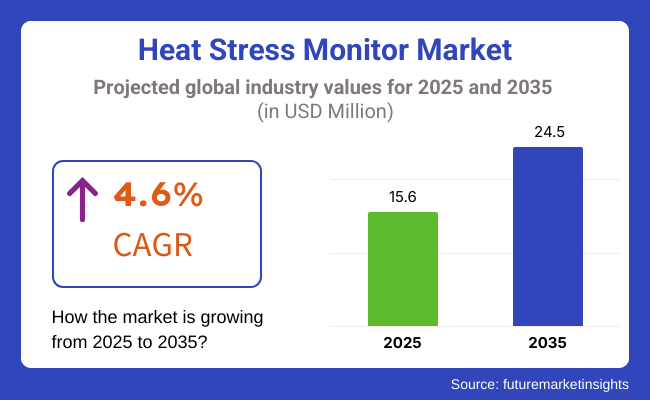

According to FMI projections, the market is set to expand from USD 15.6 million in 2025 to USD 24.5 million by 2035, with a CAGR of 4.6%. The initiatives promoted by the government aimed at occupational health standards plus the growing acceptance of real-time solutions for the monitoring of the environment are the key factors responsible for the market development. In the first line of industries, the management of workplace safety, legal compliance, and worker well-being are extremely prioritized, which causes a rise in the demand for solutions of monitoring the heat stress.

The systems are fundamentally tracking the environment that is present in the workspace and is conducive to the occupational health issues like heat stress, especially in the construction, oil and gas, manufacturing, and military applications, which are high-risk categories.

The ongoing impact of global warming and the introduction of new laws dealing with the industrial sector have placed the market on a better growth path. These developments have been of paramount importance in the direction of the companies that are looking forward to implementing the heat stress management solutions mainly for the assertion of better workers' safety.

The high price tied to the advanced heat stress monitor market is one of the biggest predicaments that the market is dealing with. The return on investment budget for the smaller firms, which is their investment in real-time tracking and predictive analytics features, is the root cause of their integration ineffectiveness. Moreover, lack of awareness in developing areas is another impediment that deters widespread adoption, as most of the organizations are oblivious to the risks concerning heat stress.

Maintenance and calibration issues are also hurdles; as proper calibration is required for accurate measures to be taken. Nevertheless, it has been observed that users in resource-challenged settings do not usually follow the prescribed practices, and this in turn affects the reliability and safety of the devices in the workplaces.

On the other hand, despite the barriers faced, there are many opportunities to develop the market, especially with the increase in funding for occupational health projects. Both state and non-governmental organizations have recognized the importance of the management of heat stress and this has resulted in the formulation of more stringent safety standards and the broader use of monitoring devices.

Furthermore, the creation of affordable and portable heat stress monitors provides more chances for these devices. Small and medium-sized enterprises, in their quest to get practical means of protecting their workers, especially lean and they are user-friendly, are the most likely to adopt wearable devices that are light in weight.

The field of technology is constantly changing, and thus the future could see highly sophisticated devices that are introduced to the market, result in a higher standard of health and safety in the global industries.

Explore FMI!

Book a free demo

Between 2020 and 2024, the heat stress monitor market grew due to rising concerns over workplace safety, climate change, and regulatory compliance. Industries such as construction, manufacturing, and agriculture adopted wearable and stationary heat stress monitors to protect workers from heat-related illnesses.

As sensor technology advanced, it enhanced real-time temperature, humidity, and physiological monitoring. Wireless communication facilitated remote tracking and data analysis. Governments and occupational safety agencies set stricter heat exposure standards, fueling demand. High prices and low awareness in the developing world stood in the way of its broad-based adoption.

Between 2025 and 2035, predictive analytics powered by AI, along with intelligent integration with IoT infrastructures, will transform heat stress monitoring. Real-time warning through wearable sensors will change according to personal risk levels. Blockchain will ensure data security and track compliance. Solar-powered and energy-saving models will help in the achievement of sustainability objectives, as global climate change policies will ensure mandatory adoption in high-risk sectors. Improved affordability and campaigns will lead to increased adoption in emerging markets.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| OSHA, NIOSH, and WHO strengthened the safety guides on heat stress. | Assisted compliance tracking by AI, real-time regulatory reporting, and Blockchain-secured safety record maintenance. |

| Wearable Heat Stress Monitors, Wet Bulb Globe Temperature (WBGT) sensors, and Internet of Things (IoT) devices for environmental monitoring. | Predictive analytics powered by AI, biometric wearables, and nanotechnology systems for heat stress detection. |

| Apparatus used in construction, manufacturing, agriculture, and military operations. | Extension of use cases into extreme sports, space expeditions, and climate-sensitive urban planning. |

| Cloud-connected heat stress monitors and automated WBGT meters. | AI-supported real-time biometrics tracking with self-powering wearable heat stress sensors and smart textiles. |

| High priced terror and poor awareness in developing regions. | Self-sustaining energy-efficient sensors, predictive-maintenance AI, and blockchain-empowered tracking of occupational health. |

| An IoT-based alert and early warning system for environmental monitoring has been developed. | AI forecasting heat stress risk, biometric data integration, and adaptive workplace climate conditioning. |

| The issues in the market were affordability and accessibility in the lower-income region. | AI-optimized supply chain management, decentralized manufacturing of heat-stress sensors, and logistics secured by blockchain. |

| The rising temperature worldwide, coupled with workplace safety regulations, increased adoption of IoT, contribute to the growth of this market. | Expansion initiated with real-time monitoring enhanced by AI, adoption of smart wearables, and next-generation tools for heat stress prevention. |

The cost of heat stress monitors varies widely based on type, technology and target market. Prices for handheld WBGT meters range from USD 150 to USD 500, with consumer-grade models resonant at the lower end and professional versions with greater calibration and logging functionality at the top. Stationary heat stress monitoring stations, intended for industrial and outdoor work environments, range from USD 2,000 to USD 10,000 in price, depending on sensor integration and real-time connectivity.

Wearable sensors for personal tracking range in price from USD 200 to USD 1,500, and military-hardened versions are even more expensive because of ruggedization and biometric capabilities. The systems (usually sites) are AI-powered IoT monitoring systems, ranging from USD 5,000 (suitable for small-scale monitoring and site-level predictive/performance analytic capabilities on a single site to workstation level) to USD 50,000 (optimized for large-scale site monitoring and IoT-linked predictive analytic capabilities - a cloud-level data analytic, perf analytic, etc.) per site, based on specific coverage per network and need.

Given that workplace safety regulations mandate compliance with safety standards for occupational health devices, the pricing for OSHA-compliant models is expected to exhibit a premium compared to non-certified versions where the end-users are cautious about high-accuracy devices.

| Aspect | Details |

|---|---|

| Wearable vs. Environmental Monitors | Wearable monitors lead personal heat stress tracking (e.g., Kenzen, CorTemp) and environmental monitors (e.g., Kestrel, TSI) address workplace and outdoor safety. |

| Real-Time IoT Monitoring vs. Traditional WBGT Sensors | While IoT-enabled monitors (such as SmartSense/BG) transmit real-time data, WBGT-based sensors (such as QUESTemp and Extech) derive WBGT by localized measurements. |

| Unique Selling Points of Market Leaders | Some of the high-end products offer smart differential sensor calibration, AI-based risk predictions and cloud interaction for monitoring on a larger scale. |

| Accuracy & Sensor Technology | High-end brands develop multi-sensor arrays for core body temperature, humidity and radiant heat to make the numbers more accurate. |

Handheld heat stress monitors with compact, accurate, real time ambient data generation have gained significant popularity. These systems track things like temperature, humidity, and Wet Bulb Globe Temperature (WBGT), which assist safety officers to fulfill workplace safety regulations and mitigate the possibilities of exposure to high warmth. Exoskeleton applications are popular in construction, manufacturing, oil and gas, agriculture and firefighting sectors with an emphasis on worker health and injury prevention.

Portable heat stress monitors are now gaining popularity in industries and work environment where it is stated to provide portability, practical and efficient usages, as it occupies a very small spatial envelope while operates intuitively and provides real time environment temperature readings. Dynamic working environments can become Türkiye (i̇n the middle of the 2021-a tamar, which means force), and most smart and interactive devices are of great help to workers who are experiencing adjustments.

Typically designed to be portable, such monitors can be equipped with an array of sensors to take measurements for air temperature, humidity, globe temperature and Wet Bulb Globe Temperature (WBGT). Due to their compact, portable designs, they fit seamlessly into industries such as construction, outdoor events management, agriculture, and sports that require frequent relocation.

Military and Defense Sectors Appear to Be the Most Important, Burgeoning End-Use Segment Fueling Growth of Heat Stress Monitors Market: This Is to Explain Why Military and Defense Sectors Demand the Heat Stress Monitors Market Growth, as Personnel Operating and Working in Extreme Climatic Conditions Require Special Consideration in Daily Operations. These are essential to prevent heat-related injuries, ensuring combat readiness, and improving soldier performance in maximal stress environments.

Wearable monitors in this realm measure core body temperature, levels of hydration and environmental conditions in real time, enabling commanders to make swift, data-based decisions. Therefore, Autonomous, connected wearables serve AI-based physiological monitoring and IoT connectivity for predictive insights, thus enabling alerts systems in as many cases as possible for prevention of heat-related casualties.

Heat stress monitors play an important role in various application segments including athletics and sports, as they not only safeguard the health of the athlete but also help to improve performance in strenuous activity under extreme weather conditions. That’s important when it comes to monitoring heat stress to prevent ailments such as heat exhaustion and dehydration, in addition to heatstroke-all of which can happen during training and competitive events.

The main challenges faced by this sector in terms of wearable technologies are in mitigating heat stress from wearing PPE, as real time metrics (core body temperature, sweat rate, hydration levels etc.) are commonly monitored by heat stress wearables. Using this knowledge, coaches and trainers can help monitor bodies of athletes, if they need to hydrate, and get training intensity or duration lowered, while keeping safety and high performance at the front.

North America is anticipated to retain a large chunk of the market share due to safety regulations in workplaces becoming stringent and awareness of health risks at workplaces increasing. The USA and Canada have played strong roles, with industries such as construction, military, and manufacturing preying into the large demand for them. Further, since leading manufacturers are present in this region, coupled with the increasing use of AI-enabled and wearable monitoring solutions, it has propelled the growth of the market.

Europe holds a notable share of the market, with Germany, the UK, and France at the forefront of implementing health and safety standards for workers. The European Union’s emphasis on climate resilience and preparedness for extreme weather events is spurring investment in heat stress monitoring technologies. Additionally, the rise in workplace safety initiatives and the expansion of smart monitoring systems are contributing to market growth.

The region expect Asia-Pacific will be the fastest-growing while a rapid industrialization is ongoing increasingly occurring heat waves, and large infrastructures expand over the coming years. This is owing primarily to the contributions of China, India, Japan, and Australia, who have a growing awareness of occupational hazards in manufacturing, agriculture, and construction. Additionally, the government regulations and occupational safety policy promoting workplace gains in addition to real-time monitoring solutions will increase adoption in the region.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

| UK | 5.1% |

| European Union | 5.2% |

| Japan | 5.3% |

| South Korea | 5.6% |

The USA growing market is driven by factors: increasing workplace safety regulations, rising concerns about occupational heat exposure, and advancement in sensor technology. OSHA enforces very tight guidelines toward heat stress monitoring, leading to the adoption of sophisticated devices for the purpose of compliance.

Industries such as construction, manufacturing, and agriculture are beginning to hire high-precision devices to protect workers from heat diseases. Integration of AI-powered analytics with IoT connectivity has enabled real-time monitoring and thus predictive maintenance.

The growing demand for wearable and portable devices allows for continuous temperature and humidity tracking in high-risk environments. Industry innovators such as TSI, Extech, and Kestrel are developing new solutions intended to meet industry-specific needs.

Growth Factors in USA

| Key Factors | Details |

|---|---|

| Increasing Workplace Safety Regulations | OSHA mandates for heat safety in industries like construction and manufacturing. |

| Rising Incidence of Heatwaves | Climate change driving demand for heat stress monitoring in outdoor workplaces. |

| Growth in Military & Defense Applications | Adoption of heat stress monitors in military training and operations. |

| Smart Wearable Technology Integration | Expansion of IoT-enabled, real-time heat stress monitoring devices. |

The UK is experiencing growth due to strict occupational safety standards, increased demand for worker protection, and advancements in monitoring technology. The UK Health and Safety Executive strictly observes the heat-related effects and encourages using proper monitoring tools to implement those assessments.

Construction and manufacturing have increasingly bought into reliable and advanced monitoring facilities for employee safety. Moreover, AI-powered analytics have improved the efficiency of risk assessment and compliance management through remote monitoring.

They demand mini portable equipment in the laboratories and organisations. Large manufactures have incorporated wireless facilities to strengthen real-time acquisition of data and thus improvement toward the safety regime.

Growth Factors in UK

| Key Factors | Details |

|---|---|

| Increased Awareness of Occupational Health | Growing emphasis on worker safety in construction and manufacturing sectors. |

| Rising Adoption in Sports & Athletics | Use of heat stress monitors in professional sports and endurance training. |

| Government Initiatives for Climate Adaptation | Regulations promoting heat stress safety in workplaces. |

| Expansion in Healthcare Monitoring | Use of heat stress monitoring in elderly and vulnerable patient care. |

The European Union is expanding due to strict workplace safety regulations, growing awareness of heat-related health risks, and increased investments in smart monitoring solutions. The European Agency for Safety and Health at Work (EU-OSHA) demands rigorous measures to assess heat stress in risky industries.

Germany, France, and Italy are leading the charge in adopting advanced monitoring solutions in the construction, mining, and logistics industries. The synergy of AI-powered analytics and cloud-based monitoring systems is accelerating real-time assessment and predictive power.

Technological innovation, such as non-contact heat stress monitoring and wearable monitoring equipment, is driving additional market growth through the ability to more quickly and effectively mitigate risk.

Growth Factors in European Union

| Key Factors | Details |

|---|---|

| Strict EU Occupational Safety Standards | Enforcement of heat safety regulations across industries. |

| Climate Change Impact | Increased demand for heat stress monitoring in agriculture and construction. |

| Growth in Industrial & Manufacturing Sector | Adoption of smart heat stress monitors to ensure worker safety. |

| Technological Advancements in Wearables | Development of connected heat stress monitoring devices with cloud integration. |

The economy of Japan is presently heading in the direction of growth due to the increased focus on climate change, tighter regulations on employee safety in workplaces, and initiatives on its part by the government for worker safety. The Japanese Ministry of Health, Labour and Welfare has very high standards on the assessment of heat stress; hence, there is a constant demand for highly advanced and sophisticated monitoring tools.

Manufacturing, logistics and agriculture are now exploring options of very high-precision solutions making workplaces safer for employees. AI-enabled diagnostics and automated monitoring systems would propel the market growth further.

There is a further increase in demand for wearables and real-time monitoring devices which will help facilitate proactive measures that prevent heat-related illnesses in a variety of work settings.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Aging Population & Healthcare Demand | Increased monitoring of heat stress risks for elderly individuals. |

| Smart City & IoT Integration | Development of AI-based heat stress monitoring systems. |

| Growing Demand in Manufacturing & Construction | Heat safety compliance in industrial workspaces. |

| Rising Heatwaves & Humidity Levels | Increased adoption in workplaces and public safety applications. |

The South Korean market is fast growing on the back of government investments towards occupational safety, the increasing climatic changes heat threat, and smart digital monitoring alternatives. Through robust MOEL laws that offer detailed assessment for heat stress identification, smart intelligent monitoring hardware are prevalent and applied on mass scale.

South Korean industries are heavily investing in AI-based analytics for real-time risk assessment and automation of safety compliances. The rapid growth of the wearable sensors and IoT-enabled monitoring solutions in South Korea also acts as a contributor to the market growth.

The introduction of smart work wear with integrated heat stress track technology is driving the speed of take-up, enabling real-time insights for worker safety and general safety improvement.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Advanced Wearable Technology Development | Growth in IoT-enabled smart heat stress monitors. |

| Expansion in Industrial Safety Compliance | Increased government initiatives for worker protection. |

| Rising Demand in Smart Factories | Heat stress monitoring in automated manufacturing setups. |

| Climate Change & Urban Heat Island Effect | Higher adoption in densely populated urban regions. |

The heat stress monitor market is experiencing significant growth due to rising concerns about workplace safety, climate change, and regulatory compliance in industries such as construction, mining, and athletics. Firms are now concentrating on advanced sensor technologies, real-time data analytics, and wearable heat-stress monitoring solutions to offer enhanced protection and increased productivity for the workers. This market contains global giants and niche manufacturers contributing towards the advancement of technology in heat index measurement, WBGT (Wet Bulb Globe Temperature) sensors, and IoT with monitoring systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| TSI Incorporated | 14-19% |

| Kestrel Instruments | 12-16% |

| Extech Instruments | 9-13% |

| Nielsen-Kellerman (NK) | 7-11% |

| REED Instruments | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| TSI Incorporated | Develops high-precision monitoring devices integrating WBGT and AI-based predictive analytics for industrial and sports applications. |

| Kestrel Instruments | Specializes in portable and ruggedized heat stress meters designed for military, sports, and occupational safety. |

| Extech Instruments | Manufactures cost-effective handheld instruments with real-time temperature and humidity tracking. |

| Nielsen-Kellerman (NK) | Focuses on compact, user-friendly monitoring solutions for athletes, first responders, and outdoor workers. |

| REED Instruments | Produces affordable devices suitable for industrial, agricultural, and meteorological applications. |

Key Company Insights

TSI Incorporated (14-19%)

TSI leads the market with innovative WBGT monitoring devices, integrating AI and IoT connectivity for real-time workplace safety tracking.

Kestrel Instruments (12-16%)

Kestrel specializes in rugged, portable devices used in extreme environments such as military training, firefighting, and athletics.

Extech Instruments (9-13%)

Extech focuses on cost-effective solutions with real-time temperature and humidity tracking, catering to occupational safety and industrial applications.

Nielsen-Kellerman (NK) (7-11%)

NK develops compact, easy-to-use monitoring tools designed for sports professionals, emergency responders, and outdoor laborers.

REED Instruments (5-9%)

REED Instruments offers affordable solutions tailored for industrial safety, agriculture, and meteorology.

Other Key Players (40-50% Combined)

Several other manufacturers contribute to the industry by advancing sensor technology, connectivity features, and regulatory compliance. These include:

These companies continue to innovate in the areas of real-time heat stress monitoring, AI-driven safety analytics, and wearable sensor technology to enhance workplace and athletic safety.

The industry is projected to witness a CAGR of 4.6% between 2025 and 2035.

The market stood at USD 15.6 million in 2025.

The industry is anticipated to reach USD 24.5 million by 2035 end.

North America is expected to record the highest CAGR, driven by increasing workplace safety regulations and rising global temperatures.

Based on product, the market is segmented into fix/portable HSM and handheld HSM.

According to application, the market is categorized into military, athletics and sports, manufacturing plants, mining and oil & gas, and other.

Based on offering, the market is segmented into hardware, software, and services.

Based on life form, the market is segmented into human and animals (cattle).

Based on technology, the market is segmented into natural wet bulb and without wet bulb.

Based on sensor type, the market is segmented into dry bulb, natural wet bulb, black globe temperature, relative humidity and air flow sensor.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Gauss Meter Market Growth - Trends & Forecast 2025 to 2035

Microplate Instrumentation and Supplies Market Growth – Trends & Forecast 2025 to 2035

Trace Oxygen Analyzer Market Growth – Trends & Forecast 2025 to 2035

Soil Field Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Water Activity Instrumentation Market Analysis by Type, Distribution Channel, End Use, and Region Forecast Through 2035

ADAS Calibration Equipment Market Analysis by Vehicle Type, End User, and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.