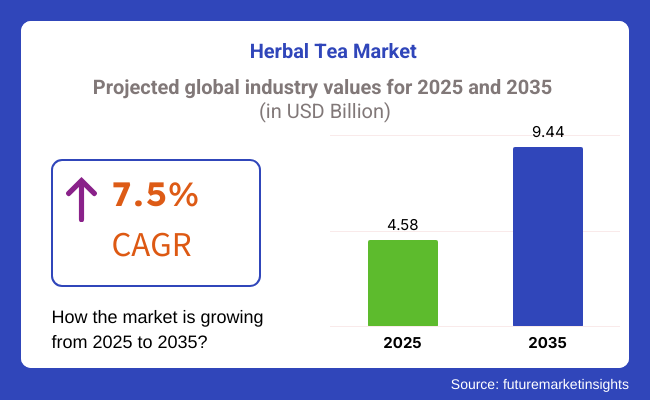

The global herbal tea market size reached USD 4.58 Billion in 2025. The industry is further expected to grow at a growth rate of 7.5% over the forecast period.

As consumers increasingly turn toward natural wellness products and functional beverages, the industry is continuing to grow, with herbal tea emerging as a popular substitute for classic tea and caffeinated drinks. With the rising demand for herbal tea, especially organic and functional blends, manufacturers are increasing their production capacities.

To keep up with changing consumer tastes, companies are upgrading with ingredient innovations, herbal blends, and premium ingredients. Herbal tea is the fastest growing beverage segment across regions as an anxiety-relieving, immunity-boosting, and digestive health drinks that boost their immune from the COVID-19 pandemic.

Another trend making its way into the herbal tea sector is the clean-label movement, with consumers demanding that products be free from artificial flavors, additives, and preservatives. There is also rising demand for naturally functional beverages free of caffeine, prompting brands to offer herbal teas infused with adaptogens, probiotics, and antioxidants.

Both retailers and names are leaning into e-commerce and direct-to-consumer models, finding herbal tea out there in subscription services and online wellness marketplaces. In addition, sustainability and biodegradability of tea bag materials, as well as eco-friendly packaging, are new competitive hot spots as the industry endeavors to reduce its environmental footprint.

Herbal tea is becoming an integral part of the functional beverage industry and one of the few product categories that will continue to grow through the next decade, thanks to the growing trend towards healthy living and natural health products globally.

Explore FMI!

Book a free demo

The industry is growing as because the customers increasingly emphisizing health, wellness, and sustainability. Retail consumers want organic, caffeine-free, and functional teas with benefits like stress relief, digestive aid, and immune system support.

The HORECA industry appreciates the variety of flavors and premium mixtures, blending herbal teas with gourmet experiences and specialty menus. In the wellness & functional drinks category, consumers increasingly demand fortified herbal teas containing adaptogens, superfoods, and probiotics to support cognitive function, relaxation, and detoxification.

The nutraceutical and pharmaceutical industry applies herbal teas for medical reasons, adding medicinal herbs such as chamomile, ginger, and Echinacea to blends for integrative healing and complementary medicine. Fair-trade and sustainable sourcing are major purchasing drivers, leading to green packaging and responsible sourcing trends in the marketplace.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the industry. This analysis highlights key shifts in performance and revenue realization patterns, offering stakeholders a clearer understanding of the growth trajectory.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.2% |

| H2 (2024 to 2034) | 7.5% |

| H1 (2025 to 2035) | 7.3% |

| H2 (2025 to 2035) | 7.6% |

The first half of the year, H1, spans from January to June, while the second half, H2, includes the months from July to December. During the first half of the decade (2025 to 2035), the industry is expected to grow at a CAGR of 7.2%, followed by an increase to 7.5% in the second half.

As the period progresses, the industry is projected to exhibit a CAGR of 7.3% in H1 and maintain a steady growth rate of 7.6% in H2. This growth pattern reflects an overall increase of 10 BPS in H1, while H2 records an additional 10 BPS, indicating stable expansion for herbal tea.

From 2020 to 2024, the herbal tea industry grew steadily with consumers moving toward natural, caffeine-free, and functional drinks. Increasing health consciousness fueled demand for teas with therapeutic benefits such as stress relief, better digestion, and boosted immunity.

Big data and AI were used to know about customer inclinations and create new blends of flavors using chamomile, ginger, peppermint, and hibiscus. Clean label and organic labels emerged as top drivers, and sustainable sourcing became essential. Seasonal variation in the growth of herbs and supply chain bottlenecks were problems created.

Molecular discovery will be driven by quantum computing to maximize bioavailability and positive impact. Supply chains will become transparent and trackable and better quality monitored as well as protect against fraudulent action through blockchain-supported supply chain management. Carbon-free processing and green herb cultivation methodologies will be prevalent in the marketplace.

AI-powered intelligent manufacturing systems will automate more, minimize waste, and normalize output. Functional herbal teas fortified with probiotics, adaptogens, and brain enhancers will drive product innovation. The herbal tea business will shift towards AI-driven, highly personalized, and sustainable product formats that are aligned with evolving health and wellness trends.

A Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Spike in demand for organic, functional, and natural herbal teas | Customized blends of herbal tea based on each person's unique health profile |

| AI-led inputs for the creation of innovative flavors and functional blends | Quantum-inspired molecular scanning for optimized bioavailability and taste |

| Seasonal fluctuations and issue of sourcing herbs | Blockchain-driven transparent supply chain with real-time tracking |

| Emphasis on organic certifications and environmentally friendly packaging | Carbon-neutral cultivation and processing of herbs through AI. |

| Compliance with organic labeling and safety regulations | Real-time compliance monitoring and automated certification using AI |

| AI and big data for flavor trend analysis and production optimization | Edge AI and smart manufacturing for efficient, automated production |

| Stress relief, digestion, and immunity-boosting benefits | Increased health benefits with adaptogens, probiotics, and cognitive enhancers |

The industry is not completely free from the shadow of risks attached to it, like regulatory constraints, raw material supply availability, and changes in consumer preferences. While traditional tea belongs to the beverage category, herbal tea blends are functional drinks that entail labeling and health claim approvals from the Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and the Food Safety and Standards Authority of India (FSSAI).

Any misleading health benefit claims related to the product can be a very serious issue because they might force the company into legal battles, or they might call for the product to be recalled, or in more severe cases, the herbal tea might have to be banned from the market.

Similarly, the industry is also at high risk because of the possible climate change effects and geopolitical instability on the sources of main botanicals such as chamomile, peppermint, hibiscus, and rooibos. For example, these weather shifts, crop failures, or transportation faults can be the causes of the overall cost addition and unsteady product readiness.

From a consumer's perspective, the need for organic, caffeine-free, and adaptogenic herbal teas has significantly risen. Those brands that do not keep up with innovations or do not comply with clean-label concepts may face the consequences of lost share. On top of that, plant-infused waters and kombucha, which are available in almost all varieties nowadays, could be a reason for the long-term sales drop.

Adulteration and quality inconsistencies do not include cases of contamination but also the lack of standardization, as many herbal ingredients are acquired from multiple suppliers. Companies need to rely on traceable supply chains, third-party testing, and sustainably sourced products to build their credibility and get customers' trust.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 4.4% |

| China | 7.3% |

| Japan | 3.3% |

| Germany | 5.67% |

| Australia | 4.3% |

The industry is likely to grow steadily in the coming years, with an estimated CAGR of 4.4% during 2025 to 2035. There is increasing awareness of health and wellness, and this is propelling a strong shift towards natural and decaf beverages. Relaxation, digestion, and immunity-fortified functional herbal teas are gaining tremendous popularity.

Drink manufacturers are responding by launching new blends with locally sourced ingredients, such as Oregon-grown chamomile and Washington-grown peppermint, to appeal to local palates. Growth in online shopping has also opened up market access, allowing consumers to purchase a wider variety of herbal teas. Sustainability is also crucial in purchasing, and this has prompted manufacturers to obtain organic certifications and use biodegradable packaging to meet consumers' demands.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Health consciousness | Consumers prefer functional and caffeine-free teas suitable for well-being. |

| Growth of e-commerce | Increased availability of herbal tea has come through online channels. |

| Flavor innovation | Companies introduce new flavors of tea that are made with locally sourced ingredients. |

| Sustainability trends | Brands highlight organic labeling and green packaging. |

The industry is likely to grow at a strong CAGR of 7.3% between 2025 and 2035. The country's rich tradition of herbal medicine continues to be a source of momentum for consumption, with today's consumers seeking convenient-to-drink, health-supporting beverages. Convenient-to-drink ready-to-drink herbal teas that are supplemented with ginseng, goji berries, and chrysanthemum are catching on.

Urban lifestyles and rising incomes have led to a shift in purchasing behavior, with premium and functional herbal teas catching on. Local manufacturers are repositioning classic recipes and packaging to target younger consumers and are also making investments in scientific research to validate health benefits. Growing demand for traditional Chinese medicine in mainstream health products is also fueling industry growth.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Strong herbal tea heritage | Herbal medicine's cultural heritage stimulates demand. |

| Ready-to-drink product expansion | Urban, health-conscious consumers demand easy-to-consume, health-focused tea products. |

| Rising disposable income | Consumer-grade herbal tea brands are preferred. |

| Scientific backing | Evidence-based health benefits instill more confidence in consumers. |

The industry is likely to register a 3.3% CAGR during 2025 to 2035. Japanese green tea culture is spreading to encompass more herb infusions. Growing interest in the functional properties of herbal tea has driven demand for drinks that promote relaxation, digestion, and metabolism.

Domestic ingredient teas like yuzu, shiso, and sakura are gaining popularity among consumers. Convenience stores, specialty tea houses, and the widening of the sales channel have promoted the consumption of herbal tea. Japan's emphasis on safety and quality, in product terms, ensures consistent demand for high-quality herbal tea types.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Reversal of green tea trend to herbal infusions | Consumers need a varied range of teas for functional properties. |

| Local ingredients demand | Teas infused with yuzu, shiso, and sakura gained popularity. |

| Convenience store availability | The easy availability of herbal teas drives the market. |

| Emphasis on quality | Japan's high safety and quality standards create confidence among consumers. |

The industry is likely to record a CAGR of 5.67% during 2025 to 2035. Natural and organic beverages remain popular, with consumers grabbing herbal teas to use as digestive aids, stress reducers, and immune system boosters.

Many herbal mixes ranging from simple European herbs like fennel and chamomile to more exotic products like lemongrass and rooibos are available in the industry. Stores are carrying premium and specialty herbal teas to address shifting consumer tastes. Sustainability matters and consumers want sustainably sourced ingredients and eco-friendly packaging.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Preference for natural and organic products | Consumers favor non-organic and natural herbal teas. |

| Additional specialty tea options | The store offers diverse herbal blends to consumers. |

| Significant sustainability emphasis | Companies use green packaging and sustainably sourced materials. |

| Functional tea segment growth | Herbal teas for relaxation and digestion are in greater demand. |

The industry is likely to expand at 4.3% CAGR from 2025 to 2035. Growing demand for health-focused beverages has been driving growth in the consumption of herbal tea. Customers prefer products with local Australian ingredients like lemon myrtle, eucalyptus, and wattle seed, which have unique tastes and medicinal properties.

With the new trend towards sustainability and ethical production, companies are emphasizing fair-trade and organic accreditation. With the new café culture and specialty tea, there has been an increased interest in herbal teas as an alternative to mainstream black and green teas.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Wellness drink demand | Consumers are seeking teas for relaxation and immunity support. |

| Native ingredients popularity | Lemon myrtle and eucalyptus teas gain traction. |

| Sustainability push | Organic and fair-trade certifications are behind purchases. |

| Café culture growth | Herbal teas gain traction as a premium option to mainstream teas. |

| Segment | Value Share (2025) |

|---|---|

| Green Herbal Tea (By Raw Material) | 35% |

Based on the type of raw material, the herbal tea segment is classified into green herbal tea, black herbal tea, and yellow herbal tea. Green herbal tea is likely to hold the largest market share of over 35% in value terms and dominate the industry in 2025 compared to other herbal tea segments.

It dominates due to growing consumer demand for antioxidant-rich and metabolism-boosting drinks. Green herbal tea is rich in polyphenols, catechins, and vitamin content and is a popular choice among those seeking immune support, weight management, and digestive health.

The trend towards functional teas drove manufacturers to embark on new blends incorporating botanicals, including ginseng, moringa, and matcha, to improve nutritional or sensory characteristics. The largest industry, owing to already established strong traditional consumption and growing health consciousness with the demand for premium organic and specialty teas, is Asia-Pacific, especially China, Japan, and India.

Black herbal tea is a niche segment that is gradually expanding, primarily due to its robust flavor profile and potential cardiovascular advantages. It’s the fastest-growing beverage category in North America and Europe, where consumers are looking for ways to derive caffeine-free benefits that black tea used to deliver.

Brands are being creative with shochu blends (infused with ashwagandha, turmeric, licorice, etc.) to capitalize on the growing interest in adaptogenic and anti-inflammatory potables. Since it is a niche segment, the bid on the yellow herbal tea can actually be breaking to the next level as its fermentation process gives the beverage a much smoother taste as well as a gentle oxide benefit.

With consumers increasingly favoring plant-based, clean-label drinks, manufacturers are prioritizing sustainability, investing in sustainable sourcing practices, biodegradable packaging, and organic certifications to respond to changing expectations and cater to a broader demographic of consumers.

| Segment | Value Share (2025) |

|---|---|

| Herbal Tea Bags (By Packaging Type ) | 45% |

The herbal tea bags hold the majority of share in the industry; this is because of the increase in demand for ready-to-use products as well as the use of tea bags for portioning and convenience. A single-use desire for tea has propelled the evolution of pyramid tea bags, biodegradable pouches, and single-serving herbal brews.

North America and Europe are following suit, with eco-aware shoppers increasingly choosing compostable and plastic-free tea bags from brands like Pukka Herbs, Yogi Tea, and Celestial Seasonings, which have led the charge for sustainable packaging materials. Demand for premium and wellness-oriented herbal tea bags is on the rise in the Asia-Pacific (APAC) industry as well, particularly in Japan, China, and India.

The herbal tea carton packs segment accounts for 40% of the industry, and it is the second-largest segment. Comfortable carton packaging for commercial tea products is preferred in terms of low cost, recyclability, and storage for tea in bulk, (which) suits mass-market and family-size products.

The lightweight, 100% biodegradable carton packs from top-name brands like Twinings, Bigelow, and Traditional Medicinals bring clean-label and eco-conscious consumer trends to the forefront. North America and Europe are the primary markets driving demand, whereas Latin America and Asia-Pacific are the emerging markets with increasing penetration of herbal teas in carton packs for supermarket retail sales.

The tea bag and carton pack have also been invented, with brands investing in higher grade innovations such as plastic-free, compostable, and plant-based packaging that can deliver against global sustainability standards and evolve customer expectations.

The industry has been rapidly growing, with significant consumer interest relating to health and wellness, functional beverages, and natural preparations. Innovations and products are placed in the model category by such increasing demand. At the same time, the boost is gained from various segments, primarily including that of the marketing of caffeine-free, organic, and immunity-boosting teas.

Thus, Hain Celestial, Tata Consumer Products, Unilever (Pukka Herbs), Associated British Foods (Twinings), and Organic India take prominence in the industryby taking an exemplary product portfolio and premium organic offerings with along strong brand positioning. Smaller brands and niche start-ups would focus on providing ayurvedic, detox, or relaxing herbal infusions that are marketed via a direct-to-consumer (DTC) model and packaged sustainably for environmentally conscious consumers.

Trends are attributed to improved formulations with functional ingredients, the sale of individualized tea mixes, and novel brewing forms such as cold brew and ready-to-drink (RTD) herbal teas. Innovations in e-commerce and subscription-based distribution services will lead to the evolution of traditional avenues.

They include organic and health claims, educating the consumer on the benefits of herbs, using high-quality ethical herbs, and being compliant with government agencies' regulations. Companies that can introduce sustainability and transparency backed by science will find it easier to outwit the competition in this highly growing and intensive industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hain Celestial Group (Celestial Seasonings) | 15-20% |

| Tata Consumer Products (Tetley Herbal Teas) | 12-16% |

| Unilever (Pukka Herbs) | 10-14% |

| Associated British Foods (Twinings Herbal Range) | 8-12% |

| Organic India | 7-10% |

| Other Players | 35-45% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Hain Celestial Group | Market leader with Celestial Seasonings, offering functional and wellness teas with organic and non-GMO certification. |

| Tata Consumer Products | Expanding Tetley Herbal range with caffeine-free, antioxidant-rich blends, targeting global wellness trends. |

| Unilever (Pukka Herbs) | Premium organic and ethically sourced herbal teas, positioned as Ayurvedic and functional wellness blends. |

| Associated British Foods (Twinings Herbal Range) | Strong legacy brand, focusing on flavored and specialty herbal tea blends. |

| Organic India | Pioneer in Ayurvedic and Tulsi-based herbal teas, emphasizing organic farming and sustainability. |

Key Company Insights

Hain Celestial (15-20%)

A big player along with Celestial Seasonings, which provides a botanically infused range of functional teas with strong brand recognition.

Tata Consumer Products (12-16%)

Tetley is being complemented in expanding its herbal tea portfolio with ingredients rich in antioxidants and functional health blends.

Unilever (Pukka Herbs) (10-14%)

The premium organic tea brand that loves ethical sourcing and Ayurvedic herbs plus holistic wellness appeal.

Associated British Foods (Twinings Herbal Range) (8-12%)

A heritage tea brand offering a wide range of herbal infusions, catering to both traditional and premium consumers.

Organic India (7-10%)

It is the leading source of organic Tulsi and Ayurvedic herbal teas, focusing on immunity-boosting and adaptogenic formulations.

Other Key Players (35-45% Combined)

Hain Celestial Group

In 2024, Hain Celestial, known for brands like Celestial Seasonings, initiated a three-year turnaround plan to enhance financial health and brand investment. This strategy focuses on improving working capital management, reducing production costs, and reinvesting in core brands to drive growth.

TH Group

In September 2024, Vietnam's TH Group launched a new line of herbal teas utilizing indigenous ingredients such as jiaogulan, lingzhi, and chrysanthemum. Derived from local forest buffer zones, the move is to encourage regional biodiversity and provide distinct products to health-oriented consumers.

Supreme Imports

In December 2024, Supreme, a company specializing in vapes and beverages, acquired Typhoo Tea for USD 13.2 million. This acquisition is part of Supreme's diversification strategy, aiming to revitalize the historic tea brand and expand its presence in the beverage sector.

These developments reflect a dynamic and competitive landscape, with companies focusing on innovation, strategic acquisitions, and sustainability to meet evolving consumer preferences in the herbal tea market.

The global herbal tea market is projected to grow at a CAGR of 7.5% from 2025 to 2035, driven by increasing demand for functional beverages and plant-based health products.

By 2035, the global herbal tea market is expected to reach approximately USD 9.44 billion, reflecting strong growth in consumer preference for organic and wellness-oriented teas.

The liquid herbal tea segment is expected to grow the fastest due to rising demand for ready-to-drink and functional beverage solutions that offer convenience and health benefits.

Key growth drivers include increasing consumer awareness of health benefits, demand for caffeine-free alternatives, expansion in e-commerce, and innovation in herbal tea formulations with medicinal and adaptogenic ingredients.

Some of the dominant players in the global herbal tea market include Hain Celestial Group, Tata Consumer Products, Unilever (Pukka Herbs), Associated British Foods (Twinings), Organic India, and Celestial Seasonings, all focusing on product innovation and expanding their global footprint.

The market is segmented into black herbal tea, green herbal tea, and yellow herbal tea, with growing demand for antioxidant-rich and functional herbal tea variants.

The market includes herbal tea instant premixes, liquid herbal tea, powdered RTD herbal tea, and herbal tea syrup, driven by increasing convenience and ready-to-drink formulations.

The market is categorized into lemongrass herbal tea, peppermint herbal tea, fruit herbal tea, hibiscus herbal tea, ginger herbal tea, and chamomile herbal tea, influenced by consumer preference for wellness and relaxation.

The market is segmented into herbal tea can packaging, herbal tea carton packs, herbal tea bags, herbal tea paper pouches, and loose herbal tea, with demand increasing for sustainable packaging solutions.

The market is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.