster order throughput and minimizes downtime, directly improving the responsiveness of the industry to complex pharmaceutical packaging requirements.

IoT is transforming how pharmaceutical film production is monitored and optimized. Sensors continuously measure environmental and mechanical parameters, enabling centralized dashboards to flag potential faults before they disrupt the process.

With IoT-enabled transparency, the market benefits from lower rejection rates and more synchronized production cycles aligned with fluctuating pharmaceutical demand.

Top high-barrier packaging films for pharmaceuticals market players are advancing their operations by embracing automation, robotics, and AI in their facilities.

Amcor is advancing digitalization and Industry 4.0 in its packaging solutions, including pharmaceutical films. The company uses packaging technologies such as NFC chips integrated into packaging, enabling digital traceability, authentication, and supply chain transparency throughout the product lifecycle.

Sealed Air employs AI-powered cloud analytics and IoT-driven monitoring in its smart packaging operations, including pharmaceutical packaging lines, to enable predictive maintenance, optimize lamination processes, and forecast material usage more precisely.

Berry Global integrates automation and IoT-enabled monitoring systems in its flexible and barrier films manufacturing, including pharma-grade packaging films. Berry's digital transformation roadmap includes deploying Industry 4.0 automation suites to enhance manufacturing agility and compliance with pharma quality standards.

Constantia Flexibles leverages machine learning and IoT sensors in its pharmaceutical packaging production, smart packaging features that support real-time environmental monitoring of pharmaceutical products to maintain efficacy and safety throughout supply chains.

3M uses IoT-enabled production lines and incorporates digital tracking & AI analytics in its high-barrier pharmaceutical packaging films manufacturing to advance traceability, optimize resource consumption, and support regulatory compliance.

Asia-Pacific region is poised to lead the market for high barrier packaging films for pharmaceuticals, with the drivers being increasing pharmaceutical production, rising access to healthcare, and growing investments in sustainable packaging solutions. Advanced barrier films are being adopted extensively in drug packaging, protection of medical devices, and sealing of diagnostic kits in countries like China, India, and Japan.

Advances in the cost-effective manufacturing of films, automation in the technologies of pharmaceutical packaging, and increased investments in bio-based barriers are further favoring the growth of the market in the region. Also, the government regulations for tamper-proof and child-resistant packaging are shaping market trends. The increasing presence of foreign pharmaceutical manufacturers in the Asia Pacific thus supports local production and product innovations.

North America is a principal marketplace for high-barrier films for pharmaceutical packaging, with new applications blossoming for biopharmaceuticals, personalized medicines, and controlled drug delivery systems. The United States and Canada lead smart packaging technology innovations in AI-based defect detection, with compliance-driven security features.

The growing attention to sustainability and high-performance pharmaceutical packaging, driven by drug safety regulations, serialization requirements, and extended shelf-life mandates, has led the market growth.

Meanwhile, rising investments in research and development of anti-tampering, moisture-proof, and AI-integrated tracking films are contributing to the growth. Intelligent packaging solutions for real-time monitoring, freshness indication, and digital authentication are also gaining traction to strengthen product integrity and patient safety.

Apart from the environmental regulations and mounting demand for recyclable drug packaging and biodegradable material investments, Europe also commands considerable share in the high barrier packaging films for pharmaceuticals. Sustainable packaging developments, high-barrier biofilms, and lightweight alternatives for pharmaceutical packaging are being led by Germany, France, and the UK as key economy players.

European markets have been molded according to EU policies that reduce plastic waste, enhance recyclability standards, and assist pharmaceutical traceability. The demand for high-grade films with child-resistance capabilities and anti-counterfeiting packaging abilities with better barrier property against oxygen, moisture, and light is aiding growth in the market.

Numerous collaborations are also occurring in the region amongst pharmaceutical companies, regulatory organizations, and packaging manufacturers for the development of next-generation high barrier films with improved durability, sustainability, and smart packaging integrations. Market innovations are expected to be stimulated by AI-driven quality control, RFID-enabled tracking, and fully recyclable barrier films.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Early focus on compliance-driven pharmaceutical packaging safety. |

| Material and Formulation Innovations | Development of basic high-barrier polymers and child-resistant packaging. |

| Industry Adoption | Widely used in blister packs, drug pouches, and liquid pharmaceutical packaging. |

| Market Competition | Dominated by traditional pharmaceutical packaging manufacturers. |

| Market Growth Drivers | Growth driven by demand for longer drug shelf-life and anti-counterfeit packaging. |

| Sustainability and Environmental Impact | Early adoption of recyclable and child-safe pharmaceutical packaging. |

| Integration of AI and Process Optimization | Limited AI use in pharmaceutical packaging quality control and serialization. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global mandates on fully recyclable, tamper-proof, and AI-integrated high-barrier pharmaceutical films. |

| Material and Formulation Innovations | Expansion of AI-driven, temperature-sensitive, and self-healing pharmaceutical films. |

| Industry Adoption | Increased adoption in controlled drug release packaging, smart labeling, and high-performance biologic drug protection. |

| Market Competition | Rise of sustainability-focused startups and AI-powered packaging firms integrating blockchain traceability. |

| Market Growth Drivers | Market expansion fueled by sustainability initiatives, AI-powered monitoring, and fully biodegradable packaging films. |

| Sustainability and Environmental Impact | Large-scale transition to biodegradable, plant-based, and carbon-neutral high-barrier packaging films. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated defect detection, and real-time cold chain tracking innovations. |

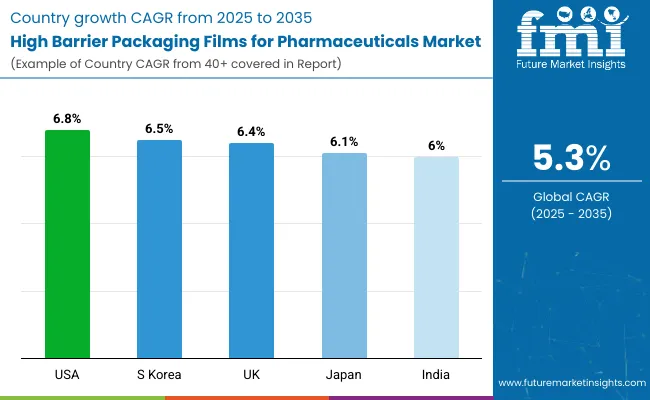

An increasing market in pharmaceuticals is the market for high-end barrier packaging films. Among the other countries, the USA leads the market in terms of sales of high barrier packaging films used in pharmaceuticals. Growing demand for high-tech advanced barrier packaging systems that offer protection from contamination in pharmaceutical applications fuels growing consumption of high barrier packaging films in pharmaceuticals.

Any product type with superior properties concerning the barrier-influencing factors moisture, oxygen, and light has been a prime driving factor for the adoption of multi-layer polymer films, aluminum-based laminates, and nanocoated films into the pharmaceutical arena.

Also, due to rigorous FDA regulations for packaging in the pharmaceutical field, such as the implementation of child-resistance criteria and tamper-evident requirements in sustainable pharmaceutical packaging, manufacturers are striving toward the development of eco-friendly, recyclable, and biodegradable barrier films.

Advancements in active packaging, intelligent barrier films, and antimicrobial coatings are improving drug packaging safety and quality. More recently, in a trend pivoting toward instituting the safety and reducing contamination risks in drug usage, extending the shelf life of medicines, and enhancing patient safety, the growth in the U.S. market is further propelled by a growing emphasis.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

As regulatory bodies encourage sustainable, high-performance packaging materials, the UK high barrier packaging films for pharmaceuticals market has been growing. Developments such as mono-material barrier films, biodegradable coatings, aluminum-free laminates, etc. are being largely influenced by the need for pharmaceutical packaging that is much more environmentally friendly yet can protect its contents well.

The focus of the pharmaceutical industry on tamper-proof, temperature- and moisture-resistant packaging drives innovations in nanotechnology-enhanced films, oxygen scavenger layers, and high-barrier recyclable films. Smart tracking solutions like QR codes, RFID-enabled packaging, and digital serialization enhance security and traceability throughout the supply chain. The movement also sees the flexible, high-barrier blister packaging and pouch-based pharmaceutical packaging evolve, further promoting growth in the UK marketplace.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.4% |

Japan's high-barrier packaging films for pharmaceuticals market is witnessing steady growth due to an emphasis on precision-engineered, ultra-thin, and high-durability barrier films. Stringent quality assurance standards continue to propel Japanese innovation for multilayered high-barrier films, aiming at protecting pharmaceutical products from phenomena such as moisture, gases, and UV rays.

Local producers are now engaged in the production of recyclable PET barrier films, PLA-coated laminates, and sustainable bio-barrier solutions keeping in view the increasing requirements for eco-friendly pharmaceutical packaging.

In addition, innovations are induced by the on-the-rise smart packaging technologies: temperature-sensitive indicators, and anti-counterfeiting solutions. Japan also enhances the innovation by establishing check-and-balance with AI-led defect capture, real-time quality checks, and high-barrier film manufacturing automation for efficiency and wastage mitigation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The market for high-barrier packaging films for pharmaceuticals in South Korea is currently on a growth trend because of the requirement for moisture-proofing, oxygen-blocking, and antimicrobial packaging in the industrial applications of the pharmaceutical and biotechnology sectors.

South Korea has a great pharmaceutical manufacturing base, and the emphasis on driving growth through exports, along with government initiatives supporting sustainable, high-performance polymer films, nanocoated barrier films, and aluminum-free laminate technologies, has provided the impetus among manufacturers to innovate.

Further enhancing growth in this market are government initiatives on green packaging technologies extended to drug shelf life and the prevention of counterfeit technologies. Related, companies are implementing AI-powered material engineering, high-barrier smart films, and RFID-enabled track-and-trace systems aimed at enhancing pharmaceutical safety and supply chain transparency.

Also, lightweight flexible, fully recyclable barrier films are driving further growth in the use of blister packs, pouches, and sachets intended for use in pharmaceuticals across South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

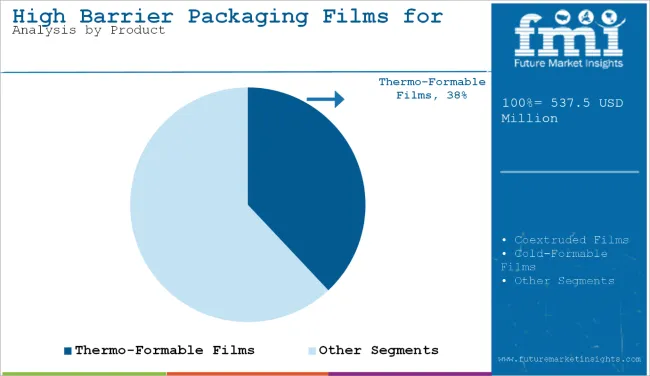

Thermo-formable films are popular in the pharmaceutical industry because they offer excellent protection, durability, and flexibility in packaging sensitive products such as tablets, capsules, and medical devices. These films can be easily molded into custom shapes through heat, creating precise cavities that securely hold pharmaceutical items in place. This ensures protection from moisture, oxygen, light, and contamination, helping to maintain product stability and shelf life.

Their compatibility with blister packaging machinery makes them ideal for high-speed production environments. Thermo-formable films also support tamper-evident features and clear visibility of the product, which enhances consumer safety and confidence. Additionally, they can be customized with child-resistant and senior-friendly designs, meeting safety regulations across different markets

Plastic high barrier packaging films are popular in the pharmaceutical industry because they provide strong protection against moisture, oxygen, UV light, and other external contaminants that can compromise drug stability. These films help maintain the efficacy, shelf life, and safety of sensitive pharmaceutical products, including tablets, capsules, and injectable formulations.

They are lightweight, flexible, and compatible with various packaging formats such as blister packs, sachets, and pouches, making them suitable for both solid and liquid medications. Plastic high barrier films also support tamper-evident features and can be easily laminated or coated for enhanced performance. Their ability to meet strict regulatory standards, including sterilization compatibility and traceability, further adds to their appeal.

Bags and pouches are a popular format for high barrier packaging films in the pharmaceutical industry due to their lightweight structure, flexibility, and excellent protective properties. They provide an effective barrier against moisture, oxygen, light, and contaminants, which is essential for maintaining the stability and potency of pharmaceutical products such as powders, granules, and liquid formulations.

These formats are also cost-effective and space-efficient, offering easy storage, transportation, and disposal compared to rigid packaging. Bags and pouches can be designed in various sizes with features like resealable closures, tamper-evident seals, and single-dose dispensing, enhancing both safety and user convenience. Their compatibility with sterilization processes and customizable structures makes them suitable for a wide range of pharmaceutical applications, from hospital use to over-the-counter medications.

High barrier packaging films market is driven by increasing demand from the pharmaceutical and biopharmaceutical segments. The market is being impacted by innovation with novel sustainable film technologies like aluminum-free laminates, bio-based polymers, and smart packages. Also driving the industry trends are advances in nanotechnology-based barrier coatings, IoT-enabled performance monitoring, and antimicrobial film materials.

Growing preference for light weight, high strength, and eco-friendly packaging solutions is further fueling the market. In addition, higher investments in circular economy projects, particularly lean manufacturing and AI-based packaging solutions, are enhancing effectiveness and increasing market possibilities.

| Company Name | Estimated Market Share (%) |

|---|---|

| Amcor plc | 10-14% |

| Sealed Air Corporation | 8-12% |

| Berry Global Group | 6-10% |

| Constantia Flexibles | 5-9% |

| Winpak Ltd. | 4-8% |

| Other Companies (combined) | 50-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amcor plc | Develops high-barrier, recyclable pharmaceutical packaging films with advanced moisture and oxygen protection. |

| Sealed Air Corporation | Specializes in sustainable, flexible high-barrier films with intelligent anti-counterfeiting features. |

| Berry Global Group | Produces multi-layer pharmaceutical barrier films optimized for extended shelf life and stability. |

| Constantia Flexibles | Expands its portfolio with eco-friendly, aluminum-free high-barrier packaging for pharmaceutical products. |

| Winpak Ltd. | Focuses on advanced multilayer high-barrier films with IoT-enabled real-time tracking and regulatory compliance. |

Develops high-barrier, recyclable pharmaceutical packaging films with advanced moisture and oxygen protection.

Specializes in sustainable, flexible high-barrier films with intelligent anti-counterfeiting features.

Produces multi-layer pharmaceutical barrier films optimized for extended shelf life and stability.

Focuses on advanced multilayer high-barrier films with IoT-enabled real-time tracking and regulatory compliance.

Expands its portfolio with eco-friendly, aluminum-free high-barrier packaging for pharmaceutical products.

Several specialty high barrier packaging film manufacturers contribute to the expanding market. These include:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Material, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Adhesion, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Adhesion, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Adhesion, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Adhesion, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Material, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Adhesion, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Adhesion, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Material, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Adhesion, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Adhesion, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Product, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Material, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Adhesion, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Adhesion, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Product, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Material, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Adhesion, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Adhesion, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Adhesion, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Adhesion, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Adhesion, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Adhesion, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Adhesion, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Material, 2023 to 2033

Figure 23: Global Market Attractiveness by Adhesion, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Adhesion, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Adhesion, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Adhesion, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Adhesion, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Adhesion, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Material, 2023 to 2033

Figure 47: North America Market Attractiveness by Adhesion, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Adhesion, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Adhesion, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Adhesion, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Adhesion, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Adhesion, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Adhesion, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Adhesion, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Adhesion, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Adhesion, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Adhesion, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Adhesion, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Europe Market Attractiveness by Material, 2023 to 2033

Figure 95: Europe Market Attractiveness by Adhesion, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Adhesion, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Adhesion, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Adhesion, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Adhesion, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Adhesion, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Adhesion, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Adhesion, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Adhesion, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by Adhesion, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Adhesion, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Adhesion, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product, 2023 to 2033

Figure 142: MEA Market Attractiveness by Material, 2023 to 2033

Figure 143: MEA Market Attractiveness by Adhesion, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

The overall market size for the High Barrier Packaging Films Market was USD 537.5 Million in 2025.

The High Barrier Packaging Films Market is expected to reach USD 900.9 Million in 2035.

The market will be driven by increasing demand for pharmaceutical-grade packaging films, advancements in smart and sustainable packaging technologies, and stricter regulatory requirements for drug protection.

Key challenges include recyclability concerns, high material costs, and evolving pharmaceutical packaging regulations. However, innovations in sustainable materials, solvent-free laminations, and AI-powered defect detection are addressing these concerns.

North America and Europe are expected to dominate due to strong regulatory frameworks, increasing pharmaceutical production, and growing investments in sustainable packaging solutions. Meanwhile, Asia-Pacific is experiencing rapid growth driven by pharmaceutical industry expansion and rising demand for high-barrier packaging solutions.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.