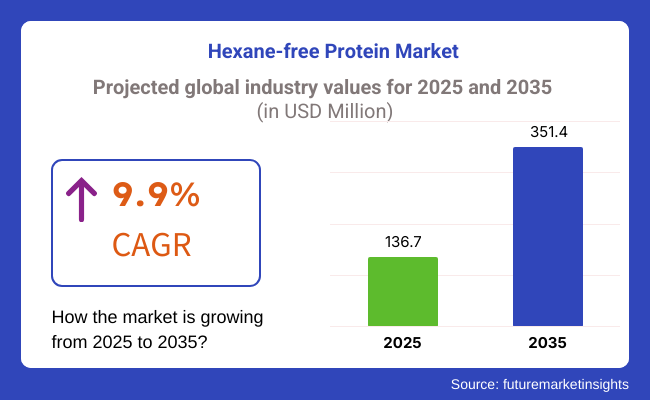

The global hexane-free protein is projected to grow from USD 136.7 million in 2025 to USD 351.4 million by 2035, reflecting a CAGR of 9.9% during the forecast period. Consumers are significantly demanding clean-label ingredients, leading to a profound shift toward chemical-free processing methodologies in hexane-free protein development.

Due to the rising concerns of consumers regarding the health risks posed by using chemical solvents, manufacturers are honing in on non-chemical extraction methods. Enzymatic and water-based extraction processes are becoming increasingly popular due to their safety and sustainability, allowing for the isolation of pure proteins with minimal loss of nutritional value.

Organizations are spending a lot of money on research design to begin with, yield effectiveness without losing the capacity of protein. This includes the efficiency of extraction by needing less time for processing and affordable.

This trend is propelling the expansion of production scale as manufacturers hurry to meet demand without resorting to traditional solvent-based processes. As regulatory authorities get stricter on chemical use, the global market is moving towards solvent-free processing and suitable businesses.

Hexane-free protein functionality enhancement receives significant focus from manufacturers to make their usage possible in multiple product categories. Specialized protein products based on, for example, emulsification, solubility, texture, etc., are in high demand, which sets the bar higher for formulation techniques.

This broad category of texture agents - also referred to as thickeners - enhances the sensory properties and stability of food and beverage products. To better enhance the functionality of proteins, companies are developing protein processing technologies like fermentation and hydrolysis.

The expanded availability of high-protein snacks, sports nutrition products, and dairy alternatives from plant sources also contributes to this trend. Manufacturers are catering to specific industry demands, such as protein ingredients ideal for meat alternatives, infant nutrition, and medical foods while broadening the ecosystem around hexane-free protein.

Explore FMI!

Book a free demo

The market of hexane-free protein is experiencing strong growth due to factors such as increasing consumer knowledge of clean-label, non-GMO, and sustainable food. In the food & beverage industry, demand is fuelled by the requirement for plant-based protein alternatives with low processing and high safety.

Sports nutritional brands focus on high protein levels, amino acid profiles, and bioavailability, and thus, pea, rice, and soy proteins are favored. Hexane-free protein is in demand in the pharmaceutical and nutraceutical industries for applications in medicinal formulations, dietary supplements, and functional foods for allergy-friendly and niche nutrition requirements.

Hexane-free proteins are gaining more importance as a replacement for traditional soy meal, with brands concerned about sustainability and responsible sourcing. There is a change in the direction of the market toward cold-pressed and enzyme-extracted proteins, providing assurance of clean processes of production, retaining nutritional content, and ensuring consumer confidence.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 9.7% |

| H2 (2024 to 2034) | 10.0% |

| H1 (2025 to 2035) | 9.8% |

| H2 (2025 to 2035) | 10.1% |

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2025) and the current year (2025) for the global hexane-free protein market. This analysis highlights crucial shifts in market performance and revenue realization trends, offering stakeholders a clearer understanding of growth dynamics throughout the decade.

The first half of the year (H1) spans from January to June, while the second half (H2) includes July to December. In the first half of the decade from 2025 to 2035, the market is expected to grow at a CAGR of 9.8%, followed by a slightly higher growth rate of 10.0% in the second half.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 9.8% in the first half and remain steady at 10.1% in the second half. During H1, the sector experienced an increase of 10 BPS, whereas in H2, it saw a increase of 10 BPS.

Hexane-free protein was used in several applications including food and feed during which its demand saw a healthy increase between 2020 to 2024, primarily attributed to the growing awareness and demand for clean-label as well as plant-based and sustainable protein among consumers. Demand for hexane-free-derived proteins from peas, soy, rice, and hemp soared as health-minded consumers, as well as those adopting vegan and vegetarian diets, turned to plant proteins.

Big data and AI assist in optimizing extraction processes and increasing protein purity without chemical solvents, such as hexane. The cold-pressing and water extraction processes became popular as they were both environmentally friendly and protein-sparing. Accurate extraction efficiency and high production costs were the challenges.

Blockchain supply chains are likely to offer enhanced ingredient traceability and enable clean-label authenticity. AI-based automated extraction will strengthen water and energy efficiencies to reduce the environmental footprint. Functional hexane-free proteins with maximized digestibility, amino acid profile, and bioactive function will be the standard.

Carbon-free processing and sustainably sourced ingredients will be in the driver's seat, led by government legislation and consumer behavior. Intelligent formulation platforms through the use of AI will enable personalized protein blends for precise dietary requirements and fitness goals. The industry will become a very personalized, efficient, and eco-friendly category of the larger plant-based protein market.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for plant-based, clean-label proteins | Personalized protein blends to meet dietary needs and fitness objectives |

| AI-driven insights for improving protein quality and flavor | Quantum-aided analysis to improve bioavailability and amino acid content |

| Clean-label ingredient sourcing and authenticity concerns | Blockchain-based transparent supply chains with real-time tracking |

| Use of water-based and cold-press extraction processes | Carbon-free AI-driven extraction and resource-efficient manufacturing |

| Regulation as per organic and clean-label labels | AI-driven automated regulation and clean-label authentication |

| AI for effective extraction and improved protein yield | Edge AI and intelligent extraction platforms for real-time production optimization |

| Increasing demand for plant protein for muscle growth and health | Improved health impacts with customized amino acid profiles and bioactive ingredients |

The industry must contend with regulating control, acquisition of raw materials, and consumers' attitudes. For instance, the FDA, EFSA, and USDA, which are the governing institutions, have policies that enforce more stringent food processing criteria.

Therefore, the companies' products will be subjected to an increase in compliance costs. On the other hand, if the brand promises are not fulfilled then the result can be included as well as brand loss, and legal consequences. The other issue is acquiring a high-quality, non-hexane-extracted protein.

While the traditional protein isolation technique relies mainly on the use of hexane as the solvent, the alternative methods tend to be more costly. The higher production cost that these processes involve will have an impact on pricing competition. The limited amount of organic, non-GMO soy, peas, and other available plant proteins can lead to supply chain interruptions.

The competition in the market is growing as plant-based protein brands apply cleaner extraction methods. Companies that do not offer their products with a new approach, eco-sustainability labels, or health benefits may have a hard time keeping customers. Besides this, consumers' doubts about the purity and efficiency, as opposed to those processed in the traditional way, could lead to lower adoption rates for the latter.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 7.2% |

| The UK | 6.5% |

| France | 6.3% |

| Germany | 6.4% |

| Italy | 5.9% |

| South Korea | 6.1% |

| Japan | 5.7% |

| China | 8.1% |

| Australia | 6.0% |

| New Zealand | 5.8% |

The industry is anticipated to grow at a 7.2% CAGR from 2025 to 2035. Increasing consumer demand for clean-label and plant-based protein sources drives this growth. The food and beverage sector continues to move towards organic and non-GMO ingredients, driving the use of protein sources.

Large food companies proactively reformulate their products to meet stricter regulations and sustainability objectives. The USA plant-based protein market, especially soy and pea protein, witnessed strong demand as consumers were concerned about health and the environment. Moreover, growing concerns regarding solvent-based extraction methods push companies to implement cleaner processing methods.

The consumer food retailing market, from supermarkets to the websites of online food stores, widens its shelves with protein powder, bars, and dairy substitute products-the innovation of functional foods, protein-enriched beverages, and sports nutrition further fuels market growth. Research and development spending further brings the process of extraction forward, positioning protein into lower-cost and more accessible segments.

The growing popularity of flexitarianism and veganism is at the heart of market growth. Regulation and certification schemes assure consumers, and collaboration between food industry giants and startups brings product diversification. As awareness increases, demand for protein increases, and the USA becomes at the center of the global market.

The industry is likely to grow at a 6.5% CAGR during 2025 to 2035. Clean-label, sustainable, and ethically sourced protein foods are becoming more demanded by consumers, driving the movement toward hexane-free extraction processes. The phenomenon of plant-based food is trending upward, leading to industry expansion.

Food firms focus on innovation with the introduction of protein foods under dairy alternatives, meat alternatives, and fortified snack lines. The stringent food safety policies of the UK prompt firms to implement cleaner processes, resulting in product transparency and consumer trust.

Retailers contribute significantly to market expansion with the increase of their organic, non-GMO, and solvent-free protein product offerings. E-commerce platforms increase sales even further by presenting clean-label products to an even wider consumer base. Moreover, greater investment in sustainable agriculture fuels the supply of high-quality plant protein sources.

Growing health awareness and eco-conservation compel humans to go for natural protein intake. Supportive policies by the government toward sustainability and low-chemical processing of foods render market appeal more stringent. As more food businesses see it as a compatible trend, proteins in the UK will continue to enjoy consistent growth rates over the next decade.

The industry is anticipated to grow at a 6.3% CAGR from 2025 to 2035. The country's strong food culture and organic, high-quality food consumption drive the demand for clean-label protein alternatives.

French consumers highly prioritize ethical sourcing and sustainability, which compel manufacturers to shift towards non-hexane extraction processes. Growing consumption of plant-based diets also drives the market, with soy, pea, and fava bean protein gaining popularity. Large food companies and startups invest in next-generation protein formulations, such as functional beverages and plant-based dairy.

Strict European Union regulations on the use of chemicals and food safety ease the trend for hexane-free extraction. There are increasingly organic and natural protein products available on the shelves, which have become available to consumers who are increasingly concerned about their health. Vigorous French farm economies also reinforce the ability to increase local, non-GMO sources of protein.

The sports nutrition market is also at play as demand, as athletes and bodybuilders turn to cleaner protein brands. As the food industry transitions to sustainability, France leads the way in the trend.

Germany is projected to grow at a 6.4% CAGR during 2025 to 2035. The nation's strong emphasis on sustainability, organic food production, and clean-label products drives market growth. German consumers prefer progressively minimally processed, and plant-based protein sources and businesses are responding by using hexane-free extraction procedures.

The food and beverage sector experiences continuous innovation in plant-based meat alternatives, dairy alternatives, and protein supplements, driving demand for solvent-free protein sources. Tighter EU food processing regulations for chemical use compel firms to turn to natural extraction techniques.

Retailers deliberately market organic, non-GMO, and ethically produced protein foods, offering them in abundance on store shelves and online sites. The high-end markets of Germany are being fueled by superior research and development capability, pushing enhanced protein extraction methods that are becoming more economical and efficient.

The new health and fitness sector is also contributing to the demand for clean protein supplements With sustainability being a core value for consumers and companies alike, Germany's industry will expand gradually and become one of the strongest performers in Europe.

The industry will advance at a 5.9% CAGR from 2025 to 2035. The country's high focus on natural and quality foods fuels the shift towards clean-label protein ingredients. Italian consumers prefer locally sourced and organic products, and protein is popular.

The trend in plant-based food continues to grow, with soy, chickpea, and pea protein dominating the market. Traditional food companies add plant-based proteins to pasta, dairy substitutes, and ready-to-eat meals, as required by consumers to be healthier.

Italy's rigorous food safety laws compel firms to utilize solvent-free protein extraction techniques to maintain the purity of the product. The business of organic premium foods grows exponentially, fueling the need for naturally processed foods that are high in protein.

The sports nutrition and functional foods industry also drive industry growth with clean protein seekers, as health-conscious consumers look for cleaner protein sources. With increased investment in sustainably made food and a change in the health-conscious market, Italy's industry will grow steadily.

The industry will expand at a 6.1% CAGR in 2025 to 2035. The sector expands due to the nation's highly developed food technology industry and increasing demand for plant-based food. South Korean health-conscious consumers look for protein sources that contain no chemical solvents, and firms respond by introducing hexane-free extraction processes.

There is a high demand for dairy alternatives, functional foods, and meal replacements, as the market for plant proteins keeps pace with the pace of urbanized life in South Korea. Government policies that support sustainable and clean-label food production also support market development.

The growing demand for veganism and flexitarianism among young consumers drives demand for solvent-free proteins. The very sophisticated e-commerce market in South Korea supports the convenient availability of protein products, which can be easily bought online. Large food giants invest in R&D for the highest efficiency of extraction and product quality. The industry in South Korea will further grow slowly as demand increases for natural and organic food.

The industry is anticipated to have a 5.7% CAGR over the years 2025 to 2035. The health-conscious, long-lived nation experiences rising demand for minimally processed protein. Japanese consumers prefer functional and plant-based foods, and as a result, there is a greater demand for protein in protein snacks, meal replacements, and dairy alternatives.

The strict food safety regulations in the country force companies to embrace solvent-free extraction technologies. Traditional food industries provide staple foods with vegetable-based proteins like soy and tofu in order to stabilize markets. Market demand also arises from the sportspersons' and fitness club individuals' requirements for natural protein supplements.

The country's aging population boosts demand for high-protein, easily digestible food, contributing further to the growth of the market. Being capable of conducting robust research and possessing advanced technology, Japan stands a strong chance to become a prime force in the hexane-free protein market.

The industry is expected to grow at an 8.1% CAGR from 2025 to 2035, the fastest growth rate among all markets. The country's increasing focus on food safety, sustainability, and health-driven diets fuels this faster growth.

Chinese consumers are increasingly turning to plant-based and clean-label protein foods, compelling manufacturers to invest in hexane-free processing. The government's shift towards enforcing food safety legislation compels companies to move towards natural processing techniques.

Increasing middle-class consumer base and growing disposable incomes propel demand for premium protein foods. Hexane-free protein is used in plant-based meat substitutes, dairy products, and functional food items, underpinning China's increasing interest in alternative proteins.

Sustained investment in biotechnology and food processing technologies drives market efficiency. Channels of e-commerce contribute significantly towards expanding the geographic reach of protein products to metropolitan and rural areas. With China's growing interest in health and sustainability, its industry will experience explosive growth.

The industry is likely to expand at a 6.0% CAGR from 2025 to 2035. Australia's robust agriculture industry and focus on organic food production fuel the growth. Clean-label and sustainable foods trend higher in Australia, prompting consumers to seek hexane-free protein. The plant-based revolution is gathering pace with increased popularity in pea, soy, and fava bean protein.

The regulatory system of the country encourages food manufacturers to adopt solvent-free extraction methods that guarantee openness in foods. The health and fitness sector also helps to widen the market, with sporty consumers and health-conscious people looking for good quality proteins.

The healthy export industry of Australia for plant proteins also stimulates industry growth. With the increasing demand for natural and minimally processed foods, the hexane-free protein industry is also anticipated to grow steadily.

The industry is anticipated to register a 5.8% CAGR during the period between 2025 and 2035. The nation's emphasis on sustainable and organic agriculture fuels the growth. New Zealand consumers increasingly demand clean-label sources of protein that encourage manufacturers to use hexane-free extraction processes. Dairy-alternative markets are surging, and oat, soy, and pea proteins are gaining popularity.

The government's emphasis on sustainable food production aids development in the industry. The sports nutrition sector also contributes significantly, with demand rising for natural protein powders and supplements. As demand for organic and hexane-free protein increases around the world, New Zealand is placed favorably in the industry to capitalize on its clean and green reputation.

| Segment | Value Share (2025) |

|---|---|

| Hexane-Free Protein Isolate (By Product Type) | 45% |

Hexane-free protein isolate is dominating the market and is expected to capture more than 45% of the global market share by 2025. With its high concentration of protein (90% or greater), its excellent digestibility, and its functional properties, it is the whey of choice for sports nutrition, functional foods, and dietary supplements.

Isolates are especially prized in plant-based diets and in clean-label formulations, thanks to a complete amino acid profile and solvent-free processing. The growing population and protein demand shift towards meat substitutes and dairy-free products, which accelerates the adoption of high-purity protein even further.

Top players like Cargill, DuPont , and ADM are focusing on investing in sophisticated extraction methods to increase the purity of the protein while lowering costs. Moreover, regulatory policies such as stringent policies favouring chemical-free protein sources are driving the market growth of isolates.

Although penne contains a lower market share, it has a considerable market share due to its lower price and wide applicability. With 70-80% protein, concentrates contain more of the natural carbohydrates and fats and can be used for cost-efficient fortification of dairy, bakery, and snack products.

In emerging markets, which are increasingly looking for affordable high-protein options, this segment continues to grow steadily. This rising demand has encouraged key players like Glanbia, FrieslandCampina, and Kerry Group to expand production capacities.

Although holding a niche, hexane-free protein flour has emerged in gluten-free baking and plant-based meals (formulation). With the increasing consumer movement towards minimally processed, whole-food protein substitutes, it requires as a source of functional protein with use of organic and natural food products.

| Segment | Value Share (2025) |

|---|---|

| Powder (By Form ) | 60% |

The global market is led by hexane-free protein in powder form, accounting for more than 60% of total market value until 2025. Whether its shelf life, ease of storage, versatility, or the preferred ingredient carrier of choice for everything from functional foods and beverages to sports nutrition, diverse functionality supports its supremacy.

They are used in powdered forms in protein powders, meal replacements, and fortified products where their greater solubility and retention of nutrients are preferable. As the demand for clean-label, high-protein dietary solutions grows, manufacturers like Cargill, ADM, and Glanbia have worked to improve taste and mixability in powder formulations.

Hexane-free powdered proteins are also gaining popularity in the bakery and dairy-alternative sectors owing to their structural and nutritional benefits. In RTD (ready-to-drink) protein beverages, functional shots, and medical nutrition products, syrup-based hexane-free proteins are beginning to take hold but have a smaller market share.

The benefits of using these products are that, since they can be absorbed quicker and they can be formulated in a liquid format, they are better suited for the busy consumer and can be tailored for special health needs. However, their relatively short shelf life and need for refrigeration make them less popular than powders.

Many innovating companies are researching stabilization technologies to convert syrup-based protein formulations for more extensive market catering. Powder and syrup formats are anticipated to grow as clean-label, plant-based, and organic protein introductions pick up steam. However, powder is expected to remain the most lucrative sector owing to its convenience, cost-effectiveness, and versatility across diverse applications across various industries.

The industry grows rapidly with increasing consumer demand for those products that are clean-label, sustainable, and plant-based. Health-conscious consumers concern that the processes by which proteins are extracted from their sources use chemicals, have prompted mechanisms to process and extract proteins personally and naturally, respectively.

The largest players, such as Axiom Foods, Cargill, DuPont, Kerry Group, and ADM, have established market presence using high technology in processing, an extensive distribution network, and superior capabilities in research and development. Regional and niche manufacturers are targeting organic, non-GMO, and allergen-free proteins in order to penetrate the health-conscious and environmentally aware consumer groups.

The evolution of the market is set forth by the ongoing innovations in the extraction of pea, rice, soy, and hemp proteins in an ammoniating hexane-free manner, thus enhancing solubility and textural and nutritional properties. Besides investing in those alternatives, companies are also opting for algae, mycoprotein, and precision fermentation in their portfolio of protein offerings.

The strategic issues that shape competitiveness include scalability, regulatory acceptance, best-cost position, and supply chain sustainability. Brands that successfully integrate transparency of sourcing, eco-friendly production methodologies, and functional benefits will enjoy a sustained competitive edge in this rapidly changing environment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Axiom Foods, Inc. | 15-20% |

| Cargill, Inc. | 12-16% |

| DuPont Nutrition & Health | 10-14% |

| Kerry Group Plc | 8-12% |

| Archer Daniels Midland Company (ADM) | 7-10% |

| Other Players | 35-45% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Axiom Foods, Inc. | Pioneer in hexane-free rice and pea proteins, focusing on sustainable plant-based protein solutions. |

| Cargill, Inc. | Offers hexane-free soy, pea, and wheat proteins, emphasizing large-scale production and global distribution. |

| DuPont Nutrition & Health | Develops high-quality hexane-free protein isolates for use in functional foods, dairy alternatives, and beverages. |

| Kerry Group Plc | Innovates in organic and non-GMO protein formulations, targeting clean-label consumer demand. |

| Archer Daniels Midland Company (ADM) | Provides hexane-free soy protein concentrates, leveraging supply chain expertise and plant-based nutrition insights. |

Key Company Insights

Axiom Foods, Inc. (15-20%)

Leading company in rice and pea protein solutions, its proprietary hexane-free extraction process being patented.

Cargill, Inc. (12-16%)

The food giant is very diversified as it invests in protein innovation with the inclusion of technologies that help process food sustainably.

DuPont Nutrition & Health (10-14%)

Functional products with clean labels for plant-based foods and dairy alternatives.

Kerry Group (8-12%)

Major Supplier of Non-GMO, Organic, and Allergen-Free Protein Solutions.

Archer Daniels Midland Company (ADM) (7-10%).

It uses a global presence to supply hexane-free soy and pea protein concentrates.

Other Key Players (35-45% Combined)

The global hexane-free protein market is projected to grow at a CAGR of 9.9% from 2025 to 2035, driven by increasing demand for functional beverages and plant-based health products.

By 2035, the global hexane-free protein is expected to reach USD 351.4 million

The plant-based protein segment is projected to grow the fastest within the hexane-free protein market, as more consumers shift towards vegetarian and vegan diets, seeking sustainable and healthy protein alternatives.

Key factors driving growth include increasing health consciousness, rising demand for clean-label products, the expansion of the vegan and vegetarian population, and a growing awareness of the environmental impact of traditional protein sources.

Dominant players in the hexane-free protein market include companies such as DuPont, Archer Daniels Midland Company, Cargill, Ingredion, and AGT Food and Ingredients, which are leading the way in innovation and product development.

The market is segmented into isolate, concentrate, and flour.

The market is divided into powder and syrup forms.

Segments include beverages (dairy-based beverages, functional beverages), cosmetics & personal care, breakfast cereal & cereal bars, energy & sports nutrition, bakery products, dairy products, and others.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.