The heavy-duty paper tags market is witnessing stable growth due to rising demand for durable, eco-friendly, and economical options for labeling across industries ranging from logistics to retail, automotive, manufacturing, and industrial packaging.

These heavy-duty paper tags are considered the best labelling solution for commodities exposed to adverse environmental conditions because of their high tear resistance, water-resistant coating, and high printability. The growth of this market is projected for the coming decades with advancements in the integration of biodegradable materials, RFID for tracking, and AI-powered inventory management systems.

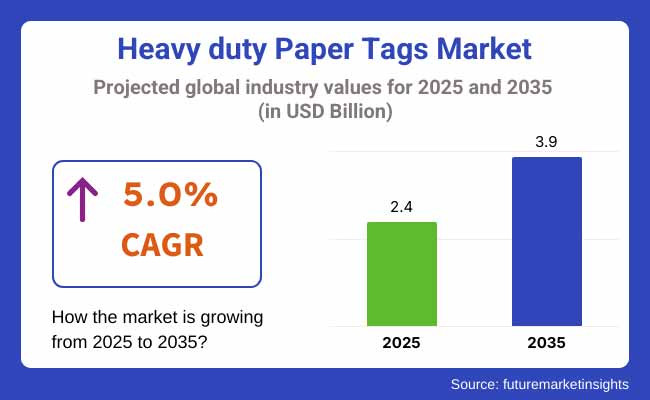

The heavy-duty paper tags market is estimated to be valued at USD 2.4 Billion in 2025, growing at a CAGR of 5.0% from 2025 onward to reach USD 3.9 Billion by 2035.

Factors driving this growth include increased acceptance of smart labeling solutions, stringent regulations on plastic-based tags, and rising demand for traceability in supply chains. Also, the growth of weatherproof coatings, AI-based solutions for logistics, and sustainable technologies for printing are enhancing adoption in this market.

Further market expansion is fostered by an increasing focus on sustainable packaging, waste reduction strategies, and government policies, which encourage the recyclable alternatives to plastic and synthetic tags. In addition, the increasing preference for strong, economical, and RFID-enabled paper tags along with developments in tamper-evident and moisture-resistant materials can only add to their functionality and to broaden the scope for their applications.

Asia-Pacific is counted among the major areas to be driving heavy-duty paper tags market in future through rapid growth of industries, increased trade activities, and higher acceptance of sustainable labeling solutions in countries like China, India, and Japan as they witness increasing market demand for strong durable paper tags in logistic, e-commerce and supply chain management systems.

Other mechanisms that propel market growth include advancements in generating cost-effective tags, automating printing technologies, investing more into sustainable alternatives, and other government initiatives such as promoting biodegradable packaging materials and abolishing plasticbased labels. In addition, increasing presence of global logistics companies and retail giants in Asia-Pacific further encourages local production and innovations in product development.

North America is one of the prominent markets for heavy-duty paper tags. Demand is on the stronger side from retail, manufacturing, automotive, and industrial packing. Innovations in this regard for the region would include those of the United States and Canada in RFID-enabled tracking, AI-related supply chain management, and high-strength water-resistant paper tags.

The trend towards sustainable and reusable labeling solutions, encouraged by regulatory great progresses in policies on the reduction of plastic waste, extended producer responsibility (EPR), and traceability in supply chain operations, is driving the market forward.

The increasing investment in research and development in areas of tamper-proof, moisture-resistant, and AI-integrated tracking tags should further propel growth. Adoption of intelligent labeling solutions with real-time tracking, blockchain-integrated digital authentication features forward being popular to drive improvements in operational efficiency and product security.

The heavy-duty paper tags market in Europe is large due to stringent environmental regulations, growing demand for sustainable labeling solutions, and a rapid boom in the e-commerce and logistics sectors. Eco-friendly innovations in tags, RFID-based tracking solutions, and highly durable paper composites are currently led by some of the largest economies in Europe: Germany, France, and the UK.

The EU's policies translate into reducing single-use plastic consumption, improving recyclability standards, and enhancing traceability in supply chains all of which are largely driving demand for heavy-duty paper tags across Europe. The demand for premium-quality paper tags that are tear-resistant, moisture-proof, well-readable by barcodes, and feature anti-counterfeit solutions is driving the expansion of this market.

This region is also witnessing good collaboration between logistics companies, retail chains, and sustainability bodies toward the next generation of heavy-duty paper tags with high durability, efficiency, and environmental benefits. The innovations of the market will be based on AI-enabled logistics automation, water-resistant coatings, and blockchain-based authentication systems.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Early focus on recyclability and reducing plastic-based labels. |

| Material and Formulation Innovations | Development of weather-resistant and tear-proof paper tags. |

| Industry Adoption | Widely used in retail, e-commerce, and inventory management. |

| Market Competition | Dominated by traditional paper tag manufacturers. |

| Market Growth Drivers | Growth fueled by demand for eco-friendly and cost-effective labeling. |

| Sustainability and Environmental Impact | Early adoption of recycled fiber-based paper tags. |

| Integration of AI and Process Optimization | Limited AI use in label tracking and inventory management. |

| Advancements in Tagging Technology | Basic improvements in durable printing and tamper-proof designs. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global mandates on fully recyclable, biodegradable, and RFID-integrated paper tags. |

| Material and Formulation Innovations | Expansion of AI-enhanced, self-tracking, and tamper-proof paper tags with smart tracking features. |

| Industry Adoption | Increased adoption in pharmaceuticals, heavy machinery, and automated logistics tracking. |

| Market Competition | Rise of sustainability-driven startups and AI-powered logistics firms integrating digital tracking solutions. |

| Market Growth Drivers | Market expansion driven by circular economy initiatives, AI integration, and fully automated tracking systems. |

| Sustainability and Environmental Impact | Large-scale transition to carbon-neutral, water-resistant, and compostable heavy-duty paper tags. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated defect detection, and real-time shipment monitoring innovations. |

| Advancements in Tagging Technology | Development of smart labels with QR codes, RFID tracking, and digital authentication features. |

Heavy-duty paper tag demand has been increasing in the USA in logistics, retail, industrial labeling, and asset tracking applications. Hence manufacturers are now focusing on producing weather-resistant and tear-proof paper tags equipped with RFID smart tagging, thereby improving inventory control and product identification. Governments now encourage the industries to switch to non-plastic and biodegradable alternatives, which is a shift toward using more recyclable and eco-friendly materials in tags. Besides, improvements on water-resistant coatings, thoroughly tamper-proof adhesives as well as UV protected printing technologies are helping to improve functionality and longevity of these heavy-duty paper tags.

This all signals a growing market in the USA taken into consideration the focus on intelligent inventory management, product authentication, and secure labeling. Developments in anti-microbial paper coatings will raise the bar on hygiene standards in the healthcare environment as well as food applications in labeling. Growth in artificial intelligence, adapted into tracking, along with integrated data analytics, will enhance monitoring of inventories while reducing human errors. Custom-made heavy-duty paper tags inscribed with QR codes engraved by lasers are on the rise in terms of usage by corporates in tracking high-security assets.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

According to the needs of the industry, UK heavy-duty paper tags are brightening with the concept of providing solutions for sustainable labels complying with stringent environmental regulations. The gradual acceptance of high-strength paper tags among retail, e-commerce, and logistics and industrial applications is redefining the market. The growing need for heavy-duty tags that are tear-resistant, waterproof, and customizable is now receiving the attention of manufacturers, especially for outdoor and warehousing applications. QR codes, NFC-enabled smart tags, and security holograms are complementarily used to assist with tracking, authentication, and branding.

This entire business of eco-friendly heavy-duty paper tags is fueled by government initiatives proposing plastic-free labeling and sustainable supply chains. Also, manufacturers are working on high-durability coatings, anti-fade print technologies for tagging, and biodegradable adhesives for tags to improve the performance of eco-friendly heavy-duty paper tags and compliance with international regulations. Furthermore, RFID-enabled paper tags are rapidly improving supply chain operations and accuracy in real-time tracking. Features that are tamper-evident secure tagging of high-value products. Companies are also researching hybrid paper-plastic composites to achieve a balance between durability and sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.1% |

Growth in the heavy-duty paper labels market of Japan is characterized by precision engineering, high-standard printing, and innovative technologies applicable in labeling solutions. Quality is paramount in Japan, with special emphasis on efficiency, thus spurring the development of RFID-enabled ultra-heavy-duty paper and tamper-proof tags for industrial and retail applications. Rising demand for smart inventory tracking and counterfeiting solutions is leading Japanese manufacturers to invest in hybrid paper tags with conductive inks, security watermarks, and thermal printing capabilities.

Besides, the increasing levels of automated activity in logistics and warehouse management have spurred innovations in weather-proof, heat-resistant, and ultra-high-tensile-strength paper tags. The automation of AI for defect detection and automated tag production increases operational efficiency and cuts down on material waste in Japan. Meanwhile, the issue of sustainability and biodegradability concerning paper tags is being tackled with further innovations. Heat-sensitive paper tags and UV-reactive tags are also under development for high-security applications. Lastly, enhancements to the durability and anti-counterfeiting strength of the tags are being made with the introduction of new designs for tamper-proof adhesive coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

Sustainable, high-performance, and digitally integrated labeling solutions are being increasingly demanded in logistics, electronics, and consumer goods industries. Thus, heavy-duty paper tags are experiencing a growth market in South Korea. In the country, a strong manufacturing base and an economy driven by exports have fueled innovations in RFID paper tags, water-resistant labels, and anti-tamper tagging systems.

The government has been supporting eco-friendly materials, plastic-free labeling, and smart packaging, thereby further accelerating transformational changes in these industries. Businesses are also melding AI-tracking solutions, blockchain-based authentication, and real-time supply chain visibility into heavy-duty paper tag production. Lightweight, recyclable, and multi-layered security tags for asset tracking, shipment monitoring, and product labels are also boosting the market in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

The weather-resistant, RFID-enabled, and tamper-proof tag segments are actively driving market growth as industries seek durable, lightweight, and eco-friendly solutions for product tracking and identification. Manufacturers are enhancing tag strength, adhesive durability, and security features to meet evolving industry needs.

Weather-Resistant Paper Tags Strengthen Market Expansion

Heavy-duty paper tags that are resistant to weather conditions remain the most favored, as industries are seeking stable options of moisture-proof and tear-resistant labeling material for their applications. Paper tags with laminated, reinforced, and polymer-coated structures are being manufactured for better durability under adverse conditions.

On the other hand, additional research in water-based protective coatings, fade-resistant inks, and tag fibers with high tensile strength is pushing innovation in this segment. And biodegradable weatherproof tags are further being looked into by companies regarding sustainability initiatives and circular economy.

RFID-Enabled Paper Tags Gain Momentum with Smart Tracking Solutions

The paper tag segment with RFID is seeing major growth as enterprises strive to attain better supply chain visibility, automate their inventory, and provide anti-theft solutions. There is a lot of investment flowing into ultra-thin RFID inlays, smart tags compatible with NFC, and imbedded chips that will enhance real-time monitoring and data integration. Moreover, innovations will be driven by advances in printable RFID antennas, environmentally friendly conductive inks, and encrypted tag data storage. The market penetration for RFID-enabled paper tags is also increasing with their growing acceptance in warehouse management, retail operations, and logistics tracking.

Tamper-Proof Heavy-Duty Tags Expand Adoption with Secure Labeling and Authentication Features

The utilitarian approach toward heavy-duty perfumed paper tags is due to the rising inclination towards high-security labeling materials from industry standards. Manufacturers have invested strenuous thought over improved potential to counteract forgery and unwanted tampering by focusing on multilayer designs, holographic seals, and destructible adhesive coatings.

AI-based engineering of materials is helping bend design and application possibilities in favor of tamper-evident tags in the industrial, retail, and government settings. Businesses are also exploring the avenues of chemically resistant, anti-forgery, high-temperature stable tamper-evident paper tags in increasing product authentication and regulatory compliance.

The research is advancing in reinforced paper fibers, digital tracking enhancements, and AI-enhanced tagging solutions for improved performance, security, sustainability-now even in high-end paper labels. Smart tags with sensors for temperature monitoring, impact detection, and authentication verification are gaining popularity among diverse industries. AI-driven supply chain optimization is also getting production efficiencies and waste reductions in the tag manufacturing process.

With the industries coming forward for newer advanced, greener, and digitally integrated solutions for labeling, the heavy-duty paper tags market will see gradual growth. Future advancements that may transform the market include material science advances, smart tracking, and more conscious design. Ultimately, heavy-duty paper tags will be an essential ingredient in asset tracking, logistics needs, retail security, and industrial applications.

Heavy-duty paper tags are gaining importance in the market, primarily due to the rising requirement for reliable, eco-friendly, and high-performing labeling solutions by industries such as logistics, retail, automotive, and manufacturing. These tags offer extreme resistance to wear and tear and to moisture as well as harsh environmental conditions, making them highly suited for applications where long-term identification and tracking is critical.

Sustainability issues and regulatory requirements are driving manufacturers to use recycled materials and biodegradable coatings for the application of heavy-duty paper tags to reduce their environmental impact and maintain strength and reliability.

The demand for heavy-duty paper tags is growing across industries because of durability, sustainability trends, and customization possibilities. High-strength materials give the tags longevity in industrial and outdoor applications. Companies are looking for more eco-friendly options than plastic-based tags. Advanced printing technologies allow barcode integration, RFID tagging, and tamper-proof designs, making these tags more valuable in different industries.

With international regulation focusing on sustainable packaging and labeling materials, the use of heavy-duty paper tags is growing. Industry players are enhancing water-resistant coatings that resist print degradation in harsh environments. RFID tags for real-time tracking of inventory and enhanced supply chain visibility are trending. Recyclable and compostable materials are also meeting eco-friendly standards.

Heavy-duty paper tags market is very competitive, with top players investing in material science, printing technology, and smart labelling technologies. Firms are combining RFID and QR code solutions to improve traceability, while technological advancements and developments in synthetic and hybrid paper tags are further stimulating market growth.

Strategic alliances among paper producers, print companies, and logistics providers are driving innovation and expanding market reach.

Also, intelligent labeling solutions that feature UV-resistant inks as well as NFC-enabled authentication tags are becoming increasingly popular for high-security use in logistics and asset management.

The advent of AI-based printing systems is simplifying the personalization of heavy-duty paper tags for different industrial uses. More investment in supply chain digitalization is also driving the use of smart tracking labels. Holographic security-laminated, customizable heavy-duty paper tags are increasingly being used in anti-counterfeiting initiatives.

Businesses are increasing production volumes to keep pace with rising demand for application-specific and specialized paper tags. Availability of heat-resistant and chemical-proof paper tags is making them more applicable to extreme environments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Avery Dennison | 12-16% |

| UPM Raflatac | 10-14% |

| Brady Corporation | 8-12% |

| 3M Company | 6-10% |

| CCL Industries | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Avery Dennison | Develops sustainable and RFID-enabled heavy-duty paper tags for industrial and retail applications. |

| UPM Raflatac | Focuses on eco-friendly labeling solutions with high durability and moisture resistance. |

| Brady Corporation | Specializes in industrial-grade paper tags with enhanced barcode and tamper-resistant features. |

| 3M Company | Innovates in high-strength, weatherproof paper tags for logistics and manufacturing sectors. |

| CCL Industries | Expands its portfolio with water-resistant and customizable industrial tags for supply chain management. |

Key Company Insights

Other Key Players (45-55% Combined)

Several specialty tag manufacturers contribute to the growing heavy-duty paper tags market, including:

The overall market size for the Heavy Duty Paper Tags Market was USD 2.4 Billion in 2025.

The Heavy Duty Paper Tags Market is expected to reach USD 3.9 Billion in 2035.

The market will be driven by increasing demand for durable labeling solutions, sustainability regulations, and the integration of smart tracking technologies like RFID and barcodes.

Key challenges include high material costs, competition from synthetic alternatives, and the need for advanced printing technologies. However, growing demand for sustainable and high-performance tags is driving continued innovation.

North America and Europe are expected to dominate due to strong industrial demand and sustainability mandates, while Asia-Pacific is experiencing rapid growth driven by expanding logistics and retail sectors.

Table 01: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 02: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 03: Global Market Value (US$ Million) Forecast by Tag Type, 2018 to 2033

Table 04: Global Market Volume (Units) Forecast by Tag Type, 2018 to 2033

Table 05: Global Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 06: Global Market Volume (Units) Forecast by Printing Technology, 2018 to 2033

Table 07: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 08: Global Market Volume (Units) Forecast by End-use, 2018 to 2033

Table 09: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Tag Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Tag Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Printing Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Tag Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Tag Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Printing Technology, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Tag Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Tag Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Printing Technology, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End-use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Tag Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Tag Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Printing Technology, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End-use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Tag Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Tag Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Printing Technology, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End-use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Tag Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Tag Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Printing Technology, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End-use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Tag Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Tag Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Printing Technology, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Printing Technology, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End-use, 2018 to 2033

Figure 01: Global Market Value (US$ Million) by Tag Type, 2023 to 2033

Figure 02: Global Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 03: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 04: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 05: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 06: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 07: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 08: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 09: Global Market Value (US$ Million) Analysis by Tag Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Tag Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Tag Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Tag Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Printing Technology, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 21: Global Market Attractiveness by Tag Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Printing Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by End-use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Tag Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Tag Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Tag Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Tag Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Tag Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Printing Technology, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 45: North America Market Attractiveness by Tag Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Printing Technology, 2023 to 2033

Figure 47: North America Market Attractiveness by End-use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Tag Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Tag Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Tag Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Tag Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Tag Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Printing Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Tag Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Printing Technology, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Tag Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Tag Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Tag Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Tag Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Tag Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Printing Technology, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End-use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Tag Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Printing Technology, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Tag Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Tag Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Tag Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Tag Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Tag Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Printing Technology, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End-use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Tag Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Printing Technology, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Tag Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Tag Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Tag Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tag Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tag Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Printing Technology, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End-use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Tag Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Printing Technology, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Tag Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Tag Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Tag Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Tag Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Tag Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Printing Technology, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End-use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Tag Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Printing Technology, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Tag Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Printing Technology, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Tag Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Tag Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Tag Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tag Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Printing Technology, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Printing Technology, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Printing Technology, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Printing Technology, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End-use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Tag Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Printing Technology, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Heavy Haul Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heavy Commercial Vehicle Eps Market Size and Share Forecast Outlook 2025 to 2035

Heavyweight Motorcycles Market Size and Share Forecast Outlook 2025 to 2035

Heavy Oil Cracking Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Vacuum Bottle Market Trends – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA