High barrier lidding film market is experiencing consistent growth as manufacturers and companies concentrate on shelf life extension, food safety, and sustainability as package solutions. High barrier lidding films prevent moisture, oxygen, and aroma, which is ideal for ready-to-eat food, dairy, meat, and pharmaceutical applications. Increases in demand for convenience food, food safety legislation, and technology innovation in film lamination drive demand in this category.

Abundant investments by manufacturers are currently being put into recyclable and compostable lidding films with innovative sealing technologies, along with intelligent packaging solutions to provide improved freshness and traceability. The market now is shifting towards lightweight, sustainable, and high-performance lidding films that deliver product protection with reduced plastic waste.

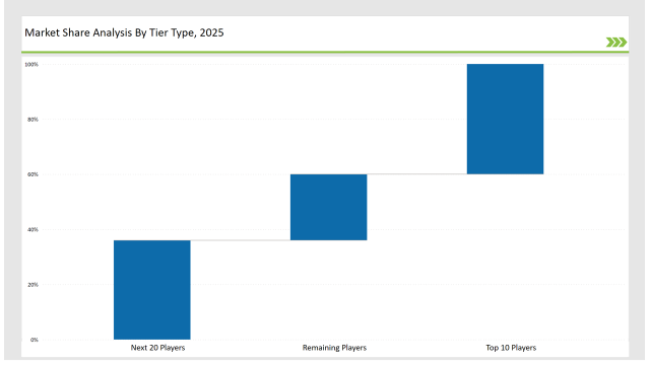

The Tier 1 players like Amcor, Sealed Air, and Mondi Group own 40% market share due to their leadership in the supply of high-performance lidding films, global supply chain extension, and sustainability innovations.

Tier 2 participants such as Berry Global, Coveris, and Winpak command 36% market share through competitive pricing, custom, and high-barrier solutions for applications including food, beverage, and pharmaceutical.

Tier 3 is regional and specialty players offering biodegradable lidding films, resealable packs, and tamper-evident packaging, which has 24% of the market. Their localized efforts are directed toward industry-specific innovations and the use of biodegradable materials.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Sealed Air, Mondi Group) | 19% |

| Rest of Top 5 (Berry Global, Coveris) | 12% |

| Next 5 of Top 10 (Winpak, Sonoco Products, ProAmpac, Plastopil, Schur Flexibles) | 9% |

The high barrier lidding film industry serves multiple sectors where freshness, packaging security, and convenience are critical. Companies are developing innovative lidding film solutions to enhance shelf appeal and product protection.

Manufacturers are optimizing high barrier lidding film production with advanced sealing technology, recyclable materials, and smart packaging enhancements.

The high-barrier lidding film industry is experiencing changes primarily driven by sustainability and convenience. Companies are developing AI capabilities for quality control, recycle high-barrier films, and intelligent packaging efficiencies. All these developments ensure that firms launch lidding films that are resealable and tamper-proof for both fresh and frozen food categories. Latest innovations by industry players include ultra-high-performance but ultra-thin lidding films that are low-waste material but highly durable. Moreover, firms could integrate smart packaging features such as freshness indicators and QR codes into lidding applications to further entice consumers.

Year-on-Year Leaders

Technology suppliers should focus on automation, smart packaging, and sustainable materials to support the evolving high barrier lidding film market. Partnering with food processors, pharmaceutical firms, and retailers will accelerate industry adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Sealed Air, Mondi Group |

| Tier 2 | Berry Global, Coveris, Winpak |

| Tier 3 | Sonoco Products, ProAmpac, Plastopil, Schur Flexibles |

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched fully recyclable high-barrier lidding films in March 2024. |

| Sealed Air | Developed tamper-evident, heat-sealable lidding films in April 2024. |

| Mondi Group | Expanded compostable lidding films for organic food in May 2024. |

| Berry Global | Released peelable, anti-fog films in June 2024. |

| Coveris | Strengthened puncture-resistant, multi-layer lidding films in July 2024. |

| Winpak | Introduced resealable film solutions for grab-and-go meals in August 2024. |

| ProAmpac | Pioneered smart digital-printed lidding films in September 2024. |

The high barrier lidding film market is evolving as companies invest in sustainability, resealable solutions, and smart packaging innovations.

AI-driven production will continue in tandem with smart packaging and sustainable materials. Manufacturers will develop high-barrier recyclable films with compliance to food safety regulations. Digital authentication will be given by companies for enhanced traceability of products. Thinner lightweight lidding films will be developed by companies for improved cost and material efficiency. Smart packaging will allow for real-time monitoring of freshness. Increased automation will also be ushered in lidding film sealing for improved efficiency and quality control.

The biodegradable high-performance lidding films will also be developed by companies to achieve sustainability. Digital printing is set to allow for greater customizability in design and interactivity in packaging. Companies will enhance control measures using machine learning to identify defects in the packaging and maintain its integrity.

Leading players include Amcor, Sealed Air, Mondi Group, Berry Global, Coveris, Winpak, and ProAmpac.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 40%.

Key drivers include sustainability, smart packaging, automation, and food safety.

Korea Industrial Electronics Packaging Market Analysis by Material Type, Product Type, Packaging Type, and Province through 2035

Snap-Lock Closure Market Analysis by Material Type, Application, and Region through 2035

Japan Industrial Electronics Packaging Market Analysis by Material Type, Packaging Type, Product Type, and City through 2035

Blister Card Market Analysis by Product Type, Technology Type, Material Type, End-use Industry, and Region Forecast Through 2035

Vietnam Plastic Bottle Market Analysis by Capacity, Material, End-use, and Region Forecast Through 2035

Magazine and Literature Bag Market Analysis by Material, Basis Weight, Sales Channel, and Region Forecast Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.