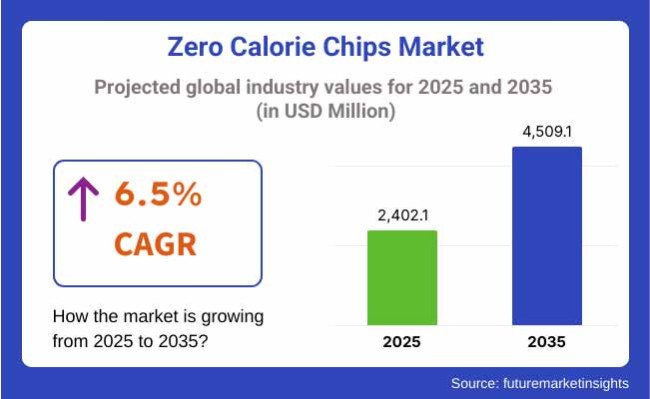

The zero calorie chips market is expected to grow significantly between 2025 and 2035, fueled by rising health consciousness, increased demand for guilt-free snacking, and innovation in alternative ingredients and fat-blocking formulations. The market is projected to be valued at USD 2,402.1 million in 2025 and is anticipated to reach USD 4,509.1 million by 2035, reflecting a CAGR of 6.5% over the forecast period.

Zero calorie chips are emerging as next-generation snacks providing the taste and texture of traditional chips without the caloric burden, usually via use of non-digestible fats, plant fibers and/or thermogenic compounds that reduce caloric absorption. While the market is still moving rapidly with innovations in food science, functional starches and microencapsulation technologies, consumer reluctance, labeling and regulations, as well as production scalability remain big obstacles.

Top trends include thermogenic snacking systems, gut-friendly formulations with prebiotics, AI-personalized snack plans and digital tools focused on zero-net-calorie claims.

The zero calorie chips market in North America holds a large share bolstered on the concern regarding obesity, dietary trend evolution followed by keto,intermittent fasting, clean eating, and functional snacking culture. We are witnessing accelerating plant-based zero calories chip startups in the USA, particularly in DTC channels and biohacker circles. In terms of diabetics friendly zero calorie snacks, Canada is concentrating on non-GMO and allergen free formulations.

Europe is a firm adopter, spurred by strict caloric labeling requirements, sugar tax movements and increasing demand for clean-label snacks. Innovations include cellulose-structured chips from Germany, UK, France, Netherlands, Scandinavia, air-crisp technologies, and reduction-focused snack reformulations. This is supported by vegan-certified zero calorie crisps and portion-controlled multipacks.

The demand for high protein and low hash was a much better recommendation for consumers' lifestyle, health index, disease state, and geographical reality. China is innovating processes for fermented vegetable crisps as India steps up Ayurveda-based zero-calorie spice blends. Japan and South Korea are at the forefront of portable wellness snacks, specifically collagen-infused, fiber-enriched, and zero-calorie chip innovations that appeal to beauty and fitness consumers.

Challenges: Ingredient Complexity, Cost, and Labeling

New engineered fibers, synthetic fats, and high-performance snack food matrices present regulatory challenges, particularly in digestibility and health claim substantiation. Developing zero calorie chips that remain crisp, stable on the shelf, and pleasant to eat is expensive from an R&D perspective. Consumer skepticism about “too good to be true” messaging and cost-per-serving premiums are also adoption barriers.

Opportunities: Functional Positioning, Medical Nutrition, and Tech-Enabled Personalization

positioning of zero calorie chips as functional food, satiety enhancer, and metabolism booster can open up opportunities. But if we take the theme of snacking to the max literally-AI-driven snack personalization, enzyme-blocking ingredients, edible scaffolding technology and the ability to snuffle zero-calorie delicacies looks like it might actually be on deck. For therapeutic zero-calorie chip platforms to be more widely commercialized, it should expand into diabetes management programs (snack kit in hospitals) and into weight-loss subscription services.

From 2020 to 2024, the zero calorie chips market was a niche but burgeoning category within functional snacking, with the convergence of keto, intermittent fasting, and weight management fueling explosive growth. Earlier products took advantage of filler made with fiber, puffed air technologies and alternative flours to provide crunch and flavor without calories.

Social media health influencers, clean-label packaging and guilt-free snacking propositions peddled such products, sparking consumer interest. But regulatory scrutiny on calorie claims, challenges on taste optimization and constraints of mass-market distribution hampered adoption.

Anticipating 2025 to 2035, the marketplace will transition to metabolic nutrition science, AI-optimized formulations, and innovative ingredient platforms including resistant starches, fermented fibers, and lab-processed insoluble compounds. Smart snacking will be made possible by appetite-regulating compounds, gut microbiome feedback, and biohacking platforms that are poised to disrupt zero-calorie chip consumption.

New packaging innovations, from portion-controlled, recyclable formats to QR-linked metabolic tracking, will speak to consumers looking for high-function, low-guilt snack solutions across lifestyle and wellness segments.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Largely unregulated; FDA and EU monitoring “zero-calorie” and “net carb” labeling accuracy. |

| Technological Innovation | Use of puffed fibers, konjac flour, and air-drying methods to mimic traditional chips. |

| Industry Adoption | Popular in keto, low-carb, and wellness communities via e-commerce and specialty stores. |

| Smart & AI-Enabled Solutions | Limited to product recommendation engines on e-commerce platforms. |

| Market Competition | Early-stage players include small wellness startups and DTC keto brands. |

| Market Growth Drivers | Demand for healthy indulgence, social media-fueled trends, and intermittent fasting lifestyle adoption. |

| Sustainability and Environmental Impact | Focus on small-batch, plant-based sourcing with minimal packaging. |

| Integration of AI & Digitalization | Limited to smart labels and influencer-led promotions. |

| Advancements in Product Design | Air-puffed chips in portioned pouches with plant-based or savory seasoning profiles. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter oversight of metabolic impact claims, calorie transparency, and functional ingredient safety across snacking categories. |

| Technological Innovation | Introduction of enzymatically resistant starches, biofermented insoluble compounds, and smart-crunch delivery technologies. |

| Industry Adoption | Mainstream expansion into retail, fitness centers, medical nutrition programs, and airline/space rations as guilt-free satiety snacks. |

| Smart & AI-Enabled Solutions | AI-enabled metabolic snacking platforms, microbiome-specific chip customization, and real-time snack timing engines linked to wearables. |

| Market Competition | Competition from functional food giants, biotech snack labs, and hyper-personalized nutrition-as-a-service platforms. |

| Market Growth Drivers | Growth driven by zero-glycemic snacking, metabolic wellness tracking, clinical weight-loss programs, and carbon-neutral functional foods. |

| Sustainability and Environmental Impact | Circular packaging ecosystems, upcycled prebiotic fiber use, and carbon footprint-labeled satiety snack lines. |

| Integration of AI & Digitalization | Fully integrated snacking apps that track glycemic load, recommend zero calorie chips in real-time, and adapt serving sizes to health data. |

| Advancements in Product Design | 3D-printed texture-tuned chips, modular snack stacks, zero-calorie prebiotic-infused crisps, and smart hydration-paired packaging. |

A boom to the USA zero calorie chips market, as demand for guilt-free snacking, keto-friendly diets, and plant-based eating habits rises. Chips made with air-puffing, vacuum frying and fiber-enrichment techniques that offer the crunch and flavor of potato chips without the calories are being embraced by consumers.

Mainstream and specialty stores have a large selection of zero calorie and ultra-low calorie chip substitutes available. Brands are also employing clean-label ingredients, high-protein blends and functional additives such as prebiotics to stand out in this rapidly changing segment.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.7% |

UK zero calorie chips market is witnessing a positive growth with rising awareness of obesity and ongoing initiatives by the nation to lower calories in packaged snacks. Demand is growing for baked, popped or dehydrated chips, made with alternative flours like lentil, chickpea and konjac root.

Shoppers want flavorful, portion-controlled choices that fit vegan, gluten-free and low-carb lifestyles. Retailers and wellness-attuned DTC brands are rolling out snack innovations in resealable pouches and multipacks targeting office workers and health-minded families.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

The EU zero calorie chips market is driven by strict nutritional labeling policies in the region along with rising preference for health-forward convenience foods, with Germany, Netherlands, and Sweden being the leading countries. European consumers respond to snack innovations that deliver on taste, crunch and calorie control.

Zero calorie chips ’ made from konjac, seaweed, and fibre-based starch substitutes are going mainstream in organic supermarkets and wellness retail chains. Move with Intention, EU guidelines around portion sizes and clean ingredient disclosures are further bolstering transparent marketing and product innovation.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.4% |

Japan has a growing market for zero calorie chips with strong mining from consumer interest base in portion-controlled, satiety-enhancing snacks. The country’s specialty in konjac (shirataki) and dietary fiber-based foods is powering innovative savory, crunchy chip substitutes that are calorie-neutral.

They’re sold as individual, plastic-wrapped mini-packs, as well as trays ready for convenience stores. Butter-rich and fat content are key in driving taste expressions, with Japanese brands also plating up gut health benefits and minimal fat content to entice health-conscious shoppers across generations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

A rapid growth in the zero calorie chips market in South Korea continues as K-wellness trends and celebrity-promoted health food products gain popularity following a hike in demand for zero calorie snacks among young working professionals. Chips from konjac, lotus root and fiber-enriched starches are taking up shelf space in hypermarkets and e-commerce platforms. Functional claims, including digestive health, skin benefits, and energy support, are being folded into domestic brands’ portfolios.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

| Source | Value Share (%) |

|---|---|

| Potato | 47.9% |

By 2025, potato continues to be the leading source in the global zero calorie chips market with a market share of 47.9% in terms of total market value. That familiarity relates to taste, texture, and international appeal, which has cemented well over a century of potato-based snacks in consumer minds. The launch of zero-calorie formulations using fat-blocking compounds, alternative starches, air-crisping technologies and the like has given the category new life as it rides the wave of health-conscious consumption

With zero calorie potato chips, you are getting the best of both worlds in terms of guilt free snacking, diet friendly, and taste satisfaction. New fiber-infused formulations and the use of plant-based emulsifiers have paved the way for manufacturers to slow or zero caloric values while retaining traditional potato chip attributes.

Potato-based zero calorie chips continue to be a trusted category driver, with strong presence in both premium and mass-market product lines. The comprehensive availability of raw materials and ongoing flavor diversification further underpins perpetual leadership in this source segment.

| Distribution Channel | Value Share (%) |

|---|---|

| B2C | 62.4% |

The B2C sub-segment within distribution channels segment is expected to dominate the overall zero calorie chips market with a projected value share of 62.4% by the end of 2025. Increasing health awareness, demand for clean-label snacks, and increasing digital penetration have prompted consumers to buy zero calorie snacks direct from online and offline retail formats. Better for you snack formulations that fit into a weight management and physically active lifestyle are in demand by consumers for convenience through retail channels and at lower calories.

In the B2C space, online stores are quickly becoming popular with doorstep delivery as well as access to niche health brands and bundled nutrition. Meanwhile, hypermarkets/supermarkets and specialty health stores also flourish by providing shelf visibility, product sampling, and curated diet sections. Convenience stores and small grocers are fielding more foot traffic from impulse shoppers and wellness-minded shoppers, too.

B2C has been and will continue to be the best and most scalable path for zero calorie chips brands build consumer trust and create repeat purchases as the market transitions to DTC models and personalized snacking solutions. Its dominance in the B2C segment is projected to be solidified further still in the coming years through strategic placement, makeover of packaging, and innovative digital marketing efforts.

Zero calorie chips are up and coming in a world of health-conscious consumers who are looking for guilt-free snacks that will work with weight management, keto, diabetic and low-carb diets. No need to feel guilty about the satisfying crunch because these chips are made with plant fibers, air-puffing and synthetic or natural zero-caloric sweeteners or fats.

However, factors such as demand for functional snacks, clean-label and satiety-enhancing ingredients, advances in food processing technologies, and growth in fitness-driven and diabetic consumer segments are expected to drive market growth.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| PepsiCo, Inc. (Frito-Lay) | 18-22% |

| Quest Nutrition (Simply Good Foods) | 13-17% |

| Popchips Inc. | 10-14% |

| Shrewd Food LLC | 7-10% |

| Thin Slim Foods | 5-8% |

| Others | 27-33% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| PepsiCo, Inc. (Frito-Lay) | In 2024, Frito-Lay piloted Lay’s Air Lite™, a zero-calorie chip alternative made with air-crisp technology and soluble corn fiber, targeting lifestyle dieters and low-GI consumers. |

| Quest Nutrition | As of 2023, Quest launched Zero Net Carb Chips with high whey protein isolate and fiber content, formulated for keto and diabetic snack aisles. |

| Popchips Inc. | In 2025, Popchips debuted its Zero Guilt Crunchers™, made with konjac flour and heat-puffed pea starch, delivering under 5 calories per serving with natural savory seasoning. |

| Shrewd Food LLC | In 2023, Shrewd Food expanded its Protein Crisps into near-zero calorie formats using resistant starches and monk fruit, with macros tailored for intermittent fasting. |

| Thin Slim Foods | As of 2024, Thin Slim Foods introduced zero-calorie baked veggie chips, featuring a clean-label mix of okra, zucchini, and konjac extract with no added oils or sugar. |

Key Market Insights

PepsiCo, Inc. (18-22%)

Leveraging its scale and innovation infrastructure, PepsiCo is testing zero-calorie snack extensions under mainstream brands, positioning them as functional indulgences for the health-savvy consumer.

Quest Nutrition (13-17%)

Known for its dominance in the low-carb space, Quest offers zero net carb chip formats with high protein and satiety benefits, widely distributed through fitness and retail channels.

Popchips Inc. (10-14%)

Focuses on air-puffed, clean-label chips that satisfy cravings with minimal caloric load, often featuring plant-based formulations and sustainable packaging.

Shrewd Food LLC (7-10%)

Innovator in snackable protein and zero-calorie formats, with strong appeal among keto, diabetic, and athletic consumers seeking portion-controlled snack options.

Thin Slim Foods (5-8%)

Specializes in zero- and ultra-low-calorie bakery and snack items with transparent ingredient profiles and growing traction in the diabetic and lifestyle wellness segments.

Other Key Players (Combined Share: 27-33%)

Numerous functional food startups and niche brands are entering the market with innovative ingredients, customizable macro profiles, and unique texture experiences, including:

The overall market size for the zero calorie chips market was USD 2,402.1 million in 2025.

The zero calorie chips market is expected to reach USD 4,509.1 million in 2035.

The demand for zero calorie chips will be driven by rising health consciousness among consumers, growing demand for guilt-free snacking alternatives, increasing popularity of low-carb and keto-friendly diets, and advancements in food processing and natural sweetening technologies.

The top 5 countries driving the development of the zero calorie chips market are the USA, Canada, Germany, Japan, and the UK.

The potato-based chips segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Price Range, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Price Range, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Price Range, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Price Range, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by Price Range, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by Price Range, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by Price Range, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by Packaging Type, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Source, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Price Range, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Packaging Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Price Range, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Source, 2023 to 2033

Figure 27: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 28: Global Market Attractiveness by Price Range, 2023 to 2033

Figure 29: Global Market Attractiveness by Packaging Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Price Range, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Source, 2023 to 2033

Figure 57: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 58: North America Market Attractiveness by Price Range, 2023 to 2033

Figure 59: North America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Price Range, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Price Range, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by Price Range, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by Price Range, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by Price Range, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Price Range, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Packaging Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by Price Range, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Price Range, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Packaging Type, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by Price Range, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Packaging Type, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Price Range, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Packaging Type, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zero-Waste Packaging Technologies Market Size and Share Forecast Outlook 2025 to 2035

Zero Emission Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Refill Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zero-Fishmeal Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Zero Friction Coatings Market Size and Share Forecast Outlook 2025 to 2035

Zero Trust Security Market Size and Share Forecast Outlook 2025 to 2035

Zero Emission Vehicle Market Growth - Trends & Forecast 2025 to 2035

Zero-Touch Provisioning (ZTP) Market - Growth & Demand 2025 to 2035

Zero Sugar Beverages Market Analysis by Product Type and Sales Channel Through 2035

Zero Liquid Discharge System Market Share, Trend & Forecast 2024-2034

Zero-Waste Packaging Market Report – Sustainable Growth & Trends 2023-2033

Africa’s Zero Liquid Discharge System Market - Size, Share, and Forecast 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-calorie Sweeteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Low-calorie Chocolate Business

Low-Calorie Toast Market Trends - Consumer Preferences & Growth 2025 to 2035

Low-Calorie Jelly Market Growth - Innovations & Market Expansion 2025 to 2035

Low-Calorie Snack Foods Market Insights - Growth & Trends 2025 to 2035

Low Calorie Sweets Market Insights - Trends & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA