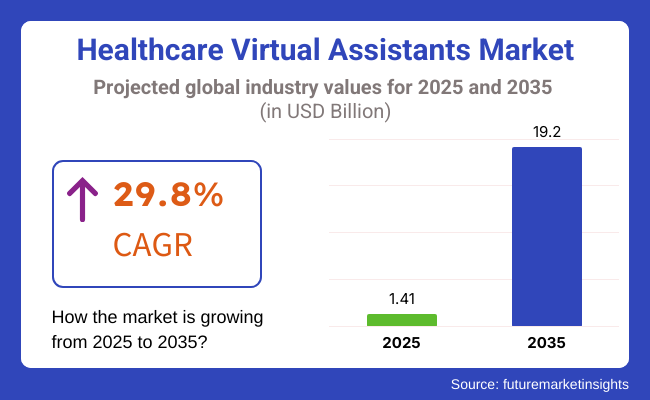

The healthcare virtual assistants market is estimated to be worth USD 1.41 billion in 2025 and anticipated to reach a value of USD 19.2 billion by 2035. Sales are projected to rise at a CAGR of 29.8% over the forecast period between 2025 and 2035.

Industry scales rapidly, driven by the use of artificial intelligence (AI) and the automation of several processes in the healthcare sector. Healthcare virtual assistants (HVAs) rely on artificial intelligence, natural language processing (NLP), and machine learning to deal with administrative workflows, boost patient engagement, etc., thereby, they are improving healthcare services as a whole.

Expanded e-health and m-health frontiers, automated demand management, and electronic delivery services are some more causes of the growing industry. The industry's progress is mainly guaranteed by the requirement for the enhancement of patient care along with the decrease in healthcare costs.

Virtual assistants find it hard to work with multiple functions like handling appointment schedules, sending medication reminders, and addressing patient queries autonomously without staff support while they help in relieving the workload of medical staff as well as they are valuable for the operational managements.

Also, the advent of AI-integrated chatbots and voice assistants in the electronic health records (EHR) systems, both tools of emphasizing clinical decision-making and improving patient interactions, is contributing to the further development of the industry. Besides, industry growth is being attributed to the virtual assistants that have the ability to aid chronic disease management and mental health support.

As reported, diabetes, hypertension, and cardiovascular diseases are among the common chronic conditions and HVA has significantly helped through e.g. remote monitoring, real-time health data, better treatment adherence, etc. Also, AI-based mental health chatbots are being used to provide psychological support and counseling while being cost-effective accessible forms of mental healthcare.

The overall situation looks bright for the industry growth that is assured by the technological innovations in voice recognition, predictive analytics, and cloud-based healthcare solutions. As virtual assistants become part of new smart speakers and health applications, they will enable patients to communicate with healthcare providers more seamlessly.

In addition, HVAs are also being integrated into wearable health technologies such as for real-time health tracking and proactive intervention. However, the industry has to face some barriers, which include data privacy concerns, overcoming regulatory compliance issues, and some of the healthcare practitioners are reluctant to adopt AI.

The popular implementation of virtual assistants such as ensuring data security and patient confidentiality are still the main concerns in this matter. Also, the necessity for constant updates and AI models to improve accuracy and efficiency demarcate the key challenges for technology providers.

Nevertheless, the promises of commercial opportunity far outweigh the downsides of the event. Personalized health and patient-driven solutions are expected to remain the frontiers stimulating the intellectual growth in applications of virtual assistants.

The establishment of precise infrastructures like AI-driven devices through 5G networks integrated with IoT will support the scaling and will bring with it a whole new paradigm of virtual health. The continuous shift of the healthcare sector towards digitization and the industry growth in the health virtual assistant sector is directly connected to this.

The industry is witnessing major growth due to the factors such as increased implementation of AI-powered chatbots and voice assistants within medical processes. The virtual assistants enhance patient experience, simplify administrative tasks, and improve diagnostic aid.

Virtual assistants are utilized in hospitals and clinics for appointment booking, symptom checking, and integration into EHRs, minimizing the workload of medical professionals. Telemedicine physicians utilize AI assistants for remote consultations, patient follow-up, and medication reminders, improving access to care.

The healthcare industry includes virtual assistants for the transmission of drug information, customer support, and clinical trial operations. On the other hand, consumers and patients gain advantage with these devices for self-management guidance, mental well-being support, and chronic disease management.

With advancements in AI technologies, the trend is shifting toward multilingual capabilities, personalized patient engagement, and stronger data security to address strict healthcare regulations. The industry will grow with the increasing demand for efficient and scalable virtual healthcare solutions.

| Company | Investment Amount (USD Million) |

|---|---|

| Suki | USD 70 |

| Teladoc Health | USD 65 |

The unrivaled expansion of the Industry in 2024 and early 2025 By raising this USD 70 million funding, Suki indicates on its own growing need for AI-powered solutions to alleviate administrative burdens in the healthcare setting using technology.

Teladoc Health’s decision to strategically acquire Catapult Health for USD 65 million is also indicative of the space’s trajectory; a step to integrate AI and to drive towards a more efficient virtual preventive care business. This is just the beginning, a small part of a growing trend to incorporate high-end technologies into patient care and to deliver healthcare services more efficiently.

The industry increased significantly between 2020 and 2024 as a result of the increasing adoption of AI-powered solutions to increase patient engagement and streamline healthcare procedures. Virtual assistants enabled appointment scheduling, medication alerts, and patient queries to be automated, relieving administrative hours for healthcare staff.

Virtual telemedicine and remote patient monitoring of growth during the COVID-19 pandemic hastened the use of virtual assistants even more. Greater natural language processing (NLP) and machine learning enabled the virtual assistants to become more capable of comprehending and responding to complex patients' requirements.

Issues related to data privacy challenges, interoperability problems, and resistance to implementation of AI integration in traditional health systems limited the maximum potential for market expansion. From 2025 to 2035, the industry will advance revolutionarily through advancements in predictive analytics, generative AI, and personalized medicine.

AI-powered virtual assistants will provide real-time diagnostic recommendations, personalized treatment plans, and mental health counseling. Voice-driven AI and multimodal interaction will facilitate human-like interaction with higher patient involvement and trust.

Blockchain technology-driven solutions for secure processing of patient data will alleviate privacy and secure processing of patient data concerns. Virtual assistants will be an integral part in addressing chronic diseases, automating administrative hassles, and assisting remote surgical guidance through AI-driven decision support. Expanded use of wearables and IoT devices will extend data capture to provide real-time monitoring and predictive care.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Faster-than-anticipated adoption fueled by expansion of telehealth and patient demand for distant care. | Mainstream integration of healthcare workflows with personalized patient activation. |

| HIPAA compliance and patient data protection in expanded virtual care adoption. | AI-based data privacy models and automated compliance monitoring build trust and security. |

| NLP (Natural Language Processing) and voice recognition integration to enhance patient engagement. | Advanced AI and context-sensitive virtual assistants provide up-to-date medical data and decision support. |

| AI-driven chatbots facilitate appointment booking, symptom monitoring, and reminders for health management. | Completely automated virtual assistants can make diagnoses, management of chronic disease, and personalized treatment plans feasible. |

| A few examples of the earliest applications of EHR integration to automaton management. | Seamless integration of EHR with AI-driven insights for predictive analysis and clinical decision support. |

The industry is gaining momentum as more and more medical centers are opting for the AI-based schemes for better patient management and administrative tasks. Notably, complex healthcare rules and data privacy laws, like HIPAA and GDPR, make the organization to comply with the challenges.

The organizations are obliged to carry out safe data handlings regulatory adherence, and implement strong cybersecurity measures for trust maintenance. Technical limitations and interoperability issues are a threat as the virtual assistants must configure perfectly with electronic health records (EHRs) and telemedicine platforms.

Issues such as incompatibility with the existing healthcare IT systems can obstruct the process. The businesses should be primarily oriented on creating the standard, scalable, and flexible solutions that would increase usability and effectiveness in healthcare institutions.

The sharp rise in hacking of the database, the intrusion of the unauthorized users, and the AI's decision-making errors cause security and ethical dilemmas. Comprehending the minor discrepancies, negating false information, and the delicate balancing of automation and human discernment are central. Forward thinking firms ought to utilize encryption that is of the highest quality, regular updates, and transparent AI models that will address these threats.

The competition in the industry is tightening, with behemoths along with startups heavily investing in the promotion of AI healthcare-related solutions. Optimizing advanced natural language processing (NLP), multilingual capabilities as well as delivering personalized patient interactions is the most significant area of differentiation.

Companies should therefore push through with their plans to innovate, forge new partnerships, and maintain user-friendly interfaces so they can thrive in the quickly diversifying industry. Factors such as funding, the policies on reimbursement, and health digitization predominate in terms of medical industry growth. As the companies grow AI technology and collaboration with healthcare dealers on reliable and cost-effective virtual assistants are handled aside from the fact that regulatory issues need to be solved beforehand.

Healthcare Providers Segment Holds Dominating Market Share in the Industry

| End User | Share (2025) |

|---|---|

| Healthcare Providers | 45.2% |

In 2025, by end users, healthcare providers accounted for 45.2% of the industry. AI-powered virtual assistants are rapidly being adopted by hospitals, clinics, and telehealth platforms to reduce administrative burden, improve patient interaction, and boost clinical workflow. Providers are getting help from solutions such as Nuance’s Dragon Medical Virtual Assistant and Amazon’s AWS HealthScribe to automate documentation, and appointments and interact with EHRs, to battle burnout and drive operational efficiency.

Virtual assistants based on natural language processing (NLP) also assist in triage, symptom checkers, and real-time clinical support, thereby aiding healthcare professionals in faster diagnostics and better management of the patient.

Driven by the growing use of AI-powered chatbots and voice assistants for remote healthcare services, medication reminders, and chronic disease management, the Patients segment created a revenue share of 35.0% in the industry. Platforms such as Ada Health, Babylon Health, and Google’s Med-PaLM offer personalized health insights, symptom analysis, and virtual consultations, enabling patients to take charge of their well-being.

As consumers become more inclined toward self-service healthcare and digital therapeutics, virtual assistants are proving to be a crucial factor in telemedicine, mental health support, and chronic disease monitoring (as in diabetes, hypertension, and mental health disorders).

With increasing AI implementations in healthcare, the industry for these virtual assistants will grow rapidly, aiding provider efficiency and improving patient access to healthcare services, reducing operating costs, and improving personalized care delivery.

Mobile-based Chatbots Segment Growing at the Highest CAGR in the Forecasted Period.

| Application | CAGR (2025 to 2035) |

|---|---|

| Mobile-based Chatbots | 30.1% |

The segment is expected to see the highest growth rate during the forecast period, with a CAGR of 30.1% from 2025 to 2035. This is attributed to the fast adoption of smartphones, the advancement of 5G technology, and the increasing use of AI-powered healthcare applications.

Mobile AI-powered applications such as those from Ada Health, Babylon Health, and Sensley are using chatbots to track patients’ health on the go in real-time; remind patients to take medication, and connect to remote consultations.

Additionally, connection with wearables e.g. the Apple Watch, various Fitbit biological systems to alarm about symptoms telehealth access, and mechanized clinical advice customized to the requirements of the patient to promote triple-layered engagement and involvement. The growing need for on-the-go healthcare solutions is likely to make mobile-based chatbots the leading players.

Second-highest CAGR of 24.5% during this period is being held by the Web-based Chatbots segment. These chatbots, embedded on hospital websites, telehealth portals, and pharmaceutical platforms, also manage appointment scheduling, symptom processing, and insurance queries.

AI-driven Web chatbots maintain instant medical advice, triage support, and administrative assistance; factors that directly correlate with reducing delays experienced by patients and lowering wait time for all patients in two of the largest Healthcare providers Mayo Clinic and Cleveland Clinic.

Some pharmaceutical companies such as Pfizer and Novartis use web chatbots for prescribing information and patient education. With healthcare digitization on the rise, chatbots of web-enabled versions will still dominate in facilitating virtual patient engagements and automating administrative processes.

Blockchain tech along with AI and NLP, the next wave of virtual healthcare assistants in mobile and web-based services will enhance the digital health experience for the next generation while increasing patient outcomes, operational efficiency, and improving access to care across the world.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 25.7% |

| Germany | 22.9% |

| UK | 26.8% |

| China | 30.2% |

| India | 31.1% |

| France | 23.5% |

| Italy | 21.7% |

| South Korea | 27.4% |

| Japan | 24.1% |

| Australia | 22.3% |

| New Zealand | 20.8% |

The USA industry for virtual assistants in the healthcare sector is anticipated to witness a CAGR of 25.7% during the forecast period of 2025 to 2035. The advanced technology nation's better digital infrastructure and high usage rate of AI-based solutions are fueling the industry's growth.

Virtual assistants are implemented on a massive scale in hospitals, clinics, and telemedicine to automate administrative tasks, improve patient engagement, and facilitate remote patient monitoring. The presence of a location for large health tech and AI players like IBM Watson Health and Nuance Communications supports the region in this area.

Government initiatives in favor of digital healthcare growth and heavy investment in AI technology further boost industry expansion. Rising rates of chronic illness and demand for low-cost healthcare solutions drive virtual assistant growth. The utilization of voice-enabled assistants on electronic health records (EHRs) and wearables also chart the way forward for digital healthcare in the USA

The UK industry is expected to grow at a 26.8% rate over the years 2025 to 2035. The National Health Service (NHS) is driving the growth of AI-based healthcare services, and virtual assistants are being implemented in telemedicine services and primary care. The necessity to minimize inefficiency and decrease the waiting time of patients has boosted the use of AI-based chatbots and voice assistants for medical consultations.

Babylon Health and Sensely are the competitors who have created AI-powered virtual assistants that deliver symptom diagnosis and health advice. The UK government's efforts to launch digital health programs such as AI-powered diagnostics and patient management systems are fueling the industry growth. The aging population and healthcare system pressures are propelling virtual assistants into the need to deliver affordable and accessible healthcare solutions.

Germany's industry will expand at a CAGR of 22.9% between 2025 and 2035. Germany's deep focus on digitalization in the healthcare sector, coupled with the implementation of the Digital Healthcare Act (DVG), has fueled the adoption of AI-powered virtual assistants. They are being widely adopted across hospitals and ambulatory care to assist healthcare workers and handle patient interactions.

Firms like Ada Health have been central in the creation of AI-based health evaluation platforms that are compatible with virtual assistants. Strong data protection laws in Germany guarantee the safe handling of patient data, with implicit trust in AI-based healthcare solutions. The increasing need for virtual assistants to take care of elderly patients and chronic conditions also fuels industry expansion.

France's industry will increase at 23.5% CAGR between 2025 and 2035. Increased investment in France towards healthcare digitalization and AI adoption has compelled telemedicine and hospitals to implement virtual assistants. AI-driven solutions via the Health Data Hub government program fuel the implementation of virtual assistants to enable medical consultation and patient management.

Firms such as Nabla and Doctolib are creating AI-based virtual assistants to improve doctor-patient relationships and facilitate appointment scheduling. France's emphasis on reducing healthcare expenditure through effective care has accelerated interest in AI-based healthcare solutions even more. Virtual assistants also help with mental healthcare through digital therapy and instant support.

The industry in Italy is anticipated to grow with a CAGR of 21.7% over 2025 to 2035. The nation is witnessing the growing adoption of AI healthcare technologies as part of initiatives aimed at enhancing patient engagement and streamlining hospital processes. Virtual assistants are being adopted on telemedicine platforms and state-run medical services to ease medical consultations and administrative functions.

Italian healthcare technology firms such as Paginemediche are investing in AI-based virtual assistants that enhance patient engagement and offer remote healthcare consultations. Government-level digitalization of the healthcare industry, coupled with higher investments in machine learning and AI, is fueling industry growth. Multilingual virtual assistants are more in demand due to Italy's multi-language population and the need for seamless healthcare communication.

The South Korean industry will increase at a rate of 27.4% CAGR from 2025 to 2035. The high technology base and internet penetration in South Korea have led to the mass use of AI-based virtual assistants in the healthcare industry. Virtual assistants are being used extensively by telemedicine platforms and hospitals for remote monitoring of patients and consulting doctors.

Firms like Kakao Healthcare and Lunit are at the forefront of establishing AI-based healthcare solutions in South Korea. Industry growth is fueled by government initiatives to expand the use of AI in healthcare, for instance, through the Digital New Deal. Virtual assistant usage for long-term care and individual health management is also fueling industry growth.

Japan's industry is estimated to grow at a CAGR of 24.1% during 2025 to 2035. Japan's expanding population of seniors and strong desire for high-quality healthcare services stimulated the uptake of AI-driven virtual assistants in hospital care and home care. Virtual assistants are gaining more prominence in aged care, prompting seniors to take medication and giving them direct health advice.

Major Japanese corporations like SoftBank Robotics and Fujitsu are investing in AI-driven virtual assistants for patient care services. Government initiatives towards digital health transformation and robot care solutions go hand-in-hand with industry growth. Synergistic integration of AI-driven chatbots and voice assistants with healthcare solutions is reshaping the digital health space in Japan.

Australia's industry will grow at a 22.3% CAGR between the five years 2025 to 2035. The increasing need for telemedicine and digital healthcare solutions in Australia has been the key driver behind the employment of virtual assistants in telehealth care and hospitals. Virtual assistants powered by artificial intelligence are opening rural patients' doors to receive superior care and automating hospital back-end processes.

Harrison.ai and Healthdirect Australia are among the top AI-driven healthcare solutions in the nation. Government investments in digital healthcare programs such as AI-aided diagnostics and virtual care platforms fuel industry growth. Increased adoption of wearable health devices with virtual assistants also supports industry growth.

New Zealand's industry is expected to grow at a CAGR of 20.8% between 2025 and 2035. New Zealand's healthcare sector is adopting AI-based solutions to improve patient interaction and assist medical services. Virtual assistants are used more and more in telehealth services and community healthcare services.

Orion Health and other companies are investing in virtual assistants powered by AI to track patients and deliver healthcare remotely. Government programs for funding digital healthcare transformation and deployment of AI within primary care facilities also fuel rising industry opportunities. Greater emphasis on personalized healthcare solutions and preventive care fuels the demand for virtual assistants in New Zealand.

HVAs are experiencing a rapid expansion because as more and more healthcare enterprises adopt artificial intelligence (AI)-based tools to engage patients better, cut down on administrative processes, and offload some of the burdens from the clinicians, HVAs will now be used to grant voice recognition, natural language processing, and machine-learning capabilities.

Some of the leading players in virtual assistants and AI-based chatbots and voice diagnostics include Nuance, Microsoft, Amazon (AWS HealthLake), Verint Systems, and ADA Digital Health. For instance, Dragon Medical One, a Nuance product, provides a comprehensive solution for clinical documentation, while Amazon's Alexa for Health offers HIPAA-compliant virtual care applications.

Again, telehealth adoption is likely to rise; regulation is maturing, and patients increasingly demand their methods of accessing healthcare digitally. Healthcare companies have been concentrating primarily on interoperability with healthcare IT systems, multi-language capabilities, and predictive analytics for smart virtual assistants.

Over the past couple of years, the strategic focus points have changed in very high-demand markets, from AI-facilitated automation and strategic alliances with healthcare providers to advancements in largely emerging countries to fill a growing void for more affordable patient-centered digital health solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Nuance Communications, Inc. | 20-25% |

| Microsoft Corporation | 15-20% |

| Amazon.com, Inc. | 12-17% |

| Verint Systems Inc. | 8-12% |

| ADA Digital Health | 5-10% |

| Other Companies (combined) | 36-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nuance Communications, Inc. | Specializes in AI-powered virtual assistants for clinical documentation and patient engagement. Integrates with EHR systems. |

| Microsoft Corporation | Offers cloud-based AI virtual assistants through Azure Health Bot, focusing on triage, patient communication, and healthcare workflows. |

| Amazon.com, Inc. | Provides Alexa-based health solutions and AI-driven tools to improve patient interaction, appointment scheduling, and medication reminders. |

| Verint Systems Inc. | Delivers AI-powered conversational interfaces tailored for healthcare, improving patient access and call center efficiency. |

| ADA Digital Health | Focuses on symptom assessment and patient guidance through intuitive virtual health assistants, enhancing telehealth experiences. |

Key Market Insights

Nuance Communications, Inc. (20-25%)

Nuance is a powerhouse in the healthcare market with virtual assistant technologies. It sits on a foundation of AI-laden clinical documentation and speech recognition technologies. The virtual assistants connect with EHR fields, save on administrative costs, and free up time for physicians.

Microsoft Corporation (15-20%)

Microsoft extends rapidly into healthcare AI solutions via the Azure Health Bot platform, which allows providers to offer custom-tailored patient experiences. Through natural language understanding and integration with present healthcare systems, the platform alleviates bottlenecks associated with triage, appointment scheduling, and follow-up care.

Amazon.com, Inc. (12-17%)

The internet giant now taps into virtual health assistants by leveraging its extensive knowledge and consumer feedback through the use of AI technology. Using Alexa, healthcare organizations are finding new engagement channels for patients, encompassing medication reminders, health monitoring, and others.

Verint Systems Inc. (8-12%)

Verint excels in increasing patient engagement levels and automating communications between patients and healthcare organizations; more importantly, it designs virtual assistants that optimize call center processes and give timely responses while reducing waiting durations for the responses.

ADA Digital Health (5-10%)

ADA Digital Health focuses on AI-based assessments of symptoms and recommendations for personalized care. The virtual assistant guides users through symptom checkers with their actionable insights and contact with healthcare professionals.

Other Key Players (36-45% Combined)

By product, the industry is segmented into web-based chatbots and mobile-based chatbots.

By end user, the Industry is segmented into healthcare providers, patients, and other end users.

By region the industry is divided as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA).

The industry is expected to generate USD 1.41 billion in revenue by 2025.

The industry is projected to reach USD 19.2 billion by 2035, growing at a CAGR of 29.8%.

Key players include Nuance Communications, Inc., Microsoft Corporation, Amazon.com, Inc., Verint Systems Inc., ADA Digital Health, Babylon Health, Amwell, Ginger, HealthTap, and Ada Health.

North America and Europe, driven by increasing investments in AI-powered healthcare, growing demand for remote patient monitoring, and advancements in natural language processing (NLP) technology.

AI-based chatbots dominate due to their ability to assist with symptom checking, appointment scheduling, medication reminders, and real-time patient support.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Healthcare Chatbot Market - Growth Trends & Forecast 2025 to 2035

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Healthcare Natural Language Processing (NLP) Market Insights – Trends & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA