Between 2025 and 2035, the worldwide market for heat recovery steam generator (HRSG) is expected to grow significantly, with energy companies placing a strong emphasis on efficiency, while in-demand for high-quality energy recovery solutions across multiple industries, ultimately driving this growth furthermore.

HRSGs are essential components of combined cycle power plants, which capture waste heat from gas turbines to produce steam for supplemental power generation thus also increasing the overall efficiency of the power plant.

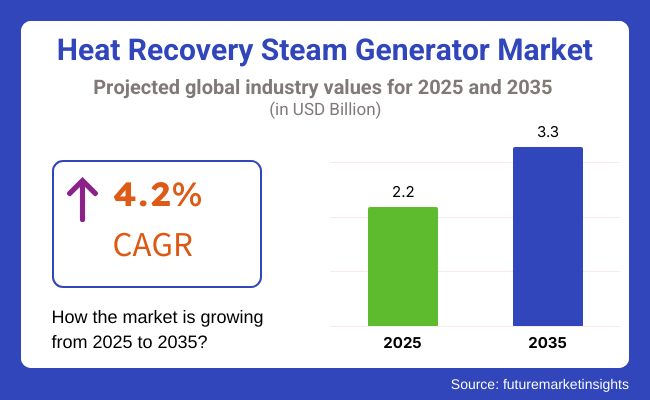

Market is expected to grow at a steady pace due to focus on energy efficiency and emission reductions across industrial sectors. The market size is expected to reach nearly USD 2.2 Billion in 2025 and USD 3.3 Billion in 2035 with a CAGR of 4.2%. The key factors driving the growth of PIP are boom in the power generation projects, especially in region which are undergoing through rapid industrialization and infrastructure development.

Advanced designs that allow for higher heat recovery ratios, advanced materials that can withstand extreme operating conditions, and modular designs that can ease quicker installations are driving market adoption. Moreover, such devices are increasingly integrated with digital monitoring and predictive maintenance technologies, which guarantee reliable performance and limited downtime.

The trend of investments in combined cycle power plants, as well as increasing environmental regulations are projected to positively impact the HRSG market over the next 10 years with opportunities for novel product development and strategies for partnerships.

Explore FMI!

Book a free demo

With several other end-use industries, North America continues to be one of the largest HRSG markets due to established power generation infrastructure and strong engagements for further conversion to cleaner, more efficient energy sources. Combined cycle power plants have seen heavy investments in the United States and Canada, relying on HRSGs to yield better thermal efficiencies.

In the USA, demand for HRSGs, is driven by the growing retirement of coal-fired plants followed by the addition of natural gas-fired facilities. In addition, new environmental regulations are forcing operators to implement energy-efficient technologies. Bundled with a focus on sustainability, Canada is also growing its fleet of combined cycle plants, providing additional support for market growth.

And the best part is that the government is creating great incentives in this sector for renewable energy projects and CHP installations, which is driving more opportunities for the HRSG manufacturers. North American operators look to improve the performance and reliability of their HRSGs by capitalizing on changes in materials and design to meet regulatory and other requirements.

As new ahead power plant projects and the retrofitting of existing facilities continue into 2023, the North America region is also expected to remain a significant player in new HRSG sales worldwide.

HRSG in the relatively energy-efficient region Europe At present, Europe is one of the most important regions with HRSG Driving forces: Energy Efficiency, Renewable Integration, and Emissions Reduction Germany, the United Kingdom, and France are early adopters, driven by their transitions to low-carbon energy systems and their needs to maximize the efficiency of their power generation assets.

Strict environmental policies in the region by the EU’s climate targets are driving utilities and industries to invest in its advanced HRSG technologies. Consequently, due to this flux in European HRSG manufacturers, European will have more developed innovations, more efficiency and modularity through their HRSGs that subsequently assure less environmental impact and greater adaptability to operational conditions.

Europe’s focus on combined cycle power plants and cogeneration (CHP) systems are creating a strong demand for HRSGs that will easily integrate with renewable energy sources such as geothermal and biomass in addition to conventional natural gas. Not only does this approach create more energy efficient spaces, but it also helps the region meet its aggressive renewable energy targets.

Asia-Pacific is estimated to be the highest growing region for HRSGs owing to the rapid industrialization, urbanization and growing electricity demand. Countries like China, India, Japan and South Korea are all making significant investments in combined cycle power plants in order to pursue energy security, efficiency and environmental compliance.

HRSG demand is being driven by China, which is experiencing a particularly massive buildup of natural gas-fired power generation capacity. The government’s drive to curb reliance on coal and purple haze, leads to a boom in combined cycle works, where HRSG becomes critical. Likewise, the rising demand for power in India and endeavors to upgrade its energy infrastructure are driving growth in the market.

HRSG market in Japan and South Korea is also driven by demand for high-efficiency HRSG due to emphasis on high advanced power plants technologies as well as integration of renewable energy sources. Guided by their strong technological capabilities, the countries create and implement cutting-edge HRSG solutions that satisfy the maximum efficiency and environmental requirements.

High Initial Investment and Maintenance Costs

As Heat Recovery Steam Generator systems are costly and complex, the initial investment can be challenging to implement. HRSG systems are costly up front, as they require sophisticated engineering and exacting manufacturing. Regular maintenance and monitoring of operational efficiency to ensure both longevity and optimal performance is also needed.

Skilled personnel are needed to install and service such systems, which also raises the total expenditure. Organizations in this line of business whose priorities are required include cost-saving production methods, modular construction, and advanced predictive maintenance technologies like that reduce the downtime and contribute to lower long-term costs.

Growing Demand for Energy Efficiency and Sustainable Power Generation

The changing international interest in energy efficiency and green energy production brings with it substantial opportunities for development within the HRSG industry. Mounting issues regarding carbon emissions and more stringent environmental regulations have compelled industries and power generators to embrace HRSG systems to enhance energy recovery and reduce waste, helping optimize performance.

By recovering waste heat, the integration of HRSG technology with combined cycle power stations and industrial cogeneration facilities notably boosts overall efficiency. Furthermore, continuing developments in smart monitoring and digital automation permit real-time optimization of function, rendering HRSGs more attractive for energy producers.

Organizations investing in eco-friendly materials, modular HRSG designs with interchangeable components, and AI-driven efficiency surveillance solutions will gain a competitive edge in this expanding market space. Continuous technological refinement should expand the addressable market and appealing of HRSG systems for recovering heat and boosting sustainable power generation.

Between 2020 and 2024, the world Heat Recovery Steam Generator market thrived significantly due to the increased application of the technology in power plants and industrial production facilities. Technological advances in heat exchanger substances and steam cycle optimizations substantially improved overall performance, rendering HRSGs an preferable selection for energy-intensive industries.

The shift toward combined cycle power plants to boost efficiency and satisfy carbon reduction aims drove demand for HRSG structures. However, fluctuating raw material pricing and supply chain interruptions posed difficulties for manufacturers, impacting production schedules and heightening installation expenses.

Despite these hindrances, HRSG adoption continued to surge forward, buttressed by government incentives promoting waste heat retrieval and clean energy remedies. Government entities recognized HRSGs as a means of attaining more sustainable outcomes economically and ecologically.

Looking ahead, the years 2025 through 2035 will surely bring continued innovation to the HRSG market. Modular and compact designs will become even more so, allowing ease of installation and use. Renewable energy integration and digital automation will see leaps utilizing artificial intelligence for predictive maintenance, forestalling failures and slashing operational costs.

Units will run longer and smoother. Coatings and materials engineering will yield gains as well, as efficiencies rise and components endure harsh industrial settings. Smart grids taking shape meanwhile create fresh ways to marry recovered exhaust heat to electricity grids, minimizing waste. Distribution realizes its decentralized potential.

Carbon neutrality ambitions drive the expansion further. Hybrid plants joining gas with solar and wind will look increasingly to HRSGs to make the most of each fuel source burned. Clean power production is within closer reach thanks to the versatile HRSG role in optimizing available fuels. Progress marches on.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter emission control policies for power plants |

| Technological Advancements | Improvements in steam cycle optimization and heat exchanger materials |

| Energy Efficiency Focus | Growth in combined cycle power plants for higher efficiency |

| Supply Chain and Manufacturing | Raw material price fluctuations impacting production costs |

| Digitalization in HRSG Systems | Early adoption of remote monitoring and performance analytics |

| Market Competition | Growth in traditional power sector HRSG installations |

| Market Growth Drivers | Rising demand for industrial waste heat recovery and power plant efficiency |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of global carbon reduction mandates and incentives for HRSG adoption. |

| Technological Advancements | AI-driven efficiency monitoring, advanced coatings for durability, and smart automation. |

| Energy Efficiency Focus | Integration with renewable energy sources and hybrid power generation systems. |

| Supply Chain and Manufacturing | Increased use of sustainable materials and localized manufacturing for cost efficiency. |

| Digitalization in HRSG Systems | Full-scale implementation of predictive maintenance and AI-driven automation for optimal performance. |

| Market Competition | Expansion into decentralized energy systems and emerging markets focused on sustainability. |

| Market Growth Drivers | Increased investment in carbon-neutral technologies and energy-efficient infrastructure. |

In the United States heat recovery steam generator market rising investment in combined cycle power plants (CCPP) along with increasing adoption of cogeneration in industrial plants and stringent emissions regulations are the key factors driving growth. Policies by the USA Environmental Protection Agency (EPA) and USA Department of Energy (DOE) that support energy efficiency and carbon emission reductions have enabled industries to deploy waste heat recovery solutions.

Heat recovery steam generator systems are mainly consumed by the power generation sector, as many utility companies and independent power producers have adopted gas-fired combined cycle plants to achieve better efficiency and comply with clean energy mandates. HRSG mounted to cogeneration systems in the industrial sectors like the chemicals, petrochemicals, and refineries for well energy management.

Moreover, with the growing adoption of renewable energy sources, hybrid power systems are propelling HRSG integration within the market including waste heat recovery to improve overall efficiency. Thanks to improving technologies in modular and high-pressure HRSG systems, the USA HRSG market can expect sustained growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The United Kingdom heat recovery steam generator market is primarily driven by favourable government measures to reduce energy consumption, rising penetration of combined heat and power (CHP) units, and growing investments in waste heat recovery from the industrial sector. Industries are forced to adapt HRSG technologies to improve energy efficiency along with CO2 reduction because the UK aims to achieve net-zero carbon emissions by 2050.

Gas-fired power generation plants are the largest consumers of heat recovery steam generator systems in the power sector, employing waste heat recovery systems to improve operational efficiency. Also, industries such as food processing, chemicals, and manufacturing are implementing HRSG integrated CHP systems to lower energy costs and justify energy efficiency standards.

Growth opportunities are anticipated due to the UK government focus on decarbonisation and the integration of heat recovery steam generators with renewable energy sources. The UK HRSG market is likely to observe steady growth owing to the increasing investments across clean energy infrastructure, complementary industrial heat recovery solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

The European heat recovery steam generator market is progressing at a steady pace, backed by strict energy efficiency standards, increasing use of combined cycle plants and growing investments in industrial waste heat recovery. Countries including Germany, France, and Italy lead the pack with respect to HRSG use in generating electricity and in industrial systems.

Europe Green Deal and Energy Efficiency Directive, with their rigorous environmental policies, are forcing, power producers and industries to adopt waste heat recovery technologies. Heat recovery steam generator (HRSG) systems contribute significantly to the efficiency of natural gas-fired power plants, district heating systems, and industrial cogeneration units and are thus increasingly being applied.

Germany is a leader in energy efficiency and industrial automation and this country is investing heavily in advanced high-efficiency HRSGs for both industrial as well as power applications. France and Italy are seeing growth in turbine integration with the manufacturing, chemical processing, and oil & gas industries with CHP installations including heat recovery steam generators.

Growth estimation in the market is steady from January 2024 onwards owing to the European push towards sustainability, regulatory system-driven energy efficiency improvements, as well as the implementation of smart heat recovery steam generator systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.3% |

In Japan the growth of the heat-recovery steam generator can be attributed to extensive governmental support for energy efficiency, rising demand for cogeneration systems, and advancements in high-efficiency gas turbines. Companies in Japan have long been at the forefront of developing operationally efficient industrial energy solutions, focusing on HRSG designs to improve the overall energy efficiency of power plants and industrial processes.

Japan with low natural resources and energy security has now turned its emphasis to waste heat recovery and CHP systems to utilize the energy effectively. Industries such as oil & gas, chemicals, and steel are incorporating heat recovery steam generators into their operations to cut energy costs and shrink carbon footprints.

Smart energy solutions push by government and investments in gas-fired combined cycle plants continue to propel the market. They have a strong industrial base and are soaking up the guys' solutions that are industry's energy sustainable in a sense.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The South Korea heat recovery steam generator market is primarily driven by the military, the government, and the ashes of the available energy sources. As industries implement industrial decarbonisation efforts to meet South Korea’s carbon reduction goals, operations are seamlessly transitioning from waste heat recovery to energy saving, as well.

One of the major driving factors of the combined cycle power generation sector is the installation of technology such as heat recovery steam generator (HRSG) in new combined cycle power plants, which significantly uprate energy output of the power plants while reducing the global gas consumption.

Moreover, the demand for HRSG systems is high among industrial plants for petrochemicals, steel and electronics production as they are building onsite for energy efficiency.

The focus of South Korea on smart grid development, industrial automation, and clean energy solutions is also supporting the heat recovery steam generator adoption. As the government is incentivizing on energy efficient technologies, heat recovery steam generator market is anticipated to grow at a steady rate during the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Modular Construction and Bundle Construction Drive Market Growth as Demand for Efficient Waste Heat Recovery Solutions Expands

The modular construction and bundle construction segments hold a notable portion in the heat recovery steam generator (HRSG) industry, as industries more and more deploy high-efficiency waste heat retrieval solutions to maximize power creation, decrease emissions, and enhance functional proficiency.

These HRSG designs play a pivotal part in guaranteeing enhanced thermal productiveness, faster undertaking completion, and diminished vitality misfortunes, making them fundamental across combined cycle power plants, cogeneration offices, and mechanical waste heat retrieval frameworks.

Additionally, the modular technique permits for less capital contributing upfront and quicker on-line dates, while the bundle configuration permits for simpler support and overhaul. Then again, larger HRSG frameworks with more complex schedules regularly pick integral development as it limits interfaces and fulfills immense steam requests from vast limit plants.

Modular construction has emerged as one of the most widely adopted HRSG design types, offering enhanced prefabrication, reduced site assembly time, and optimized thermal performance.

Unlike traditional field-erected designs requiring extensive on-site work, modular HRSG units allow for pre-assembled components to be transported and installed with minimal construction required, drastically reducing overall project timelines and costs through decreased labor needs.

The rising demand driven by the paramount need for improved efficiency, lower emissions, and faster deployment to address electricity demands has fueled widespread adoption of prefabricated HRSG units, as power producers and industrial operators prioritize operational adaptability allowing quick responses to changing energy needs and cost savings through optimized performance.

Numerous studies indicate modular HRSGs can reduce construction periods by nearly half through condensed on-site work, diminishing labor requirements and associated risks, rendering them highly practical for large-scale power generation projects with compressed schedules.

The expansion of modular HRSG solutions in recovering exhaust heat from gas turbines, comprising compact, pre-engineered designs maximizing heat recovery, has reinforced market demand through broadened applications, ensuring increasing use in process industries critical to our daily lives, including those refining fuel, producing chemicals, and crafting steel.

The integration of AI-guided predictive maintenance in modular HRSG systems, featuring intelligent sensors, constant performance tracking reported in real-time, and automated diagnostics, has further intensified adoption, ensuring elevated heat transfer productivity, limited disruption to operations, and extended usable lifetimes.

Advancements in producing high-temperature, corrosion-resistant materials for modular HRSG construction, comprising enhanced heat exchanger coatings, temperature-resistant superalloys based on nickel, and thermal barrier layers incorporating ceramics, have optimized market growth by ensuring resilience and reliable functionality even under extreme operating conditions.

The adoption of modular HRSG systems for smaller-scale distributed power generation, comprising containerized, mobile HRSG solutions allowing energy production anywhere with connectivity maintained, has reinforced market expansion ensuring adaptability to renewable and conventional resources combined forsteadier electricity supply.

Despite facilitating speedy installation, flexibility, and cost-effectiveness, modular HRSG construction endures challenges such as transport constraints, higher up-front costs, and structural limitations impeding largest-scale plants.

However, emerging innovations in modular heat exchanger architecture, AI-driven assembly streamlining, and hybrid modular-field erected configurations are enhancing design possibilities, performance personalization, and long-term cost-effectiveness, securing continued market growth for modular HRSG systems.

Heat recovery steam generator bundle construction has gained widespread acceptance, especially for high-efficiency waste heat recovery applications, customized configurations, and advanced steam cycle tweaking, as power facilities and industrial clients increasingly rely on flexible heat exchanger assemblies to maximize recovered energy harvesting.

Unlike entirely pre-assembled HRSGs, modular bundle fabrication enables individualized heat exchanger bundles tailored to unique operating prerequisites, guaranteeing higher thermal productivity and improved maintenance access.

Rising call for top-performance HRSGs in gas-fired amalgamated cycles, featuring multi-pressure heat exchanger modules with optimized surface region, has driven the take-up of sophisticated modular fabrication techniques, as plant operators look for higher efficiency, better fuel savings, and prolonged element lifespan.

Studies indicate HRSGs with customized modular construction can improve steam formation productivity by up to 20%, confirming preferable power generation economics and lessened fuel usage.

The proliferation of modular-based HRSG designs in heavy commercial applications, presenting customized superheater and reheater bundles for optimized squandered heat harnessing, has bolstered demand levels, confirming greater adoption in areas such as chemicals, concrete manufacturing, and paper and pulp handling.

The unification of interchangeable module replacement strategies, showcasing modular heat exchanger units with expedited piping fastening, has further boosted take-up, confirming preferable servicing productivity, more restrained downtime, and reduced lifecycle costs.

The evolution of hybrid HRSG modular formations, showcasing multi-stage heat retrieval cycles with sophisticated pressure regulation apparatuses, has optimized industry progress, confirming greater adoption in high-efficiency cogeneration and district warming applications.

The take-up of high-alloy and composite material bundles in HRSG construction, showcasing enhanced thermal conductivity, extraordinary corrosion invulnerability, and prolonged service lifespan, has reinforced industry expansion, confirming preferable functioning reliability in harsh operating conditions.

Despite its strengths in thermal efficiency, customization flexibility, and simplification of servicing, modular fabrication HRSGs face complications such as increased assembly difficulty, potential pressure drop constraints, and higher preliminary costs for top-performance modular materials. However, emerging innovations in AI-driven heat exchanger scheme optimization, next-generation alloy progress, and real-time heat transmitting observing are bettering energy productivity, sturdiness, and cost-effectiveness, confirming continuing industry expansion for modular-based HRSG solutions.

The horizontal drum units and vertical drum units segments represent two major market drivers, as power producers and industrial operators increasingly deploy high-performance HRSG configurations to enhance steam cycle efficiency, reduce fuel consumption, and optimize plant performance.

Horizontal drum units have long served as one of the most widely adopted HRSG configurations, delivering high heat transfer proficiency, modular scalability, and reduced gas pressure drop. Unlike vertical drum HRSGs, horizontal drum layouts offer enhanced adaptability to enormous power stations, confirming optimized emission heat usage and amplified steam generation efficiency.

The expanding demand for horizontal drum HRSGs in combined cycle gas turbine (CCGT) facilities, featuring huge-pressure steam drums for improved thermal cycling output, has fueled acceptance of large-scale horizontal HRSG frameworks, as power makers look for to maximize productivity and minimize outflows.

The enlargement of multi-pressure horizontal HRSG setups, highlighting optimized superheaters, evaporators, and economizers for progressive steam cycle optimization, has bolstered current demand, ensuring greater adoption in high-proficiency energy manufacturing applications.

In spite of its advantages in steam limit and thermal effectiveness, horizontal drum HRSGs face challenges such as bigger footprint necessities, increased structural weight, and higher introduction difficulty. However, emerging developments in modular drum fabrication, AI-helped cycle optimization, and state-of-the-art materials for heat exchanger surfaces are improving proficiency, dependability, and useful flexibility, confirming proceeding market growth for horizontal HRSG devices.

Vertical Drum Units Dilate as Compact and Space-Efficient HRSG Configurations Gain Traction in Industrial and Urban Power Applications.

Vertical drum HRSGs have gained strong market acceptance, particularly in downtown cogeneration plants, district warming applications, and process industry waste heat retrieval, as operators increasingly take advantage of compact, space-saving HRSG setups to maximize steam output in limited environments.

Unlike horizontal drum units, vertical HRSGs offer enhanced height-based heat exchanger alignment, improved natural circulation, and optimized gas flow patterns, ensuring superior productivity in confined-space installations.

The increasing demand for vertical drum HRSGs in small-scale and modular power stations, highlighting pre-fabricated, skid-mounted designs for speedy deployment, has driven approval of vertical HRSG frameworks, as designers look for reasonably priced, adaptable, and effortless-to-maintain power answers.

In spite of its advantages in compact footprint and improved natural circulation, vertical HRSGs face challenges such as lower steam generation ability, possible servicing accessibility issues, and minimal adaptability to high-power applications.

However, emerging innovations in hybrid vertical-horizontal HRSG configurations, AI-optimized gas flow modeling, and next-generation finned heat exchanger designs are improving energy proficiency, adaptability, and cost-effectiveness, ensuring continuing market growth for vertical HRSG units.

The rising demand for energy efficiency in power plants, combined cycle gas turbine (CCGT) operations, and industrial cogeneration is driving the growth of the heat recovery steam generator (HRSG) market. Demands for mitigating the energy crisis have led companies towards developing high-efficiency heat exchangers, modular HRSG designs, and employing AI-powered operational optimization to improve the aspects of energy recovery, emission reduction, and power plant economics.

Collectively, global energy technology suppliers and specialized boiler manufacturers are innovating power plant equipment systems through compact HRSG technology, high-pressure steam generation, and innovative waste heat recovery plant systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GE Vernova (General Electric) | 15-20% |

| Siemens Energy AG | 12-16% |

| Mitsubishi Heavy Industries, Ltd. | 10-14% |

| Babcock & Wilcox Enterprises, Inc. | 8-12% |

| John Wood Group PLC | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| GE Vernova (General Electric) | Develops modular HRSGs for CCGT power plants, AI-powered steam cycle optimization, and high-efficiency heat exchangers. |

| Siemens Energy AG | Specializes in compact HRSG designs, waste heat recovery units, and advanced pressure steam generators. |

| Mitsubishi Heavy Industries, Ltd. | Manufactures triple-pressure HRSGs, high-performance super heaters, and next-gen steam cycle technology. |

| Babcock & Wilcox Enterprises, Inc. | Provides customized HRSG systems for industrial power plants, heat exchangers, and energy-efficient steam recovery solutions. |

| John Wood Group PLC | Offers turnkey HRSG solutions, cogeneration heat recovery systems, and modular HRSG design for rapid deployment. |

Key Company Insights

GE Vernova (General Electric) (15-20%)

The company provides an entire modular steam generator product series, AI-based products for thermal efficiency, steam cycle optimization, and it leads the market for heat recovery steam generators (HRSG).

Siemens Energy AG (12-16%)

Siemens manufactures compact HRSG technology, waste heat recovery systems, and other components for increased energy efficiency with automated operational monitoring.

Mitsubishi Heavy Industries, Ltd. (10-14%)

Incorporating triple-pressure steam cycle technology for combined cycle applications, Mitsubishi Heavy Industries designs next-generation heat recovery steam generators (HRSGs) for high-efficiency power plant

Babcock & Wilcox Enterprises, Inc. (8-12%)

Babcock & Wilcox provides customized heat recovery steam generators (HRSGs) for steam generation for industrial power applications, and uses advanced steam cycles for the recovery of high-efficiency steam while minimizing emissions.

John Wood Group PLC (5-9%)

HRSG systems are compact and modular, and John Wood Group optimizes deployment capabilities for cogeneration and district heating applications.

New-generation HRSG technology, AI-driven optimization of thermal efficiency, and high-pressure steam generation improvements are provided by multiple energy apparatus and power plant engineering companies. These include:

The overall market size for Heat Recovery Steam Generator Market USD 2.2 Billion In 2025.

The Heat Recovery Steam Generator Market expected to reach USD 3.3 Billionin 2035.

The demand for the heat recovery steam generator market will grow due to increasing energy efficiency requirements, rising adoption of combined cycle power plants, expanding industrialization, and stringent environmental regulations promoting waste heat recovery, driving the need for sustainable power generation solutions.

The top 5 countries which drives the development of Heat Recovery Steam Generator Market are USA., UK, Europe Union, Japan and South Korea.

Modular Construction and Bundle Construction Drive Market to command significant share over the assessment period.

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Factory Automation And Industrial Controls Market Growth - Trends & Forecast 2025 to 2035

Extrusion Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.