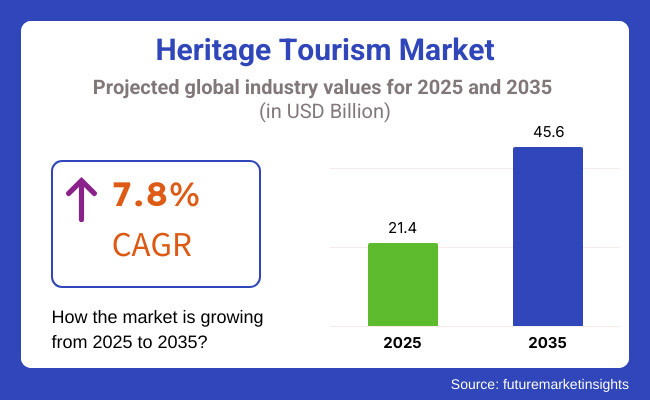

The world heritage tourism industry is set to reach USD 21.4 billion by 2025 and grow to USD 45.6 billion by 2035. The market is anticipated to develop at a CAGR of 7.8% from 2025 to 2035, driven by tourists who are looking for in-depth historical experiences, heritage conservation programs by governments, and the growth of digital narratives in cultural tourism.

Heritage tour operators are diversifying products to encompass interactive museum tours, historical reenactments, and ancestry tracing experiences with AI. Leading players like Context Travel, Smithsonian Journeys, and Heritage Expeditions are designing highly niche tours that offer travelers exposure to UNESCO sites, archival research experiences, and expert-led heritage immersions.

Travelers more and more look for places where they can be actively involved in the stories of the past, whether it is in medieval castle stays in Scotland, underground city walks in Turkey, or samurai sword-fighting classes in Japan. The increasing popularity of sustainable and responsible tourism has also brought about cooperation between governments, cultural institutions, and private tour operators to ensure responsible heritage preservation.

Virtual heritage tourism websites and AI-based ancestry research platforms are transforming the industry. Travelers can now trace their heritage prior to customized heritage travel thanks to companies like MyHeritage and AncestryDNA. Augmented reality (AR) museum tours and interactive displays also enrich visitor experiences, making history come alive in the form of immersive digital narratives.

Explore FMI!

Book a free demo

During 2020 to 2024, the market for heritage tourism grew at a CAGR of 5.9% due to post-pandemic recovery in travel and renewed enthusiasm for cultural heritage exploration. In 2024, the market stood at USD 19.8 billion and is expected to grow at a CAGR of 7.8% during 2025 to 2035, reaching USD 45.6 billion.

Governments and tourist authorities are putting big money into restorations of heritage sites and digital heritage tourism, creating more accessibility and participation. Organizations are adopting AR-enhanced history tours, genealogy-based travel through AI, and experiential activities such as living museums to build enhanced cultural connections for visitors.

Comparative Analysis: Heritage Tourism vs Cultural Tourism

| Heritage Tourism | Cultural Tourism |

|---|---|

| 2020: USD 15.2 Billion (Rise in Historical Site Visits) | 2020: USD 10.1 Billion (Demand for Local Cultural Experiences) |

| 2024: USD 19.8 Billion (Growth in Heritage Conservation Projects) | 2024: USD 13.5 Billion (Expanding Cultural Festival Tourism) |

| 2025: USD 21.4 Billion (AI-Powered Ancestry Tourism Gains Popularity) | 2025: USD 15.6 Billion (Increased Digital Storytelling in Tourism) |

| 2035: USD 45.6 Billion (Mainstream Integration of Heritage Travel) | 2035: USD 32.8 Billion (Rise of Virtual Reality Cultural Tours) |

Heritage tourism has developed in the new direction where the travelers want closer connections with their cultural and their ancestral pasts. Travelers now travel more than usual tourism, taking an experience like resting in heritage accommodations, re-enacting historical themes, and going through artisan experiences.

In Italy, visitors acquire Renaissance fresco restoration skills in Florence. In Egypt, private visits to off-the-beaten-path tombs and hieroglyph translation sessions add depth to historical experience. In Japan, meanwhile, samurai heritage villages offer tourists feudal-era experiences, from wearing traditional armor to learning ancient fighting techniques.

Technology is at the forefront of the industry. Sites like Google Arts & Culture offer virtual tours of thousands of heritage places, and augmented reality applications recreate ruins and ancient cities. Ancestry research powered by artificial intelligence is also driving demand, as tourists utilize DNA testing companies to create tailored heritage travel experiences.

Cultural icons are still the center of heritage tourism, appealing to travelers who are interested in historical context and cultural insight. Iconic destinations like the Great Wall of China, Machu Picchu, and the Colosseum continue to receive millions of tourists every year. Increased demand for ancient history and preservation of heritage has spurred governments to provide greater access to sites and enforce crowd management techniques to counterbalance the effects of overtourism.

Governments and cultural institutions are committing to sustainable tourism projects that meet the needs of conservation with visitor experience. The Heritage Cities program led by UNESCO is encouraging sustainable tourism through involvement of local communities in preservation programs. Historic towns in Europe like Dubrovnik and Prague have implemented tourism taxes and visitor limits to avoid heritage decay while sustaining economic rewards.

Technology is advancing the ways in which tourists engage with cultural monuments. Museums and archaeology sites increasingly incorporate augmented reality (AR) and virtual reality (VR) to provide immersive storytelling experiences. At Pompeii, AR navigators rebuild old cityscapes, enabling the public to experience historic scenes the way they once were. At the same time, the British Museum and Smithsonian Institution have begun digital collections, presenting thousands of historical items online to international users.

Cultural heritage experiences also include interactive activities like historical reenactments and traditional crafts workshops. In France, tourists in the Loire Valley can enjoy medieval castle banquets, while tourists in Kyoto take part in traditional tea ceremonies inside centuries-old temples. These efforts make cultural heritage relevant and exciting for contemporary travelers while creating stronger connections between tourists and history.

E-dbooking dominates heritage tourism due to its convenience, accessibility, and ability to customize trips end-to-end. More tourists are reserving accommodations, guided tours, and museum ticket bookings through web-based platforms such as Expedia, Booking.com, and Airbnb Experiences. The platforms give them real-time availability, rates, and consumers' reviews on their fingertips and thus allow them to make knowledge-based decisions before visiting heritage areas.

Governments and tourism authorities of culture also embraced online media to ticket and manage tourists. The Vatican Museums, for instance, implemented an advance online reservation program to reduce excessive waiting lines and maximize the passage of visitors. Similarly, UNESCO world heritage sites, such as Spain's Alhambra and Greece's Acropolis, charge advance online reservation to reduce congestion and optimize the experience of visitors.

Machine learning and artificial intelligence further streamline the online booking process by providing customized suggestions. Sites such as GetYourGuide and Klook look at user history and preferences to recommend customized heritage tourism packages, so travelers get experiences that are in line with their interests.

Virtual reality and mobile app integrations offer another layer of ease. The Louvre, for instance, enables users to buy tickets in advance via its app while providing AR-led tours for a richer experience. Moreover, heritage tourism operators utilize social media and influencer marketing in order to appeal to digitally literate tourists, who like to organize and book their vacations online.

The transition towards online reservation for heritage tourism will persist as technology improves and travelers look for touchless, smooth experiences. Using digital means, the sector enables access while pushing sustainable tourism patterns that conserve cultural sites for posterity.

India's rich and variegated cultural heritage makes it a top heritage tourism destination. The increasing interest in experiential travel has increased the appeal of Rajasthan palace stays, Varanasi temple tourism, and Maharashtra cave explorations dating back to ancient times. Tourists want to be more connected with India's past, participating in activities like heritage walks in Old Delhi, Hampi architectural tours, and escorted visits to Ajanta and Ellora caves.

The Indian government has invested significantly in the preservation of heritage sites through the Swadesh Darshan Scheme, developing circuits that provide experiential experiences across religious and historical sites. Large circuits, such as the Buddhist Circuit and the Desert Circuit, offer designed experiences that highlight India's spiritual and architectural heritage.

Private sector also has the credit of the development of heritage tourism. Neemrana Hotels has converted and refurbished abandoned forts and palaces into heritage luxury hotels, allowing tourists to experience the glory of India's royal past. Similarly, experiential travel companies such as Breakaway and India Someday provide customized packages that include engagement with artisans, cooking lessons in heritage homes, and traditional textile workshops in Gujarat and West Bengal.

Technology enriches India's heritage tourism experience. Virtual tours of prominent sites such as the Taj Mahal and Red Fort by the Archaeological Survey of India (ASI) have made it possible for international viewers to access India's cultural riches online. Further, augmented reality experiences at museums and heritage monuments offer tourists engaging storytelling, and historical events and personalities come alive.

The combination of government-sponsored initiatives, private sector involvement, and technological advancements renders India a top player in global heritage tourism. With travelers seeking real, experiential encounters, India continues to be a dynamic mix of historical preservation and cultural immersion, ensuring sustainable development of tourism in the future.

Japan has become the leader in world heritage conservation tourism with the push of robust government policies, technology advancements, and respect for culture preservation. The state actively conserves traditional ryokan inns, historical castles, and samurai houses so that they continue to form an important part of Japan's tourism infrastructure.

Visitors live out Edo-era life through a visit to samurai heritage villages like Nikko Edo Wonderland, where they partake in sword-fighting displays and feudal-town living reenactments. Kyoto's Gion district remains well-preserved and provides privileged geisha tea ceremonies and traditional kimono-donning activities, bridging the visitor with Japan's rich past. While this, Nara's Todai-ji Temple and Horyu-ji Temple remain favorites among history buffs who look to delve deeper into Japan's Buddhist past.

Technological innovation boosts Japan's heritage tourism industry. Augmented reality (AR) apps enable tourists to view historic sites in their former beauty. In Hiroshima's Peace Memorial Park, AR brings back the city's pre-war environments, providing greater insight into its development. The Tokyo National Museum combines virtual reality (VR) displays, enabling international viewers to view Japanese cultural heritage from afar.

Japan's emphasis on experiential cultural travel is also extended to workshops and hands-on pursuits. Visitors are taught calligraphy in Kanazawa, brewing in Takayama, and samurai swordsmanship in Osaka. These hands-on pursuits bring Japan's heritage to life and make it relevant and appealing to modern travelers.

With the blend of technology, conservation, and experiential tourism, Japan remains at the forefront of heritage conservation tourism. Japan's dedication to cultural heritage ensures that generations to come are able to experience its rich heritage firsthand.

The heritage tourism market is highly fragmented and is fueled by independent tour operators, local cultural institutions, and government tourism authorities, resulting in stiff competition. Regional initiatives such as the Europe's Historic Towns and Villages Network and UNESCO's World Heritage Cities Programme promote responsible heritage tourism and conservation.

Scope of the Report

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, MEA |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, MEA |

| Key Segments Covered | Experience Type, End User, Tourist Type, Booking Channel |

| Key Companies Profiled | Context Travel, Smithsonian Journeys, Heritage Expeditions, G Adventures, National Trust Tours, Intrepid Travel, Tauck Tours, Abercrombie & Kent, MyHeritage Travel, and AncestryDNA Heritage Tours |

The global heritage tourism market stands at USD 19.8 billion in 2024. Analysts project the market to reach USD 21.4 billion by 2025 and expand to approximately USD 45.6 billion by 2035, growing at a CAGR of 7.8%.

Rising interest in cultural heritage, government initiatives to restore historical sites, and technological advancements in immersive tourism experiences fuel the industry’s growth.

Leading companies include Context Travel, Smithsonian Journeys, Heritage Expeditions, G Adventures, National Trust Tours, Intrepid Travel, Tauck Tours, Abercrombie & Kent, MyHeritage Travel, and AncestryDNA Heritage Tours.

Augmented reality (AR) applications, virtual reality (VR) tours, and AI-driven ancestry research enhance traveler engagement.

Certifications such as UNESCO’s World Heritage status and Global Sustainable Tourism Council (GSTC) accreditation promote responsible tourism.

Travelers increasingly choose destinations that prioritize conservation and historical preservation.

Tourists prioritize immersive experiences, such as heritage homestays, archaeological site visits, and cultural workshops.

China Destination Wedding Market Insights – Growth & Forecast 2025-2035

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Spa Resorts Market Analysis by Resort Type by Visitor Profile by Region - Forecast for 2025 to 2035

Social Media and Destination Market Analysis by Platform, by Destination Type, by Region - Forecast for 2025 to 2035

Winter Adventures Tourism Market Analysis by Activity, by Destination, by Experience Type, and by Region - Forecast for 2025 to 2035

Ecotel Tourism Industry Analysis by Accommodation Type, by Traveler, by Destination Type, and by Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.