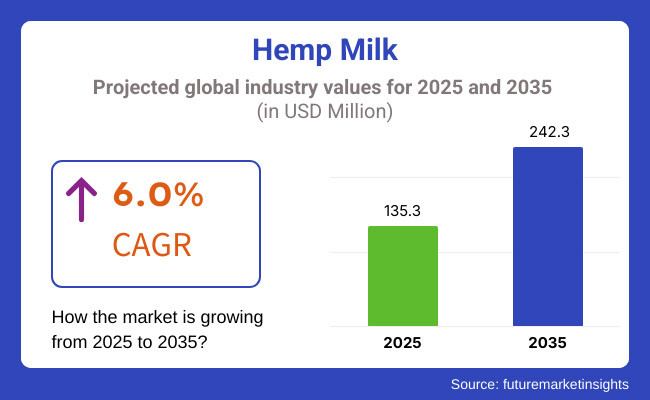

The global Hemp Milk industry is estimated to be worth USD 135.3 million by 2025. It is anticipated to reach USD 242.3 million by 2035, reflecting a CAGR of 6.0% over the assessment period 2025 to 2035.

The hemp milk market is a niche but rapidly expanding segment of the global plant-based milk market. Hemp milk is made by blending hemp seeds with water and then straining the mixture to create a creamy, smooth milk alternative.

It is among the best plant milks to balance with an assortment of benefits spanning from being a good source of omega-3 and omega-6 fatty acids, and necessary amino acids, to minerals including magnesium, iron, and calcium.

Among the prime reasons why hemp milk has been gaining momentum is due to its positive nutritional balance. Unlike other seed milks such as almond or soy milk, hemp milk contains all nine of the essential amino acids and is, therefore a complete vegetarian and vegan protein source for people with dietary needs.

Its endogenous omega fatty acids are also being credited for their potential health benefits to cardiovascular health, inflammatory fighting, and cognitive functioning. Hemp milk is also lactose-free, gluten-free, and in most instances, contains added vitamins such as vitamin D and B12, making it a suitable option for individuals with food intolerance or just those who follow a dairy-free diet.

Consumer preference for healthier and sustainable foods has been one of the most significant drivers in the growth of the hemp milk market. Individuals are becoming more aware of the effect they have on the planet, and hemp as a crop is seen as one of the most sustainable. Hemp requires less water to cultivate than other plant-based foods eaten as such, i.e., almonds or oats, and does not need herbicides and pesticides sprayed.

With increasing sustainability as a key driver of buying habits, hemp milk is taking advantage of this green tide. Rising demand for plant-based diets like veganism, flexitarianism, and dairy-free diets also propagated demand for alternative milks.

Explore FMI!

Book a free demo

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2023) and current year (2024) for the global Hemp Milk market. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.1% (2024 to 2034) |

| H2 | 6.2% (2024 to 2034) |

| H1 | 5.8% (2025 to 2035) |

| H2 | 6.7% (2025 to 2035) |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 5.8%, followed by a higher growth rate of 6.7% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to increase to 5.1% in the first half and remain considerably high at 6.2% in the second half. In the first half (H1), the sector witnessed an increase of 15 BPS; in the second half (H2), the business witnessed a decrease of 10 BPS.

Growth of Hemp Milk in Functional Beverages

The functional beverage category, which offers beverages that contribute to additional benefits of health besides general nutrition, is the most innovative development within the hemp milk industry. Historically used as a milk alternative, hemp milk is becoming an integral part of functional categories within beverages, i.e., fortified beverages, immune-boosting products, and gut-friendly formulations.

Manufacturers are blending hemp milk with other nutrients like probiotics, prebiotics, plant proteins, and adaptogens to satisfy the growing demand for beverages that contribute to overall wellness. The rise of functional hemp milk beverages is a result of increased consumer awareness of holistic health and preventive medicine.

Hemp milk, with its unique profile of essential fatty acids, protein, and antioxidants, is perfectly positioned to meet these demands. By adding hemp milk to functional drinks, business entities can offer a product portfolio that not only is a dairy-free substitute but also helps to advance consumer wellness objectives.

The impact on the market will be significant as customers continue to seek more holistic solutions to wellness, thus propelling the demand for hemp milk as an ingredient for health-enhancing beverages.

Customization through Hemp Milk-Based Protein Powders

The production of protein powders from hemp milk is one of the most thrilling developments in the hemp milk industry. While plant-based protein powders made from peas, rice, and soy have been around for a long time, hemp-based protein powder is increasingly becoming popular due to its nutritional benefits and digestibility.

These powders are being sold as a more digestible and complete protein source than other plant-based alternatives, and thus especially attractive to vegans, athletes, and consumers seeking non-dairy protein supplements. Hemp milk, which is high in essential amino acids and omega fatty acids, is the perfect foundation upon which to build these powders.

The global increase in protein consumption, fueled by increased interest in body-building, muscle growth, weight loss, and overall wellness, is driving demand for hemp protein powders. Hemp milk's popularity as a foundation for protein supplements stems from its natural and balanced nutritional profile.

Consumers are increasingly seeking protein products that do not contain the negative side effects historically associated with animal proteins or overly processed protein powders. Hemp milk protein powders are considered a natural, clean choice.

The trend will be expected to impact the hemp milk market significantly by attracting new consumer bases ready to try plant-based protein powders that are rich in nutrition, thereby growing hemp milk's share in the functional foods and supplements category.

Hemp Milk in Plant-Based Creamers and Coffee Alternatives

The creation of hemp milk creamers is a trend in the global hemp milk industry, especially in the coffee and beverage sectors. It is rich and creamy and an excellent replacement for plant-based creamers and coffee substitutes.

With a growing number of consumers turning towards dairy-free consumption, there has been a bigger demand for alternatives to coffee and tea that would provide the same amount of creaminess as dairy. Hemp milk has a unique texture and flavor profile that is very distinct from the rest of the alternatives, such as almond milk or oat milk.

Since there is ongoing expansion in the coffee culture globally, especially in the world regions such as North America, Europe, and Asia-Pacific, consumers are shifting towards plant-based milk to be consumed in their coffee.

The use of hemp milk as a non-dairy creamer is also supported by the fact that it can be used for most coffees, from lattes and cappuccinos to iced coffees. Hemp milk is perfect for coffee brewers who use vegetable-based coffee because it can create smooth, frothy textures to hot or iced beverages. Along with other vegetable milks, hemp milk is already starting to appear on the menus of coffee houses because specialty and high-end coffee shops are demanding it.

Global sales increased at a CAGR of 4.8% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on such products will rise at 6.0% CAGR.

The global market will be linear and continuously developed between 2020 and 2024, with the increasing demand for plant-based diets and the increase in knowledge of the health benefits of hemp. During this time, the tendency to move towards dairy alternatives is intensified due to increasing concerns about environmental, lactose intolerance, and dairy allergies.

Also, increasing the number of consumers on vegan and flexitarian diets contributed to market expansion, with hemp milk being a healthier option compared to ordinary dairy milk. Its rich composition of omega-3 and six fatty acids, protein, and essential minerals made it highly desirable to health-oriented consumers for dairy-free products as part of their nutritional objectives.

The global market will continue to change due to rapid and subsequent 2035 changed customer needs, diversification of the market, and convergence of continuous innovation. For more and more individuals, there would be a wider tendency to increase digestive functions, reduce inflammation and, increase heart health, focus on welfare and well-being.

Growing consumer consciousness towards holistic wellness and health will ensure that hemp milk as a functional food ingredient in beverages, protein powders, and fortified wellness drinks will grow its presence in global markets.

Increased demand for allergen-free and dairy-free products will also keep propelling hemp milk's market growth, particularly since the product has come out as a versatile plant-based alternative to individuals with lactose intolerance or gluten intolerance.

Tier 1 companies in the global hemp milk market are large, large companies with high market share, brand name and production capacity. These companies have extensive distribution channels, better product innovation and large investments in R&D, which allow them to produce several hemp-milk products to meet consumers' needs in different fields.

These companies are usually prominent names in plant -the plant-based milk category such as Hemp Milk Inc., and Pacific Foods. In advance of strategic procurement, aggressive marketing and retail, both offline and online platforms to shape the global hemp milk market.

Tier 2 companies in the global hemp milk market are the emerging competitors that have had an important presence within the last several years but don't have size, brand recognition, or reach. These companies are driven by unique value propositions such as maintaining specialized formulation, catering to niche consumer segments, or assuming local or regional enterprise. Hemp Yeah! Provamel and Naked Hemp are just a few examples of players who provide specialized goods to meet certain dietary needs or expectations.

Tier 3 participants in the global hemp milk market are often tiny, new brands that cater to very specific customer demands or domestic markets. They operate with a highly specialized strategy, focusing on producing artisanal or locally manufactured hemp milk products.

They can capture particular niche markets such as organic, raw, or small-batch hemp milk, and sell very specific customer bases such as people who have extreme food sensitivities or people who are adhering to very specific diets.

The following table shows the estimated growth rates of the top three territories. China and Japan are set to exhibit high consumption, recording CAGRs of 5.3% and 6.4%, respectively, through 2034.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 5.1% |

| Brazil | 6.9% |

| India | 7.6% |

| Japan | 5.3% |

| China | 6.4% |

The growth of China's hemp milk market is supported by numerous factors, such as its emerging food and beverage industry, increasing health awareness, and the government's endorsement of the plant-based lifestyle. The country's vast population base coupled with the emergence of a growing middle class have increased demand for plant-based alternatives like hemp milk.

The taste of vegetable meals by consumers has varied dramatically in recent times, particularly among city-dwelling consumers who are learning more about the potential health advantage of foods such as hemp milk.

From market reports, enormous opportunity for innovation in plant meals exists in China, and consumer demand for vegan, allergy-free, and lactose-free food is growing. The increased demand for wellness products in China, including supplements and plant-based beverages, makes it a more attractive market for the manufacturers of hemp milk globally.

Germany's strong expansion in the hemp milk market is fueled by Germany's early affinity for well-being, along with its strong position as the European center for plant-based food development. The growing demand for German hemp milk signals an increased customer preference, fueled by increased consumer behavior shifting towards all plant-based and all allergen-free alternatives to dairy.

This is demonstrated by the increasing number of German consumers choosing non-dairy alternatives due to health concerns, lactose intolerance, or ethical considerations. Indeed, Germany's plant-based market is one of the fastest growing in Europe, with consumption of plant-based milk smashing records. Current surveys indicate that approximately 15% of Germans prefer plant-based milks, thus the rising availability of such alternatives as hemp milk.

Germany also boasts a developed and effective regulatory framework, having encouraged robust investments into the nation's hemp sector. This encompasses investments in manufacturing, research, and retail sale of hemp products, thus making the hemp milk market more competitive. Germany has experienced increased interest from foreign hemp farmers who want to penetrate its well-established food and beverage industry.

| Segment | Value Share (2025) |

|---|---|

| Flavored (By Variant) | 64.2% |

The market increased to the market's prominence for aromatic hemp milk as the head of the industry in plant-based beverages, expansion and expansion of attraction from a variety of consumer groups. Flavored hemp milk products quickly increase among health-conscious and adventure consumers as the demand for dairy alternatives increases.

The flavor of hemp milk is mainly credited to having a nutty and earthy taste naturally, and with additional flavors added to it, the product becomes even more appealing for those who need something tasty yet healthier than cow milk. The flavor segment that delivers flavors is also attracting traditional plant milk users as well as new users who may have previously been hesitant to accept hemp milk due to the unique, and learned taste.

As the plant-based beverage market experiences a high growth rate, consumers are no longer satisfied with the plain, unflavored version. Flavored hemp milk satisfies this need by being available in a range of flavors, from vanilla and chocolate to seasonal varieties such as pumpkin spice or coconut, and is thus an easy ingredient to add to anything from smoothies to desserts. That convenience has rendered it a sought-after addition to the retail store shelves, with numerous products to cater to personal taste and dietary requirements.

| Segment | Value Share (2025) |

|---|---|

| Nutraceutical Industry (By End Use) | 28.4% |

The nutraceutical segment of the market for hemp milk has rapidly taken the position of a market leader, due to the demand for functional foods that combine health benefits and pleasure. Nutraceutical foods, filling the gap between nutrition and pharmaceutical benefits, are becoming increasingly popular as consumers try to find the benefits that can provide certain health benefits. Some of the following driving forces are causing nutraceutical industry to emerge: rising concern for preventive care, the push for functional food, and rising trends for custom nutrition.

Hemp milk is a quality product from the point of view of nutraceutical value. The type of nutrient composition appeals to health-conscious consumers wishing to supplement their diets with natural, plant-based alternatives that are good for general health.

These innovations offer consumers holistic, quality product that is great tasting and serves a purpose toward one's health objective, be it enhancing immune response, promoting digestive balance, or bone wellness.

Additionally, the increasing individualization of well-being is another driving force that affects the nutraceutical hemp milk industry. Consumers are increasingly looking for products that suit their own dietary requirements, be it gluten-free, dairy-free, vegan, or protein-based.

The global hemp milk market is very competitive, with both established brands and new entrants. Companies prioritize product quality, affordability, and creative formulae, particularly in packaging and flavor diversity. As consumer preferences shift, there is a greater emphasis on developing unique flavor profiles, convenient serving sizes, and accessible formats.

With continued demand growth in different regions, especially in new markets, competition is increasingly getting more intense. Further, companies are making investments in locking in supply chains and building distribution networks to guarantee constant availability of products, thus adding fuel to the market's dynamic and competitive nature.

For instance

The global industry is estimated at a value of USD 135.3 million in 2025.

Sales increased at 4.8% CAGR between 2020 and 2024.

Some of the leaders in this industry include Hemp Foods Australia, JOI, Good Hemp, Pacific Foods, Nutiva, Living Harvest, Elixinol, Hemp Milk Company, Seventh Generation, The Hemp Company, Oatly, Planet Hemp, REBBL, and Vitasoy, among others.

The North American territory is projected to hold a revenue share of 21.2% over the forecast period.

The industry is projected to grow at a forecast CAGR of 6.0% from 2025 to 2035.

As per Variant, the industry has been categorized into Flavored and Unflavored.

As per Type, the industry has been categorized into Sweetened and Unsweetened Milk.

As per End Use, the industry has been categorized into Food Processing Industry, Bakery Products, Beverage Industry, Nutraceutical Industry, and Others.

As per the Distribution Channel, the industry has been categorized into business-to-business and Business to Consumer.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltics, and the Middle East & Africa.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.