The global herbs and spices market is moderately fragmented, with global leaders, regional players, startups, and private labels all playing a role in the overall market dynamics. The major share of about 42% is held by multinational companies such as McCormick & Company, Inc., Olam International, and Givaudan, primarily because of their wide product portfolios, global distribution networks, and investments in R&D.

Regional players, in the likes of MDH Spices or Everest Spices in India and Baria Pepper in Vietnam, make up for about 30% of market share through playing on local strength and consumer acceptability. Finally, niche companies and startups-the likes of Vahdam India and The Spice House-make up the remaining 18%, through high-end, sustainable, organic play.

The rest 10% is held by private labels. These are offered by retailers, such as Tesco's Finest and Walmart's Great Value. The market, therefore, has moderately distributed concentration with the top five global players accounting for almost 35% of the market share.

Explore FMI!

Book a free demo

| Global Market Share, 2025 | Industry Share % |

|---|---|

| Top Multinationals (McCormick & Company, Givaudan, Olam) | 40% |

| Regional Leaders (MDH Spices, Everest Spices, Baria Pepper) | 30% |

| Startups & Niche Brands (Vahdam India, The Spice House, Bart Ingredients) | 18% |

| Private Labels (Walmart’s Great Value, Tesco’s Finest) | 12% |

The market is moderately fragmented. Both the global and regional players have considerably contributed to the overall dynamics of the market.

The product type segment is dominated by Spices, holding 53.6% of the market share because of their basic function of adding flavors in food across different parts of the world. The prime spices used include black pepper, turmeric, and cardamom in processed food, home-cooked food, and food service.

Turmeric, with its functional benefits, has grown quite rapidly in North America and Europe. Herbs comprised 31.5%, where an increase in preference for fresh and dried herbs like basil, oregano, and thyme for gourmet and home cooking continues to grow especially in Europe and North America.

Paprika (Hot Pepper) and Cumin have 14.9% altogether with paprika continuing to gain grounds in Western dishes and cumin in Asian and Middle Eastern cuisines. This segment's growth is being fueled by increasing demand for ethnic flavor profiles, healthier alternatives, and functional properties in herbs and spices.

Powder & Granules hold 38.2% of the market share as it is easier to store and transport and used more in different kinds of food and beverage products; examples include powdered turmeric, and granulated garlic are common worldwide households and in food manufacturing.

Flakes, accounting for 23.6%, are commonly used for garnishing and quick-prep meals, which are popular in regions such as North America and Europe. Whole or Fresh forms, at 24.6%, are mainly sold in local markets and high-end culinary preparations, with fresh basil and coriander being examples.

Paste, at 13.6%, has gained popularity in urban markets with the growing popularity of ready-to-cook meal kits and sauces. Examples include garlic paste and ginger paste, which are extensively used in Asian cuisines. The increasing trend of convenience food has increased the demand for all sub-segments.

2024 saw impressive contributions from both global and regional players in the herbs and spices market. Global players such as McCormick & Company and Olam International led the innovation with new regional blends and sustainability initiatives.

Regional leaders like MDH Spices and Everest Spices were the ones that could reach more rural and semi-urban markets with the right affordability and local flavors. The start-ups Vahdam India could ride the wave of growing demand for organic and premium products, particularly in export markets like the USA and Europe.

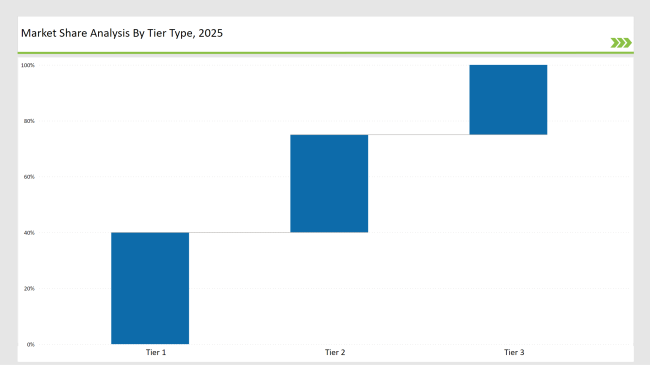

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 40% |

| Example of Key Players | McCormick, Givaudan, Olam |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 35% |

| Example of Key Players | MDH Spices, Everest Spices, Baria Pepper |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 25% |

| Example of Key Players | Vahdam India, Bart Ingredients, Private Labels |

| Brand | Key Focus |

|---|---|

| McCormick’s Sustainability Push | Launched carbon-neutral spice packaging and expanded eco-friendly farming initiatives. |

| Olam’s Digital Traceability | Introduced blockchain -based traceability for black pepper supply chains. |

| Givaudan’s Co-Creation Program | We partnered with chefs to create bespoke spice blends for the foodservice sector. |

| MDH’s Localized Marketing | Focused on region-specific TV ads promoting its traditional spice mixes. |

| Vahdam’s Subscription Model | Introduced monthly spice box subscriptions to target loyal consumers in the USA. |

| Bart Ingredients’ Expansion | Partnered with major UK supermarkets to expand shelf space for its premium spice range. |

| Everest’s E-Commerce Integration | launched a direct online store offering discounts on popular spice blends. |

| The Spice House’s Storytelling | Used storytelling in marketing campaigns to emphasize the origins of its artisanal spices. |

| Badia’s Community Programs | Invested in farmer training programs in Latin America. |

| Tesco’s Custom Blends | Developed limited-edition spice blends for seasonal promotions. |

Demand for organic spices will increase significantly in North America and Europe. This will be particularly beneficial to manufacturers who will expand their organic product lines while maintaining premium pricing certifications. Example: Introduce USDA-certified organic spices used by health-conscious consumers.

Online Sales Channel: D2C will be the focus as it caters to personalized customer experience. Premium and rare spices will be resorted through subscription models. Example: Seasonal spice blend subscription box.

Asia and Africa will grow in demand for spices due to rapid urbanization and rising disposable incomes. The companies need to set up local manufacturing plants that can help reduce the costs and supply chains. Example: Open processing units in India, which can cater to the growing domestic market.

Packaging, processing, and formulation innovation through artificial intelligence will revamp the paradigms for quality and convenience. Blockchain enables transparency in supply chain, therefore establishing trust with customers. Example: Roll out smart-label packages to inform and engage the consumers regarding origin authenticity.

Key players include McCormick, Givaudan, Olam, MDH Spices, Everest Spices, and Baria Pepper.

Key innovations include AI-based spice formulations, eco-friendly packaging, and blockchain-based supply chain traceability.

By introducing organic, low-sodium, and functional spice blends like turmeric and ginger for wellness applications.

E-commerce enables direct-to-consumer sales, convenience, and personalized experiences, especially for premium and niche products.

Challenges include fluctuating raw material prices, supply chain disruptions, and competition from private labels.

Regional players leverage local expertise, traditional flavors, and cost advantages to capture market share.

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

USA Aqua Feed Additives Market Analysis from 2025 to 2035

Comprehensive Analysis of Europe Fish Meal Market by Product Type, Application, Source, and Country through 2035

Comprehensive Analysis of ASEAN Fish Meals Market by Product Type, by Application, Source, and Region through 2035

A Detailed Analysis of Brand Share Analysis for Fungal Protein Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.