Top players like Dyson, Honeywell, and Coway lead the HEPA air purifier market by offering advanced filtration technologies and smart connectivity. These companies focus on removing allergens, pollutants, and airborne viruses, catering to health-conscious consumers and urban households.

The market, expected to grow at a CAGR of 11.2% to USD 68,195 million by 2035, thrives on innovations like app-based monitoring, energy efficiency, and whisper-quiet operations. Brands introducing portable and compact designs gain traction among apartment dwellers and small office users.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 68,195 Million |

| CAGR during the period 2025 to 2035 | 11.2% |

E-commerce platforms drive growth, enabling Brands to showcase product comparisons and consumer reviews. Partnerships with healthcare providers and wellness advocates enhance credibility and consumer trust.

Differentiation lies in sustainable manufacturing practices, such as recyclable filters and energy-efficient motors. Companies investing in IoT integration and personalized air quality solutions will dominate this competitive market.

Explore FMI!

Book a free demo

Market Growth

The HEPA air purifier market is expanding rapidly due to increasing concerns over air pollution and its adverse health effects. With the proliferation of allergens, viruses, and fine particulate matter, consumers and businesses are investing in HEPA air purifiers for healthier indoor environments. The technology's proven efficacy in filtering out 99.97% of particles as small as 0.3 microns further reinforces its demand.

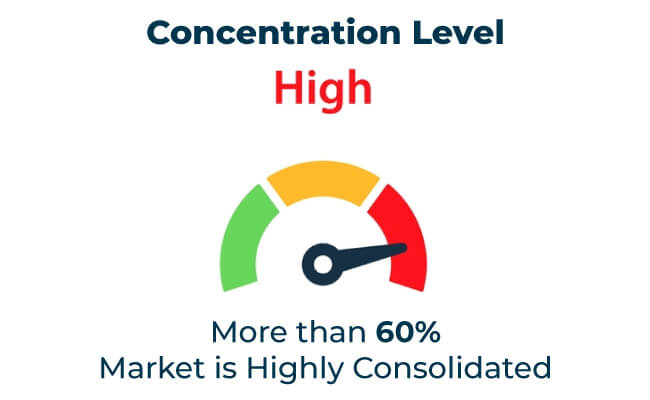

Global Brand Share & Industry Share (%):

| Category | Industry Share (%) |

|---|---|

| Top 3 (Dyson, Blueair, Honeywell) | 35% |

| Rest of Top 5 (Philips, Coway) | 25% |

| Next 5 of Top 10 (Sharp, Levoit, others) | 15% |

Type of Player & Industry Share (%):

| Type of Player | Industry Share (%) |

|---|---|

| Top 10 | 75% |

| Top 20 | 20% |

| Rest | 5% |

Year-over-Year Leaders:

Advanced HEPA Filtration

Smart Features

Energy Efficiency

Eco-Friendly Materials

Sustainable Manufacturing

Minimal Packaging

Focus on Health and Wellness

Preference for Compact and Stylish Designs

Rising Adoption in Smart Homes

North America: The EPA enforces standards for air purification efficiency and emissions, boosting adoption in residential and commercial spaces.

Growing demand for affordable air purifiers in Latin America and Africa creates lucrative export opportunities.

High Initial Costs: Premium HEPA air purifiers may deter cost-conscious consumers, particularly in emerging markets.

Emerging Markets: Rising urbanization and health awareness in Asia-Pacific and Africa create significant growth potential.

North America: Leads with 40% of the market, driven by high health awareness and regulatory standards for indoor air quality.

In the HEPA air purifier market, residential use dominates with a revenue contribution of 60%, driven by growing concerns about indoor air quality and health.

Focus on Affordability: Develop cost-effective HEPA air purifiers for price-sensitive markets.

Leverage Smart Features: Integrate IoT and AI technologies to cater to tech-savvy consumers and smart home ecosystems.

Prioritize Sustainability: Invest in reusable filters, recyclable components, and carbon-neutral manufacturing practices.

The HEPA air purifier market will continue to grow as brands innovate with advanced filtration technologies, smart integrations, and sustainable designs. Companies investing in regional expansions, product diversification, and enhanced consumer education will dominate the market. Emerging trends, such as personalized air purification and portable models, will further shape the industry.

Revenue and Share by Brand

Market leaders like Dyson, Blueair, and Honeywell maintain dominance through innovation, scalability, and strong distribution networks.

Figures/Visuals

| Brand | Dyson |

|---|---|

| Market Contribution (%) | 15% |

| Key Initiatives | Focused on multi-functional, energy-efficient purifiers |

| Brand | Blueair |

|---|---|

| Market Contribution (%) | 13% |

| Key Initiatives | Expanded ultra-quiet, smart-enabled models |

| Brand | Honeywell |

|---|---|

| Market Contribution (%) | 12% |

| Key Initiatives | Developed scalable solutions for commercial applications |

Scope of Market Definition

The HEPA air purifier market includes devices equipped with certified HEPA filters for residential, commercial, and healthcare use. This analysis excludes non-HEPA air purification systems, such as ionizers and UV light-based purifiers.

Key Terms and Terminology

The primary research involved a combination of primary interviews, secondary data analysis, and industry-specific modelling. The data was cross-validated with market experts and industry stakeholders to validate the accuracy and relevance of the data.

The global HEPA Air Purifier market will grow at a CAGR of 11.2% between 2025 and 2035.

The global HEPA Air Purifier market will reach USD 68,195 million by 2035.

The top 10 players account for over 58% of the global market.

Key manufacturers include Dyson, Honeywell, and Coway among others.

Duck Boots Market Trends - Growth & Industry Outlook 2025 to 2035

Eco Flooring Market Analysis - Growth, Demand & Forecast 2025 to 2035

Dishwashing Additives Market Growth - Size & Forecast 2025 to 2035

Electric Clothes Drying Hanger Market Trends – Growth & Demand 2025 to 2035

Desert Boots Market Growth - Trends & Demand Forecast 2025 to 2035

Doula & Birth Coaching Services Market Trends – Growth to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.