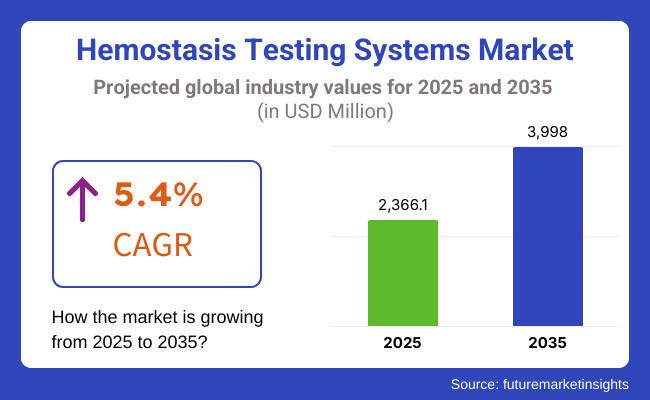

The global market for hemostasis testing systems is forecasted to attain USD 2,366.1 million by 2025, expanding at 5.4% CAGR to reach USD 3,998.0 million by 2035. In 2024, the revenue of this market was around USD 2,253.7 million.

The Hemostasis Testing Systems Market is predicted to have a considerable leap due to the drivers which are creating opportunities for advanced testing in coagulation. High prevalence of bleeding disorders and thrombotic conditions such as hemophilia, factor V leukemia, deep vein thrombosis (DVT), and pulmonary embolism is also one of the reasons as to why these diagnostics will be in demand.

Given the world’s increasing age, the risk of such conditions is anticipated to have increased which necessitates the proactive inclusion of effective diagnostic tools for better control and management of such disorders. In addition, there is a growing tendency for surgical interventions and trauma injuries which increases demand for expeditious and accurate assessment of hemostasis status and prophylaxis of potential bleeding disturbances.

Besides these, another aspect of enhancing the processes within these markets to proliferate is the incorporation of modern functionality to hemostasis analyzers and point-of-care (POC) testing. The trend in this regard to automated testing, the use of artificial intelligence and the production of complex and easy to use analyzers is guide for increased test performance, reduced turnaround time and square metre use.

Moreover, the cost of treatment continues to rise and “encouragement to have treatment,” coagulations take over and this encourages the authorities and funding from the private sector into even better diagnostic equipment.

In the near future, the application of gender specific therapies and coagulation testing based on markers in patients is bound to increase in many regions, serving as one of the drivers of market advancement. There are also great outlooks for the application of microfluids, lab-on-chips, and AI in medical data analysis repeatedly in regard to greater accuracy of diagnostics, less cost, and more effective management of hemostasis for the patients.

The Hemostasis Testing Systems Market has changed a lot over the years. It's mainly due to better technology and more awareness about blood clotting disorders. At first, testing for blood coagulation was slow and took a lot of manual work. This often led to delays in diagnosing and treating patients. Those early methods set the stage, but they weren’t very accurate or fast.

With lab automation becoming popular, semi-automated and fully automated machines came into play. These machines made tests more accurate and quicker. The rise in heart diseases, hemophilia, and blood clots pushed the need for fast and dependable tests even more.

New developments in testing materials and quicker tests made it easier for more places, like emergency rooms and clinics, to use these systems. The industry also faced tougher regulations, and digital health solutions started fitting in. This change improved patient care and made hemostasis testing a regular part of diagnostic processes.

Explore FMI!

Book a free demo

North American hemostasis testing systems market is increasing on account of growing cases of venous thromboembolism (VTE), increasing usage of modern coagulation analyzers, and robust representation of major diagnostic firms. The United States spearheads the regional market, being buoyed by augmented healthcare spend, enhanced level of awareness among patients regarding clotting disorders, and widespread automation in laboratories.

Yet, difficulties including strict FDA guidelines, hemostasis testing device costs, and inequalities in access to healthcare cap market growth. The expanding use of AI-based diagnostics, increasing use of portable POC hemostasis analyzers, and growing clinical research into coagulation disorders will propel market growth in North America.

Europe represents an important market for hemostasis test systems, which is inspired by the increasing demand for monitoring anticoagulant therapy, strong regulatory structures for clinical testing, and increasing incidence of cardiovascular disease. Countries such as Germany, France and the United Kingdom are large markets, which benefit from well -established hematology laboratories and increases automatic hemostasis analyzers in hospitals.

However, challenges such as lack of prices, reimbursement issues and regulatory delays during the European Medicine Agency (EMA) can affect the market extension. Increasing changes to POC testing, increasing investments in research for new hemostasis system and expansion of precision medicine applications in coagulation management form the European market landscape. In addition, partner efforts between pharmaceutical companies and clinical companies in co -operative surveillance technology.

The Asia-Pacific area is seeing fast growth in the hemostasis testing market. This is due to more cases of blood clotting problems, more surgeries, and better access to testing tech. Key players in this market include China, Japan, and India. These countries are building up their healthcare systems and raising awareness about the risks of blood clots. Plus, there’s more government support for improving testing.

But there are some roadblocks. Many people can’t afford the tests. There’s also a lack of standard practices and not enough specialized labs in rural areas.

On the bright side, more global testing companies are entering the market. There’s also growth in clinical trials for blood clot disorders, and the use of AI in testing machines is on the rise. Wearable devices that monitor blood clotting and telehealth options for testing are also making it easier for patients to get care in this region.

Challenges

Stringent regulatory requirements and compliance burdens is a major challenge

The Hemostasis Testing Systems Market is also observed to have challenges in regulation with regard to hemostasis testing with respect to diagnostic devices from the facet of coagulation. As the testing of hemostasis aids the management of hemorrhaging and thrombotic disorders, approvals under this scenario would be extremely complex; thus getting them shall take a lot of time as well.

It is the testing companies' obligation to get approving quality testing systems to measure the accuracy, reliability, and safety of their products. Such strict evaluating legal standards as those set by the FDA, EMA, and even other regional agencies are used to ensure accuracy, reliability, and safety of these tests.

The frequent changes of regulations long approval processes, which often delay the introduction of products and increase development costs. The outsourcing process to meet GMP standards, QC standards, and laboratory accreditation creates challenges that also have an impact on the operations.

Its effect would be more felt by emerging and small companies regarding their capability to compete with large operators. The above challenge demands operations be routinized in terms of the approval pathway as well as industry partnerships to ensure no mandate is meant to forestall innovation.

Opportunities

Expansion of point-of-care (POC) testing present lucrative growth opportunity

The Hemostasis Testing Systems Market presents an excellent opportunity in expanding the practice of point of care (POC) coagulopathy testing. With the gradual transformation from the hospital-based care to regional aids, it is only logical to expect an escalation in the use of practical, fast, and efficient hemostasis devices.

POC testing, because of what it involves, the determination of blood test results in real time, is an essential technique in dealing with patients in critical condition. Emergency Department, as well as with patients on the antiplatelet and anticoagulation drugs in the community setting.

The trend towards using biosensors that are wearables and microfluidics from samples as well as some A.I.-based testing gives further encouragement to the use of POC hemostasis testing. Moreover, there are also opportunities in less developed countries where there is potential for expansion within the health sector, cases of hemorrhagic disorder being common in hospitals without specialists.

The companies putting efforts in the development process other than having it in place of inexpensive POC solutions will result in enhancing competitiveness, translate into better health and well-being of the patients and also help in quick and predictive treatment of coagulation disorders.

Expansion of Home-Based Coagulation Monitoring and Wearable Devices

The expansion of home-based coagulation monitoring and wearable equipment is emerging as a major trend in the hemostasis testing systems market. With the rise of digital health solutions, patients on anticoagulation therapy can now monitor their coagulation status in real time using wearable sensors and remote monitoring platforms.

These technologies increase the patient's adherence, reduce hospital visits, and are able to detect clots of abnormalities, improving overall disease management. Integration of AI-operated analytics and smartphone connectivity further enhances data interpretation and physician-communication. As the demand for individual and decentralized healthcare increases, the wearable coagulation monitoring is scheduled to replace hemostasis diagnostics.

For 2020 to 2024, the Hemostasis Testing Systems Market has demonstrated moderate growth over the years. As there has been heightened awareness of coagulation in bleeding and thrombotic diseases, there has been the need for improved coagulation-testing facilities within hospitals, diagnostic laboratory environments, and point-of-care settings.

The new developments in automated systems and POC devices are transforming the speed and precision at which one is diagnosed, which results in even improved disease management for conditions like hemophilia or DVT due to their aid in the detection of blood deficiency or clotting in the blood.

Looking forward from 2025 to 2035, wearable coagulation sensors that transmit live data to monitor the coagulation statuses of patients thus influencing several shifts in coagulation management. Moreover, integration of AI with digital health into diagnostics will definitely create more quality and efficiency.

Increasing health expenditure and personalized medicine adaptability in treatment provision are major drivers for market growth. As healthcare spending continues to rise across the world, especially in the emerging parts of the world, we can expect an increase in the demand for highly advanced hemostasis test systems.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | In the approval streamlining process by regulatory bodies, secure a much-loved and convenient approval for both point-of-care automated devices for hemostasis testing. |

| Technological Advancements | Adoption of analyzers and automated modalities of testing at the POC, which will quicken the process by enhancing dwindling laboratory turnaround times and also improve specific diagnostic accuracy in clinical settings. |

| Consumer Demand | Awareness among both the clinicians and healthcare workers is increasing, making it higher demand for the right and accurate equipment or diagnostic measures placed right from the prevention side and then adopted to the early treatment of bleeding disorders. |

| Market Growth Drivers | Bleeding diseases in technology have ascended significantly through advanced detection and diagnostic instruments and better-performing treatments.. |

| Sustainability | Early initiatives in green manufacturing process and environmental sustainability of medical devices, with some firms embracing sustainable production and supply chain procedures. |

| Supply Chain Dynamics | Dependence on established chains with assurance of availability of hemostasis testing equipment and reagents in hospitals and diagnostic laboratories, with challenges extending as far as remote or resource-poor regions. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Put in place intense standards and regulations for AI-based tested devices for testing of hemostasis. This would ensure good guidelines and higher patient safety when employed in different clinical setups. |

| Technological Advancements | Create programmed algorithms for AI and machine learning tested for better accuracy of diagnostic designing of transportable, more user-friendly equipment to be used across every healthcare setting and real-time monitoring. |

| Consumer Demand | The need for such diagnostic equipment that is customized and keeps the aggregate patient base of a hospital requires analyzing the data in real-time, while remotely monitoring and adapting the functionality to suit many patients- for those who might live very far and those who might live in local and rural contexts. |

| Market Growth Drivers | Growing to emerging markets with enhanced healthcare infrastructures, greater research and development investment in new diagnostic products, and strategic partnerships between medical device firms and healthcare providers to expand the availability and affordability of products. |

| Sustainability | Mass deployment of sustainable principles, such as manufacturing from recyclable and biocompatible materials, energy-efficient manufacturing, and efforts towards reducing medical waste related to disposable diagnostic elements. |

| Supply Chain Dynamics | Supply chain optimization through digital technologies and e-commerce platforms, increasing transparency, efficiency, and accessibility, for timely delivery of diagnostic equipment and supplies to a global customer base, including remote and underserved communities. |

Market Overview

Perhaps the most apparent reason the United States hemostasis testing systems market is expanding so quickly is the sustained increase in the number of people suffering from bleeding disorders, the rise in surgical procedures, and progress in diagnostic technology. All these factors are driving the growth of the market in the United States. In addition, a strong healthcare infrastructure and the increasing adoption of point-of-care (POC) testing has augmented this growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.7% |

Market Outlook

The commercialization of hemostasis testing systems in Germany is favored by a healthcare system that is well evolved, a continuously developed field of work in the area of coagulation diagnostics, and above average levels of automation in diagnostic laboratories.

Furthermore the prevalence of heart diseases continues to be on the rise as well as the need for precision therapies. There is strict enforcement of medical compliance and efficient payment of costs for most advanced diagnostic methods such as extensive coagulation studies using automation.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.3% |

Market Outlook

The economics of China would shift towards the biggest increase in medtech-ie expenditure in healthcare. Knowledge about hemostasis is on the rise, and many have already embraced the new techniques so to have correct diagnostics that are in house as well. The hemostasis testing systems are more convenient in that their installing processes are less exhaustive. In addition to these factors, the government itself is supposed to improve basic facilities in terms of medical training and even in terms of machine supply.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.3% |

Indian hemostasis testing systems constitute a fast evolving market due to the increase of patients with blood disorders, healthcare development and the desire of preventive diagnostics. The increasing number of patients undergoing surgery for different reasons has facilitated the spreading of portable diagnostics leading to growth in this market. Furthermore, more specific government programs aimed at enhancing diagnostic tests services across the segment have serious potential to touch the market fronts.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.1% |

The Brazilian hemostasis testing systems market shows healthy growth trends, driven by the increased incidence of blood disorders, health infrastructure improvements and rapid increase of surgical procedures during the last decade. Dependence on advanced diagnostics and government promotion of liberalized access to coagulation testing in public hospitals form key market drivers.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.3% |

Laboratory analyzers are expected to dominate as they provide accurate, efficient, and high-throughput coagulation testing

A substantial segment into the Hemostasis Testing Systems Market is that of Laboratory analyzers, which play a pivotal role in the execution of precise, high-throughput coagulation testing. Its automation role includes the actual measuring, evaluation, and calculating while ensuring a coagulation parameter, such as prothrombin time (PT), activated partial thromboplastin time (aPTT), and level of fibrinogen.

This almost guarantees precision and eliminates the human errors. Large sample sizes are made possible with automation systems that are perfect in any kind of clinical laboratories, hospital, or any other place that needs fast results in terms of monitoring bleeding and thrombotic disorders.

Fact is that the industry drives from semi-automated to completely automated and ultimately high throughput has further been facilitated diagnostic workflow and offers rapid and reliable test results. With further improved technology, laboratory analyzers based on digital health are extremely sought after amplifications inside the Hemostasis Testing Systems Market.

Point-of-care (POC) testing systems segment holds the second largest share due to their effective real-time coagulation monitoring

Second largest segment for Hemostasis Testing Systems is Point-of-Care (POC) Systems. These diagnostic systems allow patients to acquire a real-time patient status in terms of coagulation and can be utilized on a bedside, in an emergency setting, and even by a patient. Their meaningful features include short turnaround time for test results leading to real-time management of coagulation in anticoagulated patients without the expensive laboratory testing requirements.

In addition to being portable, pointing to a small footprint of the device, ease of use, and provision of immediate results, the myriad benefits point towards a scenario where quick decisions are necessary-in intense care and surgical settings where time is of utmost value.

Today functionality aspect. with such POC devices is one of a number of factors pointed out by the uptake in this technology powered by developments in digital health, wearable devices, and telemedicine, making coagulation management more accessible and efficient. Portable, user-friendly POC testing solutions in line with evolving tendencies in healthcare-it is moving towards more emphasis on decentralized care, and therefore, such systems are a continued growing market trend.

Hospitals segment will dominate due to advanced treatment options and specialized care

Hospitals are the largest end-user group for hemostasis testing systems because the majority of bleeding disorders, surgeries, and trauma all need urgent coagulation monitoring. Hemostasis analyzers in hospitals enable preoperative screening, emergency bleeding management, and routine anticoagulant therapy patient monitoring.

The increasing occurrence of bleeding disorders, growing use of automated hemostasis analyzers, and expanding requirement for real-time coagulation monitoring in surgical and intensive care environments are driving market expansion.

North America and Europe lead in hospital-based hemostasis testing, while the Asia-Pacific region is experiencing rapid growth with growing healthcare investments into advanced diagnostic facilities. Future breakthroughs include AI-based coagulation risk models, linked hemostasis monitoring to ICU patient management systems, and bedside hemostasis analyzers for quicker decision-making.

Hemostasis testing laboratories is also a key segment as they provide rapid coagulation testing for complex bleeding disorders.

Referral hemostasis testing laboratories are increasingly becoming leading centers of care because they can provide comprehensive, high-throughput coagulation testing for complex bleeding disorders. The laboratories conduct comprehensive coagulation panels, genetic testing for inherited disorders, and specialized clotting factor assays to aid in correct diagnosis and treatment planning.

Emergence of the requirement for centralized high-accuracy coagulation diagnostic needs, growth in acquired and inherited bleeding disorder prevalence, and technology advancements for laboratory-based hemostasis tests are fueling market growth.

North America and Europe dominate lab-based hemostasis testing, whereas Asia-Pacific is experiencing development through growing ties between diagnostic businesses and healthcare institutions. Emerging trends involve artificial intelligence-based automated coagulation laboratory systems, cloud-based exchange of coagulation information for teleconsultation, and next-generation hemostasis biomarker panels for enhanced disease stratification.

Hemostasis testing systems market is highly competitive owing to the growing prevalence of bleeding disorders, emerging advancements in technology of coagulation testing, and growth in point-of-care diagnostic requirements. The investments in high-sensitivity hemostasis analyzers, automated coagulation testing systems, and data analysis software integrated with artificial intelligence are being placed by companies in order to be competitive.

The market is influenced by established diagnostic companies, medical device manufacturers, and nascent biotech innovators that contribute to the dynamic future of hemostasis testing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic | 22-26% |

| Siemens Healthcare GmbH | 18-22% |

| Abbott | 10-14% |

| Roche Diagnostics Limited | 8-12% |

| Nihon Kohden Corporation | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic | Medtronic offers advanced hemostasis testing systems, including point-of-care coagulation monitors. Their devices enable real-time, accurate testing for bleeding disorders and anticoagulation management, supporting critical care environments with efficient, automated solutions for improved patient outcomes |

| Siemens Healthcare GmbH | Siemens Healthcare provides a wide range of automated hemostasis analyzers for high-throughput coagulation testing. Their solutions offer precision, reliability, and efficiency, enabling rapid and accurate diagnostics for managing coagulation disorders in hospital and laboratory settings. |

| Abbott | Abbott offers a variety of coagulation testing solutions, including point-of-care devices and laboratory analyzers. These systems provide rapid, accurate results for anticoagulation therapy management, improving patient monitoring and enabling decentralized healthcare in both hospital and home settings. |

| Roche Diagnostics Limited | Roche Diagnostics specializes in automated hemostasis testing systems, offering accurate, high-quality coagulation analyzers. Their systems, paired with advanced reagents, support clinical decision-making, improving diagnosis and treatment of bleeding and thrombotic disorders in healthcare facilities. |

Key Company Insights

Medtronic

Medtronic is a market leader in the segment of hemostasis testing systems, with advanced devices for monitoring critical care coagulation. With a name for innovative point-of-care testing systems, Medtronic invests heavily in R&D to develop automated, user-friendly devices that yield accurate and rapid results for bleeding and thrombotic disorders.

Medtronic solutions are made available to hospitals, surgical facilities, and home care, which enables hemostasis management across the world. The company aims to expand its portfolio with a variety of bundled digital health solutions in the position as a leader of personalized coagulation testing markets.

Siemens Healthcare GmbH

Siemens Healthcare is one of the major manufacturers of full-automated coagulation analyzers for the high-throughput testing. Siemens still holds the front with its comprehensive and reliable systems, making the clinical laboratory process much simpler. Siemens has been the leading investor in R&D to advance its technology in the hemostasis testing area with a view to enhancing diagnostic performance and efficiency.

Siemens is advancing in technology with such fields like AI technologies and digital integration so as to find ways that can further optimize coagulation testing, institutionalizing the personalized practices and advancing towards decentralized health service.

Abbott

Abbott leads the point-of-care coagulation testing market by providing handy, portable AVANTIX cTnI immunoassay analyzers. They are small systems used to monitor patients for thromboembolic events. A patient can check it up at the general practitioner's office or in the emergency room and get results in 15-20 minutes.

High performance software ensures the scanner can be connected to a central IT system for direct access. The device thereby helps to increase patient compliance, as the patient needs little time. It is easy so that users don't have a high threshold against obtaining themselves tested.

Roche Diagnostics Limited

The Roche Diagnostics operate in the production of automated hemostasis testing system. Roche uses its highest quality hardware alongside reagents to manufacture feasible coagulation measurements. The systems are used widely in public hospitals and clinical laboratories.

Noticeably, the handling of hemorrhagic and thrombotic disorders is managed efficiently by these systems and reagents when coagulation is measured. With regard to research and technology, Roche is keeping a data cloud for the new generation sharing in the world of artificial intelligence to enable a first order approach in terms of high-level data inputs.

Nihon Kohden Corporation

Nihon Kohden is renowned for its advanced coagulation analyzers utilized in clinical and hospital environments. The firm is adept at delivering on-time and accurate results for coagulation testing in emergency and critical care environments.

Nihon Kohden's products are noted for having high reliability and ease of use to facilitate enhanced patient outcomes for the management of bleeding and thrombotic disease disorders. Helping to facilitate its establishment of a steady stream of innovation in its products and subsequent growth internationally, Nihon Kohden set its sights on expanding its presence in the fast-growing hemostasis testing market.

Other Key Players

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The global hemostasis testing systems industry is projected to witness CAGR of 5.4% between 2025 and 2035.

The global hemostasis testing systems market stood at USD 2,253.7 million in 2024.

The global hemostasis testing systems market is anticipated to reach USD 3,998.0 million by 2035 end.

China is expected to show a CAGR of 6.3% in the assessment period.

The key players operating in the global hemostasis testing systems industry are Medtronic, Siemens Healthcare GmbH, Abbott, Roche Diagnostics Limited, Nihon Kohden Corporation, Werfen, Haemonetics Corporation, Sysmex, Beckman Coulter, Inc., Grifols, S.A., GeTein BioMedical and others.

Laboratory analyzers, point-of-care testing systems and consumables

Hemophilia, von willerbrand disease, and acquired bleeding disease

Hospitals, academic institutions, diagnostic laboratories and others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.