The global hemp protein powder market is estimated to account for USD 423.7 million in 2025. It is anticipated to grow at a CAGR of 10.4% during the assessment period and reach a value of USD 1,031.1 million by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Hemp Protein Powder Market Size (2025E) | USD 423.7 million |

| Projected Global Hemp Protein Powder Market Value (2035F) | USD 1,031.1 million |

| Value-based CAGR (2025 to 2035) | 10.4% |

Hemp protein is a complete protein source, that contains nine essential amino acids not produced by the human body. Hemp protein powder includes all the vital nutrients that boosts overall health and well-being. It is rich in high-quality protein, dietary fiber, healthy fats including omega-3 and omega-6 fatty acids, and essential minerals such as magnesium and iron.

It is highly digestible and free of commonly known allergens such as lactose and gluten; hence, it is more prevalent among people who consume diet-restrictive and allergy-driven dietetics. The demand for hemp protein powder is mainly driven by the rise in general awareness and benefits of functional foods contributing to fitness needs and managing overweight issues, heart care problems, and obesity.

Hemp protein powder exports and imports have grown steadily in the past few years. Global exports recorded 5,000 tons in 2021, while imports were a bit lower at 4,800 tons. The same was reflected in the exports of 2022, which increased by 5,500 tons, while imports also grew by 5,200 tons in the same year.

This growth can be attributed to rising consumer interest in plant-based proteins and the expanding applications of hemp in the food and beverage industries.

| Year | Export Data (in Tons) |

|---|---|

| 2021 | 5,000 |

| 2022 | 5,500 |

| 2023 | 6,000 |

By 2023, export and import volumes increased to 6,000 tons for exports and 5,500 tons for imports. The global market for hemp protein powder is growing, mainly because of rising health consciousness and demand for plant-based food products.

The steady rise in imports, mainly in markets such as the USA and European Union countries, highlights the expanding global acceptance of hemp protein as a viable alternative to sustainable and eco-friendly products, making hemp a popular choice among environmentally conscious consumers.

Rising Demand for Plant-Based Nutrition

A significant driver for the hemp protein powder market growth is the shift toward plant-based diets. The number of vegetarians and vegans has been on the rise, thus creating demand for alternative sources of protein.

Hemp protein powder processed from hemp plant seeds is a major attractive source because it is a complete protein industry containing all nine essential amino acids. Its plant-based origin also appeals to those who care about sustainable and ethical food sources, which further fuels its popularity.

Environmental Sustainability of Hemp

Hemp is one of the eco-friendly crops which has a minimal requirement for natural resources. The crop is used to produce other sources of proteins, which require more water than hemp and grow slower, hence, there is no excessive use of herbicides or pesticides.

Hemp replenishes nutrients in the soil, thus being eco-friendly in the agricultural sector for sustainable agriculture. Many customers prefer less environmentally impact products, which has made hemp protein powder the top choice in the market for protein supplement products.

Increasing Demand for Hemp and Hemp-derived Products

One of the important restraining factors for the market is the problematic regulatory climate associated with growing hemp and hemp-derived products. In spite, of there being a general increase in acceptance of hemp-based products, laws as well as regulations are still vague and incoherent among countries and regions. In some regions, growing hemp is heavily regulated or subjected to very strict licensing, and this hinders companies from moving ahead.

Rise of Organic and Non-GMO Hemp Protein

Organic and non-GMO hemp protein products are becoming popular as consumers care more about the quality and sourcing of their food. Several consumers are seeking out products that have no pesticides, herbicides, or genetic modification, and these are the consumers who prefer organic and non-GMO hemp protein products.

This trend has motivated producers to certify their hemp protein as organic and to feature these attributes in their marketing, further driving demand in niche health and wellness segments.

Functional Food and Beverages

Hemp protein is gaining recognition as a supplement to support muscle growth and recovery. It is in high demand within the sports nutrition domain, because hemp is generally considered to be a good balance of essential fatty acids, fiber, and antioxidants, which could help with recovery after exercise and overall athletic performance.

More athletes and fitness enthusiasts are turning to hemp protein powder as a natural supplement for their diet and training routines, especially in combination with other plant-based proteins like pea or organic rice protein.

Regulatory Development

In some places, such as Europe and North America, more precise and uniform regulatory frameworks regarding hemp-derived products, including protein powder, will further solidify hemp protein as a legitimate mainstream dietary supplement.

Consumer education and awareness of the more significant health benefits of hemp protein and its various uses will increase acceptance and expand markets with time as the regulations evolve and markets mature.

Mover Toward Holistic Wellness and Sustainability

Move toward holistic wellness and sustainability has become a mega-consumer trend. Consumers are increasingly looking for products that reflect their value of health, environmental responsibility, and ethical sourcing. Hemp protein powder is in line with this trend as it provides a natural, plant-based solution to support personal health while also contributing to ecological balance.

Additionally, from a wellness perspective, hemp protein powder is valued for its comprehensive nutritional profile, supporting fitness, digestion, and heart health. As people become more proactive in managing their health, they switch to functional foods to improve their overall well-being.

Simultaneously, the sustainable nature of hemp requires fewer resources to grow and the cultivation contributes to soil health appeals to eco-conscious consumers helps in decreasing their environmental footprint.

Greater Accessibility and Supply

| Attributes | Details |

|---|---|

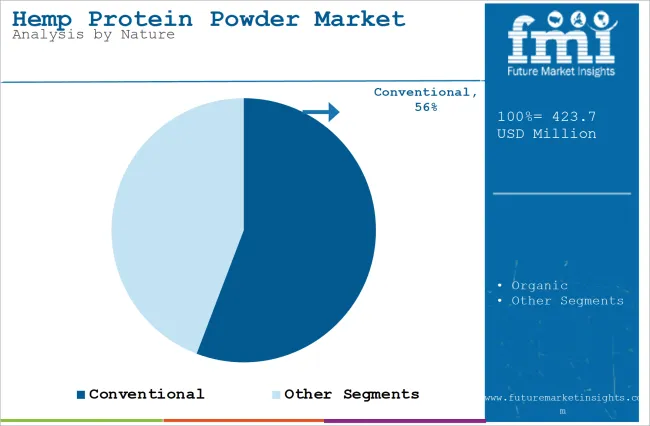

| Top Nature | Conventional |

| Market Share in 2025 | 55.8% |

Based on Nature, the market is divided into organic and conventional. The conventional segment is expected to account for 55.8% share in 2025. Conventional hemp protein powder is much more widely available and produced in higher volumes than its organic counterpart. As demand for plant-based protein continues to grow, producers of conventional hemp protein keeps pace with demand and ensure that supply chains are ready to support the growing consumer base. Organic hemp production generally tends to be more limited by stringent regulations and environmental conditions.

Enhance Taste and Palatability

| Attributes | Details |

|---|---|

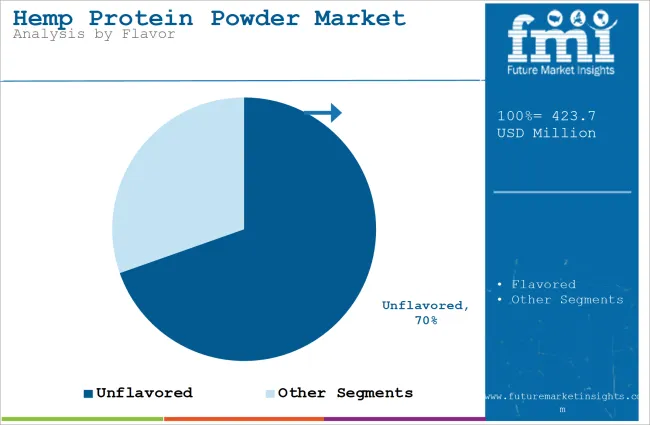

| Top Flavor | Flavored |

| Market Share in 2025 | 30.4% |

Based on flavor, the market is divided into flavored and unflavored. The flavored segment is expected to account for 30.4% share in 2025. One of the main reasons flavored hemp protein powder is in such demand is its enhanced taste. Hemp protein, in its natural state, tastes simple or grassy.

Consumers find consuming less palatable if not flavored with other tastes, such as chocolate, vanilla, or berry. It makes it even more attractive to a broader audience, specifically the newcomers in the world of plant-based proteins, or even for an easy-to-consume option in one’s daily routines, such as smoothies or shakes.

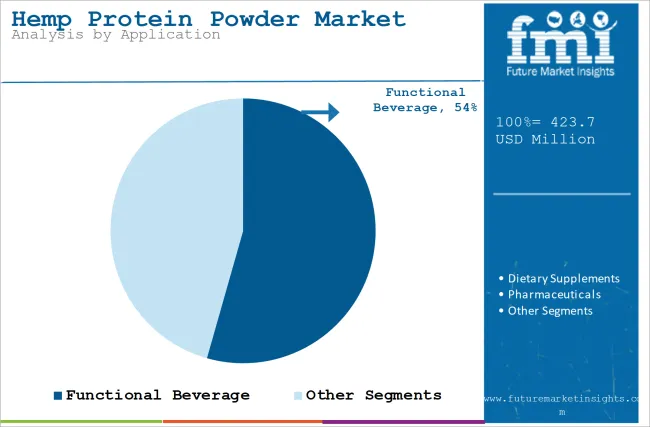

Increasing Demand for Plant-Based and Nutrient-Dense Drinks

Based on application, the market is divided into functional beverages, dietary supplements, pharmaceuticals, and personal care. One of the main applications of hemp protein powder is in functional beverages. The rising demand for plant-based, nutrient-dense drinks including smoothies, protein shakes, and energy drinks has increased the use of hemp protein.

It can provide a complete source of protein, along with other essential nutrients such as fiber and omega-3 fatty acids, making it a valuable ingredient in beverages targeted at health-conscious consumers. Hemp protein powder mixes well into liquid formulations, making it a good fit for the functional beverage industry, where convenience and nutrition are highly valued.

Based on distribution channel, the industry is divided into online retail, supermarkets/hypermarkets, and specialty stores. Convenience and extensive reach make online retail the primary distribution channel for hemp protein powder. With the rise in e-commerce, it is easier for consumers to browse through the vast range of hemp-based products available in the comfort of their homes.

Detailed information about products, customer reviews, and a comparison of various brands are also provided on the online platforms, which helps the consumer make a well-informed decision.

Moreover, many health-conscious consumers prefer to shop online because they have a wider choice of plant-based products that are not readily available in the local stores. The option of shipping directly to consumers increases the appeal of online retail for hemp protein powder.

India hemp protein powder is poised to experience a CAGR of 15.4% till 2035. India’s legal framework has also evolved concerning hemp, providing a more favorable environment for increasing and producing hemp-based products.

Over the last few years, many Indian states have legalized industrial hemp to produce non-psychoactive products, greatly facilitating the supply chains of raw materials for local hemp protein powder producers.

Italy is poised to witness at a CAGR of 11.8% in the forecast period. Italy has a long history of valuing high-quality, natural food products, and there is an increasing interest in sustainable, plant-based options.

With its minimal environmental impact and nutritional benefits, hemp protein powder fits well with the rising demand for eco-friendly food products in Italy. Consumers are becoming more environmentally conscious and are increasingly seeking alternatives to animal-based proteins.

UK is poised to attain at a CAGR of 10.5% from 2025 to 2035. Consumers in the UK are gradually focusing more on sustainability and ethical sourcing as part of the broader eco-conscious consumption trend.

As such, hemp protein powder is catching attention because of its low environmental footprint. UK increasingly, more consumers, so the generations younger, tend to seek to decrease ecological impact as an increasing attraction toward sustainable products such as hemp protein powder.

The USA is expected achieve a CAGR of 10.5% in the forecast period. The regulatory landscape in the USA is another factor contributing to the growth of the hemp protein powder market. The 2018 Farm Bill legalized industrial hemp production, that implies more farmers are enabled to grow the crop freely.

This move has made hemp greatly available to the producers, leading to a more stable and rising supply of raw materials. Additionally, favorable regulations supporting hemp cultivation have increased domestic production of hemp-based products, such as protein powder.

Hemp protein powder market size in Germany will grow at around 8% CAGR till 2035. With Germany being at the forefront of innovation in plant-based food and plant-based diets for consumers in Europe, the scope is quite high for hemp protein powder.

In Germany, hemp protein powder is being distributed through both traditional and online retail channels. Health food stores, gyms, and wellness-focused online platforms are the key distribution points. E-commerce is growing rapidly, providing direct access to niche products like hemp protein powders.

The growing interest in plant-based proteins has driven an increasing market share of hemp protein powder. Veganism, vegetarianism, and flexitarianism are gaining popularity; therefore, it increases the demand for hemp plant-based protein products. However, the market is still developing, and consumer awareness of the benefits of hemp protein is slowly growing.

The regulatory environment in Spain is changing because the country is still integrating hemp-based products into mainstream life. Still, specific issues have been faced regarding the regulation of hemp-derived products; however, it is much less restrictive than in European countries like the UK or France.

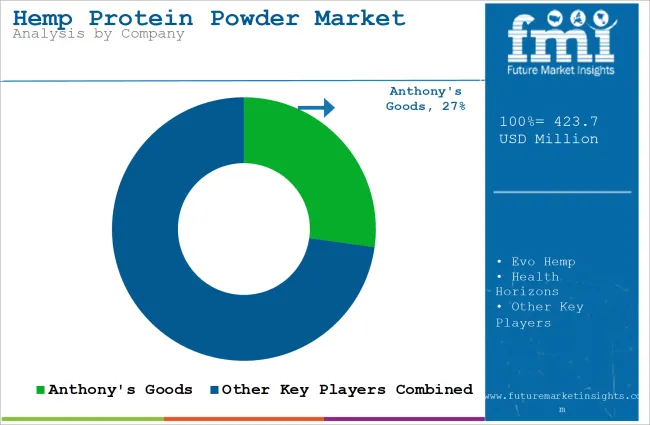

The competitive landscape for hemp protein powder market consists of both well-established health and wellness brands and emerging companies specializing in plant-based nutrition. Major players include Manitoba Harvest, Nutiva, Navitas Organics, and Bob’s Red Mill, each of which has developed unique strategies to increase its footprint and revenue share.

These companies focus on providing high-quality, organic, and non-GMO hemp protein products to meet the rising demand for clean-label and plant-based options. They also emphasize sustainability, where they brand their hemp cultivation as environmentally friendly to appeal to the eco-conscious consumer.

Additionally, another common practice to increase visibility and gain consumer confidence is through collaborations with fitness influencers and other plant-based brands. In this competitive space, the steady evolution is sure to be dictated by consumer demands for health, sustainability, and innovation.

The industry has witnessed the emergence of several innovative startups with differentiated growth strategies.

For example, an Irish start-up called Hemp Heros has made sustainability and product diversification its core elements for growth. Moreover, their strategy for involves collaborations with large health and wellness retailers and also B Corp status, among other certifications, to appeal to environmentally conscious consumers.

Another notable startup is India Hemp and Co., Bengaluru, India. The company emphasizes local sourcing of hemp from regional farmers to ensure quality products while contributing to regional farmer welfare. Its growth strategy involves consumer education about the nutritional and ecological benefits of hemp protein through workshops, social media campaigns, and partnerships with health influencers.

Through its campaigns, it highlights the convenience of hemp protein for regular use and expanding online sales channel, it has created customer loyalty in the health food market in Asian markets.

In terms of nature, the market is segmented into organic and conventional.

In terms of flavor, the market is segmented into flavored and unflavored

In terms of application, the market is segmented into functional beverages, dietary supplements, pharmaceuticals, and personal care.

In terms of distribution channel, the market is segmented into online retail, supermarkets/hypermarkets, and specialty stores.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, and Middle-East and Africa.

The market is predicted to reach USD 423.7 million by 2025.

The market is predicted to reach USD 1,031.1 million by 2035.

The prominent companies in the hemp protein powder market include Evo Hemp, Health Horizons, Manitoba Harvest, and Navitas Organics.

India is likely to create lucrative opportunities for the hemp protein powder market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hemp-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hemp Seed Oil Moisturizers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hemp Oil Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Hemp Animal Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hemp Seed Oil Market Trends - Growth, Demand & Forecast 2025 to 2035

Analysis and Growth Projections for Hempseed Milk Business

Hemp Milk Market Analysis by Variant, Type, End Use, and Sales Channel Through 2035

Industry Share Analysis for Hemp Fiber Producers

Hemp Paper Bag Market Trends & Industry Growth Forecast 2024-2034

Hemp Protein Skincare Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Demand for Hemp Seed Oil in EU Size and Share Forecast Outlook 2025 to 2035

Industrial Hemp Market

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA