As far the market of healthy fat-free snacks, the manufacturers target low-calorie, fat-free snacks customers, health-conscious consumers, weight management plan and diet dependent deliveries. They can include baked chips, rice cakes, fat-free granola bars, sugar-free fruit snacks, popcorn, and plant-based products high in fiber, protein, and nutrient-dense ingredients.

The increasing consumer demand for clean label and functional foods, healthy-snacking behavior, and rising awareness of obesity-related health problems drive the market. Additionally, advancements in food processing technology and raw materials is enhancing zi growth of fat-free snack types.

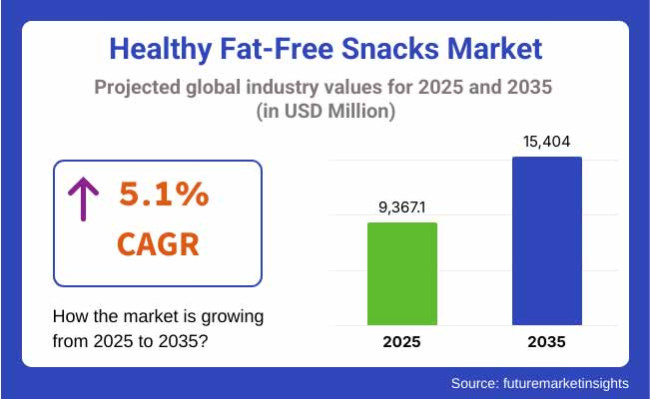

In 2025, the global healthy fat-free snacks market is projected to reach approximately USD 9,367.1 million, with expectations to grow to around USD 15,404.0 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 5.1% during the forecast period.

The anticipated CAGR highlights the increasing consumer preference for guilt-free snacking, expanding product offerings by major food brands, and rising demand for allergen-free, gluten-free, and non-GMO snack alternatives. Additionally, improvements in plant-based and sugar-free snack formulations are expected to drive further market adoption.

Consumption of clean-label food, increasing interest in weight-loss diets and established distribution chains of healthy snacking food gives a bulk share to North America for healthy fat-free snacks market.

Innovation across the United States and Canada in snacking, specifically with organic and functional features, is yet another area that large food companies are leading the charge with, as they supplement their own line of low-calorie fat-free snacking products. With the expansion of online businesses and investment into diet-friendly snacks, this stokes industry growth even more.

Europe holds a significant market share and with regard to its support for fat-free and reduced-calorie food products, Germany, France, and the United Kingdom are leading the way. The European Union's focus on public health and obesity prevention programs is driving demand for fat-free snack foods in supermarkets and health food stores. In addition, increasing demand for Mediterranean diet lifestyles and high-fiber snacking habits fuelling market growth.

The center of gravity of healthy fat-free snacking is shifting to Asia-Pacific as health issues are becoming more salient, incomes are rising and Western-style ingestion patterns are becoming more prevalent in Australia, China, India and Japan. Factors like booming plant-based foods market, growing online food platforms, and government initiatives to facilitate healthy consumption are propelling demand.

Challenges

Taste and Texture Limitations, High Processing Costs

Healthy fat-free snacks market is hindered due to the restrictions in flavor and texture that restrict fat removal in snack food. Snack producers believe that many consumers think of fat-free snacks as dry, tasteless, and containing artificial preservatives, leading to fewer repeat purchases. All sophisticated food processing methods (air-puffing, plant emulsifiers, fat replacers) increase production costs and price high-grade fat-free snacks above average market prices for conventional products.

Opportunities

Growth in Functional Ingredients, Clean-Label, and AI-Personalized Nutrition

The rising trend for healthy snacking, clean-label ingredients, and functional food ingredients is driving the market growth. Advances in protein-based fat replacers, high-fiber formulations and AI-based personalized nutrition are enhancing taste, texture and health. Emerging market opportunities also exist in plant based, gut friendly, and sustainable fat free snack foods.

The market witnessed a rise in consumer demand for fat-free and low-calorie snacks owing to surging obesity levels, weight controlling trends, and health-oriented dietary habits (including high-protein, high-fiber, and keto-diet-friendly alternatives) during the period from 2020 to 2024. However, product appeal, production cost and competition from “healthy fat” snack food segments (e.g., nuts, avocados, and MCT products) stunted mass adoption.

Moving forward, by around 2025 to 2035, the market will be redirected towards AI-based personalized nutrition, alternative fat replacers, and functional fat-free snacks. The rising production of fat-free high-protein, gut-healthable, as well as adaptogen-based snacks will continue to reshape the health snacking market. In addition, the study identifies innovations of sustainable plant-based snacks, as well as the firm establishment of biotech-derived fat substitutes and formulation based on AI as key elements for differentiation and growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EU Food Safety, and Clean Label Project guidelines |

| Technology Innovations | Growth in air-puffed snacks, fruit-based chips, and fiber-based fat substitutes |

| Market Adoption | Demand for low-calorie, weight management snacks (e.g., rice cakes, fat-free popcorn, baked chips) |

| Sustainability Trends | Shift toward natural fat alternatives, organic ingredients, and plastic-free snack packaging |

| Market Competition | Dominated by health snack brands (Quaker, PopCorners, Kellogg’s, General Mills, Annie’s, Smartfood, Nabisco, Snack Factory) |

| Consumer Trends | Demand for low-fat, high-fiber, and weight-conscious snacking options |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter labelling requirements on artificial fat replacers, ultra-processed foods, and functional ingredients |

| Technology Innovations | Advancements in AI-optimized food formulations, biotech-derived fat-free substitutes, and sustainable plant-based snacks |

| Market Adoption | Expansion into protein-rich, gut-health-enhancing, and AI-personalized fat-free snacks |

| Sustainability Trends | Large-scale adoption of biodegradable packaging, carbon-neutral snack production, and regenerative agriculture sourcing |

| Market Competition | Rise of AI-driven food startups, biotech-powered fat-replacement brands, and sustainable snack innovators |

| Consumer Trends | Growth in AI-personalized diet snacks, functional adaptogenic snacks, and microbiome-friendly fat-free products |

The USA healthy fat-free snacks market is expanding at a slow pace, due to growing consumption for healthy and low-calorie snack foods among consumers. Increased awareness among people for obesity, cardiovascular health, and clean-label drive the market. The availability of popular health food brands along with technological developments in fat-free snack foods, including air-popped popcorn, baked chips, and protein-based snacks, is still fuelling the growth of this market. In addition, e-commerce and direct-to-consumer health food subscriptions are also making fat-free snacks more accessible.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

UK healthy fat-free snacks market is growing due to rising health consciousness among consumers and increasing adoption of plant-based and functional snack products. This is driving product development where gluten-free, sugar-free, and fat-free are trending. Government efforts to eat better and stricter labelling regulations are prompting companies to create cleaner, fat-free snack options. And, the trend toward grocery ordering online is bringing fat-free snacks within reach of shoppers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

The EU healthy fat-free snacks market is growing at a rate of moderate growth, driven by increased demand for diet, plant-based and high-fiber snacks. Strict EU legislation on food labelling and healthy consumption patterns is driving innovation in fat-free snack foods. Germany, France and Italy: these European countries are the largest markets for low-fat and similar products, and consumers look for low-fat bakery products, rice cakes, and fat-free dairy alternatives. Moreover, the increasing availability of sustainable and organic snacks is also propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.8% |

Rising consumer preference for balanced, portion-controlled and functional foods in Japan is supporting the growth of Japan Healthy Fat-Free Snacks market. The growing demand for fat-free, low-calorie snack foods, such as rice crackers, dried seaweed, and soy-based snacks, is further propelling market expansion.

The increasing availability of advanced food processing technology and the need for long life and wellness-oriented diets among the consumers propels the demand for healthy fat-free snacks. Innovations in clean-label fat-free formulations are being driven by Japan's unforgiving food safety regulations, too.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The South Korea healthy fat-free snacks market is growing at a steady pace, with a surge in demand for diet, K-health trends, and plant-based diets by consumers. There is growing demand for traditional but modernized fat-free snacks, such as roasted sweet potatoes, fat-free yogurt, and air-dried fruit chips.

The celebrity endorsement of wellness products and K-pop are contributing to a greater awareness toward healthy snacking. Additionally, the infiltration of convenience-led and online retail channels is widening the accessibility of fat-free snack foods across South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

There is increasing demand from consumers seeking healthier snacks to replace traditional sugary, high fat snacks. Among other snacks (fat-free granola bars, fruit chips, rice cakes, yogurt bites, sugar-free baked goods), they offer delicious satisfaction while still upholding health or weight-loss goals.

Passion for alternative sweeteners, fiber, and functional nutrients, is a major factor in sweet snack growth. Most manufacturers use monk fruit, stevia, or erythritol as sugar substitutes, offering balanced sweetness without additives.

In addition, sweet, fat-free snacks are widely used in the body building industry, in weight loss and diabetic diets that promise higher nutritional intake at the cost of low calorie consumption. Most of these pseudo-food companies are using protein, probiotics, and superfoods like chia seeds and flaxseeds, where taste and health are almost guaranteed.

Sweet fat-free snacks are healthy and have some limitations in taste and texture, and as a result, companies are developing natural flavor enhancers, unique baking processes, and plant-based sweet systems to provide more palatability and better acceptance by consumers.

Demand for fat-free savory snacks is primarily driven by the growing preference for guilt-free snacking without compromising on taste or texture. Consumers are turning to low-sodium, high-fiber, and protein-rich savory snacks to feel full and energetic throughout the day.

Furthermore, delicious fat-free food products are widely used in the forms of office snacks, travel snacks, and school lunchboxes to maintain convenience and availability among all the age groups. Most food companies invest in herb-flavored, naturally seasoned, and air-baked formulations, ensuring a better taste and avoiding too much sodium and preservatives.

Fat-free savory snacks have certain advantages over regular snacks, but have to trade-off between the two; savory snacks need flavor strength vs low-fat processing, which has stimulated manufacturers to search for elements such as plant-based umami flavor, spice mixture, and fermentation-based seasoning processes as the optimal means toward greater sensory attraction and health value of savory snacks.

Health-oriented consumers who value chemical-free, natural components and minimal processing at the same time favour organic fat-free snacks. Their all-natural puggs uses organic fruits, whole grain, legumes, and naturally dried ingredients to provide you with pure and clean snack options that are completely free of synthetic preservatives.

Increasing awareness regarding pesticide-free, non-GMO and sustainable food production is one of the driving factors for adoption of organic fat-free snacks. Consumers most often believe that they are aware that a product has an organic production mark, which guarantees transparency and compliance with quality standards.

Further market penetration of fat-free organic foods in the specialized diet segments are seen in vegan, gluten-free and other plant-based diets. Most brands offer fair-trade ingredients, recyclable material packaging and ethical sourcing, catering more to eco-conscious consumer demand.

The high costs associated with organic snacks, even healthy snacks, have led manufacturers to develop methods of producing organic based snacks more effectively, including organic bulk food processing methods alongside bulk packaging systems, as well as organic blends contained in healthy snack mixes that are available in most grocery stores for a reasonable price.

Traditional fat-free snacks are still the most popular category, based on affordable, convenient and recognizable snack products. They are available in grocery stores, supermarkets, vending machines, and on sites of online shopping, giving their mass-market appeal and wide distribution.

Increased consumption of fat free snacks is mainly attributed to factors including availability and relatively long shelf life, making it an easy and low-cost option, especially amongst consumers. So, in order to have yet another boom in this new market of fat-free snacks lead, manufacturers are actually producing fat-free cereal bars, baked snacks, baked fruit snacks & multitudes of options within fat-free categories for consumers from different demography.

In addition, their application to school lunch menus, office snack packs, and meal replacement make traditional fat-free snacks attractive due to their utility and ease of consumption.

Rising consumer interest in low-calorie, healthy, and guilt-free snacking is driving the growth of the Healthy Fat-Free Snacks Market. Fat-free snacks are popular among health-conscious consumers, weight-loss programs, and those with food restrictions. The market is driven by the rise of plant-based diets, clean-label products, and food processing technologies to enhance taste and texture without the fat.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| General Mills, Inc. | 18-22% |

| Mondelez International, Inc. | 14-18% |

| PepsiCo, Inc. (Quaker, Lay’s) | 12-16% |

| Nestlé S.A. | 10-14% |

| Kellogg Company | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| General Mills, Inc. | Produces fat-free granola bars, fruit snacks, and whole-grain cereals under brands like Nature Valley and Fiber One. |

| Mondelez International, Inc. | Offers low-fat and fat-free snack options including belVita breakfast biscuits and Ritz crackers. |

| PepsiCo, Inc. (Quaker, Lay’s) | Develops air-popped snacks, fat-free popcorn, and baked chip alternatives under brands like Quaker and Smartfood. |

| Nestlé S.A. | Specializes in fat-free dairy-based snacks, fruit snacks, and protein-enriched snack bars. |

| Kellogg Company | Provides fat-free breakfast bars, rice cakes, and low-calorie cereals under Special K and Rice Krispies. |

Key Market Insights

General Mills, Inc. (18-22%)

General Mills dominates the healthy fat-free snacks market with diverse offerings in granola bars, cereals, and fruit snacks targeting fitness and wellness consumers.

Mondelez International, Inc. (14-18%)

Mondelez provides fat-free and low-fat snack alternatives, including baked crackers, biscuits, and whole-grain snack options.

PepsiCo, Inc. (12-16%)

PepsiCo’s portfolio includes baked chips, air-popped snacks, and oat-based fat-free snack bars, catering to on-the-go healthy snacking.

Nestlé S.A. (10-14%)

Nestlé focuses on nutrient-dense fat-free snack options, including fruit-based and dairy-based snack alternatives.

Kellogg Company (8-12%)

Kellogg provides low-fat and fat-free breakfast options, such as high-fiber cereals, rice cakes, and portion-controlled snacks.

Other Key Players (26-32% Combined)

Several emerging brands and startups are expanding the fat-free snacks market with natural, organic, and protein-enriched options, including:

The overall market size for healthy fat-free snacks market was USD 9,367.1 million in 2025.

The healthy fat-free snacks market is expected to reach USD 15,404.0 million in 2035.

Growing consumer focus on health and wellness, increasing demand for low-fat and guilt-free snack options, and rising availability of innovative, clean-label products will drive market growth.

The top 5 countries which drives the development of healthy fat-free snacks market are USA, European Union, Japan, South Korea and UK.

Organic fat-free snacks expected to grow to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthy Fats Low Carb Market Trends - Demand & Consumer Shifts 2025 to 2035

Healthy Low-Fat Desserts Market Growth – Innovations & Trends 2025 to 2035

Healthy Takeout Market Trends - Convenience & Clean Eating Growth 2025 to 2035

Healthy Food Market – Trends, Demand & Consumer Shifts

Healthy Aging Supplement Market – Demand, Innovations & Market Growth

Healthy Snacks Market Size and Share Forecast Outlook 2025 to 2035

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

Kid Snacks Market Analysis by Source, Type, and Distribution Channel Through 2035

Pet Snacks and Treats Market Analysis by Product, Pet Type, Distribution Channel, and Region Through 2035

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Protein Snacks Market Growth - Demand, Trends & Industry Forecast 2025 to 2035

Extruded Snacks Market Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Pregnancy Snacks Market Analysis by Product Type, Nutritional Content, Distribution Channel, Packaging Format and Stage of Pregnancy Flavors Through 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA