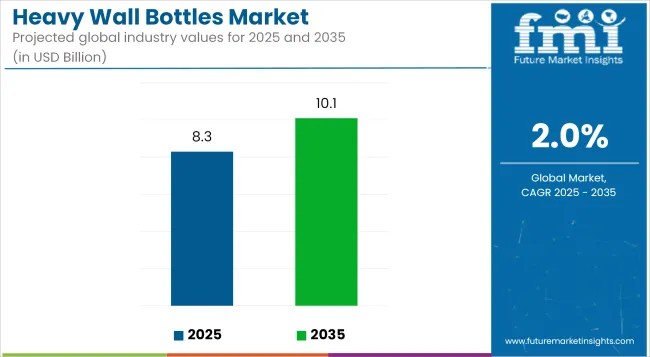

The heavy wall bottles market is projected to grow from USD 8.3 billion in 2025 to USD 10.1 billion by 2035, registering a CAGR of 2.0% during the forecast period. Sales in 2024 reached USD 7.5 billion, indicating a robust demand trajectory.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8.3 billion |

| Industry Value (2035F) | USD 10.1 billion |

| CAGR (2025 to 2035) | 2.0% |

This growth has been attributed to the increasing consumer preference for premium and durable packaging solutions across various industries, including cosmetics, pharmaceuticals, and food and beverages.

The rise in demand for aesthetically appealing and protective packaging has necessitated the adoption of heavy wall bottles that ensure product safety and enhance brand image. Additionally, innovations in sustainable materials and manufacturing processes have further propelled market growth, aligning with the growing emphasis on environmental responsibility among consumers and manufacturers alike.

In May 2025, Gerresheimer, an innovative systems and solutions provider and global partner for the pharma, biotech and cosmetics industries, has successfully completed an expansion and modernization project at its Lohr site.

“Our investments in cutting-edge production technology, such as the new facility in Lohr, secure the future,” explains Dietmar Siemssen, CEO of Gerresheimer AG. “With state-of-the-art facilities for high-value products, we are strengthening our competitiveness, securing long-term jobs in the region and making significant progress toward our ambitious sustainability goals.”

The heavy wall bottles sales is expected to witness robust growth, driven by increasing demand in the cosmetics, pharmaceuticals, and beverage sectors. Manufacturers focusing on sustainable and innovative solutions are anticipated to gain a competitive edge.

Emerging markets in Asia-Pacific and Latin America are projected to offer significant growth opportunities due to rising consumer awareness and industrialization. Strategic collaborations and investments in research and development are likely to foster product innovation and market expansion. As environmental concerns continue to influence consumer behavior, the adoption of eco-friendly heavy wall bottles is expected to become a key differentiator in the industry.

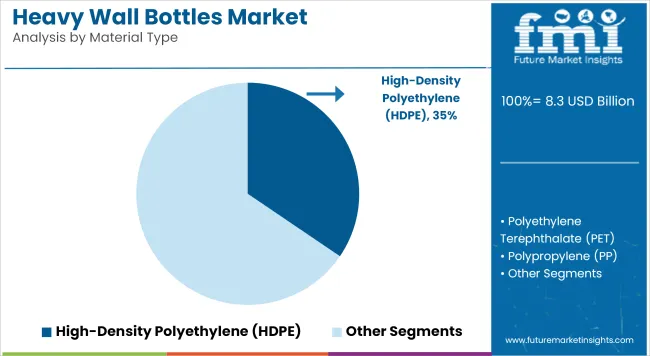

The market is segmented based on material type, size, end use, sales channel, and region. By material type, the market includes polyethylene terephthalate (PET), high-density polyethylene (HDPE), polypropylene (PP), glass, and acrylic. In terms of size, the market is categorized into 20&-30 ml, 50-80 ml, 80-120 ml, 120-150 ml, and 150-200 ml.

By end use, the market comprises cosmetics & personal care, pharmaceuticals & nutraceuticals, food & beverages, chemicals & industrial liquids, and luxury packaging. Based on sales channel, the market is segmented into hypermarkets/supermarkets, independent stores, specialty stores, multi-brand stores, online retailers, direct sales, and other sales channels. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

HDPE has been projected to account for 34.5% of the heavy wall bottles market by 2025 due to its superior strength, impact resistance, and excellent moisture barrier. It has been utilized extensively for packaging creams, shampoos, cleaning liquids, and pharmaceutical syrups.

The material has been favored for its compatibility with extrusion blow molding, which enables precise wall thickness and dimensional consistency. HDPE’s recyclability and cost-effectiveness have further increased its acceptance among manufacturers prioritizing durability and sustainability.

Customization in color, texture, and closure compatibility has been supported effectively by HDPE, allowing brands to maintain identity without compromising performance. Surface treatment options have also been explored to enhance label adhesion and printability.

Global regulations for food contact and pharmaceutical packaging have been met by medical-grade HDPE variants, enabling its use in critical packaging formats. The material has continued to be deployed across both high- and low-volume production cycles with consistent reliability.

The cosmetics and personal care industry has been estimated to contribute 38.1% to the global heavy wall bottles market in 2025, led by demand for premium packaging across skincare, haircare, and fragrance categories. These bottles have been chosen for their visual appeal, ergonomic design, and product protection qualities.

Luxury brands have adopted thick-walled bottles to convey product richness and improve shelf impact in competitive beauty retail environments. Compatibility with droppers, pumps, and dispensing closures has enhanced consumer convenience and product dosing accuracy.

Sustainability trends have encouraged the use of refillable and recyclable heavy wall designs, particularly in prestige skincare and clean beauty ranges. PET and HDPE have been coated or treated to simulate glass while preserving functionality and safety. Global expansion of cosmetic brands and the rise of e-commerce platforms have accelerated demand for durable and visually distinct packaging. Heavy wall bottles have been favored for their resistance to deformation during shipping and ability to maintain product quality under varied environmental conditions.

High production costs and recycling difficulties

Challenges in the heavy wall bottles market include high production costs of thick-walled bottle fabrication as well as difficulties in recycling caused by material density. Though the moulds used to make these bottles needs to be tougher, cooling times are longer and they are manufactured using specific techniques to ensure uniform wall thickness and durability used in pharmaceuticals, cosmetics and speciality chemicals.

They're also less economical, as the increased raw material usage means a higher price tag compared to standard bottles. Thick plastic and glass bottles face challenges in being recycled because of the greater energy requirement to reprocess them and their limited acceptance in traditional recycling streams.

Demand for premium packaging and sustainable alternatives

The increase in demand for high-durability premium packaging solutions are driving the heavy wall bottles market. Heavy wall bottles are favoured in product categories like luxury cosmetics, high-end pharmaceuticals, and specialty food packaging due to their high-quality feel, durability, and ultimate protection for the product inside.

The wide range of advanced eco-friendly material formulations, including biodegradable resins and lightweight reinforced glass that is at the same time, non-permeable, offers sustainable alternatives to heavier wall packaging. Innovation in refillable and reusable packaging solutions is also driving growth among circular economy initiatives, making it a win for brands to use high quality, long-lasting heavy wall bottles that contribute towards sustainability goals.

Growing demand across the cosmetics, pharmaceuticals, and personal care industries and the growing investment in the heavy wall brands are projected to be the primary drivers sustaining growth in the heavy wall bottles market in the United States. Luxury packaging applications are increasingly featuring heavy wall bottles, which are more durable, have a premium aesthetic and are less prone to breakage.

The increasing beauty and skincare industry, along with the rising demand for sustainable and premium packaging solutions, is driving the heavy wall PET and glass bottles market. Pharmaceutical industries also require chemically resistant and tamper-proof containers for commercial reasons, which actively fuels market growth.

The growth of direct-to-consumer (DTC) brands and e-commerce platforms has created a new challenge for these brands, namely the need for durable packaging to ensure product integrity during transit.

| Country | CAGR (2025 to 2035) |

|---|---|

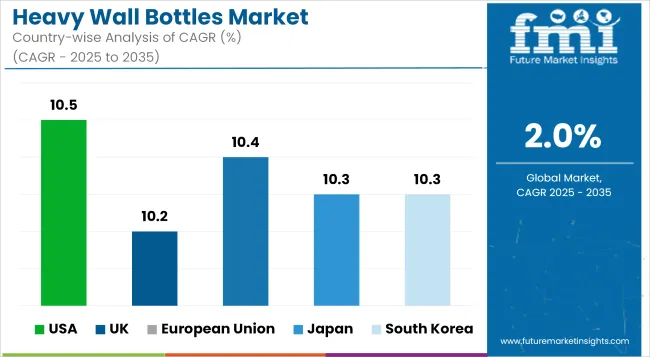

| USA | 10.5% |

The UK heavy wall bottles market is fuelled by a rise in the demand for luxury packaging in cosmetics, personal care, and specialty beverages. Luxury botellones tend to be thicker walled, which many luxury skin and fragrance brands prefer for their upscale look and protective qualities.

Sustainability trends in the marketplace are also driving the market, with brands looking for recyclable, reusable and eco-friendly materials. Glass and PET heavy wall bottle trends are becoming more common as the UK’s plastic packaging regulations drive manufacturers to lift the quality of lightweight, refillable bottle solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.2% |

Demand for luxury packaging for cosmetics, pharmaceuticals, and beverages are fuelling the growth of the EU heavy wall bottles market. Markets are mainly concentrated in France, Germany, and Italy where high consumer demand for premium skincare, perfumes, and nutraceuticals drives the industry.

The EU’s strict sustainability regulations have led to brands using recyclable and bio-based materials when it comes to packaging. Also, improvements in glass moulding and PET manufacturing technology allow for lightweight but durable heavy wall bottles. The concept of refillable and reusable packaging has also expanded and further stimulates innovations in this segment.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 10.4% |

The heavy wall bottles market for cosmetics and pharmaceuticals in Japan is becoming increasingly competitive, driven by demand for high-end cosmetics and drug packaging. Japanese brands tend to focus on minimalist but high-quality packaging designs, which leads to a lot of demand for thick-walled glass and PET bottles in skincare, wellness and high-end beverages.

The market is being shaped by a number of factors, including the growth of Japan’s beauty and nutraceutical sectors, and a growing focus on sustainable and refillable packaging solutions. Moreover, the rising trends of precision moulding and lightweight glass manufacturing provide an impetus to attract the luxury heavy wall bottle specifications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.3% |

The South Korean heavy wall bottles market is somewhat nascent and is growing at a healthy pace with the renovation of K-beauty products & growing requirement for premium personal care products. High wall PET and glass containers are widely used for premium cosmetic brands and herbal health supplements as South Korea focuses heavily on innovative and sustainable packaging.

The company's low-Carbon heavy wall containers are also becoming recyclable with the projections of the target from eco-friendly and refillable packaging are pushing it towards South Korea's environmental regulations. As the e-commerce market and overseas K-beauty exports grow, more and more demand is still remaining for packaging that is both shock-resistant and aesthetically pleasing, so packaging manufacturers are trying to rely on those factors and make packaging that satisfies customers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.3% |

The heavy wall bottles market operates as a competitive field which serves pharmaceutical and cosmetic sectors and food & beverage and chemicals industries because it provides lasting protective solutions. Heavy wall bottles establish three essential traits through their design because they deliver maximum strength alongside stability along with superior protective capabilities suitable for liquids with high value alongside essential oils and serums and laboratory chemicals.

Leading companies in the market emphasize both premium quality polymer and glass materials together with sustainable packaging developments and regulatory-compliant solutions that serve various industrial requirements. Professional bottle manufacturing along with customized packaging solutions and specialized bottle development form the core group of contributors to this market segment.

Other Key Players

The overall market size for the heavy wall bottles market was USD 8.3 billion in 2025.

The heavy wall bottles market is expected to reach USD 10.1 billion in 2035.

The increasing demand for premium packaging solutions, rising adoption in the cosmetics and personal care industries, and growing preference for sustainable and durable packaging materials fuel the heavy wall bottles market during the forecast period.

The top 5 countries driving the development of the heavy wall bottles market are the USA, UK, European Union, Japan, and South Korea.

50-80ml bottles and face care segments lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Heavy Haul Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heavy Commercial Vehicle Eps Market Size and Share Forecast Outlook 2025 to 2035

Heavyweight Motorcycles Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Oil Cracking Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Heavy Duty Vacuum Bottle Market Trends – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA