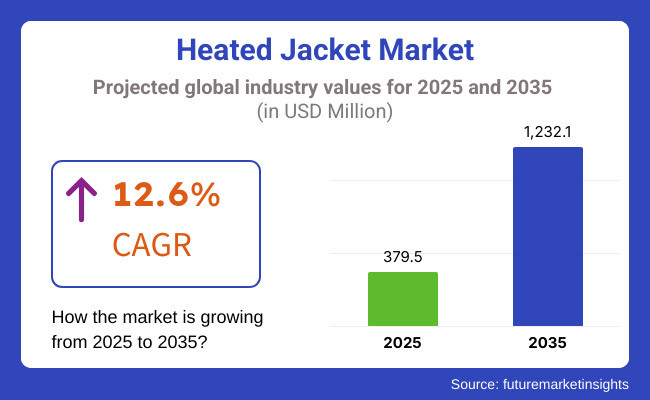

The global heated jacket market is poised for substantial expansion, increasing from USD 379.5 million in 2025 to USD 1,232.1 million by 2035. The market is expected to grow at a CAGR of 12.6% from 2025 to 2035.

Heated jackets gain traction worldwide because they offer warmth and comfort efficiently in really cold harsh winter conditions. Market growth surges rapidly nowadays due to rising consumer demand for innovative winter wear solutions offering functionality and style. Heated jackets serve diverse individuals like outdoor aficionados and workers in harsh environments seeking cutting-edge thermal garments daily.

Rapidly increasing awareness of battery-powered heating technology fuels market growth alongside innovations in super lightweight materials. Heated jackets provide pretty consistent warmth nowadays without the bulk of old-school winter gear. Advanced innovations like advanced battery efficiency and clever temperature controls fuel the adoption of heated jackets prompting sustained market expansion.

E-commerce platforms drive demand for heated jackets with easy access via numerous online brand outlets daily. Online marketplace facilitates rapid expansion making heated jackets more accessible for outdoor enthusiasts workers and casual users overall somehow. Heated jacket market witnesses rapid growth fueled by demand from consumers seeking innovative energy-efficient winter wear very quickly nowadays. Sustainability being key nowadays battery-powered heated jackets offer eco-friendly option reducing reliance on bulky layering.

Advanced heating systems coupled with meticulous product evaluation guarantee heated jackets provide remarkably steady results under various conditions meeting modern consumers' expectations. Evolving work environments and recreational settings rapidly drive demand for highly functional winter gear thus accelerating market growth significantly.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the heated jacket industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 11.3% |

| H2 (2024 to 2034) | 13.5% |

| H1 (2025 to 2035) | 14.0% |

| H2 (2025 to 2035) | 11.2% |

The CAGR exhibits a fluctuating trend, initially increasing by 124 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. However, a slight increase of 140 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external constraints. Growth rebounds in H2 (2025 to 2035) with a 112 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

Rising Demand for Advanced and Energy-Efficient Heated Apparel Fuels Heated Jacket Market Growth

Global heated jacket market expands rapidly owing to rising demand for energy-efficient winter wear solutions nationwide very quickly every day. Heated jackets offer a cost-effective solution for individuals seeking reliable warmth without excessive layering. The growing need for high-performance cold-weather gear, especially among outdoor workers, adventure enthusiasts, and urban commuters, is driving market adoption.

Heated jackets significantly reduce dependence on disposable solutions for warmth thereby boosting demand rapidly. Sophisticated jackets feature cutting-edge heating elements powered by batteries and clever temperature controls that provide comfort over extended periods making them pretty appealing. Heated jackets' affordability and durability significantly contribute to their rising popularity over time.

Growing Shift Toward Smart and Functional Winter Wear Propels Market Expansion

Heated jackets gain widespread acceptance among consumers due to growing demand for clothing that serves multiple purposes and boasts cutting-edge technology. Demand for smart clothing propels market growth rapidly in regions with harsh winters somehow. Consumers prioritize apparel integrating seamlessly with their lifestyles through jackets offering adjustable heating via USB charging and weather resistant features.

These jackets incorporate superlight materials enhancing insulation properties beneath multiple layers for optimum breathability. Sustainability gains prominence slowly over time manufacturers incorporate eco-friendly textiles and rechargeable battery systems in weird ways aligning roughly with global sustainable fashion trends. Rapidly growing demand for smart apparel fuels heated jacket market expansion across diverse age groups at incredible rates now.

E-Commerce Platforms and Online Marketplaces Drive Sales of Heated Jackets

E-commerce platforms rapidly rising has significantly boosted sales of heated jackets online lately. Digital platforms offer shoppers a plethora of brands and styles with cutting-edge features nearby allowing easy product comparisons somehow. Reviews facilitate informed purchasing decisions through transparent pricing thereby boosting market presence significantly every day.

Digital shopping offers numerous benefits and direct consumer strategies make heated jackets more accessible globally nowadays. Promotions online bundled with seasonal discounts typically boost sales during winter months. Browsing technical specs online boosts consumer confidence pretty significantly in heated jacket purchases via detailed customer testimonials.

Technological Advancements in Heated Clothing Enhance Product Appeal

Innovations in battery technology, heating elements, and fabric integration have significantly enhanced the performance of heated jackets. Modern designs feature longer-lasting battery life faster heating times and customizable temperature settings making jackets way more efficient.

Advancements in flexible heating tech facilitate remarkably even heat distribution through cleverly designed smart temperature control features that allow users adjust warmth. Extended battery warranties coupled with improved safety mechanisms bolster consumer confidence somewhat in these products. Heated apparel sees frequent upgrades thereby making such jackets preferred by folks seeking warmth and comfort in pretty harsh winter conditions.

The global heated jacket market experienced strong growth between 2020 and 2024, expanding at an average annual rate of 11.5%. The market surged from USD 218.4 million in 2020 to USD 337.3 million by 2024, driven by increasing consumer demand for high-performance winter apparel. Heated jackets gained significant traction rapidly among outdoor enthusiasts workers in extremely cold conditions and everyday users seeking enhanced warmth.

Significant advancements in battery tech alongside smart heating solutions bolstered product appeal somehow. The COVID-19 pandemic had a profound impact on consumer preferences with people increasingly gravitating towards outdoor pursuits like hiking and winter sports. Expansion of e-commerce platforms greatly facilitated market growth through the provision of remarkably easy access to a pretty diverse range of heated apparel.

Looking ahead, the global heated jacket market is projected to witness accelerated growth from 2025 to 2035, reaching an estimated USD 1,232.1 million by 2035, with a projected CAGR of 12.6%.

Rising consumer preference for technologically advanced winter wear that's lightweight and energy-efficient will drive growth significantly upwards. Increasing awareness of sustainable and rechargeable heating solutions is expected to further boost market demand. Continuous improvements in battery life and heating efficiency enhance product reliability through material innovation somehow. Digital retail channels expanding rapidly alongside significant investment in smart apparel will likely fuel market growth at incredible rates soon.

Tier-1 Players dominate the global heated jacket market, holding a market share of approximately 35-40%. These companies leverage cutting-edge heating technology and premium materials alongside strong brand recognition maintaining a fairly significant presence. Their focus offers high-performance heated jackets with remarkably extended battery life and advanced insulation for outdoor pros and extreme athletes. Customers seeking reliability and innovation are really drawn deeply into products offering premium features daily. Notable Tier-1 players in the heated jacket market include Columbia, The North Face, and Milwaukee Tool.

Tier-2 Players capture around 30-35% of the market, targeting mid-range consumers, outdoor workers, and casual users seeking a balance of affordability and quality. These firms prioritize budget-friendly heating systems beneath rather rugged conditions. Their jackets frequently boast decent battery life and heating efficiency with noticeably fewer cutting-edge features than high-end brands. Frugal shoppers seeking warm winter gear with heat features make up main clientele for such brands. Notable Tier-2 players include Dewalt, ORORO, and Venustas, alongside various regional brands.

Tier-3 Players primarily serve niche markets, offering budget-friendly heated jackets for cost-conscious buyers. These companies operate regionally or through online platforms, capturing roughly 15-20% of the market share. They prioritize affordability with simplified heating elements shorter battery life and pretty basic insulation overall. Their products somehow appeal directly to users needing occasional heating functionality at relatively low cost. Notable Tier-3 players include PROSmart, TIDEWE, and several independent online retailers specializing in heated apparel.

| Countries | Population (millions) |

|---|---|

| United States | 345.4 |

| China | 1,419.3 |

| India | 1,450.9 |

| United Kingdom | 67.2 |

| Germany | 84.0 |

| Countries | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 12.50 |

| China | 9.20 |

| India | 6.50 |

| United Kingdom | 8.00 |

| Germany | 7.80 |

The USA heated jacket market, valued at USD 51.2 million, benefits from extremely strong consumer demand in freezing regions. Rise of winter sports hiking and outdoor work environments really fuels demand for incredibly durable heated apparel in cold climates daily. Bigger paychecks coupled with fondness for fancy outdoor equipment boost per capita spending significantly over time.

Canada's heated jacket market, valued at USD 8.3 million, experiences consistent demand due to its prolonged and harsh winters. Customers who work outside or engage in sports frequently buy heated clothing for added warmth during extremely cold weather conditions. High-quality heated jackets that boast impressive battery efficiency fuel market growth at relatively steady pace overall.

Germany’s heated jacket market, valued at USD 31.6 million, benefits from a strong focus on winter gear innovation and sustainability. Consumers generally favor heated jackets that boast energy efficiency longer battery life and pretty advanced insulation technology. Growing recognition of practical cold-weather gear across outdoor sports segments and workwear fuels market growth rapidly upwards now.

The UK’s heated jacket market, valued at USD 32.4 million, is driven by unpredictable winter conditions and increasing consumer interest in heated apparel for outdoor commuting. Demand runs extremely high particularly among sports enthusiasts and motorcyclists who work outdoors frequently. Sustainable and durable heated clothing options are gaining traction in the market.

China's heated jacket market valued at USD 43.9 million experiences rapid growth fueled by urbanization and rising outdoor recreation trends rapidly. Consumers seek pretty darn affordable heated clothing for everyday wear during freezing cold winter months. Local brands expand offerings rapidly beneath mounting pressure for reasonably priced heated jackets that perform exceptionally well outdoors.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.5% |

| Canada | 18.6% |

| UK | 12.2% |

| China | 11.1% |

| India | 12.3% |

The USA heated jacket market will likely grow rapidly at 8.5% CAGR from 2025 till 2035 driven by rising demand for sophisticated winter wear solutions in outdoor recreational pursuits and harsh industrial work settings. Consumers desperately seek efficient heating apparel for battling brutal cold temperatures thus boosting adoption of battery-powered heated jackets rapidly.

Smart clothing with temperature control and rechargeable batteries fuels rapid market growth somehow. Rise in winter sports participation fuels demand rapidly alongside need for protective gear in cold-weather industries like construction. E-commerce platforms substantially increase revenue through myriad styles and functionalities that appeal directly to diverse consumer groups somehow. Eco-aware buyers drive adoption of green heated jackets boasting robust designs and power-savvy heating elements that last remarkably longer.

The UK heated jacket market is anticipated to grow at a CAGR of 12.2% over the next decade, driven by the increasing demand for smart wearable technology and sustainable winter clothing. Eco-conscious shoppers seek heated jackets offering high performance and energy efficiency amidst wildly popular sustainable fashion movements. Growing preference for outdoor pursuits like hiking and trekking under harsh weather conditions fuels demand for super lightweight heated jackets somehow.

The rising cost of conventional winter clothing and the appeal of technologically advanced alternatives encourage consumers to opt for rechargeable heated jackets with customizable heating levels. Strong e-commerce channels significantly boost product availability thereby driving adoption rates upward extremely quickly online. Sustainable practices drive market expansion as firms incorporate recycled materials and biodegradable fabrics into their products rapidly.

India’s heated jacket market will likely expand rapidly at a CAGR of 12.3% from 2025 till 2035 fueled by increasing adoption of heated apparel in extremely cold regions and soaring disposable incomes. Harsh winters in northern states fuel a growing demand for cost-effective winter wear solutions that propels market growth rapidly upwards. People really appreciate ridiculously warm heated jackets nowadays especially when outdoors in harsh weather conditions for extended periods.

E-commerce platforms facilitate market growth pretty aggressively offering customers a plethora of products at really low prices. Multinational corporations swiftly flood India's market with fierce competition greatly boosting overall product quality. Rapidly growing awareness of energy-efficient clothing prompts individuals buying increasingly more battery-powered heated jackets heating really long periods. Rapid urbanization fuels demand for high-tech winter gear nationwide via massive shifts towards outdoor pursuits daily

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Battery-powered Heated Jackets | 9.8% |

The battery-powered heated jackets segment, in terms of product type, dominates the heated jacket market and is expected to witness substantial growth with a CAGR of 9.8% from 2025 to 2035. This growth is driven by the rising consumer demand for enhanced comfort and warmth in cold climates, particularly among outdoor enthusiasts, construction workers, and commuters. Rechargeable lithium-ion battery tech significantly boosts heated jacket efficiency and usability somewhat rapidly making them pretty popular among users. Affordability of battery-powered heated jackets draws many consumers like outdoor enthusiasts and factory workers needing reliable thermal insulation.

Additionally, advancements in smart heating technology, such as adjustable heat settings and Bluetooth-enabled controls, further boost the popularity of this segment. The rising focus on sustainable and energy-efficient winter wear also contributes to the growing demand for battery-powered heated jackets.

| Sales Channel | CAGR (2025 to 2035) |

|---|---|

| Online Retailers | 7.1% |

The online retailers segment dominates the heated jacket market in terms of sales channel and is expected to experience strong growth, with a market CAGR of 7.1% from 2025 to 2035. E-commerce platforms offer extensive product variety and competitive pricing which makes online retail a wildly popular purchasing channel for heated jackets nowadays. Consumers greatly benefit from easy comparisons and flexible return policies via online platforms for purchasing heated apparel. Digital marketplaces have depth with exclusive online discounts and seasonal promotions that effectively boost heated jacket sales online daily.

Brands leverage DTC models pretty extensively nowadays for enhanced customer engagement via super personalized shopping experiences daily. Social media marketing heavily influences consumer purchasing behavior online fueling growth of heated jacket sales via eccentric retailers

The global heated jacket market faces intense competition from key players like ORORO, Milwaukee Tool, DEWALT, and Bosch dominating the industry with unique offerings. ORORO utilizes pretty sophisticated heating tech thereby delivering remarkably long-lasting warmth and comfort through its top-notch heated jackets. Milwaukee Tool boasts incredibly durable heated jackets with robust battery-powered solutions for outdoor workers in harsh weather. Emerging brands like Ravean and Gobi Heat redefine market trends through innovative designs. Specialized heating solutions flooding market spaces rapidly gain traction amongst workers battling extreme cold.

Renowned brands now face stiff competition from these newcomers offering wonky yet effective heating solutions. Ravean offers ridiculously lightweight heated jackets featuring adjustable temperature controls that handle wildly different weather situations effortlessly. Gobi Heat offers ridiculously warm gear featuring super rapid heat somehow beneath ridiculously durable outer layers for winter thrill seekers. Brands prioritizing energy efficiency durability and user-friendly features in heated jackets experience fairly rapid substantial growth. Rising adoption of smart heating technologies rapidly positions industry leaders for market expansion alongside growing awareness of cold-weather safety

Recent Industry Developments in the Heated Jacket Market

January 2025: ORORO Introduces Smart Heated Jacket with App-Controlled Features

ORORO launched a new line of smart heated jackets, featuring app-controlled temperature adjustments and extended battery life. This initiative targets tech-savvy consumers and outdoor enthusiasts seeking customizable warmth solutions. The move reinforces ORORO’s commitment to innovation in heated apparel and strengthens its market position.

Milwaukee Tool enhanced its heated jackets with improved battery efficiency, enabling longer runtime and faster charging. This upgrade aligns with the brand’s focus on providing high-performance workwear for professionals operating in extreme weather conditions, boosting its appeal among construction and industrial workers.

DEWALT introduced a new line of rugged heated jackets designed for outdoor adventurers, law enforcement, and military personnel. These jackets feature reinforced materials, wind and water resistance, and multiple heat zones for optimal warmth distribution. The development caters to the growing demand for durable, high-performance heated apparel in challenging environments.

The global heated jacket industry is projected to witness a CAGR of 12.6% between 2025 and 2035.

The global heated jacket industry stood at USD 337.3 million in 2024.

The global heated jacket industry is anticipated to reach USD 1,232.1 million by 2035 end.

The East Asia region is set to record the highest CAGR of 7.6% in the assessment period.

The key players operating in the global heated jacket industry include ORORO, Milwaukee Tool, DEWALT, Bosch, and Venture H among others.

In terms of product type, the industry is divided into battery-powered heated jackets, USB-powered heated jackets, motorcycle heated jackets, and hybrid heated jackets.

The industry is further divided by a sales channel that are multi-brand stores, mono-brand stores, hypermarkets/supermarkets, online retailers, direct sales, and other sales channels.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

Korea Tennis Equipment Market Analysis - Size, Share, and Forecast 2025 to 2035

Leather Goods Market Outlook - Size, Share, and Growth 2025 to 2035

Asia Pacific Hats Market Analysis – Size, Share & Trends 2025 to 2035

The Bar Soap Market is segmented by material type, application, quality, and sub-region from 2025 to 2035.

Work Shoes Market Trends - Demand & Forecast 2025 to 2035

Wedge Boots Market Growth - Trends & Demand Forecast to 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.